AI is reshaping SaaS pricing and valuations by driving a shift from fixed subscriptions to usage-based models. This transition ties revenue directly to customer usage, offering fairer pricing and new growth opportunities. However, it also introduces challenges like revenue unpredictability and operational complexity, which AI tools are uniquely equipped to handle.

Key Insights:

- Consumption-based pricing: Customers pay based on usage (e.g., API calls or data processed), unlike subscriptions with fixed fees. This aligns costs with value received, benefiting both light and heavy users.

- AI's role: AI simplifies usage tracking, forecasts revenue, adjusts pricing dynamically, and optimizes customer retention strategies.

- Investor appeal: Strong usage metrics and predictive analytics improve long-term revenue forecasts, making SaaS companies more attractive to investors.

- Hybrid models: Combining subscription and usage-based pricing balances revenue stability with growth potential.

AI-powered tools like revenue intelligence platforms, customer success software, and pricing optimizers are crucial for implementing and managing this pricing strategy effectively. While adoption requires infrastructure upgrades and process changes, the benefits include better customer satisfaction, improved retention, and scalable growth.

Your SaaS Pricing Model is Broken! Here’s How to Fix It.

Subscription vs. Consumption-Based Pricing: Key Differences

As AI reshapes how SaaS companies approach valuations, it's essential to understand the distinctions between subscription and consumption-based pricing. These two models influence everything from revenue predictability to customer satisfaction and operational strategy.

Subscription-Based Pricing: Benefits and Challenges

Subscription pricing has long been the backbone of SaaS revenue models. Its appeal lies in its simplicity: customers pay a fixed monthly fee, which makes billing straightforward and revenue highly predictable. For companies, this predictability simplifies financial planning, streamlines investor communications, and supports growth strategies like hiring and scaling operations.

This model works especially well for businesses offering standardized products where most customers use similar features at comparable levels. Tiered pricing structures also make it easy to upsell or guide customers toward higher-value plans, minimizing administrative complexity.

However, subscription pricing isn't without its drawbacks. It often struggles to accommodate customers with varying usage needs. For heavy users, plan limits can feel restrictive, while light users may feel they're overpaying for features they barely use. This mismatch can obscure the true value customers derive from the product, leaving potential revenue untapped - particularly from high-usage customers. Additionally, customers may resist upgrading to higher tiers, even when their usage justifies it, creating artificial barriers to revenue growth.

Consumption-Based Pricing: A Usage-Driven Alternative

Consumption-based pricing flips the script by charging customers based on their actual usage. Whether it's API calls, data processed, or transactions completed, customers pay for what they consume, aligning costs directly with value received.

This model offers clear advantages. Customers who use more pay more, while lighter users benefit from lower costs, creating a fairer and more flexible pricing structure. For SaaS companies, this approach can tap into previously unreachable revenue from high-value users who were limited by subscription tiers. It also lowers the entry barrier for new customers, allowing them to start small and scale as they see value in the product.

Industries with fluctuating usage patterns - like data analytics, cloud computing, or API services - often find this model particularly effective. By tying revenue to customer usage, it provides a clearer picture of customer value, which can enhance overall business valuation.

That said, consumption-based pricing comes with its own challenges. Revenue becomes less predictable, complicating financial forecasting and cash flow management. Customers may also face unexpected costs if their usage spikes, leading to potential dissatisfaction. This is where AI tools can play a crucial role, helping SaaS companies manage the added complexity and optimize customer relationships.

Comparison Table: Subscription vs. Consumption Models

Here's a side-by-side look at the key differences between these pricing models:

| Factor | Subscription-Based | Consumption-Based |

|---|---|---|

| Revenue Predictability | High - fixed monthly payments | Variable - depends on usage patterns |

| Customer Entry Barrier | Medium to High - fixed monthly commitment | Low - pay only for what you use |

| Revenue Growth Potential | Limited by plan tiers | Scales with usage |

| Billing Complexity | Simple - fixed monthly billing | Complex - requires tracking usage |

| Customer Value Alignment | Moderate - fixed cost regardless of usage | High - cost reflects actual value received |

| Forecasting Difficulty | Easy - predictable patterns | Challenging - requires advanced analytics |

| Customer Retention Strategy | Feature-based upgrades | Usage-based value optimization |

| Cash Flow Management | Stable and predictable | Variable - needs careful planning |

| Customer Acquisition Cost | Higher - larger upfront commitment | Lower - smaller initial investment |

| Revenue per Customer Ceiling | Capped by highest plan tier | Uncapped - grows with usage |

A Hybrid Approach: The Best of Both Worlds?

For many SaaS companies, the choice between subscription and consumption-based pricing isn't an either-or decision. Hybrid models - combining a base subscription fee with usage-based add-ons - offer a balanced solution. This approach provides the stability of predictable revenue while capturing additional value from customers with higher usage levels.

Ultimately, the right pricing strategy depends on your customer base, their usage patterns, and your operational capabilities. Businesses with fluctuating usage patterns and strong analytics capabilities often stand to gain the most from consumption-based pricing, especially when supported by AI tools to handle the added complexity.

How AI Changes Revenue Management and Valuation Metrics

The move from subscription-based pricing to consumption-based models has introduced fresh challenges for SaaS companies. But AI is turning these hurdles into opportunities. By using machine learning and predictive analytics, businesses can now handle revenue streams with a level of precision that was previously out of reach. Let’s dive into how AI is reshaping both customer usage insights and valuation metrics.

Using AI to Optimize Customer Usage Patterns

With the rise of consumption-based pricing, AI has made it possible to analyze customer behavior in real time. Instead of relying on outdated monthly or quarterly reports, AI tools track usage patterns as they happen, providing actionable insights to enhance customer value and reduce churn.

AI examines metrics like feature usage frequency, session durations, API call patterns, and user engagement. This detailed analysis uncovers trends that traditional methods might miss. For instance, AI can pinpoint when a customer is ready for an upgrade or when declining usage signals a risk of churn.

Predictive modeling takes this a step further by forecasting future customer actions, rather than just analyzing past behavior. This approach helps maximize revenue from top-tier customers while offering competitive options for those who are more price-sensitive.

AI also automates responses based on usage data. It can send upgrade suggestions, offer credits to soften overage charges, or provide personalized onboarding to encourage the use of underutilized features. This automation allows companies to scale customer success efforts without adding operational costs, making it both efficient and effective.

Improving SaaS Valuation Metrics with AI Data

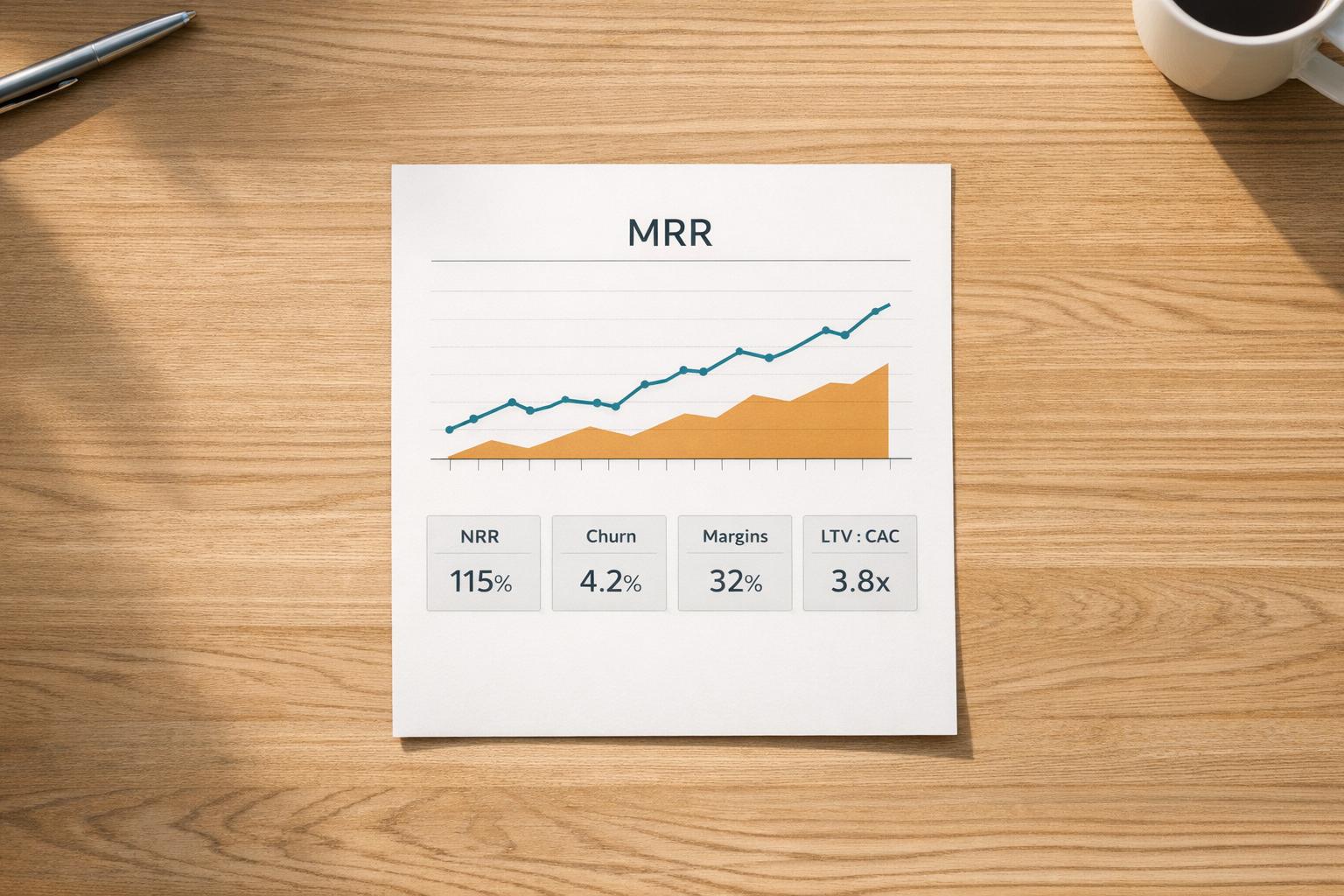

AI doesn’t just optimize customer usage - it also redefines key valuation metrics. Traditional SaaS metrics gain new depth and accuracy when AI is involved. For example, Net Revenue Retention (NRR) becomes more forward-looking as AI models predict customer expansion rather than relying solely on past data. This proactive approach gives companies a clearer view of future revenue trends.

Customer Lifetime Value (CLV) is another area where AI excels. Standard models often rely on basic averages and cohort analysis, but AI integrates a wider range of variables - like usage patterns, feature adoption, support interactions, payment history, and even market conditions. This leads to more precise estimates of individual customer value, which is crucial for forecasting revenue in consumption-based models.

Metrics like Revenue per Employee (RPE) also benefit from AI. By automating repetitive tasks, AI frees up human resources for strategic decision-making, boosting operational efficiency.

AI even introduces new metrics that were previously hard to measure. For instance, usage efficiency scores evaluate how effectively customers are engaging with product features, while churn prediction models provide probabilistic forecasts instead of simple yes-or-no outcomes. Revenue volatility indices, meanwhile, help businesses communicate revenue predictability to investors.

Forecasting, a traditional pain point for consumption-based pricing, also sees vast improvements with AI. Predictive models can deliver monthly recurring revenue estimates with a reliability that rivals subscription models. This enhanced predictability can boost company valuations by fostering greater investor confidence.

Comparison Table: Standard vs. AI-Powered Valuation Metrics

| Metric | Standard Approach | AI-Powered Approach |

|---|---|---|

| Net Revenue Retention (NRR) | Historical analysis with periodic reporting | Real-time tracking with predictive insights |

| Customer Lifetime Value (CLV) | Basic cohort averages | Detailed, individualized projections |

| Churn Prediction | Simple usage thresholds | Multi-factor risk scoring for proactive action |

| Revenue Forecasting | Manual, less reliable projections | Automated, consistent predictions |

| Pricing Optimization | Annual reviews and adjustments | Dynamic, real-time pricing updates |

| Customer Segmentation | Static demographic-based groups | Behavior-driven, dynamic segmentation |

| Expansion Revenue | Reactive upselling | Timely, proactive recommendations |

| Usage Analytics | Basic trend reports | Real-time insights with anomaly detection |

| Valuation Multiple | Based on industry norms | Data-driven, analytics-informed valuations |

| Investor Confidence | Rooted in past trends | Strengthened by predictive accuracy |

AI also impacts how SaaS companies are perceived in the market. For example, Enterprise Value to Revenue (EV/Revenue) multiples often reflect the stronger growth potential and predictability of AI-driven businesses. Similarly, monthly recurring revenue becomes more stable when optimized with AI, making these companies more appealing to investors who prioritize reliability.

Another advantage is the ability to perform more refined cohort analyses. Rather than grouping customers by signup dates alone, AI allows businesses to segment based on behaviors, feature adoption patterns, or other meaningful criteria. This deeper understanding translates directly into better customer success strategies and improved retention rates.

sbb-itb-9cd970b

AI Tools and Methods for Better SaaS Valuation

As AI shifts the landscape of SaaS metrics, choosing the right tools becomes critical to staying ahead. With the rise of consumption-based pricing, businesses need tech solutions that handle real-time data, predictive analytics, and automated decision-making effectively.

AI Tools for SaaS Growth

To leverage AI for SaaS valuation, start by selecting tools tailored to specific needs:

- Revenue intelligence platforms like Gong and Chorus analyze sales conversations to uncover patterns that lead to successful deals. These platforms capture insights from customer feedback, such as sentiment, objections, and feature requests, which are essential for refining pricing strategies.

- Customer success platforms such as Gainsight and ChurnZero use AI to track usage trends and engagement levels. They predict growth opportunities and flag accounts at risk of churn, helping teams prioritize efforts that boost net revenue retention.

- Pricing optimization tools like ProfitWell (now part of Paddle) and Zuora rely on machine learning to analyze customer behavior. These tools recommend pricing tiers and consumption-based models that balance revenue growth with customer satisfaction.

- Business intelligence platforms such as Mixpanel and Amplitude provide detailed analytics on user behavior. They track metrics like feature adoption and session frequency, offering the insights needed to set consumption thresholds and forecast revenue trends.

For a comprehensive resource, the Top SaaS & AI Tools Directory helps businesses discover AI tools for lead generation, sales optimization, and marketing automation - key areas that influence valuation metrics.

How to Add AI to Your SaaS Operations

Bringing AI into your SaaS operations requires careful planning to avoid disruption. Start by strengthening your data infrastructure. Ensure all customer data flows seamlessly into centralized systems, as clean and accessible data is the backbone of effective AI.

- API-first integration is a must. Choose tools with robust APIs to enable smooth data sharing between AI systems, supporting real-time decisions across sales, marketing, and customer success teams.

- Phased implementation works best. Begin with a single focus area, like customer usage tracking, before expanding to pricing optimization and revenue forecasting. This gradual approach allows teams to adapt without overwhelming existing workflows.

- Data preparation is crucial. Invest in cleaning and standardizing data before deploying AI analytics to avoid errors in predictions and pricing decisions.

- Team training and change management are equally important. Sales teams need to understand how AI insights affect their quotas, while customer success teams should be trained to interpret usage forecasts. Finance teams also require guidance on new metrics and forecasting tools.

- Modular AI solutions offer flexibility. Instead of committing to large, all-in-one platforms, combine specialized tools for different functions. This approach makes it easier to scale and reduces reliance on a single vendor.

Once integrated, advanced AI agents can take automation to the next level, enhancing revenue operations without disrupting workflows.

Using AI Agents to Increase Recurring Revenue

AI agents go beyond analytics by automating actions that directly impact recurring revenue. Here's how they work:

- Conversational AI agents handle customer inquiries about billing, usage limits, and upgrade options, eliminating the need for human intervention in routine tasks.

- Proactive engagement agents monitor customer behavior and trigger personalized outreach when opportunities arise, such as suggesting plan upgrades as customers near usage limits.

- Churn prevention agents analyze data to detect at-risk customers and initiate retention workflows, offering discounts, feature suggestions, or direct outreach to keep customers engaged.

- Revenue recovery agents tackle failed payments by retrying transactions at optimal times, sending personalized reminders, and negotiating payment plans for high-value customers.

- Upselling agents track usage patterns to identify the best times and methods for upgrade offers, tailoring recommendations to actual customer behavior and business growth.

For maximum impact, combine multiple AI agents into coordinated workflows. For instance, a usage monitoring agent can flag increased activity, prompting an engagement agent to send educational content while notifying the sales team about potential expansion opportunities.

By integrating these agents with existing CRM systems, businesses ensure that AI supports human efforts rather than replacing them. These tools handle repetitive tasks, leaving teams free to focus on building relationships and driving strategy.

The result? Streamlined operations and stronger SaaS valuations. Companies often see improved net revenue retention, faster expansion, and more predictable growth - key factors for success in both subscription and consumption-based models.

Action Steps for SaaS Businesses in the AI Economy

Shifting to a consumption-based pricing model requires more than just a new billing structure - it demands a strong infrastructure and strategic use of AI. By aligning your tools and processes, you can make the most of this pricing approach and unlock its potential.

Is Your Business Ready for Consumption-Based Pricing?

Before diving into consumption-based pricing, take a step back and evaluate your business infrastructure and customer behavior. Are your users engaging with your product at varying levels - some barely scratching the surface, while others are power users? If so, this model might help you generate more revenue by charging based on actual usage. However, businesses with consistent, predictable customer usage may find traditional subscription models more effective.

To make this transition work, your infrastructure must support real-time usage tracking, flexible billing, and accurate metering. These tools are essential for AI-driven pricing adjustments. Without reliable data, implementing a fair and effective consumption-based model becomes nearly impossible.

Your finance team also needs to adapt to the fluctuating revenue patterns that come with this pricing strategy. And don’t overlook customer education - users need to understand how charges are calculated, what usage triggers costs, and how they can monitor their spending.

Using AI Tools to Grow Revenue

Once your infrastructure is ready, it’s time to use AI to drive revenue growth. AI can transform how you analyze customer behavior, enabling smarter pricing strategies and better customer segmentation.

AI can help you optimize revenue across the entire customer lifecycle. By analyzing usage patterns, feature preferences, and growth trends, AI tools can recommend tailored pricing strategies for different customer segments. For instance, predictive analytics can identify accounts likely to upgrade or downgrade based on their usage trends, engagement levels, and support interactions. This insight allows you to take proactive steps - whether it’s offering an upsell or preventing churn.

AI can also streamline revenue recovery. Tools powered by AI can handle failed payments by determining the best times to retry, sending personalized reminders, or even negotiating payment plans based on the customer’s history and value.

Real-time pricing adjustments are another game-changer. AI can suggest price increases during peak usage or offer promotional pricing to encourage customers to explore underused features. And when AI integrates with your existing sales and marketing tools, the benefits multiply. For example, usage data flowing into your CRM can help sales teams prioritize high-value leads, while marketing automation can trigger campaigns based on user activity.

US Market Considerations

If your SaaS business operates in the US, your pricing strategy must align with local regulations and financial standards.

Revenue recognition under US accounting rules like ASC 606 becomes more complex with consumption-based pricing. Revenue must now be recognized as services are consumed, rather than following predictable subscription cycles. This requires more advanced accounting systems to track performance obligations accurately.

Data privacy compliance is another critical area. State laws like the California Consumer Privacy Act (CCPA) and sector-specific regulations mean you must balance detailed usage tracking with customer privacy. Clear consent mechanisms and well-defined data retention policies are essential to avoid legal risks.

Tax implications can also vary widely. Some states treat usage-based software services differently than fixed subscriptions, which may affect how sales tax is calculated. It’s smart to consult tax experts to navigate these differences.

Payment processing introduces additional challenges. From handling failed payments to accommodating international customers paying in USD, your payment systems must support real-time billing for variable charges. This flexibility is key to ensuring smooth transactions.

Contract terms will also need updates. Usage-based pricing creates new scenarios, such as disputes over billing accuracy or unexpected charges. Service agreements must address these concerns while protecting your revenue.

Finally, investor relations require careful communication. Metrics like monthly recurring revenue (MRR) become less relevant under this model. Instead, investors will want to see metrics like net revenue retention or average revenue per usage unit. Be prepared to explain how these new metrics reflect your company’s growth and stability.

For US-based SaaS companies, resources like the Top SaaS & AI Tools Directory can be invaluable. It includes tools specifically designed to help with compliance tracking, financial reporting, and customer communication strategies tailored to American business practices.

FAQs

How does AI simplify managing consumption-based pricing for SaaS companies?

AI makes managing consumption-based pricing much easier for SaaS companies by offering tools that analyze and predict how customers use their services. These insights allow businesses to allocate resources more efficiently, make more accurate revenue forecasts, and minimize the unpredictability that often comes with variable pricing models.

With AI-powered analytics, companies can spot patterns in user behavior, helping them fine-tune their pricing strategies and enhance customer satisfaction. This approach not only stabilizes revenue streams but also boosts the overall financial health and valuation of SaaS businesses in today's AI-driven market.

What are the key advantages and challenges of moving from subscription-based to consumption-based pricing in SaaS?

Switching from subscription-based pricing to a consumption-based model brings both opportunities and hurdles for SaaS businesses. In a consumption-based structure, customers are charged based on their actual usage, such as the number of API calls or the amount of data storage they use. This approach shifts the focus to flexibility and value.

Why It Works: For customers, this model lowers the barrier to entry by reducing upfront costs. As they see results, they can scale their usage without feeling locked into a rigid plan. For SaaS providers, this often leads to higher customer engagement and the potential for steady revenue growth, as users are encouraged to expand their usage over time.

The Catch: That said, consumption-based pricing introduces challenges. Revenue can become less predictable, making it harder to forecast income accurately. On top of that, billing processes may become more complex, and customers might face budgeting difficulties due to fluctuating costs. Still, many SaaS companies find that the chance to achieve greater scalability and improve customer satisfaction outweighs these obstacles.

How can SaaS companies comply with US regulations when adopting AI-powered consumption-based pricing models?

To align with US regulations when adopting AI-driven consumption-based pricing models, SaaS companies should prioritize data privacy, transparency, and fairness. Compliance with laws like the California Consumer Privacy Act (CCPA) and, where applicable, the General Data Protection Regulation (GDPR) is critical to safeguarding customer data and building trust.

It's also important for businesses to routinely audit their AI systems. This helps identify and address any biases in pricing algorithms, ensuring they operate within ethical boundaries. Partnering with legal professionals who specialize in US regulations can provide valuable guidance, helping companies meet specific requirements and sidestep potential issues. Keeping up with regulatory updates is key to maintaining compliance and fostering long-term success.