Selling your SaaS or AI business is a big decision, and choosing the wrong buyer can cost you time, money, and even your company’s legacy. To avoid these pitfalls, you need to ask buyers three critical questions upfront:

-

Can you prove you have the money to buy this business?

Verify their financial capability by requesting documents like bank statements, credit reports, and audited financials. This ensures you're not wasting time on unqualified buyers. -

What will you do with the business after you buy it?

Understand their plans for growth, employee retention, and operational changes. This helps you assess whether their vision aligns with your values. -

How did you calculate your offer price?

Ask for detailed data behind their valuation, including revenue multiples, comparable sales, and financial models. This allows you to negotiate effectively.

Question 1: Can You Prove You Have the Money to Buy This Business?

Why You Need to See Proof of Funds

Time is money when selling your business. For SaaS and AI companies, where both time and proprietary information are critical, confirming a buyer’s financial capability upfront protects your business’s value. The typical sales process lasts 2–4 months, with 1–2 months dedicated to due diligence. If a buyer without verified funds backs out, it can cost you thousands in legal, accounting, and advisory fees [7]. In fact, over 80% of unsolicited offers are either revised downward or fall apart entirely when sellers skip professional representation during the verification stage [11].

"The major mistakes most entrepreneurs make during the early phases of a transaction are wasting energy on buyers who aren't qualified and judging the attractiveness of an offer without first obtaining background information on the buyer."

- Jacob Orosz, President, Morgan & Westfield [7]

What Documents to Request

Take a step-by-step approach to financial screening. Start by requesting a signed Non-Disclosure Agreement (NDA), a detailed buyer profile, and a personal financial statement before sharing any sensitive business information [7]. This initial step helps filter out uncommitted buyers while keeping serious prospects engaged.

When a buyer makes an offer, ask for the following documents to confirm their financial standing:

- Bank statements (no older than 180 days)

- Audited financial statements for the past three years

- Credit reports [8][9]

If you’re offering seller financing, treat the buyer as a bank would. Request their credit score and conduct a background check [7]. Also, ensure they have enough funds for a down payment before moving into the due diligence phase.

For buyers involving outside investors, require the investor to sign an NDA and complete the same qualification forms [7]. Confirm whether their funding depends on third-party approvals or contractual conditions that could delay fund transfers [10]. For SaaS businesses, it’s essential to verify that the buyer has sufficient funds to handle license transfers or lease assignments, especially if you’ll remain a guarantor on the lease [7].

Once you’ve collected these documents, pay close attention to how the buyer responds to further verification requests. Their willingness to cooperate can reveal how serious they are about the purchase.

Warning Signs of Unqualified Buyers

Refusing to provide documentation or relying on vague funding sources are major red flags. Serious buyers understand the need for financial screening and will comply with reasonable requests [7]. If a buyer refuses to complete a personal financial statement or submit a buyer profile, it’s best to walk away. This behavior often signals trouble ahead in negotiations and closing [7].

"Most buyers who aren't serious won't go to the trouble of completing a detailed buyer profile and personal financial statement, so the screening process itself will help weed out tire kickers."

- Jacob Orosz, President, Morgan & Westfield [7]

You can also do some basic research on the buyer. A quick Google search of their name, phone number, and email address can uncover public red flags [7]. Look for inconsistencies between their bank statements and the revenue figures in their profit and loss statements [8]. Buyers who are overly critical, unresponsive, or rigid about the screening process often lack the financial readiness or intent to close the deal [7]. If a buyer becomes unresponsive, limit your follow-ups to two or three attempts - this behavior often predicts future negotiation hurdles [7].

"The most revealing red flags often appear in month-over-month operational metrics rather than annual statements. Subtle variations in working capital patterns can expose underlying business model weaknesses."

sbb-itb-9cd970b

Question 2: What Will You Do With the Business After You Buy It?

What the Buyer's Answer Reveals

The buyer’s plans for your business after the acquisition can provide valuable insight into their intentions - whether they’re in it for the long haul or aiming for a quick turnaround. Different types of buyers have different approaches: strategic buyers often aim to integrate your business into their existing operations for synergy [2], private equity firms focus on growing EBITDA to prepare for a future sale [2], and next-generation operators typically prioritize maintaining continuity and honoring the business's legacy [1]. By identifying which category your buyer fits into, you can get a better sense of how they’ll treat your employees, customers, and the business overall.

It’s a good idea to ask for a detailed 12–18 month plan. This will help you gauge whether the buyer is planning for sustainable growth or simply looking to extract value quickly [1][2]. Be cautious of vague responses or an overemphasis on aggressive cost-cutting, as these can indicate a lack of preparation or a short-term mindset [1].

"A buyer's post-acquisition vision reveals whether they're aligned with your legacy and goals. It also helps you assess whether their plans are realistic and sustainable."

- Ali Masoud, Director in PCE's M&A practice [2]

Another key area to focus on is how the buyer plans to manage your team and day-to-day operations.

Questions About Employees and Operations

When evaluating a buyer’s intentions, pay close attention to their plans for your employees. Ask directly if they intend to retain key members of the management team, implement layoffs, or restructure the organization [2]. This is especially critical for SaaS businesses, where institutional knowledge - such as customer relationships and product architecture - plays a significant role in maintaining the company’s value. Losing core team members can have a detrimental impact.

You can also request examples of the buyer’s past acquisitions and, if possible, speak with previous owners who’ve sold to them [2]. Additionally, clarify whether they expect you to stay on during a transition period. Typically, handover periods last about six months [12], but some buyers may require a longer timeframe to ensure a smooth transfer of knowledge and customer relationships.

Finally, it’s important to understand their approach to growth and how it aligns with your business’s future.

How SaaS Buyers Approach Growth

SaaS buyers generally follow one of three growth strategies: expanding their market reach, consolidating technology, or enhancing AI capabilities. A common trend is consolidating applications to increase the Total Addressable Market (TAM) [5]. This strategy is particularly appealing because, according to Gartner, 20–30% of SaaS budgets are wasted on duplicate or unused tools [4]. Buyers who can streamline tech stacks stand to gain significant value.

In the AI space, buyers are increasingly moving beyond generic GPT-based tools to focus on specialized solutions that leverage proprietary data for a competitive edge [3][4]. With 78% of companies now using AI - up from 55% just a year ago [4] - tools trained on company-specific data offer deeper insights and more tailored applications.

Ask potential buyers about their strategy for maintaining AI model stability and their contingency plans for disruptions in large language models (LLMs). Detailed answers here can indicate a strong understanding of operational challenges [3].

| Buyer Type | Primary Focus | Typical Post-Acquisition Vision |

|---|---|---|

| Strategic Buyer | Market share, brand, or technology [2] | Integration into existing operations to realize synergies [2] |

| Private Equity | EBITDA growth and operational efficiency [2] | Value creation through investment or streamlining for a future exit [2] |

| Next-Gen Operator | Continuity and legacy [1] | Building on the existing foundation and honoring the founder's vision [1] |

Six Questions Every Business Owner Should Ask a Buyer

Question 3: How Did You Calculate Your Offer Price?

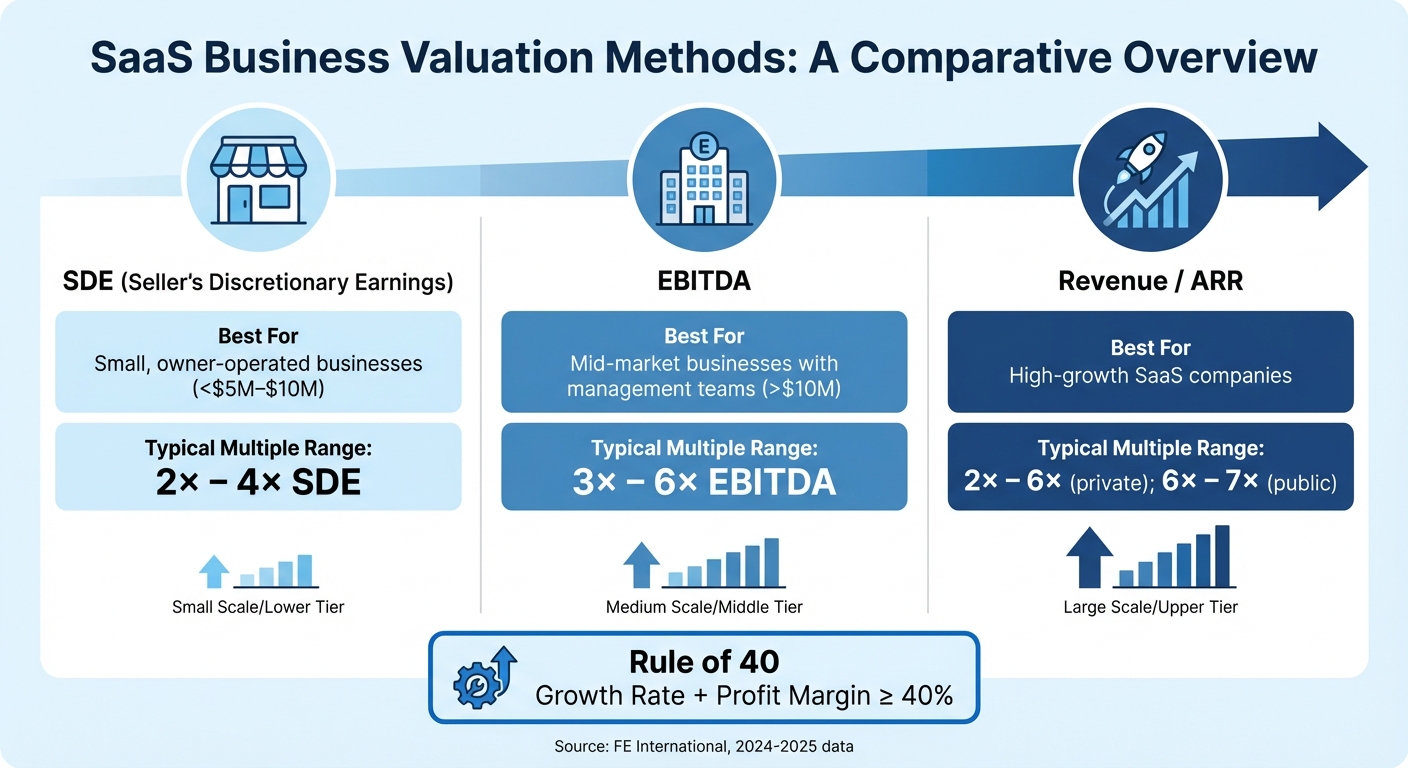

SaaS Business Valuation Methods and Multiples Comparison

How SaaS Businesses Are Typically Valued

Understanding how buyers assess the value of your SaaS business can give you a critical edge during negotiations. The valuation approach often depends on your company's size and growth stage. For smaller, owner-operated SaaS businesses valued under $5–10 million, buyers generally use Seller's Discretionary Earnings (SDE) multiples. This method accounts for your salary and personal expenses to reflect the actual earnings of the business. Typically, these businesses are valued at around 2× to 4× SDE [13].

For larger businesses with established management teams, buyers shift to using EBITDA multiples. Mid-market companies usually see valuations in the range of 3× to 6× EBITDA, while significant buyouts (exceeding $1 billion) have averaged about 15.5× EBITDA in 2024 [13]. High-growth SaaS companies, where profitability might be low but future potential is high, are often valued using revenue multiples based on Annual Recurring Revenue (ARR). By early 2025, public SaaS firms were trading at roughly 6–7× revenue, whereas private companies generally sold for 2–6× revenue [13].

One key metric that buyers often rely on is the Rule of 40. This principle states that the sum of your growth rate and profit margin should be at least 40%, serving as a measure of your business's overall health [15].

"Valuation is both an art and a science, especially post-pandemic."

- Thomas Smale, CEO of FE International [13]

Armed with this knowledge, you can better evaluate the justification behind any offer.

Ask for the Data Behind the Offer

Never take a valuation at face value. Always ask the buyer to provide detailed data supporting their offer. This includes comparable sales data (comps) and the financial models they used to calculate their multiple [13]. Request specifics about similar SaaS businesses they've assessed - such as transaction sizes, growth rates, and multiples paid - to ensure the conversation is based on solid numbers.

Make sure buyers also document all add-backs - adjustments for one-time expenses, owner perks, or unusual costs - as these directly impact your SDE or EBITDA [13]. Additionally, ask how they evaluated the quality of your recurring revenue. Monthly Recurring Revenue (MRR) is often valued more highly than lifetime revenue because of its predictability [15].

How to Negotiate a Better Deal

Once you understand the buyer's valuation approach, you can highlight metrics that justify a higher price. For example, an NRR (Net Revenue Retention) above 110% demonstrates strong revenue growth [16]. Similarly, a healthy LTV/CAC ratio of 3:1 can showcase your marketing efficiency [15].

Other factors that can strengthen your position include low churn rates (under 5–7% annually) and a diverse customer acquisition strategy, both of which reduce perceived risk for buyers.

If there’s a gap between your valuation expectations and the buyer's offer, consider proposing creative deal structures. For instance, an earn-out or performance-based payment - where part of the purchase price is tied to achieving future growth milestones - can help bridge the difference [14].

"Knowing what a business is truly worth turns negotiation from a tug-of-war into a math problem you can both solve."

- Clearly Acquired Blog [14]

If you're negotiating with a strategic buyer, ask them to explain the "synergy value" they’ve calculated. This refers to the cost savings or revenue benefits they expect from integrating your business. Strategic buyers may sometimes pay a premium - up to 1.5× your standalone financial value - for companies that offer unique technological advantages or access to a desirable customer base [13].

By leveraging these strategies, you can work toward a deal that reflects the full value of your SaaS business.

| Valuation Method | Best For | Typical Multiple Range |

|---|---|---|

| SDE (Seller's Discretionary Earnings) | Small, owner-operated businesses (<$5M–$10M) | 2× – 4× SDE [13] |

| EBITDA | Mid-market businesses with management teams (>$10M) | 3× – 6× EBITDA [13] |

| Revenue / ARR | High-growth SaaS companies | 2× – 6× (private); 6× – 7× (public) [13] |

Conclusion

Selling your business is a major financial decision that starts with asking the right questions. Ensuring a buyer has proof of funds, understanding their post-acquisition goals, and requiring clarity on how they calculated their offer can help you avoid uncommitted buyers and safeguard your interests [2][6].

These steps aren't just about getting the best price - they're about protecting what you've built. Many business owners prioritize continuity, valuing the preservation of their company’s culture and the well-being of their employees over short-term monetary gains [1]. The ideal buyer will not only offer a fair valuation but also respect your team, maintain your company’s identity, and invest in its future rather than stripping it down for a quick profit.

"The real success of an exit isn't just measured in dollars; it's measured in legacy, continuity and the future of what you've built."

- Mark Kravietz, Managing Partner and Founder, ALINE Wealth [1]

As highlighted earlier, thoroughly vetting potential buyers is critical. Proper screening equips you with leverage during negotiations. By understanding a buyer’s financial capacity and their strategic reasoning, you can confidently push back against undervalued offers with data to back your position [2]. This insight ensures you're not at the mercy of buyers who might exploit gaps in information.

For those navigating the SaaS and AI marketplace, expert support from Agile Growth Labs can connect you with buyers who align with your vision. With the right preparation and thoughtful questions, you can shape your business exit into a success story that meets your financial goals while preserving your legacy.

FAQs

What should I do if a buyer refuses to provide proof of funds?

If a buyer refuses to share proof of funds, it’s a red flag you shouldn’t ignore. This document is crucial because it confirms they have the financial means to complete the purchase. Without it, you could end up spending time on someone who might not be able to follow through.

In such cases, it’s wiser to step away from negotiations and redirect your efforts toward a buyer who is upfront and financially ready. Your time is valuable, and prioritizing a smooth, hassle-free transaction is always the smarter choice.

How can I make sure the buyer’s plans align with my company’s values and goals?

To make sure a buyer aligns with your company’s values and goals, think of the process as a reverse interview. Start by digging into their track record with previous acquisitions. Ask questions like how they’ve tackled integration challenges, whether they’ve preserved the culture of acquired companies, and how they’ve managed employee transitions. Buyers who’ve demonstrated respect for legacy values in the past are more likely to do the same for your business.

Then, explore their motivation for purchasing your company and how it fits into their broader strategy. Questions such as, “How will you maintain our product vision and customer experience?” or “What are your plans for our team and leadership?” can reveal a lot about their intentions and priorities.

Lastly, seek specific commitments to safeguarding your company’s legacy. A reliable buyer should be able to outline concrete actions, like keeping key employees on board or protecting your brand identity. Whenever possible, make sure these promises are written into the agreement to hold them accountable after the sale.

How can I negotiate a better offer when selling my business?

To negotiate a stronger offer, it’s essential to first understand the buyer’s financial situation. Ask about their funding sources - are they using cash, loans, or equity? If external financing is involved, emphasize your business’s steady cash flow and overall stability as reasons to justify a higher price. You can also introduce time-sensitive terms to create urgency, especially if their financing has strict deadlines.

Engaging multiple buyers is another effective strategy. By fostering competition, you can position your business as a more desirable asset. Ask potential buyers why they’re interested and what their plans are after the purchase. If you can demonstrate that other buyers see strategic value in your business - such as enhancing their product lineup or gaining access to your customer base - you can use that as leverage to push for higher bids.

Finally, tailor your negotiation to align with the buyer’s goals. For buyers focused on growth, consider offering performance-based incentives like earn-outs to showcase your confidence in the business’s future potential. For those prioritizing stability, highlight the importance of retaining key employees or preserving the company’s culture as part of the deal. By addressing their priorities directly, you can strengthen your position and secure a deal that works for both sides.