Private equity (PE) is neither inherently bad nor good - it’s a tool with trade-offs. PE firms manage $6 trillion in assets in the U.S., contributing 5% of GDP and employing nearly 9 million people. While PE-backed companies often achieve faster growth and productivity (8%-12% improvement within two years), they also face higher risks, including a 20% bankruptcy rate over a decade.

Key takeaways:

- Growth Potential: PE firms like Thoma Bravo and Vista Equity Partners focus on boosting revenue through acquisitions, AI integration, and long-term strategies.

- Risks: Heavy debt, workforce reductions, and cultural shifts can create challenges for companies under PE ownership.

- AI in Focus: Vista’s "Agentic AI Factory" and Thoma Bravo’s AI-driven SaaS strategies highlight PE’s increasing reliance on automation and AI innovation.

- Stages Matter: Early-stage startups gain scaling capital, but growth-stage and mature companies face stricter benchmarks, leadership changes, and cost-cutting measures.

PE’s impact depends on execution. Firms prioritizing growth over short-term gains can drive better outcomes, but risks like debt and employee resistance remain significant. For founders, aligning goals with the right PE partner is critical to navigating these challenges.

Private Equity 101: Everything You Need to Know to Be Dangerous in 20 Minutes

1. Thoma Bravo SaaS Acquisitions

Thoma Bravo has become a prominent force in the SaaS industry, utilizing a strategy that goes far beyond the typical cost-cutting measures often associated with private equity. Their recent acquisitions highlight how modern private equity can push growth and innovation in the tech sector, addressing the ongoing debate about whether these firms focus more on creating value or simply extracting it from tech companies.

Growth Acceleration

In December 2022, Thoma Bravo took Coupa Software private in an $8 billion deal [9]. Instead of slashing budgets, Managing Partner Holden Spaht emphasized their commitment to growth:

"Look forward to partnering with (…) the (Coupa) management team to keep investing in the company's product strategy while driving growth both organically and through M&A" [9].

Earlier in May 2022, Thoma Bravo also acquired Bottomline Technologies for $2.6 billion, setting the stage for significant synergy opportunities. By integrating payment processing into Coupa's platform and combining networks, the firm now serves over 12,000 clients and 8 million suppliers globally, creating a comprehensive solution for B2B transactions [9]. Additionally, they project that Coupa Pay could reach 10% penetration of total spend under management by 2027 [9], illustrating a clear focus on long-term growth.

AI Innovation

Thoma Bravo has also leaned heavily into AI. In August 2025, the firm entered advanced talks to acquire Dayforce, an HR and payroll SaaS platform valued at over $9 billion [6]. What makes this deal especially interesting is Dayforce's embedded AI capabilities, which streamline workforce management and scheduling. Beyond acquisitions, Thoma Bravo actively promotes AI adoption across its portfolio. They provide "AI transformation teams" to help legacy software companies modernize operations in areas like sales, marketing, and R&D [7]. This proactive approach demonstrates their commitment to staying ahead in a rapidly evolving tech landscape.

Cost-Cutting Risks

While Thoma Bravo emphasizes growth, cost management remains a key part of their strategy. For example, the acquisition of SailPoint for $6.9 billion at a 50% premium raised concerns about potential price increases [8]. However, analysts argue that removing the pressures of public markets could actually enhance product innovation. As Forrester noted:

"With meeting the quarter-over-quarter, year-over-year growth mandates dictated by Wall Street removed, Thoma Bravo will be able to increase innovation investments at SailPoint. Ultimately, this means better product features, product quality, and greater value for customers" [8].

Still, high debt levels from these deals could pose challenges if revenue goals are not met [2]. Despite these risks, Thoma Bravo's recent moves indicate a clear pivot toward driving revenue growth rather than focusing solely on margin improvements.

Control and Ownership

Taking companies private gives Thoma Bravo the flexibility to pursue long-term strategies without the constraints of quarterly earnings reports. For instance, in the integration of Coupa and Bottomline, the firm introduced Bottomline's "Record and Replay" fraud management technology into Coupa's platform. They also combined bank partner networks - including major players like Bank of America, JPMorgan, and Citi - to boost sales opportunities [9]. This level of control allows for bold, strategic decisions that public companies might shy away from. While Thoma Bravo keeps a close eye on financial goals, they allow existing management teams to drive product-level innovation, as long as it aligns with their overarching growth strategy [9] [1].

Next, we’ll explore how Vista Equity Partners is navigating the AI landscape.

2. Vista Equity Partners AI Strategy

Vista Equity Partners, managing a staggering $100 billion in software-focused assets, has taken a unique approach to private equity. Instead of merely acquiring companies and focusing on margin improvements, the firm introduced the groundbreaking "Agentic AI Factory." This initiative aims to transform its portfolio of over 90 enterprise software companies into leaders in autonomous AI technology [10]. It’s a bold move that showcases how private equity is reshaping the tech landscape.

AI Innovation

At the heart of Vista's strategy is what CEO Robert Smith describes as "agentic AI" - a type of artificial intelligence designed to perform tasks autonomously. The firm plans to deploy between 4 and 8 billion autonomous agents, with an average of 5 to 10 agents per user [11]. By January 2026, 30 companies in Vista's portfolio were already generating revenue through agentic AI, with another 30 to 40 expected to follow by mid-2026 [10].

Vista has also forged partnerships with major players like Microsoft, Google, and AWS, securing priority access to top-tier AI infrastructure and discounted cloud services [10]. For example, in June 2025, Gainsight, a Vista portfolio company, rolled out "Atlas AI Agents" using Microsoft's Azure Foundry. These agents autonomously manage customer renewals, confirm contract terms, track license usage, and initiate follow-ups - enabling Gainsight to scale its customer service without adding staff [11]. Another portfolio company, SimplePractice, integrated AI agents in January 2026 to assist mental health professionals by automating session recordings, transcriptions, and clinical note drafting [10]. These examples highlight how Vista’s approach is driving operational improvements.

Growth Acceleration

Vista’s AI initiatives are already delivering tangible results. Portfolio companies have reported a 30% to 50% boost in code-writing efficiency [10]. According to Smith, the cost of running an AI model - just 20 cents of "inference" - can yield up to $10 in operational savings [10].

"AI will not eat software; it will feed it, accelerating innovation, automating routine tasks and enhancing productivity across every business function" [11].

To counter potential challenges, such as customers using AI to reduce their own software subscriptions, Vista is shifting its portfolio companies from traditional per-seat pricing to usage-based models [12].

Cost-Cutting Risks

While the growth potential is evident, Vista's AI strategy comes with workforce implications. CEO Robert Smith has acknowledged that AI-driven automation could cut staffing levels by as much as 33% in roles like junior analysts and back-office positions [12]. He made a striking prediction:

"We think that next year, 40 per cent of the people at this conference will have an AI agent and the remaining 60 per cent will be looking for work" [12].

Still, the firm highlights that companies systematically building AI capabilities tend to achieve nearly double the return on invested capital compared to those that don’t [5].

Control and Ownership

Vista’s "Value Creation Team" plays a crucial role in ensuring AI adoption across its portfolio. The team actively monitors and scores companies on their AI progress, making it a key driver of EBITDA growth before exit [13]. The firm’s hands-on approach also includes rethinking workflows to achieve what they call the "efficient frontier" of software development, focusing on converting traditional SaaS tools into agentic systems [10].

Next, we’ll explore how AgileGrowthLabs.com fits into the broader private equity landscape.

sbb-itb-9cd970b

3. AgileGrowthLabs.com

While firms like Thoma Bravo and Vista Equity Partners set new industry standards with acquisitions and advancements, AgileGrowthLabs.com takes a different approach - it empowers SaaS and AI founders to align with private equity (PE) standards from the very beginning. Instead of operating as a PE firm, this platform acts as a guide for founders navigating the complexities of potential PE partnerships, helping them scale recurring revenue and prepare for successful exits.

Growth Acceleration

AgileGrowthLabs.com encourages founders to embrace a "full-potential" mindset, pushing them to identify their ultimate growth ceiling before engaging in PE conversations. Today, private equity investors don't just look at where a company is - they evaluate where it could go with bold, strategic moves [1]. This growth-first perspective is vital for founders aiming to meet the rigorous expectations of PE investors.

AI Innovation

The platform places a strong emphasis on integrating AI into business strategies, recognizing that companies with advanced AI capabilities often see improved ROI [5]. AgileGrowthLabs.com focuses on areas that align with PE priorities, such as strategic decision-making, process automation, and enhancing commercial operations [5]. For SaaS companies on its waitlist, understanding these AI strategies is critical. By leveraging cloud infrastructure and APIs, founders can build the intelligent automation systems that PE investors expect [5]. Much like the playbooks used by Thoma Bravo and Vista Equity Partners, AgileGrowthLabs.com helps founders harness technology to drive growth while minimizing risks tied to PE involvement.

Tackling Cost-Cutting Risks

AgileGrowthLabs.com also prepares founders for the challenges that may arise during PE partnerships. One of the most notable risks is employee resistance, often referred to as "organ rejection", which can occur during significant operational changes. Additionally, early AI integration can temporarily increase costs of goods sold (COGS) due to heightened customer support demands [14][15]. By addressing these potential pitfalls early, founders can better equip their teams and streamline operations, ensuring smoother transitions into PE-backed growth strategies.

Advantages and Disadvantages

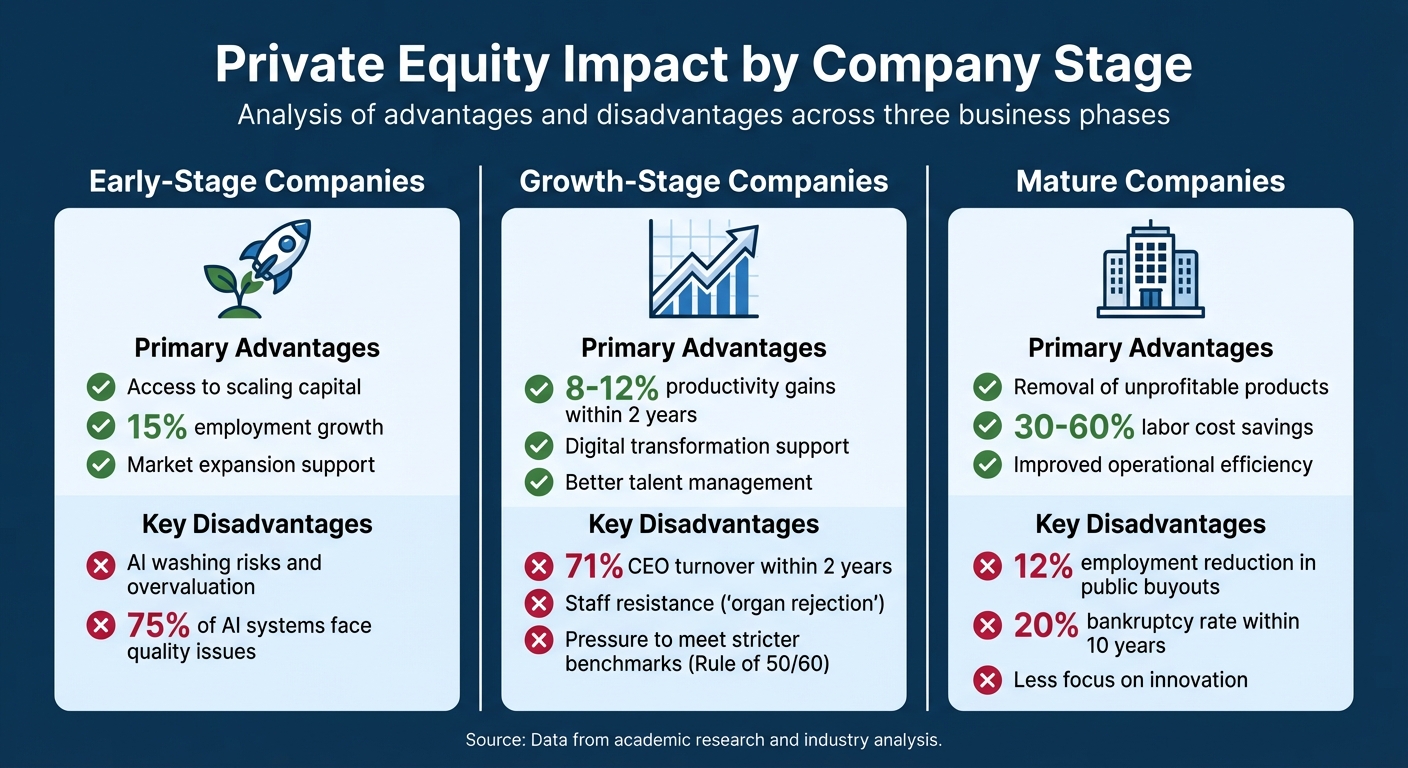

Private Equity Impact by Company Stage: Advantages vs Disadvantages

Private equity (PE) has a varied impact on SaaS and AI companies, depending on where they are in their lifecycle. Early-stage startups often gain the most from these partnerships, with access to capital and scaling expertise leading to a 15% increase in employment after buyouts of privately held firms [4]. However, these benefits come with challenges. Many startups face risks like AI washing - where AI capabilities are exaggerated - and quality issues, as 75% of AI systems struggle with poor engineering [16].

Growth-stage companies see notable productivity improvements, typically ranging from 8% to 12% in the first two years under PE ownership [1]. But these gains often come at a price. For instance, 71% of large PE acquisitions result in a CEO change within the first two years [1], which can disrupt company culture and create instability. Additionally, the pressure to meet higher performance benchmarks - such as Vista's "Rule of 50 or 60", instead of the traditional "Rule of 40" [14] - can strain operations. This pressure sometimes leads to what employees refer to as "organ rejection", where staff resist the new performance-driven culture [14].

Mature companies often benefit from PE's focus on eliminating "bad revenue", or unprofitable products, which can significantly improve cash flow. For example, discontinuing product categories with a negative $223 million cash flow led to a 17% boost in total cash flow [1]. However, these changes can be tough on employees. Public company buyouts by PE firms typically result in a 12% reduction in employment [4], with lower-skilled workers being particularly affected. PE firms often employ "clean-sheet" labor strategies that can slash labor costs by 30% to 60% within six months [1].

Despite these benefits, private equity isn't without risks. About 20% of PE deals end in bankruptcy within a decade, compared to just 2% for companies that aren't acquired [3]. Steven Kaplan, a professor at the University of Chicago Booth School of Business, highlights a key evolution in PE's approach:

"The number one factor private equity firms focus on now is the ability to grow the revenue of the company" [2].

This shift from cost-cutting to driving revenue growth reflects a broader change in PE strategies. While PE can foster growth and operational efficiency, it also introduces significant risks and challenges.

Summary by company stage:

| Company Stage | Primary Advantages | Key Disadvantages |

|---|---|---|

| Early-Stage | Access to scaling capital; 15% employment growth [4]; market expansion | Risks of AI washing and overvaluation [16]; 75% of systems face quality issues [16] |

| Growth-Stage | 8-12% productivity gains [1]; digital transformation; better talent management | 71% CEO turnover [1]; staff resistance ("organ rejection") [14]; pressure to meet stricter benchmarks [14] |

| Mature | Removal of unprofitable products [1]; 30-60% labor cost savings [1]; improved efficiency | 12% employment reduction in public buyouts [4]; 20% bankruptcy rate within 10 years [3]; less focus on innovation [17] |

Conclusion

Private equity isn’t inherently bad or good - it’s a tool, and its impact depends entirely on how it’s used. When businesses approach private equity with careful planning and partner with firms that emphasize long-term growth rather than chasing quick financial returns, the results can be game-changing. For instance, in August 2025, deals in software, AI, and data platforms accounted for 54.8% of all technology transactions, amounting to $23 billion [19]. This highlights the potential of prioritizing sustainable growth over short-term profits.

Firms like Thoma Bravo and Vista Equity Partners exemplify the shift in private equity’s approach. Modern PE firms are moving away from traditional financial engineering and focusing more on operational improvements and fostering revenue growth. This trend aligns with the growing importance of AI, with 54% of private equity firms identifying AI as their top investment focus for 2026 [18].

For founders, making informed decisions is essential. It’s important to assess whether a private equity firm offers tailored resources, such as a Center of Excellence, and whether its growth strategies align with the company’s goals. Firms that prioritize customer value and innovation over mere cost-cutting can help drive modernization, enhance pricing strategies, and instill operational discipline - areas that public markets often overlook. This approach supports long-term product development and innovation [19].

FAQs

What are the key risks of private equity ownership?

Private equity ownership brings a mix of opportunities and challenges, but it’s crucial to understand the risks involved. One of the biggest concerns is the reliance on high leverage, where companies are often saddled with significant debt. This debt burden can push businesses to implement aggressive cost-cutting strategies and prioritize short-term profits, which might come at the cost of long-term stability and growth.

Another issue is the potential for job reductions. Research indicates that employment can decline by an average of 12% within two years following a private equity acquisition. These job cuts, combined with financial pressures, can sometimes weaken a company’s overall health and even increase the likelihood of bankruptcy. While private equity has the potential to fuel growth and innovation, it’s essential to weigh these risks carefully before committing to such partnerships.

How do firms like Thoma Bravo and Vista Equity Partners use AI to grow their portfolio companies?

Thoma Bravo incorporates AI technologies throughout its network of software companies to boost creativity, improve efficiency, and support swift growth. By weaving AI into their operations, they aim to uncover fresh product opportunities and elevate overall business results.

Vista Equity Partners takes a similar approach, employing AI-driven automation to simplify workflows and refine operations across its portfolio. This strategy often focuses on cutting out inefficiencies and enhancing scalability, helping their investments grow faster and achieve better performance.

These examples highlight how AI serves as a powerful tool for driving growth, sparking innovation, and creating value in the tech industry.

Why do some companies backed by private equity end up filing for bankruptcy?

Private equity-backed companies often carry a higher risk of bankruptcy, largely because these buyouts are typically funded with substantial debt. This financial burden can become overwhelming if the business faces declining revenues or sudden market disruptions.

On top of that, private equity owners may adopt aggressive cost-cutting strategies or focus on achieving quick financial returns. While such moves might improve efficiency in the short term, they can also jeopardize the company's long-term stability, leaving it more exposed to unforeseen challenges or economic downturns.