Getting an acquisition offer can be overwhelming, especially if it’s unexpected. The key to handling it effectively? Stay calm, document everything, and avoid rushing into decisions. Here’s a quick breakdown of what you need to know:

- Document the Offer: Write down all details like price, payment structure, and conditions.

- Don’t Commit Immediately: Avoid making promises or sharing sensitive information too early.

- Vet the Buyer: Research their credibility, financial stability, and past acquisitions.

- Know Your Worth: Calculate your valuation using metrics like ARR and market benchmarks.

- Build a Team: Hire advisors - M&A specialists, lawyers, and accountants - to guide you.

- Understand Deal Structures: All-cash, earn-outs, and equity rollovers each have pros and cons.

- Negotiate the LOI: Focus on terms like exclusivity, working capital, and escrow provisions.

- Prepare for Due Diligence: Organize key documents and disclose potential red flags upfront.

The process is complex and can take 6–12 months, but with careful planning and expert advice, you can protect your company’s value and make the right decision.

How Founders Can Drive Their Own Acquisition Process

Step 1: Stay Calm and Document Everything

When an acquisition offer comes your way, your first move should be to take a deep breath and carefully assess the situation. It's easy to get caught up in the moment, but buyers often rely on their extensive M&A experience and a sense of urgency to gain the upper hand. Glenn Solomon, Managing Partner at Notable Capital, puts it best:

"Acquisition negotiations are complex and the potential buyer usually has a lot more experience than you getting deals done. Good advisors will help you approach the process methodically." [2]

Consider the case of Coupa Software. Between December 9 and December 11, 2022, the Qatalyst investment banking team successfully negotiated a price increase for the company, raising its offer from $73 per share to $81 per share. This move added $700 million in equity value for the sellers - a reminder of how strategic negotiations can make a significant difference. [4]

Write Down the Offer Details

Start by documenting everything discussed during your initial conversation with the buyer. Request that they follow up with an email summarizing the key aspects of their offer. This not only creates a clear record but also gives you time to evaluate the proposal thoroughly. Be sure to note down details like the proposed purchase price or range, the payment structure (cash versus stock), the timeline for due diligence, any conditions mentioned, and whether the offer involves a stock purchase (acquiring your entire company) or an asset purchase (targeting specific assets). [7][10]

Understanding the buyer’s motivations is just as important. Are they after your market share, intellectual property, or your team? Before sharing sensitive metrics like revenue, expenses, or customer attrition rates, ask for a formal list of questions from the buyer. Having these in writing allows you to review them with your advisors before making any disclosures. [8]

Once everything is documented, resist the urge to make any commitments until all details have been verified.

Don't Make Any Promises Yet

Hold off on agreeing to anything - verbally or in writing - until you’ve had time to analyze the offer thoroughly. David G. Cohen, Founder of Techstars, offers a critical piece of advice:

"Recognize that the NDA won't protect you from giving the 'fake acquirer' exactly what they wanted. This is your leverage to get the ballpark offer, so don't give it away." [8]

Avoid signing NDAs or sharing data prematurely. Instead, focus on securing a non-binding range for the offer, including details like the likely cash-stock split. This step keeps you in control and ensures you’re not giving away leverage too soon.

Also, limit who knows about the offer. Share the news with only a small, trusted group - perhaps just your co-founders and one or two board members. Letting the information spread too widely can lead to employee anxiety, rumors, and even key departures, which could jeopardize the deal. It's worth noting that only about 20% of Letters of Intent actually result in a completed transaction. [4]

Step 2: Check the Buyer's Background and Intentions

Before jumping into negotiations, it’s crucial to confirm the buyer’s credibility and financial stability. Todd Sullivan, Founder of Exitwise, explains the challenge well:

"In the world of mergers and acquisitions, a stark reality often emerges - when it comes to unsolicited offers, buyers are prepared, while sellers often are not." [9]

While the buyer is assessing your business, you should also conduct your own investigation. Start by confirming that the person reaching out has the authority to finalize a deal on behalf of their company. If they lack seniority, they might just be testing the waters without official backing [8].

This initial step lays the groundwork for a more thorough examination of the buyer’s track record and strategic goals.

Investigate the Buyer's History

Dig into the buyer’s background and previous acquisitions. Look at how they’ve handled integration in the past - did they retain teams, or were assets shut down? Also, check whether they rely on cash reserves or private equity funding. Strategic buyers often use cash, while private equity firms typically depend on "dry powder" [3].

Public sentiment can also provide valuable insights. Platforms like Glassdoor can reveal potential red flags, such as low CEO approval ratings or recurring complaints about workplace culture. If possible, connect with founders of other companies the buyer has acquired to gain firsthand insights into their post-merger experiences. Keep in mind that 30–40% of M&A deals fail during due diligence because of undisclosed problems [7].

After reviewing their history, you’ll need to determine whether their vision aligns with your company’s long-term goals.

Determine If the Buyer Aligns With Your Goals

Understanding the buyer’s strategic intent is essential. Are they looking to address a product gap, scale their business quickly, or implement a buy-and-build strategy? It’s also important to clarify whether they plan to integrate your business into their operations or keep it running independently [1][3].

Cultural alignment is another critical consideration. Take a close look at what behaviors the buyer’s organization rewards versus discourages. For example, a relationship-driven sales culture might clash with a strictly transactional approach, creating friction post-acquisition. Ask for a detailed integration plan that outlines how they intend to manage your employees and product. This level of transparency will help you determine whether their long-term vision complements yours - or if their goal is simply to acquire assets and move on.

Step 3: Calculate Your Company's Current Worth

Now that you've documented your offer and completed due diligence, it's time to assess whether the offer aligns with your company's real market value. For smaller SaaS companies in 2025–2026, valuation multiples typically range from 3× to 5× ARR, while companies with steady growth often achieve 7× to 12× ARR [12].

Aaron Solganick, CEO of Solganick & Co., highlights the importance of detailed financial data:

"If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple. The more KPIs and the more financial data I have to work with, the more accurate your valuation will be." [12]

Knowing which metrics influence your valuation can give you an edge in negotiations.

Review Your Core Financial Metrics

Start by gathering your most important financial indicators. While ARR is the baseline, potential buyers will also examine your Committed Annual Recurring Revenue (CARR) - contracts that are signed but not yet active. A monthly churn rate under 2% signals strong product–market alignment. Additionally, aim for an LTV:CAC ratio of at least 3:1; ratios above 5:1 can increase valuation multiples by as much as 30–50% [13]. Have a detailed, editable profit and loss statement ready in Excel or Google Sheets [11].

If any single customer accounts for more than 25% of your revenue, it could lower your valuation and complicate the deal. To address this risk, consider extending contracts with key clients before negotiations intensify [11][7].

Once these metrics are organized, you’ll have the tools to benchmark your valuation against the market.

Compare the Offer to Market Valuations

With your metrics in hand, compare them to recent SaaS acquisitions to establish a benchmark. In 2026, mid-market SaaS companies with healthy growth are targeting 20–35% ARR growth, and the Rule of 40 has become a vital metric - your year-over-year growth rate plus profit margin must exceed 40% to attract premium valuations [13]. Sectors like AI, data analytics, and cybersecurity are commanding higher multiples due to strong buyer interest [12].

Keep in mind that private deals often close at lower multiples compared to public company valuations, and deal structures like earnouts or seller financing can further reduce the effective multiple [13]. If your company has been operating for more than three years, this track record of resilience through economic shifts can lead to higher valuations [11].

Before entering further negotiations, align internally on your minimum acceptable offer, factoring in preferences for cash versus stock [8].

sbb-itb-9cd970b

Step 4: Build Your Team of Advisors

Once you've assessed your company's value, the next step is to assemble a skilled advisory team. Why is this so critical? Because a large number of deals fall apart during the due diligence phase. Sellers who come prepared with a strong team can close deals two to three times faster than those scrambling to find help at the last minute[7]. Todd Sullivan from Exitwise puts it bluntly:

"Experienced buyers are full-time predators... Inexperienced Sellers are part-time prey"[9].

Your advisory team should include three key players: an M&A advisor, a lawyer with M&A expertise, and a tax accountant. Jeff Thieman, Group Head of Investment Banking at Fifth Third Bank, highlights the importance of preparation:

"Middle-market companies should have a solid team of advisors - including bankers, lawyers, accountants, and wealth managers - in place before considering a sale offer"[3].

Let’s break down how each advisor plays a vital role in protecting your interests during the sale process.

Hire M&A Advisors

M&A advisors bring structure and efficiency to what can be a chaotic process. They help fine-tune your company's valuation, create competition among buyers, and negotiate on your behalf. This is especially valuable if you plan to stay involved with the company after the acquisition, as they can handle tough conversations while preserving your relationship with the buyer[15].

The right advisor will also perform "reverse due diligence", investigating the buyer to ensure they’re credible and financially stable[9]. If a buyer pressures you to move forward without assembling your team, consider it a warning sign - they may not be serious about the deal[9].

While M&A advisors oversee the big picture, legal and financial experts focus on the finer details to ensure everything is airtight.

Work With Lawyers and Accountants

Your legal counsel will draft and review critical documents like the Letter of Intent and the final Purchase Agreement. Their role is to ensure every aspect of the deal is thoroughly vetted, from intellectual property rights to indemnification clauses. For example, escrow terms - often 10–20% of the purchase price held for 12–24 months - are negotiated to protect you from future liabilities[7]. It’s essential to work with lawyers who specialize in M&A transactions, as general corporate attorneys may lack the expertise required for these complex deals[6].

Tax accountants, on the other hand, focus on your financial records and tax obligations. They’ll ensure your statements comply with GAAP standards and identify potential State and Local Tax issues that could derail the deal[16]. Additionally, they can help you calculate your personal "big number" - the amount you need post-sale to retire comfortably or fund your next venture. Having this figure in mind ensures you're negotiating with a clear financial goal[5][14].

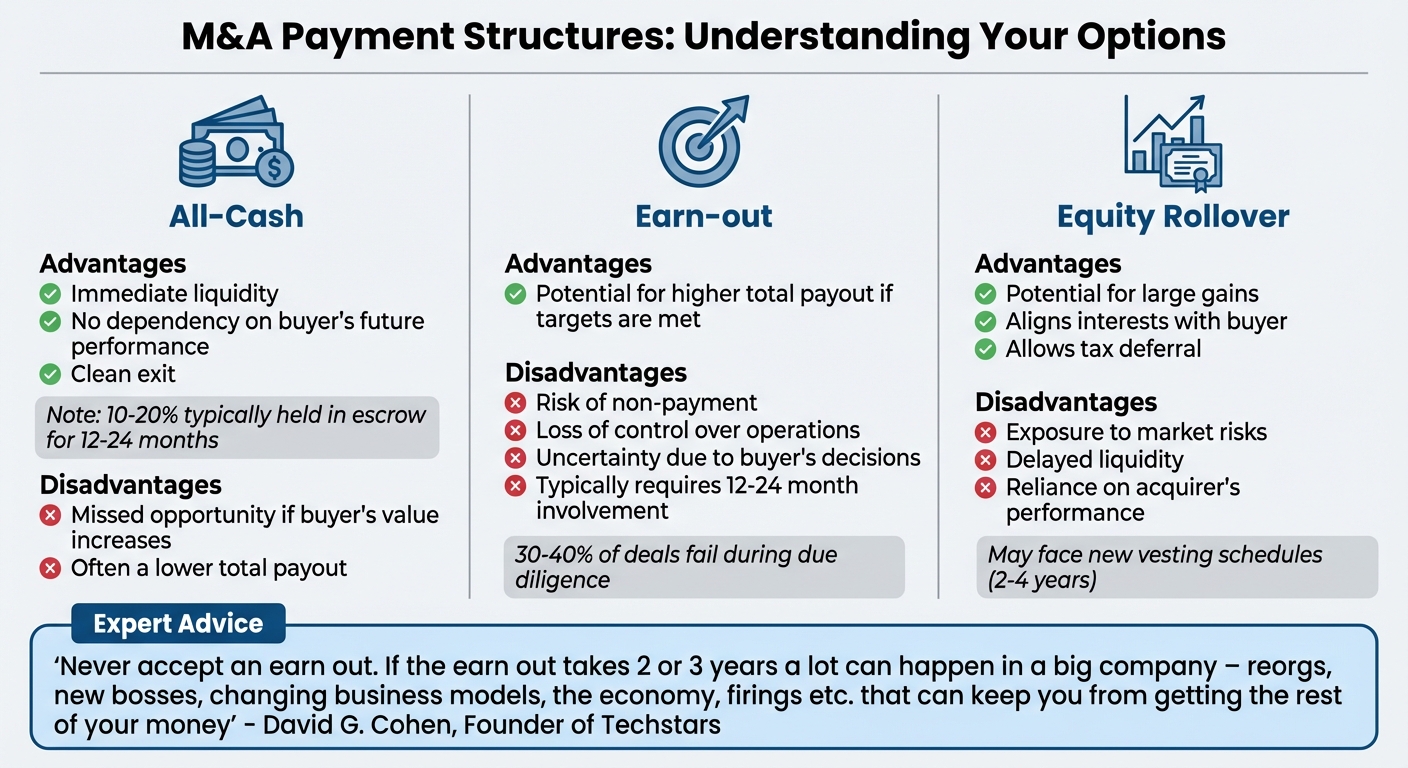

Step 5: Understand Different Deal Structures

M&A Deal Payment Structures: Cash vs Earn-out vs Equity Rollover Comparison

When it comes to acquisition offers, the headline number is just one piece of the puzzle. How and when you get paid can make a huge difference in the actual value of the deal. For instance, a $10 million all-cash offer might be more appealing than a $15 million deal loaded with earn-outs tied to future performance. The structure of the deal determines your payout timeline, your level of control, and the risks you’ll need to take on. To make informed decisions, it’s essential to understand the common payment structures and weigh their risks and rewards.

Review Common Payment Structures

In mergers and acquisitions, three payment structures are most common: all-cash deals, earn-out arrangements, and equity rollovers. Each comes with its own set of pros and cons.

All-cash deals are straightforward. You receive the full purchase price at closing (though a portion - typically 10–20% - might be held in escrow for 12–24 months)[7]. This structure gives you immediate liquidity and a clean exit, with no dependence on the acquirer’s future performance or stock price fluctuations[7][8]. However, the downside is that you won’t benefit from any future growth of the buyer’s business.

Earn-out arrangements tie part of your payout to hitting specific performance metrics, such as revenue, EBITDA, or ARR[7]. While this can boost the total valuation if targets are met, it also introduces significant risks. Once the deal closes, you may lose control over operations, and the buyer’s decisions - like reorganizing teams or changing pricing strategies - could make it harder to achieve those targets[7][8]. David G. Cohen, Founder of Techstars, advises caution:

"Never accept an earn out. If the earn out takes 2 or 3 years a lot can happen in a big company – reorgs, new bosses, changing business models, the economy, firings etc. that can keep you from getting the rest of your money"[8].

If you go this route, negotiate safeguards, such as requiring the buyer to operate the business as usual, securing audit rights to verify performance calculations, and including clauses that accelerate payments if you’re terminated without cause[7][14].

Equity rollovers involve exchanging part of your company for stock in the acquiring company. This approach offers potential upside if the acquirer performs well, but it also ties your financial future to market volatility and the buyer’s success[7][14]. Additionally, you might face new vesting schedules, requiring you to stay employed for 2–4 years to fully realize the value of your equity[8][14].

| Payment Structure | Advantages | Disadvantages |

|---|---|---|

| All-Cash | Immediate liquidity; no dependency on buyer’s future performance; clean exit[7][8] | Missed opportunity if buyer’s value increases; often a lower total payout[7][8] |

| Earn-out | Potential for a higher payout if targets are met[7] | Risk of non-payment; loss of control; uncertainty due to buyer’s decisions[7][8] |

| Equity Rollover | Potential for large gains; aligns interests with buyer; allows tax deferral[7][17] | Exposure to market risks; delayed liquidity; reliance on acquirer’s performance[7][8] |

Think About Future Implications

The payment structure you choose doesn’t just affect your bank account - it also impacts your role in the company and its future direction. For example, most earn-out deals require founders to stay involved for 12–24 months to ensure performance targets are met[7]. This can be tricky, as you’re no longer the one calling the shots but are still held accountable for results[8].

Consider this: Are you comfortable working as an employee for the next two years? If not, you might want to push for more cash upfront and avoid compensation tied to future performance. On the other hand, equity rollovers tie your returns to the acquirer’s success, leaving you vulnerable to market swings or unexpected changes in the company’s strategy, like a pivot or a competitor’s acquisition[7][8].

Finally, think about whether staying independent could create more value. If your business is growing faster than the acquirer, it might make sense to walk away from the offer altogether[1]. Work closely with your advisors to crunch the numbers and determine if holding onto your company is the better long-term play.

Step 6: Navigate the Letter of Intent Process

After evaluating the offer and assembling your advisory team, the buyer will likely present a Letter of Intent (LOI). This document outlines the key terms of the acquisition and serves as a major milestone in the process. Here's the catch: around 90% of LOI provisions are non-binding, with only exclusivity, confidentiality, and expense clauses typically holding legal weight[21]. However, don’t underestimate its importance - the LOI sets the tone for everything that follows. Once you sign it, your leverage to negotiate diminishes significantly.

Even though most terms in the LOI aren’t legally binding, they’re notoriously tough to renegotiate later. As Chris Roper, Managing Editor at Bootstrappers, explains:

"The LOI is the first sign of serious interest, but it's also an invitation to the negotiation table. Deferring tough conversations might speed up an acquisition, but failing to negotiate early puts you at a disadvantage"[18].

It’s worth noting that only about 20% of LOIs lead to a completed transaction[4]. This phase requires careful strategy, as how you negotiate the LOI often predicts your success post-closing in nearly 73% of cases[21]. That makes this one of the most critical steps in the entire acquisition process.

Negotiate Key LOI Terms

Focus on the provisions that directly influence your payout and strategic flexibility.

Exclusivity (the no-shop clause) is one of the most important terms. This clause prevents you from engaging with other potential buyers for a specific period - usually 30 to 90 days[20]. During this time, the buyer can conduct due diligence and potentially attempt to lower the deal price. To maintain leverage, aim for an exclusivity period of no more than 30 days[18][20]. If the buyer insists on a longer period, propose a tiered structure where the first 30 days are free, but they must pay a fee to extend it beyond that timeframe[21]. This keeps the process moving efficiently.

Working capital adjustments can also trip up sellers. The LOI should clearly define how working capital is calculated (typically current assets minus current liabilities) and establish a target amount to leave in the business at closing[19][20]. Vague language here can lead to surprise price reductions later. Collaborate with your accountant to ensure the calculation method is precise before signing.

Representations and warranties are statements you make about your business, such as "all intellectual property is properly assigned" or "there are no pending lawsuits." If these claims turn out to be incorrect, you could face significant liability. Negotiate to limit the survival period (the time you can be held accountable) to 12 months or less, and cap indemnity at 10% of the purchase price[18]. These limits help protect you from lingering risks after the sale.

Lastly, consider escrow and holdback provisions. Buyers often hold 5% to 20% of the purchase price in escrow for 12 to 24 months to cover potential post-closing claims[20]. Negotiate for a smaller percentage and a shorter holdback period whenever possible.

| Provision | What to Negotiate | Why It Matters |

|---|---|---|

| Exclusivity | Limit to 30 days or less[18][20] | Preserves your ability to walk away or explore other offers |

| Working Capital | Define calculation method and target[19][20] | Prevents unexpected price reductions during final negotiations |

| Reps & Warranties | Limit survival period to 12 months; cap indemnity at 10%[18] | Reduces post-sale liability risks |

| Escrow Holdback | Negotiate for 5–10% held for 12 months[20] | Minimizes the portion of your payout held in reserve |

Securing favorable LOI terms paves the way for a smoother due diligence process.

Get Ready for Due Diligence

Once the LOI is signed, the due diligence phase begins, typically lasting 4 to 12 weeks[7]. During this time, the buyer will examine every aspect of your business - financial records, contracts, intellectual property, employee agreements, and more. Sellers who are well-prepared can close deals 2 to 3 times faster than those who aren’t[7]. Organization is key.

Start by creating a Virtual Data Room (VDR) to compile all necessary documents. Organize files into categories like Corporate (incorporation documents, bylaws), Legal (contracts, IP assignments), Financial (profit and loss statements, tax returns), Commercial (customer lists, pricing structures), HR (employee agreements, benefits), Technology (source code, licenses), and Operations (vendor agreements, insurance policies)[7]. Use a VDR platform with access controls and audit logs to monitor document activity and protect sensitive information.

Adopt a tiered disclosure strategy to balance transparency and confidentiality. Early on, share high-level financials and sample contracts. Grant full access to the data room only after the LOI is signed. Reserve highly sensitive information - such as source code, detailed customer lists, or proprietary pricing models - for the final stages when the deal is nearly finalized[7].

If there are any potential red flags - like incomplete IP assignments or pending lawsuits - disclose them upfront with a prepared explanation or plan to address the issue[7]. Attempting to hide problems can derail the deal during due diligence and potentially lead to its failure.

Designate a single internal point person to handle buyer requests. A decline in business performance during due diligence is a top reason deals fall apart[4][7]. Keep your internal team small (2 to 5 key members) and use a project code name to avoid unnecessary gossip that could harm morale[4][22]. Around 30% to 40% of M&A deals fail during due diligence due to undisclosed issues[7], so preparation and transparency are your best defenses against setbacks.

Conclusion

Receiving an acquisition offer is a rare opportunity - only about 20% of Letters of Intent (LOIs) actually lead to completed deals [4]. Achieving a successful exit demands a careful, strategic approach, guided by experienced advisors, rather than impulsive decisions driven by emotions.

To maximize your chances of success, there are a few key practices to keep in mind. First, protect your leverage: never share sensitive information without a signed NDA, and secure a written ballpark offer before moving forward [8]. Conduct thorough reverse due diligence on the buyer [6][23], and if possible, engage multiple buyers to create competition, which could raise the final price by 25–50% [8]. Meanwhile, maintain strict discipline in running your business - any decline in performance during negotiations is one of the main reasons deals fall through [4][23]. Keep internal disclosures to a minimum to avoid unnecessary distractions, and appoint a single point person to handle buyer inquiries, allowing you to stay focused on daily operations.

Remember, selling your business is a permanent decision. As Mark Zuckerberg once said after rejecting a $1 billion offer:

"I don't know what I could do with the money. I'd just start another social networking site. I kind of like the one I already have" [4].

If your company is thriving and showing strong growth, waiting an additional 12 to 18 months might lead to a significantly better offer - or simply confirm that continuing to build is the right choice. As Andrew Gazdecki wisely puts it:

"Wait to pop the Champagne until after the money lands in your bank account on closing day" [23].

The real celebration comes only when the funds are in your account. A patient, well-thought-out plan ensures that your exit aligns with your long-term goals and leaves you with no regrets.

FAQs

How do I determine if an acquisition offer supports my company's long-term strategy?

To figure out if an acquisition offer aligns with your long-term plans, start by examining how it matches your company’s vision and goals. Look at key elements like market positioning, growth opportunities, and whether the offer supports your overall objectives. Think about how this move could affect your team, customers, and the reputation of your brand.

It’s equally important to seek advice from trusted professionals, such as financial advisors or legal experts. They can help you break down the offer, evaluate its financial value, identify potential risks, and determine if it fits into your future strategy. By taking a careful and informed approach, you can make the best choice for your company’s growth and success.

What should I consider when choosing between all-cash, earn-out, and equity rollover offers?

When considering all-cash, earn-out, or equity rollover deal structures during an acquisition, it's important to assess your financial priorities, comfort with risk, and desired level of future involvement with the business.

An all-cash deal offers immediate payment, which can be appealing if you value liquidity and want to minimize uncertainty. This option reduces risk but may not allow you to benefit from the company's future growth.

An earn-out agreement ties part of your payment to the company's performance after the sale. While this approach can align the interests of both parties, it brings potential risks, including disagreements over performance metrics. It’s a suitable choice if you’re confident in the company’s future and open to staying involved.

With an equity rollover, you retain partial ownership in the company, giving you the chance to benefit from its future growth. This structure is ideal if you have faith in the company’s long-term success and want to stay connected to its operations.

Your choice should reflect your financial goals, risk appetite, and vision for the future. Take the time to evaluate how each structure will affect your payout and your role after the sale.

How can I verify the credibility of a potential buyer during an acquisition offer?

To determine if a potential buyer is reliable, start by looking into their financial health and business history. Examine their financial statements, past acquisitions, and corporate records to confirm they have the resources to complete the deal and operate with integrity. Digging into their strategic goals can also help you see if their objectives align with your business.

Reputation matters too. Reach out to companies they’ve worked with or acquired to get insights into their trustworthiness and professionalism. Additionally, consulting with seasoned M&A advisors or legal experts can help you uncover any potential red flags, like hidden liabilities or problematic contracts. These steps can protect your business and reduce risks throughout the acquisition process.