Private equity (PE) firms are no longer just looking at your revenue - they’re digging deep into the efficiency and scalability of your business. Hidden issues like outdated systems, messy data, and weak financial processes can quietly destroy your valuation. In fact:

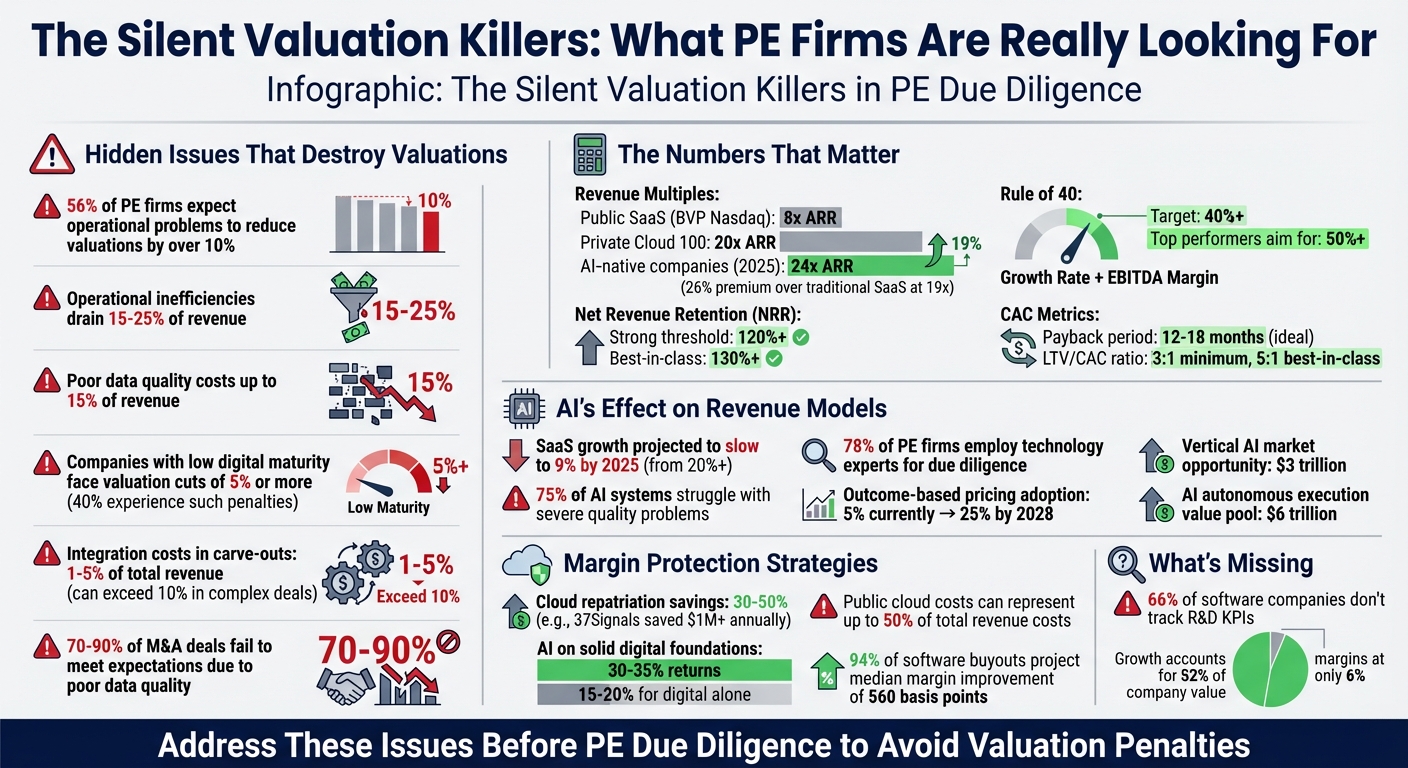

- 56% of PE firms expect these problems to reduce valuations by over 10%.

- Operational inefficiencies can drain 15–25% of revenue.

- Poor data quality can cost companies up to 15% of revenue.

These problems affect everything from customer retention to growth potential. PE firms now prioritize businesses with streamlined systems, clear data, and scalable operations. If your company has gaps in integration, lacks real-time data, or relies on outdated tools, expect valuation penalties.

The solution? Modernize your systems, improve data governance, and refine your cost structure. Focus on metrics like ARR, Rule of 40, and NRR to prove your business can grow profitably. Address these issues early to avoid valuation cuts and attract PE interest.

How Operational Issues Impact PE Valuations: Key Statistics and Benchmarks

The PE Due Diligence Trap Most Founders Fall Into

Operational Problems PE Firms Scrutinize

Private equity (PE) firms don’t just focus on your revenue - they dig deep into how efficiently your business operates. If they uncover fragmented systems, delayed integrations, or messy data during due diligence, they see red flags that could shrink your valuation.

PE firms expect streamlined processes, accurate data, and systems that can scale. Falling short in these areas can slash your valuation by 5% or more [4]. Below, we’ll explore the operational weaknesses that directly influence your exit multiples.

Integration Gaps and Delayed Implementation

When system integrations are delayed, it creates a domino effect of operational setbacks. For instance, if core systems like Salesforce or NetSuite aren’t properly integrated, it slows onboarding, delays revenue recognition, and frustrates customers. In carve-out scenarios, the costs of separating technology systems can eat up 1% to 5% of total revenue - and for particularly complex deals, those costs can exceed 10% [6].

"Mediocre integrations turn deals that might have been transformative into slow-growing add-ons. At worst, poorly managed integrations can erode investor returns." – McKinsey & Company [8]

Modernizing essential systems like ERP and CRM can make a big difference. Companies that upgrade these systems can deploy AI 40% faster and see much stronger returns [4]. PE firms take notice of this because outdated systems lead to compounding technical debt. A good example is when CVC acquired a minority stake in TOPdesk in late 2023. Their due diligence revealed that updating the company’s cloud architecture and user interface could speed up customer acquisition and drive growth.

The urgency to address these issues is even greater with the looming 2030 deadline for SAP ECC migration. A recent survey found that 56% of PE investors anticipate valuation cuts of over 10% if a portfolio company’s ERP system is nearing its end of life [5]. Tackling integration challenges isn’t just a technical necessity - it’s a key step in preserving and boosting valuation.

But integration isn’t the only operational hurdle. Data quality is another critical area that PE firms scrutinize.

Data Quality and Transparency Problems

Fragmented or inaccurate data is a major liability. When your data is scattered across multiple systems, it’s nearly impossible to forecast cash flow, monitor customer health, or measure key metrics like unit economics. Poor data quality often leads to bad decisions, and it’s a big reason why 70% to 90% of M&A deals fail to meet expectations [9].

The financial impact is severe. Companies with poor data quality can lose up to 15% of their revenue [9]. Regulators are also paying closer attention. For example, Insight Venture Management LLC was fined $1.5 million (plus $865,000 in disgorgement) for errors in management fee calculations caused by data inaccuracies [9]. Similarly, KKR had to pay between $28 million and $30 million to resolve issues related to fee misallocation due to poor data transparency [9].

The problem is compounded by the fact that 66% of software companies don’t track key performance indicators (KPIs) for R&D [1]. Without metrics like scrum team velocity or defect escape rates, these companies lack the insights needed to measure and improve performance. PE firms prefer companies that integrate ERP systems directly to provide real-time operational and financial data, rather than relying on cobbled-together spreadsheets.

Strong data governance isn’t just about compliance - it’s about building a foundation for AI and advanced analytics. Companies that implement triple-validation processes and standardized reporting frameworks reduce risk, attract more investor interest, and often secure higher valuations.

Recurring Revenue and Scalability Risks

After fine-tuning operations, ensuring steady recurring revenue and scalable unit economics becomes a top priority for private equity (PE) valuation. PE firms don’t just focus on the revenue you’re generating today - they’re also evaluating how well your business can scale over time. Recurring revenue models with shaky assumptions or thin margins can significantly hurt valuation. For example, SaaS top-line growth is projected to slow from over 20% in past years to just 9% by 2025 [11]. This highlights the importance of creating revenue models that can withstand pricing pressures and protect margins. After all, growth accounts for 52% of a company’s value, while margins only contribute 6% [14]. The takeaway? Growth alone won’t cut it - you need to show that your unit economics can scale profitably.

Emerging AI trends are adding a new layer of complexity to these revenue models. Let’s break it down.

How AI Commoditization Affects Revenue Models

Generative AI is shaking up traditional pricing strategies, pushing businesses to explore usage- or outcome-based models instead of the usual per-seat pricing. Here’s why: AI reduces the need for human labor, which in turn shrinks the Total Addressable Market (TAM) for software sold on a per-user basis [11][12]. If your customers use AI to downsize their workforce, your revenue could take a hit - even if your product is performing exactly as promised.

"What happens when software isn't hard to build anymore? Market saturation skyrockets. Competitive differentiation collapses." – Nitin Gupta, Founder of FlytBase [12]

AI-assisted development has made it easier for competitors to replicate SaaS products in a matter of weeks rather than years [12]. This intensifies pricing pressure and squeezes margins. To counter this, consider moving away from seat-based pricing and instead adopt outcome-based or usage-based models. While only 5% of companies currently use outcome-based pricing, this figure is expected to jump to 25% by 2028 [16]. For instance, charging $1.50 per AI-resolved support ticket ties your pricing directly to measurable results.

Another risk lies in "reciprocal commitment" deals, where companies purchase each other’s services to inflate revenue and Remaining Performance Obligations (RPO). Devon Coombs, a Fractional CFO/CAO Advisor, warns that "a significant portion of reported growth, and therefore market valuation, is now tied to the longevity of AI labs with limited operating history and extreme burn rates" [10]. PE firms often discount revenue tied to customers with unsustainable burn rates, viewing it as potential contra-revenue.

These shifts in revenue models directly influence your unit economics, which brings us to the next critical area: cost structure alignment.

Unit Economics and Cost Structure Alignment

To attract PE interest, your unit economics need to show that growth doesn’t come at the expense of profitability. A common benchmark used by PE firms is the Rule of 40 - the sum of your annual revenue growth rate and EBITDA margin [15]. Larger companies, especially those generating $80 million or more in revenue, are more likely to hit this target. However, businesses with high Gross Revenue Retention (GRR) and low customer acquisition costs are the real standouts.

Despite growing revenue, many software companies struggle to expand their margins. In fact, a study revealed that 94% of software buyouts projected a median margin improvement of 560 basis points, but actual margin growth often fell short of these expectations [14]. To address this, you need a clear plan for profitability, supported by strategic cost adjustments.

One effective tactic is cloud repatriation - shifting predictable workloads from public to private cloud environments. Companies like 37Signals saved over $1 million annually by making this move [17]. By converting variable, usage-based cloud costs into fixed expenses, businesses can directly protect their EBITDA margins. For companies where public cloud costs can account for up to 50% of total revenue costs [17], this strategy can deliver 30–50% in savings [17].

Additionally, it’s crucial to model the scalability of both fixed and variable costs. PE firms pay close attention to how you optimize R&D spending. For example, keeping new-product development onshore helps maintain strong customer relationships, while offshoring maintenance can cut costs [15]. They also value proactive measures like AI-driven early-warning systems that monitor customer usage patterns and help prevent churn, safeguarding GRR [15]. Without these strategies in place, PE firms may assume that your margins will shrink as you scale, ultimately lowering your valuation.

sbb-itb-9cd970b

Competitive Differentiation and Market Positioning

Once you've fine-tuned your unit economics, the next step is proving to private equity (PE) firms that your business has a strong competitive moat. In today’s AI-driven landscape, the traditional edge of proprietary code isn’t enough. Instead, what sets companies apart are proprietary datasets, deep operational integration, and a focus on specific verticals [19]. Without these, PE firms may assume your margins will shrink under competitive pressure.

And the stakes? They're massive. An estimated 75% of AI systems currently struggle with severe quality problems, like poor maintainability and incomplete documentation [13]. This creates a golden opportunity for companies that can showcase engineering discipline and clear data origins. It’s no surprise that 78% of PE firms now employ at least one technology expert to dig into these technical aspects during due diligence [7]. If your AI infrastructure is superficial or riddled with technical debt, you’re likely looking at a lower valuation.

This brings us to the importance of proprietary innovations in securing your market position.

Building a Competitive Moat

Once your operations and revenue are optimized, the focus shifts to safeguarding your market position. The strongest competitive moats today are built on exclusive data and learning loops. Proprietary datasets that improve over time create a significant barrier for competitors [12][13]. For instance, as your AI model learns from each customer interaction, it gains a compounding advantage that others can’t easily replicate. PE firms also value products deeply embedded in workflows, where switching becomes costly [12][18]. If your solution functions as a "system of record", the friction of migration protects your revenue streams.

"AI systems tend to have a very low maintainability score... Data scientists - AI engineers - are focused on creating working models, they haven't been trained or managed sufficiently to create working models that need to work in reality." – Rob van der Veer, Software Improvement Group [13]

Another key factor is vertical specialization. Focusing on specific industries - like healthcare or legal - through tailored "Vertical AI" solutions offers stronger defensibility and pricing power compared to general-purpose tools [7]. The potential value of vertical AI is estimated at around $3 trillion [7]. By embedding your product into industry-specific workflows, you create a moat that’s tough for competitors to cross. Additionally, AI systems that evolve from analytics to autonomous execution tap into an even larger $6 trillion value pool, offering PE firms a compelling path to EBITDA growth [7].

Avoiding the Commoditization Trap

The threat of commoditization is very real, especially in the AI space. As Nitin Gupta, Founder of FlytBase, explains:

"What happens when software isn't hard to build anymore? Market saturation skyrockets. Competitive differentiation collapses. Customer acquisition becomes the real battle" [12]

To avoid this trap, steer clear of "AI washing" - the practice of labeling basic solutions as AI-powered. For example, in April 2024, Amazon’s "Just Walk Out" technology faced criticism when reports revealed that over 1,000 workers in India were manually verifying nearly 75% of transactions, exposing the system as far less automated than advertised [13]. PE firms now use advanced analytics during due diligence to uncover such discrepancies, and any hint of fake automation can have a devastating impact on valuation.

Instead, focus on niche markets and ensure transparency in your data practices. Maintain detailed records of how your data was sourced, annotated, and prepared to meet PE firms’ standards for ethical sourcing and intellectual property security [13]. Additionally, prioritize code maintainability by improving documentation and testing protocols. By targeting specialized domains where your proprietary data gives you a clear edge, you can secure a premium valuation and stand out in a crowded market. This kind of differentiation not only strengthens your position but also shields you from potential valuation penalties during PE evaluations.

Valuation Benchmarks and Metrics

Tackling operational challenges and addressing competitive risks can position your business to meet - or even surpass - key valuation benchmarks. Once you’ve secured strong operations and built a solid competitive edge, the next step is quantifying your value through critical metrics.

Benchmarking Against Industry Leaders

Private equity (PE) firms often compare your company to industry standards. For public SaaS companies, the BVP Nasdaq Emerging Cloud Index is a key benchmark, trading at approximately 8x Annual Recurring Revenue (ARR) [20]. On the private side, companies in the Cloud 100 achieve significantly higher multiples, averaging around 20x ARR [20]. For AI-native companies, the gap is even more striking: as of 2025, they are valued at an average revenue multiple of 24x, compared to 19x for traditional SaaS companies [20]. This 26% premium highlights the added value of integrating AI into your core offerings. During due diligence, PE firms often bring in technology experts to validate AI-related claims.

Before entering discussions with PE firms, prepare a comparables analysis. Identify 5–10 companies in your vertical and revenue range, and compare your metrics to theirs. This not only helps justify your valuation but also shows a thorough understanding of your market position. Tools like Meritech Benchmarking can help ensure your data is current and accurate [26].

Once you’ve benchmarked your position, focus on the metrics that directly influence valuation.

Key Metrics That Drive Valuation

Annual Recurring Revenue (ARR) is the cornerstone of PE valuations [21]. Unlike GAAP revenue, which can lag behind customer acquisition trends, ARR offers a forward-looking view of your growth potential. However, ARR alone won’t seal the deal. PE firms also evaluate your scalability and focus on achieving "smart growth" - a balance between revenue expansion and operational efficiency [22].

The Rule of 40 has become a critical metric for cloud companies. This calculation combines your annual revenue growth rate and EBITDA margin, with a score of 40% or higher signaling strong valuation potential [15][22]. For example, a company growing at 30% with a 10% EBITDA margin scores exactly 40%. Top-performing public cloud companies often aim for closer to 50% [21]. Statistical analysis shows a stronger correlation between valuations and the Rule of 40 (r²=0.38) than with growth rate alone (r²=0.34) [27].

Another key metric is Net Revenue Retention (NRR). Companies with an NRR above 120% demonstrate that their existing customers are increasing spending, fueling growth even without new customer acquisition [15][24]. Many top-tier enterprise SaaS companies aim for NRR levels of 130% or higher [24]. As Bessemer Venture Partners points out:

"Every percentage taken out of your retention is taken out of your growth rate" [21]

Don’t forget to evaluate your Customer Acquisition Cost (CAC) payback period and LTV/CAC ratio. A CAC payback period of 12–18 months is ideal, while your Lifetime Value (LTV) to CAC ratio should be at least 3:1. Best-in-class companies often achieve a ratio closer to 5:1 [23][24][25]. For enterprise-focused businesses, a payback period of up to 24 months may be acceptable due to higher lifetime value, but SMB-focused companies should aim for under 12 months [21].

Finally, consider how valuation multiples scale with your company’s size. As of 2024, companies with under $1 million in ARR averaged multiples of 3.1x, while those exceeding $20 million ARR commanded multiples closer to 7.8x [22]. Larger companies tend to attract higher multiples as PE firms gain confidence in their ability to sustain growth. If your metrics fall below these benchmarks for your revenue tier, expect your valuation to be adjusted accordingly.

Conclusion: Preparing for PE Scrutiny

Private equity firms have shifted their focus from traditional financial engineering to operational excellence as the key driver of returns. With rising leverage costs and limited opportunities for multiple expansion, the spotlight is now on operational performance. As McKinsey puts it:

"The role of operations in creating more value is no longer just a source of competitive advantage but a competitive necessity for managers" [2].

This transformation means that operational shortcomings - like outdated ERP systems or poorly managed R&D - can directly hurt valuation. For example, companies with low digital maturity often face valuation cuts of 5% or more, with 40% experiencing such penalties [4]. These issues are not just inconvenient; they can derail deals entirely.

To meet the high standards of private equity scrutiny, operational diligence is essential. Focus on identifying margin expansion opportunities, upgrading data infrastructure, and empowering leadership to drive meaningful change. These steps will not only improve operational control but also enhance transparency - an increasingly critical factor for PE firms.

Transparency is your best defense against risk. Implement weekly cash forecasting [3], automate KPI tracking for R&D [1], and establish a Transformation Management Office (TMO) [2] to demonstrate measurable progress. PE investors now expect real-time access to your systems and operations, and companies that deliver this level of visibility are seen as lower-risk, more attractive investments.

Another key step is leveraging AI to boost EBITDA. Start with 2–3 high-impact use cases that can directly improve financial performance [7]. AI initiatives, when built on solid digital foundations, can drive returns of 30%–35%, compared to 15%–20% for digital efforts alone [4]. But before diving into AI, ensure your core systems are modernized, data is well-structured, and infrastructure can support advanced technologies.

These actions not only help you withstand private equity scrutiny but also set the stage for sustainable, premium valuations. Clean data, strong governance, and scalable operations create a foundation for long-term success. With PE firms holding investments for longer periods - up to three years beyond historical averages [3] - they need confidence in your ability to consistently perform. Address operational weaknesses now, and you'll approach PE discussions with confidence, positioning your business as a strong, reliable investment rather than scrambling to justify valuation discounts.

FAQs

How can outdated systems and poor data quality hurt my company’s valuation during a private equity review?

Outdated technology and poor data quality can seriously impact your company’s valuation during private equity (PE) evaluations. Legacy systems, such as aging ERP or CRM platforms, often come with tech debt - a hidden burden that stifles scalability, automation, and cost-efficient growth. PE firms tend to adjust valuations downward to factor in the high costs and disruptions tied to replacing these outdated systems. And let’s be clear: these replacements can take years and cost millions of dollars.

Data quality issues only add fuel to the fire. When your data is incomplete or riddled with inaccuracies, PE analysts are forced to spend extra time untangling risks. This not only slows down the process but can also result in lower valuation multiples or deals that are mispriced. Clean, reliable data is essential for evaluating performance and uncovering cost-saving opportunities. Without it, confidence in your company’s metrics can take a serious hit.

If you want to safeguard - and potentially boost - your valuation, it’s worth modernizing your tech stack and adopting strong data governance practices. These measures can help minimize risk, streamline operations, and make your company far more appealing to prospective investors.

What operational metrics do private equity firms focus on when valuing SaaS and AI companies?

Private equity firms take a deep dive into operational metrics when evaluating SaaS and AI companies, as these numbers reveal both risks and growth potential. A key focus is on revenue quality - specifically, whether the income is recurring, spread across a diverse customer base, and backed by contracts rather than one-off deals. Metrics like churn rate, net revenue retention (NRR), and the time required to recover customer acquisition costs (CAC) are critical. For instance, a high churn rate or an extended CAC payback period can significantly hurt a company’s valuation.

Another area of scrutiny is the company’s cost structure and profit margins. High gross margins paired with a streamlined operating expense ratio indicate that the business can scale without costs ballooning. Metrics such as EBITDA margin, sales efficiency (revenue generated per salesperson), and revenue concentration (reliance on a handful of major clients) are used to measure financial health and pinpoint risks.

Lastly, scalability factors play a major role. These include how quickly the company can onboard new users, the extent of automation in its processes, and its ability to grow revenue without a corresponding spike in hiring. Together, these metrics help private equity firms assess whether a business can expand efficiently, maintain steady cash flow, and deliver solid returns.

How can I prepare my SaaS or AI business for private equity evaluations and avoid valuation risks?

To get ready for private equity (PE) evaluations and reduce valuation risks, it's essential to present a clear, data-backed view of your business. PE firms dive deep into areas like operational efficiency, financial performance, and scalability. Addressing weaknesses in these areas can help you sidestep penalties that might hurt your valuation.

Start by tightening up your financial reporting. Show consistent ARR growth, maintain low churn rates, and keep your CAC-to-LTV ratios disciplined. Upgrade your technology infrastructure to remove outdated systems that could slow growth. Introducing AI-powered tools can also boost analytics and automation, significantly improving operational efficiency. Lastly, ensure your leadership team can confidently outline a growth strategy that’s directly tied to revenue opportunities.

By showcasing strong operations, scalability, and a leadership team with a clear vision, you can make your business more appealing to investors while reducing hidden risks and boosting your valuation potential.