Your first acquisition deal can shape your company's future and your role for years. But without preparation, it’s easy to make costly mistakes. Here’s what you need to know:

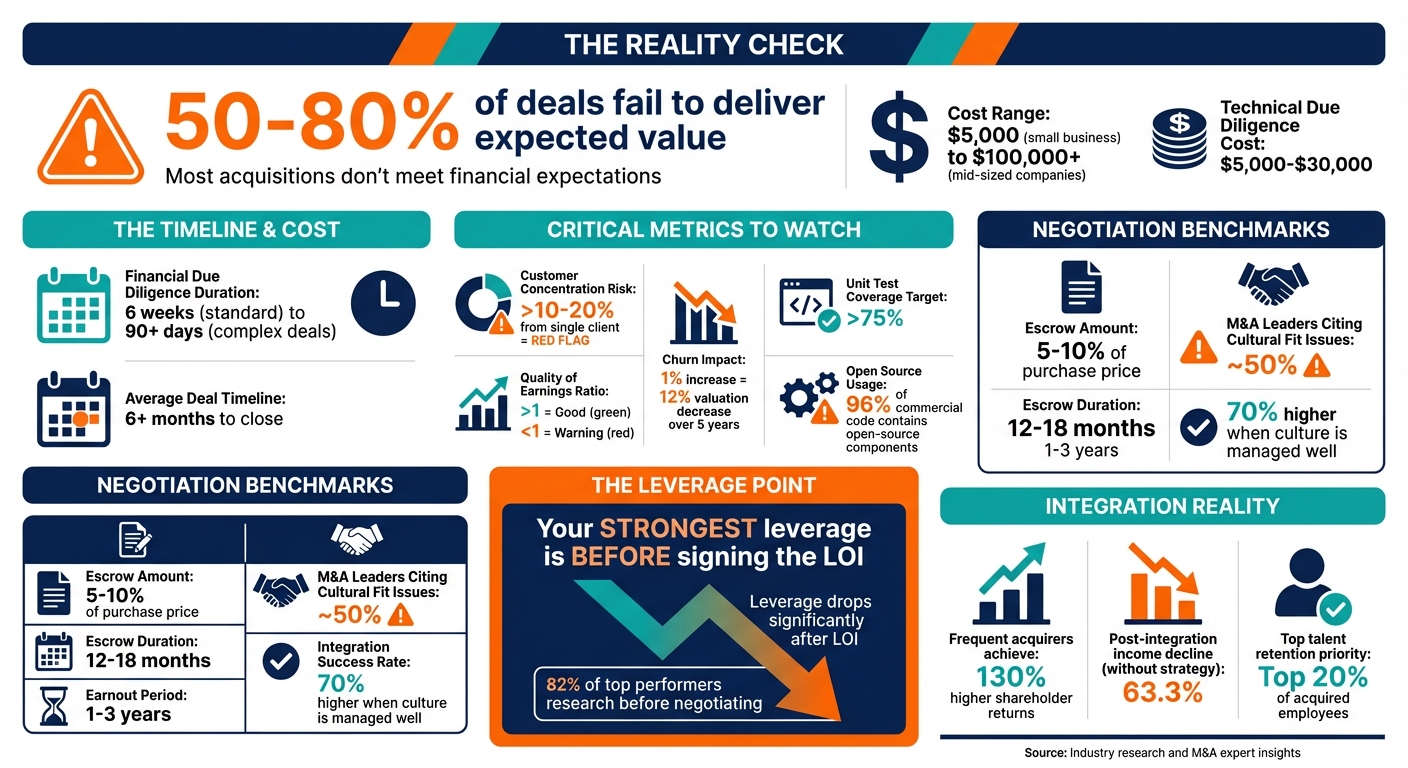

- Acquisition Reality Check: 50%-80% of deals fail to deliver expected value. Founders often overestimate their company’s worth and underestimate the time needed to close a deal.

- Financial Due Diligence: Buyers scrutinize every detail - revenue, churn rates, customer concentration, and EBITDA. Inconsistent financials or risky metrics can scare them off.

- Technical Risks: Outdated code, poor documentation, or unclear IP ownership can derail a deal. A deep technical audit is critical.

- Negotiation Leverage: Your strongest position is before signing the Letter of Intent (LOI). After that, your leverage drops significantly.

- Integration Challenges: Merging teams, systems, and customer bases is harder than it seems. Missteps here are a top reason deals fail.

To succeed, focus on clean financials, thorough technical audits, and negotiating terms that protect you. Plan for post-acquisition integration early to avoid pitfalls. The right preparation can make all the difference.

First Acquisition Deal: Key Statistics and Benchmarks for Founders

Do Not Do Your First Acquisition Until You Watch This

sbb-itb-9cd970b

Financial Due Diligence: Avoiding Expensive Mistakes

Financial due diligence is all about verifying a company’s financial health before it’s acquired. Pierre-Alexandre Heurtebize, Investment and M&A Director at HoriZen Capital, describes it like this:

"Financial due diligence is where a buyer or their representative verifies and validates your company financials before acquisition. They'll check the authenticity of your numbers, explain trends, and check for any red flags that suggest the business is not what it seems." [6]

This process usually takes around six weeks with a team of 10 people, but more complex deals can stretch up to 90 days or longer [7][12]. Costs vary widely, starting at $5,000 for small businesses and climbing above $100,000 for detailed reviews of mid-sized companies [7]. Buyers typically request three to five years of historical financial statements to analyze revenue patterns and profit margins [9]. This forms the foundation for evaluating critical financial metrics.

Financial Metrics You Must Review

For SaaS businesses, certain metrics take center stage: Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), churn rate, Customer Acquisition Cost (CAC), and Customer Lifetime Value (LTV) [6][13]. These figures reveal whether your growth is sustainable or if there are hidden vulnerabilities. Buyers also pay close attention to EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), often using a multiple of normalized EBITDA to estimate a company’s value [6][7].

Another critical metric is the Quality of Earnings (QoE) ratio. Chris Walton, CEO of Eton Venture Services, explains its importance:

"The purpose of a QoE analysis is to ensure that profits come from ongoing, repeatable business activities rather than one-time events, accounting manipulations, or temporary boosts." [7]

A QoE ratio above 1 signals reliable earnings supported by cash flow, while a ratio below 1 indicates inflated profits or dependence on non-recurring factors [7]. Additionally, customer concentration risk is a big concern. If more than 10% to 20% of your revenue comes from a single client, your business could be at risk if that client leaves [7][9].

Financial Warning Signs to Watch For

Buyers tend to back out when they spot inconsistencies. A major red flag is when your financial reports don’t match up with CRM data - this can quickly erode buyer confidence [6]. Other warning signs include overly aggressive revenue recognition (such as booking future revenue as current income), sudden spikes in churn, or a CAC that’s dangerously close to - or even exceeds - your LTV [6][13].

Another key check is the Proof of Cash analysis, where buyers compare reported revenue directly with bank statements to verify that cash inflows align with claims [7]. Deferred capital expenditures or postponed necessary expenses, which artificially inflate cash flow, are often revealed during a net working capital trend analysis [8][14]. Elyse A. Reilly, Partner at Ernst & Young LLP, highlights the risks of overlooking these details:

"Companies that merely view diligence as a cost to obtain financing and insurance, and only focus on finance and tax, will miss key risks in today's market." [10]

Steps to Prepare Your Financial Records

Start by adopting accrual-based accounting, which aligns with GAAP standards and gives an accurate picture of profitability. Then, ensure all your financial data is reconciled - your profit and loss statements, balance sheets, cash flow statements, tax returns, and bank statements should all align [7][9].

Calculate adjusted EBITDA by excluding one-time expenses (like restructuring costs or asset sales) and discretionary owner costs (such as personal travel or non-business meals) [7]. Organize a virtual data room with essential documents, including three years of tax returns, cap tables, debt maturity schedules, and monthly financial reports, so they’re ready to share at a moment’s notice [6][13]. Lastly, consider hiring an advisor to conduct a vendor due diligence self-audit. This can help you identify potential issues early and prepare for tough buyer questions.

Technical and Product Risks: What You Need to Check

Financial metrics might give you part of the story, but your code and infrastructure often tell the rest. Technical due diligence is your chance to determine if the product you're acquiring can actually deliver - or if you're signing up for a host of hidden problems. Industry data shows that 62% of deals fail to meet financial expectations, with technical issues often being the underlying cause [19]. A thorough audit of your code and systems is critical to uncovering these risks.

Auditing Your Code and Infrastructure

Start by evaluating the state of the codebase. Issues like poor documentation, outdated frameworks, or monolithic architectures that don't scale are clear warning signs [16][17]. These problems can slow down development and lead to costly fixes after the acquisition [17]. As VeryCreatives explains:

"A modern, well-documented architecture isn't just a technical achievement; it's a powerful business asset that de-risks an acquisition and accelerates post-merger integration." [17]

To assess code quality, tools like SonarQube can help, while Snyk or Black Duck are excellent for identifying security vulnerabilities [15][17]. Check repositories for hardcoded secrets to maintain trust during the audit. Performance testing tools like JMeter or K6 can help you pinpoint bottlenecks before they become major issues [17]. Keep in mind, application failures can cost up to $100,000 per hour [15].

Another critical aspect is developer retention. As Matt Van Itallie, Founder and CEO of Sema, points out:

"The single most important factor for a codebase to clear TDD is if the developers who have created or maintained the code are still active at the company." [20]

If key developers leave, it can create serious operational challenges [16][18][20].

Confirming IP Ownership and Third-Party Tools

Intellectual property (IP) issues can completely derail a deal. For instance, one startup lost a multi-million dollar acquisition opportunity because a key algorithm had been developed by a freelancer who never signed an IP assignment agreement [17]. To avoid this, ensure all contributors have signed agreements assigning IP rights to the company [17].

Request a Software Composition Analysis (SCA) report to identify open-source components in the codebase. With 96% of commercial code relying on open-source elements [20], it's crucial to verify compliance with licenses like GPL, which may require you to make proprietary code public if integrated with certain open-source components [20]. Additionally, review third-party commercial licenses for clauses that could void your usage rights after the acquisition [21][15]. Confirm that domain names, social media accounts, and app store registrations are in the company’s name, not tied to an individual or external firm [21]. As PatentPC aptly puts it:

"IP is not just paperwork. It's power. And diligence is how you make sure you're actually buying it." [21]

Technical Due Diligence Checklist

To simplify the process, here's a checklist of the key areas to address during technical due diligence:

| Area | What to Check |

|---|---|

| Code Quality | Unit test coverage (>75%), technical debt tracking, automated linting [22][17] |

| Infrastructure | Cloud instance sizes, auto-scaling capabilities, disaster recovery plans, uptime history [22][17] |

| IP Ownership | Signed IP assignments, open-source license audits (SCA), patent verification [17][15] |

| Security | Regular vulnerability scans, penetration tests, encryption protocols, multi-factor authentication [22][17] |

| Scalability | Load balancer configurations, database sharding, session state management, CDN usage [22] |

| Operations | Centralized logging, incident response plans, postmortem processes [22] |

Technical due diligence services typically cost between $5,000 and $30,000, depending on the size and complexity of the system [19]. While this might seem steep, it's a small price to pay compared to the potential fallout of unresolved technical issues. For example, in 2017, Verizon slashed $350 million off its $4.83 billion offer for Yahoo after uncovering two massive data breaches affecting over 1 billion accounts [17].

Negotiating Contract Terms That Matter

After completing your technical and financial due diligence, the next crucial step is negotiating contract terms that safeguard your interests. These terms don’t just dictate how much money you’ll receive - they also define when you’ll get paid and what protections you’ll have if things go sideways. As Mital Makadia, Partner at Grellas Shah, aptly points out:

"The LOI is where a seller has the most leverage. Once the LOI is signed, a seller is locked in for a significant period and will have more difficulty taking tough stances during negotiations" [1].

Using the insights gained during due diligence, you can shape these terms to secure your position and finalize the deal structure effectively.

Payment Structures and Milestone Terms

When it comes to acquisitions, cash is king. However, deals often involve a mix of cash, stock, promissory notes, and earnouts. Each option comes with its own pros and cons. Cash provides immediate liquidity, while stock can offer tax benefits like capital gains deferral and the potential for future upside [1][5]. Earnouts, which are payments tied to future performance metrics like revenue or EBITDA, can help bridge valuation gaps but shift a significant amount of risk onto the seller [5].

If earnouts are part of your deal, it’s critical to negotiate control over the metrics used to measure them. Without this, the buyer could make internal changes - like reallocating your sales team or discontinuing a product line - that make it impossible for you to hit your targets [23][24].

Another area to watch is working capital adjustments. The final purchase price is often adjusted based on "normal working capital" at closing. To avoid an unexpected price reduction, carefully negotiate the baseline (also known as the "peg") [5][24]. For any holdbacks or vesting equity, include acceleration clauses that protect you in the event of termination without cause after the acquisition closes [1].

Including Exit Clauses for Protection

Exit clauses are your safety net for dealing with post-deal complications. Closing conditions function as pre-deal exit options, allowing either party to walk away if certain requirements - like regulatory approvals or accurate representations - aren’t met. Indemnification provisions are another key safeguard, protecting you from losses caused by contract breaches. Be sure to negotiate caps on liability and thresholds (known as "baskets") that must be met before claims can be made to limit your exposure [5][29].

Negotiate penalties, such as service credits or contract extensions, if the buyer fails to meet agreed performance standards post-integration [25]. Termination clauses should include clear notice periods, data migration processes, and explicit language confirming your ownership of data, along with the right to export it at any time [25].

Additionally, review your current customer agreements for "change in control" clauses. These provisions could allow customers to block your acquisition or demand unfavorable terms, potentially jeopardizing the entire deal [3].

Comparing Your Terms to Industry Standards

Don’t negotiate blindly. Use industry benchmarks to strengthen your position. Databases like RMA, Bizminer, or PitchBook can provide insights into standard terms, helping you justify your demands [26]. If your company has stronger growth or profitability than its peers, leverage that data to push for higher valuation multiples. A lack of strategic negotiation can result in an average net income decline of 63.3% [30].

Create competitive tension by engaging multiple buyers - both strategic and financial. This approach can give you more leverage and lead to better terms [27][28]. Assaad Nasr, Corporate Partner at Buhler Duggal & Henry LLP, offers this advice:

"While your M&A counsel will help you navigate the legal terms, negotiating the commercial terms is often primarily the job of the founder" [5].

| Term | Industry Standard | What to Negotiate |

|---|---|---|

| Escrow Amount | 5-10% of purchase price [5] | Push for a lower percentage and shorter duration |

| Escrow Duration | 12-18 months [5] | Aim for 12 months or less |

| Earnout Period | 1-3 years [28] | Shorter period; ensure milestones are achievable |

| Liability Caps | Tied to escrow amount [5] | Set clear maximum liability |

Use these benchmarks to justify your terms and secure a stronger outcome. Before negotiations begin, prepare a Quality of Earnings (QoE) report - a third-party analysis introduced during financial due diligence. This report can help ease buyer concerns and reduce the likelihood of last-minute valuation adjustments [28]. Remember, 82% of top-performing professionals conduct research before entering negotiations [30]. Showing up prepared can make all the difference.

Post-Acquisition Integration: The Overlooked Challenges

After the deal is signed and the celebrations wind down, the real challenge begins: integration. It's a phase that often determines whether the acquisition succeeds or fails. In fact, integration issues are one of the leading reasons acquisitions don't deliver on their promise [31]. While financial and technical due diligence lay the groundwork, the post-acquisition phase demands a different kind of effort, one that many founders underestimate.

One common problem is the disconnect between the teams involved. The due diligence team, which focuses on risks and valuations, often has little overlap with the integration team, which is tasked with turning the deal into value. This gap can lead to silos, repeated questions, and lost opportunities [35]. Successful integration isn’t just about combining systems or consolidating offices; it requires tackling three key challenges: ensuring customer success, aligning company cultures, and crafting a practical integration plan. These areas form the backbone of a smooth and effective transition.

Evaluating Customer Success and Retention

Customers are paying attention. Any hiccup - whether it’s delayed support, unexpected product changes, or unclear communication - can push them toward the exit. The stakes are high: even a 1% increase in churn can reduce a company’s valuation by 12% over five years [41].

Before the deal closes, take a hard look at your customer metrics. Focus on key indicators like cohort retention rates, Customer Lifetime Value (CLV), Net Promoter Score (NPS), and churn rates to identify potential risks [13]. Implement automated alerts - such as flags for inactivity or sharp usage drops - to intervene before problems escalate [41]. For your most valuable accounts, Quarterly Business Reviews (QBRs) can help uncover opportunities for growth and address concerns directly [41].

Communication is critical. Customers should hear about the acquisition directly from you, with a clear emphasis on how it benefits them - whether it’s through better products, improved services, or enhanced support [39][40]. A great example is Dell's acquisition of EMC. Instead of rushing to integrate systems, Dell focused on cross-selling through separate sales teams, which led to billions in revenue synergies within the first year [31].

While keeping customers happy is essential, ensuring cultural alignment within the organization is equally important.

Aligning Company Culture and Values

Cultural differences can quietly derail an acquisition. Nearly half of M&A leaders cite "lack of cultural fit" as a top reason for failure [36]. This isn’t about surface-level quirks; it’s about deeper issues like decision-making styles, management practices, and workplace norms [31][33]. Ignoring these differences can lead to a drop in productivity and even talent loss.

Take, for instance, the clash between a fast-moving, top-down acquirer and a target company that values collaborative decision-making. Resolving such differences early - by clarifying decision-making authority, for example - can prevent friction [36]. Research from McKinsey shows that companies that successfully manage cultural integration are up to 70% more likely to hit their revenue targets [37]. Conducting a cultural diagnostic during due diligence, using employee surveys and focus groups, can provide valuable insights [37].

Hitachi’s acquisition of GlobalLogic offers a useful example. To preserve GlobalLogic’s innovation-driven culture, Hitachi organized cross-cultural workshops and set up a dedicated team to address potential issues before integration began [31]. A key decision in cultural integration is determining how the acquired company will operate - whether as a standalone entity, a fully integrated unit, or a hybrid. For instance, brands like YouTube and Skype often remain independent to protect their identity, while infrastructure platforms like DoubleClick are better suited for full integration [32].

Once cultural and customer challenges are addressed, the focus shifts to creating a robust integration plan.

Creating an Integration Plan

A well-thought-out integration plan is essential for success. Companies that view integration as a repeatable skill rather than a one-off event tend to perform better. Frequent acquirers, for example, achieve 130% higher shareholder returns than those who rarely acquire, largely due to their refined integration processes [31].

Start by forming an Integration Management Office (IMO) - a cross-functional team that includes representatives from Finance, HR, IT, and Operations, led by senior leaders. As Insight Partners aptly puts it:

"If you're not willing to dedicate the resources, don't do the deal" [34].

Using insights from due diligence, the IMO should focus on a few critical decisions, such as defining the combined operating model or the R&D roadmap. Avoid getting bogged down by endless checklists; instead, prioritize decisions that drive the most value [31]. For instance, Drillinginfo successfully completed eight acquisitions by pairing a General Manager with an integration manager for each deal, achieving cost synergies while driving growth [38].

Staffing is another crucial element. High-performing acquirers prioritize retaining the top 20% of talent from the acquired company, creating personalized retention plans to secure their commitment [34]. Losing key employees early can significantly complicate integration efforts [34].

Communication, once again, plays a pivotal role. Stephanie Young from The Buyer-Led M&A Summit emphasizes:

"You can't over-communicate in M&A. Sharing is caring - get all the information out there" [35].

Hold individual meetings with key employees to address concerns before making broader announcements. Small gestures, like providing new business cards and email addresses on Day 1, can help employees feel included right away [38].

Finally, ensure operational continuity. JPMorgan Chase’s integration of Washington Mutual is a standout example. Over a single weekend, the team converted more than 1,800 bank branches to a new IT system, avoiding disruptions [40]. While your integration might not require such dramatic measures, the principle remains: meticulous planning is essential to avoid IT failures or supply chain disruptions during the transition [39].

| Integration Priority | High-Performer Approach | Low-Performer Risk |

|---|---|---|

| Governance | Tailors decision-making to deal goals | Imposes decisions without considering value |

| Talent | Retains top 20% of key employees early | Loses critical talent to competitors |

| Speed | Paces integration by function (e.g., back-office fast, sales slow) | Rushes integration, disrupting operations |

| Culture | Focuses on management practices and norms | Fixates on surface-level differences |

| Synergies | Updates targets with detailed, bottom-up data | Relies on unrealistic projections |

Conclusion: What to Remember Before You Sign

Your first acquisition isn't just a milestone - it's the start of a much bigger journey. How you prepare before signing the deal can make or break its success. While most mergers and acquisitions take over six months to finalize and even longer to fully integrate [2], skipping key steps along the way can lead to costly mistakes.

3 Most Important Lessons

First, financial due diligence is critical. Scrutinize audited financial statements, revenue recognition policies, debt terms, and working capital needs to ensure the numbers add up [11][12]. Even a small change, like a 1% difference in customer churn, can impact a company’s valuation by 12% over five years [41]. Pay close attention to retention rates and avoid customer concentration exceeding 10% of total revenue [41].

Second, technical and intellectual property (IP) reviews help uncover hidden risks. Verify ownership of intellectual property, evaluate the technology stack, and assess cybersecurity and data privacy vulnerabilities [11][10][43]. A lack of proper technical audits has derailed deals in the past [42], and you don’t want to be the next cautionary tale.

Third, negotiate terms while you still have leverage. Tom Tunguz, General Partner at Theory Ventures, explains it best:

"The startup can exert maximum leverage immediately before signing the term sheet. Once the term sheet is signed, the startup's leverage vaporizes" [4].

Lock in favorable indemnification caps, shorter survival periods, optimized earnout structures, and escrow terms to limit post-closing liabilities [5].

These lessons provide the foundation for navigating your first deal.

Final Advice for Founders

Turn these insights into action. Approach your first acquisition with a mix of confidence and caution. Lean on third-party experts - like attorneys, accountants, and industry specialists - to uncover risks you might miss and act as a neutral buffer between you and the buyer [12][43]. Keep backup buyers or financing options in play to protect yourself in case the deal falls through at the last minute [2]. Elyse A. Reilly, Partner at Ernst & Young LLP, offers a critical reminder:

"Companies that merely view diligence as a cost to obtain financing and insurance, and only focus on finance and tax, will miss key risks in today's market" [10].

To stay ahead, arm yourself with insights that are sharper and more detailed than those of your competitors [42]. Start planning for integration during the due diligence phase [42]. With the right preparation, your first acquisition can lay the groundwork for lasting growth.

FAQs

What financial metrics should I review before signing an acquisition deal?

Before closing an acquisition deal, it's essential to dive into the numbers that truly matter. Pay close attention to revenue (including Annual Recurring Revenue, or ARR), EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), net working capital, cash flow, and profit margins. These key metrics reveal the company's financial stability and operational efficiency.

It’s also worth examining the valuation multiples being applied, like revenue or EBITDA multiples, to see how the deal stacks up against industry benchmarks. This step helps you gauge whether the price aligns with market norms.

By thoroughly analyzing these financial indicators, you'll gain a deeper understanding of the company's overall health and its potential for future growth. This groundwork can save you from unpleasant surprises later.

What steps should I take to ensure a thorough and effective technical due diligence process?

Technical due diligence is a critical step when assessing a company's technology before an acquisition. It digs into the tech stack, product capabilities, and potential risks, offering insights into the codebase, architecture, scalability, security, and intellectual property. The goal? To evaluate the current value while identifying challenges that could arise down the road. This process ensures the technology is ready to support growth, integrate with your systems, and steer clear of hidden technical debt.

To get the most out of this process, start by setting clear objectives and bringing together a team of seasoned professionals - think former CTOs or experienced product leaders. Key areas to focus on include:

- Code quality: Is the code maintainable and efficient?

- Scalability: Can the technology handle future growth?

- Security: Are there vulnerabilities that need addressing?

- Intellectual property ownership: Is everything legally sound?

It’s also essential to meet with key team members to gauge their expertise and ensure all documentation is well-organized for review. By taking a methodical approach to these areas, you'll reduce risks, safeguard your investment, and approach the acquisition with confidence.

How can I keep leverage during acquisition negotiations?

To ensure you maintain a strong position during acquisition negotiations, it's smart to bring in an experienced investment banker early in the process. Their expertise can help spark competition among potential buyers while offering key insights to guide your decisions. One essential step is to prepare a comprehensive Letter of Intent (LOI). This document should outline critical terms like the purchase price, payment structure, earn-outs, and any contingencies before moving deeper into negotiations.

It's also wise to keep multiple buyers in the mix. Having several interested parties not only encourages competitive bidding but also provides a safety net if one deal falls apart. By staying informed and actively managing the process, you can approach negotiations with greater confidence and control.