Your inbox could hold the key to your startup's growth. For SaaS and AI founders, a single email can lead to funding, partnerships, acquisitions, or mentorship. Founders like Jason Lemkin and Jared Zelman have proven that a well-crafted cold email can connect you with top investors and industry leaders.

Here's what you need to know:

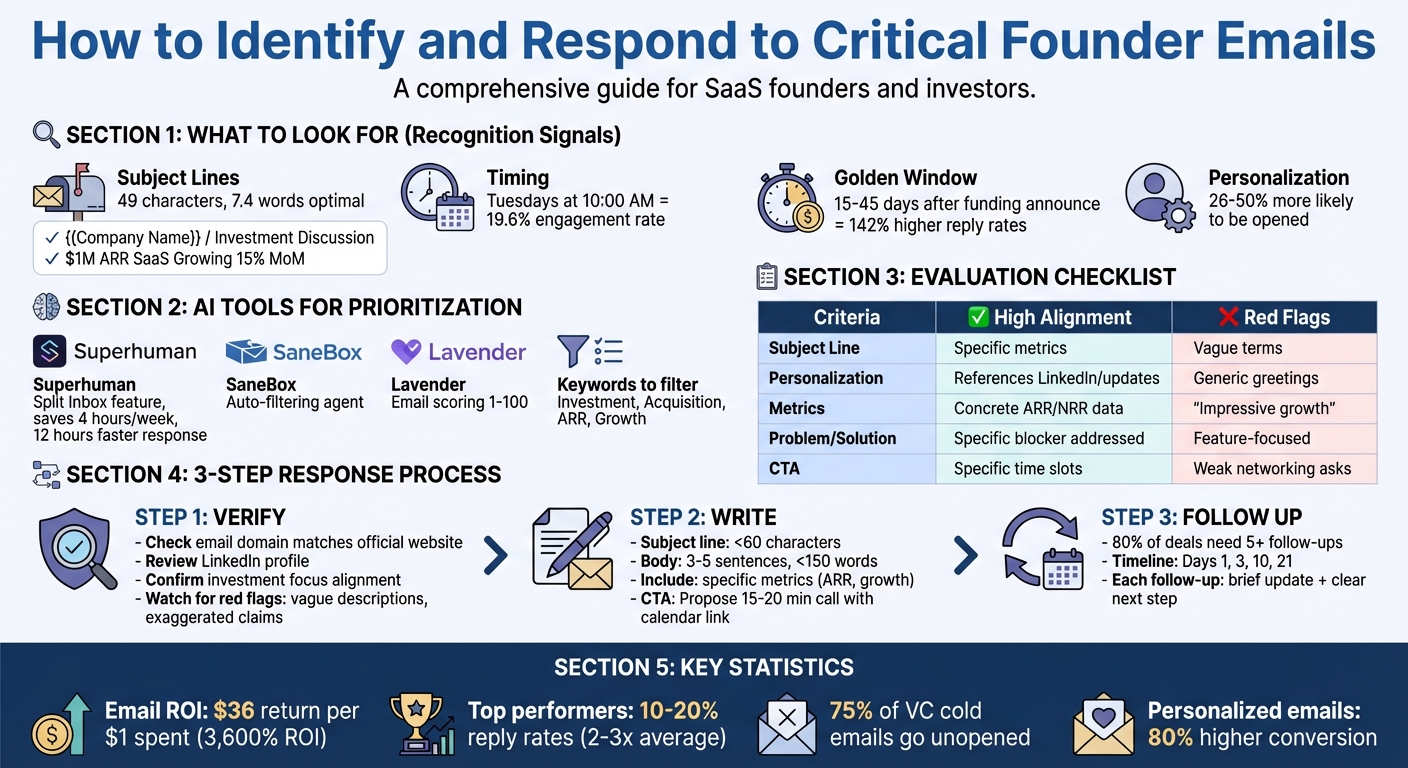

- What to look for: Subject lines like "Investment Discussion" or "$1M ARR SaaS Growing 15% MoM", credible details (ARR, growth rates), and personalized sender information.

- Timing matters: Emails sent on Tuesdays at 10:00 AM or within 15-45 days of a funding announcement get higher engagement.

- How to respond: Verify the sender, craft a concise reply with clear metrics, and propose a specific next step, like a short call.

With the right approach, these emails can directly impact your business's growth, revenue, and opportunities. Don’t miss out - learn how to identify and act on them effectively.

How to Identify and Respond to Critical Founder Emails: A Step-by-Step Guide

What Makes an Email Critical for SaaS and AI Founders?

Not every email deserves your attention, but some carry the potential to change the game. These critical emails are more than just pitches - they’re strategic opportunities that can significantly influence your growth and financial trajectory.

Understanding the Email's Purpose

Critical emails often revolve around investment opportunities, acquisition offers, or partnership proposals. These are the kinds of messages that can directly shape your company’s future.

"Founders don't respond to sales emails. They respond to signals of relevance, credibility, and momentum." - Shaun Hinklein, Apollo.io [6]

What makes these emails stand out? Specific, measurable details like ARR, year-over-year growth, or prominent customer logos instantly build credibility. Subject lines such as "Investment Discussion", "Strategic Partnership", or "[Company] / Acquisition" signal potential financial or strategic benefits [6]. Timing also plays a role - emails sent on Tuesdays at 10:00 AM show the highest engagement rates at 19.6%, reflecting an understanding of founder behavior [6].

The best emails don’t just ask for something; they offer value upfront. This could include introductions to design partners, invitations to exclusive pilot programs, or insights into niche buyer segments [3]. Personalization is key - emails that reference your recent LinkedIn activity, funding news, or specific industry challenges are 26% to 50% more likely to get opened compared to generic ones [8].

How It Affects Growth and Revenue

Responding to the right emails at the right time can have a direct impact on your business. For example, a strategic outreach partnership recently increased pipeline velocity by 36% within three months [3]. This demonstrates how recognizing and seizing the right opportunities can accelerate growth.

These emails also help reduce risks by opening doors to acquisitions, adjacent market expansions, or partial exits that can stabilize your personal finances [6][7]. For SaaS and AI founders, offers that include marketplace access or directory listings can provide social proof and help attract new customers. These platforms connect you with buyers actively seeking solutions like yours, creating new channels to scale your monthly recurring revenue (MRR).

Timing and relevance are crucial. Emails sent 15 to 45 days after a funding announcement often hit a "golden window" of opportunity. When combined with multi-point personalization, reply rates can jump by 142%, especially when the offer aligns with your current growth stage [6][8]. Up next: learn how to identify these critical emails using precise signals and AI-driven tools.

How to Spot This Email in Your Inbox

High-priority emails can easily get lost in the flood of daily messages. With so many newsletters, automated alerts, and generic pitches competing for attention, it's easy to overlook the ones that truly matter. The difference between catching a golden opportunity and missing it often lies in your ability to recognize the specific signals that set high-value emails apart. Below, we break down the key indicators to help you identify these critical messages in your inbox.

Signs of a High-Value Email

These emails often represent opportunities for partnerships, investments, or growth. Here’s how to spot them:

- Subject Lines That Stand Out: High-priority emails tend to have concise, specific subject lines - typically around 49 characters and 7.4 words [11]. Look for phrases like "{{Company Name}} / Investment Discussion", "Investor inquiry", or references to milestones such as "$1M ARR" [6]. These types of subject lines often signal business opportunities.

- Credibility Cues: Keep an eye out for references to well-known investors, peer companies, or established organizations. For example, Dhruv Ghulati, CEO of Factmata, secured a $1M seed round in 2017 by cold emailing investors like Mark Cuban and Biz Stone. His email stood out because he introduced himself as the "founder of a Google-backed startup", immediately building credibility [16].

- Low-Pressure Call-to-Actions: Phrases like "Worth a quick conversation?" signal a thoughtful, non-pushy tone, which is often more effective than aggressive pitches [6].

- Personalized Sender Information: Emails from individuals - such as a CEO, Founder, or Product Lead - carry more weight than generic addresses like "hello@" or "info@" [16]. These signals suggest the sender has taken the time to reach out personally, which can indicate a serious opportunity.

AI Tools for Email Prioritization

Manually identifying these signals can be time-consuming, especially with the sheer volume of emails most professionals receive daily. That’s where AI tools come in, offering a smarter way to manage your inbox.

- Superhuman: This tool uses a "Split Inbox" feature to automatically separate VIP contacts, team communications, and critical business tools from less important emails like newsletters and promotions. Users report saving an average of 4 hours per week and responding to emails 12 hours faster [13][15]. Over time, it learns from your behavior to improve its prioritization [14][15].

- SaneBox: Acting as a filtering agent, SaneBox learns your email habits and moves less urgent messages into a separate folder, keeping your main inbox focused on what matters most [15].

- Clean Email: For those overwhelmed by subscription clutter, Clean Email helps clean up and organize unwanted messages automatically, making it easier to focus on high-value emails.

- Lavender: This tool scores emails on a scale from 1 to 100 and analyzes tone, helping you decide which messages deserve immediate attention [12].

To get the most out of these tools, train them by correcting any misclassified emails early on. Additionally, setting up filters with keywords like "Investment", "Acquisition", "ARR", and "Growth" ensures critical messages are flagged and don’t slip through the cracks [6]. These small adjustments can make a big difference in keeping your inbox focused and efficient.

Understanding the Email's Business Impact

Once you've identified a high-value email, it's time to evaluate how it aligns with your business goals and financial metrics. This step helps you determine whether the offer has the potential to make a meaningful impact. Pay close attention to the details of the offer and the sender's understanding of your company’s challenges.

Reviewing Offers for SaaS and AI Platforms

Focus on measurable metrics like ARR (Annual Recurring Revenue), MRR (Monthly Recurring Revenue), and month-over-month growth. Avoid being swayed by vague claims of success or growth.

When done right, email marketing can deliver an impressive ROI - up to 3,600%. Specifically, cold emails can generate approximately $36 in return for every $1 spent [18][3]. However, this level of success only happens when the offer serves as a "force multiplier", helping you grow faster without increasing your burn rate. Look for opportunities that positively impact metrics like payback period, churn rate, and NRR (Net Revenue Retention).

Also, evaluate whether the sender has a detailed understanding of your business challenges. Personalization is key - emails that address specific pain points, like scaling RevOps or achieving Q4 pipeline goals, are far more effective [8]. As Alex Tanaka, a Product Builder and Revenue Velocity Explorer, explains:

"Prospects don't care about your product - they care about their problems. Lead with value or you'll be ignored" [8].

Once the numbers check out, take a step back to see how the proposal fits within your broader business strategy.

Checking Alignment with Your Business Strategy

Numbers are important, but they’re not everything. A strong email will also show a clear understanding of your industry and funding stage, demonstrating what’s often called a "thesis fit" [2]. The sender should show familiarity with your niche and present a proposal that aligns with your strategic priorities [2].

Be on the lookout for red flags that indicate misalignment. For example, deceptive subject lines like "RE:" or "FWD:" when there’s no prior conversation, missing physical addresses, or buzzword-heavy value propositions are all warning signs [8][17]. Around 75% of cold emails sent to venture capitalists go unopened because they’re too long, unclear, or irrelevant [5]. A good email should have a clear, low-friction call to action, such as scheduling a quick 15-minute call, instead of vague networking requests [9].

Here’s a quick breakdown of what to look for:

| Evaluation Criteria | High Alignment Indicators | Low Alignment Red Flags |

|---|---|---|

| Subject Line | Specific (e.g., "$1M ARR SaaS Growing 15% MoM") [1] | Vague (e.g., "Investment opportunity") [2] |

| Personalization | References specific LinkedIn posts or company updates [8] | Generic greetings like "Hi there" or "Dear Sir/Madam" [2] |

| Metrics | Provides concrete data (e.g., ARR, NRR, payback period) [1] | Uses vague terms like "impressive growth" [2] |

| Problem/Solution | Pinpoints a specific blocker in your strategy [10] | Focuses solely on the sender’s features [8] |

| CTA | Offers specific time slots (e.g., "Tuesday at 2pm") [8] | Makes weak asks like "exchange notes in the spirit of networking" [2] |

Look for emails that deliver immediate value upfront. This could be an introduction to a potential customer, access to a design partner, or a unique market insight [3]. These tangible “gives” can signal a sender who genuinely understands your needs and is invested in your success.

sbb-itb-9cd970b

How to Respond to the Email: A Step-by-Step Guide

Once you've identified a critical email, crafting the right response can be the key to unlocking partnerships, securing funding, or accessing transformative opportunities. Here's a clear guide to handling it with confidence and professionalism.

Step 1: Verify the Sender and Offer

Before responding, confirm the sender's authenticity. Start by checking if their email domain matches the official website of the organization they claim to represent (e.g., a venture firm email should use the firm's verified domain)[22]. Take it a step further by reviewing their LinkedIn profile, company website, or blog to verify their role and look for any mutual connections. It’s also wise to confirm that their firm's investment focus aligns with your sector, stage, location, and funding needs, as many founders waste time engaging with investors who aren’t a fit[19][20].

"A good VC wants to meet founders who fit their mandate. It's literally their job." - Matan Hazanov, VC [20]

Be on the lookout for red flags like vague descriptions, missing links, or exaggerated claims (e.g., "5,000% returns"). Legitimate investors often start with modest requests, such as asking for a short introductory call or permission to receive updates, rather than demanding sensitive information right away[19]. Once you've confirmed their legitimacy, you’re ready to craft a concise and impactful response.

Step 2: Write a Professional Reply

Your reply should be short, specific, and to the point. The subject line is crucial - keep it under 60 characters, as nearly half of recipients decide whether to open an email based on the subject alone[16].

Start your email with a friendly greeting, using the recipient's first name, and reference something specific, like a recent investment or social media post. In 3–5 sentences, explain your main point clearly, focusing on the problem your business solves rather than listing features. Back up your message with solid metrics like ARR, monthly growth, or key customer wins to establish credibility.

For example, in August 2021, Aneesh, the founder of Knit, sent a cold email introducing Knit as "the Qualtrics for multimedia." He highlighted a specific pain point (noting that an hour of video takes ten hours to analyze) and shared traction data, while also personalizing his message by referencing a fund's similar investment[23]. Similarly, Allie Janoch, CEO of Mapistry, secured $2.5 million in seed funding by tailoring her outreach with revenue details and a nod to a specific investor talk[16].

Close your email with a single, clear call to action, such as proposing a 15–20 minute call. To make scheduling easier, include a link to your calendar. Don’t forget to add a professional signature with your full name, title, email, and phone number. Once your email is ready, focus on maintaining momentum through follow-ups and negotiations.

Step 3: Negotiate Terms and Follow Up

Research shows that 80% of successful deals require at least five follow-up interactions[21]. A good strategy is to follow up on Days 1, 3, 10, and 21, providing a brief update each time to keep the conversation moving forward[24]. Each follow-up should include a clear next step, such as scheduling a 20-minute call or granting access to a data room. When suggesting a meeting, propose a specific time window and include a calendar link to simplify the process.

If you don’t hear back after several attempts, consider sending a "close the loop" email. This gives the recipient an easy way to either wrap up the conversation or schedule a final check-in.

For instance, between 2023 and 2024, The GIST, a female-led sports media startup, used dynamic content blocks and automated onboarding journeys through Campaign Monitor to grow its email list from 30,000 to 100,000 subscribers in under a year. They achieved open rates twice the industry average and cut time spent on segmentation by 75%[25]. This kind of persistence and strategic follow-up can yield impressive results.

Mistakes to Avoid and Best Practices

When crafting your email response, steering clear of common mistakes is crucial to maintaining its impact. Especially in high-stakes situations, avoiding these errors can make all the difference in capturing attention and maximizing opportunities.

Avoid Misaligned Pitches

A poorly targeted response can do more harm than good. For instance, pitching a SaaS product to a biotech investor shows a lack of research and wastes everyone's time[26][4].

Simplify Your Language

Buzzwords like "disruptive" or "revolutionary" often weaken your message. Instead, focus on clarity. As Fred Wilson of Union Square Ventures advises:

"Cold emails should be clear. Avoid jargon and focus on the problem you're solving."

Think of explaining your business as if you’re speaking to a smart teenager. Stay away from phrases that convey insecurity, such as "Sorry to bother you" or "Running out of cash." Nikita Blanc, an entrepreneur and angel investor, emphasizes:

"If your email is messy, they assume your business is messy. If your email is lazy, they assume you are a lazy founder."

Avoid Technical Errors

Simple mistakes can undermine your credibility. For example, CC'ing multiple people at the same firm not only appears unprofessional but also suggests a scattershot approach[26][27]. Similarly, asking for an NDA early on is a major red flag for VCs, signaling a lack of understanding of industry norms[27].

On the technical side, ensure your email infrastructure is solid. Verify that SPF, DKIM, and DMARC protocols are active to avoid landing in spam folders[10]. Keep your subject line concise (under 60 characters) and your email brief (under 150 words) - remember, investors often decide whether to delete an email in under 10 seconds[26].

Be Clear with Your Call-to-Action

Vague phrases like "Let me know what works for you" or "I'd love to connect" leave the recipient with extra work, which can significantly lower your response rate[26]. With approximately 75% of cold outreach emails to VCs going unopened[5], every detail matters.

Table: Effective Responses vs. Common Mistakes

| Action | Advantage | Disadvantage |

|---|---|---|

| Using Specific Metrics | Builds instant credibility and shows your business's fit. | Requires verified, impressive data upfront. |

| Direct Meeting Request | Simplifies decision-making for the recipient. | May come across as pushy if the value isn't clear. |

| Personalized Research | Can boost conversion rates significantly (up to 80%). | Time-intensive; limits outreach volume. |

| Requesting an NDA | Protects sensitive information. | Major turn-off; signals lack of industry knowledge. |

| CC'ing Multiple Partners | Increases visibility within the firm. | Looks unprofessional and signals desperation. |

| Using Buzzwords | Attempts to sound forward-thinking. | Often perceived as shallow or overly hyped. |

Conclusion

Every important email has the potential to shape your business's future. Whether it’s an investor intrigued by your progress, a strategic partner suggesting collaboration, or an opportunity you’ve pursued, your approach to these moments can directly influence your growth path.

The numbers back it up. Founders who excel at email communication achieve reply rates between 10% and 20% - that’s two to three times the average[8]. These results aren’t random. They come from effective communication, showcasing expertise, and thoughtful follow-up.

It’s not just about the content of your emails, though. Your email setup and follow-up systems need to work seamlessly to support your outreach. These technical details are just as crucial in ensuring your message hits the mark.

Start building relationships early. Share monthly milestone updates with potential investors and partners well before you’re actively fundraising[19]. By the time that pivotal email lands - or you’re ready to send one - you’ll already have the connections, trust, and communication skills to transform opportunities into meaningful business outcomes.

FAQs

How do I recognize an important email as a founder?

To identify an email worth your attention, keep an eye out for relevance, credibility, and urgency. Emails that include impactful metrics like ARR (Annual Recurring Revenue), customer growth, or recent traction often signal importance, especially when they align with your business objectives. Timing can also be a clue - emails sent on Tuesday mornings around 10 a.m. typically see higher open rates.

Prioritize messages that feel personalized, speak to your current goals, and come from trusted sources. These are the ones most likely to influence key decisions, spark valuable partnerships, or open doors to growth opportunities for your business.

What’s the best way to respond to important emails as a founder?

When replying to important emails, aim to be clear, professional, and composed. Begin by acknowledging the sender’s message and directly addressing their key points. Maintain a calm and respectful tone throughout, steering clear of language that might come across as defensive or overly emotional. This helps keep the exchange productive.

While it’s important to respond promptly to demonstrate attentiveness, take the time needed to craft a well-thought-out reply. If there’s any confusion, clarify the details and offer solutions or suggest actionable next steps. For more delicate matters, you might recommend a follow-up call or meeting to address the issue in greater depth. The ultimate goal is to preserve your credibility, build stronger connections, and manage the situation effectively.

What AI tools can help founders prioritize important emails?

AI tools are a game-changer for founders juggling overflowing inboxes. By leveraging machine learning and natural language processing, these tools can sort, categorize, and spotlight the emails that truly need your attention, helping you focus on what matters most.

Take AI-powered email assistants like Superhuman or the smart features in Microsoft Outlook, for instance. They can prioritize important messages, suggest responses, and even handle routine tasks automatically. This not only saves you time but also clears up mental space, ensuring you never overlook key opportunities, partnerships, or decisions hidden in a crowded inbox.