When SaaS vendors give you their first price, it’s often inflated by 10% to 30% - a tactic called anchoring. Hidden fees for implementation, training, or usage can add another 20% to 50%. Contracts may also include unfavorable terms like auto-renewals, price hikes, or weak service guarantees. Without preparation, you risk overpaying or locking into bad deals.

Here’s how to avoid this:

- Research Market Rates: Compare vendor prices to industry benchmarks and real-world data.

- Use AI Tools: Tools like Vendr analyze contracts, flag hidden costs, and suggest fair pricing.

- Negotiate Beyond Price: Push for better terms, like flexible pricing, co-termination, and performance-based fees.

- Avoid Contract Traps: Look out for auto-renewals, fragmented end dates, and sudden price changes.

The key is to treat the first offer as the start of a negotiation, not the final deal. Use data to counter inflated prices and secure better terms.

A Different SaaS Renewal Negotiation Tactic to Consider

Why Initial Offers Miss the Mark

When it comes to pricing, the first offer is rarely the best deal. Vendors often use a mix of psychological tricks, hidden fees, and vague contract terms to ensure their initial pitch works in their favor - not yours.

How Vendors Use Pricing Tactics Against You

That first number you see? It’s not random. Vendors rely on anchoring bias, a psychological strategy where the initial price sets the tone for all future negotiations. Studies show this tactic is incredibly effective, with initial offers influencing final prices by as much as 85% [4].

But it doesn’t stop there. Vendors often employ precision pricing - for example, quoting $4,985 instead of $5,000. This subtle difference makes the price feel more thought-out and less negotiable [3]. Another common trick is using illusory higher prices, where they float an inflated "pre-quote" to make their actual offer appear like a bargain [3].

Even your appearance can impact the numbers. Vendors often adjust their pricing based on "wealth cues." If you look like you're in a higher income bracket, expect a higher starting quote. Research also shows that the tone vendors use - whether "tough and firm" or "warm and friendly" - can influence how much buyers are willing to counteroffer [4].

And while these pricing tactics set the stage, the real costs often come from what’s hidden beneath the surface.

Hidden Fees and Contract Restrictions

The price you see is rarely the price you pay. Many AI tools, for example, come with extra charges that aren’t obvious upfront. Costs for tasks like AI inference, token usage, or fine-tuning can quickly pile up. Take this example: A SaaS company advertised a flat rate of $15 per user per month for an AI chatbot. But when complex queries increased computing demands, the real cost jumped to $22 per user [5].

This isn’t a one-off issue. Computing costs are projected to rise 89% between 2023 and 2025, with 70% of executives blaming generative AI for the spike [6]. If your contract doesn’t account for these variables, you might find yourself hit with unexpected charges or usage limitations.

Then there are overage fees and fine-print restrictions. Without clear visibility into your actual usage, it’s easy to end up paying more than you anticipated. By the time you realize it, the damage is already done.

Using Data to Strengthen Your Negotiating Position

When a vendor gives you an initial quote, think of it as the opening move in a negotiation - not the final word. By leveraging data, you can counter inflated offers and secure better terms with confidence.

Research Market Rates and Benchmarks

Before you respond to any offer, it’s essential to know what others in your position are actually paying. SaaS benchmarks can give you a clear picture of where you stand compared to industry norms and top performers [8]. Unfortunately, many buyers skip this step, leaving them without a solid foundation for negotiation.

Instead of relying on vendor-provided list prices, dig into pricing benchmarks based on real-world purchases. For instance, the Blended Customer Acquisition Cost (CAC) Ratio rose by 22% in 2024, reaching $1.61 [8]. If a vendor insists their pricing is “standard,” you can use this data to compare their offer against the broader market.

It’s also smart to establish your Zone of Possible Agreement (ZOPA) before negotiations even begin. Research what companies similar to yours - both in size and industry - are paying. When presenting a counteroffer, providing a specific figure (e.g., $349,900 instead of $350,000) shows you’ve done your homework [3].

Public SaaS companies often maintain Net Revenue Retention (NRR) rates around 110% [8]. If a vendor’s pricing threatens to drive your retention metrics below this benchmark, you have solid grounds to push back with data to support your case.

AI Tools for Pricing Analysis

Beyond market research, AI tools can sharpen your insights and speed up analysis. These platforms have transformed the way negotiations unfold, closing the information gap between buyers and vendors. Tools like Vendr’s "Ruth" tap into over $15 billion in SaaS pricing data and more than 1 million real price points [9]. With this kind of intelligence, you can uncover the “floor price” - the lowest figure a vendor has charged - before you even start discussions.

Take the example of Sören Petsch, Head of Procurement at Root Inc., who used Vendr’s pricing benchmarks in late 2024 to validate software contracts. By comparing vendor quotes with real-world data, his team achieved a 2x return on investment in just four months [9].

AI-powered platforms don’t stop at pricing. They scan contracts for inflated costs, hidden fees, and risky clauses, providing actionable insights within minutes. These tools even assign risk scores to unusual terms, helping you spot potential issues that might otherwise take days to uncover [10]. This kind of rigorous analysis directly counters the deceptive pricing strategies some vendors use.

"Vendr's negotiation agent and team of SaaS experts have become an essential part of how we buy software. The combination of real pricing intelligence, fast contract analysis, and hands-on negotiation support helps us save money and move faster." - Nicole LaFrancesca, Corporate Controller VP, Quickbase [9]

Data trends can also strengthen your position. For example, the Expansion CAC Ratio jumped 45% year-over-year to $1.00 in 2024 [8]. If a vendor tries to inflate their pricing for expansion revenue, this trend gives you a strong basis to challenge them.

With 70% of SaaS companies now experimenting with or monetizing AI-driven tools [8], these technologies aren’t just optional anymore - they’re becoming essential for anyone serious about negotiating from a position of strength.

sbb-itb-9cd970b

Negotiation Tactics That Get Better Deals

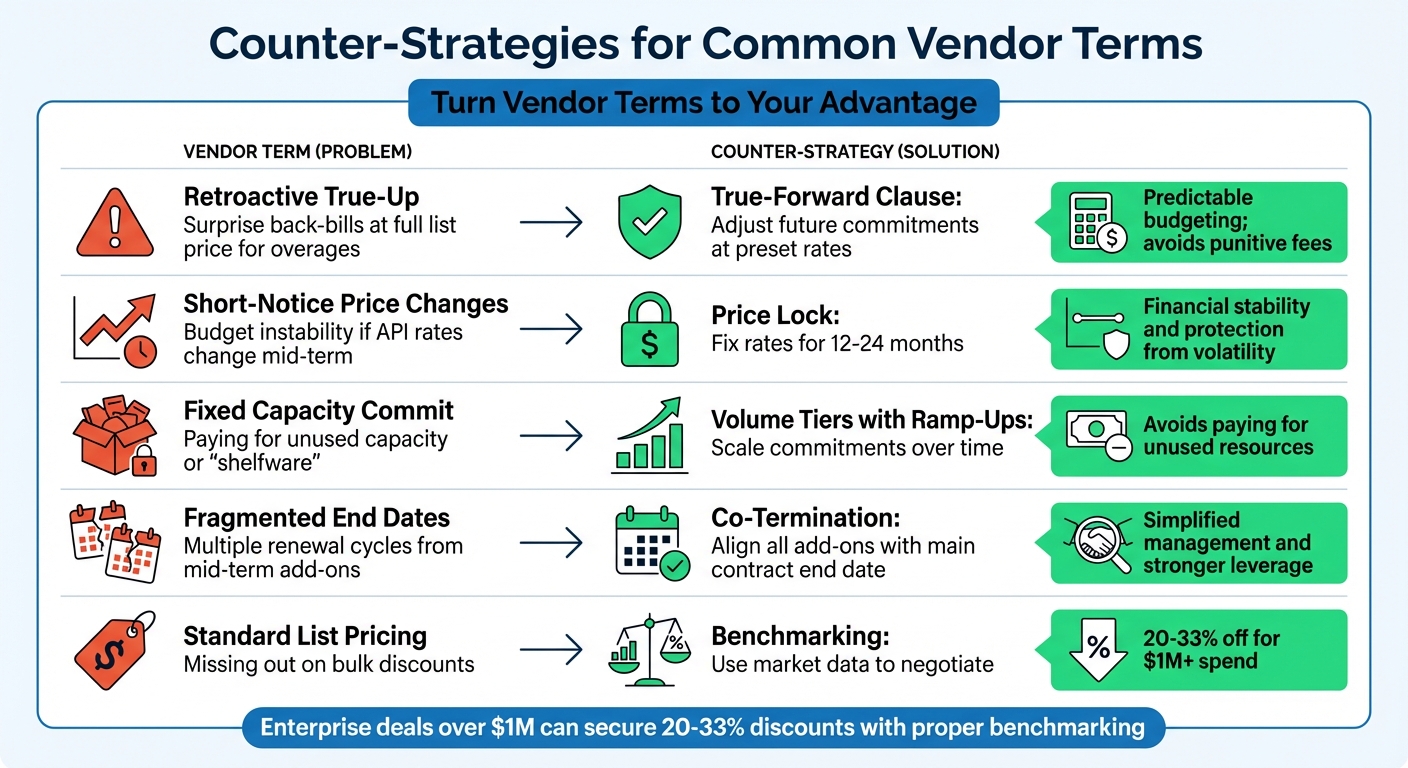

SaaS Contract Negotiation: Standard Vendor Terms vs. Winning Counter-Strategies

Once you’ve gathered all the relevant data, it’s time to use it to your advantage. The aim isn’t just to get a lower price - it’s about reshaping the deal to better align with your business goals.

Armed with market insights, focus on negotiating beyond just the price tag.

What to Negotiate Beyond Price

Price is only one part of the equation. The real value often lies in negotiating the terms around it. For instance, consider requesting fungibility - the ability to shift spending between products. In 2025, 65% of buyers rated this as very or extremely important [11]. Without this option, you risk wasting money on unused credits in one tool while overspending on another.

Another approach is performance-based pricing, which ties costs to measurable results. For example, Zendesk charges $1.50 per successfully resolved customer interaction [11]. This outcome-driven model ensures you only pay when the tool delivers tangible results. Push vendors to structure fees around specific outcomes rather than vague promises of efficiency.

If you’re dealing with AI tools or services where usage can be unpredictable, negotiate a true forward mechanism instead of accepting immediate overage penalties. This setup adjusts future commitments based on actual usage - at your negotiated discount rate, not inflated list prices [12]. A CFO from a Fortune 500 company expressed frustration over unpredictable AI spending caused by scattered vendor charges [11]. This tactic can help you avoid similar headaches.

Next, take a closer look at the contract terms to ensure these benefits aren’t undermined by unfavorable clauses.

Contract Traps to Avoid

Even a great price can lose its appeal if the contract includes restrictive terms like auto-renewals, fixed capacity, or fragmented renewal cycles. Auto-renewal clauses, for example, can trap you into another full term if you miss the renewal deadline. To keep control, start your renewal process 6–12 months before the contract ends [12].

Inflexible pricing tiers are another common issue. Fixed capacity commitments can leave you paying for resources you don’t use. Instead, negotiate volume tiers with ramp-ups that allow you to start small and scale as your adoption grows [12].

Be wary of short-notice price changes as well. For instance, OpenAI’s standard terms allow them to adjust API prices with just 14 days’ notice [12]. To avoid surprises, demand a price lock for your initial term - typically 12 to 24 months - so you can plan your budget with confidence.

Finally, watch out for fragmented end dates. Adding new products or services mid-contract often creates separate renewal cycles, which can weaken your negotiating position. Insist on co-termination, aligning all add-ons with your main contract’s end date [12]. This simplifies management and strengthens your leverage at renewal time.

Negotiation Tactics vs. Standard Vendor Terms

To secure a better deal, you need to understand the gaps between standard vendor terms and what you should demand. Here’s how you can counter common vendor practices:

Counter-Strategies for Common Vendor Terms

| Typical Vendor Term | Common Problem | Counter-Strategy | Potential Benefit |

|---|---|---|---|

| Retroactive True-Up | Surprise back-bills at full list price for overages | True-Forward Clause: Adjust future commitments at preset rates | Predictable budgeting; avoids punitive fees [12] |

| Short-Notice Price Changes | Budget instability if API rates change mid-term | Price Lock: Fix rates for the initial term (12–24 months) | Financial stability and protection from volatility [12] |

| Fixed Capacity Commit | Paying for unused capacity or "shelfware" | Volume Tiers with Ramp-Ups: Scale commitments over time | Avoids paying for unused resources [12] |

| Fragmented End Dates | Multiple renewal cycles from mid-term add-ons | Co-Termination: Align all add-ons with the main contract end date | Simplified management and stronger leverage [12] |

| Standard List Pricing | Missing out on bulk discounts | Benchmarking: Use market data to negotiate (e.g., 20–33% off for $1M+ spend) | Significant cost savings [12] |

For large enterprise deals exceeding $1 million, leveraging volume can lead to discounts of 20–33% off list prices [12]. Use this data to back your counteroffer and show that you’re well-informed about market trends.

It’s also critical to maintain a single voice policy within your organization. Assign one procurement lead to handle all vendor communications. This prevents vendors from exploiting internal missteps, like revealing budget urgency or high dependency [12]. Vendors are adept at finding weak spots - don’t give them the chance.

How to Evaluate and Finalize Agreements

Once you've negotiated better terms, it's crucial to take a methodical approach to evaluate the proposed agreement. Rushing through this step can be costly - poorly structured contracts can erode up to 9% of annual revenue [15]. By leveraging the data you gathered during negotiations, you can assess the final offer with precision. A disciplined evaluation process helps you avoid expensive missteps.

Start by comparing the offer to your BATNA (Best Alternative to a Negotiated Agreement) - essentially, your backup plan. Make sure the offer clearly outperforms your Plan B. Then, identify the ZOPA (Zone of Possible Agreement) [2] to determine whether there's room for further negotiation.

Offer Evaluation Checklist

To ensure you're making a sound decision, use this checklist to evaluate and refine the offer before signing.

- Scalability Clauses: Verify that the agreement allows for adjustments as your business grows. Volume tiers with ramp-ups are often more flexible than fixed-capacity terms.

- Benchmarking Clauses: Check for clauses that keep pricing aligned with market standards. Research indicates that 80% of procurement teams lack awareness of competitive terms, and most contracts omit benchmarking clauses [15].

- Weighted Scoring System: Instead of focusing on a single number, assess the offer across multiple factors - such as price, terms, scalability, and support [13]. This approach provides a balanced view.

- Non-Standard Terms: Look for terms that stray from industry norms. For example, companies like CrowdStrike, Cohesity, and Fortinet began using NVIDIA Nemotron Safety models in January 2026 to analyze contracts with AI. These tools can flag unusual liability shifts or restrictive data usage rights by assigning risk scores to specific clauses [14][10].

Aligning Contracts with Business Growth

A good agreement doesn't just meet your current needs - it should also support your future growth. Structure contracts with built-in scalability, allowing you to add users, features, or capacity at predetermined rates. This helps you avoid costly renegotiations or inflated pricing as your business expands.

On average, SaaS contracts take about 40 days to finalize, with legal teams involved in 85% of cases [15]. A well-structured agreement can save you both time and resources in the long run.

Conclusion: Getting Better Results from SaaS and AI Negotiations

First offers are often designed to anchor expectations and push final prices higher. Research reveals that for every $1.00 increase in a seller's initial offer, the final sales price typically rises by $0.50 [7]. Even seasoned negotiators, who may believe they’re immune to such tactics, can still fall prey to anchoring bias [2]. The key to overcoming this challenge is using data-backed strategies to regain control of the negotiation process.

One effective approach is leveraging market data and clearly defining your Zone of Possible Agreement (ZOPA). For instance, countering with specific, non-rounded numbers - like $5,630 instead of $5,600 - demonstrates that your offer is grounded in thorough research rather than arbitrary estimates [2].

AI-powered tools take this a step further by enhancing your ability to analyze complex proposals. In October 2024, NVIDIA introduced its Nemotron-3 models, adopted by Cadence and IBM, to streamline the review of intricate documents [14]. These tools can uncover hidden fees and restrictive clauses that might otherwise go unnoticed, ensuring that initial offers are carefully scrutinized and adjusted to align with your goals.

To secure agreements that promote growth, focus on structuring contracts with renewal caps, right-sizing clauses, and flexible terms. Starting renewal discussions at least 90 days before the opt-out date can lead to significantly better savings compared to waiting until the last minute [1]. Combining data-driven insights with strategic planning ensures you’re well-equipped to negotiate deals that support long-term success.

FAQs

How can I avoid being influenced by the first price a vendor offers?

The first price a vendor throws out often becomes a mental reference point - this is known as anchoring bias. To sidestep its influence, do your homework. Dive into market research and determine a realistic price range before you even start negotiating. This way, you'll have a solid foundation to assess offers without being swayed too easily.

When you're faced with an initial offer, resist the urge to accept it outright. Instead, counter with your own price range, backed by the data you've gathered. This approach steers the conversation toward numbers that work in your favor, minimizing the weight of the original anchor. Armed with preparation and confidence, you'll be in a much stronger position to secure a better deal.

What important contract terms should I negotiate besides price?

When negotiating a contract, it's crucial to go beyond just the price and focus on other key terms that can greatly influence the overall value and potential risks. These terms include payment schedules, delivery timelines, performance guarantees, confidentiality agreements, and dispute resolution plans.

For instance, well-defined payment terms can help avoid cash flow problems, ensuring smoother financial management. Clear delivery schedules keep both parties on the same page regarding expectations and deadlines. Performance guarantees and warranties act as safeguards, offering a layer of protection against unforeseen issues. Confidentiality clauses help protect sensitive information from being disclosed improperly. Lastly, outlining how disputes will be handled - whether through arbitration or specifying a legal jurisdiction - can save time and money by preventing drawn-out conflicts.

By carefully addressing these elements, you can minimize risks, establish clear responsibilities, and ensure the contract aligns with your broader objectives, creating a stronger foundation for all parties involved.

How can AI tools improve negotiations for SaaS agreements?

AI tools have the power to reshape SaaS negotiations by delivering data-backed insights and strategic leverage. These tools sift through massive datasets to highlight market trends, pricing standards, and competitor deals. This means you can make smarter choices instead of jumping on the first offer, which might not be the best fit for your needs. Plus, they analyze proposals in real time, helping you craft counteroffers that are in tune with current market conditions.

AI also steps in to tackle the psychological side of negotiations, like the effect of anchoring - when an initial offer sets the tone for the entire discussion. By predicting likely responses and suggesting strong opening positions, AI helps you negotiate with clarity and confidence. This takes the guesswork out of the process and boosts your chances of landing terms that work in your favor.

Related Blog Posts

- I literally helped SaaS founders replace $5K+ monthly labor costs with $300/month AI agents that run their entire business in 30 minutes a day

- SaaS Business Models in 2025: How Pricing & Monetization Must Evolve for Maximum Value

- Are You Leaving Millions on the Table? How Mid-Market SaaS Firms Can Bridge the Value Gap

- 3 Questions to Ask ANY Buyer Before You Sell Your Business