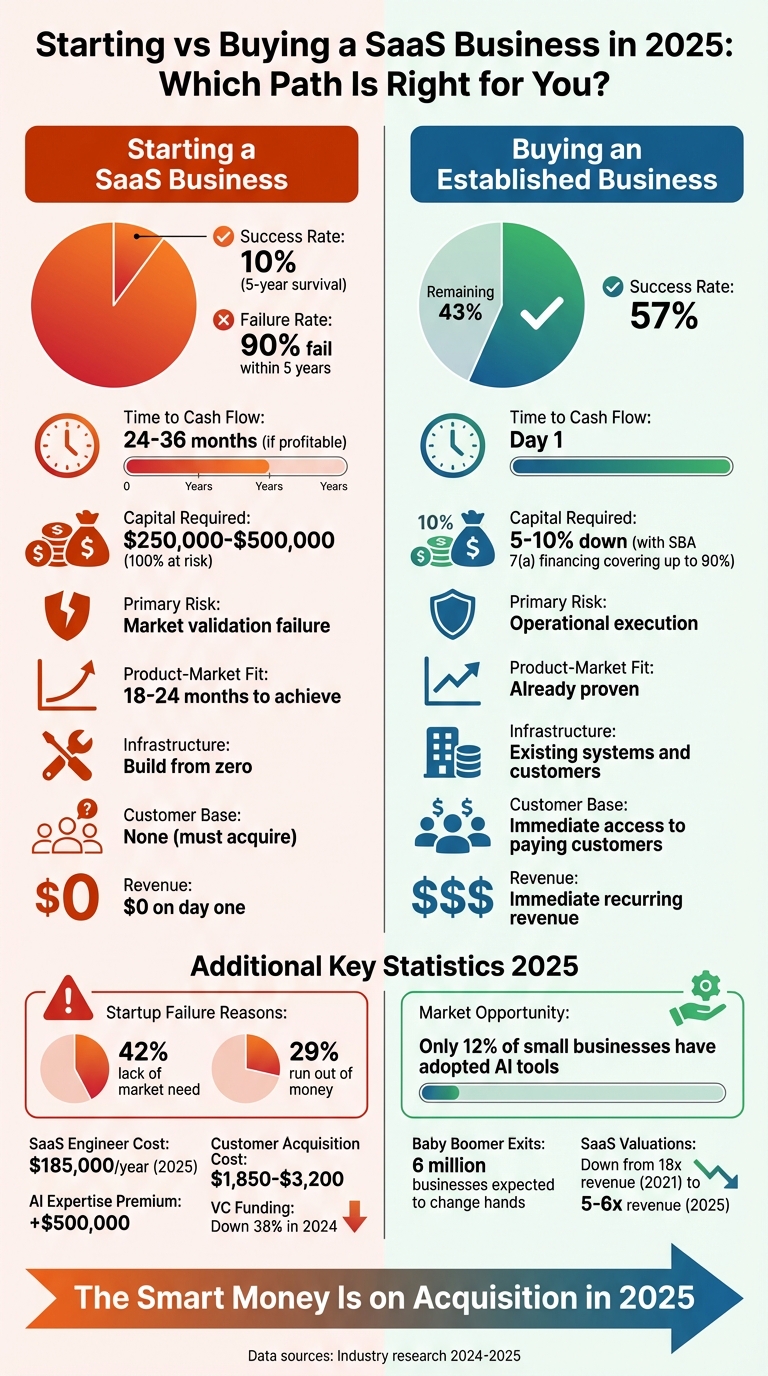

Buying an established business in 2025 offers a safer, faster, and more predictable path to success than starting from scratch. Here’s why:

- Startup failure rates are high: 90% fail within five years, while 80% of small businesses survive past that mark.

- Immediate revenue: Acquiring an existing business provides cash flow and a proven customer base from day one.

- Lower risk: Buying shifts the challenge from market validation to operational execution, which is more controllable.

- Cost-effective opportunities: Valuations for SaaS businesses have dropped to 5–6x revenue (down from 18x in 2021), making acquisitions more accessible.

- Baby Boomer exits: Millions of businesses are up for sale, many with untapped growth potential, especially in AI.

Starting a business in 2025 is expensive and uncertain, with high upfront costs ($250,000–$500,000) and long timelines to profitability (24–36 months). By contrast, buying an established SaaS or AI-focused business lets you skip the hardest parts - building a customer base, achieving product-market fit, and generating revenue.

This article explains why buying is the smarter choice, how to evaluate acquisition targets, and strategies to scale after purchase.

Starting vs Buying a SaaS Business in 2025: Key Metrics Comparison

The Challenges of Starting a SaaS Business in 2025

High Failure Rates and Long Paths to Profitability

Starting a SaaS business is no small feat. The stats paint a grim picture: 90% of startups fail within five years, with 42% failing due to lack of market need and 29% running out of money before they can turn a profit [7]. Even for those who manage to survive the early stages, it takes 18–24 months to achieve product-market fit and another 24–36 months to reach positive cash flow [7].

The financial barriers are just as daunting. Launching a SaaS business demands an upfront investment of $250,000 to $500,000, with no guarantees of success [7]. And in today’s landscape, integrating AI into your product isn’t optional - it’s expected. Danielle Hunt from EBIT Community sums it up well:

"For startups: AI is table stakes, not differentiation. You're competing with OpenAI, Google, and thousands of funded AI companies" [7].

This means founders must pour significant resources into developing advanced AI infrastructure, all while navigating a crowded and competitive market.

Market Saturation and Scaling Challenges

The SaaS space is more crowded than ever, and breaking through the noise is harder than it’s ever been. By 2025, organizations are using an average of 305 applications, up from 275 in 2024. In some niches, like online training, companies are juggling 14.2 different applications on average [6]. This growing complexity has led many businesses to consolidate their tech stacks instead of adding new tools.

Take Adobe’s experience in 2025–2026 as an example. After auditing its software ecosystem, Adobe found 2,600 software titles - 800 more than anticipated. Under Sr. Director Vinod Vishwan, they trimmed their portfolio to 400 titles, saving $60 million and freeing up 20,000 licenses [6]. For new SaaS startups, this trend toward consolidation makes it even tougher to stand out and secure a place in these leaner tech environments. Add to that the rising costs of development and marketing, and the challenges multiply.

Rising Costs in Development and Marketing

Building a competitive SaaS product has never been more expensive. In 2025, the average cost for a SaaS engineer is around $185,000 per year, and if your product requires specialized AI expertise, you’ll need to budget an additional $500,000 premium [8]. Hiring doesn’t come cheap either - recruitment fees eat up 20–25% of a first-year salary, and new hires typically take 6–9 months to reach full productivity [8].

Then there’s the cost of acquiring customers. Depending on the sector, customer acquisition costs range from $1,850 to $3,200, which can extend your burn period to 18–24 months before you start seeing revenue [7] [8]. And with venture capital funding down 38% and startup closures up 25.6% in 2024 [5], there’s little room for error. Peter Walker, Head of Insights at Carta, offers a blunt take on the funding landscape:

"The working hypothesis is that VCs didn't improve their ability to pick winners... the funding market seemed to have an 'F**k it, I'll fund it' ethos" [5].

For many founders, these hurdles make buying an established SaaS business a more appealing path to stability and growth.

sbb-itb-9cd970b

Key Advantages of Buying an Established SaaS or AI Tools Business

Immediate Revenue and Customer Base

When you acquire an established SaaS business, you skip the long wait for profitability - often 24–36 months - and start with immediate cash flow. These businesses already have paying customers, recurring revenue, and a tested business model. Instead of gambling on an idea that may or may not work, you're stepping into a business with a proven track record.

Reduced Risk and Faster Time-to-Value

Starting a business from scratch is risky, especially considering the high failure rate of startups. However, acquisitions flip the odds. Research shows that 57% of business acquisitions succeed, delivering an average internal rate of return of 35%[7]. Danielle Hunt from EBIT Community puts it this way:

"The question shifts from 'Will anyone buy this?' to 'Can I run this well?' - a controllable risk for corporate operators."[7]

Financing options like SBA 7(a) loans make acquisitions even more appealing. These loans enable financing up to 90% of the purchase price, requiring only 5–10% down. Compare that to starting a business, where you'd need $250,000 to $500,000 upfront, all of which is at risk. By leveraging such financing, you reduce your initial exposure while increasing the return on your investment.

Scalability in a High-Growth Market

Established SaaS businesses come with built-in advantages: solid technical frameworks, proven systems, and effective go-to-market strategies. This eliminates the 18–24 months typically needed to find product-market fit, letting you focus immediately on scaling and optimizing[7].

The market also offers unique opportunities, particularly with AI. While only 12% of small businesses have adopted AI tools[7], this creates what some call an "AI arbitrage window." By acquiring SaaS businesses still operating at pre-AI valuations and integrating AI features, you can achieve significant efficiency improvements. Many of these businesses are owned by retiring Baby Boomers who haven't embraced AI, leaving room for growth.

Take the October 2025 acquisition of Claap by Lemlist as an example. Lemlist, with $40 million ARR, acquired Claap, an AI note-taking app, for $25 million. Despite Claap's high-quality product, it was stuck at $2 million ARR due to poor distribution. Lemlist used its audience and expertise in product-led growth to aim for $10 million ARR within three years[10]. This case illustrates how acquiring and optimizing underperforming assets can lead to substantial gains.

Buying vs. Starting a Business: Side-by-Side Comparison

| Factor | Starting a SaaS Business | Buying an Established Business |

|---|---|---|

| Success Rate | 10% (5-year survival) | 57% |

| Time to Cash Flow | 24–36 months (if profitable) | Day 1 |

| Capital Required | $250,000–$500,000 (100% at risk) | 5–10% down (with SBA financing) |

| Primary Risk | Market validation failure | Operational execution |

| Product-Market Fit | 18–24 months to achieve | Already proven |

| Infrastructure | Build from zero | Existing systems and customers |

Data source: [7]

The numbers speak for themselves. Acquiring an existing business not only reduces your risk but also gives you immediate access to revenue, customers, and a solid infrastructure. It’s a way to invest in a business that’s already demonstrated its potential.

How to Evaluate SaaS and AI Businesses for Acquisition

Key Metrics to Analyze

When evaluating SaaS and AI businesses for acquisition, it's crucial to focus on metrics that reveal the company's financial health and growth potential. Start with Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) - these provide insight into the business's stability and predictable income streams[12][13].

Next, examine Net Revenue Retention (NRR). This metric shows whether customers are increasing their spending through upsells or cross-sells. A strong NRR - above 110% - indicates that even without new customers, revenue could grow at least 10% annually. High gross margins (over 70%) are another positive sign, reflecting efficiency and scalability[11][13].

The Rule of 40 is a quick way to assess overall business health. This formula combines revenue growth rate and profit margin, with a result of 40% or more signaling a balance between growth and profitability. As Andrew Gazdecki, CEO of Acquire.com, explains:

"The Rule of 40 has become a key benchmark... appealing to investors looking for both growth and stability"[13].

Pay close attention to unit economics, especially the LTV/CAC ratio (Lifetime Value to Customer Acquisition Cost). A ratio above 3:1 is generally a strong indicator[12][16]. Additionally, the CAC payback period - the time it takes to recover customer acquisition costs - should ideally be under 12 months, signaling efficient capital use[13][16].

For AI businesses, it's critical to determine whether the technology is genuinely proprietary or just a repackaging of existing models. As iMerge Advisors cautions:

"AI must be a moat - not a marketing tactic"[11].

| Metric | Healthy Benchmark | Why It Matters |

|---|---|---|

| NRR (Net Revenue Retention) | >110% | Shows product stickiness and revenue growth potential[11] |

| Gross Margin | >70% | Indicates operational efficiency and scalability[13] |

| LTV/CAC Ratio | >3:1 | Ensures marketing spend is generating sustainable value[12][16] |

| Rule of 40 | >40% | Balances growth with profitability[13] |

| Gross Churn | <5% | Reflects high customer satisfaction and retention[11] |

| CAC Payback | <12 months | Measures how quickly capital is recycled into growth[13][16] |

Once these metrics are assessed, thorough due diligence ensures there are no hidden risks.

Due Diligence Best Practices

Due diligence is a make-or-break phase in acquisitions, with 30% to 40% of deals failing due to undisclosed issues[17]. To avoid costly mistakes, dive deep into the company's financials, operations, and technical infrastructure.

Start by reviewing 3–5 years of financial statements and tax returns[14][15]. Look for consistent revenue patterns and be cautious of one-time adjustments that could artificially inflate EBITDA. As Vaibhav Totuka from Qubit Capital notes:

"Financial performance often separates a fast, clean deal from a costly missed opportunity"[12].

Evaluate customer concentration risk. If a single customer accounts for more than 20–30% of ARR, the business could face revenue instability[11][12][15]. Also, review customer and vendor contracts for change-of-control clauses, which could lead to terminations after acquisition[15][17].

On the technical side, engage experts early to inspect the codebase and infrastructure. A lack of proper IT due diligence can lead to expensive oversights. For example, during the Marriott-Starwood acquisition in 2018, a missed data breach resulted in a $123 million fine for Marriott[15]. Conduct penetration testing to uncover potential cybersecurity vulnerabilities not visible in documentation[15].

Verify intellectual property ownership. Ensure that all founders, employees, and contractors have signed IP assignment agreements to avoid disputes. Also, check for compliance with open-source licenses like GPL or AGPL, as violations can jeopardize proprietary software[17].

To safeguard against post-closing risks, structure deals with protective measures. For instance, use escrow holdbacks (10–20% of the purchase price) or earnouts, where part of the payment depends on hitting specific revenue targets[17].

Using Top SaaS & AI Tools Directory for Research

After financial and technical diligence, tools like the Top SaaS & AI Tools Directory can help identify promising acquisition targets. This resource highlights market leaders in niches like AI-driven customer support, sales automation, and content creation.

Cross-reference potential targets with acquisition marketplaces like Acquire.com. These platforms allow you to filter businesses by metrics such as MRR, customer churn, and tech stack[4]. Listings with verified financial data from Stripe or Google Analytics reduce the risk of misleading information[4].

The directory also helps assess market positioning. Compare features, pricing, and customer feedback to determine if you're acquiring a leader or an underperformer. Additionally, check for API access and scalability without requiring significant infrastructure upgrades[18].

Use this research to refine your due diligence. For example, if vertical SaaS in healthcare or legal is achieving premium valuations due to low churn rates[11], ask questions about the target's niche and customer loyalty. This targeted approach ensures you're making an informed decision.

Strategies for Acquiring and Scaling SaaS Businesses

Structuring the Deal

How you structure a deal can shape both the risks and rewards of acquiring a SaaS business. In 2025, all-cash deals remain a straightforward option. They provide immediate control with no strings attached, though they require significant upfront capital. As SureSwift Capital puts it:

"Cash is king... for Founders, a cash deal guarantees liquidity with no required involvement in the future of the business" [19].

Other options, like earnouts, tie part of the purchase price to the business's future performance. These can help bridge valuation gaps but come with risks if performance targets aren’t met. For smaller deals, seller financing - where the buyer pays 25–30% upfront and the seller finances the rest - can preserve cash while showing the seller's confidence in the business. In some cases, hybrid deals combining cash and equity are used to retain key talent and share future gains. For instance, Clio’s 2025 acquisition of vLex aimed to integrate AI legal research capabilities, with integration plans set to roll out within 100 days [20].

Here’s a quick breakdown of deal structures:

| Structure | Buyer Advantage | Seller Advantage | Key Risk |

|---|---|---|---|

| All-Cash | Immediate ownership; no future debt | Guaranteed liquidity; clean exit | High upfront capital (Buyer); potentially lower price (Seller) |

| Earnout | Bridges valuation gaps; aligns incentives | Potential for higher total payout | Risk of missing targets (Seller); integration friction (Buyer) |

| Seller Financing | Lower initial cash outlay; easier to close | Earns interest; widens buyer pool | Risk of buyer default (Seller) |

| Equity | Preserves cash; retains talent | Participation in future upside | Dilution (Buyer); value depends on acquirer's stock (Seller) |

To protect against unforeseen liabilities, buyers often use escrow holdbacks, holding back 10–20% of the purchase price for 6–18 months [2]. When acquiring tech-driven businesses, ensure the AI technology provides genuine value rather than being just a marketing gimmick [11].

Once the deal is in place, the focus shifts to integrating and optimizing operations to unlock the business's full potential.

Integrating and Optimizing Operations

Integration is where many acquisitions succeed - or fail. A solid plan for the first 100 days can make all the difference. Divide this period into three phases: the first month for learning and team input, the second for detailed planning, and the third for implementation [21]. Avoid rushing into system overhauls, as this can lead to poor adoption and wasted resources.

Retaining key team members - usually 3–5 individuals critical to the business - is essential. Stay bonuses and other incentives can help preserve institutional knowledge [21] [22]. Bain & Company emphasizes the human factor in acquisitions:

"Settle people and power issues early... In the end, AI acquisitions are all about people" [20].

Establishing a rolling 13-week cash flow statement immediately after closing can help you understand the financial rhythms of the business [21]. A great example is Waterglass’s acquisition of Pxl, where AI-driven improvements quadrupled monthly recurring revenue (MRR) [9]. In many AI acquisitions, the focus is less on cross-selling and more on integrating the acquired product into the buyer’s existing customer base.

To maintain structure without stifling creativity, consider adopting the Entrepreneurial Operating System (EOS). Weekly "L10" meetings with scorecards can provide clarity while allowing the acquired team some autonomy [21]. Addressing operational alignment early is also key - decide which systems to standardize and which teams should remain independent [20].

Once operations are running smoothly, the next step is to focus on growth strategies that can amplify the impact of the acquisition.

Post-Acquisition Growth Strategies

Scaling a SaaS business after acquisition means acting quickly on product roadmaps and go-to-market strategies. Ideally, integration planning should begin before the deal closes. Sophisticated buyers often map out revenue strategies, pricing models, and sales incentives during this pre-close phase to ensure a seamless transition [20] [23].

Incorporate any acquired AI capabilities into your core platform within the first 100 days [20]. AI is becoming a major driver in tech deals - nearly 50% of acquisitions in 2025 included AI components, with the value of these deals more than doubling from 2024 [20].

Standardize key systems like finance, CRM, and KPIs to create a unified platform, while allowing the acquired company to retain its local strengths in areas like customer service [23]. Weekly operating reviews can help track revenue, margins, and integration challenges, ensuring your strategy translates into measurable results [23].

Customer communication is another critical area. A high-touch approach during the first 90 days post-acquisition can prevent churn and build trust [23]. For example, HubSpot’s $27 million acquisition of The Hustle gave them immediate access to 1.5 million engaged entrepreneurs, showcasing how acquiring established channels can accelerate growth faster than building from scratch [8].

For SaaS founders aiming to prepare their businesses for acquisition or scale up, resources like the Top SaaS & AI Tools Directory can help identify gaps in your tech stack and uncover ways to boost recurring revenue.

What serial acquirers are looking for in SaaS businesses in 2025 with Tim Schumacher @saas.group

Conclusion

Starting a SaaS business from scratch in 2025 comes with steep challenges - 90% of startups fail within five years [3][7]. On the flip side, buying an established business significantly improves those odds. Acquisitions succeed 57% of the time and deliver an average 35% IRR [7]. Instead of spending 24–36 months burning cash to reach profitability, you step into a business that’s already generating revenue with a validated product and customer base [7]. This shift in approach changes the risk landscape entirely.

With a startup, the gamble is whether anyone will buy what you're building. In an acquisition, the focus shifts to running an already-proven business. As Danielle Hunt from EBIT Community explains:

"The question shifts from 'Will anyone buy this?' to 'Can I run this well?' - a controllable risk for corporate operators" [7].

The market conditions right now make this strategy even more appealing. Only 12% of small businesses have adopted AI tools [7], and around 6 million baby boomer-owned businesses are expected to change hands this decade [3][7]. This creates an opportunity to acquire established, cash-flowing businesses at valuations that don’t yet reflect the potential of AI-driven efficiencies. Alex Boyd from Wildfront highlights the shift in priorities:

"Code is not a moat. Code is a commodity. What matters is community and distribution" [1].

Financing options like SBA 7(a) loans make acquisitions even more accessible. These loans can cover up to 90% of the purchase price, meaning you only need to put down 5–10% [7]. This dramatically reduces the capital risk compared to starting a business from scratch.

FAQs

How do I know a SaaS business is worth buying?

When considering whether to purchase a SaaS business, it's crucial to examine a few key aspects. Start with the basics like valuation, revenue, growth rate, customer retention, and profitability - these numbers provide a snapshot of the company’s financial health. But don’t stop there.

Dig deeper into the company’s market position and competitive edge. Does it dominate its niche? What differentiates it from competitors? Also, think about its growth potential - are there untapped opportunities or emerging markets it could expand into?

Equally important is conducting thorough due diligence. This helps uncover potential risks, such as technical debt (outdated or inefficient systems) or potential market disruptions that could impact future performance.

By combining hard financial data with a qualitative understanding of the business, you'll get a clearer picture of its true value and potential.

What are the biggest red flags in SaaS due diligence?

When evaluating a SaaS company, certain warning signs can indicate potential risks or challenges. Here are some of the key areas to keep an eye on:

- Financial inconsistencies: Look out for discrepancies like overstated revenue or irregular cash flow. These could hint at deeper financial instability or mismanagement.

- High customer concentration: If a significant portion of the company’s revenue comes from just a few clients, it increases vulnerability. Losing even one major customer could have a big impact.

- Legal or compliance issues: Pending lawsuits, regulatory violations, or unresolved legal matters can pose serious risks for investors.

- Outdated systems: Aging technology or infrastructure that requires expensive upgrades can be a hidden cost that affects profitability.

- High employee turnover or unstable management: Frequent leadership changes or a revolving door of employees can signal internal issues, such as poor culture or lack of direction.

Spotting these red flags early allows investors to steer clear of potential liabilities and make more informed decisions.

How can I add AI to a SaaS business without breaking it?

To bring AI into your operations smoothly, take it step by step. Begin with smaller, manageable tasks - like automating customer support or streamlining repetitive processes - while keeping your core product intact. This gradual rollout helps lower risks and maintain stability.

Another option is acquiring AI tools that already fit well with your existing systems. This can speed up the process while sidestepping some of the usual hurdles. Whatever approach you choose, make sure AI aligns with your business goals, enhances the user experience, and undergoes rigorous testing to keep everything running smoothly.