Mid-market SaaS companies often miss out on millions in potential revenue due to outdated pricing, high churn rates, and inefficient operations. This "value gap" reflects the difference between a company's current worth and what it could achieve with optimized strategies. Here's why this matters and what you can do about it:

- Key Challenges: Fixed pricing models, customer churn, and reliance on gut-based decisions prevent growth.

- Metrics to Watch: Revenue growth rate, net revenue retention (NRR), gross margin, CAC payback period, and Rule of 40 score.

- Solutions: Use AI for dynamic pricing, improve customer retention with health scoring and proactive support, and streamline sales and marketing processes.

- Why It Matters: Closing this gap boosts recurring revenue, strengthens valuation, and prepares your company for growth or exit opportunities.

To close the gap, focus on smarter pricing, better retention strategies, and scalable systems. Companies that act now can significantly improve their market position and valuation.

Key Metrics That Drive SaaS Valuation and Growth

Core Valuation Metrics for Mid-Market SaaS Firms

If you're aiming to close the value gap and boost your company's appeal to investors, knowing which metrics matter most is essential. While SaaS companies track many performance indicators, a handful of key metrics consistently carry the most weight in valuation discussions.

- Revenue Growth Rate: This measures the growth of Annual Recurring Revenue (ARR). Faster ARR growth tends to lead to higher valuation multiples, making it a critical metric for investors.

- Net Revenue Retention (NRR): NRR reflects how well your business grows revenue from existing customers through retention, upselling, and cross-selling. It’s a strong indicator of product-market fit and customer satisfaction.

- Gross Margin: This metric highlights cost efficiency. Higher gross margins suggest your business is scalable and capable of driving profitability, which directly influences valuation.

- Customer Acquisition Cost (CAC) Payback Period: This measures how quickly you recover the costs of acquiring new customers. A shorter payback period means you can reinvest in growth more effectively.

- Rule of 40 Score: This combines growth and profitability into a single indicator. A balanced score signals operational efficiency and strong revenue momentum, which are increasingly valued by investors.

By focusing on these metrics, you can build a solid framework to assess and improve your company's market value.

Industry Performance Standards

Once you understand these metrics, comparing your performance to industry standards can help identify where you have room to improve. Many mid-market SaaS companies struggle to sustain rapid revenue growth as they mature. However, leading firms often break through these challenges by expanding into new markets or finding ways to maximize revenue from their existing customer base. Benchmarking your metrics against top-performing peers can guide targeted efforts to close the value gap and drive growth.

Improving Pricing Models with AI and Value-Based Strategies

Problems with Fixed Pricing Models

Modernizing pricing models is a key step for mid-market SaaS companies looking to close the value gap. Many of these firms still rely on fixed pricing tiers, which often fail to capture the diverse ways customers derive value from their products. This outdated approach can result in missed revenue opportunities. For instance, fixed pricing may overlook customers willing to pay more for advanced features or higher usage limits, while simultaneously discouraging smaller customers with price points that feel out of reach.

Another challenge is that fixed pricing rarely evolves with customer needs. As customers use a product more or their requirements shift, rigid pricing structures often fail to align with these changes. This misalignment can create inefficiencies, leaving revenue on the table and impacting overall company valuation.

AI-Driven Pricing Optimization

To address the limitations of fixed models, AI-powered pricing tools are transforming how companies approach their strategies. These tools analyze customer behavior, usage trends, and market data to recommend dynamic pricing strategies tailored to specific segments. Unlike basic usage-based pricing, AI incorporates factors like customer lifetime value, competition, and price sensitivity. It also continuously tests and refines pricing variations, uncovering patterns like seasonal demand or popular feature combinations that might otherwise go unnoticed.

AI tools make value-based pricing more achievable by offering predictive insights into how different customers perceive a product's worth. This allows businesses to align pricing more closely with the actual value delivered. Even more, AI enables personalized pricing at scale, adjusting rates to suit each prospect’s unique circumstances. This personalization not only boosts conversion rates but also balances margins, driving the kind of revenue growth that investors prioritize.

Case Study: AI Pricing Success in the US Market

SaaS companies in the US have seen measurable gains in both revenue and customer satisfaction through AI-driven pricing strategies. By analyzing customer behavior, these tools have revealed surprising insights that challenge traditional pricing assumptions and uncover untapped revenue opportunities.

A common best practice involves starting small - running targeted experiments with new price points in specific markets or customer groups. This approach allows companies to validate AI-generated recommendations while minimizing potential risks. Pairing AI-driven pricing with smart segmentation - based on usage, company size, or perceived value - has proven especially effective. Such strategies not only make pricing feel fairer to customers but also ensure it aligns closely with their unique needs. These early experiments often lead to broader operational improvements, setting the stage for long-term success.

SaaS pricing debunked: AI impact, value metrics, and pricing strategies for 2025

sbb-itb-9cd970b

Improving Customer Retention and Account Value

Once pricing models are optimized, the next step in driving growth is focusing on customer retention. This approach not only strengthens long-term relationships but also unlocks new opportunities for revenue.

Retention as a Growth Driver

For mid-market SaaS companies, customer retention is a key factor in building predictable revenue. While acquiring new customers is vital, retaining existing ones often delivers a greater return on investment. Even small improvements in retention can significantly boost monthly recurring revenue (MRR) and customer lifetime value (CLTV). Plus, long-term customers tend to increase their spending over time, helping to offset the high costs of acquisition.

Proven Strategies for Customer Success

Successful customer retention starts early - ideally before onboarding - by assigning dedicated managers and setting clear, achievable milestones to ensure customers see value quickly.

Proactively preventing churn is now more effective than ever, thanks to health scoring systems. These tools monitor customer engagement, feature usage, and support interactions, making it easier to identify at-risk accounts. With this data, teams can step in with tailored support, training, or product tweaks to address issues before they escalate. Combining these insights with direct customer feedback provides a well-rounded view of account health.

Regular business reviews and check-ins are another cornerstone of strong customer relationships. Many SaaS companies schedule these sessions to highlight ROI and discuss strategic goals, helping customers see the ongoing value of the product while uncovering opportunities for deeper engagement. Additionally, investing in customer education - through webinars, detailed guides, and certification programs - encourages higher product usage and reduces churn. Beyond keeping customers onboard, these efforts also open the door for upselling and cross-selling, driving further revenue growth.

Growing Revenue Through Upsells and Cross-Sells

Existing customers are a goldmine for revenue expansion. Selling to them is not only easier but also more effective than acquiring new customers, making account growth an essential part of any SaaS strategy.

Upselling works best when it's tied to clear usage patterns or milestones. For example, when customers achieve specific business goals or engage heavily with the product, it’s the perfect time to introduce upgrades or additional features. These conversations are most effective when they happen naturally - after the customer has already experienced the product’s value.

Cross-selling, on the other hand, requires a deeper understanding of a customer’s broader needs and challenges. By maintaining detailed profiles and paying attention to feedback, companies can identify complementary products or services that align with the customer’s goals. Tailored recommendations not only help customers achieve better results but also strengthen the relationship, increasing the likelihood of renewals and advocacy. Together, these strategies for retention and account growth play a crucial role in boosting revenue and enhancing overall company valuation.

Scaling Operations and Preparing for Growth

For mid-market SaaS companies, scaling operations is crucial as they gear up for growth. The difference between those that thrive and those that stagnate often lies in how well they prepare their systems to handle expansion.

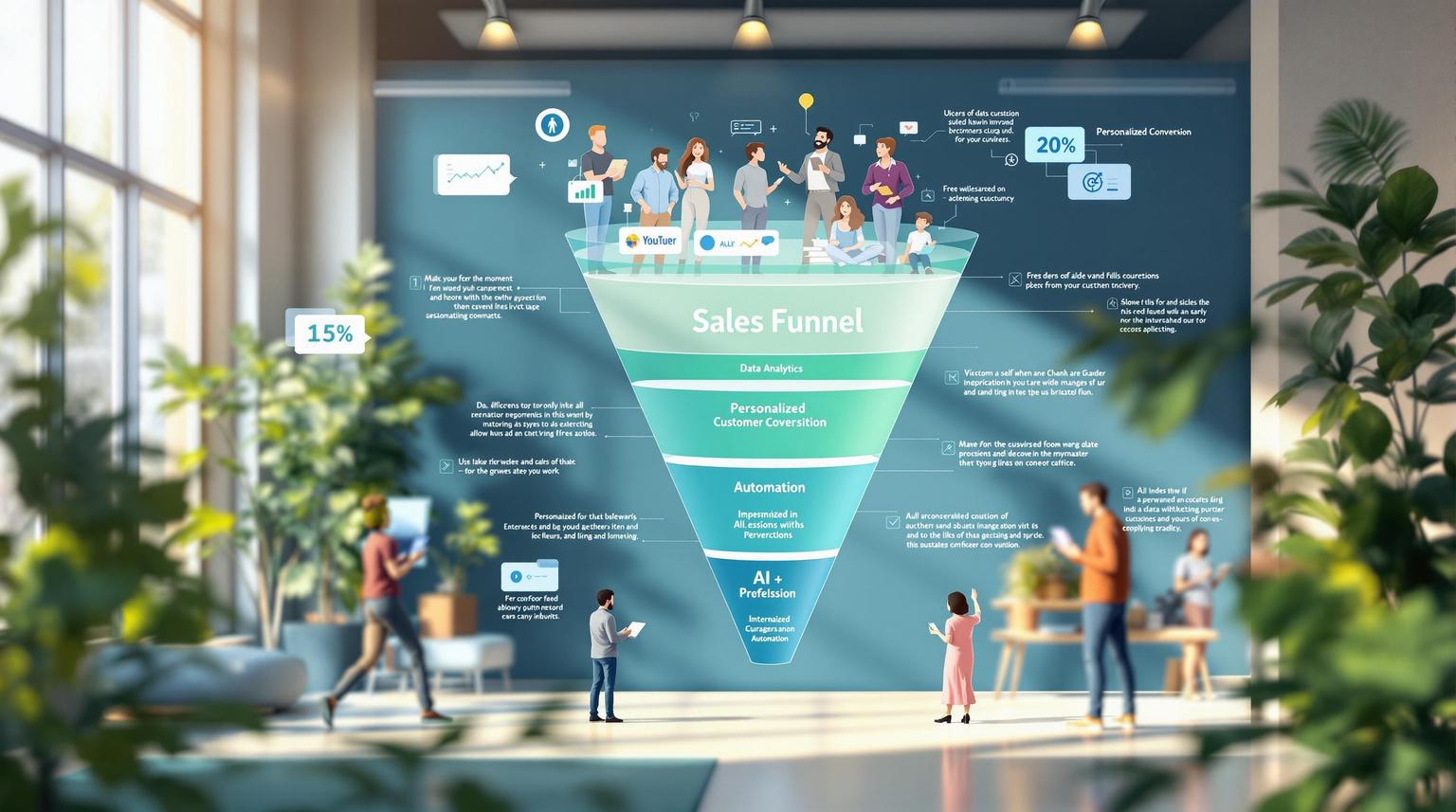

Building Scalable Sales and Marketing Systems

Many mid-market SaaS companies rely too heavily on standout individual performers instead of creating systems that can be replicated. To scale effectively, standardizing the sales process is essential.

This begins by mapping out every step of the customer journey - from the first interaction to closing the deal. Key actions include documenting qualification criteria, designing consistent demo flows, and establishing clear handoff procedures between marketing and sales teams. When companies adopt structured sales methodologies, prospects enjoy a consistent experience, which often leads to better conversion rates, regardless of who handles the sale.

Marketing automation also plays a pivotal role at this stage. Rather than manually managing every lead, automated systems can deliver timely, relevant content to prospects. For example, lead scoring helps sales teams prioritize the most promising opportunities, while email automation ensures consistent communication without requiring constant manual input. These tools free up marketing teams to focus on strategic goals rather than repetitive tasks.

In addition, clear territory assignments, realistic quotas, and regular pipeline reviews help improve forecasting accuracy and quota attainment, laying a strong foundation for scalable growth.

Using AI and Automation for Better Operations

Artificial intelligence is reshaping operations for SaaS companies, particularly in areas that traditionally required significant manual effort. The focus should be on identifying time-consuming processes and leveraging AI to handle them more efficiently.

AI-powered tools are transforming customer support by reducing ticket volumes and improving satisfaction. On the sales side, AI-driven intelligence can analyze prospect behavior, predict deal outcomes, and recommend the best times for follow-ups. These systems process and interpret data far beyond human capacity, uncovering patterns that lead to higher closure rates.

AI also enhances operations across departments like support, sales, and finance. For example, instead of spending hours compiling reports, teams can use AI to spot trends, predict churn risks, and identify opportunities for expansion. These efficiencies not only reduce costs but also help companies plan for growth more effectively.

Preparing for Exit: Buyers and Valuation in the US Market

Streamlined operations don’t just fuel growth - they also make your company more appealing to potential buyers. Understanding the acquisition landscape is vital for mid-market SaaS companies aiming to maximize their valuation when pursuing an exit. Different buyers value different aspects of a business, so preparation should align with the type of buyer you’re targeting.

- Strategic buyers often pay higher multiples because they’re acquiring capabilities that complement their existing offerings. They prioritize companies with strong product-market fit, defensible technology, and customer bases that align with their goals. To attract these buyers, it’s essential to document your competitive advantages, highlight leadership in niche markets, and demonstrate how the acquisition could accelerate growth.

- Private equity firms focus on companies with predictable revenue streams, strong unit economics, and scalable operations. They use ARR-based multiples to evaluate growth and efficiency.

- Financial buyers and smaller investment groups look for steady cash flows and proven business models. While their valuations may be lower, they often favor companies with consistent profitability and strong cash generation.

Regardless of the buyer type, preparing for an exit requires meticulous planning. Clean financial records, documented processes, and robust management systems are non-negotiable. Buyers want to see that the company can operate smoothly without heavy reliance on founders or key individuals. This means having standardized procedures, clear organizational charts, and succession plans for critical roles.

Starting due diligence well in advance is critical. This includes organizing legal documents, ensuring compliance with data privacy laws, and conducting internal audits to address any potential issues. Companies that take these steps typically secure higher valuations because they inspire greater confidence in their financial projections and operational stability.

Conclusion: Closing the Value Gap to Maximize Potential

The value gap is the main hurdle standing between mid-market SaaS companies and their full market potential. It directly affects your revenue, customer satisfaction, and overall company valuation.

Taking action to bridge this gap is essential. Start by making data-driven decisions, leveraging AI strategically, and focusing on operational improvements. For instance, clearly defining your ideal customer profile can increase win rates by up to 68% [1][2]. This goes beyond just refining your marketing - it’s about pinpointing where your product delivers the most value and channeling your efforts in those areas.

Incorporating AI and automation can deliver exponential advantages. From real-time pricing adjustments to proactive customer success initiatives, these tools empower mid-market companies to compete with larger players by running lean, value-focused operations.

To support sustainable growth, invest in scalable and standardized systems. These improvements not only enhance your day-to-day operations but also make your company more attractive to potential buyers. By refining pricing strategies, boosting retention, and streamlining operations, you can effectively close the value gap.

The next step is clear: assess your metrics, implement AI-based optimizations, and develop systems that turn untapped potential into measurable profits. Companies that move quickly and decisively will be the ones transforming missed opportunities into tangible gains, adding millions to their valuation instead of leaving them unclaimed.

The value gap isn’t just a challenge - it’s your biggest chance to grow. Address it now, or risk leaving millions on the table.

FAQs

How can mid-market SaaS companies use AI to improve pricing strategies and boost revenue?

Mid-market SaaS companies have a powerful tool at their disposal: AI-driven insights. These insights can help refine pricing strategies and boost revenue by analyzing customer data in ways that were once impossible. AI can segment users based on factors like how they use the product, their preferences, and what they're willing to pay. This allows businesses to create pricing models that align closely with the needs of different customer groups.

On top of that, AI doesn't just stop at customer data. It can track market trends, competitor pricing, and even shifts in the economy, making it possible to adjust pricing models in real time. This kind of dynamic pricing keeps SaaS companies competitive and ensures they capture as much value as possible from their products. By using AI to continuously fine-tune their pricing, businesses can uncover untapped revenue opportunities and improve profitability.

What metrics should mid-market SaaS companies prioritize to boost valuation and attract investors?

To attract investors and boost valuation, mid-market SaaS companies should pay close attention to critical metrics such as Annual Recurring Revenue (ARR), Customer Churn Rate, Customer Acquisition Cost (CAC), and Lifetime Value (LTV). These numbers paint a clear picture of revenue consistency, customer retention, and overall profitability - key factors investors look for.

It's also essential to keep an eye on Gross Margins and maintain predictable revenue growth, as these are strong indicators of long-term stability. Many investors use the Rule of 40 - a guideline that balances revenue growth and profitability - to gauge a company's financial health. By refining these metrics, SaaS companies can bridge valuation gaps and unlock their full market potential.

How can mid-market SaaS companies improve customer retention and boost growth?

Mid-market SaaS companies have a real opportunity to strengthen customer retention by focusing on a smooth onboarding process and emphasizing customer success. Clear communication during onboarding and continually highlighting the distinct benefits of your product can go a long way in building trust and loyalty.

Beyond onboarding, staying connected with your customers is key. Regular, personalized interactions - like check-ins, gathering feedback, or offering tailored solutions - help nurture those relationships. On top of that, leveraging AI-powered tools to track customer behavior and predict churn can give you the insights needed to tackle problems before they grow. Together, these approaches not only improve retention but also pave the way for sustainable growth and profitability.