Private equity isn’t what you think. It’s not just about writing checks and attending board meetings. Instead, it’s about rolling up your sleeves and becoming deeply involved in the daily operations of the businesses you invest in. From the first 100 days of an acquisition, private equity partners dedicate over 50% of their time to hands-on work - rebuilding processes, implementing technologies, and working directly with management teams to drive growth.

Here’s what stood out most:

- Daily involvement matters: Private equity partners act as co-leaders, not passive investors, diving into operational details and driving swift decision-making.

- SaaS and AI demand attention: These sectors require constant monitoring of metrics like customer churn and AI integration due to their fast-evolving nature.

- AI is a game-changer: PE firms prioritize companies with strong data foundations to deploy AI effectively, as it directly impacts profitability and valuations.

- Longer holding periods: Firms are holding companies longer than planned due to valuation challenges, shifting focus to profitable growth over top-line revenue.

Private equity today is less about financial engineering and more about driving measurable results through active partnership. If you’re a SaaS or AI founder, success means preparing your business with strong data systems, clear leadership, and a focus on scalable growth strategies.

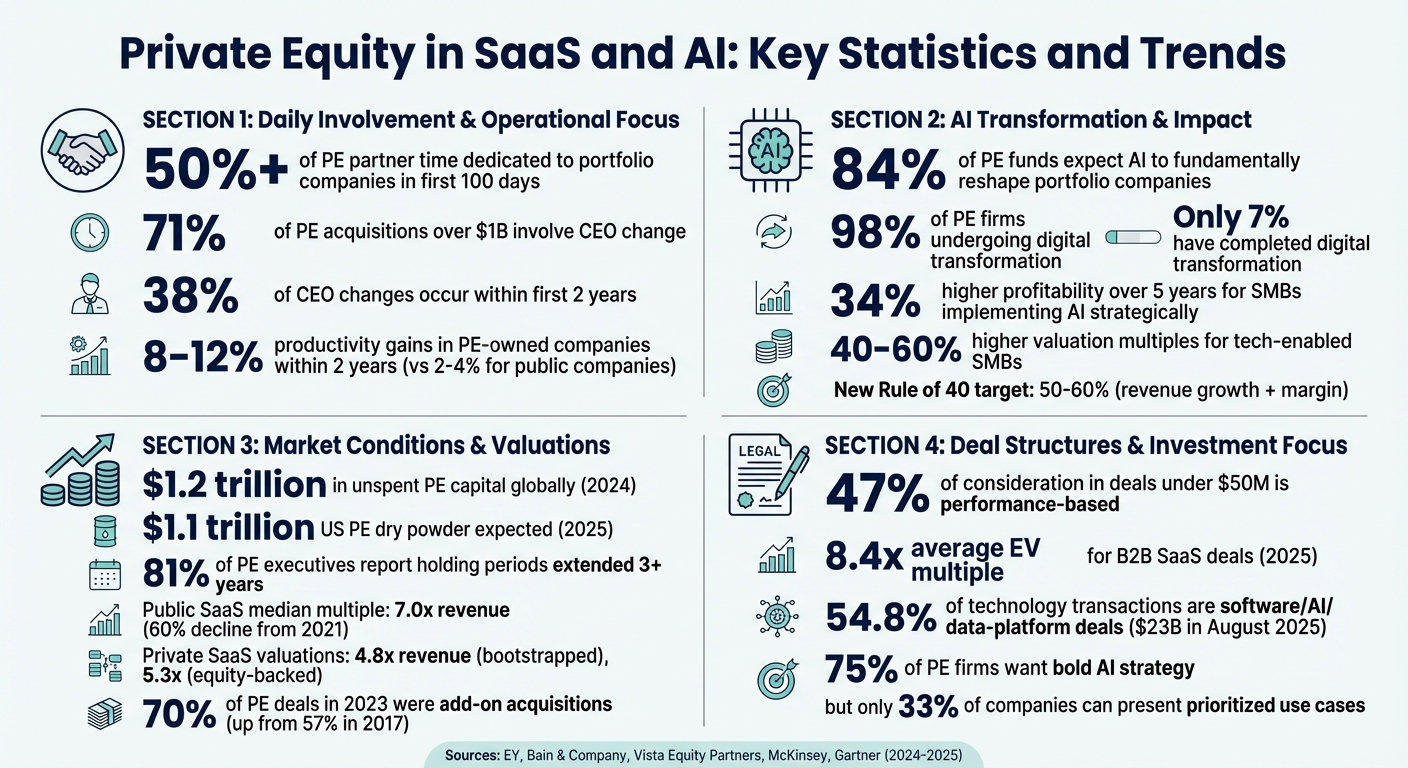

Private Equity in SaaS and AI: Key Statistics and Trends 2024-2025

What Private Equity Firms Look For When They Buy SaaS Companies

The Biggest Surprise: Private Equity Demands Daily Involvement

Private equity isn't just about funding - it’s about diving headfirst into the day-to-day operations. Once a deal is signed, PE partners don’t step back; they step in. During the critical first 100 days of a successful deal, partners dedicate over 50% of their time to the business, meeting with executives daily [6]. This isn't casual oversight; it's full-on co-leadership.

This shift from being passive stewards to active owners changes everything. While public company boards often focus on quarterly results and maintaining stability, PE boards take a much more hands-on approach. They act as "coleaders," mastering the operational details, challenging assumptions, and driving change [7]. McKinsey describes it this way:

"With a deeply engaged private-equity board, members not only grasp the business circumstances immediately but also vote the stock and can be an almost 'instant shareholder meeting,' if need be." [7]

Decisions are made quickly, and accountability is immediate. This hands-on approach transforms PE firms from passive investors into daily operational partners.

From Investor to Daily Partner

The transition from investor to operational partner happens immediately. PE firms don’t just attend board meetings; they visit company sites, talk directly with customers, and hold impromptu advisory sessions [7]. They break down value-creation plans into detailed initiatives, tracking progress weekly through shared systems visible to the entire organization [2]. This level of oversight ensures nothing gets overlooked but also creates significant pressure to execute.

In fast-moving industries like SaaS and AI, this intensity is even greater. Take the example of search fund entrepreneur Michael Coleman, who acquired Westbrook Mechanical Services in 2022 - a 35-year-old HVAC company still relying on paper tickets and an outdated AS400 system. Over 18 months, Coleman digitized decades of service records and developed a predictive maintenance platform. The results? Margins that outpaced industry norms by 47%, with predictive maintenance contributing 28% of total revenue [8]. Transformations like this require deep involvement in operations, technology upgrades, and customer engagement - they can’t be achieved from a distance.

Talent is another critical area of focus. PE firms emphasize "talent density," ensuring the right people are in the right roles to align with the company’s growth strategy [2]. If the existing management team doesn’t fit the plan, changes happen quickly. For instance, 71% of PE acquisitions over $1 billion involve a CEO change, with 38% of those changes occurring within the first two years [2].

This relentless focus enables the constant adjustments needed for SaaS and AI companies to thrive.

Why SaaS and AI Companies Need Constant Attention

SaaS and AI businesses operate in a rapidly evolving landscape. Market conditions shift, AI technologies advance, and customer expectations grow more demanding. For PE firms, quarterly check-ins just don’t cut it - they need real-time insights into metrics like customer churn, AI integration progress, and competitive threats. This urgency is underscored by the fact that 98% of PE firms are undergoing their own digital transformations, yet only 7% have completed the process [1].

AI integration, in particular, adds complexity. Katherine Milligan from Gartner’s SMB practice explains:

"The greatest predictor of post-acquisition AI implementation success isn't the target's current technology stack, but rather its data architecture foundation." [8]

This means PE partners often spend months working with management to clean up and modernize data infrastructure before meaningful AI deployment can even begin.

The financial stakes make this level of involvement essential. Small and medium businesses that strategically implement AI see 34% higher profitability over five years compared to their peers [8]. Additionally, tech-enabled SMBs command valuation multiples 40% to 60% higher than traditional businesses with similar financials [8]. These results aren’t accidental - they’re the product of PE firms treating their time as an investment and committing deeply to the success of their acquisitions.

The Real Problems: Expectations vs. Market Conditions

Private equity firms are now holding onto companies far longer than they originally planned. The once-standard 3-year exit strategy has all but disappeared. According to EY's CEO Outlook Pulse, 81% of private equity executives say that holding periods have stretched up to three years beyond the historical norm [12].

Longer Hold Times and Valuation Challenges

The core issue boils down to a significant pricing gap. Public SaaS companies are trading at a median multiple of 7.0x revenue, marking a steep 60% decline from their 2021 highs [9]. Private SaaS valuations have taken an even harder hit, dropping to 4.8x revenue for bootstrapped companies and 5.3x for equity-backed firms [9]. At the same time, global buyout funds are sitting on a record $1.2 trillion in unspent capital as of 2024 [11]. This creates a frustrating paradox: private equity firms have money to invest but face difficulties exiting deals at prices they find acceptable.

Hugh MacArthur, Chairman of Global Private Equity at Bain & Company, sheds light on the liquidity bottleneck:

"The real culprit behind lackluster fund-raising is a persistent liquidity situation for global limited partners (LPs). While exits grew, distributions as a portion of net asset value sank to the lowest rate in over a decade." [10]

For SaaS and AI founders, this shift means private equity partners are now prioritizing profitable growth over chasing top-line revenue. The focus has shifted to improving margins, optimizing revenue streams, and keeping costs in check. These valuation hurdles are setting the stage for the next major challenge: incorporating AI effectively while navigating operational pressures.

AI Integration Pressure in SaaS Companies

As valuation pressures build, AI adoption has shifted from being a growth opportunity to becoming a business necessity. In fact, 84% of private equity funds now expect AI to fundamentally reshape their portfolio companies [11]. And this isn't just a suggestion. According to Vista Equity Partners:

"AI's outsize impact on a software company's top and bottom lines will rewrite the Rule of 40... Vista believes the new standard for revenue growth plus margin will reach 50% or even 60%." [4]

However, integrating AI is no small feat. It requires significant resources and often disrupts other business priorities. Take Cengage, a portfolio company of Apollo Global Management, as an example. In 2024, the company implemented eight AI-driven projects that slashed content production costs by 40% and cut lead generation expenses by 15% to 20% [4]. Achieving these results took months of dedicated effort, which temporarily slowed down other growth initiatives.

For SaaS companies, the stakes are high. Delaying AI adoption could render a business irrelevant, but rushing the process can lead to wasted resources and missed opportunities. For private equity firms managing longer holding periods, balancing AI transformation with the need to maintain cash flow is critical to justifying extended valuations.

sbb-itb-9cd970b

How SaaS and AI Companies Can Succeed with Private Equity

Positioning your company as an attractive investment for private equity requires deliberate action today. With firms holding significant unspent capital, they're actively seeking businesses that excel in operations, integrate AI effectively, and have scalable growth strategies. A key area of focus is how companies weave AI into their core operations to drive tangible results.

Building AI into Your Core Business

AI needs to go beyond back-office automation and start delivering value directly to customers. Private equity firms expect AI to generate measurable revenue and margin improvements. For example, Vista Equity Partners has highlighted that AI should push the traditional Rule of 40 standard to 50% or even 60% [4].

Look at how companies like LogicMonitor and Shutterfly have used AI to create value. LogicMonitor's "Edwin AI", launched in 2025, helped customers save an average of $2 million annually by summarizing complex data center alerts and predicting infrastructure issues. This not only saved costs but also boosted recurring revenue [4]. Similarly, Shutterfly introduced an AI-powered auto-fill feature for photo book creation in 2025, generating $5 million in new revenue within its first year [4].

AI also enhances internal productivity. It can improve software development by 30–50%, increase conversion rates by 10–30%, and even a modest 1% price optimization can lift operating profits by 8–10% [13][4][15].

"Where AI-enabled solutions can deliver ROI for the end customer (not just the portfolio company), the odds of outpacing the market soar." – Vista Equity Partners [4]

For success, AI initiatives need leadership from the top. Javier Rojas, Founder of Savant Growth, stresses the importance of CEO involvement:

"We help on working with their AI thesis and where to create that value and how to capture that when they go to exit." [16]

Start by building a solid data foundation. Private equity firms prioritize companies with standardized data systems, unified reporting, and data lakes that support effective AI training and deployment [1]. Implementing Robotic Process Automation (RPA) for routine tasks can also establish baseline efficiency before scaling AI [1].

Using Platform Roll-Ups and Secondary Sales

Strategic acquisitions are another powerful growth lever. Add-on acquisitions accounted for 70% of private equity deals in 2023, up from 57% in 2017 [20]. For SaaS companies, this strategy can expand market reach, streamline operations, and achieve economies of scale.

These roll-ups work best when they create real synergies. In 2025, Salesforce acquired AI-focused startups like Dodie (enterprise search), Spindle AI (business analytics), and Appramore (process mining). By integrating these capabilities into its ecosystem, Salesforce avoided building solutions from scratch while enhancing its offerings [14].

Timing is critical. Private equity firms often push for add-on deals early, typically within the first three years of ownership, to maximize synergy benefits [20]. If you're eyeing acquisitions, ensure you have a repeatable integration process with clear ROI metrics and timelines [20].

Secondary sales and GP-led secondaries offer another path. These structures provide founders with liquidity while allowing private equity firms to guide strategy without taking full control [17]. With 84% of private equity funds expecting AI to significantly reshape their business, secondary sales can help bridge the gap between current valuations and future potential [11].

Getting Ready for Private Equity Investment

Operational upgrades and strategic acquisitions are just part of the equation. To secure private equity investment, SaaS companies must demonstrate maturity, strong unit economics, and predictable revenues [17]. The bar for investment is higher than ever, and preparation is key.

Transparent financial reporting is essential. Avoid inflating metrics, such as counting short-term AI contracts as Annual Recurring Revenue (ARR). Investors are scrutinizing these numbers closely. In 2025, enterprise value multiples for B2B SaaS deals averaged 8.4x, up from 7.9x in 2024, but only for companies with clean financials and realistic growth plans [14].

Decouple growth from headcount by using AI in sales and marketing to improve lead quality and conversion rates without increasing staffing costs [19]. SaaS companies leveraging AI are growing revenues 35% faster than their traditional counterparts [18].

Be ready for performance-based deal structures. For deals under $50 million, nearly 47% of the total consideration now depends on meeting post-acquisition milestones like revenue or profitability targets [14].

Specialize your product offerings. Investors are increasingly drawn to "Vertical SaaS" solutions tailored to specific industries and compliance requirements [5]. In August 2025, software, AI, and data-platform deals made up 54.8% of all technology transactions, totaling $23 billion [5].

Finally, demonstrate efficient capital use. Private equity firms, like Savant Growth, favor companies that scale without burning excessive cash [16]. Show that your AI investments drive measurable returns and contribute to sustainable growth, not just higher expenses.

Conclusion: What SaaS and AI Founders Should Know

In the world of private equity, operational readiness beats lofty growth promises. By 2025, US private equity firms are expected to have $1.1 trillion in dry powder, and they’re looking for companies that can already show measurable execution [3]. This requires strong data systems and clear leadership accountability [2]. The takeaway? Early, strategic operational preparation is non-negotiable.

Start your preparation well in advance - ideally two to three years before seeking investment. Conduct a thorough operational audit to identify areas where bold improvements can drive results [2]. Spend at least a year standardizing financial reporting and building a unified data architecture before diving into large-scale AI initiatives [1]. While 75% of private equity firms want to see a bold AI strategy, only 33% of companies can present prioritized use cases with defined metrics and ROI [21]. That gap is where opportunity lies.

Another key factor? The right team. Focus on talent density. Research shows that private equity-owned companies see productivity gains of 8%–12% within two years, compared to just 2%–4% for public companies [2]. Building a high-performing team is a critical step toward meeting investor expectations.

As we’ve discussed earlier, the shift from financial engineering to operational value creation is here to stay. In fact, two-thirds of general partners believe operational excellence will outshine financial engineering in importance over the next five years [11]. For SaaS and AI founders, this means embedding operational discipline and AI integration into the DNA of your business now. The capital is out there - are you ready to rise to the challenge?

FAQs

Why is daily involvement essential in private equity operations?

Private equity firms know that achieving measurable results goes beyond financial maneuvers - it’s about rolling up their sleeves and staying deeply involved in the day-to-day operations of their portfolio companies. By embedding operational teams directly within these businesses, they can closely monitor progress, spot growth opportunities, boost efficiency, and tackle performance challenges head-on.

This approach is especially crucial in fast-moving industries like SaaS and AI, where market dynamics shift constantly. Regular engagement allows firms to adapt quickly to new metrics, safeguard profit margins, and maintain steady growth. By staying actively connected to the daily workings of their investments, private equity firms ensure their expertise drives real, lasting impact.

How does integrating AI boost profitability for SaaS companies?

AI is reshaping how SaaS companies achieve profitability by automating tasks, improving customer experiences, and offering premium, AI-driven features. Tools like generative AI and real-time decision-making systems help businesses simplify workflows, cut operational expenses, and deliver smarter solutions that customers find valuable - and are often willing to pay extra for.

The financial impact of AI is hard to ignore. Companies using AI frequently report better EBITDA margins and higher valuations, as investors increasingly favor SaaS businesses with solid AI strategies. For entrepreneurs, adopting AI doesn’t just enhance the product - it also positions the company as a scalable and efficient option, making it more appealing to private equity investors.

What challenges do private equity firms face with longer holding periods?

Private equity firms are finding themselves in a tough spot as they hold onto their portfolio companies for longer than the typical 3- to 5-year window. What’s causing this shift? A crowded deal market, rising interest rates, and slower exit opportunities are making it harder to secure financing and forcing firms to rethink their playbooks.

When investments stretch beyond the original timeline, the initial strategy often becomes outdated, no longer aligning with evolving market conditions. To stay on track, firms have to explore new ways to create value, which can put pressure on their expected returns and internal rate-of-return (IRR) benchmarks. On top of that, longer hold periods demand more operational involvement, requiring firms to dig deeper into value creation efforts over an extended timeline.

Adding to the challenge, limited partners (LPs) are becoming increasingly impatient. They’re scrutinizing fund allocations more closely, which has slowed down fundraising efforts and created liquidity pressures. For private equity managers, these prolonged cycles are proving to be both financially and strategically demanding.