Private equity (PE) can seem like a threat to some SaaS and AI founders, often associated with cost-cutting and layoffs. But the truth is, PE can be a powerful tool to scale your business, improve efficiency, and unlock growth. Here’s what you need to know:

- PE drives results: PE-backed companies often see productivity gains of 8–12% in two years, far outpacing public companies.

- Metrics matter: Strong SaaS metrics like ARR growth, Net Dollar Retention (120%+), and CAC payback (12–18 months) are essential to attract PE.

- Scalability is key: Businesses that show they can grow without proportional cost increases stand out to PE investors.

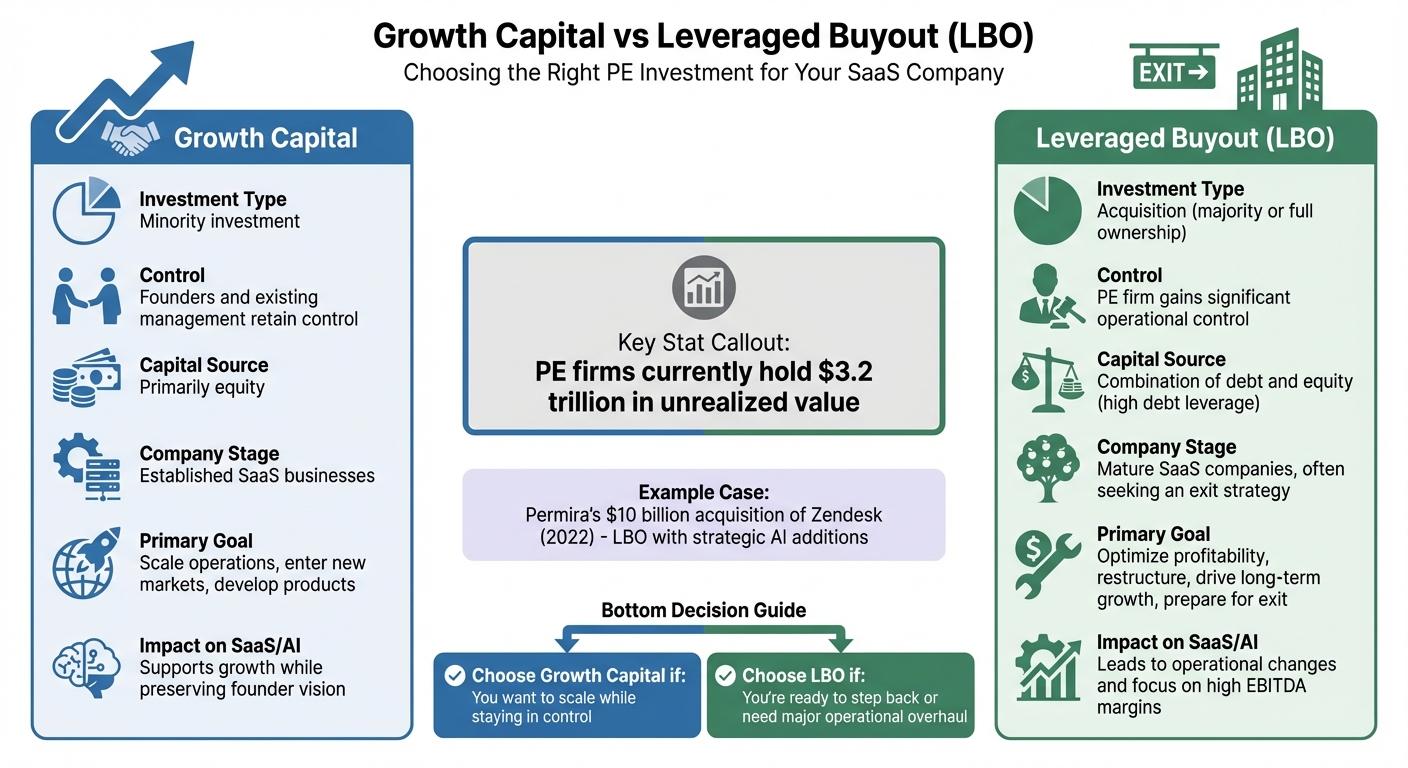

- PE investment types: Growth capital lets founders retain control while scaling operations, while leveraged buyouts (LBOs) involve more control shifts but focus on profitability and exits.

- AI focus: 98% of PE-backed firms are already investing in generative AI, making AI integration a growth priority.

PE firms offer more than funding - they bring expertise, industry connections, and proven strategies to help SaaS and AI companies expand into new markets, adopt AI, and improve processes. By preparing your business with scalable operations and strong metrics, PE can become a partner in driving growth, not just cutting costs.

Inside a Private Equity–Backed SaaS: The Real Playbook for Enterprise AI

Preparing Your Business for PE Investment

To attract private equity (PE) investment, your business needs to show it can grow efficiently and handle scaling without breaking a sweat. This involves sharpening your metrics and building operations that can support expansion. Interestingly, the very steps that make your business appealing to PE investors also make it stronger overall.

Fine-Tune Key SaaS Metrics

PE firms zero in on metrics like ARR (Annual Recurring Revenue), breaking it down into New ARR, Expansion ARR, and Churn ARR to measure growth potential. For example, at $10 million ARR, a growth rate of 250% year-over-year places you in the 75th percentile, while a 100% growth rate falls below the 25th percentile [6]. If your growth has slowed, you’ll need solid reasons to explain how you plan to accelerate again. This could mean launching a new product or restructuring your sales team [6].

Net Dollar Retention (NDR) is another critical measure, reflecting how well you expand revenue from existing customers. An NDR over 120% is strong, while best-in-class companies often exceed 130%. Other key benchmarks include maintaining a Magic Number of 1.0x, a CAC (Customer Acquisition Cost) Payback period of 12–18 months, and ensuring that 75% of fully ramped sales reps hit their quotas [6]. Achieving net negative churn - where expansion revenue outpaces churn - is a clear sign that your product naturally grows within customer accounts [6].

While these metrics demonstrate growth potential, scalable operations are what truly seal the deal with PE investors.

Create Scalable Operations

PE firms look for businesses that can expand without a matching spike in costs or headcount. Scalable operations show that your company can grow efficiently, which is a key confidence booster for investors.

For SaaS and AI-driven companies, integrating AI into day-to-day operations is a game-changer. Businesses with AI at the core of their products tend to grow faster [9]. But it doesn’t stop at the product level - AI can streamline your teams, processes, and customer interactions [8]. Whether it’s refining pricing strategies, delivering hyper-personalized customer experiences, or automating code generation, AI-powered automation proves your ability to scale without adding unnecessary complexity [7].

Before approaching PE firms, conduct a thorough review of your business. Assess strategic, commercial, financial, and operational factors, including your cost structure, capital expenditures, and working capital [1]. Build a leadership team where each executive is clearly responsible for specific value drivers [1]. This level of preparation sends a clear message: your business is ready for rapid growth fueled by PE investment.

Choosing the Right Type of PE Investment

Growth Capital vs Leveraged Buyout: PE Investment Types for SaaS Companies

Private equity (PE) deals come in different flavors, and picking the right one depends on your company's current stage and your growth objectives. Two of the most common types are growth capital and leveraged buyouts (LBOs). Each serves a distinct purpose, so understanding their differences is crucial.

Growth capital is ideal if your business is already generating solid revenue but needs funding to scale further. With this approach, PE firms take a minority stake, allowing you to retain control over daily operations[10][12]. The capital infusion can help you expand into new markets, enhance your product offerings, or scale your operations. For established SaaS companies, this option provides the resources to accelerate growth without giving up control.

Leveraged buyouts (LBOs), by contrast, involve PE firms acquiring your company using a mix of debt and equity[10][12]. In this scenario, the PE firm gains significant control, often restructuring operations to improve profitability. A notable example is Permira’s $10 billion acquisition of Zendesk in 2022, where they later added AI capabilities through strategic acquisitions[11]. LBOs are typically suited for mature SaaS companies where founders are looking for an exit or when major operational changes are needed to unlock value[10][12].

Currently, PE firms are sitting on $3.2 trillion in unrealized value, focusing heavily on operational changes to boost EBITDA margins beyond 40%[11]. The choice between growth capital and an LBO often comes down to how much control you're willing to give up. Growth capital offers strategic input and funding while keeping you in the driver’s seat. On the other hand, LBOs bring deeper operational shifts, higher debt obligations, and a clear path to a potential exit.

| Feature | Growth Capital | Leveraged Buyout (LBO) |

|---|---|---|

| Investment Type | Minority investment | Acquisition (majority or full ownership) |

| Control | Founders and existing management retain control | PE firm gains significant operational control |

| Capital Source | Primarily equity | Combination of debt and equity (high debt leverage) |

| Company Stage | Established SaaS businesses | Mature SaaS companies, often seeking an exit strategy |

| Primary Goal | Scale operations, enter new markets, develop products | Optimize profitability, restructure, drive long-term growth, prepare for exit |

| Impact on SaaS/AI | Supports growth while preserving founder vision | Leads to operational changes and focus on high EBITDA margins |

Ultimately, the decision hinges on your goals. If you're focused on scaling while staying in control, growth capital is your best bet. If you're ready to step back or need a major operational overhaul, an LBO might be the better choice.

sbb-itb-9cd970b

Using PE Partnerships for Rapid Growth

Private equity (PE) partnerships can be a game-changer for businesses looking to scale quickly. Beyond providing capital, PE firms bring a wealth of expertise, industry connections, and proven growth strategies that can propel your SaaS or AI business to new heights. These partnerships are about more than just funding - they're about leveraging the operational insights and frameworks that PE firms have honed over time to unlock growth opportunities [13][14].

The secret lies in focusing on high-impact initiatives rather than spreading resources too thin. PE firms typically zero in on specific areas like pricing strategies, international expansion, or strategic acquisitions - each designed to deliver measurable value [11]. This laser-focused approach ensures growth efforts remain efficient and tied to clear ROI goals. By prioritizing these strategies, businesses can tap into new markets and embrace AI-driven innovation effectively.

Expanding Into New Markets

One of the standout strengths of PE firms is their ability to help SaaS companies expand both geographically and vertically. A popular method is the "buy-and-build" strategy, which works particularly well in fragmented B2B SaaS sectors. By acquiring complementary businesses, companies can quickly broaden their market reach and customer base [11].

PE partnerships provide the capital and operational expertise needed to break into new markets with speed and precision. Whether your goal is international expansion or targeting adjacent customer segments, PE firms offer the local insights and strategic direction required to make these moves successful. This ability to enter markets swiftly can give you a significant competitive advantage.

But growth isn’t just about entering new territories. PE funding also enables the operational upgrades necessary for scaling successfully. This might include hiring sales teams in new regions, tailoring your product for local markets, and setting up robust support systems to serve a diverse customer base. With a focus on achieving EBITDA margins above 40%, PE-backed companies can reinvest aggressively in growth without sacrificing profitability [11].

While market expansion is a key focus, PE partnerships also play a pivotal role in driving technological progress.

Advancing Innovation Through AI

AI is becoming a top priority for PE firms, with 54% identifying generative AI and agentic AI as their main investment focus for the coming year [15]. The potential of AI to enhance efficiency, improve customer experiences, and establish a competitive edge is immense.

With PE funding, companies can accelerate their AI initiatives far faster than organic growth would allow. This includes investing in predictive analytics to better understand customer needs, incorporating AI-driven personalization into products, and automating time-consuming workflows. While 77% of SaaS companies have already launched or announced generative AI offerings, only 15% are currently monetizing them effectively [11]. PE firms can help close this gap by providing the expertise and resources needed to turn AI investments into tangible results.

AI also delivers significant productivity boosts. Studies show that generative AI tools can speed up 47% of tasks, increasing call center agent productivity by 14% overall - and by 34% for less experienced agents [3]. For SaaS companies, AI can cut programming time by more than 50%, freeing up engineering teams to focus on innovation instead of maintenance [15]. However, realizing these benefits requires strong leadership from the CEO and a solid investment in clean, reliable data infrastructure. After all, AI is only as powerful as the data it relies on [7][13].

Practical Tips for Post-PE Success

Achieving success after partnering with a private equity (PE) firm means seeing them as more than just a financial backer. PE firms bring a wealth of experience with strategies like ongoing full-potential analysis, building tailored management teams, and maintaining a disciplined focus on execution [1]. Companies that leverage this expertise can set themselves up for consistent growth and a profitable exit.

Using PE Expertise to Your Advantage

PE firms excel at operational transformation, offering a structured approach to value creation. One key step is to collaborate with your PE partner on regular full-potential analyses. This involves identifying missed opportunities, uncovering hidden costs, and exploring bold actions that could improve results. Independent diligence teams often play a crucial role in this process [1].

Leadership alignment is another critical element. Each executive should own specific value drivers that align with your growth strategy. Interestingly, 71% of PE acquisitions over $1 billion involve a CEO change, with 38% of those changes happening within the first two years [1]. These changes aren't about instability - they're about ensuring the leadership team has the skills to execute the plan. If needed, be ready to bring in external talent for roles that require specialized expertise to meet ambitious goals.

Operational efficiency is key, and strategies like "clean-sheeting" can deliver significant results. By eliminating low-value tasks, centralizing operations, and streamlining organizational structures, companies can cut labor costs by 30% to 60% in just six months [1]. The focus should be on building lean, effective teams rather than simply increasing headcount.

Revenue quality is just as important as revenue growth. Work closely with your PE partner to identify and phase out unprofitable products or customers that drain resources. This approach shifts the focus from vanity metrics to cash flow, allowing your team to channel its energy into high-value opportunities [1].

Break your value-creation plan into actionable initiatives with clear targets, business cases, and execution timelines. Use a shared system to track progress, hold weekly reviews, and address underperformance swiftly [1]. CEOs should prioritize activities with the greatest impact rather than getting bogged down in routine meetings. This disciplined approach paves the way for a strong exit strategy.

Preparing for a Successful Exit

A successful exit isn’t just about hitting financial targets - it’s about showcasing a sustainable blend of cost reductions and growth strategies that inspire confidence [2]. Forecasting accuracy plays a huge role here. Reliable projections and a predictable business model can significantly boost investor confidence and even justify higher valuations [16].

To build early momentum, execute a 100-day digital operating plan with clear milestones and accountability [5]. This demonstrates to potential buyers that your technology infrastructure is ready to scale and support future growth.

If you've invested in AI, quantify its impact. Show how AI capabilities are driving measurable value and position them as a growth engine for the future. This can attract buyers and justify valuation premiums [4]. However, it’s worth noting that over 80% of AI programs fail, often due to poor alignment among leadership, low user adoption, or unclear success metrics [4]. Avoid these pitfalls by linking AI projects to specific business outcomes from the outset.

Throughout the exit preparation process, maintain open and transparent communication with your PE partner. Whether your goal is an IPO or an acquisition, aligning on the strategy ensures everyone is working toward maximizing returns for all stakeholders.

Conclusion: Making PE Work for Your Growth

Private equity doesn’t have to mean losing control or compromising your vision. When approached thoughtfully, it can act as a powerful catalyst for SaaS and AI companies looking to scale. The metrics speak for themselves - PE offers immense growth opportunities when leveraged effectively.

The journey starts long before the deal is signed. Strengthen your key SaaS metrics, build scalable operations, and determine whether growth capital or a buyout best aligns with your long-term goals. Partnering with the right PE firm isn’t just about funding - it’s about gaining access to their expertise in areas like operational improvements, market expansion, and AI-driven advancements. These firms aren’t merely financial backers; they are strategic allies with proven methods for creating value. This alignment paves the way for precise execution.

Execution is where success takes shape. Break your growth strategy into actionable steps, monitor progress closely, and ensure your team stays accountable to clear, measurable goals. Leadership changes and restructuring shouldn’t be viewed as setbacks but as deliberate moves to enhance your company’s value. Nearly three out of four buyouts in North America now incorporate buy-and-build strategies, unlocking opportunities for growth through targeted acquisitions [17].

Companies that thrive after PE investment are those that strike a balance between discipline and innovation. These businesses cut unprofitable revenue streams, double down on AI capabilities that deliver tangible results, and maintain open, consistent communication with their PE partners. Whether your future involves an IPO or acquisition, the foundation you build during your PE partnership will ultimately shape your success.

Private equity isn’t about giving up control - it’s about gaining the tools, expertise, and support to achieve what might have seemed out of reach on your own. With careful preparation and a clear focus, PE can become the driving force that helps your SaaS or AI company reach its full potential.

FAQs

How can SaaS and AI companies attract private equity investment?

To draw private equity (PE) investment, SaaS and AI companies need to focus on showcasing consistent and scalable revenue growth. PE firms often look for companies generating between $20 million and $50 million in annual recurring revenue (ARR) with steady growth patterns. This minimizes risk and makes the business a more appealing acquisition target. Sharing metrics like customer churn rates, unit economics, and pipeline health can help demonstrate stability and potential for future growth.

Being operationally prepared is equally important. Companies should optimize their tech stacks, automate financial workflows, and use AI tools to boost efficiency and innovation. Highlighting strategies for improving margins - such as adopting cloud-native infrastructure or leveraging AI-driven pricing models - can indicate strong growth prospects. Additionally, maintaining transparent governance and disciplined financial practices aligns with PE firms' focus on long-term value creation, making your company stand out as a compelling investment option.

What’s the difference between growth capital and leveraged buyouts in private equity?

When it comes to private equity strategies, growth capital and leveraged buyouts (LBOs) serve very different purposes and operate under distinct frameworks.

Growth capital involves making a minority investment in a company that's already generating revenue. These businesses often need funding to scale their operations, enter new markets, or develop new products. A key feature of this strategy is that these companies typically carry little to no debt, and the investor doesn't aim for full ownership or control. It's about fueling growth without drastically altering the company's structure or ownership.

On the other hand, an LBO is all about taking control. Here, private equity firms acquire a majority stake in a mature, cash-generating business. What sets LBOs apart is the heavy use of debt financing, which can account for 60–80% of the purchase price. The strategy revolves around improving the company’s performance, paying down the debt, and leveraging financial gains to maximize returns.

In essence, growth capital is about supporting expansion with minimal disruption, while LBOs focus on gaining control, restructuring, and using leverage to drive higher returns.

How can AI help SaaS companies scale and attract private equity investment?

AI has the power to turn a SaaS business into a fast-growing, scalable platform that grabs the attention of private equity (PE) investors. By automating everyday tasks - like coding, testing, and customer support - AI not only cuts operational costs but also speeds up the development of new features. On top of that, AI-powered analytics deliver real-time insights into user behavior, churn risks, and upsell opportunities, helping businesses craft smarter, revenue-boosting strategies.

For PE firms, these AI-driven efficiencies translate into higher profitability and quicker scalability. AI tools simplify due diligence, shorten deal timelines, and enhance portfolio management by offering clear, actionable insights into metrics like infrastructure costs and revenue per user. SaaS companies that use AI to streamline onboarding, tailor user experiences, and anticipate churn can achieve impressive growth in annual recurring revenue (ARR) while keeping operations lean - making them especially appealing to PE investors.