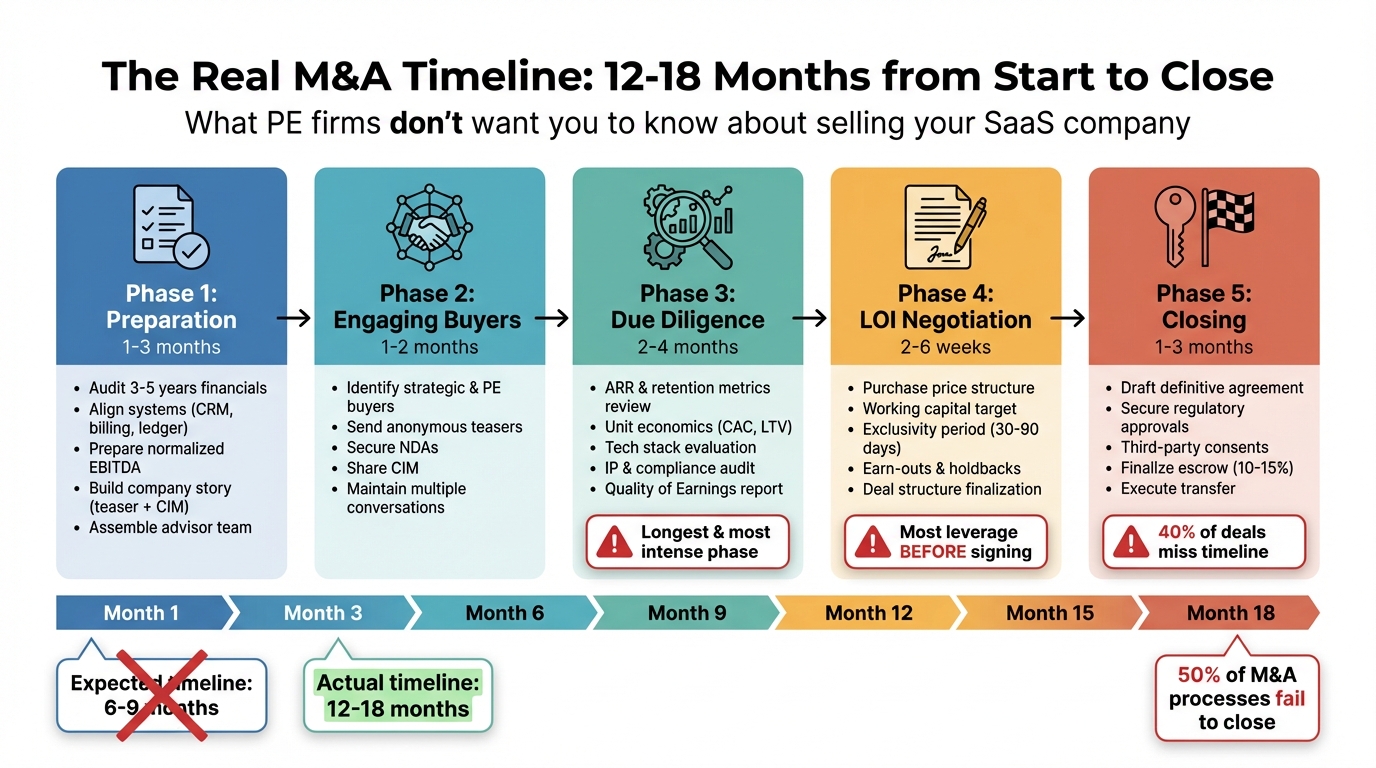

Selling your SaaS company? Be prepared for a process that often takes 12–18 months, not the 6–9 months you might expect. Private equity (PE) firms use extended timelines to gain leverage, knowing seller fatigue can lead to lower valuations. Here’s what you need to know:

- Preparation Phase (1–3 months): Audit financials, align systems, and craft a strong company story. Key metrics like ARR, CAC, and churn will be scrutinized.

- Engaging Buyers (1–2 months): Build interest while protecting sensitive data. Use NDAs and keep multiple buyers in play to maintain leverage.

- Due Diligence (2–4 months): Buyers will analyze financials, customer retention, and tech infrastructure. Be ready to address red flags like inconsistent KPIs or IP gaps.

- Negotiation & LOI (2–6 weeks): The LOI sets terms like price, exclusivity, and earn-outs. Negotiate carefully - post-LOI flexibility is limited.

- Closing (1–3 months): Finalize agreements, secure approvals, and meet closing conditions. Delays are common, so maintain cash reserves and plan for contingencies.

Key Insight: Private equity firms often use tactics like earn-outs, escrow holdbacks, and delays to pressure sellers. Preparation, clear milestones, and a strong financial foundation can help you stay in control. Expect the unexpected and plan ahead to maximize your outcome.

Complete SaaS M&A Timeline: 5 Phases from Preparation to Closing (12-18 Months)

M&A Sale Process and Timeline

Phase 1: Preparing for Sale (1-3 Months)

Before reaching out to potential buyers, it’s crucial to get your house in order. This stage, which usually takes 1 to 3 months [6], is where founders either lay the groundwork for a smooth sale or set themselves up for challenges during due diligence. The main objective here is to identify and resolve any issues before buyers have the chance to uncover them.

Conducting a Pre-Sale Audit

Start by gathering at least 3–5 years of financial records. This includes balance sheets, income statements, cash flow statements, tax returns, and payroll documentation [6][10]. For SaaS businesses, buyers will pay close attention to both your revenue and its consistency. They’ll dive into metrics such as Annual Recurring Revenue (ARR) versus non-recurring revenue, usage patterns, and whether your billing system, CRM, and general ledger are properly aligned [9]. Misalignments in these systems can raise red flags about operational control and potential risks.

Retention data is another critical piece. Be ready to provide trends for Gross Dollar Retention (GDR) and Net Dollar Retention (NDR), broken down by customer segments and product offerings [9]. Buyers will also want to see cohort churn analysis and key unit economics, like Customer Acquisition Cost (CAC) payback periods and LTV/CAC ratios [9]. A good example of the importance of due diligence is Verizon’s 2017 acquisition of Yahoo. After uncovering data breaches, Verizon renegotiated the deal, reducing the sale price from $4.83 billion to $4.48 billion - a $350 million difference [10].

Don’t forget to review your cap table. Tools like Carta can help you audit your ownership records and confirm that all equity issuances are backed by valid 409A valuations [8]. Additionally, check if your stock qualifies for Qualified Small Business Stock (QSBS) tax benefits, which could exempt up to 100% of federal capital gains tax [8].

"Due diligence is not a closing-stage formality. It is one of the most influential drivers of valuation, deal certainty, and overall transaction success." – Chad Harding, Managing Partner, Peak Tech [9]

Lastly, prepare a normalized EBITDA report. This report adjusts for non-recurring expenses and owner-specific perks, providing a clearer picture of your company’s earning power [6]. Many founders also hire an independent third party to create a Quality of Earnings (QofE) report. This report breaks down revenue by product, geography, and customer mix, offering buyers an in-depth look at your financial health [1].

Building Your Company Story

Once your financials are in order, it’s time to craft a compelling narrative that showcases your company’s strengths. A strong story can make your business stand out. Start with a one-page teaser - an anonymous profile designed to spark interest without revealing your identity [1][6]. This teaser should include a brief description of your business, an overview of your products, and some high-level financial highlights. Its purpose is to attract buyers and motivate them to sign a Non-Disclosure Agreement (NDA).

After securing an NDA, you can share a detailed Confidential Information Memorandum (CIM). This document, often exceeding 50 pages, is your main storytelling tool. It outlines your investment thesis, market position, revenue profile, team, and financial history [1][6][8][13].

"The CIM is a comprehensive document that tells the story of your business, its financial performance, and its growth opportunities." – SOVDOC [6]

Focus on explaining why your business is valuable, not just presenting the numbers. The teaser should highlight the most compelling, non-identifiable parts of your CIM, but never share the full CIM - or any sensitive information - without a signed NDA [12].

Selecting Advisors and Assembling Your Team

With your audit complete and your narrative polished, it’s time to bring in the right experts. M&A advisors, legal counsel, and financial consultants play a key role in navigating the complexities of a sale [6]. A skilled M&A advisor can help you refine your financials, craft marketing materials, identify potential buyers, and keep competition alive throughout the process. Their expertise in buyer behavior ensures your company is positioned strategically to maximize value.

Legal counsel is equally important. They’ll review your contracts for any clauses - like "change of control" or assignability provisions - that could complicate a stock or asset sale [8][9]. Financial consultants, on the other hand, can model exit scenarios and estimate payouts for different shareholder classes based on various sale values and debt levels [8].

If your management team isn’t already strong, consider hiring key executives like a CFO, CTO, or VP of Sales 12 to 24 months before your exit [11][9]. Buyers prefer businesses that can scale without heavy involvement from the founder. A founder-dependent operation can limit scalability and reduce the company’s appeal [11].

This preparation phase is essential for a successful transaction. By organizing your financials, crafting a compelling story, and assembling the right team, you’ll set yourself up to avoid costly delays and maximize your sale’s potential.

Phase 2: Engaging Buyers and Signing NDAs (1-2 Months)

Once your groundwork is solid, it’s time to start engaging with potential buyers while keeping your company’s sensitive information secure. This phase, typically lasting 1 to 2 months, is all about striking the right balance - building interest among buyers while protecting your confidential details. The ultimate goal? Create competitive tension by involving multiple buyers without revealing too much too soon or to the wrong parties.

Identifying the Right Buyers

Not all buyers are the same, and choosing the right ones can significantly impact both the sale price and what happens after the deal closes. Broadly, buyers fall into two categories: strategic acquirers and financial buyers like private equity (PE) firms. Strategic buyers typically include:

- Horizontal buyers: Competitors in your industry.

- Vertical buyers: Companies at other points in your supply chain.

- Concentric buyers: Firms offering different products but targeting similar customers [8].

Strategic acquirers often look for synergies and aim to integrate your company into their long-term plans. On the other hand, PE firms tend to focus on "roll-ups" or "bolt-ons", where they acquire multiple businesses in the same space to improve performance and prepare for a future exit [8].

The most successful exits often result from long-standing relationships built well before the formal sale process begins [14][4]. Instead of relying solely on corporate M&A teams, reach out to specific executives who deal directly with the problem your startup solves. These individuals, often referred to as "champions", are more likely to advocate for your acquisition within their organization. Key buying signals to watch for include executive-level meeting requests (especially with the CEO), detailed questions about your product’s value, or inquiries into your company’s cap table or revenue structure [14].

"One of the most important things for founders to understand is that you are selling something to an executive, who has a problem. And as the startup CEO - you are that solution." – Daniel Debow, VP of Product, Shopify [14]

Keeping multiple conversations active with potential acquirers is critical. This prevents any one buyer from gaining too much leverage or attempting to renegotiate terms later. By maintaining competitive dynamics, you encourage buyers to put forward their best offers [14][4].

Managing the Outreach Process

Once you’ve identified potential buyers, the next step is to approach them carefully while maintaining confidentiality. Start with an anonymous teaser - this brief, high-level document gives buyers a sense of your business without revealing your identity. It’s a low-risk way to gauge interest while avoiding leaks that could harm employee morale, customer trust, or your negotiating position [16].

Handle all communications securely. Use encrypted virtual data rooms and keep your outreach team small to minimize risks [16]. Remember, corporate buyers often treat M&A discussions like a job interview - they’re evaluating whether you’ll be a good fit after the acquisition. Unlike venture capitalists, who may tolerate unconventional behavior, corporate buyers are quick to walk away from founders who seem difficult to work with [14]. Many deals also require founders to stay with the acquiring company for at least 18 months [14].

Timing matters, especially in fast-moving markets. Acquisitions often happen in waves, and once major players make their moves, others may pivot to building rather than buying [4].

"During downturns, think of M&A as a game of musical chairs. The companies that test the market earlier in the cycle... tend to see better outcomes." – Vishal Lugani, General Partner, Acrew Capital [4]

Securing NDAs and Sharing Initial Information

When a buyer shows interest, the next step is securing a Non-Disclosure Agreement (NDA) before revealing your identity or sharing any detailed information [1][15]. A well-crafted NDA safeguards your proprietary data, talent, and customer relationships [1].

"A correctly drafted NDA can be viewed as a very helpful assistant, aiding the parties to trust each other, thus making the process more relaxed and easier to navigate." – Maria Lilliestierna, Partner, Deloitte [17]

The NDA should clearly define what constitutes confidential information, such as pricing, forecasts, customer lists, and marketing strategies [17]. It should also include non-solicitation clauses to prevent buyers from poaching your employees or customers during the evaluation process [1]. Typically, confidentiality obligations last 2 to 3 years after discussions end if no deal is reached [17]. The agreement should also outline remedies for breaches, like penalty fees.

If the buyer is a competitor, consider adding a Clean Team Agreement (CTA). This limits access to sensitive information - like margins, R&D, or customer lists - to a small group of non-operational individuals, such as external advisors or legal staff [18]. In regions like the EU and Germany, sharing competitively sensitive information unlawfully during due diligence can result in fines of up to 10% of the company’s total turnover from the previous year [18].

Once the NDA is signed, you can share your Confidential Information Memorandum (CIM), which provides an in-depth look at your business. Include a "return or destroy" clause in the NDA, requiring buyers to either return or confirm the destruction of all sensitive data if the deal doesn’t go through [18].

Phase 3: Due Diligence and Buyer Evaluation (2-4 Months)

Once the NDA is signed and your CIM is shared, the due diligence process begins. This phase, lasting 2 to 4 months, is the most intense part of the M&A journey. During this time, buyers dig deep into every aspect of your business - financials, operations, and even your technology stack - to uncover risks and ensure the investment is sound. For SaaS and AI companies, this stage can be particularly challenging and pivotal for the deal's success.

Key Metrics for SaaS Due Diligence

Buyers don't just look at total revenue - they analyze its breakdown. Metrics like Annual Recurring Revenue (ARR) are crucial, as recurring income is more predictable and often commands higher valuation multiples compared to one-time fees [9][19]. Expect detailed questions about how you recognize revenue and whether your accounting follows GAAP standards.

Retention metrics are another major focus. Buyers assess Gross Dollar Retention (GDR) and Net Dollar Retention (NDR) by customer cohorts, segments, and product lines [9]. Public SaaS companies with NDR exceeding 120% achieved a median revenue multiple of 11.7x in 2024, while those with NDR below 90% saw multiples drop to just 1.2x [20].

"The data is clear: working to get your Annual NRR at least above 100% is absolutely essential before a sale process commences." – Ryan Allis, CEO, SaasRise [20]

Buyers also evaluate unit economics to ensure your business scales efficiently. Metrics like Customer Acquisition Cost (CAC) payback periods, Lifetime Value (LTV) to CAC ratios, and contribution margins are scrutinized [9][19]. Many private equity firms apply the "Rule of 40" - the sum of your growth rate and EBITDA margin should equal at least 40% - as a key investment filter [20].

Your technology stack undergoes rigorous evaluation, too. Buyers assess scalability, technical debt, and reliance on third-party cloud providers like AWS or Azure [19]. They verify ownership of source code, compliance with open-source software licenses, and ensure intellectual property (IP) is legally assigned to your company [9][19]. For SaaS companies, IP often represents the most critical asset in differentiating from competitors [19].

"IP is the most valuable asset for SaaS and tech companies. Ensuring proper ownership and protection of intellectual property is essential to avoid legal and operational risks post-acquisition." – Meridian Trust [19]

Cybersecurity and compliance are also under the microscope. Buyers review past breaches, penetration test results, and adherence to standards like SOC 2, ISO 27001, GDPR, and CCPA [19]. Any gaps in data privacy practices can delay the process, especially with stricter global regulations.

Another area of concern is customer concentration. If a few clients account for most of your revenue, buyers will evaluate the risk of losing key contracts [19]. They'll also examine contract assignability clauses and renewal histories to gauge the stability of your customer base.

To verify the "true quality" of your business, buyers often commission Quality of Earnings (QofE) reports. These reports break down revenue by product, geography, and customer mix while identifying any questionable adjustments in your financials [1]. Unsupported adjustments can erode trust and give buyers leverage to negotiate a lower valuation [9].

Understanding Private Equity Red Flags

Private equity (PE) firms take a meticulous approach during due diligence, often looking for leverage to influence negotiations. Once you sign an Exclusivity Agreement, you're restricted from engaging with other bidders for 30 to 60 days [1][15]. This lack of competition allows PE firms to control the pace of the process.

Operational inconsistencies are a major red flag. If key performance indicators (KPIs) differ across dashboards or your CRM and billing systems don't align with your general ledger, buyers may expand their diligence scope [9]. Such issues signal a lack of operational maturity and can slow down the process.

"When information is difficult to verify, buyers slow down, expand their diligence scope, and often reassess their level of conviction." – Chad Harding, Managing Director, Peak Technology Partners [9]

Technical debt and scalability challenges are often used as negotiation tools. If buyers uncover significant architectural weaknesses or missing IP documentation, they may demand a price reduction - sometimes late in the process, after you've invested significant time and resources [2][9]. In extreme cases, unresolved IP issues can even derail the deal entirely [9].

Since 2023, rising interest rates have made buyers more cautious, often extending due diligence timelines [2]. In 2024, the median revenue multiple for private SaaS firms was 4.1x, while the median EBITDA multiple reached 19.2x [20]. Knowing these benchmarks can help you differentiate between valid concerns and mere negotiation tactics.

Addressing potential red flags early can help ensure a smoother due diligence process.

Avoiding Delays

Preparation is your best defense against delays. Build on your pre-sale audit by aligning your financials and IP documentation well in advance. Establish a single source of truth for all financial statements and SaaS metrics, ensuring they are GAAP-compliant and internally consistent [9]. Reconciling systems like your CRM, billing platform, and general ledger early can prevent discrepancies that often trigger delays [9].

Organize your Virtual Data Room (VDR) using standard frameworks that cover financial, operational, technology, legal, HR, and tax documents [1][9]. A well-structured VDR signals professionalism and keeps the process moving. Include renewal histories and pipeline-to-forecast performance data to demonstrate operational maturity [9].

Proactively address IP gaps. Confirm that all employee and contractor agreements include non-compete and IP assignment clauses [19]. If any documentation is missing, resolve it immediately - don’t assume buyers won’t notice.

"Due diligence is not a closing-stage formality. It is one of the most influential drivers of valuation, deal certainty, and overall transaction success." – Chad Harding, Managing Director, Peak Technology Partners [9]

Conducting sell-side diligence 12 to 24 months before your sale can give you ample time to identify and fix issues in areas like IP, contracts, or financial reporting [9]. Quick, accurate responses to buyer inquiries keep them engaged and prevent delays caused by "information gaps" [9].

For SaaS businesses, aim for a monthly churn rate below 3% for SMB-focused companies and under 1% for enterprise-focused ones before entering the sale process [20]. Improving retention metrics can significantly impact valuation multiples, making this a key area to optimize beforehand.

Phase 4: Negotiation and Signing the LOI (2-6 Weeks)

As due diligence progresses, the buyer typically presents a Letter of Intent (LOI). This document outlines the proposed deal terms and lays the groundwork for the final agreement. This phase, lasting about 2–6 weeks, is pivotal. Once signed - especially if it includes an exclusivity clause - your ability to negotiate significantly diminishes.

"The LOI is where a seller has the most leverage. Once the LOI is signed, a seller is locked in for a significant period and will have more difficulty taking tough stances." – Bloomberg Law [23]

Research indicates that a written commitment through an LOI increases the likelihood of completing the transaction by 65%. Moreover, the way the LOI is negotiated can predict 73% of post-closing integration success [21]. This stage bridges the gap between due diligence and the deal's finalization.

Key LOI Terms to Negotiate

The LOI serves to solidify the terms agreed upon after due diligence, ensuring clarity before moving into final negotiations.

-

Purchase Price and Payment Structure

The purchase price is a focal point. Buyers often propose a range (e.g., $10 million to $12 million), but they nearly always settle on the lower end after due diligence [24]. Specify the payment method - whether it's cash at closing, seller notes, rollover equity, or earn-outs [21]. For SaaS companies, where recurring revenue is critical, valuations typically range from 3 to 7x ARR, depending on growth rates [21]. -

Working Capital Target

Define the working capital - accounts receivable plus inventory minus accounts payable - that must be delivered at closing [22]. If the actual amount falls short, the purchase price is reduced dollar-for-dollar. Avoid vague terms like "customary working capital." Instead, insist on a precise dollar amount or a formula based on your historical operations [26]. -

Exclusivity (No-Shop Clause)

Exclusivity is one of the most binding terms in the LOI. It prevents you from negotiating with other buyers for a set period, typically 30 to 90 days [21]. Limit this period to 30 days, tied to buyer milestones like completing a Quality of Earnings report by a specific date [21].

"Time kills deals. Buyers obviously have an incentive to give themselves as much time as possible so they can do their diligence and find issues." – Justin Yi, Partner, Orrick [28]

-

Earn-Outs and Holdbacks

Clearly define the metrics for any earn-outs or holdbacks, such as revenue or EBITDA targets, along with the amount and duration of escrowed funds [23][24]. Include provisions for source code escrow, intellectual property assignments, and warranties for ARR and churn [21]. -

Deal Structure and Restrictive Covenants

Decide whether the deal will be structured as an asset purchase or a stock purchase, as this affects tax and liability considerations [22][25]. For example, in healthcare M&A, 70% of deals are structured as asset purchases to avoid legacy liabilities [26]. Be specific about the scope, geography, and duration of restrictive covenants like non-compete or non-solicitation agreements [25][26].

Avoiding LOI Traps

Once the core terms are outlined, the focus shifts to avoiding common pitfalls that can weaken your position.

Buyers, especially private equity firms, are skilled negotiators. A frequent tactic is the vagueness trap - using ambiguous terms like "customary working capital" or "standard non-compete" to leave room for renegotiation later. Insist on clearly defined dollar amounts, formulas, or specific restrictions, such as exact mileage for geographic limits or precise durations for non-compete clauses [21][26].

"The moment you sign an LOI that contains such an exclusivity clause, your negotiating position disintegrates." – Jacob Orosz, President, Morgan & Westfield [24]

Watch out for "subject to diligence" qualifiers, which can allow buyers to reduce the valuation post-signing. Instead, aim for closing conditions limited to essential approvals and material contracts [27].

Another red flag is earn-out manipulation. Some buyers structure earn-outs with unrealistic targets or metrics they can control after closing [29]. Push for more upfront cash or achievable benchmarks that the buyer cannot influence. Before agreeing to exclusivity, request proof of committed capital or third-party financing to confirm the buyer's ability to close the deal [27].

Lastly, avoid the "time as leverage" trap. Buyers may drag out negotiations to increase pressure on the seller. Set firm deadlines and milestones for due diligence to keep the process moving. A well-negotiated LOI can save an average of $47,000 in abandoned due diligence costs by identifying deal-breakers early [21].

| Provision | Traditional Trap | Strategic Avoidance |

|---|---|---|

| Exclusivity | Flat 60–90 days | Tiered: 30 days free, then tied to milestones [21] |

| Due Diligence | Broad, open-ended access | Staged with clear milestones [21] |

| Working Capital | "Customary" amount | Defined formula or specific dollar target [26] |

"An LOI is not merely a term sheet - it is a signaling document that reflects the buyer's sophistication, deal readiness, and respect for the seller's priorities." – Monica Kwok, Associate, Goodwin Law [27]

Keep in mind that while business terms like price are usually non-binding to allow for due diligence adjustments, procedural terms like exclusivity, confidentiality, and governing law are almost always legally binding [22][24][26]. A well-structured LOI increases the likelihood of closing the deal to 87%, with an average closing time of 23 days [21].

sbb-itb-9cd970b

Phase 5: Closing the Deal (1-3 Months)

Once the Letter of Intent (LOI) is signed, the transaction enters its most delicate stage. The closing phase is where many M&A deals unravel, with more agreements falling apart here than at any other step in the process [30]. For middle-market transactions, this phase generally lasts two to three months. However, delays are common - 40% of deals miss their original timelines, with most delays stretching beyond three months [30][31].

"More deals fall apart in M&A closing process than at any other point." – Joe Anto, Managing Director, PCE [30]

During this phase, the LOI evolves into a binding agreement. The definitive agreement is finalized, closing conditions are met, and ownership is officially transferred. This period involves securing buyer financing, obtaining regulatory approvals, and executing numerous ancillary documents. Delays can increase risks, as market conditions may shift and unforeseen challenges can arise.

Drafting the Definitive Agreement

The definitive agreement - whether a Stock Purchase Agreement (SPA) or an Asset Purchase Agreement (APA) - serves as the cornerstone of the transaction. It spells out everything from the purchase price structure to post-closing obligations [33][1].

The purchase price mechanics need to be crystal clear. The agreement should outline the breakdown: how much is paid in cash at closing, the portion held in escrow, any equity rollovers, and the calculation of contingent payments like earn-outs [31][1].

Representations and warranties (R&W) provide assurances about the business's condition. These should align with findings from due diligence, and interim disclosures can help bridge the gap between signing and closing [30]. Use disclosure schedules to address any issues uncovered during due diligence, reducing the risk of breach claims later.

Indemnification and escrow terms are also critical. Sellers should negotiate for smaller escrow amounts (typically 10–15% of the purchase price), shorter retention periods (12–18 months), and clear limits on indemnity claims through defined baskets and caps [30][31]. For instance, the agreement might include a basket threshold for indemnification claims and cap your total exposure.

"An M&A attorney will earn every penny of their fee – they've been through the process countless times and will help eliminate surprises." – Jacob Orosz, President, Morgan & Westfield [31]

It’s also important to include "drop-dead" dates - specific termination triggers if conditions like financing or regulatory approvals are not met. Additionally, ensure the agreement includes procedures for resolving disputes over working capital adjustments or indemnity claims without resorting to lengthy litigation [30].

| Component | Key Elements for Seller Protection | Risk Mitigation |

|---|---|---|

| Purchase Agreement | Finalize R&W, indemnities, and termination triggers | Tie carve-outs to due diligence; use interim disclosures [30] |

| Escrows/Holdbacks | Define release schedules and narrow claim windows | Use shorter timeframes; set clear dispute resolution [30] |

| Adjustments | Document working capital and earn-out formulas | Make adjustments formula-based, not subjective [30] |

| Third-Party Consents | Map all contracts with change-of-control triggers | Consider incentives or collateral to secure waivers [30] |

Managing Closing Conditions

Closing conditions are the final hurdles to clear before the deal is completed. These commonly include securing regulatory approvals (such as under the Hart-Scott-Rodino Act), obtaining third-party consents from landlords or key customers, and executing required non-compete agreements [33][5][31]. For all-cash tender offers, the Hart-Scott-Rodino (HSR) Act generally imposes a 15-day waiting period, though a second request for information can extend this timeline [32].

Third-party consents should be arranged 30 to 60 days before the anticipated closing date. Contracts with change-of-control clauses often allow landlords, franchisors, or key customers to renegotiate terms or fees, potentially causing delays [30]. These conditions, once satisfied, ensure a smoother transition of ownership.

For example, in December 2025, Paramount Skydance amended its $108.4 billion bid for Warner Bros. Discovery to include an "irrevocable personal guarantee" of $40.4 billion in equity financing from Oracle founder Larry Ellison. This addressed prior concerns about financing certainty after the bid had been criticized as "illusory" [4].

To streamline the process, appoint a "deal captain" to coordinate legal, tax, and operational advisors [30]. Conducting a dry run of the closing process can help catch potential issues, such as missing signatures or mismatched wire instructions. Throughout this phase, maintain "business as usual" - avoid major investments, hiring key personnel, or altering pricing models without the buyer's consent. Additionally, verify the buyer’s financing early by coordinating lender diligence to avoid last-minute complications [31][30].

| Component | Key Closing Activities | Common Risk/Delay Factor |

|---|---|---|

| Third-Party Consents | Secure approvals from landlords, customers, and vendors | Holdouts or exercise of termination rights [30] |

| Financing | Finalize lender agreements and confirm funding | Financing fall-through or changing interest rates [30] |

| Regulatory | Complete antitrust filings (HSR) and secure approvals | Second requests or unexpected regulatory demands [30][32] |

| Legal Mechanics | Finalize Disclosure Schedules and Bill of Sale | Missing signatures or mismatched wiring details [30][31] |

Finalizing the Sale

With due diligence complete and the LOI firmly negotiated, the final stage is executing all agreed terms and transferring ownership. On closing day, the purchase agreement, Bill of Sale, IP assignments, Disclosure Schedules, and any necessary Transition Services Agreement (TSA) are signed [31].

Ensure that wire transfers are confirmed before signing [31]. Schedule the closing during business hours - ideally in the morning - to allow same-day wire processing. An escrow firm can handle prorations for utilities, taxes, or lease payments, and hold a portion of the purchase price (typically 10–15%) for 12–18 months to cover indemnification claims.

If seller financing is part of the deal, insist on a Promissory Note personally guaranteed by the buyer [31]. This safeguard is essential in case the business struggles post-sale. Clearly define the scope and compensation for any post-sale support in the TSA to avoid unplanned, unpaid commitments.

After closing, expect working capital adjustments within 60–90 days. If the actual working capital falls short of the agreed target, the purchase price will be adjusted downward accordingly.

PE Tactics That Can Impact Your Timeline

Private equity (PE) firms often employ strategies to stretch the M&A timeline, giving them the upper hand in negotiations. Over the years, the median time from signing to closing has grown to about 6.4 months - a 25% increase compared to two decades ago [34][35]. Even more striking, between 2023 and 2024, the time between signing and closing PE deals jumped by 64% [3].

Understanding these tactics early can help level the playing field. PE firms have a distinct advantage: they’ve navigated this process countless times, while most founders are selling their business for the first time. Here’s how these firms use financial tools and delays to tip the scales in their favor - and what you can do to push back.

Aggressive Earn-Outs and R&W Insurance

One common tactic involves contingent payments and adjustments through insurance. Earn-outs, which typically account for 10–20% of the purchase price, are frequently used to bridge valuation gaps [36]. While they may seem reasonable at first glance, earn-outs shift the risk of future performance onto the seller. These are often tied to vague or subjective milestones, making them difficult to achieve.

To protect yourself, insist on clear, measurable milestones tied to factors you can directly influence, such as revenue from existing customers or specific product development goals. Avoid provisions tied to ambiguous metrics, and ensure that accounting methods used to calculate performance align with those established during due diligence. Additionally, include dispute resolution mechanisms to avoid costly litigation.

Representations and Warranties (R&W) Insurance is another tool PE firms use to shift risk. While it’s designed to protect both parties, buyers often leverage it to justify more aggressive indemnification terms. Typically, 10–20% of the purchase price is held in escrow for 12–24 months to cover potential warranty breaches [36]. When R&W insurance is involved, buyers may push for even broader representations, knowing the insurance will cover their downside while you’re still exposed to escrow holdbacks.

If R&W insurance is part of the deal, negotiate for lower escrow amounts and shorter retention periods. The insurance should replace escrow, not add to it. Make sure the coverage limits match the escrow amount to minimize your exposure.

| PE Tactic | Impact on Valuation | Seller Counter-Measure |

|---|---|---|

| Earn-out (10–20% of price) | Payment tied to post-close performance you can’t fully control | Demand clear, measurable milestones; avoid vague triggers |

| Escrow/Holdback (10–20%) | Delays in cash release for 12–24 months | Push for shorter periods and lower percentages; ensure defined release conditions |

| R&W Insurance | Broader representations with insurance covering buyer risks | Use insurance to replace escrow; cap your liability |

Using Delays as Leverage

Beyond financial adjustments, PE firms often rely on delays to gain leverage. They know that the longer a deal drags on, the more eager sellers become to close. By slowing negotiations, expanding due diligence, or introducing last-minute complications, they can exploit your growing frustration.

"Private equity firms love to drag out negotiations. They assume prolonged processes increase seller desperation." – MergersAndAcquisitions.net [29]

A common tactic is the "discount everything" approach. After months of negotiations, buyers suddenly highlight flaws - like shifting market conditions, higher customer concentration, or concerning churn rates - to justify a lower valuation or stricter terms. The timing is deliberate, banking on your deal fatigue to force concessions.

When faced with these "risk concerns", demand concrete financial data to back up their claims. Ask why their analysis differs from third-party reports, such as the Quality of Earnings (QofE) report they commissioned. If they can’t provide solid evidence, it’s likely a negotiating ploy [29].

Another delay tactic involves expanding the diligence scope. Sponsors may stretch the timeline by weeks or months under the pretense of needing "greater certainty" [3]. To counter this, set firm deadlines for each diligence phase in the Letter of Intent (LOI). If they miss these milestones, reserve the right to re-engage other bidders or walk away. Similarly, watch for last-minute changes to deal terms. PE firms often introduce new provisions just before signing, hoping you’ll accept them due to fatigue. If this happens, respond with equivalent demands to show you’re willing to push back.

PE firms also employ a "divide and conquer" strategy, offering different terms to shareholders to create internal conflict [29]. To avoid this, ensure all stakeholders are aligned on acceptable deal terms before negotiations begin.

Regulatory reviews provide another opportunity for delays. From 2017 to 2022, the length of these reviews in the U.S. and Europe increased by 50% [34]. For instance, Broadcom’s $61 billion acquisition of VMware faced intense regulatory scrutiny in China, the EU, and the U.S., delaying the deal by 18 months before closing in November 2023 [34]. While some regulatory delays are unavoidable, buyers may use them as an excuse to slow the process and apply pressure.

To maintain leverage, engage competing buyers, especially strategic ones who may act faster and offer better terms. This creates urgency and prevents the PE firm from assuming they’re your only option. Set clear deadlines for financing confirmation, and only grant exclusivity after receiving a strong LOI with minimal conditions.

Case Studies: Real SaaS M&A Timelines

Case studies offer a closer look at how M&A timelines play out in real-world scenarios, shedding light on the challenges and strategies involved. Examining deals from 2025 reveals how timing impacts outcomes and exposes the tactics private equity firms often use.

In May 2025, Salesforce announced its acquisition of Informatica for about $8 billion. This deal had a complex backstory: initial negotiations began in 2024 but were paused. Talks resumed in April 2025 after private equity firms, including Thoma Bravo, showed interest in Informatica. Salesforce's acquisition, aimed at strengthening its Agentforce AI platform, is expected to close in early fiscal 2026 - roughly 8 to 10 months after the announcement. Marc Benioff, Salesforce’s CEO, emphasized the strategic importance of the deal:

"Salesforce and Informatica will create the most complete, agent-ready data platform in the industry" [38].

This case demonstrates how competitive pressure can accelerate timelines. Another major deal highlights how strategic buyers often navigate these processes differently.

Palo Alto Networks’ $25.1 billion acquisition of CyberArk in 2025 is a prime example of how strategic buyers can complete transactions faster than private equity firms. The deal was timed to establish a comprehensive security platform for AI, reflecting the growing trend of tech consolidations driven by integrated AI capabilities [37].

On the other hand, larger deals often face significant delays. The $55 billion leveraged buyout of Electronic Arts by a consortium led by Silver Lake Group, Saudi Arabia's Public Investment Fund, and Affinity Partners stands as the largest leveraged buyout ever. However, deals of this scale come with extended financing and regulatory hurdles, often stretching timelines to 12–18 months or more. For founders, this underscores a critical point: the bigger the deal, the longer the process and the higher the likelihood of renegotiations.

These examples underscore the unpredictable nature of SaaS M&A timelines. In 2025, around 40% of deals failed to close within the initially projected timeline [39], and 16% took over a year from signing to closing [35]. Founders should anticipate delays and remain prepared to adapt while maintaining leverage throughout the process.

Tools and Methods to Control the Process

Successfully managing the M&A timeline starts with having the right systems in place before approaching potential buyers. It's worth noting that about 50% of typical M&A sales processes fail to result in a successful exit [42]. To improve your odds, you'll need tools and frameworks that not only streamline due diligence but also transform your exit strategy into a clear, actionable plan.

Using AgileGrowthLabs for Exit Preparation

One way to take control of your M&A timeline is by using frameworks designed to enhance exit readiness. AgileGrowthLabs offers a 3-Step Growth & Exit Engine™, specifically tailored for SaaS and AI businesses. This framework focuses on three key areas: driving growth through AI-powered systems, improving valuations by addressing margin issues, and maintaining "exit-readiness" even if you're not actively pursuing a sale [40]. Companies adopting this approach have reported valuation increases of up to 5× within just 90 days [40].

The platform also includes an Integrated Due Diligence Framework that addresses six critical pillars: Commercial, Financial, Operational, Technology, Legal/Regulatory, and ESG. It’s designed to work with SaaS-specific metrics like ARR, MRR, CAC, LTV, and churn [41]. By identifying and addressing potential red flags early, founders can avoid surprises during due diligence. On average, this approach improves SaaS metrics by 40% within a year and boosts enterprise value by 25% or more within 24 months [41].

AgileGrowthLabs also equips you with advanced AI tools and analytics, such as a SaaS Benchmarking Database, which compares your performance with over 1,000 industry peers. Additional features include real-time dashboards for tracking customer health and revenue forecasts, along with automated financial analysis tools that flag anomalies [41]. These tools can cut the typical due diligence timeline to 8–10 weeks, compared to the usual 2–4 months [41].

Another effective strategy offered by AgileGrowthLabs is the Two-Stage Exit Method. This involves a 6–18 month "Stage 1" where you position your company and engage with potential buyers, followed by an accelerated "Stage 2" for the formal M&A process. As Victor Basta, CEO of Artis Partners, puts it:

"The difference between a successful exit and a failed one often comes down to whether the company is bought, not sold" [42].

This method helps you build buyer conviction well before negotiations begin, giving you a stronger position and greater control over the process.

Exit Prep Checklist for Founders

In addition to advanced tools, a comprehensive checklist ensures that no critical elements are overlooked. This checklist complements earlier steps and reinforces the importance of thorough preparation.

- Financial Validation: Review and validate three years of financial statements. Adjust EBITDA for any owner-specific perks or one-time expenses. Confirm the accuracy of SaaS metrics like Net Revenue Retention (NRR), Gross Revenue Retention (GRR), and Customer Acquisition Cost (CAC).

- Legal Structure: Ensure corporate governance is sound and intellectual property assignments are clear. Verify compliance with regulations like GDPR, CCPA, and SOC 2 [41]. Addressing these areas early prevents delays and protects your valuation during due diligence.

- Virtual Data Room: Use tools like Intralinks or Datasite to set up a well-organized virtual data room. Include 3–5 years of financial statements, tax returns, debt structures, and legal documents [1]. A streamlined data room keeps the due diligence phase on track, avoiding unnecessary delays.

- Internal Champions: Identify advocates within potential buyers' organizations. Deals often require a senior product executive to champion the acquisition [43]. Build these relationships through partnerships or industry events long before entering formal negotiations [4].

- Company Story: Craft a compelling narrative that highlights why acquiring your company is a strategic necessity. A strong story strengthens your negotiating position and builds buyer confidence.

- 409A Strategy: Develop a 409A plan to manage employee stock options after the term sheet is signed. Retention plans for key employees are crucial to minimizing "talent flight risk" once the acquisition is announced [10].

- Cash Reserves: Maintain at least nine months of cash reserves to avoid desperation during the sale process [4]. As Vishal Lugani, General Partner at Acrew Capital, advises:

"Every week you wait to cut spend makes the cuts you will need hurt that much more" [4].

Conclusion: Taking Control of Your Exit

When it comes to mergers and acquisitions, being prepared isn't just helpful - it's essential. Each stage of the process is a chance to either strengthen your position or lose ground. Your greatest leverage lies in the pre-LOI phase, where early and strategic preparation can make all the difference. Once you enter the 30–60 day exclusivity period, your flexibility diminishes, and the buyer typically gains the upper hand[28][4]. By mastering these critical phases, you can take charge and set yourself up for a smooth, profitable exit.

Preparation isn't just about ticking boxes; it's about building a strong foundation. Cleaning up your financials, aligning your team internally, and fostering relationships with multiple potential buyers are all key steps. These aren't just administrative chores - they're critical strategies for success. Whether it's conducting a thorough pre-sale audit or implementing integrated due diligence systems, these methods help you avoid common pitfalls. Often, the difference between a seamless exit and drawn-out negotiations comes down to controlling the timeline, avoiding reliance on a single buyer, and locking in key terms before exclusivity begins. A structured, proactive approach ensures the process stays on your terms.

The timeline for closing deals has changed. What used to take 45 days can now stretch to 12 to 18 months[7]. This makes preparation even more crucial. Strong cash reserves can help you avoid making decisions out of desperation[4], and using a "peel-the-onion" approach during due diligence can prevent your team from burning out[7][6].

The most successful exits aren't rushed or reactive - they're planned and deliberate. By understanding the timeline, staying alert to private equity tactics, and leveraging the right tools to remain exit-ready, you can ensure that when it's time to sell, you're the one calling the shots.

FAQs

Why do private equity firms often delay M&A deals?

Private equity firms often hold off on closing M&A deals for a variety of reasons. These could range from dealing with heightened regulatory scrutiny to managing the intricate details of a transaction or even responding to shifts in the economy or global political environment.

Taking more time can also work to their advantage strategically. For instance, they might use the delay to line up funding, increase transaction costs for sellers, or negotiate more favorable pricing and terms. It also gives them a chance to map out potential synergies early on, positioning themselves ahead in the deal-making process.

For founders, being aware of these strategies can make a big difference. It helps them enter negotiations better prepared and ensures they're in a strong position to protect and maximize their company’s value during a sale.

What key metrics should I prepare before selling my SaaS company?

To attract buyers to your SaaS business, you need to showcase key financial and operational metrics that paint a clear picture of your company's performance. Start with critical indicators like Annual Recurring Revenue (ARR) and its growth rate, Monthly Recurring Revenue (MRR), churn rate, gross margin, EBITDA margin, and retention rates - both gross and net dollar retention.

Don’t forget to emphasize essential unit economics, such as the Customer Acquisition Cost (CAC) payback period and the Lifetime Value (LTV)-to-CAC ratio. These numbers help potential buyers assess your business's profitability, scalability, and overall health. Presenting these metrics in an organized and compelling way can play a major role in determining your valuation and speeding up the M&A process.

How can I maintain leverage when selling my company during the M&A process?

To keep your bargaining power strong during the M&A process, preparation and a clear strategy are essential. Start by organizing a detailed data room and developing a persuasive "value story" that emphasizes your company's key strengths. This approach compels buyers to provide solid, data-backed reasons for any discounts they propose, rather than relying on vague justifications. At the same time, create competitive pressure by involving multiple potential buyers, setting firm deadlines for bids, and being prepared to walk away if offers fall short of your expectations.

Timing can also be a powerful tool. Regulatory reviews and due diligence often stretch the timeline, so release information strategically to maintain control over the process. Consider using clean teams - groups dedicated to integration planning - to show you're ready for the next phase while keeping room to renegotiate if the buyer's terms shift. Staying proactive allows you to push for better terms, like higher cash payouts or more favorable escrow conditions.

It's equally important to understand the typical phases of a deal - teaser, NDA, due diligence, valuation, and closing. Knowing these stages lets you anticipate when you'll have the most leverage and plan your actions accordingly. With the right preparation and smart timing, you'll be in a stronger position to negotiate a favorable outcome.