Private equity (PE) is often criticized for prioritizing profits over people, with high employee turnover and aggressive cost-cutting fueling its negative image. However, this perception is shifting. Some PE firms are proving that balancing financial success with employee well-being is not only possible but profitable. Here's how:

- Data-Driven Employee Support: PE firms are using AI to identify workforce needs, provide training, and reduce repetitive tasks, boosting both employee satisfaction and productivity.

- Employee Ownership Models: Companies like KKR have introduced equity programs for non-management employees, improving morale and retention.

- AI-Powered Customer Experience: Investments in AI tools are helping firms improve customer satisfaction while cutting costs and increasing revenue.

- Retention as a Priority: With turnover costs as high as 200% of an employee’s salary, PE firms are focusing on keeping talent, especially in sectors like SaaS and AI.

The numbers back it up: PE-backed companies leveraging AI see nearly double the return on invested capital compared to those that don’t. By combining advanced technology with people-focused strategies, modern PE firms are rewriting the rules for growth and profitability.

Data, Deals, and Disruption The Real AI Shift in Private Equity

sbb-itb-9cd970b

How PE Firms Use Data to Support People and Growth

The idea that private equity (PE) firms only care about numbers overlooks a major transformation happening in the industry. Today, PE firms are leveraging AI and analytics not just to cut costs, but to make smarter decisions about their most important resource - people. In fact, PE-backed companies that integrate advanced AI capabilities across their operations see nearly double the return on invested capital compared to those that don’t [6]. This shift isn’t about replacing humans; it’s about reshaping workplaces to better support employees and enhance customer experiences.

Using AI Analytics for Better Employee Decisions

Forward-thinking PE firms are using advanced analytics to understand employee behavior and outcomes, moving beyond simply tracking performance failures. By monitoring how processes are adopted, they can identify where employees need support and tailor solutions accordingly.

When acquiring SaaS and AI companies, many PE firms now conduct AI capability assessments to identify skill gaps across the workforce. These assessments often lead to actionable steps like internal training programs and AI bootcamps, which help traditional developers transition into AI-focused roles. The aim isn’t to cut jobs but to shift talent toward more meaningful, high-value work. As Ron Blaylock, Founder and Managing Partner at GenNx360 Capital Partners, explains:

"As data and decision-making become more AI-driven, the human edge - insight, empathy, strategic vision - becomes more critical than ever." [10]

AI tools are also taking over routine tasks like customer service tickets or fixing coding errors, freeing employees to focus on creativity, empathy, and strategic thinking - areas where machines fall short. This shift is paying off: 92% of private equity professionals report positive valuation impacts from AI-driven insights [7]. Employees, now unburdened from repetitive tasks, can focus on what they do best, which directly ties into efforts to improve customer experiences.

Improving Customer Experience Through AI Investment

PE firms are heavily investing in AI tools to enhance how customers interact with their portfolio companies. These tools analyze customer data to enable hyper-personalized experiences and role-specific recommendations, significantly improving satisfaction. 53% of PE investors view customer experience as the area where digital transformation delivers the most impact [6].

The results speak for themselves: AI-driven strategies are cutting costs by up to 28% while increasing revenues by as much as 44% [7]. By handling predictive analytics and routine queries, AI allows employees to focus on building deeper customer relationships and solving complex problems that require human judgment.

This tech-driven approach is delivering measurable results. PE firms leveraging AI report a median EBITDA growth of 11%, compared to 6–8% for traditional methods [7]. Javier Rojas, Founder of Savant Growth, sums it up well:

"We help on working with their AI thesis and where to create that value and how to capture that when they go to exit." [8]

Combining Data Insights with People-First Leadership

The most successful PE firms are proving that data and empathy can go hand in hand. By weaving both into their strategies, they’re achieving impressive results. Digital initiatives typically deliver 15% to 20% ROI, but when AI is built on strong digital foundations, returns can climb to 30% to 35% [6]. However, achieving these returns requires more than just advanced technology - it demands trust.

Some PE firms are now incorporating psychological safety as a key metric for building high-performing teams [1]. They’ve restructured performance reviews to focus on factors like safety, engagement, and turnover, recognizing that strong financial results stem from human-centered practices [9].

The numbers back up this approach. 90% of investment professionals plan to increase digital budgets at the portfolio level over the next three years [6]. But they’re not just buying software - they’re investing in the people who will use it. For companies lagging in digital maturity, the consequences are clear: 40% of investors report valuation losses of 5% or more when workforce support is lacking [6]. The takeaway is simple: firms that prioritize their workforce during technological transitions don’t just perform better - they’re worth more. By combining advanced analytics with a people-first mindset, PE firms are redefining growth strategies, balancing profitability with human value.

Why PE Firms Focus on Keeping Employees

The old image of private equity (PE) firms slashing jobs during acquisitions is becoming outdated, especially in the world of SaaS and AI. Today, 76% of CFOs at the largest private equity firms say that finding and retaining talent is crucial for growth [11]. High employee turnover can wreak havoc on productivity. In industries where turnover can hit 40% annually, the financial math just doesn’t add up. Replacing an employee can cost anywhere from 50% to 200% of their annual salary [13], and that doesn’t even account for the loss of institutional knowledge. For SaaS and AI companies, where technical expertise drives success, losing key engineers or product experts can completely derail plans for growth and transformation. PE firms now understand that retaining employees isn’t just the right thing to do - it’s a smart financial move.

Clear Communication About AI Changes

When it comes to AI, employees often fear the unknown more than the technology itself. Leading PE firms address this by being transparent about upcoming changes. For example, in April 2025, KKR launched an empathy training program for CEOs across its 250 portfolio companies. The initiative included workshops on active listening and "kaizen" meetings - a Japanese practice where employees at all levels collaborate to identify improvements [2][3]. The goal? To reduce fear by ensuring that everyone has a voice in the conversation about technological change.

This approach highlights that AI is being introduced as a tool for "cognitive augmentation", not as a replacement for workers [12]. By explaining that AI will handle repetitive tasks - like debugging code or responding to routine customer inquiries - leaders can show employees how their roles will evolve rather than disappear. When employees see a clear path forward, retention improves. This transparency also lays the groundwork for targeted skill development, helping employees adapt to new responsibilities.

Training Programs for New Technology

Transparency is only the first step. PE firms are also investing heavily in training programs to ensure employees can thrive in an AI-driven workplace. 84% of the largest PE firms plan to make significant IT investments over the next three years to support better decision-making [11]. A large portion of this spending goes toward upskilling current staff. These firms are implementing role-specific micro-trainings to teach essential AI skills, creating prompt libraries, and establishing "AI champion" networks where early adopters help colleagues learn [5].

The strategy is twofold: build general digital literacy across the workforce while also fostering deep technical expertise within IT and operations teams [6]. This way, everyone - from frontline workers to tech specialists - can play a role in leveraging AI to drive value.

Real Results: Better Employee Retention After Acquisition

The results speak for themselves. Take the example of Charter Next Generation (CNG), a specialty films manufacturer acquired by KKR and Leonard Green & Partners in 2021. Under CEO Kathy Bolhous, the company introduced an employee ownership model and focused on empathetic leadership through active listening and tracking "people metrics." By 2025, CNG’s valuation skyrocketed from $58 million in 2010 to $5 billion [3]. KKR monitored key metrics like employee engagement and resignation rates, proving the connection between retention efforts and business success.

Since 2011, KKR has rolled out similar employee ownership models at over 65 portfolio companies, including Simon & Schuster LLC [2]. These models give equity stakes to non-management employees, including factory and frontline workers, fostering loyalty and engagement during times of change. For example, at an industrial plant in Minnesota, this approach helped tackle low morale and high accident rates by giving workers a financial stake in the company’s success [2].

It’s clear that when employees feel valued and included, both morale and business outcomes improve. PE firms are learning that investing in people is just as important as investing in technology.

Putting Customers First in SaaS and AI Growth

Focusing on people isn’t just a feel-good strategy - it’s a smart business move. By leveraging targeted AI strategies, companies are improving product quality and deepening customer engagement.

Better Products Through AI Development

Private equity firms are increasingly realizing that investing in AI leads to better products and speeds up innovation. Take Apollo, for example. In 2023, they guided Cengage Group through eight AI projects in areas like sales and product development. The results? A 40% reduction in content production costs and a 15% cut in customer support expenses, all while speeding up product innovation [15]. This freed up resources to tackle what really matters: meeting students' needs.

Speed is another major advantage. AI-driven software development can slash programming time by over 50% [5]. Many private equity firms are also modernizing essential systems like CRM and ERP to create the data backbone needed for AI-powered personalization. The payoff is clear - companies that systematically develop AI capabilities across their operations see nearly double the return on invested capital compared to those that don’t [6]. These advancements in product development not only improve offerings but also help forge stronger connections with customers.

Building Customer Loyalty for Long-Term Growth

A customer-first mindset, boosted by strategic AI investments, goes hand in hand with internal people-focused initiatives. However, adopting generative AI comes with challenges - 80% of business leaders cite ethics, bias, and trust as key concerns [14]. To address this, leading private equity firms are implementing explainable AI systems. These systems don’t operate as mysterious "black boxes"; instead, they provide transparency by showing customers how decisions are made [16]. Additionally, firms are defining clear terms around data usage for AI training, ensuring strict confidentiality [11, 34].

This focus on customer engagement is delivering tangible results. For instance, Brookfield introduced AI across its residential infrastructure companies, Enercare and HomeServe. AI bots now manage 45% of the 3.6 million annual repair calls, cutting call times by 15–20% and boosting sales, upgrades, and customer retention by 25% [15]. By using predictive analytics to spot early signs of dissatisfaction, these companies are solving problems before customers even know they exist, building loyalty that extends far beyond a single transaction.

Case Study: Growing a SaaS Company by Focusing on Customers

In 2023, New Mountain Capital merged three healthcare portfolio companies - Access Healthcare, SmarterDx, and Thoughtful AI - into a single platform called Smarter Technologies. A key part of this strategy was integrating SmarterDx’s clinical natural language processing engine, which identifies missed billable conditions. The result? An average of $2 million in net new annual revenue per 10,000 patient discharges for their clients [15].

This wasn’t just about squeezing more revenue from existing customers. Instead, the focus was on solving a persistent issue for healthcare providers: revenue leakage caused by documentation gaps. By addressing this specific pain point, the merged entity not only recovered measurable revenue but also earned trust, leading to long-term contracts. This example highlights how solving real customer problems can drive revenue while aligning with a broader commitment to sustainable, people-centered growth.

Finding the Balance Between Profits and People

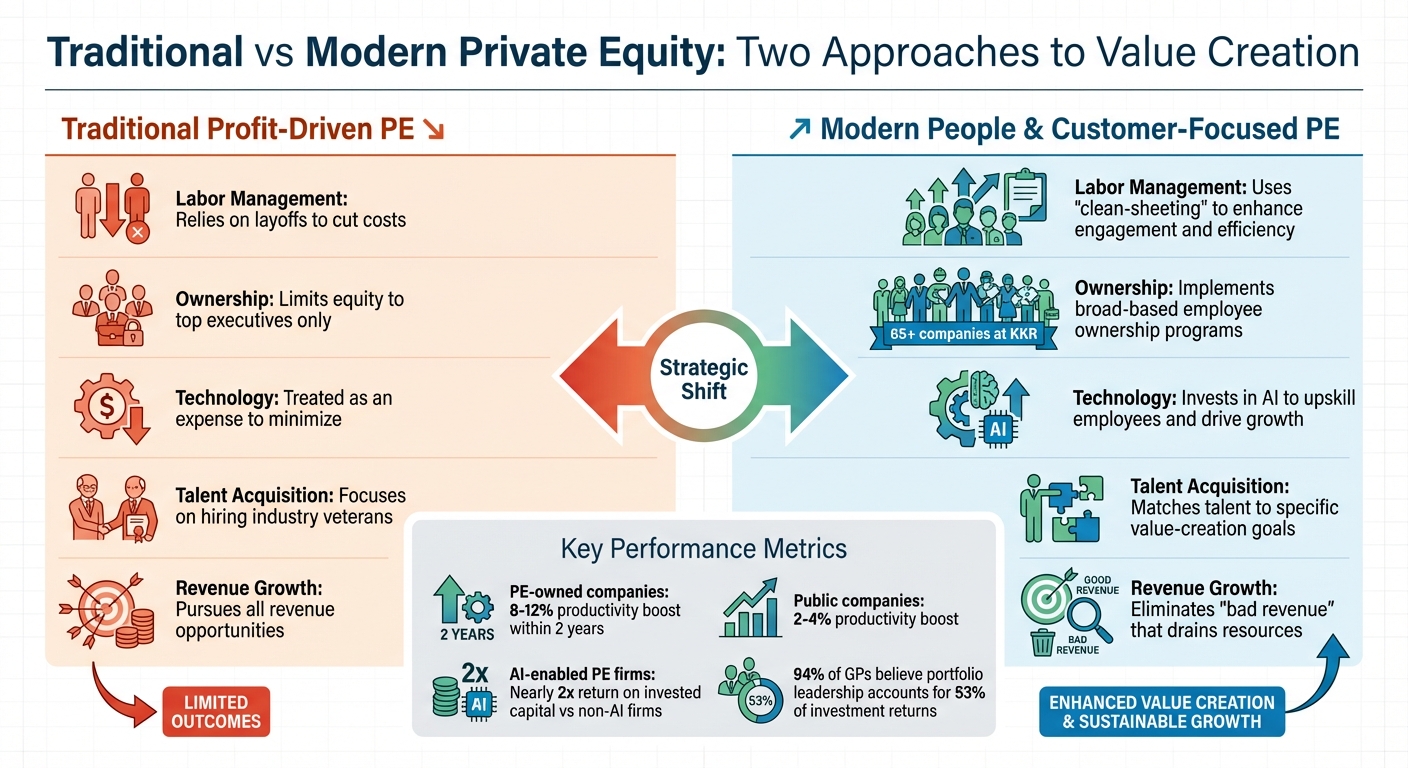

Traditional vs Modern Private Equity Approaches: Profit-Driven vs People-Focused Strategies

Modern private equity (PE) firms are proving that prioritizing people can lead to better financial outcomes. On average, PE-owned companies see an 8%-12% productivity boost within two years, compared to just 2%-4% for public companies [4]. This gap is driven by smart talent strategies rather than simple cost-cutting.

Comparing Different PE Approaches

Private equity firms don't all follow the same playbook. Here's a look at how traditional profit-driven approaches stack up against modern people-focused strategies:

| Strategy Component | Profit-Driven PE | People & Customer-Focused PE |

|---|---|---|

| Labor Management | Relies on layoffs to cut costs. | Uses "clean-sheeting" to enhance engagement and efficiency [4]. |

| Ownership | Limits equity to top executives. | Implements broad-based employee ownership programs [2]. |

| Technology | Treated as an expense to minimize. | Invests in AI to upskill employees and drive growth [5]. |

| Talent Acquisition | Focuses on hiring industry veterans. | Matches talent to specific value-creation goals [17]. |

| Revenue Growth | Pursues all revenue opportunities. | Eliminates "bad revenue" that drains resources [4]. |

Take KKR as an example. The firm extended its employee ownership model to over 65 portfolio companies, significantly reducing turnover in industries where annual rates often exceed 40% [2]. These differences highlight a growing shift toward creating value through talent and technology.

What SaaS and AI Leaders Should Know

For leaders in SaaS and AI, adopting people-first strategies can unlock growth. Consider tying management bonuses and equity stakes to measurable milestones like digital transformation and customer retention [4]. Instead of defaulting to headcount cuts, use "clean-sheeting" to redesign workflows, eliminate low-value tasks, and retain top talent [4].

Think of your CEO's time as a valuable resource. Conduct calendar audits to ensure leadership efforts are focused on strategic priorities rather than getting bogged down in internal processes [4]. It's worth noting that 94% of general partners believe portfolio company leadership accounts for 53% of investment returns on average, emphasizing the importance of strong management [17].

The Truth About PE and Empathy

The idea that private equity lacks empathy doesn't tell the whole story. Leading PE firms today recognize that investing in talent quality delivers results [4]. Firms that adopt AI capabilities, for instance, achieve nearly double the return on invested capital compared to those that don't [6]. By introducing employee ownership programs, prioritizing upskilling, and using data-driven approaches to manage people strategies, these firms are enhancing both productivity and engagement.

This shift proves that focusing on people and achieving strong financial returns aren't conflicting goals - they're deeply connected. Strategic talent management combined with advanced AI investments is rewriting the playbook for modern private equity.

FAQs

How do private equity firms support employee well-being while pursuing profitability?

Private equity firms are starting to embrace strategies that aim to benefit both their bottom line and their employees. A notable trend is offering employees equity stakes in the companies they work for. This not only gives workers a sense of ownership but also ties their personal success directly to the company’s performance.

Another key focus is empathy-driven leadership development. Many firms are training portfolio company CEOs to lead with empathy, which has been shown to boost employee engagement, improve retention, and enhance overall company performance. By combining people-focused strategies with data-backed decisions, private equity firms are proving that strong financial returns and employee well-being can go hand in hand.

How does AI enhance the customer experience for companies backed by private equity?

AI is transforming how private equity-backed SaaS and AI companies enhance their customer experiences. By processing massive amounts of data - like user behavior, support tickets, and transactions - AI can reveal actionable insights in real time. This helps businesses anticipate customer needs, cut down churn rates, and deliver personalized product recommendations. Instead of waiting to react, companies can now proactively engage with customers through tools like intelligent chatbots that handle routine questions or by efficiently directing complex issues to the right experts.

Beyond improving individual customer interactions, AI gives private equity firms a broader perspective on customer experience across their entire portfolio. With advanced analytics, firms can spot trends, measure performance against benchmarks, and pinpoint areas that need attention. This enables PE investors to align their profitability goals with strategies focused on customer satisfaction, ensuring that AI-powered advancements bring measurable value to both customers and the businesses they support.

Why are private equity firms focusing more on employee retention?

Employee retention has taken center stage for private equity (PE) firms, and for good reason. Keeping skilled employees onboard plays a critical role in ensuring the success and growth of their portfolio companies. Industries like technology and manufacturing often grapple with turnover rates exceeding 40%, which can wreak havoc on operations, dampen morale, and stall ambitious growth plans. To tackle this, some firms are introducing equity stakes for frontline workers - a strategy that has proven effective in boosting loyalty, engagement, and overall performance.

Today’s PE firms are also turning to data-driven talent strategies. By tying metrics like hiring, development, and retention directly to their value-creation goals, they’re ensuring the right people are in the right roles to execute their vision. Retention isn’t just about cutting costs - it’s about aligning incentives, fostering stronger teams, and driving sustainable growth in fast-paced, competitive sectors like SaaS and AI.