Private equity (PE) plays a key role in scaling SaaS and AI companies, but misalignment between PE firms and their portfolio companies often leads to underperformance. Despite significant investments, over 80% of AI programs and 40% of acquisitions fail to meet expectations. The main issues include:

- Conflicting timelines: PE firms focus on short-term exits, while SaaS and AI require long-term R&D and market development.

- Growth vs. profitability: PE firms prioritize margins, but SaaS/AI companies need upfront investments for growth.

- Strategy mismatches: PE's cost-cutting approach often clashes with the demands of SaaS and AI development.

To fix this, companies must focus on early alignment during due diligence, clear value creation plans, and measurable metrics post-deal. Tools like AI platforms, shared governance, and ecosystems can help maintain focus and deliver results. Misalignment isn’t inevitable - addressing these gaps early can turn PE partnerships into growth engines.

Private Equity Misalignment: Key Statistics and Impact on SaaS and AI Companies

The Surprising ROI of Executive Alignment in Private Equity

Common Misalignments in Private Equity Partnerships

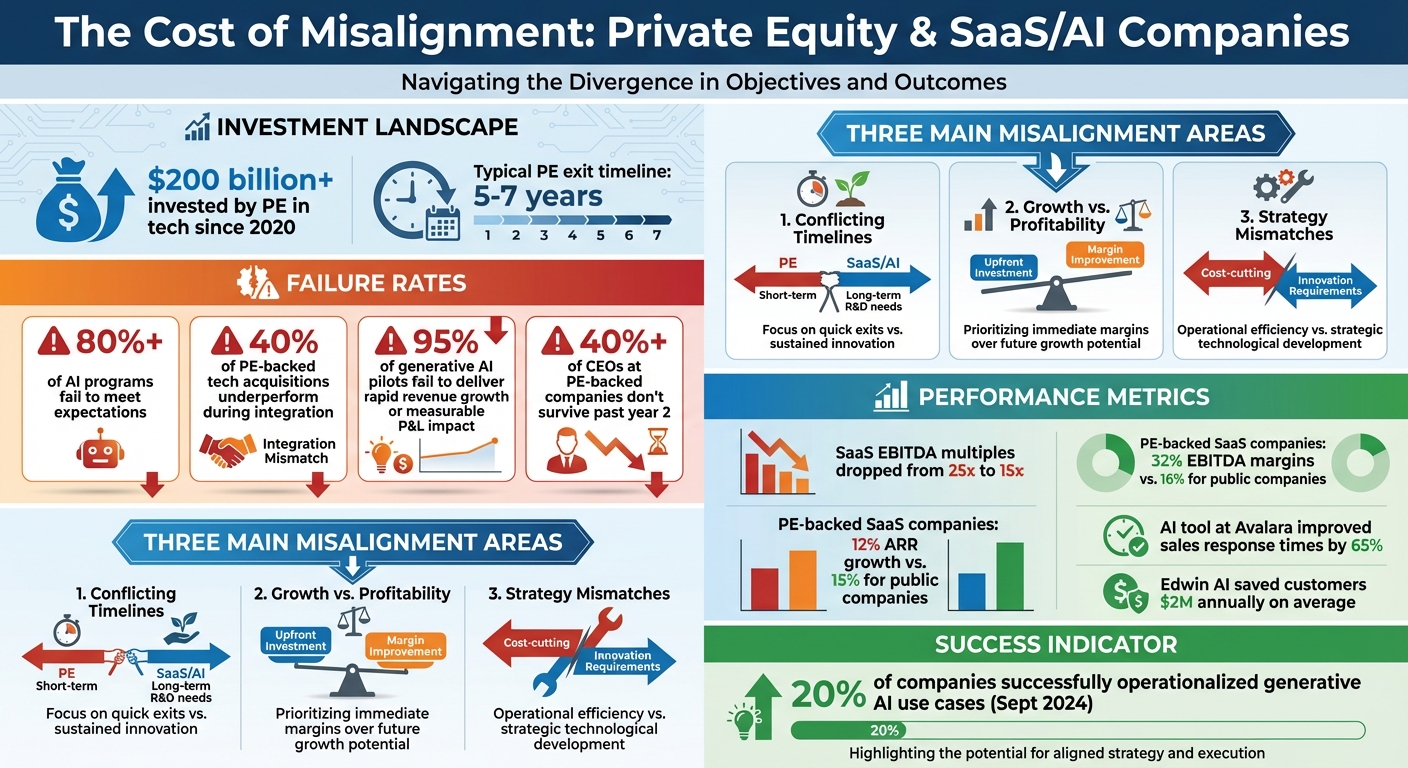

Misalignment between private equity (PE) firms and SaaS/AI companies can lead to serious setbacks. For instance, nearly 40% of PE-backed tech acquisitions underperform during the integration phase[4]. Considering that private equity has poured over $200 billion into tech since 2020[6], it's clear that aligning investor and company goals is critical. Let’s break down where these disconnects often arise.

Conflicting Investment Timelines

Private equity firms typically work within a five-to-seven-year exit timeline, which places immediate pressure on portfolio companies to deliver fast, measurable growth. This approach often clashes with the realities of building SaaS platforms and AI products, which demand years of R&D, data collection, and market penetration to fully mature. The disconnect becomes even starker as PE teams push for quick wins, while company leaders recognize that these technologies require patience and sustained investment. As Javier Rojas, Founder of Savant Growth, puts it:

"We help on working with their AI thesis and where to create that value and how to capture that when they go to exit."[1]

This emphasis on exit-driven results often forces companies into short-term strategies, potentially stifling long-term innovation.

Growth vs. Profitability Trade-Offs

Balancing aggressive revenue growth with profitability often creates tension in PE-backed SaaS companies. Growth-stage SaaS firms prioritize expanding ARR (Annual Recurring Revenue) and NRR (Net Revenue Retention), which requires significant upfront investment. On the other hand, PE firms - focused on their buy-to-sell model - push for operational efficiency and margin improvement to boost financial performance within their limited timeframe[10].

This conflict is particularly evident in generative AI budgets. Over half of these budgets are directed toward sales and marketing tools, even though the highest ROI often comes from back-office automation[5]. Companies are left navigating a tough choice: aggressively invest to capture market share or cut costs to showcase profitability.

Strategy and Operations Mismatches

Operational and cultural misalignments between founder-led companies and PE-driven frameworks can derail even the best-funded projects. The traditional PE playbook, which prioritizes rapid cost-cutting and short-term financial gains, doesn’t always align with the human-centric and complex nature of SaaS and AI businesses. This friction becomes especially problematic when PE teams fail to grasp the technical intricacies of AI development or the importance of maintaining an innovative engineering culture. As Trajectory Group explains:

"PE Operators have a number of playbooks to choose from when determining the post-investment path forward. The decisions taken should align with the PortCo's strategic goals. Having alignment between the Operating and PortCo Management Teams about the ultimate PortCo goals and how best to achieve those is key to the two teams working well together."[9]

The challenge is stark: 95% of generative AI pilots fail to deliver rapid revenue growth or a measurable P&L impact[5]. This is often because the strategic vision between PE operators and company management remains misaligned, undermining the potential for success.

How to Diagnose and Fix Misalignment

Catching misalignment early can make all the difference between success and failure. The good news? Many alignment issues can be resolved if addressed promptly. The key is to start this process even before a deal is finalized.

Pre-Deal Alignment Assessment

When conducting due diligence, don’t stop at the financials. It's just as important to analyze how well the product and AI strategy align. Does the product roadmap support growth? Is the AI product positioned correctly in the market? Are there gaps in the competitive landscape that need to be addressed? And, perhaps most importantly, are customers ready to embrace AI-native tools? These are the questions that can reveal potential alignment issues before they become problems [11].

Once you've identified areas of alignment, the next step is ensuring they remain intact after the deal is closed.

Post-Close Alignment Strategies

The first 90 days after closing a deal are crucial. Think of this period as the foundation for long-term success. Integration isn’t a one-and-done task - it’s an ongoing process, especially for companies following a buy-and-build strategy. To succeed, you’ll need to execute carefully across key areas like finance, digital transformation, human resources, and strategy [12][13]. Having a well-structured AI playbook can be a game-changer, helping operating partners pinpoint and scale AI-driven opportunities [13].

Using Data and Tools to Maintain Alignment

Keeping everything on track requires real-time visibility. GTM AI platforms with unified workflows make collaboration easier and ensure your go-to-market strategy stays consistent [8]. These tools offer a clear view of operations, helping you confirm that opportunities align with the company’s roadmap [2]. Many leading private equity firms are doubling down on technology by bringing in AI talent, setting up governance protocols, and building teams of expert advisers. These efforts are designed to help both the firm and its portfolio companies stay ahead in a rapidly evolving landscape [8].

sbb-itb-9cd970b

Practical Strategies for Realigning Private Equity and SaaS/AI Companies

Private equity has shifted its approach - from simply acquiring undervalued assets to actively transforming businesses during ownership [14]. But this evolution comes with challenges. More than 40% of CEOs at private equity–backed companies don’t make it past their second year [14]. A major culprit? The dreaded "first board meeting surprise", where misaligned goals and unclear communication cause early setbacks [14]. To avoid these pitfalls, it’s critical to implement strategies that promote alignment from the very beginning.

Building a Shared Value Creation Plan

Strong partnerships start with a solid, well-thought-out plan. A five-point framework can define clear goals, whether it’s increasing efficiency, cutting costs, or achieving strategic milestones [14][3]. For founder-led SaaS and AI companies - especially those scaling from $10 million in revenue - this often means focusing on areas like expanding distribution channels, strengthening leadership teams, and planning for succession. These steps can help drive 5-10x growth [14].

Equally important is preserving the founder’s "innovative spark." This creativity fuels the development of market-leading products that not only stand out but also appeal to future strategic buyers [14].

Aligning Metrics and Incentives

Having a shared plan is just the first step - tracking the right metrics is just as essential. For SaaS companies integrating AI, this means going beyond traditional metrics. Measures like token efficiency and cost per outcome are becoming key indicators of success in these evolving business models [15].

Setting Up Governance and Operating Models

The most effective partnerships embrace a "no-surprises" approach [14]. This involves openly sharing diligence findings and agreeing on a clear action plan before making any commitments. Once the deal is finalized, solid governance becomes the backbone of success. This ensures AI initiatives are transparent, compliant, and aligned with broader business objectives [3].

To keep things running smoothly, it’s important to establish clear decision-making rights, structured board operations, and regular operating rhythms. With over 80% of private equity workflows already relying on structured processes [14], these frameworks are critical for reducing friction between investors and management teams and setting the stage for long-term growth.

SaaS and AI-Specific Alignment Considerations

SaaS and AI companies often operate in ways that don't always align smoothly with private equity (PE) expectations. Understanding these differences is crucial for forging partnerships that work. Let’s dive into how SaaS revenue models and AI investment challenges shape these dynamics.

SaaS Revenue Models and Contract Structures

SaaS businesses rely on subscription-based revenue models, which can conflict with PE’s focus on predictable, short-term profitability. This tension forces SaaS companies to juggle rapid growth with maintaining strong financial fundamentals. Over the years, the market has shifted significantly - average EBITDA multiples for SaaS companies have dropped from 25x to 15x, reflecting a growing investor preference for profitability over pure growth [17].

This shift has real-world implications. PE-backed SaaS companies tend to grow slightly slower than their public counterparts, with annual recurring revenue (ARR) growth rates of 12% compared to 15%. However, they often deliver double the EBITDA margins - 32% versus 16% - showcasing the operational discipline PE firms demand [16]. As Development Corporate explains:

"Private equity only wants category leaders with AI integration and paths to 40%+ EBITDA margins" [17].

For SaaS companies, this means focusing on solid financial metrics and clear, achievable profitability goals rather than relying solely on future growth projections.

AI Investment Challenges

AI integration adds another layer of complexity to the equation. Developing AI models, maintaining cloud infrastructure, and ensuring data privacy compliance require hefty upfront investments. Since PE firms typically hold investments for three to five years, AI initiatives must deliver measurable results within a tighter timeframe than traditional development cycles allow.

There’s encouraging progress, though. A Bain & Company survey in September 2024 found nearly 20% of companies had successfully operationalized generative AI use cases and were already seeing tangible benefits [18]. Vista Equity Partners serves as a prime example of how AI can deliver results at scale. The firm requires its portfolio companies to set specific AI goals and measure their outcomes. For instance, Avalara, a Vista-backed company, used a generative AI tool from Drift (now part of Salesloft) to improve sales response times by 65%. Similarly, LogicMonitor implemented its AI solution, Edwin AI, saving an average of $2 million annually per customer [18].

Vista even predicts that AI’s impact could reshape the traditional "Rule of 40" (the sum of revenue growth and margin), potentially raising it to 50% or even 60% within the next three to five years [18]. However, achieving such ambitious results requires companies to focus on a handful of high-priority use cases rather than spreading resources thin across numerous experiments. This underscores the need for external resources - enter marketplaces and ecosystems.

Using Marketplaces and Ecosystems

Top SaaS and AI companies avoid reinventing the wheel for every solution. Instead, they leverage external ecosystems to stay on top of technological advancements, explore new tools, and connect with trusted implementation partners [18]. Platforms like the Top SaaS & AI Tools Directory help businesses find complementary tools that enhance customer value without requiring significant internal development.

Private equity firms are also creating internal networks within their portfolios, especially among companies with similar operating models. These networks allow businesses to share AI solutions, exchange best practices, and collaborate to tackle shared challenges [18]. This collaborative approach not only reduces individual risks but also speeds up results - an essential factor given PE’s tight timelines. By combining internal networks with external ecosystems, companies can align their strategies more effectively with PE expectations.

Conclusion

The success of partnerships between SaaS/AI companies and private equity firms hinges on achieving alignment from the very beginning. It's not private equity itself that leads to underperformance - it's the misalignment on timelines, growth expectations, and operational strategies that derails results. To avoid this, companies need clear value creation plans, shared performance metrics, and governance structures that define decision-making roles and ensure accountability.

Focusing solely on cost-cutting doesn’t work in SaaS, where innovation and company culture are central to driving value [19]. Instead, a unified, platform-driven approach - one that standardizes data interfaces, governance, and go-to-market strategies - can pave the way for seamless innovation and unlock revenue synergies [7].

For SaaS and AI companies, adopting a "deals mindset" is essential. This means prioritizing speed, maintaining focus, and making data-driven decisions [19][20]. AI roll-ups that integrate product roadmaps, data standards, and customer success initiatives into a centralized operating system provide a clear example of how this approach can lead to faster cross-selling, more efficient onboarding, and consistent value delivery [7].

While hitting financial targets is undeniably important, addressing cultural and human elements is just as critical. Decision paralysis and execution gaps are common obstacles for technology companies, including those in SaaS and AI [19]. By implementing governance frameworks that clearly outline decision-making responsibilities, these challenges can be mitigated.

Ultimately, focusing on alignment rather than pointing fingers is what drives better outcomes. When alignment strategies are paired with external partnerships and forward-thinking operational practices, both technological advancements and strategic objectives can progress in harmony.

FAQs

How can private equity firms and SaaS or AI companies align their goals and timelines effectively?

To ensure a partnership runs smoothly, private equity firms and SaaS or AI companies need to establish clear, shared objectives from the very beginning. This means outlining specific milestones, defining expected results, and agreeing on timelines that are both realistic and achievable. Open and consistent communication is key to keeping strategies aligned, especially as market dynamics shift.

Embracing flexible methods, like agile development or rapid pilot programs, can also make a big difference. These approaches allow teams to test ideas quickly and adjust plans as needed, helping both parties stay responsive to the fast-changing SaaS and AI landscapes while keeping their eyes on long-term success.

How can SaaS and AI companies achieve both growth and profitability under private equity ownership?

SaaS and AI companies can find the right mix of growth and profitability under private equity ownership by honing in on efficiency and scalable approaches. Using AI to streamline operations, dive deep into data analysis, and enhance customer interactions can cut costs while still fueling expansion.

Embracing a Product-Led Growth (PLG) model is another smart move. By focusing on delivering value through the product itself and enhancing the user experience, companies can keep customer acquisition costs in check. On top of that, investing in scalable AI-driven platforms positions the business for steady growth without sacrificing profit margins. Success lies in ensuring the company’s objectives and the private equity firm’s strategies are closely aligned.

What are effective ways to address misalignment between private equity firms and tech companies?

Addressing the disconnect between private equity (PE) firms and tech companies begins with open and consistent communication. Both sides need to collaborate early on to define mutual goals, set clear expectations, and align their strategies. Regular check-ins and planning sessions can help ensure everyone stays aligned throughout the partnership.

To tackle operational challenges, AI-powered tools can play a big role. These tools simplify data sharing and decision-making, making processes more transparent and workflows more consistent. On the cultural side, building trust and fostering collaboration are key. Leadership support, shared key performance indicators (KPIs), and tailored training programs can help smooth the integration process. By focusing on these elements, PE firms and tech companies can build a partnership that’s both effective and productive.