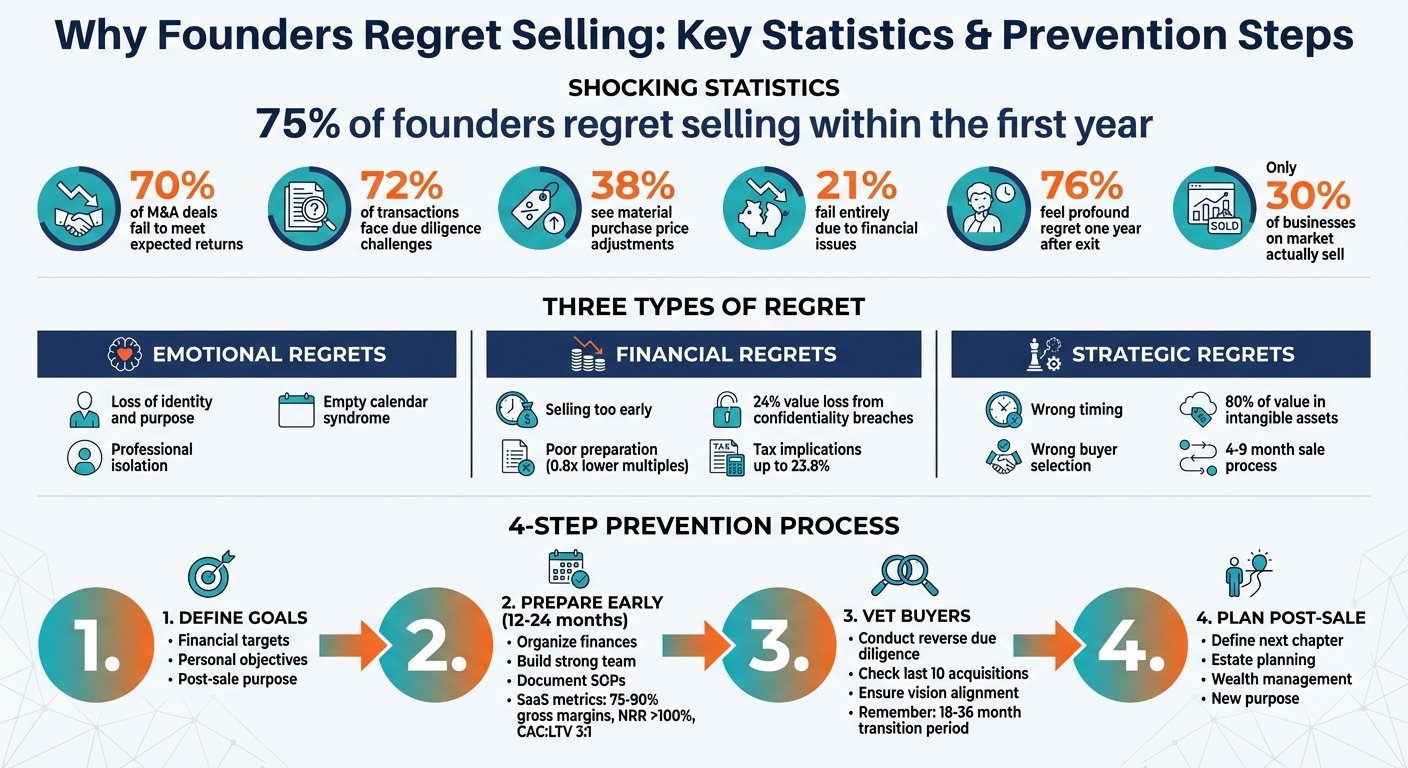

Many founders dream of selling their business, but 75% regret the decision within the first year. Why? It’s not just about money. Selling a SaaS or AI company often leads to emotional struggles, financial missteps, and strategic mistakes. Founders feel a loss of identity, regret missed opportunities, or struggle with post-sale transitions. Here’s what you need to know to avoid these pitfalls:

- Emotional Regrets: Losing purpose and identity after the sale.

- Financial Regrets: Selling too early, mishandling payouts, or undervaluing the business.

- Strategic Regrets: Choosing the wrong buyer or timing the sale poorly.

Key steps to avoid regret:

- Define Goals: Know your financial and personal goals before selling.

- Prepare Early: Organize finances, reduce founder dependence, and build a strong team.

- Vet Buyers: Look for alignment with your vision, not just the highest offer.

- Plan for Post-Sale: Have a clear purpose for your next chapter.

Selling your business is a major decision. With careful planning, you can avoid regret and set yourself up for a fulfilling next step.

Founder Exit Regret Statistics and Key Preparation Steps

37: Why 75% of Founders Regret Selling - and How to Avoid It with Better Planning

Emotional Regrets: Losing Identity and Purpose

The toughest part of selling your company isn't the negotiation or the endless paperwork. It's what comes after the wire transfer clears. Kevin Hong, Co-founder of Caprae Capital, sums it up perfectly:

"The deal is done, the wire transfer is cleared, yet for many founders, the real crisis is just beginning" [8].

For SaaS and AI founders who’ve spent years immersed in solving technical challenges and leading teams, selling the company often creates what experts call an "identity void." Your company becomes an extension of who you are. When it's gone, the question looms: Who am I without it?

This identity void can mark the start of a deeply personal struggle.

The Identity Crisis After Stepping Down

Transitioning from being a founder to a "former founder" is more emotionally jarring than most anticipate. Take Rami Essaid, for example. In 2019, he sold his bot mitigation platform, Distil Networks, to Imperva. He chose to leave on the day of the sale - walking away from a seven-figure bonus - just to avoid being relegated to a middle-management role. What followed was a period of intense grief. He described the experience like this:

"It felt like not only had I lost my identity, but it also felt like I lost my friends because day in and day out, they were interacting in meetings or whatever and I was on the outside" [3].

The loss isn’t just about missing the daily grind. It’s about losing the very structure that defined who you are. Eric Smith, a Business Owner Advisory Strategist at Wells Fargo, explains the emotional shift: "If people no longer seek your guidance and decision-making skills, that can lead to a sense of professional and personal loss" [2]. For founders who were deeply involved in every aspect of their business, the sudden silence can feel overwhelming.

This silence becomes a constant reminder of the loss of purpose and direction.

The Empty Space After the Sale

The first Monday post-sale is when the reality sets in. Your calendar is blank - no meetings, no Slack notifications, no fires to put out. That emptiness can spark an existential crisis, even when the financial outcome is life-changing.

Tracy Young, who sold PlanGrid to Autodesk for $875 million in 2018, stayed on as a VP for over a year. But the emotional toll was immense. She saw her company as her "first child" and found it painful to watch someone else reshape it [3]. The money wasn’t the issue - it was the loss of meaning. After spending seven years building something she deeply cared about, letting it go felt like losing a piece of herself.

This is where many founders fall into a trap. They focus on "push factors" - the stress, the competition, the relentless burnout - to justify selling. But they often overlook the "pull factors": what they’ll move toward after the sale [1]. Without a clear vision for "what’s next", the newfound freedom can quickly turn into a sense of aimlessness. That’s when regret creeps in.

This emotional void often sets the stage for even bigger challenges in making financial and strategic decisions post-sale.

Financial Regrets: Money Left on the Table

For many founders, the sting of unrealized financial gains can hit harder than any emotional void left by selling their business. Nearly 70% of mergers and acquisitions (M&A) fail to meet their expected returns, often because of avoidable mistakes made by the seller [9]. The realization that a higher exit valuation was possible can lead to deep regret.

These financial missteps generally fall into three main areas: selling for less than the company’s true value, mishandling the transition from recurring revenue to a one-time payout, and exiting before the business has reached its full potential. With the right preparation and guidance, all of these pitfalls can be avoided.

Selling for Less Due to Poor Preparation

One of the most painful lessons for founders is discovering that their lack of preparation directly impacted their sale price. A staggering 72% of transactions face challenges during due diligence, with 38% seeing material purchase price adjustments and 21% failing entirely due to financial issues [9].

A common issue is inadequate financial presentation. Using unaudited financial statements, failing to adjust for personal expenses, or relying on non-standard owner compensation can lower EBITDA, which in turn reduces the exit valuation. Jeff Barrington, Managing Director at Windsor Drake, explains:

"The difference between proper and improper valuation preparation is not merely theoretical - it often determines whether a transaction closes at all" [9].

Professional preparation of financials can make a huge difference. On average, companies with professionally normalized statements achieve multiples that are 0.8x higher than those using standard financials [9]. For a growing SaaS business, this can mean a significantly higher valuation. Additionally, breaches of confidentiality early in the sale process can reduce transaction values by an average of 24% [9].

Another common misstep is anchoring price expectations to irrelevant benchmarks, such as public company valuations or high-profile acquisitions, rather than focusing on their own metrics like growth, churn, and profitability [11].

Managing a Large Payout After Years of MRR

For founders accustomed to steady monthly recurring revenue (MRR), transitioning to a lump-sum payout can be overwhelming. Without a plan, this windfall can lead to poor financial decisions.

Take Brian Dean, who sold his SEO blog and course business, Backlinko, to Semrush in early 2022. He, like many founders, faced the challenge of managing a large payout [10]. Similarly, when Chris Coyier sold CSS-Tricks to DigitalOcean in March 2022, he immediately allocated part of his proceeds to safe, short-term bond investments to cover hefty tax liabilities, which can climb as high as 23.8% on business sales [10].

Matthew Fischer, a Wealth Advisor at Chicago Partners, emphasizes the importance of planning:

"No windfall is too small. Your strategic planning can make significant long-term differences with regards to tax savings as well as returns" [10].

This transition requires a shift in mindset - from focusing on growth to preserving wealth. Without proper planning, founders may rush into risky investments. Instead, taking the time to pause and create a thoughtful financial strategy can make all the difference [10].

Selling Before MRR Reaches Its Peak

One of the most frustrating regrets is selling too early, only to watch the business continue to thrive under new ownership. Exiting prematurely can mean missing out on the "quality premium" - a valuation boost awarded to companies with strong EBITDA margins and revenue growth exceeding 10%. In 2024, businesses with these traits earned, on average, a 15% higher valuation compared to their peers [9].

Many founders choose to sell when they sense growth may plateau, whether due to market saturation, competition, or personal burnout. However, if growth remains strong, buyers often focus on the company’s future potential rather than its past performance. Selling too soon can leave substantial value unrealized.

Daniel Debow, who sold Helpful to Shopify in 2019 after multiple successful exits, has developed a strategy for timing sales. He advises founders to use the valuation from their most recent funding round as a benchmark during negotiations. This ensures that the company’s growth trajectory is accurately reflected [6]. The goal is to sell before any slowdown becomes evident, as declining growth can quickly erode valuation multiples.

In some cases, these financial regrets are compounded by strategic missteps, such as selecting a buyer whose vision doesn’t align with the company’s long-term potential.

sbb-itb-9cd970b

Strategic Regrets: Wrong Timing or Wrong Buyer

When founders look back after selling their businesses, it's not just the financial or emotional aspects that can weigh on them. Strategic missteps, like selling at the wrong time or to the wrong buyer, can leave a lasting impact, especially when the company takes a direction they hadn't envisioned.

The Cost of Selling Too Early

Timing the sale of a business is one of the toughest calls for any founder. Interestingly, the best time to sell often isn't when you've maximized every ounce of value, but rather when there's still room for growth. Einar Vollset from Discretion Capital explains it well:

"Because growth dominates all other factors when it comes to valuation multiple, you should sell your business when there's still some growth left." [12]

The process of selling a business is no small feat. It often takes 4 to 9 months of intense effort, essentially like juggling two full-time jobs [12]. If you're still feeling energized by tackling customer challenges or brainstorming future opportunities, it might mean there's more value to build before you step away [13]. However, waiting too long can also backfire. Jessica Fialkovich, founder of Exit Factor, advises:

"Smart owners don't wait to 'ride it out a few more years.' They sell while the company is on the upswing, not after it peaks." [13]

The numbers back up this delicate balancing act: 75% of entrepreneurs regret selling their business within the first year [4]. And with only about 30% of businesses on the market actually being acquired [4], timing becomes even more critical.

But even if the timing is right, selling to the wrong buyer can create its own set of challenges.

When Buyers Don't Share Your Vision

Choosing the highest offer without considering alignment can lead to regret. Many founders overlook factors like shared values, deal structure, and post-sale expectations [15]. This can jeopardize the legacy and direction of the business they worked so hard to build.

Beyond the financial or identity challenges that come with selling, a buyer who doesn't share your vision can derail the company's future. This often happens when founders prioritize deal size over compatibility with the buyer's goals and culture.

The takeaway? Treat the M&A process like a job interview. After all, you’ll likely work with the acquiring company for 18 to 36 months post-sale [6][7]. Daniel Debow, who sold Helpful to Shopify in 2019, highlights the importance of professionalism during negotiations:

"When you're dealing with corporate executives, they don't want to deal with unpredictable players. If a founder shows up and acts entitled, arrogant, or doesn't act like a team player - those execs will walk away." [6]

Debow’s own experience selling Rypple to Salesforce in 2011 offers a good example. Before the sale, he collaborated with his team to design mockups showing how Rypple’s product would integrate with Salesforce’s platform. This exercise helped ensure both companies were aligned on the product’s future [6].

To avoid surprises, founders should conduct "reverse due diligence." Reach out to CEOs of the last 10 companies the buyer acquired and ask about their post-sale experiences, including any unexpected terms [5]. Look for buyers who have a dedicated "product acceleration" team and leadership that values entrepreneurial thinking [6].

Hidden Problems That Surface After the Sale

Some challenges only become apparent after the deal is done. Around 80% of a company's value often lies in intangible assets - things like employee expertise, customer relationships, internal systems, and company culture [16]. If these areas aren't properly addressed during the sale, founders risk leaving money on the table and facing complications later.

Operational readiness is another common issue. Messy financials, unclear metrics, or overdependence on the founder can lead to surprises during due diligence, potentially lowering the final sale price. Statistics show that only 2 out of every 10 businesses on the market actually sell [16].

Then there’s the personal toll. Many founders experience a sense of loss or an identity crisis after selling. While 80% of business owners aim to exit within a decade, only 30% have a concrete plan for life post-sale [14]. Without a clear purpose, 76% of business owners report deep regret within a year of exiting [16]. Alex Jensen, a Wealth Strategist at Carson Wealth, notes:

"An exit opportunity is never guaranteed... 76% of respondents indicated feeling profound regret one year after the exit." [16]

To avoid these pitfalls, it’s essential to prepare well in advance. Strengthen your leadership team so the business can thrive without you. Clean up your financials, tax records, and compliance documents early to prevent last-minute headaches during due diligence [6]. These steps can help ensure a smoother sale and fewer regrets down the line.

How to Avoid Post-Sale Regret

Sidestep post-sale regret by setting clear personal and financial goals before making any decisions. Most regrets can be avoided with careful planning - knowing what you want, preparing your business to secure the best deal, and ensuring the buyer aligns with your values and vision.

Clarify Your Goals Before You Sell

Before considering any offers, take time to reflect on your true objectives. Separate your identity from your business. Many founders struggle with this, especially when their sense of self is deeply tied to their company. If you're planning to exit completely, think about how you'll fill that gap in your life. If you're staying on for a transition period (typically 18 to 36 months [6]), make sure you're prepared to work under someone else's leadership.

Next, define your financial expectations. Identify your minimum "walk-away" number - the amount you need to feel confident about your future. Factor in tax implications, as different deal structures (like stock sales versus asset acquisitions) can significantly affect your net proceeds [17]. Also, carefully weigh the risks and benefits of seller financing. While staggered payments can increase your sale price by over 15% [17], they come with added risks.

Finally, think strategically about your ideal buyer. Are you simply looking for the highest bidder, or do you want someone who will protect your team and respect the product you've built? Daniel Debow, VP of Product at Shopify, offers this perspective:

"One of the most important things for founders to understand is that you are selling something to an executive, who has a problem. And as the startup CEO - you are that solution." [6]

Prepare Your Finances and Operations

Start preparing your finances well in advance - ideally 12 to 24 months before selling, or even three to five years for maximum impact [17][18]. Begin by organizing your financial records, including at least three years of tax returns, monthly bank statements, and profit and loss statements.

If you're running a SaaS business, focus on key metrics like Annual Recurring Revenue (ARR), Net Revenue Retention (NRR), and Gross Margins. Top-performing SaaS companies typically maintain gross margins between 75% and 90% [18]. If your NRR exceeds 100% and your Customer Acquisition Cost (CAC) to Lifetime Value (LTV) ratio is at least 3:1, you're in a strong position to attract buyers.

Beyond numbers, reduce founder dependence by building a capable leadership team and documenting Standard Operating Procedures (SOPs). Amanda Cybul of Merge emphasizes this point:

"If you're the business, your business isn't sellable. Buyers want scalability and autonomy." [18]

Assemble an advisory team early, including a CPA, legal counsel, and an M&A advisor. Independent business appraisals - costing between $3,000 and $7,500 - can give you a clearer picture of your company's worth and usually take two to three weeks to complete [17]. Additionally, consider transitioning customers from monthly to annual contracts about two years before selling to improve revenue predictability [18].

Once your finances and operations are in order, shift your focus to finding a buyer who aligns with your long-term vision.

Vet Potential Buyers Carefully

Choosing the right buyer is crucial, especially since you'll likely work closely with them for 18 to 36 months post-sale [6][7]. Treat the M&A process like a job interview. Look for "founder-friendly" buyers - teams that value entrepreneurial principles and prioritize smooth transitions, such as Shopify's "Product Acceleration" team [6].

Ask direct questions to gauge their approach: Who makes the final decisions? Does the deal require board approval? How quickly can they act?

Conduct "reverse due diligence" by reaching out to CEOs of the last 10 companies the buyer acquired [5]. Learn about their post-sale experiences and uncover any unexpected issues. Building relationships with potential buyers well in advance can also be beneficial. Daniel Debow recommends connecting through mentorships or partnerships rather than starting with a sales pitch [6]. For example, when his team sold Rypple to Salesforce, they created mockups to show how their product could integrate seamlessly with Salesforce's platform - this demonstrated alignment and helped secure the deal [6].

Transparency is key. If there are potential challenges or red flags in your business, address them early. As Debow wisely puts it:

"When you are sitting across the table from an executive, you have to make them want to like you. Because they might work with you for three years. It's a job interview, simple as that." [6]

Conclusion: Planning an Exit You Won't Regret

Selling your SaaS or AI company is a major decision, one that can leave you feeling either fulfilled or full of regret. The difference often lies in how well you prepare - emotionally, financially, and strategically. By detaching your personal identity from your business, maximizing its value, and choosing a buyer who aligns with your vision, you can greatly reduce the chances of post-sale regret during that critical first year [19].

Here’s what founders need to keep in mind as they prepare for this transition.

Key Takeaways for Founders

Start planning well in advance - years, not months. Build systems that allow your business to thrive without your direct involvement [20]. When it comes to valuation, ground your expectations in measurable benchmarks like your last funding round or revenue multiples. Surround yourself with a knowledgeable advisory team, including CPAs, M&A advisors, and estate planning attorneys [6]. And don’t just chase the highest offer - find a buyer whose vision and values align with your own.

Keep the "three buyers" rule in mind: one buyer sets the price, two buyers create competition, and three buyers let you take control of the market [11]. To create that competitive environment, start building relationships with potential acquirers long before you’re ready to sell.

Once the sale is finalized, the next phase of your journey begins.

What to Do After You Sell

Don’t wait until the ink dries on the deal to figure out what’s next. The absence of your business can leave a significant void, one that needs to be filled with purpose. Whether it’s launching a new venture, taking on advisory roles, starting a family foundation, or finally pursuing personal passions, having a plan for your next chapter can help you avoid the post-sale blues [21].

A great example is Rana el Kaliouby, who sold her emotion AI company, Affectiva, to Smart Eye for $75.1 million in June 2021. She navigated the transition by stepping into a new role as Deputy CEO at Smart Eye, maintaining a strong self-care routine, and reframing the sale as an opportunity for growth. Reflecting on her experience, she said:

"I need to remind myself that this is not the end of Affectiva, it's a new chapter" [22].

After the sale, it’s also essential to revisit your financial and estate plans. Define clear goals for what you want your wealth to achieve - and just as importantly, what you don’t want it to do [19]. This step ensures that your newfound resources align with your long-term vision.

FAQs

How can founders handle the emotional challenges of selling their business?

Selling a business often stirs up a whirlwind of emotions - anything from excitement about the future to uncertainty or even a sense of loss. Start by taking a step back and asking yourself why you’re selling. Are you truly ready for this transition? Understanding your reasons and preparing for what comes next can help you feel more grounded and reduce the chances of second-guessing your decision.

Planning ahead is just as important. Think about how you’ll fill your time and channel your energy after the sale. Will you dive into a new venture, explore hobbies you’ve put on hold, or focus on personal goals? Expanding your sense of self beyond being a founder can make the transition smoother. Talking to mentors, coaches, or others who’ve sold their businesses can also give you a fresh perspective and some much-needed support.

With self-reflection, thoughtful planning, and a clear vision for what’s next, you can navigate the emotional challenges of selling your business and move forward with confidence.

What financial steps should founders take before selling their SaaS or AI company?

Before you sell your SaaS or AI company, laying the groundwork with solid financial preparation is crucial. This not only ensures a smoother selling process but also helps you avoid potential regrets down the road.

First, tackle the tax implications head-on. Understand how much of the sale proceeds will go toward taxes and research ways to reduce the impact. Options like tax-efficient investing or estate planning can make a big difference in preserving your earnings.

Next, make sure your financial records are in impeccable order. Well-organized, accurate documentation is essential for due diligence, helping you avoid unnecessary delays and giving you a stronger position during negotiations.

Lastly, think about how the sale aligns with your personal financial goals. Develop a clear post-sale plan that includes strategies for investing, managing liquidity, and budgeting for the future. This approach ensures your financial windfall works toward your long-term aspirations. With careful planning, you’ll be able to make informed decisions and walk away from the sale with confidence.

How can I choose the right buyer to avoid regretting the sale of my business?

Choosing the right buyer goes far beyond just looking at the purchase price. It's about finding someone whose values, intentions, and plans for the business align with what you've worked so hard to build. Think about whether they’ll respect the culture and legacy you’ve created and whether their vision complements your long-term goals.

Equally important is understanding your own reasons for selling. Take time to reflect on your motivations and ensure you’re emotionally prepared for the transition. Selling a business is a significant step, and being clear about your "why" can help you avoid second-guessing your decision later.

Don’t skip the step of thoroughly researching potential buyers. Look into their reputation and what they plan to do with the business after the sale. This due diligence can give you peace of mind and help you choose someone who feels like the right fit for your goals. Taking these steps ensures you’re making a well-informed decision that you’ll feel good about in the long run.