When sourcing deals as an operator, your approach is fundamentally different from that of investment bankers. Operators focus on building relationships, leveraging industry expertise, and identifying off-market opportunities, while bankers rely on auctions and intermediaries. Here's the key takeaway: if you're finding deals through brokers or public listings, you're already at a disadvantage.

- Operators' Edge: Use succession signals (e.g., owners over 55, outdated websites) to identify businesses ready to sell before they hit the market. This strategy avoids inflated valuations and broker fees (5–10% of the deal value).

- Proactive Approach: Build trust with sellers over 6–12 months. Frame acquisitions as partnerships, not quick flips, to stand out from transactional buyers.

- Systematic Process: Use tools like AI platforms (e.g., Grata, CorpDev.Ai) to scan millions of companies, track signals, and streamline research. This approach can uncover 40–60% more opportunities than traditional methods.

- Flexible Deal Structures: Combine cash, seller financing, earn-outs, and equity to align with both your goals and the seller's legacy.

Operators succeed by focusing on relationships and operational fit, rather than just financial metrics. This article outlines how to build a repeatable sourcing framework, leverage technology, and negotiate deals for long-term success.

The Secrets to Sourcing Proprietary Deals in Private Equity with Ryan Gable

sbb-itb-9cd970b

How Operator-Led Deal Sourcing Works

Operator vs Banker Deal Sourcing: Key Differences in M&A Approach

Operator-led deal sourcing takes a different path from the traditional M&A methods used by bankers. Instead of relying on formal auctions or polished databases, operators lean on their deep industry knowledge and personal networks to identify and acquire companies. Their approach is less about impersonal processes and more about presenting themselves as committed successors who value a business's legacy [13]. As Torge Barkholtz, Co-founder of Novastone Partners, puts it:

"Sellers are a little bit suspicious sometimes of traditional private equity. They want to keep their legacy. And with our mid-career professionals, they see their successor." [13]

This approach appeals particularly to profitable small and medium-sized enterprises (SMEs) with $3M to $10M in EBITDA, especially those facing leadership gaps or succession issues. Operators focus on finding businesses that align with their expertise and improving operations, often spotting inefficiencies and technical debt that bankers might overlook [15].

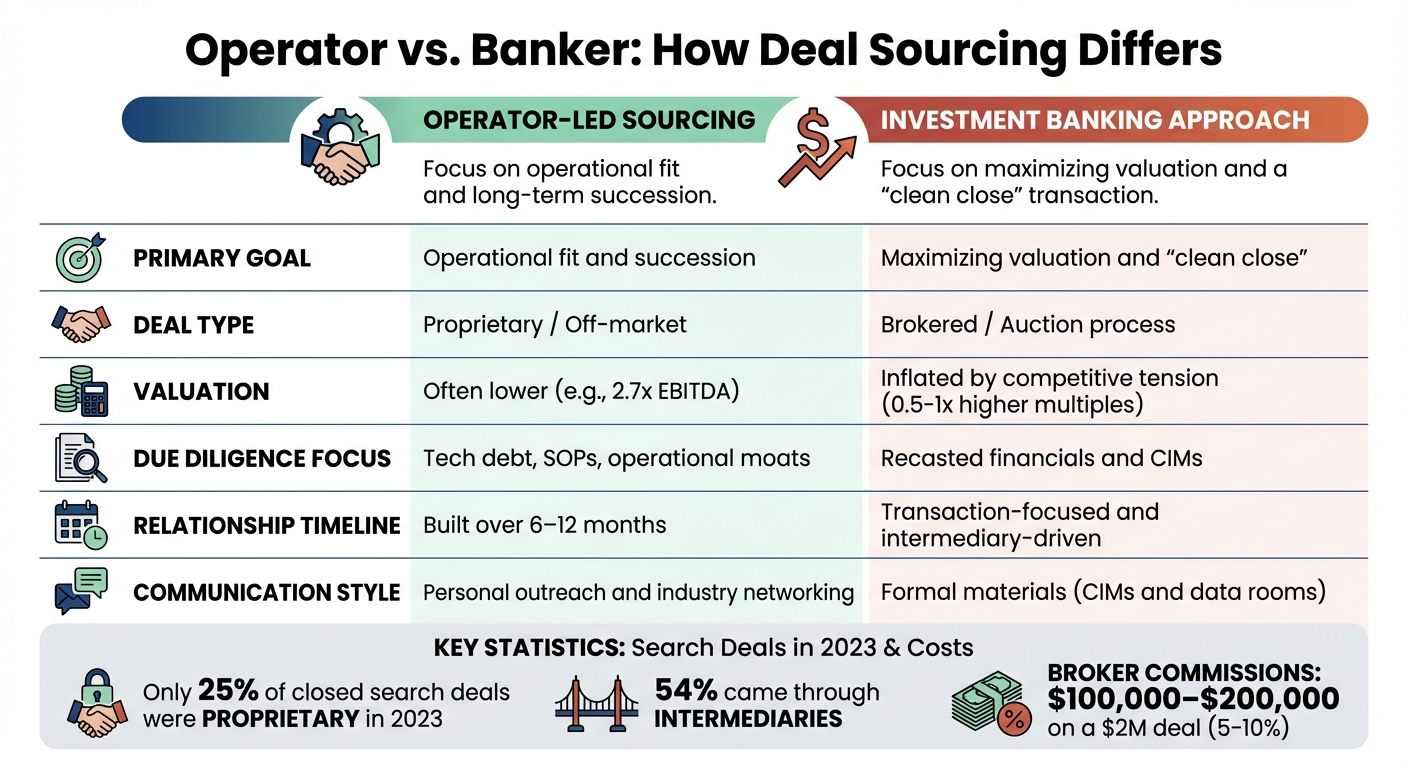

Operator vs. Banker: How Deal Sourcing Differs

Bankers and operators approach deal sourcing with very different priorities. Bankers focus on financial metrics - spreadsheets, multiples, and adjusted financials - while operators dig deeper into areas like the company’s tech stack, organizational maturity, and the practical realities behind the numbers [15].

In 2023, only 25% of closed search deals were proprietary, with the majority (54%) coming through intermediaries like bankers [14]. Deals brokered by bankers often come with inflated valuations - typically 0.5–1x higher multiples - due to competitive bidding. This can limit flexibility in negotiations. For instance, a $2M brokered deal might require sellers to pay $100,000–$200,000 in commissions, money that could have stayed within the transaction [2].

Here’s a quick comparison of the two approaches:

| Feature | Operator-Led Sourcing | Investment Banking Approach |

|---|---|---|

| Primary Goal | Operational fit and succession | Maximizing valuation and "clean close" |

| Deal Type | Proprietary / Off-market | Brokered / Auction process |

| Valuation | Often lower (e.g., 2.7x EBITDA) | Inflated by competitive tension |

| Due Diligence | Focus on tech debt, SOPs, operational moats | Focus on recasted financials and CIMs |

| Relationship | Built over 6–12 months | Transaction-focused and intermediary-driven |

| Communication | Personal outreach and industry networking | Formal materials such as CIMs and data rooms |

Operators take a relationship-first approach, building trust over time. Dana Marohn Spiliotis, Operator LP and former SVP at ZoomInfo, explains:

"M&A deals that get done down the road will primarily be done through relationships you've made somewhere along the way." [8]

This long-term relationship-building positions operators as the natural choice when an owner decides to sell, contrasting sharply with the bankers’ more transactional, time-bound processes. By leveraging their industry expertise, operators can uncover opportunities that traditional screenings often miss.

Using Your Industry Knowledge to Find Opportunities

Your industry expertise is a powerful tool for identifying opportunities that bankers might overlook. While bankers rely on formal databases and standard screening criteria, operators often discover deals through personal introductions and recommendations from other entrepreneurs and industry contacts [11]. For example, succession signals - like an owner over 55 without a clear successor or declining ad spend - can help operators negotiate better terms and avoid the inflated valuations common in brokered deals [2][14].

Operators also bring a unique ability to assess technical nuances. Take AI-native platforms, for example. Companies that use AI as the core engine of their workflow are commanding 2.0x to 3.0x higher multiples compared to those that are merely "AI-enabled" [15]. These distinctions often escape traditional bankers. N2M Capital Advisors highlights this gap:

"Most investment banks speak the language of finance, but they don't speak the language of the Tech Stack." [15]

Operators also evaluate operational excellence through metrics like the "Rule of 40." Companies scoring 40 or higher can achieve valuations 1.5x to 2.0x above those with lower scores. This insight gives operators an edge when negotiating with business owners early in the process [15].

The numbers back up the operator-led strategy: proprietary deal sourcing can boost investment returns by 10% to 20%. For a middle-market deal averaging $150M with a 19% IRR, this approach could generate an additional $13M in carry per deal [12]. As David Paul, CEO and Managing Director of DWP Capital, succinctly states:

"Anybody can write a check. Everyone wants to get that founder high. Where the rubber meets the road is sourcing." [12]

Building a Systematic Deal Sourcing Process

Turning deal sourcing into a predictable process starts with systematic market mapping. This involves a four-step method: identifying target markets by sectors and locations, compiling a list of companies from databases and registries, applying filters like revenue and ownership structure, and prioritizing targets for outreach [18]. This structured approach ensures you’re actively seeking opportunities that align with your expertise, rather than waiting for deals to find you.

Another essential element is signal-led discovery. By tracking specific indicators, such as founders over 55, over 20 years of tenure, operational fatigue, or lack of a successor, you can identify businesses ready for transition [2][9]. Traditional methods often miss 40–60% of these opportunities [9]. Monitoring these signals quarterly allows you to connect with owners before they list with brokers, potentially saving 5–10% in broker commissions [2].

Keeping your sourcing system updated is equally important. Refresh your target database every quarter to include new entrants and adjust for changes in companies’ statuses [18]. This ensures your pipeline stays relevant and avoids wasted efforts on businesses that no longer fit your criteria. Personalized cold outreach typically yields a 5–15% response rate [18], while AI-generated letters and voicemail drops see lower rates, ranging from 0.5–3% [2]. Engaging sellers often requires persistence, with 4–6 follow-ups being the norm [1].

For a balanced strategy, aim for a mix of 60–70% proprietary (direct) sourcing and 30–40% intermediated (banker-led) deals [18]. This blend gives you access to off-market deals while still benefiting from traditional channels. As Bryan Hunsinger aptly states:

"The best acquisitions aren't listed. They're uncovered." [5]

Setting Your Deal Criteria and Target Profiles

Using your operational expertise, define specific criteria to focus your efforts. Avoid broad filters like "any business with $1M EBITDA." Instead, narrow your focus to a niche, such as "Commercial HVAC contractors in the Midwest" [1]. This precision not only makes your outreach more credible but also helps you develop deeper expertise in a particular sector.

Your Ideal Acquisition Profile (ICP) should include clear parameters: industry focus, revenue or EBITDA range, location, and business model (e.g., recurring vs. one-time revenue) [5][2]. For SaaS or AI companies, consider their tech stack to identify compatibility early [5]. Financial parameters are also crucial. For example, in SBA-backed deals, keep customer concentration below 30%, as exceeding this can jeopardize lender approval [2].

Organize your prospects into "A" and "C" lists. The A-list should include about 25 high-priority targets that align perfectly with your size, location, and operational maturity criteria [17]. With over 10 million baby boomer business owners nearing retirement [16] and approximately 500,000 small businesses changing hands annually in the U.S. [7], a focused approach ensures you’re not overwhelmed by irrelevant opportunities.

Look for owners aged 55+ with 20+ years of tenure. Track local business journals for "lifetime achievement" awards or similar recognitions, and use employee count as a proxy when revenue data isn’t available [2].

Creating a Repeatable Market Scanning Process

A consistent market scanning process helps you spot opportunities before they hit the open market. Start by building a sourcing stack to automate top-of-funnel activities. Tools like Leadbay or Apollo (free to $145/month) can generate lead lists, Clay ($149–$349/month) enriches data, and AI tools like Claude ($20–$200/month) analyze unstructured data for succession signals [2]. An automated system costs $500–$1,000 per month, far less than professional sourcing fees [2].

Expand beyond standard databases by exploring Secretary of State filings, industry directories, SBA 504 loan records, and tools like BuiltWith or SimilarTech for SaaS targets [1][5][2].

Timing matters. Direct mail works best in Q4 during tax planning or Q1 when owners are thinking about their business goals for the year [2]. Avoid summer outreach, as decision-makers are often unavailable.

Once your scanning process is in place, the next step is forming partnerships to further enhance your deal pipeline.

Building Partnerships to Increase Deal Flow

Strategic partnerships can significantly boost your deal flow without demanding more time or money. Focus on relationships with professional scouts like CPAs, wealth managers, and estate attorneys who work with business owners during transition planning. Create a list of 10–15 local professionals in these fields and share a one-page profile outlining your background, acquisition criteria, and long-term vision [2][1]. Regular quarterly check-ins can turn these professionals into reliable sources for referrals.

When building these partnerships, emphasize "succession" rather than "acquisition" [2]. Owners often view their business as their legacy and respond better to someone interested in continuing that legacy rather than flipping the business. Propose a phased transition plan: Phase 1 (6–12 months as a consultant or partner), Phase 2 (12–24 months taking over operations), and Phase 3 (24–36 months completing the buyout) [2]. This approach reassures professional advisors and creates a smoother path for SBA financing [2].

Additionally, participating in industry associations and niche online communities can enhance your reputation. Engaging in forums, conferences, and local chapters positions you as a knowledgeable operator rather than just a financial buyer. With 70% of investment bankers predicting increased M&A activity in 2025 and beyond [17], establishing yourself as a trusted successor in your niche can yield long-term benefits. Sean Smith, Managing Partner at Search Fund Ventures, summarizes it well:

"Proprietary sourcing is not just 'cold outreach.' It's the long, slow creation of relationship inventory." [16]

Using AI and Technology to Find Deals

In the SaaS and AI sectors, leveraging AI has become essential for staying ahead in deal sourcing. AI transforms the process into a dynamic, data-driven system capable of scanning millions of companies in real time. Unlike traditional databases, AI tools uncover opportunities that might otherwise go unnoticed. For instance, platforms like Grata provide insights into over 19 million companies, 3 million financials, and 800,000 deals [20]. Meanwhile, CorpDev.Ai has indexed more than 70 million companies, far surpassing databases like Pitchbook (9.5 million) and Crunchbase (4 million) [23].

This shift is game-changing. Users of AI-powered sourcing platforms report sourcing 2 to 6 times more deals compared to traditional methods [20]. Conventional approaches often miss 40% to 60% of the market [9], especially when it comes to founder-led or bootstrapped companies. AI bridges this gap by analyzing unstructured data to reveal hidden opportunities [20][21]. This capability is central to the advanced tools offered by modern AI sourcing platforms.

AI-Powered Deal Sourcing Platforms

AI platforms excel through features like "lookalike targeting", which identifies companies similar to your best past deals. By inputting a successful acquisition, the system can instantly surface businesses with comparable profiles [6][20]. This feature, known as "Similar Search", uses natural language processing to match patterns across vast datasets, saving weeks of manual effort.

Another powerful tool is predictive lead scoring, which analyzes subtle indicators of transaction readiness. AI tracks factors like hiring trends, changes in ownership, growth milestones, and financial pressures to predict which companies are likely to transact [3]. For example, if a SaaS company posts its first-ever General Manager role, AI may flag this as a succession planning signal [2]. These insights enable faster, more informed decisions aligned with strategic goals.

Platforms like CorpDev.Ai take this further with multi-model AI searches, querying systems like Claude, GPT-5, and Gemini simultaneously [23]. This allows users to describe targets in natural language rather than relying on rigid filters. Instead of searching by industry codes, you might specify, "B2B SaaS companies with recurring revenue models serving mid-market healthcare providers in the Southeast." The AI interprets the context and delivers highly relevant results.

AI also generates estimated data for private companies, such as revenue or industry classification, with over 97% accuracy on benchmark datasets [21]. This level of precision speeds up the evaluation process, helping operators determine fit without waiting for detailed disclosures.

Automating Market Research and Lead Generation

AI dramatically reduces the time spent on research. Tools like Clay ($149–$349/month) automate data enrichment by pulling information from over 100 providers [2]. Similarly, Claude ($20–$200/month) acts as a desktop assistant, capable of crawling websites, summarizing owner bios, and identifying succession signals [2]. These tools create a cost-effective "off-market" sourcing stack compared to traditional fees [2].

Users of platforms like Sourcescrub report a 51.7% improvement in research turnaround time [22], with a 50% boost in direct sourcing pipelines [22]. Christian Stewart of AKKR explains:

"Sourcescrub is the lifeblood of my sourcing, and something I can't survive without. Gone are the days of manually looking up market maps, award lists, and conferences." [22]

AI also enables personalized outreach at scale. Instead of sending generic messages, AI tailors communication by analyzing a target's corporate tone, recent activities, and existing relationships [3][19]. This approach increases response rates, especially from founders inundated with acquisition inquiries. For physical outreach, services like LettrLabs ($2–$5 per letter) use robotic handwriting to create personalized mailers, achieving 1–3% open rates among older business owners [2].

Generative AI further streamlines the process by producing research briefs. It can summarize Confidential Information Memorandums (CIMs), financials, and news into concise one-pagers, highlighting key drivers and potential red flags [3]. This accelerates "go/no-go" decisions, enabling teams to evaluate more opportunities without adding staff.

As research and lead generation become more efficient, centralized tools ensure that deal flow management remains seamless.

Managing Deal Flow with Centralized Tools

Centralized platforms bring deal data, relationship intelligence, and market signals into one unified system [3][20]. This eliminates the inefficiencies of scattered spreadsheets and CRMs, where information can get duplicated or lost.

These platforms also integrate relationship intelligence, overlaying existing connections onto company profiles [20]. For example, if a colleague has a relationship with a founder, the system flags it before a cold email is sent. By analyzing emails and meetings, the platform identifies the warmest path to decision-makers [3].

Real-time monitoring is another key advantage. AI-driven alerts track changes in a target's product offerings, management, or regulatory status during the deal process [19]. If a competitor raises funding or a key executive departs, you'll know instantly and can adjust your approach.

Currently, 36.8% of deals in top firms' pipelines are sourced from AI-powered platforms like Sourcescrub [22]. Jessica Ginsberg, Head of Corporate Development, highlights:

"Sourcescrub not only expands our ocean of proprietary sourcing opportunities, it also gives us the ability to fish with spears instead of nets." [22]

For maximum efficiency, ensure two-way CRM integration. This allows AI tools to sync proprietary relationship data with new market opportunities, creating a feedback loop that improves targeting over time [20]. The result is a more precise and effective sourcing process.

Structuring and Negotiating Deals as an Operator

Once you’ve nailed down a systematic way to source deals, the next hurdle is figuring out how to structure them in a way that works for both the business’s operational future and the seller’s legacy. Unlike bankers, who often focus on maximizing transaction fees, operators need to prioritize long-term success and ensure the seller feels confident in the business’s direction after the deal closes.

Creating Flexible Deal Structures

Good deal structures balance cash, equity, earn-outs, and seller financing to reduce risk while keeping sellers invested in the outcome [24]. In most search fund deals, the capital stack typically includes 20-30% equity, 50-70% debt, and 10-30% seller financing [25]. This mix helps avoid over-leveraging while reassuring sellers about the company’s future.

Earn-outs are a practical way to handle valuation disagreements by tying payments to actual performance. The trick is to use clear, measurable metrics [24]. Many operators are moving beyond broad financial goals like EBITDA and instead focusing on operational KPIs - things like first-pass yield in manufacturing or customer health scores for SaaS businesses [10]. These "operational earn-outs" focus on the factors that drive long-term success rather than just hitting short-term financial targets.

Rollover equity is another tool to keep sellers engaged. By having them reinvest a portion of their proceeds into your entity, they remain actively involved. This is especially effective in founder-led businesses where continuity is crucial. For example, if a founder retains 10-20% equity, they have a vested interest in ensuring a smooth transition. If you’re hesitant about taking full ownership immediately, the "Partner" approach offers a gradual path: start as a consultant or minority partner for 6-12 months, then proceed with a full buyout once you’ve established a solid operational fit [2].

Seller financing is often a key piece of operator-led deals. Seller notes typically account for 10-30% of the purchase price and are usually subordinated to senior debt [25]. If you’re working with SBA lenders, they often require these notes to be on standby (no payments) for two years, which not only demonstrates the seller’s confidence but also improves your chances of loan approval [25]. Danielle Hunt from the EBIT Community highlights the value of direct negotiations:

"Going direct means the seller's net is higher even if you pay a lower purchase price. Both sides win" [2].

By avoiding brokers, you can save on hefty commissions and preserve more value for both parties.

These financial structures are just the starting point. To fine-tune the details, you’ll need to lean on data and operational insights during negotiations.

Using Data to Strengthen Negotiations

As an operator, you bring a unique advantage to the table: operational expertise. While bankers tend to zero in on financial metrics, you can dig deeper, using AI-driven tools to uncover operational challenges that might not be obvious in a sanitized data room [10]. In fact, around 86% of leaders now use generative AI in dealmaking [26], and for good reason - it helps identify risks that traditional due diligence might miss.

For instance, AI can analyze system logs, productivity data, or maintenance records to differentiate between genuine automation and manual workarounds [10]. If a SaaS company claims full automation but the logs reveal frequent manual interventions, you can price that risk accordingly and negotiate adjustments to cover post-close investments [10]. Ahmed Malik from Acquis Consulting puts it this way:

"Pricing risk accurately means nothing if that assessment does not shape deal terms" [10].

Your findings can also inform specific contractual protections. For example, if you discover incompatible management systems, you could require the seller to implement compatible software before closing or negotiate retention bonuses for key technical staff [10]. Including provisions like source code escrow and retained engineering support can increase the likelihood of successful technology integrations by 70% [10]. These measures not only protect your investment but also show the seller you’ve done your homework, fostering trust and flexibility.

The Letter of Intent (LOI) is where all these insights come together. Dana Marohn Spiliotis, former SVP of Strategic Finance at ZoomInfo, stresses its importance:

"The LOI is the foundation for the entire transaction. This is the stage where most deals go awry and punting does not help you" [8].

The LOI should address more than just the purchase price - it’s your opportunity to outline the mix of cash and stock, set exclusivity windows, and include terms for employee retention and non-competes, all informed by your operational analysis [8]. By approaching the seller with genuine curiosity about their business’s history and vision, you can build the trust needed to craft a deal structure that works for everyone [2].

Building a Repeatable Deal Sourcing Framework

The difference between those who consistently uncover great deals and those who struggle often comes down to one thing: treating sourcing as a systematic, core function. As Adam Womersley from FounderNest explains:

"Sourcing is the defining competitive advantage in M&A, far outweighing valuation, financing, or execution speed." [4]

Start by refining your approach with technology. Automate repetitive tasks with AI lead generation tools and revisit your Ideal Acquisition Profile. Instead of casting a wide net with vague targets like "SaaS companies", get specific. For example, aim for "vertical SaaS for dental practices in the Southeast with $2M–$5M in revenue." Build a tech stack that works for you - tools like Leadbay for discovery, CIENCE for prospect insights, and LettrLabs for personalized outreach can streamline the process. Expect to invest around $500–$1,000 per month for this setup.[2]

Move away from passively waiting for deals to surface. Instead, adopt a proactive strategy that focuses on identifying sell signals. Look for indicators like declining ad spend, outdated websites, or the absence of a clear succession plan.[9] Use a weighted scorecard to objectively evaluate potential targets based on their strategic fit and other key deal signals.[27] This approach not only saves time but also taps into your operational expertise, making your sourcing framework more effective.

Take Edgemont, a healthcare M&A firm, as an example. In July 2025, they shifted from manual workflows to Grata's AI-powered platform. Under the leadership of Ben Hughes, Head of Business Development, Edgemont used AI search and CRM tools to uncover niche healthcare targets with minimal digital presence. The result? A significant spike in calls and meetings.[6]

Don’t forget the human side of sourcing. Build and maintain a strong referral network.[2] When reaching out to potential sellers, use the "Partner" approach - focus the conversation on succession planning rather than pitching a quick sale.[2] Danielle Hunt from the EBIT Community highlights this balance perfectly:

"Deal sourcing is still emotional and relational work. The stack handles the manual labor so you can focus on the human side - which is where deals actually close." [2]

This combination of a robust tech stack and a personal touch turns sourcing into a predictable, repeatable process.

Finally, make sure your framework evolves by tracking key metrics. Monitor response rates, cost per qualified conversation, and follow-up persistence - most deals require 4–6 touches.[1] For off-market sourcing, a 1–3% response rate on initial direct mail campaigns is considered excellent.[2] Review these metrics quarterly to fine-tune your outreach and messaging. This ongoing feedback loop transforms sourcing into a reliable, scalable engine for uncovering high-quality opportunities.

FAQs

What’s the fastest way to find off-market SaaS deals?

The quickest way to discover off-market SaaS deals is by leveraging AI-powered tools for targeted outreach. These tools can pinpoint potential opportunities and connect directly with business owners, bypassing the need for traditional brokers or public marketplaces. By focusing on proactive and organized engagement, you can efficiently uncover valuable opportunities.

How do I spot real succession signals before a sale?

To identify succession opportunities, keep an eye on trigger events like retirements, health challenges, or shifts in personal circumstances affecting owners or CEOs. Other telltale signs include equity owners offloading subsidiaries or industries experiencing rapid consolidation.

Take it a step further by leveraging AI-powered tools to uncover patterns. These tools can analyze factors like the owner's age, changes in ownership, or private equity investment timelines. By blending traditional insights with advanced analytics, you can position yourself to engage with potential sellers before formal sale processes kick off.

What deal structure works best when price is unclear?

When the exact price of a business isn't clear, using structures like seller financing or earnouts can be a smart approach. These methods help align the interests of both buyers and sellers while offering flexibility in determining the final valuation. For buyers, they reduce risk by spreading out payments or tying them to the company’s performance. Meanwhile, sellers get the chance to share in any future success the business achieves.