Operators, unlike financial buyers, excel in acquiring and scaling tech companies because they bring hands-on experience in building businesses. They focus on improving the business itself - product, teams, and systems - rather than just analyzing spreadsheets.

Key takeaways:

- Deep expertise in tech and SaaS metrics: Operators analyze metrics like CAC, NRR, and Rule of 40 to assess growth potential and profitability.

- Hands-on post-acquisition improvements: They refine sales processes, product roadmaps, and team structures using an AI growth platform to drive growth.

- AI and technical audits: Operators ensure tech stacks are efficient and AI systems are reliable, which is critical with AI-native businesses commanding 2-3x valuation premiums in 2026.

- Integration success: With frameworks like the "100-Day Playbook", operators manage integrations effectively, avoiding the common pitfalls of M&A deals.

Operators don’t just buy businesses - they transform them into scalable, high-performing assets ready for long-term growth or profitable exits.

Skills and Experience Operators Bring to Acquisitions

Understanding of SaaS Metrics and Unit Economics

Operators bring a sharp eye to SaaS metrics, going beyond surface-level financial reviews. Take the Rule of 40 score, for instance. It’s not just a figure on a spreadsheet - it’s a key indicator of how efficiently a company balances growth and profitability. In 2026, SaaS companies with Rule of 40 scores above 40% are commanding valuations 1.5x to 2.0x higher than those in the 20-25% range [1].

Operators also dive deep into unit economics. They know that customer acquisition costs (CAC) in SaaS typically range from $500 to $2,000 [8], and they analyze each acquisition channel individually to spot where CAC is sustainable. Net Revenue Retention (NRR) is another critical focus. Companies with NRR above 120% show they’re growing revenue through upsells rather than churning through new customers [9]. A 5-point improvement in net retention can boost enterprise value by over 20% [2].

"If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple. The more KPIs and the more financial data I have to work with, the more accurate your valuation will be." - Aaron Solganick, CEO, Solganick & Co. [10]

Operators and financial buyers prioritize very different things. While financial buyers focus on cash flow predictability and EBITDA margins [10], operators dig deeper into details like gross margins (ideally above 75%), unit-cost efficiencies, and product stickiness [1][2]. They also consider factors like training data quality and model reliability, which can significantly impact valuation multiples. For AI-native companies, these technical aspects justify the 2.0x to 3.0x premium multiples seen in 2026 [1].

Armed with this financial expertise, operators don’t just assess metrics - they use them to build scalable teams and systems.

Experience Scaling Teams and Systems

Operators excel at identifying and closing operational gaps. Their hands-on experience in scaling teams and systems gives them a major edge during integration. They recognize that acquiring an established team offers "talent arbitrage" - a shortcut to gaining proven processes, team chemistry, and operational efficiency that would otherwise take over a year to replicate [5].

A great example is Zach Simmons’ acquisition of Appraiva in January 2026. Appraiva’s proprietary property condition datasets covered 100 million U.S. properties using computer vision. Instead of dismantling the team, Simmons retained them through aligned incentives. This preserved execution speed and institutional knowledge, allowing him to scale the asset quickly for insurance and construction markets [7].

Post-acquisition failures are common - 70% to 90% of deals fall short due to poor integration [4]. Operators reduce this risk by implementing a "100-Day Integration Playbook" with weekly reviews across key functions [1][2]. Companies that maintain strong operating rhythms are 40% more likely to achieve profitable growth during tough economic times [2].

"Having experience in buying companies, having business experience at running companies and what the integration process is going to be, and using operations people for the M&A team makes us be able to get a deal done very, very quickly." - Bradley Jacobs, Chairman, XPO [4]

Operators also rely on a "Replacement Ladder" approach to scale systematically. They start by outsourcing administrative tasks, then move to delivery, marketing, sales, and finally leadership [6]. This method ensures the business remains stable even after the original owner exits - a frequent failure point for small, owner-operated businesses.

But their expertise doesn’t stop at team building. Operators also revamp operational systems to unlock growth.

Hands-On Approach to Creating Value

Operators don’t just tweak the balance sheet - they overhaul business operations to drive growth. They fix fragmented execution by aligning sales, marketing, and product teams under shared KPIs tied to unit economics and cash flow [2]. Often, operators step into interim executive roles to redesign workflows and ensure weekly metrics drive measurable outcomes [2].

The results speak for themselves. High-performance operating models can increase productivity by up to 25% and accelerate revenue growth [2]. Operators achieve this by standardizing practices like 13-week cash forecasting, directly linking operational metrics to financial impact [2]. They also focus heavily on retention strategies. Top-performing SaaS companies maintain gross margins above 75% and net retention rates exceeding 115% [2].

"You do not fix execution gaps with advisory boards. You fix them with hands-on operators who own outcomes." - Anubhav Awasthi, Basis Vectors Capital [2]

This ownership mindset is what sets operators apart. While financial acquirers often see software as an asset to trim costs and leverage, operators see it as a system of interconnected functions - product, sales, and customer success - that need execution focus to create lasting value [2]. With B2B software CAC rising nearly 60% over five years [2], operators know that sustainable growth depends on improving retention and operational efficiency, not just slashing expenses.

sbb-itb-9cd970b

Acquiring a SaaS Business & Scaling it From $5k - $80k P/mth In 1 Year with Chanakya Yerneni

Case Studies: Operator-Led Acquisitions in SaaS and AI

These examples highlight how operators leverage their expertise to turn strategies into scalable outcomes. They show how operator-driven approaches can lead to impressive growth in the SaaS and AI sectors.

Relay Commerce: Scaling E-Commerce SaaS Tools

Relay Commerce specializes in e-commerce software, focusing on scaling acquired brands while keeping their teams intact. In August 2022, they acquired Fomo, a social proof SaaS tool, from founder Ryan Kulp in a 7-figure deal. At the time, Fomo boasted over $1 million in ARR with 70% margins and handled up to 1 billion JavaScript widget requests during peak months like Black Friday [11].

Instead of cutting costs, Relay retained Fomo's entire team, including CEO Hideko Tachibana. They provided marketing budgets and technical resources to fast-track the product roadmap. Kulp had built 103 native integrations to drive co-marketing, and Relay doubled down on this strategy [11]. The deal progressed from initial to final offer in just 7 to 10 days - a rare speed in SaaS acquisitions [11].

"The team at Relay has deep operating experience and has helped scale some of the biggest names in ecommerce and SaaS. They approached us with the perspective to add growth resources and accelerate our roadmap." - Ryan Kulp, Founder, Fomo [12]

Relay's method is straightforward: let the companies they acquire operate independently while providing the resources needed for growth. This approach preserves the brand's identity and team dynamics, avoiding the disruptions often caused by traditional acquisitions.

SureSwift Capital: Long-Term Growth Through a Buy-Grow-Hold Model

Since 2015, SureSwift Capital has acquired over 40 bootstrapped B2B SaaS businesses, operating with a long-term mindset. Unlike private equity firms that aim to flip businesses within 3 to 5 years, SureSwift takes a more patient approach, managing a global remote team of over 120 people [15][16].

For example, they acquired Mailparser and Docparser from founder Moritz Dausinger in 2016 and 2018. Under CEO Jason Good, hired in 2020, the team expanded from 7 to 20 members. SureSwift addressed technical debt early on and introduced formal product development processes, including a Technical Delivery Manager role. They also began integrating AI and machine learning to enhance data extraction and created a library of thousands of pre-built templates for SEO-driven organic growth [14].

Their "Exceptional Operator Framework" (EOF) is built on four pillars: Strategic Alignment, Best Practices, Performance Metrics & Accountability, and Continuous Improvement & Learning [15]. Portfolio companies operate semi-independently but benefit from centralized support for HR, finance, and tech security. The firm also fosters collaboration through "Guilds", internal groups that allow professionals to share challenges and successes across the portfolio [15][16].

"Unlike traditional VC firms who are looking to buy and rapidly accelerate growth or 'flip' a business, we look at all of our acquisitions with a long-term lens." - Jac Stark, Director of Operations, SureSwift Capital [15]

SureSwift's fee structure - 2% of revenue and 20% of EBITDA - aligns incentives toward sustainable growth and profitability [13][18]. This operator-led model has proven effective even in an industry where M&A failure rates can reach as high as 90% [17].

Tiny: Speed and Founder-Friendly Deals

Tiny has built its reputation as the go-to buyer for founders, offering quick and fair deals with minimal disruption. The firm has grown to nearly $300 million in revenue across a portfolio of 35 to 40 businesses and a global team of over 900 employees [19][21][22].

Tiny’s acquisition process is refreshingly simple: a fair offer within 7 days and deal closure in as little as 30 days [20][21]. For instance, in April 2021, WeCommerce (a Tiny-founded entity) acquired Stamped.io, an e-commerce marketing tool, for $110 million - $85 million of which was in cash and stock at closing. At the time, Stamped.io had a revenue target of around $10 million, reflecting an 11x revenue multiple [20].

Tiny’s approach is hands-off, leaving acquired companies to operate as they were. They prioritize preserving management teams and avoid the cost-cutting "synergy" mindset typical of traditional acquirers [19][22]. When Tiny acquired Dribbble, co-founder Dan Cederholm described the transition as a "seamless passing of the torch" with no disruption to the team or community [21].

"When Tiny buys a company we generally just leave them alone." - Andrew Wilkinson, Co-Founder, Tiny [19]

Tiny focuses on acquiring "New Zealand companies" - hidden gems with steady growth and durable advantages like strong brands or network effects [20]. Inspired by Warren Buffett, Tiny avoids financial jargon to build trust with founders who are often skeptical of traditional investors [22]. Their success underscores the value of maintaining founder-friendly practices while achieving rapid closings.

Frameworks Operators Use After Acquisition

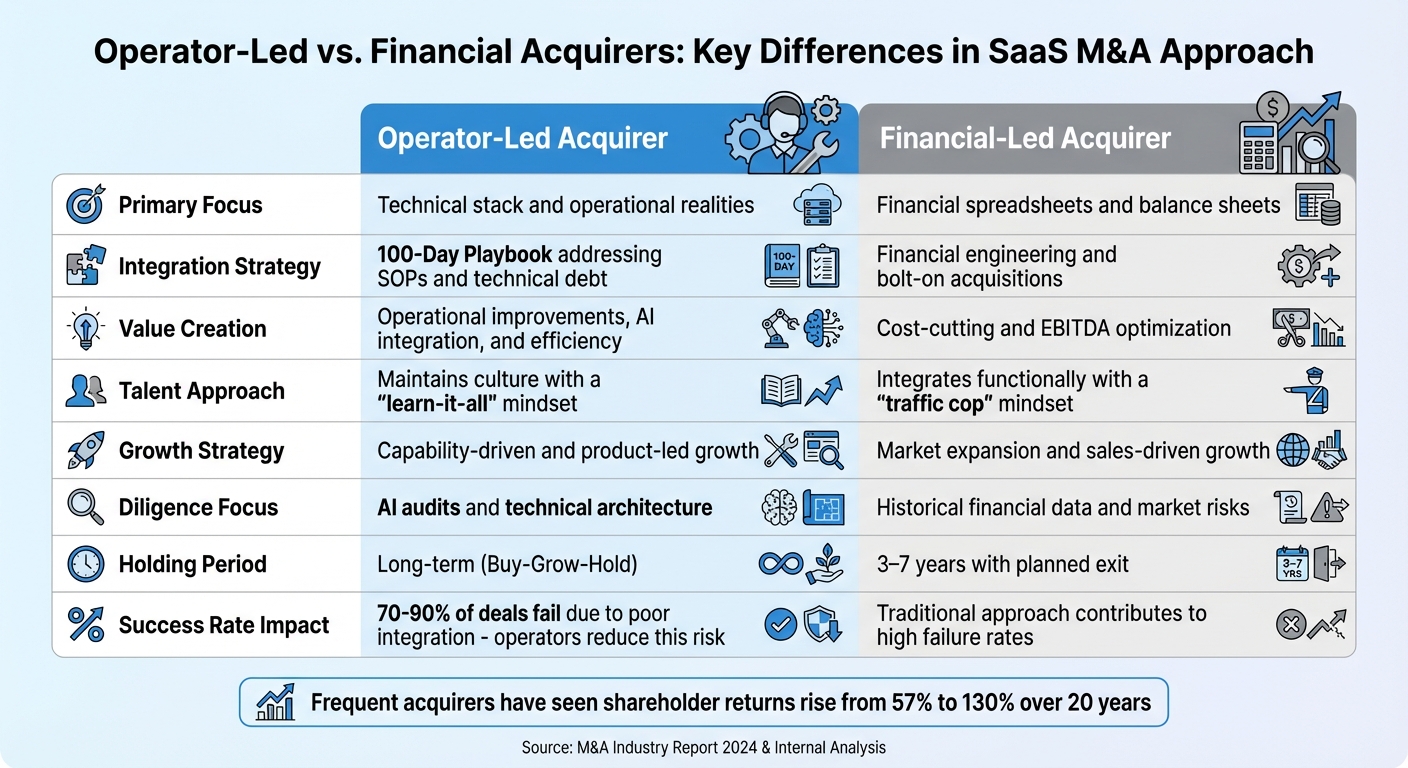

Operator-Led vs Financial Acquirers: Key Differences in SaaS M&A

Operators rely on structured frameworks post-acquisition to ensure long-term success. These frameworks focus on integrating, optimizing, and growing acquired businesses with a steady, deliberate approach.

The Buy-Grow-Hold Model for SaaS

The Buy-Grow-Hold model emphasizes patience and operational discipline. Unlike private equity firms that aim for a quick exit within three to five years, operators take the long view, acquiring businesses they plan to run indefinitely. This mindset influences how they approach integration and growth.

Integration planning begins as early as due diligence. Operators perform "Pre-Wired Diligence", which involves cleaning up tech stacks and documenting Standard Operating Procedures (SOPs) to make the business ready for seamless operation from day one [1].

One key tool is the 100-Day Mandate, where operators finalize an integration playbook even before signing the Letter of Intent (LOI) [1]. This playbook addresses technical debt, sets measurable performance goals, and outlines strategies to capture synergies quickly. Given that integration issues are responsible for 83% of deal failures, this proactive approach is crucial [23].

For smaller acquisitions, typically in the $1–$5 million range, operators often manage the business themselves initially, building cash reserves before bringing in new leadership [6]. As they scale, they follow a specific hiring sequence - starting with Admin, then Delivery, Marketing, Sales, and finally Leadership roles. This order ensures stability as the business grows.

Operators also prioritize performance metrics that financial buyers may overlook. For example, the "Rule of 40" (growth rate plus EBITDA margin) is a critical metric. SaaS companies with a Rule of 40 score above 40 often achieve valuations 1.5× to 2.0× higher than those with scores of 20–25 [1]. Another key metric is maintaining Net Revenue Retention (NRR) above 110%, which signals strong customer loyalty and potential for growth [1].

In addition to this model, operators leverage vertical integration to unlock further synergies.

Vertical Integration and Creating Synergies

Operators are moving beyond traditional SaaS licensing models by adopting vertically integrated approaches. These involve combining software with services to deliver guaranteed outcomes, often powered by AI.

Take Eudia's acquisition of Johnson Hana in July 2025 as an example [25]. By integrating proprietary AI with a team of over 300 legal professionals, Eudia automated tasks like contract analysis and M&A due diligence. This allowed them to offer legal services on a subscription model, blending technology with human expertise.

Similarly, Titan MSP acquired RFA, a managed service provider for financial services, and implemented AI tools to streamline tasks such as new user onboarding. What once took weeks was reduced to minutes, enabling staff to focus on high-value tasks without increasing headcount [25].

Another standout example is Crescendo, an AI customer service platform. After acquiring PartnerHero, a call center firm, Crescendo introduced its AI platform to PartnerHero's 200 customers. This move aimed to increase gross margins to 60–65% while tripling the number of resolved calls, shifting the focus from selling software to delivering measurable results [25].

Long Lake offers further proof of the benefits of vertical integration. Across its 18 businesses in residential and infrastructure services, AI tools boosted productivity by 25–30% and increased the customer pipeline tenfold. Owning both the software and service delivery allowed Long Lake to capture value at multiple stages of the customer journey [25].

Operators focus on achieving technical and operational synergies without resorting to layoffs. To manage this process effectively, they establish an Integration Management Office (IMO) before the deal closes. The IMO monitors system integration and tracks synergy progress weekly, preventing the chaos that often derails acquisitions [23].

"M&A doesn't create value - integration redeems it." - TheOperators.pe [24]

Comparison: Operator vs. Financial Acquirers

Operator-led acquirers take a fundamentally different approach compared to financial buyers, focusing on operational excellence rather than cost-cutting or financial engineering.

| Feature | Operator-Led Acquirer | Financial-Led Acquirer |

|---|---|---|

| Primary Focus | Technical stack and operational realities [1] | Financial spreadsheets and balance sheets [1] |

| Integration Strategy | 100-Day Playbook addressing SOPs and technical debt [1] | Financial engineering and bolt-on acquisitions [1] |

| Value Creation | Operational improvements, AI integration, and efficiency [1][25] | Cost-cutting and EBITDA optimization [1] |

| Talent Approach | Maintains culture with a "learn-it-all" mindset [3][23] | Integrates functionally with a "traffic cop" mindset [23] |

| Growth Strategy | Capability-driven and product-led growth [25][26] | Market expansion and sales-driven growth [27] |

| Diligence Focus | AI audits and technical architecture [1] | Historical financial data and market risks [1] |

| Holding Period | Long-term (Buy-Grow-Hold) [15] | 3–7 years with planned exit [1] |

Dell's $67 billion acquisition of EMC highlights this operator mindset [23]. Instead of spending significant time merging systems, Dell chose to cross-sell products through separate sales teams immediately. This decision generated multibillion-dollar synergies within the first year.

Hitachi's acquisition of GlobalLogic offers another example [23]. To maintain GlobalLogic's innovative culture, Hitachi used cross-cultural teams and workshops to address differences in working methods. This approach preserved the target's strengths while ensuring smooth integration.

In capability-focused deals, operators often collaborate with target leadership to create joint value-creation plans. For instance, when AgriCo acquired FeedCo, an animal nutrition company, they allowed FeedCo's leadership to take the lead on integration planning [3]. This approach not only retained all key employees but also set the stage for doubling revenue over five years - an outcome unlikely with a cost-cutting strategy.

The benefits of operator-led acquisitions are clear. Over the past 20 years, frequent acquirers have seen their shareholder returns rise from 57% to 130% [23]. This widening gap reflects the growing importance of operational expertise, especially as 22% of M&A practitioners now use generative AI for integration planning [23]. Operators who conduct detailed technical audits - examining training data, legal rights, and AI architecture - can distinguish between superficial AI tools and true AI-native systems [1].

"When you reduce a buyer's integration risk, you increase your exit price." - N2M Capital Advisors [1]

How Operator Experience Drives Scalability and Growth

Operators don't just buy businesses - they turn them into well-oiled machines primed for growth. Their expertise lies in spotting inefficiencies, building systems to address them, and setting companies up for long-term success or profitable exits. The secret? Focusing on creating scalable, transferable systems rather than just chasing revenue.

As of 2026, the business landscape prioritizes efficiency and quality over unchecked growth. Consider this: 73% of SaaS companies never reach $10 million in Annual Recurring Revenue (ARR) because they get bogged down in operational chaos [30]. Operators tackle this by eliminating founder dependency, which can drag down a company’s valuation by as much as 40% [30]. They follow a structured "Replacement Ladder" to systematically outsource key functions - starting with administration, then moving to delivery, marketing, sales, and eventually executive leadership [6]. This methodical approach ensures scalability and underscores how operator expertise directly drives value.

"Acquirers Don't Buy Revenue, They Buy Systems. Clean, transferable operations are what turn ARR into 8–9 figure exits."

- Henry Kraus, Founder, Agile Growth Labs [30]

With these solid foundations in place, operators are also leveraging tools like AI to supercharge efficiency and cut costs.

Using AI for Growth and Efficiency

AI is becoming a game-changer for operators aiming to streamline processes and save money. For example, while maintaining a traditional Sales Development Representative (SDR) team might cost around $20,000 a month, an AI stack that handles lead scraping, scoring, personalized outreach, and auto-booking costs only about $200 per month [30]. That’s a staggering 99% cost reduction - and it can even boost qualified demos by 35% [30].

Operators differentiate between basic AI tools and AI-native systems that serve as the backbone of operations [1]. These AI-native platforms go beyond simple automation, driving decision-making and achieving efficiencies that traditional software can’t touch. In the 2026 M&A market, businesses leveraging AI-native systems often command valuation multiples 2.0× to 3.0× higher [1]. Transitioning from manual, people-heavy workflows to AI-powered systems can increase a company’s valuation multiple from around 1.5× to as high as 7.5× in just 90 days [30].

But operators don’t just adopt AI blindly - they conduct thorough audits to ensure the quality and legality of the AI’s training data and to confirm the reliability of the models being used [1]. This level of due diligence helps secure premium valuations and protects against risks.

Preparing for Exits or Continued Scaling

Operators excel at creating businesses that are ready to scale or sell. Buyers aren’t just looking at revenue - they want businesses that can integrate smoothly and grow without relying on the founders.

To achieve this, operators conduct "Exit-Readiness Tech Audits" to eliminate technical debt, document all standard operating procedures (SOPs), and modernize the tech stack [1]. They also reduce buyer risk by implementing "Pre-Wired Diligence" processes and preparing a 100-Day Integration Playbook, often before a Letter of Intent (LOI) is even signed [1]. These proactive steps make the business more attractive to buyers and increase its potential exit price.

Another key metric operators focus on is Net Revenue Retention (NRR). Keeping NRR above 110% shows that customers are not only sticking around but also spending more over time [1]. This kind of customer loyalty and growth is a major selling point for buyers in 2026.

For operators planning to scale rather than sell, building cash reserves is often a top priority. Many begin by running the business themselves, particularly for acquisitions in the $1–$5 million range [6]. This hands-on approach deepens their understanding of the business and ensures a smooth transition when external leadership is eventually brought in. Hiring an experienced operator typically costs around $250,000 annually [6].

Some firms are even experimenting with creative models like "Sales-to-Equity" [29]. In this setup, portfolio companies earn equity in one another through measurable sales contributions, creating a network effect that accelerates growth. This approach has already driven over 300 acquisitions, with a combined transaction value exceeding $43 billion [28].

Conclusion

Operators have a unique ability to turn businesses into scalable, high-performing assets. Their hands-on experience in running and growing companies gives them an advantage that financial-only acquirers often lack. By addressing fragmented execution, fixing technical debt, and building systems that scale without relying on the founder, they essentially rework a business's operating system for long-term success [2].

Acquisitions frequently fail - estimates suggest between 70% and 90% fall short from the acquirer's perspective, often due to poor post-acquisition management [4]. Operators, however, take a different approach. They bring what some call "deep-tech DNA" to the process. This means they understand the tech stack, audit AI provenance, verify model architecture, and uncover hidden technical debt before deploying capital [1]. This level of strategic insight is a key reason behind their consistent success across various deals.

"The 2026 Tech M&A Playbook isn't written in a spreadsheet; it's written in the server room and the boardroom."

- N2M Capital Advisors [1]

In a market increasingly focused on quality, operators secure premium deals by using structured integration frameworks and tracking key performance metrics. For example, companies with strong unit economics - those achieving a Rule of 40 score of 40 or higher - are fetching valuations 1.5× to 2.0× higher than less efficient competitors [1]. Similarly, AI-native businesses are commanding even higher premiums, with multiples ranging from 2.0× to 3.0× [1]. Operators excel at quickly integrating these businesses and unlocking their value.

Their ability to redesign workflows, embed AI into core operations, and create scalable, self-sustaining systems sets them apart. Whether the goal is to prepare for an exit or scale for long-term growth, operators consistently transform acquired businesses into efficient, high-performing organizations. This makes them the most effective acquirers in today's SaaS and AI-driven markets.

FAQs

What makes an “operator” different from a financial buyer in SaaS M&A?

An operator plays a unique role in SaaS M&A because of their direct experience in managing and growing businesses. This background equips them with practical knowledge to spot growth opportunities, streamline operations, and create lasting value. On the other hand, financial buyers tend to concentrate on financial performance, cost reductions, and leveraging assets. While effective in their own way, they often lack the hands-on industry expertise and day-to-day involvement that operators bring - especially when it comes to SaaS and AI tools marketplaces.

Which SaaS metrics matter most when deciding what to buy?

Key metrics to watch in SaaS include revenue growth, customer retention, churn rate, customer lifetime value (CLV), and gross margin. Together, these numbers offer a clearer picture of your business's long-term health and how customers are interacting with your product. They’re essential for making smarter decisions about customer acquisition and overall strategy.

What should a 100-day post-acquisition integration plan include?

A well-thought-out 100-day post-acquisition integration plan lays the groundwork for a smooth transition, ensuring stability while setting the stage for growth. Start by digging deep into the target company’s operations, workplace dynamics, and key players. Pinpoint immediate priorities - things like overlapping costs or potential cultural clashes - that need attention right away. At the same time, make sure to safeguard crucial areas like compliance and customer service, so nothing critical falls through the cracks.

Look for opportunities to streamline processes and boost efficiency, but don’t forget the power of early wins. Quick successes, paired with open and honest communication, can go a long way in building trust and creating momentum for sustainable, long-term progress.