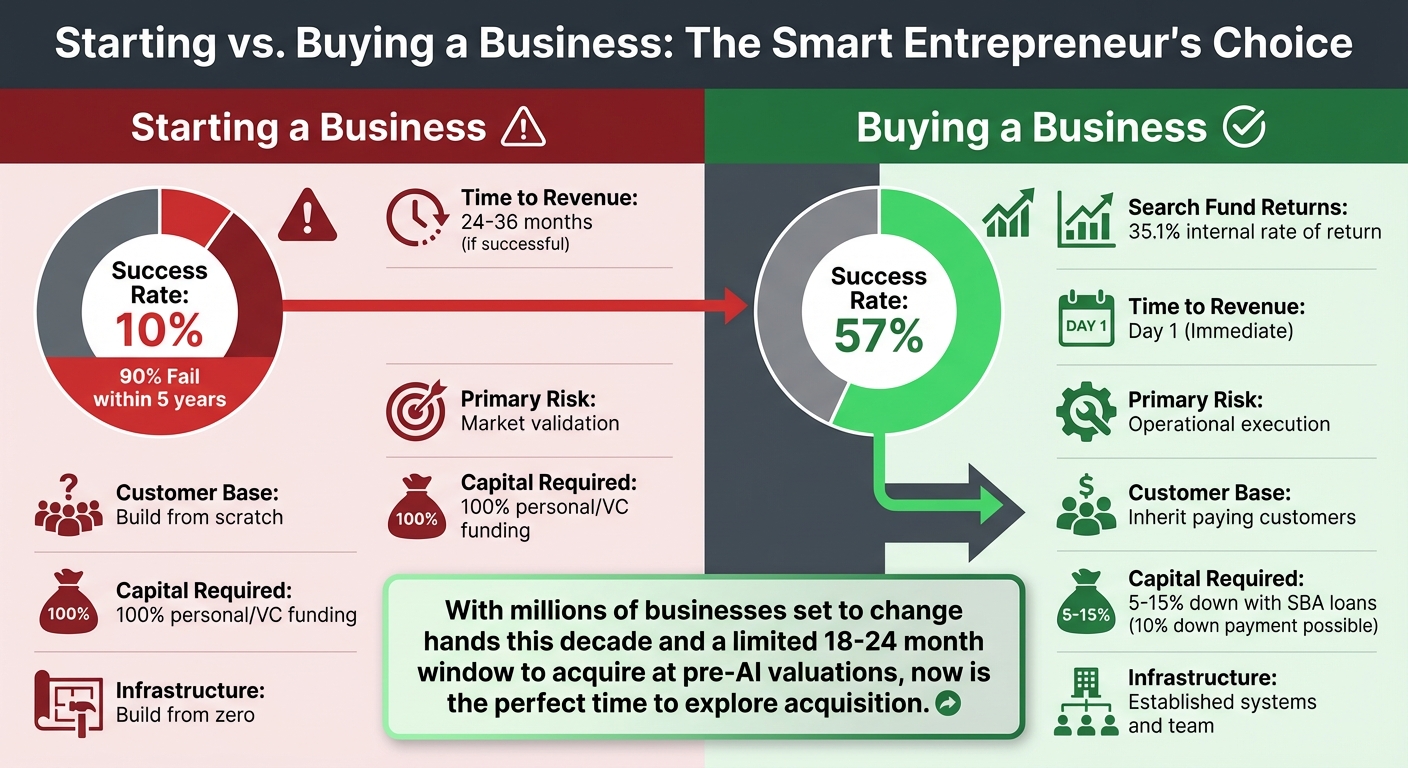

Why? Because startups are risky - 90% fail within five years, often due to unproven ideas or financial strain. In contrast, acquiring an established SaaS or AI business offers immediate revenue, loyal customers, and proven market fit. Plus, you bypass the hardest part: building from zero.

Here’s why buying makes sense:

- Success Rates: Acquisitions succeed 57% of the time, compared to only 10% for startups.

- Immediate Cash Flow: Start earning from day one instead of waiting 2–3 years for profitability.

- Lower Risk: Proven products and existing customers reduce uncertainty.

- Financing Options: SBA loans let you buy with as little as 10% down.

- Growth Potential: Many businesses lack AI integration, leaving room for optimization.

Quick Comparison

| Factor | Starting a Business | Buying a Business |

|---|---|---|

| Success Rate | 10% (5-year survival) | 57% |

| Time to Revenue | 24–36 months (if lucky) | Immediate |

| Primary Risk | Market validation | Operational execution |

| Customer Base | Build from scratch | Inherit paying customers |

| Capital Required | 100% personal/VC funding | 5–15% down with loans |

Instead of gambling on an untested startup, buying a business lets you focus on growth from day one. With millions of businesses set to change hands this decade, now’s the perfect time to explore this path.

Starting vs Buying a Business: Success Rates, Timeline, and Capital Requirements Comparison

Benefits of Buying a SaaS or AI Business

Immediate Revenue and Lower Risk

When you acquire a SaaS or AI business, you're stepping into a venture that already generates consistent monthly revenue (MRR). This means you can start drawing a salary and covering operating costs right away - without risking your personal finances on the uncertain path of building a startup from scratch.

The numbers back this up: acquisitions succeed at a 57% rate, while 90% of startups fail [2][6]. Search funds, which focus on buying existing businesses, have reported an impressive 35.1% internal rate of return across numerous deals [2][6]. Lenders, including banks and SBA programs, also favor financing businesses with proven cash flow. For instance, the SBA 7(a) loan allows you to finance up to 90% of the purchase price, leaving you with only a 10% down payment [2].

"The question shifts from 'Will anyone buy this?' to 'Can I run this well?' - a controllable risk for corporate operators." – Danielle Hunt, EBIT Community [2]

Beyond the financial advantages, buying a business positions you to leverage existing market strengths.

Existing Customers and Market Position

One of the biggest perks of buying a business is inheriting an established, paying customer base. Unlike startups, which often fail because they create products nobody wants (a pitfall for 42% of failed startups [2][5]), the business you're acquiring has already proven its market fit. Customers are actively using and paying for the product.

Additionally, you gain operational infrastructure that would take years to develop from scratch. The tech stack is already functional, databases are set up, and the team knows how to execute their roles. Brand recognition and customer trust - assets that typically require significant investment and time to build - are already in place [3]. A great example is Intuit's $12 billion acquisition of MailChimp in 2021. Intuit instantly gained millions of active users and a well-established email marketing platform, bypassing the enormous effort of building such a system from the ground up [3].

These advantages make it easier to enter the market and focus on scaling.

Faster Market Entry and Growth Potential

Acquiring an existing business lets you skip the slow and uncertain startup phase. Instead of spending years on development, you can dive straight into optimizing and scaling. With the global SaaS market growing at 19.7% annually [3] and only 12% of small businesses currently using AI tools [2], there's a massive opportunity to modernize and expand the business you acquire. You can find actionable ways to apply AI to your new acquisition on our blog.

AI automation offers another exciting avenue. By purchasing SaaS businesses that haven't yet implemented AI, you can improve efficiency and increase profit margins almost immediately. As David Deeds, Schulze Professor of Entrepreneurship, puts it:

"Instead of asking, 'What should I build?,' Entrepreneurship Through Acquisition asks a simpler and far more practical question: 'What already works, and how can I make it work better?'" [5]

Comparison Table: Starting vs. Buying a SaaS or AI Business

Here's a quick look at how buying a business stacks up against starting one:

| Factor | Starting a Business | Buying a Business |

|---|---|---|

| Success Rate | 10% (5-year survival) | 57% |

| Time to Revenue | 24–36 months (if successful) | Day 1 |

| Primary Risk | Market validation | Operational execution |

| Capital at Risk | 100% personal/VC capital | 5–15% (with SBA leverage) |

| Infrastructure | Build from zero | Established systems and team |

| Customer Base | Must acquire from scratch | Existing, paying customers |

Source: Stanford Study, EBIT Community [2][6]

sbb-itb-9cd970b

How to Find a SaaS or AI Business to Buy

Using Marketplaces and Directories

Online marketplaces are a go-to option for finding businesses for sale. One of the most popular platforms is Acquire.com (formerly MicroAcquire), which specializes in vetted online businesses. SaaS and AI startups listed here generally range from $50,000 to $5 million. Since all listings are pre-vetted, it saves you the hassle of sorting through unsuitable deals.

Another option is Flippa, which offers a broader range of digital assets. However, the quality of listings can vary significantly, so you’ll need to perform more thorough due diligence. For a more hands-on approach, Quiet Light Brokerage provides broker-assisted listings, focusing on established digital businesses. This service includes professional guidance, which can be helpful if you’re new to the process.

You can also explore direct outreach. Many high-quality opportunities never make it to public marketplaces. Consider reaching out directly to SaaS founders in your network or using directories like Top SaaS & AI Tools Directory. These directories often feature AI-driven tools for tasks like lead generation or analytics, helping you identify businesses with solid technical foundations and growth potential.

Once you’ve identified potential businesses, the next step is to evaluate their financial metrics to ensure they’re stable and positioned for growth.

Key Metrics for Evaluating a Business

Before making an offer, it’s essential to dive into the numbers. Start by examining Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) - these provide insight into the predictability of the business’s income. Request financial statements spanning at least 3–5 years to evaluate trends and cash flow reliability [8].

Pay close attention to the churn rate, which measures the percentage of customers leaving annually. High churn is a red flag. Also, compare Customer Acquisition Cost (CAC) to Customer Lifetime Value (CLTV). If acquiring a customer costs more than the revenue they’ll generate, the business model isn’t sustainable. Another critical metric is Net Revenue Retention (NRR) - a figure above 100% signals that the business is growing revenue from its existing customer base, indicating strong product-market alignment [10].

AI integration can also significantly influence valuation. Companies leveraging AI for tasks like predictive analytics, personalized recommendations, or operational efficiency often command higher multiples due to their scalability potential [10]. For context, in 2023, profitable SaaS companies had a median revenue multiple of 7.8x, compared to 6.7x for unprofitable ones [10].

By carefully analyzing these metrics, you reduce your risk. However, there are still potential pitfalls to be aware of.

Common Mistakes to Avoid When Selecting a Business

One of the most common errors is overlooking declining revenue trends. A temporary boost from a one-off promotion doesn’t equate to long-term growth. Request monthly financial reports to uncover seasonality or hidden patterns [8][9].

Customer concentration is another critical factor. If a single customer contributes more than 20% of total revenue, losing that client could jeopardize the entire business [9].

Operational risks also deserve scrutiny. Technical debt is a major concern - ensure the seller has clear ownership of the source code and intellectual property. If they can’t prove it, it’s best to walk away [11].

Lastly, evaluate owner dependency. If the founder is solely responsible for coding, marketing, and customer support without documented processes, you’re essentially buying a job instead of a scalable asset [11][8]. Dan Martell, Founder of SaaS Academy, highlights the risks:

"If the support metrics are tanking (ie. volume of issues, time to respond, unanswered tickets, etc.)... then even if all the other metrics look favorable, the company could be in line for a mass customer exodus the moment you take it over." [7]

435: Acquire.com: Buying & Selling Bootstrapped SaaS Startups

How to Value SaaS and AI Businesses

Getting the valuation right is crucial when acquiring a SaaS or AI business. It ensures you're paying a fair price based on established metrics and future growth opportunities. Familiarity with standard valuation multiples and the impact of AI features can help you evaluate potential acquisitions and avoid operational risks.

Standard Valuation Multiples for SaaS

For SaaS businesses, ARR multiples (Annual Recurring Revenue) are the go-to benchmark. Most SaaS companies are valued at 5x to 15x ARR, though high-growth leaders can exceed 20x [12]. As of September 2025, public SaaS companies traded at a median of 6.1x revenue, while private M&A deals averaged 4.7x [13].

The company's size influences the multiple applied. For businesses with less than $2 million in ARR, buyers often use Seller Discretionary Earnings (SDE) multiples, which typically range from 3x to 10x SDE. The median for smaller B2B SaaS deals is 3.64x [14]. Once ARR surpasses $2 million, the focus shifts to revenue-based multiples.

Gross margin plays a major role in determining valuation. To qualify for "True SaaS" multiples, gross margins should exceed 80%. Margins below 70% often lead to discounts of 0.5x to 1.0x, as the business starts resembling a service-oriented company rather than a scalable software platform [14].

The Rule of 40, which combines growth rate and profit margin to reach at least 40%, is another key factor. Companies exceeding this benchmark often secure premium valuations. Andrew Gazdecki, CEO of Acquire.com, notes:

"Public SaaS businesses with [Rule of 40] scores >60% often trade at 2–3× the valuation of peers scoring <20%." [12]

For comparison, profitable SaaS companies had a median revenue multiple of 7.8x in 2023, versus 6.7x for unprofitable ones [10]. High-growth startups with 100%+ year-over-year growth can command 10x to 15x ARR, while mature companies with 20% to 50% growth usually fall between 5x and 8x ARR [12]. Private companies, however, often face a liquidity discount of 20% to 30% compared to public counterparts [13]. Metrics like Net Revenue Retention (NRR) over 120% can add a 1x to 3x premium to the base multiple [12]. For instance, Snowflake hit 80x to 100x ARR multiples during its IPO in 2020, driven by triple-digit growth and an NRR exceeding 170% [12][15].

Next, let’s explore how AI features influence valuation.

How AI Features Affect Valuation

AI capabilities add a unique layer to valuation metrics, often commanding higher multiples. In 2025, AI companies traded at 25x to 30x revenue multiples, compared to around 6x for traditional SaaS businesses [18]. This premium stems from proprietary technologies, exclusive datasets, and the scalability of machine learning [16][18].

Intangible assets - such as proprietary algorithms, training datasets, and patents - can make up 70% to 80% of an AI company's value [18]. Validated proprietary AI technology may boost valuation by 15% to 20% [16]. Companies with strong "data moats" (exclusive, high-quality datasets) can see valuation premiums of 15% to 35% [18].

For example, in September 2025, Anthropic raised $13 billion at a $183 billion post-money valuation, representing a 36.6x revenue multiple, thanks to its proprietary large language model technology [16][18]. Similarly, Databricks reached a $134 billion valuation at a 27.9x ARR multiple, leveraging its AI/ML platform and patented data processing technologies [16].

The distinction between core AI (like LLM infrastructure) and applied AI (industry-specific tools) also affects valuation. Core AI providers often secure 50x revenue multiples, while applied AI tools typically trade in the low-to-mid teens, as they are seen as complementary features rather than standalone platforms [17]. Thomas Smale, CEO of FE International, explains:

"An AI business valuation model in 2026 must capture the value of proprietary algorithms, unique datasets, recurring revenue, and scalability factors that increasingly define market leaders and drive premium multiples." [16]

However, AI businesses face unique risks. Regulatory challenges or non-compliance can result in valuation discounts of up to 30% [16]. Additionally, technical obsolescence may reduce multiples by 15% or more if research and development efforts stagnate [16]. M&A multiples for AI companies are often lower than private funding multiples, as acquirers focus on real-world integration costs and normalized margins over future potential [17].

These considerations highlight how AI integration not only elevates revenue multiples but also sets market leaders apart.

Markdown Table: Key Valuation Metrics and Multiples

Here’s a quick summary of the key metrics and their typical valuation ranges, covering both SaaS fundamentals and AI-specific premiums:

| Metric | Typical Range / Benchmark | Impact on Valuation |

|---|---|---|

| ARR Multiple | 5x – 15x | Baseline for subscription revenue |

| SDE Multiple | 3x – 10x | For businesses under $2M ARR; reflects owner value |

| Rule of 40 | ≥ 40% (Growth + Margin) | Higher scores often lead to 7x+ ARR multiples |

| Net Revenue Retention | >120% | Adds 1x–3x premium to the base multiple |

| Gross Margin | >80% | Below 70% leads to valuation discounts |

| AI Integration | Proprietary / Predictive | Adds 15%–35% premium; strategic multiples apply |

| Churn (Monthly) | <1% (Enterprise) | Lower churn enhances predictability, boosting value |

| LTV/CAC Ratio | >3:1 | Ratios above 5:1 can increase valuations by 30%–50% |

Using AI Tools and SaaS Platforms for Due Diligence

When it comes to acquisitions, thorough due diligence can make or break a deal. The traditional process often drags on for over 60 days and costs between $10,000 and $25,000 per deal. In contrast, AI platforms can slash this timeline to mere minutes, with monthly costs ranging from $99 to $499. Despite this, around 60% of M&A deals still fail due to insufficient analysis [19][22][21].

By the end of 2023, only 10% of private funds had fully adopted AI into their workflows [19]. But the potential is undeniable. AI processes data - like financial statements, customer metrics, and market intelligence - at speeds 20 times faster than manual efforts, while also identifying risks that might escape human analysts [24]. From financial analysis to competitive benchmarking, AI tools are transforming every stage of the due diligence process.

AI for Financial and Operations Analysis

AI tools excel at extracting and standardizing financial data, making it easy to calculate key metrics such as MRR bridges, LTV/CAC, and Net Revenue Retention [23].

One standout use case is revenue reconciliation. AI systems can cross-check reported ARR against raw data from billing platforms like Stripe or QuickBooks and match those figures to bank statements. This process quickly identifies discrepancies between reported and actual revenue, helping to avoid costly missteps during negotiations [23].

Companies like Centerline Business Services and SYNSA Financial Analysis have seen impressive gains in both productivity and accuracy by leveraging AI for multi-source data verification and automation [19][20]. Trey Heath, CEO of Centerline Business Services, highlighted the value of advanced AI tools:

"The key differentiator with V7 is its ability to understand complex documents with detailed charts and tables. We have seen nothing that compares to the accuracy we get with using V7." [19]

SYNSA Financial Analysis took this a step further in November 2025 by using multi-agent AI validation to create an Investment Memo. The process involved analyzing 24 different data sources and cross-referencing findings across three independent systems, resulting in a thoroughly verified report [20].

Machine learning models also play a critical role in flagging issues like high customer concentration (e.g., if a single reseller accounts for 30% of revenue) or inconsistent profit margins. This "smart audit" approach uncovers operational and financial vulnerabilities that could derail a deal [23]. Beyond crunching numbers, AI also provides insights into customer behavior and market trends.

Customer Data and Market Insights

Evaluating customer health is a crucial part of assessing a company's growth potential. AI tools analyze product usage by customer segments to spot patterns in retention and highlight risks, such as high churn rates [23].

These platforms also monitor Net Revenue Retention (NRR) and identify customer concentration risks, like when one client accounts for more than 30% of total revenue. Spotting these red flags early gives buyers the chance to renegotiate terms or include safeguards in their agreements [23].

Competitive Benchmarking with AI

AI-powered benchmarking platforms make it easier to understand how a target company compares to its competitors. They analyze pricing, features, and customer satisfaction to provide a clear picture of where the business stands. For instance, Comparables.ai uses semantic matching of business models and boasts a database covering over 360 million active companies worldwide, offering near-complete global coverage [24][25]. Tools like SuiteCompete provide automated, side-by-side feature comparisons, while GrowthPal identifies off-market targets and benchmarks them based on product alignment and customer overlap [27][28].

Andreas Anderberg, a partner at IMAP Sweden, emphasized the efficiency of these platforms:

"Comparables.ai has revolutionized our approach, saving time with remarkable efficiency and ensuring comprehensive data selection... becoming a cornerstone tool for thorough market analysis." [24]

GrowthPal has already facilitated over 210 Letters of Intent (LOIs) and closed 42 deals, representing a pipeline worth more than $300 million [28].

For valuation benchmarking, platforms like AcqNinja and ExitVelocity.ai use AI to perform detailed analyses with methods such as EBITDA multiples, DCF analysis, and comparisons to similar sales. These tools ensure buyers avoid overpaying due to inflated seller expectations. Traditional evaluations can take 6 to 8 weeks and cost tens of thousands of dollars, but AI platforms complete this work in minutes at a fraction of the cost [21][26].

A growing trend in "glass-box AI" ensures that every calculation and finding is fully documented and traceable back to its source [20]. This transparency builds trust, allowing buyers to verify AI-generated conclusions and present defensible data to lenders or partners. As Bain & Company explained:

"Just as the tech function itself has moved out of the back room to become a strategic centerpiece for many companies, the most effective way to evaluate a target's technology capability has had to evolve as well." [19]

How to Optimize an Acquired Business for Growth

Closing the deal is just the beginning. The real challenge begins when you take ownership and focus on optimizing and scaling the acquired business. The first 100 days are critical - 40% of dealmakers report that GenAI enabled 30% to 50% faster deal cycles, and those who act swiftly on integration often see the biggest returns [30]. The key is to prioritize high-impact areas like streamlining operations with AI, improving customer retention, and achieving quick wins that build momentum. This phase relies heavily on insights from earlier due diligence to drive scalable growth.

Using AI to Improve Operations

AI can significantly reduce operational costs and free up your team to focus on growth initiatives. Start by using AI in three main areas: customer support, marketing automation, and sales outreach [29]. These tools handle repetitive tasks - such as answering common support questions, generating ad copy, or conducting initial market research - allowing your team to focus on more strategic work.

Take Scribendi as an example. After Magnum Capital Partners acquired the company in 2015, they used AI to automate customer orders, developed a grammar correction tool for scientific articles, and optimized order fulfillment timing. These changes led to Scribendi's acquisition by Edanz in 2023 [29]. Enrico Magnani, Founding Partner at Magnum Capital Partners, explained:

"I like to think about AI as a bicycle for your mind. Let's say your brain used to walk, and then you hop on a bicycle: A whole new world of opportunities opens up." [29]

Another example is Pxl, a SaaS product acquired by Waterglass. By integrating AI into distribution channels and workflows, the new owners achieved a 4x increase in Monthly Recurring Revenue (MRR) [31].

Start small - pilot AI in one key area, like triaging support tickets. Measure the results and expand from there. Businesses that redesign workflows around AI see 2-3X higher productivity gains compared to those that treat AI as a supplementary tool [33]. Focus on embedding AI into essential workflows rather than isolating it in "innovation pods."

One simple yet effective approach is using AI as a digital assistant for routine tasks, leaving senior staff free to handle complex challenges. For instance, junior employees can use tools like ChatGPT to resolve technical issues before escalating them to senior staff if needed [29]. This system saves valuable engineering time every week.

Improving User Experience and Customer Retention

Once operations are streamlined, turn your attention to the customer journey. Retention is critical, especially for SaaS businesses, where even minor improvements in churn can significantly boost lifetime value (LTV) and profitability. Begin by mapping the entire customer journey - from discovery to renewal - and pinpoint areas where users drop off. Tools like heatmaps and session recordings can highlight friction points [34].

However, data alone isn't enough. Speak directly with customers. Conduct focus groups, interview front-line support staff, and ask open-ended questions to uncover why users stay or leave. This qualitative feedback provides context for the numbers [34].

After identifying pain points, use predictive analytics to spot at-risk accounts through usage patterns, like declining logins, and take proactive steps to retain them [35][36].

Quick wins can make a big difference. For example, personalized calls-to-action (CTAs) can increase conversion rates by 42%, and reducing page load times to under 3 seconds can boost conversions by 300% [34].

Pricing optimization is another area with high potential. Only about 40% of SaaS businesses use value-based pricing, meaning many leave money on the table [34]. Instead of basing prices on costs or competitors, determine what your ideal customers are willing to pay for specific features. Andrew Gazdecki, CEO of Acquire.com, summed it up:

"Fair pricing is charging what the customer is willing to pay." [34]

Test new pricing models with a small segment of your user base - around 10% - before rolling them out fully. Communicate changes early, emphasizing added value or offering "grandfathered" discounts to loyal customers to ease the transition [34].

Examples of Post-Acquisition Success

The most successful post-acquisition transformations combine operational efficiency with strategic growth. Long Lake, a homeowner association management business backed by General Catalyst, is a prime example. By February 2026, the company reached $100 million in EBITDA in under two years by acquiring traditional property management firms and implementing AI. Their strategy, funded with $672 million, automated 30-70% of labor-intensive tasks [32].

Similarly, Crescendo, an AI-native call center platform, reached a $500 million valuation by early 2026. The company acquired traditional contact centers and used AI to automate repetitive tasks, achieving profit margins four times higher than industry norms [32].

In the accounting industry, Crete Professionals Alliance grew to over $300 million in annual revenue across 30+ firms by 2025. Backed by Thrive Capital, they were named Accounting Today's fastest-growing firm of 2025, thanks to AI automating 30-70% of labor-intensive tasks [32].

On a smaller scale, an IT services firm in Toronto acquired a consulting firm in Edmonton for $12 million CAD in March 2025. Within 30 days, they used AI to consolidate customer data, streamline service workflows, and manage communications. By day 60, they had reduced customer service response times by 40%, eliminated $2,400 CAD per month in duplicate software costs, and uncovered $180,000 CAD in annual synergies [35].

These examples show that integrating AI and focusing on operational improvements can lead to measurable growth. The first 100 days are crucial for setting the tone and achieving long-term success.

Conclusion

Acquiring an existing SaaS or AI business can often be a quicker, safer, and more profitable path compared to starting a venture from scratch. While startups face a daunting 90% failure rate within five years, business acquisitions have a 57% success rate [2][6]. With an acquisition, you gain immediate revenue from day one and inherit established infrastructure, including customer databases and supplier relationships [3][4].

Right now, the timing is especially favorable. There's a limited 18–24 month window to acquire businesses at pre-AI valuations. By integrating automation, you can increase margins before sellers start pricing these efficiencies into their deals [2].

Using advanced tools is essential for smooth due diligence and scaling. For example, verify revenue with read-only Stripe access, review contracts for hidden liabilities, and assess technical debt before finalizing the purchase [1]. After acquisition, focus on high-impact improvements like automating customer support, optimizing pricing strategies, and reducing churn. Resources like Top SaaS & AI Tools Directory can help you find vetted opportunities and access the AI tools needed for both due diligence and growth.

Starting from scratch isn't the only route to entrepreneurship. Acquiring and optimizing a proven business may just be the smarter choice.

FAQs

How do I know a SaaS business is actually stable?

To gauge the stability of a SaaS business, prioritize consistent revenue - for instance, steady Monthly Recurring Revenue (MRR) - and low churn rates, which reflect strong customer retention. Dive into due diligence by examining the company’s financial health, the quality of its customer base, and its operational stability. This helps identify potential risks, such as fraud or hidden technical debt. It's also critical to assess growth patterns, customer satisfaction levels, and the strength of the technology infrastructure to ensure the business is set up for sustained success.

What should I check during due diligence before I buy?

During due diligence, it's crucial to dig into the financial health of the business. This means examining financial statements, cash flow, and revenue patterns to ensure stability. Take a close look at operational readiness - evaluate the efficiency of processes, the reliability of systems, and whether the team is likely to remain intact post-purchase. Don't overlook legal and security factors like existing contracts, intellectual property rights, and compliance with regulations. Finally, assess the market position, customer base, and potential for growth. This helps verify the business's value and uncover any risks before making a purchase.

How much cash do I need to buy a business with an SBA loan?

When purchasing a business with an SBA loan, you’ll generally need a down payment of about 10%. However, this amount can sometimes drop to 5% if the seller offers financing as part of the deal. Always double-check the terms of your specific loan to understand the exact requirements.