Relying too heavily on one client or sales channel can hurt your business valuation. Private equity (PE) firms see this as a major risk because losing that client or channel could disrupt cash flow and derail growth. Here's what you need to know:

- Revenue Concentration Risks: If one client makes up more than 10% of your revenue, or your top five clients contribute over 25–35%, PE firms may discount your valuation by 1–3x EBITDA.

- Due Diligence Scrutiny: PE firms analyze customer-specific risks, contracts, and revenue stability to assess concentration issues.

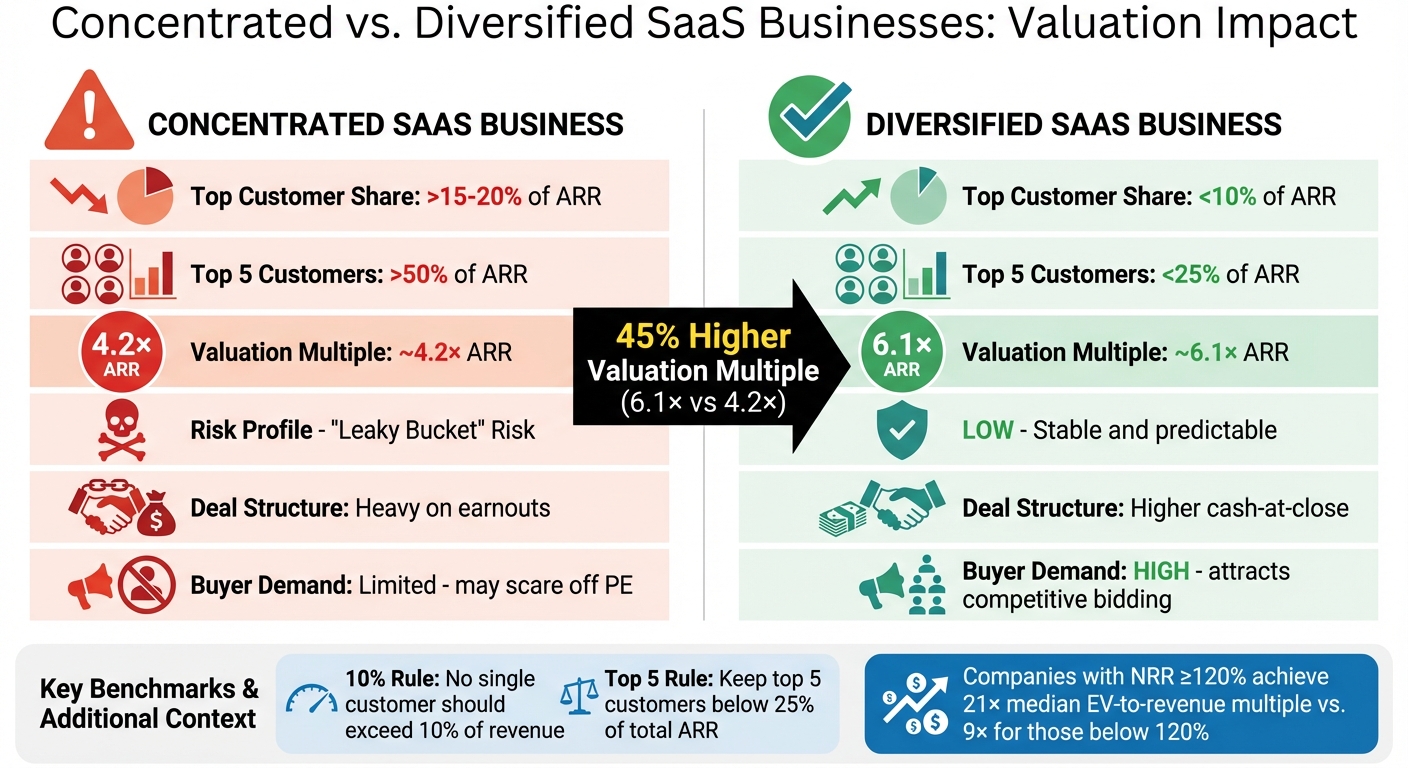

- Valuation Impact: Concentrated businesses often face lower multiples (e.g., 4.2× ARR) compared to diversified ones (e.g., 6.1× ARR).

- Diversification Benefits: Companies with balanced revenue streams attract more buyers, secure better deal terms, and achieve higher valuations.

To protect your valuation, diversify your revenue streams, reduce reliance on key clients, and build multiple sales channels. PE firms value stability and resilience, so taking these steps before an exit can make a big difference.

Customer Concentration Risk Will Kill Your Fundraise or Exit | SaaS Metrics School | SaaS Risks

sbb-itb-9cd970b

How Concentration Reduces PE Valuations

Revenue concentration can be a red flag for private equity (PE) firms, often leading to reduced valuations. When a business is heavily reliant on a few clients or a single channel, it creates a fragile foundation. The loss of even one major account could spark a financial crisis or, in extreme cases, jeopardize the entire business [5][6]. To account for this elevated risk, PE firms typically apply valuation discounts.

The reasoning here is pretty simple. If a single customer accounts for more than 10% of revenue, or if the top five clients together contribute over 25%, it signals a potential vulnerability [5][6]. This is especially true in industries like AI and big data, where businesses often tailor their offerings to meet the needs of one dominant client. While this might drive short-term gains, it can hinder scalability and adaptability for a broader market [6].

"Customer concentration can be a double-edged sword; it can either propel a startup to new heights or leave it teetering on the edge of a precipice, vulnerable to the slightest shift in client loyalty or market demand."

– Lior Ronen, Founder, Finro Financial Consulting [6]

Revenue concentration also creates strategic challenges. For instance, if a key client decides to shift priorities - like moving development in-house - it can render specialized services irrelevant [6]. Additionally, over-reliance on one client often gives that client significant leverage, enabling them to dictate terms or influence product direction. This can stifle long-term growth potential [5][6]. Real-world examples highlight how these risks play out.

Case Studies: SaaS Companies That Lost Value Due to Concentration

Consider an analytics firm that built its business around a single Fortune 500 client. Despite solid margins and steady growth, investors flagged the concentrated client base as a major risk. Why? Because losing or downgrading that one client would have an outsized impact on the company's revenue stream [5][6].

Another example involves a SaaS startup in the government services sector. The company secured a multi-year contract that accounted for 45% of its annual recurring revenue. While the contract provided short-term stability, it also boxed the startup into a corner. The product had been so heavily customized to meet government compliance requirements that adapting it for a broader market became difficult. When the contract neared renewal, the startup's vulnerability became evident, raising concerns for potential investors.

"Relying on one customer to keep your startup afloat is simply too risky. If that customer churns or downgrades, you're going to be in a tough spot financially."

– Lighter Capital [5]

How Diversified Businesses Command Higher Multiples

On the flip side, businesses with diversified revenue streams tend to secure higher valuations. Why? Because they spread risk across multiple clients and markets, making them more stable and scalable. Many investors now use the "Rule of 40" as a benchmark - where a company's growth rate plus profit margin should total at least 40% to achieve top-tier valuations [4]. Diversified companies, unburdened by over-customization for a single client, enjoy greater flexibility and more predictable revenue.

A well-diversified SaaS company typically ensures no single client contributes more than 10% of revenue, with the top five clients collectively accounting for 25–35% [5][6]. This approach not only strengthens the company's position during negotiations but also supports consistent growth, even in fluctuating market conditions.

When PE firms evaluate diversified businesses, they aren't just looking at current cash flows. They're betting on a resilient business model - one that's built to weather economic cycles and adapt to market changes with ease. This resilience is what often earns diversified companies premium valuations.

Metrics PE Firms Use to Measure Diversification

Concentrated vs Diversified SaaS Business Valuation Metrics Comparison

Private equity (PE) firms rely on specific metrics to evaluate how diversified a business is, particularly when assessing revenue risks. These metrics help determine whether a company can handle losing a major client or acquisition channel - a factor that heavily influences valuation.

Client and Channel Diversification Benchmarks

One key benchmark is the 10% rule: if a single customer contributes more than 10% of your total revenue, it raises concerns[7]. Similarly, top-performing SaaS companies aim to keep their top five customers' revenue share below 25% of the total[7].

Relying exclusively on one acquisition channel - whether it’s paid search, a single affiliate, or organic traffic - poses another major risk[9]. PE firms prefer to see a mix of acquisition channels actively driving customer growth.

To quantify customer concentration, firms often use the Customer Concentration Ratio, calculated as:

(Top Customer Revenue / Total Revenue) × 100[7].

Additionally, they assess the reliability of acquisition channels. For instance, a strong organic backlink profile is typically more sustainable than depending heavily on competitive paid search campaigns[9].

Premium-valued businesses limit any single new deal's revenue contribution to 8–10% annually[7]. They also diversify their customer base across industries and company sizes - spanning SMBs, mid-market, and enterprise clients - to reduce exposure to sector-specific risks. By auditing their concentration ratios monthly, these businesses can catch potential problems early and protect their valuations[7].

Concentrated vs. Diversified Business Metrics Comparison

The contrast between concentrated and diversified SaaS businesses becomes apparent in their metrics. For example, a concentrated business might have one customer contributing over 15–20% of annual recurring revenue (ARR), whereas a diversified business keeps that figure under 10%[7]. Similarly, concentrated firms often see their top five customers accounting for more than 50% of ARR, compared to less than 25% for diversified companies[7].

This level of concentration has direct valuation implications. Concentrated businesses typically receive valuation multiples of about 4.2× ARR, while diversified companies can achieve multiples closer to 6.1× ARR, significantly increasing their enterprise value[7]. Concentrated firms are also more likely to face deal structures with heavy earnouts - where future payouts depend on retaining key customers. In contrast, diversified companies often secure more cash upfront at closing[7].

| Metric | Concentrated SaaS Business | Diversified SaaS Business |

|---|---|---|

| Customer Share | >15–20% of ARR [7] | <10% of ARR [7] |

| Top 5 Customer Revenue | >50% of ARR | <25% of ARR [7] |

| Valuation Multiple | ~4.2× ARR [7] | ~6.1× ARR [7] |

| Risk Profile | High; "Leaky Bucket" risk [8] | Low; Stable and predictable [7] |

| Deal Structure | Heavy on earnouts [7] | Higher cash-at-close [7] |

| Buyer Demand | Limited; may scare off PE [7] | High; attracts competitive bidding [7] |

SaaS firms with a net revenue retention (NRR) rate of 120% or higher achieve a median EV-to-revenue multiple of 21×, while those below 120% see a median of 9×[11]. Companies like Twilio (139% NRR), Crowdstrike (128% NRR), and Elastic (130% NRR) illustrate how top-quartile diversified firms achieve higher valuations by growing over 20% annually without relying solely on new customer acquisitions[11].

"If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple. The more KPIs and the more financial data I have to work with, the more accurate your valuation will be."

– Aaron Solganick, CEO, Solganick & Co.[7]

Even small changes in churn can have a big impact. For instance, a 1% difference in churn can lead to a 12% change in valuation over five years[7]. Likewise, SaaS companies with gross margins above 80% had a median multiple of 6.9× in Q4 2023, compared to 5.9× for those with margins between 70–80%[7]. Over-customizing for key clients - often a side effect of high concentration - can erode margins and ultimately hurt valuation.

How to Diversify Revenue Before a PE Exit

If you're gearing up for a private equity (PE) exit, addressing revenue concentration risks is a must. Diversifying your revenue streams at least 18 months before the sale can significantly enhance your company's value by mitigating key risks[14][12][17].

Step 1: Audit Your Revenue Concentration

Start by calculating your Customer Concentration Risk (CCR). This is done by dividing your largest customer's revenue by your total revenue[5]. If a single customer accounts for more than 10% of your revenue, it signals potential risk. If that number exceeds 20%, it can become a serious obstacle, potentially derailing deals or leading to earnout-heavy agreements[10].

Use your CRM and analytics tools to map out your revenue streams well in advance of the exit[10]. Interestingly, 72% of PE firms cite insufficient data and KPIs as major challenges when assessing companies[14]. For SaaS companies with under $200K ARR, no single customer should contribute over 50% of recurring revenue[5]. By the time you hit $1 million ARR, aim to have at least four customers to minimize risk[5].

Also, review your contracts for "change-of-control" clauses or termination provisions that could be triggered by a sale[10]. If your top clients can opt out after the transaction, it introduces uncertainty, which can lower your valuation significantly.

Step 2: Use AI and SaaS Tools to Create New Revenue Streams

AI-driven tools can open doors to new revenue opportunities. Automation can help optimize pricing and tailor customer interactions, making it easier to expand into new market segments[13]. In fact, 85% of General Partners expect AI to transform their businesses within the next five years[3]. Use AI to identify adjacent markets where your existing solutions can make an impact.

Streamline your onboarding processes with SaaS tools to reduce the cost and effort of acquiring smaller accounts[10]. Transitioning from project-based revenue to subscription models not only stabilizes your cash flow but also makes your business more appealing to buyers[10].

"We help on working with their AI thesis and where to create that value and how to capture that when they go to exit."

– Javier Rojas, Founder, Savant Growth[13]

Generative AI can also take on up to 30% of due diligence tasks and enhance another 20%, freeing up your team to focus on growth strategies[2]. Predictive analytics can help you spot market trends and eliminate inefficiencies, improving both margins and scalability[3].

Step 3: Build and Scale Additional Sales Channels

Once you've diversified your revenue streams, it's time to expand your sales channels. Relying too heavily on a single acquisition channel is risky. Instead, aim for multiple channels to drive customer growth. Diversify your customer base by targeting smaller accounts across various industries and company sizes - from SMBs to mid-market and enterprise clients.

Consider adding new sales channels, such as direct sales teams, strategic partnerships, or online marketplaces. Document your sales processes to ensure they are easy to replicate and scale. It's worth noting that 70% of PE deal activity in 2023 involved add-on acquisitions, highlighting buyers’ preference for businesses that integrate well and grow across multiple channels[16].

Keep an eye on your Magic Number (Net New ARR ÷ prior-quarter sales and marketing spend). A 1.0x benchmark is a good target[15]. Additionally, strive for a Net Dollar Retention rate of 130% or higher, which reflects strong growth from existing customers without over-relying on new acquisitions[15].

Step 4: Test Your Business Against PE Evaluation Standards

To prepare for a PE exit, model diversified revenue scenarios and develop a playbook of quick wins that can be executed within 12 months[14].

Ensure your data is clean and integrated 12–24 months before the exit. This will allow your KPIs to stand up to the scrutiny of potential buyers[14]. Sixty-five percent of PE firms report challenges in fully capturing value creation initiatives in exit EBITDA, so having detailed, reliable data to back up your diversification efforts is critical[14].

Present clear, actionable value-creation opportunities to potential buyers to boost your valuation[17]. If you can’t sufficiently reduce concentration risks before the sale, consider earnouts or seller notes tied to retaining key customers. This can help instill confidence in buyers[10].

"Data can provide the edge needed to outmaneuver other sellers in the same sector and allow for a swift and optimal exit."

– Konstanze Nardi, Partner, Transactions, Ernst & Young LLP[12]

Conclusion: Protect Your Valuation Through Diversification

Revenue concentration directly impacts how your business is valued. If a single client accounts for more than 10% of your annual revenue, private equity (PE) firms see it as a red flag. Once that number climbs above 20%, it’s often a deal-breaker, leading to lower EBITDA multiples, stringent earnouts, or seller notes tied to customer retention[10]. In short, high revenue concentration creates uncertainty - and uncertainty drives valuations down.

Diversification isn’t just about reducing risk; it’s also a way to boost your valuation. Companies with diversified revenue streams tend to secure higher multiples and better deal terms. They avoid the pitfalls of relying too heavily on a few key clients, making them more appealing to lenders and less vulnerable to pricing pressures or contract changes. With PE buyout entry multiples dropping from 11.9 to 11.0 times EBITDA in the first nine months of 2023[1], every fraction of a point can make a big difference.

"The role of operations in creating more value is no longer just a source of competitive advantage but a competitive necessity for managers."

– Jose Luis Blanco, Senior Partner, McKinsey[1]

This shift toward operational value creation means PE firms are paying closer attention to revenue stability. With 81% of PE executives noting that holding periods have extended by up to three years[3], buyers are looking for businesses that can withstand economic ups and downs without being overly reliant on a handful of relationships. Diversified companies consistently show this kind of resilience.

If you want to command higher multiples and achieve sustainable growth, start diversifying well before you plan to exit. Aim to build a broad customer base by targeting multiple smaller accounts across different industries. Expand into adjacent markets, and make sure your contracts are transferable without restrictive clauses that could scare off buyers. Use data to showcase stable revenue streams across a variety of clients, giving potential buyers the confidence to pay premium multiples. With 90% of private equity professionals reporting that targeted exit preparations improve asset valuations[18], diversification remains one of the most effective ways to maximize your returns.

FAQs

Why do private equity firms lower valuations for businesses heavily reliant on one client or channel?

Private equity firms tend to lower valuations for businesses that rely heavily on a single client or sales channel. Why? Because it introduces a higher level of risk. If that key client walks away or market conditions shift, the revenue stream could take a significant hit.

Beyond the immediate risk, this kind of dependency can also stifle growth and raise doubts about the business's ability to scale over the long term. To stand out during private equity evaluations, companies need to show they’ve diversified their revenue sources. A balanced and varied income stream signals stability, reduces vulnerabilities, and can lead to better valuations.

How can businesses reduce reliance on a single client or sales channel to improve valuation before a private equity exit?

To boost your company's valuation ahead of a private equity (PE) exit, it's crucial to diversify your revenue streams. A good starting point is expanding your customer base. Aim to ensure that no single client contributes more than 10–20% of your total revenue. This reduces dependency on any one customer and signals stability - something PE investors value highly.

Another key step is diversifying your sales channels. Consider adding options like e-commerce, physical retail locations, or wholesale partnerships. This multi-channel approach not only increases your market reach but also shields your business from risks tied to relying heavily on one sales method.

You might also want to explore strategies such as developing new products or services tailored to different customer groups, tapping into new geographic markets, or building strategic partnerships. These moves demonstrate that your revenue is both resilient and scalable, making your business more appealing to potential PE investors.

What are the dangers of depending on a single client for most of your revenue?

Relying too much on a single client for a large chunk of your revenue can put your business in a vulnerable position. If that client cuts back on spending or decides to end the relationship, your income could take a serious hit, jeopardizing your financial health. This over-reliance also limits your ability to adapt to market shifts or chase new growth opportunities.

On top of that, private equity firms and other investors tend to see high customer concentration as a warning sign. It suggests potential instability, which can lower your company’s valuation. To mitigate these risks, it’s crucial to diversify your revenue streams. Not only does this make your business more resilient, but it also increases its appeal to potential investors.