Private equity (PE) firms often prioritize short-term profits over long-term business health. Their strategies, such as leveraged buyouts and aggressive cost-cutting, can leave companies burdened with debt, stripped of resources, and at higher risk of bankruptcy. For example, companies acquired by PE firms are 10 times more likely to go bankrupt than their non-PE-backed counterparts. This is especially harmful for SaaS and AI businesses, which require significant investment in innovation and talent to remain competitive.

Key takeaways:

- Debt-Driven Acquisitions: PE firms use leveraged buyouts, saddling companies with debt that limits funds for growth or R&D.

- Short-Term Focus: PE firms often aim to exit investments within 3–5 years, prioritizing quick financial gains over sustainable growth.

- Cost-Cutting Measures: Mass layoffs and underfunding of critical areas like R&D are common, undermining long-term stability.

- High Failure Rates: Around 20% of PE-acquired companies go bankrupt within a decade, compared to just 2% of standard businesses.

For SaaS and AI companies, these tactics can erode innovation and disrupt business models that rely on long-term investments. To protect your business, focus on building self-sustaining revenue, conducting due diligence before partnerships, and maintaining control over key decisions like hiring and R&D funding.

Why PE Firms Prioritize Quick Returns Over Growth

Quick Profit Extraction vs. Building Long-Term Value

Private equity firms operate within 10-year fund lifecycles, which means they face immense pressure to deliver returns and exit investments in just 3 to 5 years [5][9][10]. This tight timeline significantly influences their investment strategies, often prioritizing short-term value extraction over sustainable growth.

The internal rate of return (IRR) formula rewards early cash flows, incentivizing firms to focus on immediate EBITDA growth rather than making long-term investments [8]. For instance, why would a firm invest in upgrading a factory or funding an R&D project that takes four years to pay off, when cutting costs today can show instant results on the balance sheet?

"PE firms are less likely to make capital-intensive investments if the payback period extends beyond their expected exit timeline." - Sunil Sharma, National Leader, Private Equity, BDO Canada [5]

The reliance on high leverage compounds this problem. With significant debt loads, such as the $530 billion in debt maturing for PE portfolio companies by the end of 2025, firms are forced to prioritize immediate cost-cutting measures to ensure steady cash flow for debt servicing [1][7]. As a result, companies are often reduced to cash-generating machines, leaving little room for innovation or growth.

This short-term mindset directly conflicts with business models that thrive on sustained, long-term investment.

Why PE Goals Conflict with SaaS and AI Business Models

The PE approach to quick returns inherently clashes with the growth strategies of tech companies, especially those in SaaS and AI. These businesses rely on continuous innovation and substantial upfront investments in technology and talent - exactly the kind of spending that private equity firms are hesitant to support. Unlike traditional businesses, SaaS and AI companies prioritize building recurring revenue streams over time rather than achieving immediate profitability. For example, SaaS companies often invest heavily in customer acquisition and product development for years before reaching favorable unit economics. Similarly, AI companies require extended timelines to train models, refine algorithms, and establish competitive advantages.

From the perspective of private equity, these upfront costs often appear as "bad revenue" - growth that doesn’t immediately translate into improved cash flow after accounting for expenses like capital charges [13]. As a result, PE firms frequently underfund R&D efforts critical to tech companies. They may even cut product lines or customer segments that hold long-term strategic value. Instead, the PE playbook emphasizes immediate EBITDA growth through cost reductions, which runs counter to the "land and expand" strategy that drives success for SaaS businesses [5][6].

The financial pressures tell the story. PE firms typically need to meet a hurdle rate of around 8% before they can access their lucrative "carried interest" payouts [10]. To achieve these returns within their compressed timelines, they shy away from capital-intensive projects with longer payback periods [5]. For a SaaS company investing in AI capabilities - which could take 18 to 24 months of development before generating revenue - this creates a significant challenge. These companies require patient, long-term capital, but PE firms are focused on achieving quick wins.

sbb-itb-9cd970b

How Private Equity Keeps Killing Your Favorite Brands

PE Tactics That Damage Companies

Private equity (PE) firms often employ financial strategies that can severely harm a company's long-term growth and stability. For SaaS and AI businesses, these tactics pose significant risks by undermining operational resilience.

Leveraged Buyouts and Excessive Debt

One of the most damaging strategies is the leveraged buyout. Here, PE firms take out massive loans using the company's own assets as collateral, leaving the acquired business - not the PE firm - responsible for the debt [1].

This approach creates an immediate financial burden. In fact, PE-backed company bankruptcies in the U.S. hit a record high in 2024, with the healthcare sector alone experiencing a staggering 112% increase in bankruptcies over five years [14].

The debt forces companies to prioritize paying interest over investing in essential areas like research and development, marketing, or operational upgrades [1]. Some PE firms even pile on additional debt to pay dividends to their owners, draining cash flow further [1]. This leaves companies with little to no cushion to weather challenges like rising interest rates or economic downturns [14].

"The vampire image is apt because of the industry's model of taking over companies for a few years, 'bleeding' the firm of cash through short-term strategies that can hurt in the long-run, then moving on to the next 'victim.'" - Private Equity Stakeholder Project [1]

High Management Fees and Asset Stripping

PE firms also profit heavily from aggressive fee structures and asset-stripping practices. The standard 2% management fee and 20% profit share, combined with tactics like sale-leaseback arrangements, often divert funds away from reinvesting in the business. These fees can account for up to two-thirds of a PE firm's total profits [2].

Sale-leaseback deals provide quick cash for the PE firm but burden the company with ongoing rental costs for properties it previously owned. This creates a long-term financial strain [2].

Meanwhile, top executives at firms like Blackstone and KKR have exploited tax loopholes, collectively saving $335 million over five years through the carried interest provision [1].

"If reducing the quality of service, selling off real estate, and collecting fees are more profitable than running a successful business, liquidation is not just the best option, but indeed the only one." - Megan Greenwell, Author [2]

Mass Layoffs and Aggressive Cost-Cutting

To manage debt and boost short-term EBITDA, PE firms frequently resort to drastic cost-cutting measures, including mass layoffs. Employment typically drops by about 12% within two years of a PE buyout of a publicly listed firm [11]. Between 2009 and 2019, private equity involvement in the retail sector alone led to 1.3 million job losses in the U.S. [2].

These cuts are often blunt and harmful. For example, when Great Hill Partners took over Gizmodo Media Group in 2019, CEO Jim Spanfeller's sweeping changes prompted the resignation of Deadspin's entire staff. The site's traffic plummeted, and by 2025, G/O Media announced a full shutdown despite claims of increased shareholder value [2].

Layoffs like these erode institutional knowledge and cripple operations. Companies lose experienced middle managers and specialized teams essential for maintaining service quality and meeting customer needs. The long-term consequences are stark: around 20% of companies acquired by private equity go bankrupt within a decade, compared to just 2% of non-PE-owned companies [2].

"The tragedy of digital media isn't that it's run by ruthless, profiteering guys in ill-fitting suits. It's that the people posing as experts know less about how to make money than their employees, to whom they won't listen." - Megan Greenwell, Former Editor-in-Chief of Deadspin [2]

The fallout from these tactics is evident in numerous high-profile failures, as detailed in the next section of case studies.

Case Studies: Companies Damaged by PE Firms

Toys "R" Us and Red Lobster

Two well-known American brands highlight how private equity (PE) practices can severely undermine a company's long-term stability.

Toys "R" Us reveals the dangers of leveraged buyouts. Back in 2005, KKR, Bain Capital, and Vornado Realty Trust acquired the beloved toy retailer for $6.6 billion. The catch? Only $1.3 billion of that came from equity, leaving Toys "R" Us saddled with a staggering $5.3 billion in debt. This financial burden forced the company to shell out $400 million annually just to cover interest payments - more than it spent on maintaining its stores and website combined. With so much cash tied up in debt servicing, reserves plummeted from $2.2 billion to just $301 million. By September 2017, the company declared bankruptcy, leading to the loss of 30,000 jobs [12][15]. Meanwhile, the PE firms walked away with $470 million in fees and interest payments, even as the company collapsed.

Red Lobster is a textbook example of asset-stripping gone wrong. In July 2014, Golden Gate Capital acquired the seafood chain for $2.1 billion. To fund the purchase, they immediately sold the real estate of 500 Red Lobster locations for $1.5 billion to American Realty Capital Properties [16]. Instead of using the proceeds to improve operations, the money was funneled into the acquisition itself. This left Red Lobster leasing back its former properties at inflated rates, with a mandatory 2% annual rent increase. By 2023, these escalating rental costs drained revenue and severely hampered operations. Combined with poor management by its next owner, Thai Union, the chain filed for bankruptcy in May 2024, closing nearly 100 locations and affecting 36,000 employees [16].

"Red Lobster is yet another example of that private-equity playbook of harming restaurants and retailers in the long run." - Andrew Park, Senior Policy Analyst, Americans for Financial Reform [16]

The takeaway is stark: companies weighed down by aggressive financial tactics and excessive debt face a much higher risk of failure. In fact, private equity-backed firms are 10 times more likely to go bankrupt compared to those not acquired by such investors [16]. These cautionary tales serve as a warning for SaaS and AI companies considering partnerships with PE firms.

How to Spot Warning Signs in PE Partnerships

Healthy vs Extractive Private Equity Partnerships Impact on SaaS Companies

Red Flags That Signal Predatory PE Tactics

One of the clearest warning signs in private equity (PE) partnerships is excessive leverage. For example, if a PE firm plans to finance more than 80% of an acquisition with debt - especially when it involves over $7 in debt for every $1 of profit - this should raise serious concerns [18]. In such cases, the debt burden is shifted onto the company’s balance sheet, leaving the PE firm free to extract value while your company shoulders the financial risk.

Another tactic to watch out for is dividend recapitalizations, where companies are forced to take on additional debt just to pay out investors. This increases the likelihood of financial distress by a staggering 2.4 times the average [17]. Similarly, sale-leaseback proposals, which provide immediate cash at the cost of locking in future rent hikes, often signal asset-stripping strategies.

Aggressive exit timelines and fee structures are additional red flags. Be cautious of firms that push for exits within 2–3 years or frequently mention "secondary buyouts" (selling the company to another PE firm) instead of aiming for an IPO or strategic acquisition [18]. Fixed management fees that aren’t tied to performance milestones are another concern. In fact, SEC examinations have revealed fee collection and expense allocation violations in more than half of the PE firms reviewed [19].

"By far, the most common observation our examiners have made when examining private equity firms has to do with the adviser’s collection of fees and allocation of expenses."

- Andrew J. Bowden, Director, Office of Compliance Inspections and Examinations, SEC [19]

Operational warning signs are equally critical. If a PE firm plans mass layoffs within the first six months or talks about "clean-sheeting" labor costs by cutting them 30%–60%, this often indicates a focus on quick margin boosts rather than sustainable growth. Alarmingly, 71% of PE acquisitions involving companies valued over $1 billion result in a CEO change, with 38% of those changes occurring within the first two years [13].

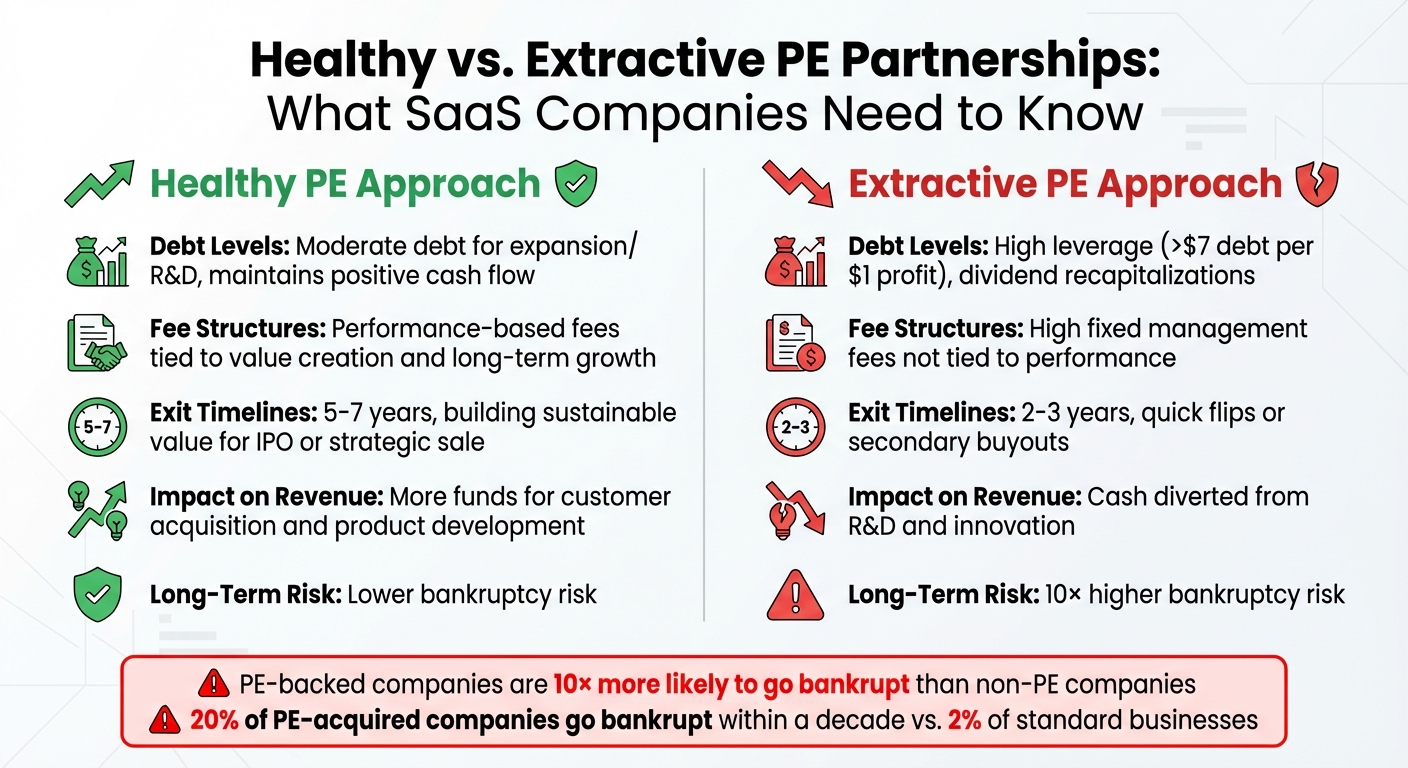

The table below highlights the differences between healthy and extractive PE approaches and their impact on SaaS companies.

Comparison Table: Healthy vs. Extractive PE Partnerships

| Strategy | Healthy PE Approach | Extractive PE Approach | Impact on SaaS Revenue | Long-Term Risk |

|---|---|---|---|---|

| Debt Levels | Moderate debt used for expansion or R&D; focus on maintaining positive cash flow | High leverage (>$7 debt for every $1 profit) and reliance on dividend recapitalizations [18][17] | More funds available for customer acquisition and product development | 10× higher bankruptcy risk due to financial engineering [1] |

| Fee Structures | Performance-based fees tied to value creation and long-term growth milestones | High, fixed management fees not tied to performance [1][19] | Revenue can be reinvested in growth | Cash diverted from R&D and innovation |

| Exit Timelines | 5–7 years; aimed at building sustainable value for an IPO or strategic sale | 2–3 years; focused on quick flips or secondary buyouts [18] | Allows time to build recurring revenue | Rushed decisions may damage customer relationships and product quality |

How to Protect Your SaaS or AI Company

After exploring private equity (PE) tactics, it’s time to focus on strategies that prioritize sustainable growth and maintaining control over your company’s direction.

Build Revenue That Stands on Its Own

One of the best ways to counter the financial strain of external funding is to build a self-sustaining revenue model. Here’s an eye-opening stat: 82% of bootstrapped SaaS companies either break even or turn a profit, compared to just 43% of equity-backed companies [20]. Bootstrapped businesses often focus on generating what’s known as “good revenue” - revenue that creates positive cash flow after factoring in all costs, taxes, and capital charges [13]. This approach provides a strong financial foundation and reduces dependency on outside funding.

For AI-integrated companies, the numbers are even more encouraging. AI-enabled businesses report 61% profitability, compared to 54% for those without AI [20]. Real-world examples highlight this advantage: in May 2025, Shutterfly’s AI-powered auto-fill feature brought in $5 million in new revenue, while Avalara’s use of a generative AI tool from Drift cut sales response times by 65%, leading to higher conversion rates without adding extra staff [4]. These cases show how leveraging AI can organically boost your financial health, making PE funding less appealing.

Take Control of Negotiations and Safeguard Your Vision

Building revenue is one thing, but protecting your company’s direction is equally important. Before entering any partnership with a PE firm, take the time to conduct your own due diligence. As one expert puts it:

"I am continually amazed by what we find when we pause and take a short amount of time - six weeks or so - to do diligence ourselves and quantify full potential" [13].

By clearly defining your company’s goals and trajectory, you can set performance expectations on your terms, rather than letting a PE firm dictate them.

When negotiating, push back on terms that could undermine your autonomy. For example, avoid management fees that aren’t tied to measurable performance milestones. Perhaps most critically, retain control over key hiring decisions. PE firms often move quickly when making talent changes - typically within 1–3 months, compared to the 6–12 months it takes public companies [13]. To protect your long-term vision, secure approval rights for hires in roles that are essential to your company’s future.

Leverage AI to Strengthen Operations and Stability

Innovation is essential for staying competitive, and AI offers a powerful way to enhance both efficiency and revenue. For instance, AI-based tools can reduce software programming time by over 50%, and companies that scale these tools report productivity gains of up to 30% [22][4]. This means you can deliver key features faster and at a lower cost [21]. A great example is LogicMonitor’s Edwin AI solution, which, as of May 2025, generated an average of $2 million in annual savings per customer - boosting recurring revenue significantly [4].

However, AI adoption isn’t without challenges. A staggering 75% of AI systems face major quality issues, often due to poor maintainability and insufficient testing [3]. To avoid these pitfalls, establish clear metrics and implement strong governance practices. As one expert warns:

"AI systems tend to have a very low maintainability score... Data scientists focus on developing functional models but often lack training in creating robust, production-ready systems" [3].

To address this, document your data lineage, maintain human oversight for critical decisions, and ensure your AI solutions are genuine innovations - not just chatbots layered onto outdated software. These steps not only strengthen your financial position but also prepare your company for the scrutiny of PE due diligence.

Conclusion

Private equity (PE) partnerships can be beneficial, but only when their goals align with your company's long-term vision. However, certain warning signs indicate extractive tactics that prioritize short-term gains over sustainable growth. If a PE firm saddles your business with excessive debt, mandates aggressive cost-cutting within months, or pushes asset sale-leasebacks that deplete future cash flow, these are clear indicators of a focus on immediate returns rather than building lasting value.

Spotting these red flags early is crucial for protecting your business. By focusing on creating self-sustaining revenue streams, conducting thorough independent due diligence, and leveraging tools like AI to optimize operations, you can reduce reliance on external funding and maintain control of your company's direction.

This is especially critical for SaaS and AI companies, where a competitive edge hinges on ongoing R&D, specialized talent, and innovation. These are often the first areas targeted for cuts by extractive PE firms. To safeguard your advantage, ensure strategic control over product development and hiring. Scrutinize any debt arrangements that shift repayment burdens onto your company, and confirm that management fees are tied to clear, measurable outcomes.

Ultimately, alignment is everything. If a PE firm's short-term exit strategy conflicts with your long-term objectives, it can strip value from your business instead of enhancing it. Staying vigilant, maintaining operational control, and aligning PE terms with your strategic vision are essential steps to securing a partnership that supports - not undermines - your company's growth and success.

FAQs

Why do some private equity firms focus on short-term profits instead of long-term growth?

Private equity firms tend to focus heavily on short-term profits, largely because of the way their fee structures and incentive models are designed. These systems often reward quick financial wins, which can be achieved through strategies like aggressive cost-cutting or financial maneuvers aimed at rapidly boosting a company’s valuation. On top of that, PE firms commonly rely on significant amounts of debt to amplify short-term profitability. While this tactic can deliver impressive returns in the near term, it often puts a strain on a company’s long-term health and stability.

Executive compensation also plays a role in this dynamic. Many executives see their pay tied to immediate performance metrics rather than long-term growth. This setup creates intense pressure to show fast results, even if it means sacrificing the company’s future potential. While this approach can generate appealing gains for investors in the short run, it often leaves businesses exposed to operational risks and challenges that emerge later.

What are the risks of leveraged buyouts by private equity firms?

Leveraged buyouts (LBOs) often leave companies carrying heavy debt loads, which can put a strain on their financial health and limit opportunities for growth. This debt pressure frequently forces businesses to make tough decisions, such as cutting costs through layoffs. In fact, research indicates that employment tends to drop by about 12% within two years after a buyout.

This focus on achieving quick profits can sometimes come at the expense of long-term stability. It may lead to reduced spending on innovation, operational challenges, and even financial trouble. Companies considering private equity partnerships need to weigh these risks carefully and ensure that such arrangements align with their commitment to sustaining long-term value.

How can SaaS and AI companies protect themselves from risky private equity practices?

To guard against potentially harmful practices from private equity (PE) partnerships, SaaS and AI companies should focus on building strong governance structures and financial safeguards. Start by thoroughly researching the PE firm's track record - pay close attention to their history with cost-cutting measures, debt practices, and fee arrangements. For instance, some PE-backed companies face steep job cuts and mounting debt, which can stifle long-term growth.

When negotiating, include protections like limits on debt-financed dividends, caps on management fees, and clauses that grant your team veto power over critical decisions, such as asset sales or workforce reductions. Securing board-level rights - like a guaranteed founder seat or super-majority voting - can also ensure that essential priorities like R&D and data privacy remain front and center.

Consider diversifying your funding sources to reduce dependence on PE capital. Look into performance-based earn-outs tied to SaaS-specific metrics, such as ARR growth or churn reduction, instead of relying solely on EBITDA targets. Additionally, safeguard your talent by negotiating retention bonuses and preserving employee benefits - high employee turnover can severely impact innovation and growth. By embedding these measures, your company can retain strategic control and protect its long-term value, even under PE ownership.