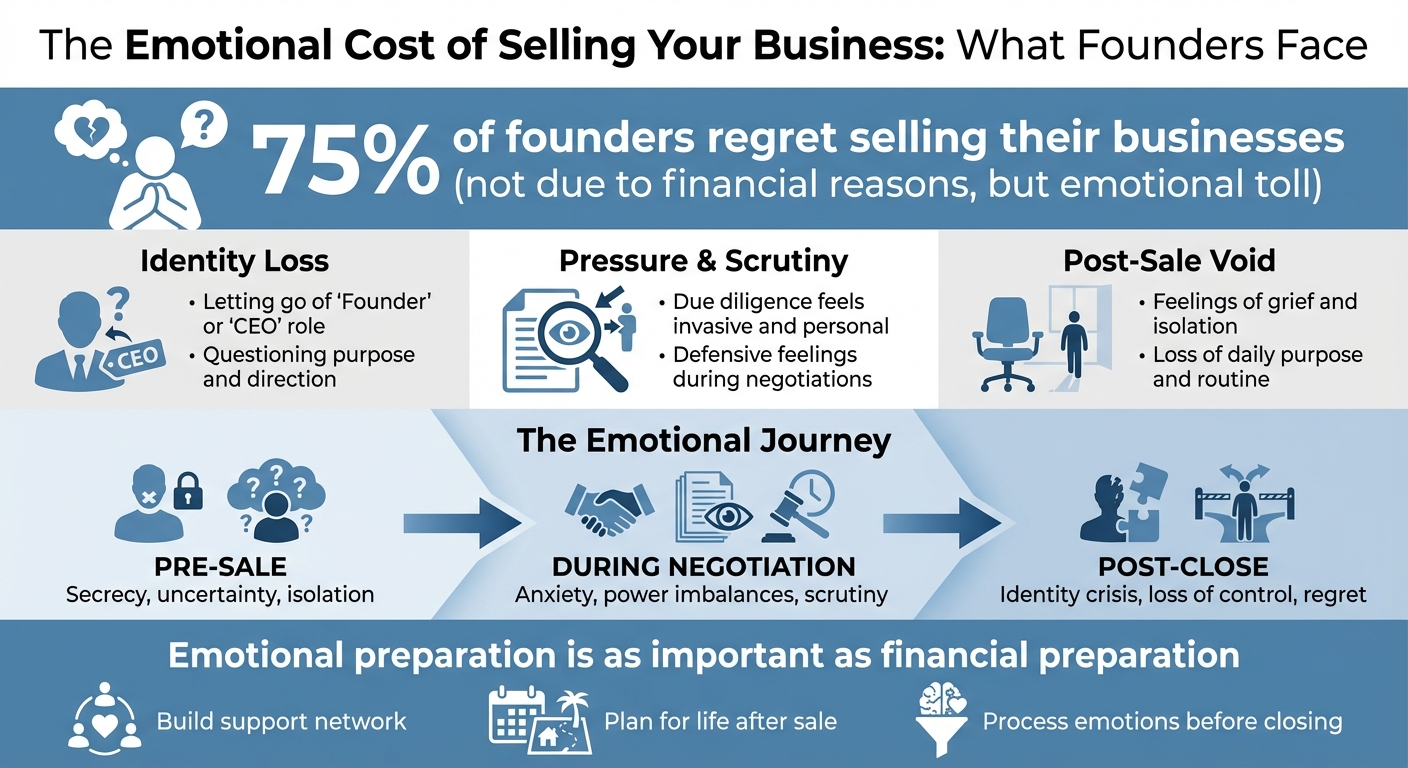

Selling your business isn’t just a financial decision - it’s an emotional journey that can leave founders grappling with identity loss, regret, and uncertainty. While the financial rewards may be enticing, 75% of founders regret selling their businesses, not because the deal was bad, but due to the unexpected emotional toll.

Key emotional challenges include:

- Identity loss: Letting go of the role of "Founder" or "CEO" can leave you questioning your purpose.

- Pressure and scrutiny: The due diligence process can feel invasive and personal.

- Post-sale void: Many founders struggle with feelings of grief and isolation after the deal is done.

For SaaS and AI founders, the stakes are even higher as their businesses often feel like an extension of themselves. Preparing emotionally, building a support network, and planning for life after the sale are just as important as negotiating the financial terms.

This article explores the emotional stages of selling, the unique challenges for SaaS and AI founders, and strategies to navigate this life-changing transition.

Emotional Challenges Founders Face When Selling Their Business

The Emotional Challenges of Exiting a SaaS or AI Business

The Psychological Phases of Selling a Business

Selling a business often takes founders through several emotional stages. The journey typically begins with an identity crisis. After years of being known as the "Founder" or "CEO", these roles become a core part of who you are. Letting go of the company can leave you questioning your purpose and direction, as your personal and professional identities are so deeply intertwined.

Then comes the vulnerability phase during due diligence. This is when potential buyers dive deep into every corner of your business. While it’s a standard part of the process, the intense scrutiny can feel personal, leaving many founders feeling defensive or frustrated.

Another common experience is the "one more year" syndrome - a tendency to delay selling, even when it’s clear that moving on is the right choice. And after the deal is done, the post-sale void often sets in. Take entrepreneur Marie Biancuzzo, for instance. She sold her microbusiness in October 2024 and later shared that she struggled with a profound "sense of loss and grief" during the transition [5].

These emotional hurdles are only magnified for founders in the SaaS and AI sectors, where the challenges are even more personal and complex.

Why SaaS and AI Exits Are Emotionally Harder

For SaaS and AI founders, selling a business isn’t just a financial transaction - it’s deeply tied to their sense of self. Many in these industries experience what’s called identity fusion, where the company feels like an extension of who they are. Stepping away can feel like losing a part of themselves.

There’s also the "Mama Bear" syndrome. A striking example is Rana el Kaliouby, Co-Founder and former CEO of Affectiva. In June 2021, she sold her company to Smart Eye for just over $75 million. Despite the financial success, she faced an identity crisis. As she put it:

"I remember telling Smart Eye's CEO, 'You're evoking all of the mama bear feelings in me because this company is my baby!'" [6]

In fast-paced sectors like SaaS and AI, external forces often drive the timing of an exit. A pandemic, a competitor’s leap forward, or shifting investor priorities can push founders to sell before they feel emotionally ready. Add to this the pressure from venture capitalists and investors, who are focused on returns, and even a multi-million-dollar deal can feel underwhelming. Then there’s the guilt - founders often worry about the employees who joined to help realize their vision. There’s always a lingering fear that new ownership might not uphold the values that the company was built on [5].

Financial Success vs. Emotional Readiness

A big payday doesn’t guarantee emotional closure. Affectiva, for instance, raised $53 million over 12 years before selling for around $75 million. Yet Rana el Kaliouby later admitted to feeling torn - proud of the journey but disappointed it wasn’t the financial "home run" she had envisioned [6].

This emotional conflict is far from rare. Even when an offer checks all the boxes financially, founders often hesitate because of their deep attachment to the business. In 2020, Jon Hainstock sold his SaaS startup, Zoomshift, to a private equity firm. To navigate the emotional challenges, he kept a minority stake and stayed involved as he transitioned into an M&A advisor role [3].

The truth is, no amount of money can fully sever the emotional ties founders have with their companies. Unresolved feelings can derail deals, even when the financial terms are excellent. This underscores the importance of addressing not just the financial aspects of a sale, but the psychological ones as well [3].

Emotional Stressors During the Sale Process

Pre-Sale: Secrecy, Pressure, and Uncertainty

The pre-sale stage can be an emotional rollercoaster, often catching founders off guard. One of the biggest challenges is maintaining absolute secrecy. You can’t openly discuss the sale with your team, close friends, or even trusted advisors, leaving you feeling isolated and burdened by the weight of the decision[7].

Then there’s the fear of the unknown. Questions like "Am I making a huge mistake?" or "What will happen to my employees?" can linger in your mind. These uncertainties can make it hard to move forward confidently. In fact, experts point out that many deals fall apart simply because the seller isn’t emotionally prepared to let go[3].

Timing transparency with your team adds even more complexity. Sharing the news too early could create unnecessary worry, but waiting too long risks them finding out from someone else - something that can feel like a betrayal[2]. Denise Logan, a founder coach and author, captures this emotional struggle perfectly:

"What kills deals is unprocessed emotions. And those emotional needs don't go away because you're getting a big sack of cash"[3].

This mix of secrecy, uncertainty, and emotional tension sets the tone for the challenges that come during negotiations.

During Negotiation: Anxiety and Power Imbalances

Negotiations bring their own emotional hurdles. Due diligence, for instance, can feel invasive. Buyers meticulously examine every detail of your business, often pointing out flaws or weaknesses. After years of pouring your heart into the company, this level of scrutiny can feel deeply personal[4][3].

Power dynamics also come into play. Buyers often have more resources, experience, and a team of advisors on their side, while you’re trying to protect your company’s legacy, your team, and your vision. When Rana el Kaliouby sold Affectiva to Smart Eye for around $75 million in June 2021, she relied on a strict routine of sleep, diet, and exercise to stay mentally sharp during remote negotiations[6].

This is where professional advisors - like CPAs, attorneys, and M&A experts - can make a world of difference. They act as a buffer, helping you navigate negotiations without letting emotions overwhelm you. As Kyle Griffith, Managing Partner at The NYBB Group, explains:

"Advisors... act as a buffer, guiding you through negotiations and keeping your best interests at heart. The insights and reassurance of a team with experience in exits can bring you peace of mind"[4].

Once the deal is finalized, however, new emotional challenges often emerge, particularly around identity and control.

Post-Close: Loss of Control and Transition Struggles

After the sale, many founders face an unexpected emotional void. A common struggle is an identity crisis - realizing you’re no longer the person running the company you built from the ground up. Jerome Myers, Founder of Exit to Excellence, sums it up well:

"When the deal closes, you often lose your identity and feel isolated"[1].

Without the daily routines, decision-making responsibilities, and interactions with your team, it’s easy to feel unmoored. This disconnection can lead to regret. In fact, 75% of founders who sell their businesses eventually wish they hadn’t[1]. The regret often stems from underestimating the emotional attachment to the company. Even when the financial outcome is positive, feelings of grief and nostalgia can creep in. For example, when Rana el Kaliouby sold Affectiva, she returned $53 million of investor capital and ensured her team was invited to join Smart Eye. Yet, she later described a "dual talk track" - feeling proud of her accomplishments but also like an "epic failure" because the exit didn’t feel like a major financial win[6].

Concerns about your team’s future can also intensify post-sale. You might worry about culture clashes, changes in leadership, or whether the new owners will honor the values you worked so hard to establish. In 2020, Jon Hainstock managed these concerns when he sold Zoomshift to a private equity firm by retaining a minority equity stake. This allowed him to stay informed through regular updates while transitioning into his new role as an M&A advisor at Quiet Light[3].

These emotional stressors - both during and after the sale - highlight the complexity of letting go, even when the numbers make sense.

How to Manage the Emotional Toll of Selling Your Business

Mindset Shifts for SaaS and AI Founders

Selling your business is more than a financial transaction - it’s an emotional journey. One of the first steps is to reframe how you see yourself. Instead of thinking, "I am my business", try shifting to, "I am a creator who built something valuable." This subtle change can make a big difference. When your identity is too closely tied to being the CEO, stepping away can feel overwhelming. But when you see the sale as transferring an asset you’ve nurtured, it becomes less personal and more about growth.

Another helpful perspective is to view the sale as stewardship rather than abandonment. Many founders feel guilty about leaving their team or customers, but sometimes, a business needs fresh leadership or additional resources to reach the next level. By seeing yourself as someone who guided the company to this point, you can let go of that guilt.

During negotiations, adopting an "Investor Mindset" can help you stay grounded. When buyers critique your business during due diligence, it’s easy to feel attacked. Instead, think of it as an objective review of an asset, not a reflection of your worth. To stay focused, jot down your non-financial reasons for selling - whether it’s pursuing a new passion or gaining more personal time - and revisit them when emotions run high.

Lastly, focus on "exiting to" something rather than "exiting from" something. As Jerome Myers, founder of Exit to Excellence, puts it:

"Make sure you exit to something, instead of exiting from something" [1].

If you’re selling just to escape burnout, you might feel lost once the deal is done. Before letting go, have a clear plan for what’s next - whether it’s a new venture, mentoring others, or diving into a passion project. These mindset shifts provide a strong foundation for navigating the emotional challenges of selling your business.

Psychological Tools for Founders

Beyond changing your mindset, psychological tools can help you handle the emotional weight of selling. One powerful technique is cognitive reframing - seeing the sale not as an ending, but as a transformation that opens doors to new opportunities and personal growth.

It’s also crucial to acknowledge and normalize feelings of grief. Selling a business often brings emotions like sadness, nostalgia, and even a sense of loss. Experts warn that ignoring these feelings can derail deals, even when financial terms are favorable [3]. By facing these emotions head-on, you create space for healthier progress.

Setting boundaries after the sale is another essential step. Founder Marie Biancuzzo learned this firsthand when she sold her microbusiness in 2024. Struggling with guilt about her former team, she adopted the mantra, "Not your circus, not your monkeys", to remind herself to let go [5].

Practical stress-management techniques can also make a big difference. For instance, when Rana el Kaliouby sold Affectiva to Smart Eye for $75 million in 2021, she stuck to a strict routine of sleep, diet, and exercise to stay sharp during negotiations [6]. Tools like meditation, journaling, and deep breathing can help you stay calm during the ups and downs of the process. Celebrate small milestones, like signing a letter of intent or completing due diligence, to create moments of positivity along the way. These strategies can help you stay balanced as you prepare for life after the sale.

Accepting Change in Post-Sale Business Operations

One of the toughest challenges after selling is stepping back and allowing someone else to lead the company you built. To navigate this, try to separate your identity from the business. You’re no longer the “soul” of the company - you’re the creator who successfully handed it off. This shift can make it easier to accept changes, whether it’s in product direction, pricing, or company culture.

Choosing the right buyer can also ease the transition. Some founders find that retaining a minority stake or taking on an advisory role allows them to stay connected without interfering in daily operations. But it’s important to resist the urge to micromanage. As Marie Biancuzzo noted:

"I didn’t want to blunder into giving them directives or otherwise usurping the power to the new owner" [5].

Limiting communication with former employees is another way to respect the new leadership and avoid confusion.

The best way to embrace change is to have a clear, ambitious plan for your next chapter. Jerome Myers, who sold his $20 million business, founded Exit to Excellence to help other founders avoid the emotional slump that can follow a sale. His advice? Set tangible goals - whether it’s starting a new venture or taking on a meaningful project - before the deal closes [1]. With a compelling next step in place, you’re less likely to dwell on what’s happening with your former business and more likely to thrive in your new journey.

Support Systems, Tools, and Resources for Founders

Building a Founder Support Network

Beyond emotional strategies, having a reliable support network can provide much-needed stability during the sale of your business. This process demands more than just financial expertise - you need a team that understands the emotional toll it can take. Professional M&A advisors, for instance, act as a buffer during negotiations, offering an objective viewpoint when emotions might cloud your judgment [4]. As Denise Logan, author and coach, puts it:

"It pays to bring in someone skillful to help your business owners handle these big emotions" [4].

These advisors not only help you navigate tough emotions but also ensure you maintain your professional composure throughout the process.

Equally important is seeking psychological support. Therapists, counselors, and executive coaches can guide you through the emotional challenges of selling a business, often described as a form of "grief" tied to such a significant life transition [9]. Michael Schwerdtfeger, Managing Director at Chapman Associates, highlights this:

"The most difficult part of middle market business transactions is caring for the emotional well-being of the business owner" [8].

Additionally, peer and mentor networks can be invaluable. Talking with entrepreneurs who have already gone through an exit can reassure you that feelings of doubt and uncertainty are completely normal [8][5]. Specialized financial advisors can also help you adjust your mindset - from "business owner" to "investor" - easing concerns about your financial future [2][9]. Involving your family and close friends early in the process is just as critical. Their support can help you navigate the social shifts and lifestyle changes that come with selling a business [9].

Start building your support team well before the sale. A CPA, attorney, and business advisor can help you organize important documentation early, avoiding last-minute stress [4]. Look for advisors who understand not only the financial aspects but also the emotional journey of selling. Dr. Daniel Lerner, Founder of Strategic Family Solution, LLC, emphasizes:

"Quality of life and mental health after the sale is highly correlated on who you were and what you valued while building your business" [9].

Using SaaS and AI Tools to Reduce Stress

Digital tools can play a big role in reducing the stress of selling your business. Tools like exit readiness assessments and financial projection dashboards help you prepare essential statements and respond confidently to buyer questions [2][10].

Platforms designed for due diligence make it easier to consolidate legal, accounting, and HR documents in a ready-to-inspect format. Joe Anto of PCE Companies explains:

"The process of due diligence... can be tedious, intrusive, and downright uncomfortable... Most business owners just aren't used to this level of questioning - or to being second-guessed" [10].

Using these tools early helps you stay organized and reduces the discomfort of the process.

For founders who feel unprepared, transition planning resources like webinars and digital coaching programs provide structured guidance. Programs such as "How to Sell Your Microbusiness in 12 Months" offer clear steps to navigate the transition [5]. By leveraging these digital tools, you can streamline the process and focus on executing a well-thought-out plan.

Streamlining the Transition Process

Once your support systems and tools are in place, creating a clear transition plan becomes the next priority. A detailed transition calendar with key milestones, deadlines, and responsibilities ensures everyone stays on track and minimizes the uncertainty that can lead to emotional stress [11]. In many cases, sellers remain involved in a consulting or leadership role for months - or even years - after the sale. Defining these boundaries early is essential [11].

Delegating tasks is another key step. Work with your advisors to identify responsibilities that can be handed off to your team or the new owner. This not only lightens your workload but also helps you get comfortable with the idea of stepping back before the sale is finalized. Set clear digital boundaries by outlining your post-sale role in the transition calendar. Whether your involvement lasts a few months or several years, having these expectations in writing prevents misunderstandings and reduces emotional strain [11].

Choose advisors who understand both the financial and emotional sides of the exit process [2][11]. As the team at Acquira wisely says:

"Selling a business is not just a transaction but a transition" [2].

sbb-itb-9cd970b

Life After the Exit: Building a New Chapter

Adjusting to Life Without Your Business

Closing the deal on your business can bring an unexpected emotional shift. Many founders experience a sense of loss, as their identity and daily routines were deeply tied to their company. Moving from the fast-paced demands of running a business to having unstructured free time can feel unsettling. In fact, the absence of purpose and structure can be harder to navigate than the financial changes.

Instead of diving headfirst into a new venture, consider taking a breather. A sabbatical - even a few weeks without alarms or major commitments - can give you the space to decompress and adjust to this new phase of life[5].

The focus should be on transitioning toward something meaningful, not just walking away from something. As Jerome Myers wisely advises:

"Make sure you exit to something, instead of exiting from something" [1].

With time to reflect, you can better understand your priorities and start exploring roles that align with your new outlook.

New Roles and Opportunities After an Exit

Once the dust settles, channeling your energy into purposeful activities can help you regain momentum. Starting over isn’t necessary; instead, many former founders find fulfillment in roles that leverage their experience without the same level of intensity. Mentoring, angel investing, joining advisory boards, or leading philanthropic efforts are great ways to stay connected to the entrepreneurial world while maintaining a healthier work-life balance.

These avenues often provide a sense of purpose and satisfaction. As Dr. Daniel Lerner, Founder of Strategic Family Solution, LLC, explains:

"Quality of life and mental health after the sale is highly correlated on who you were and what you valued while building your business" [9].

For those who thrived on learning and personal growth during their entrepreneurial journey, this is a chance to set new goals. Whether it’s mastering a skill, spearheading a nonprofit initiative, or diving into a completely different industry, the possibilities are endless[1].

Creating Healthy Personal Systems Post-Exit

Establishing new routines can help fill the gap left by your business and create a sense of stability. Incorporate activities like exercise, personal reflection, and hobbies into your daily schedule to restore balance[2][10]. It’s also important to define boundaries regarding your involvement with the business you’ve sold. Decide early on whether you’ll stay connected with former colleagues or take a step back to avoid potential complications[9].

Planning ahead for your post-exit life is crucial. Begin exploring mentoring opportunities, passion projects, or even travel plans months before the sale is finalized. This preparation prevents you from feeling aimless once the deal is done[9][11]. Dr. Kim Henderson, Head of Wealth Management Health and Wellness Education at Morgan Stanley, highlights the emotional impact of selling a business:

"A business that you create, perfect and ultimately sell may trigger feelings of grief" [9].

Acknowledging these emotions, rather than ignoring them, can help you build a solid foundation for the next phase of your journey. By embracing this transition with intention, you can create a fulfilling and balanced new chapter.

How to Avoid Business Owner Remorse

Conclusion

Selling your SaaS or AI business is more than just a financial transaction - it’s a life-altering shift that can redefine your identity, daily habits, and sense of purpose. While much of the focus tends to be on the financial and operational details of the sale, the emotional side of this journey often takes founders by surprise. Feelings like loss, uncertainty, or even grief are completely normal, and acknowledging them can make this transition smoother and more manageable.

Interestingly, 75% of founders regret selling their business, not because of financial setbacks, but due to unresolved emotional challenges. Denise Logan captures this perfectly: "What kills deals is unprocessed emotions" [1][3]. Preparing yourself emotionally, in addition to financially, can help you steer clear of the doubts and regrets that often follow such a major decision.

Building a strong support network and having a clear vision for your next steps - whether that’s mentoring, angel investing, or diving into a passion project - can help fill the post-sale void. As discussed earlier, combining financial planning with emotional readiness sets you up to approach this next chapter with confidence and purpose.

FAQs

What emotional challenges do entrepreneurs face when selling their business?

Selling a business is often more than just a financial transaction - it’s an emotional journey. For many entrepreneurs, their business isn’t just something they built; it’s a reflection of who they are. So, when it’s time to part ways, it can feel like losing a part of themselves. This separation can spark a mix of emotions, including sadness, nostalgia, and even a sense of aimlessness as they grapple with redefining their purpose.

But it doesn’t stop there. After the sale, anxiety about the future can creep in. Entrepreneurs may find themselves questioning what comes next - how to fill the void left behind or whether they made the right choice. These feelings can be magnified by shifts in their relationships, whether with employees, family, or professional connections. Even with a solid financial outcome, these emotional hurdles can leave some founders feeling uncertain or regretful.

By acknowledging and preparing for these emotional challenges, entrepreneurs can approach this transition with a clearer mindset and greater confidence in their next chapter.

Why is selling a SaaS or AI business so emotionally challenging?

Selling a SaaS or AI business often feels like letting go of a part of yourself. For many founders, their company isn’t just a business - it’s a reflection of their identity, vision, and years of hard work. It’s the countless hours spent refining ideas, solving problems, and bringing something new into the world. So, deciding to sell can be an emotional journey.

What makes this even more complex is the nature of SaaS and AI businesses. These companies are typically built on intangible assets - think proprietary algorithms, intellectual property, or a mission that drives the company forward. This unique foundation, paired with the uncertainty about what the future holds, can make the decision to sell feel even more daunting. It’s not just a transaction; it’s a deeply personal milestone.

How can business owners emotionally prepare for selling their company?

Selling your business isn’t just a financial decision - it’s an emotional journey, too. Start by asking yourself why you want to sell. Is it to gain more freedom? Dive into a new venture? Or step away completely? Writing down your goals can bring clarity to your motivations and help you uncover any lingering doubts or concerns. This step ensures you’re mentally and emotionally prepared for what’s ahead.

Think about how selling might affect your sense of identity. For many founders, their business feels like a part of who they are. Letting go can stir up feelings of loss. To ease this transition, create a plan for life after the sale. Maybe it’s picking up hobbies you’ve put on hold, spending more quality time with loved ones, or sharing your expertise by mentoring others. Having a clear vision for your next chapter can make the process feel more like a new beginning than an ending.

Lastly, surround yourself with a strong support system. Seek advice from trusted advisors, coaches, or peers who’ve walked this road before. Their experiences can help normalize the emotional highs and lows, offering perspective and reassurance. Regular check-ins - whether through journaling, therapy, or heart-to-heart talks with confidants - can help you process your emotions and confidently navigate this major life change.