76% of business owners regret their exit strategy within a year. Why? They rush the process, fail to plan, or overlook critical details like taxes, fees, and leadership transitions. Selling your business is not the finish line - it’s a step in your journey. To avoid regret, start planning 12–24 months ahead.

Here’s what you need to know:

- Define your goals: What do you want post-sale? A clean break or ongoing involvement?

- Know your "walk-away" number: Calculate your post-tax and fee cash needs.

- Prepare your business: Build a leadership team, document processes, and reduce reliance on yourself.

- Track key metrics: SaaS businesses, for example, should focus on ARR, churn, and CAC-to-LTV ratios.

- Choose the right buyer: Strategic buyers, private equity, or search funds - each has pros and cons.

- Understand deal structures: Cash, earnouts, or equity rollovers impact your payout and role.

Start early, align your goals, and ensure your business can thrive without you. A smooth sale depends on preparation, clarity, and the right buyer fit.

The Complete Business Exit Strategy You Need to Know

Align Your Personal and Business Goals First

Before diving into buyer meetings or hammering out valuations, take a step back and ask yourself: what do you really want from this exit? Many founders skip this crucial step, rushing into negotiations without aligning their exit strategy with their long-term goals. Start by figuring out your post-exit cash target. Be sure to factor in taxes, M&A advisor fees (usually 3–5%), legal expenses, and any outstanding debts [2][5].

Define What You Want After the Sale

The role you want post-sale is just as important as the sale price itself. Are you looking for a clean break, or would you prefer staying on as a consultant for a year or more? The type of buyer you work with will often dictate this. Strategic buyers - like competitors or companies in related markets - typically want you to step away after a short transition. On the other hand, Private Equity buyers may expect you to stay involved for 3–5 years to help hit growth milestones [1][8].

"If you are a founder who doesn't want to be CEO, that's fine, but you should figure that out early and save yourself and everyone else a lot of pain." – Ben Horowitz, co-founder of Andreessen Horowitz [9]

Take a moment to reflect: are you still motivated by the responsibilities of being a CEO - managing teams, securing deals, and raising funds? Or are you yearning to return to the "maker role", where you can focus on building products or writing code? If the day-to-day demands of leadership no longer excite you, it might be time to consider stepping away, not just for your own well-being but for the health of the business. Once you've clarified your goals, you can work backward to determine the sale price needed to secure your financial future.

Calculate Your Financial Requirements

Start with your lifestyle goals and build from there. For example, if you need $5 million after taxes and fees, you might need to sell for around $7.6 million, assuming a 30% tax rate and 4% in fees. Many founders overlook this math, only to be disappointed when their "big payday" shrinks significantly after closing [5].

"After you pay all the fees and taxes, does that give you enough money to live off of? If not, how do we make it more valuable at the time of transition?" – Amy Wirtz, Certified Exit Planner [5]

Talk to a tax advisor early to explore different deal structures. For instance, stock sales are often more tax-friendly for sellers, with long-term capital gains rates of 15–20%. In contrast, asset sales can result in higher ordinary income taxes [6]. Understanding these nuances 12–24 months before your exit gives you the chance to restructure and optimize your net proceeds. Once you've nailed down your financial plan, it's time to focus on making your business self-sufficient.

Plan for Business Stability After You Leave

Buyers aren’t just purchasing your revenue - they’re buying a business that can run without you. If your company relies heavily on your daily involvement, it’s not a sellable asset - it’s a job [10].

"If your company can't run without you, it's not a business, it's a job." – Daniel Marcos, CEO of Growth Institute [10]

To make your business more appealing, start building a strong management team (think CFO, CTO, VP of Sales) at least 12–24 months before your planned exit [1][2]. Document all critical workflows - like customer onboarding, support escalation, billing, and product updates - into clear Standard Operating Procedures (SOPs). This creates a "turnkey" operation that a new owner can step into with minimal disruption [2][6]. Not only does this operational independence make your business more attractive, but it also reduces risk for the buyer, which can lead to a higher valuation and fewer strings attached, like lengthy earn-out periods tied to your continued involvement.

Determine the Right Timing and Improve Your Valuation

Timing your exit is all about maximizing value. Exiting too soon or waiting too long could cost you millions. To get it right, keep a close eye on key metrics, fine-tune your operations, and stay informed about market conditions. Let’s dive into the metrics you need to track and the steps to boost your valuation.

Track Your Key SaaS Metrics

Annual Recurring Revenue (ARR) forms the backbone of your valuation. Buyers often apply multiples ranging from 3x–5x ARR for smaller companies, while larger, steady-growth businesses can see multiples as high as 10x–15x ARR by 2025 [11]. But ARR alone isn’t enough - investors want to see metrics that reflect long-term growth potential.

Here are a few critical benchmarks to monitor:

- Monthly churn below 2%: Even a 1% increase in churn could reduce your valuation by 12% over five years [11].

- CAC to LTV ratio between 3:1 and 4:1: This shows you can scale profitably without excessive spending [11].

- The Rule of 40: Add your revenue growth rate to your EBITDA margin. A combined score of 40% or higher typically attracts premium valuations [11][12].

Aaron Solganick, CEO of Solganick & Co., emphasizes the importance of detailed metrics:

"If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple. The more KPIs and the more financial data I have to work with, the more accurate your valuation will be." [11]

Gross margins are another key area. Businesses with margins over 80% achieved a median revenue multiple of 6.9x as of Q4 2023, compared to 5.9x for margins in the 70–80% range [11]. Consistently track these metrics for 12–24 months before your exit to show stability and reliability [2].

Improve Operations to Increase Value

Streamlining your operations can significantly boost your valuation. Start by upgrading your financial systems. If you’re still using basic tools like QuickBooks, consider switching to platforms like NetSuite or Sage Intacct. These systems provide accurate, auditable reporting for SaaS KPIs, which is crucial for buyers [11].

Aaron Solganick advises:

"If your company is still using simple accounting systems like QuickBooks, I'd generally recommend that you implement a more robust system that can correctly report KPIs and operating metrics. That data is key in helping a buyer see your value." [11]

Diversify your customer base to reduce concentration risk. If a single client accounts for more than 10% of your revenue, buyers may discount your valuation or require protections like earnouts [7][11]. Audit your tech stack to cut unnecessary licenses and optimize your cloud infrastructure. These steps can improve your gross margins by 5–10% [11].

Additionally, implement tools like chatbots and self-service knowledge bases to lower your Cost of Goods Sold (COGS). Automated alerts for customer disengagement - such as no logins for seven days - can help proactively address churn before it impacts your bottom line [11]. A well-optimized operation not only enhances valuation but also positions your business as a resilient and scalable asset.

Analyze Market Conditions

The broader market environment plays a huge role in determining the right time to exit. The SaaS market is projected to hit $716.52 billion by 2028, with private equity firms accounting for about 60% of SaaS M&A transactions [13][4]. Even during the market downturn in 2022, M&A multiples showed resilience, dropping only 4.5% compared to an 83% decline in IPOs [4].

The Software Equity Group highlights this stability:

"Macroeconomic factors are not impacting M&A multiples like they have in the public markets." [4]

Certain sectors, such as AI, cybersecurity, and data analytics, are currently commanding premium valuations due to heightened demand [11][12]. If your business operates in these areas, you’re in an advantageous position. Maintain a "Top 10" list of potential buyers and track their acquisition trends [13].

Don’t overlook your Total Addressable Market (TAM). A limited TAM can cap your valuation, no matter how strong your internal performance is. With 97% of business leaders reporting increased cybersecurity threats since early 2022, ensuring robust security and compliance measures is essential before starting the sale process [3]. By combining strong internal metrics with favorable market conditions, you can align your exit strategy with your long-term business goals.

Prepare Your Operations and Documentation

When it comes to selling your business, buyers will scrutinize every detail. Companies that close deals quickly and secure top valuations are the ones that have their records organized and transparent well in advance. Start preparing your documentation 12–24 months before your exit. This gives you ample time to address any gaps and gather missing signatures [1][2]. Once your operations are solid, focus on organizing your documentation and leadership structures to pass buyer verification with ease.

Document Your Standard Operating Procedures

Buyers want assurance that your business can run smoothly without you. This is where detailed Standard Operating Procedures (SOPs) come in. SOPs demonstrate that your company can continue to operate efficiently even after your departure [3][14]. Be sure to document all critical processes, such as customer onboarding, support, product deployment, and server maintenance. For SaaS and AI businesses, codebase documentation is equally critical. Your developers need to navigate and update the codebase without requiring your input [3].

Thomas Smale, CEO of FE International, emphasizes the importance of transparency during this process:

"Misrepresentations and conflicting statements will always be found out (we've never seen it otherwise) so it's best to be completely open and honest from the outset." [3]

Additionally, ensure that all contractor and employee agreements assign intellectual property rights to your company. Buyers will scrutinize this during due diligence, and missing IP assignments can jeopardize deals [3][6].

Build a Leadership Team That Can Run Without You

To make your business more appealing to buyers, ensure your leadership team can run the company independently. A business that operates without the founder’s daily involvement is far more attractive and commands higher valuations. Ideally, your management team should be able to function autonomously for at least 90 days [10]. This might involve hiring key executives like a CFO, CTO, or VP of Sales as your company grows [1].

Daniel Marcos, CEO of Growth Institute, doesn’t mince words:

"If your company can't run without you, it's not a business, it's a job. Buyers want a system that operates independently, not your daily involvement." [10]

Private equity firms, which dominate 60% of SaaS M&A transactions, specifically seek out businesses with stable management teams that can stay in place to drive growth [1][4]. To ensure continuity, cross-train your staff so no single person holds all the knowledge for critical operations. Monthly management meetings focused on KPIs - not day-to-day issues - can help instill discipline and align your leadership team [7].

Organize Your Financial Records and Contracts

Accurate financial records are essential. Gather at least three years of financial statements, including profit and loss (P&L), balance sheets, cash flow statements, and tax returns [6][8]. These should adhere to GAAP standards and, whenever possible, be audited or reviewed by a third party [7][2]. Keep personal and business finances separate - messy financials can shake buyer confidence [10].

Make sure to compile supporting documentation, such as monthly bank statements, credit card statements, merchant processor records, and invoices that back up your P&L [3]. Review all customer, supplier, and lease agreements for "change of control" clauses that may require third-party approval before transferring ownership [10]. Organize your cap table, equity agreements, employee contracts, and NDAs [2]. To streamline due diligence, set up a Virtual Data Room (VDR) with folders categorized for financials, corporate documents, legal contracts, HR records, and intellectual property [6][8].

Clear and well-organized records not only make the due diligence process smoother but also reinforce the trust you've built with potential buyers.

| Document Category | Specific Items to Organize |

|---|---|

| Financials | P&L, balance sheets, tax returns, bank statements [3][2] |

| Legal/Corporate | Cap table, equity agreements, articles of incorporation, NDAs [2] |

| Contracts | Customer agreements, supplier contracts, leases, IP assignments [3][10] |

| Operations | SOPs, codebase documentation [3][2] |

| Human Resources | Employment contracts, organizational chart, payroll records [4][2] |

Consider conducting a Quality of Earnings (QofE) report before engaging with buyers. This pre-sale financial review can help you identify and resolve any discrepancies before they become red flags during due diligence [6][8].

sbb-itb-9cd970b

Find the Right Buyers and Choose Your Exit Path

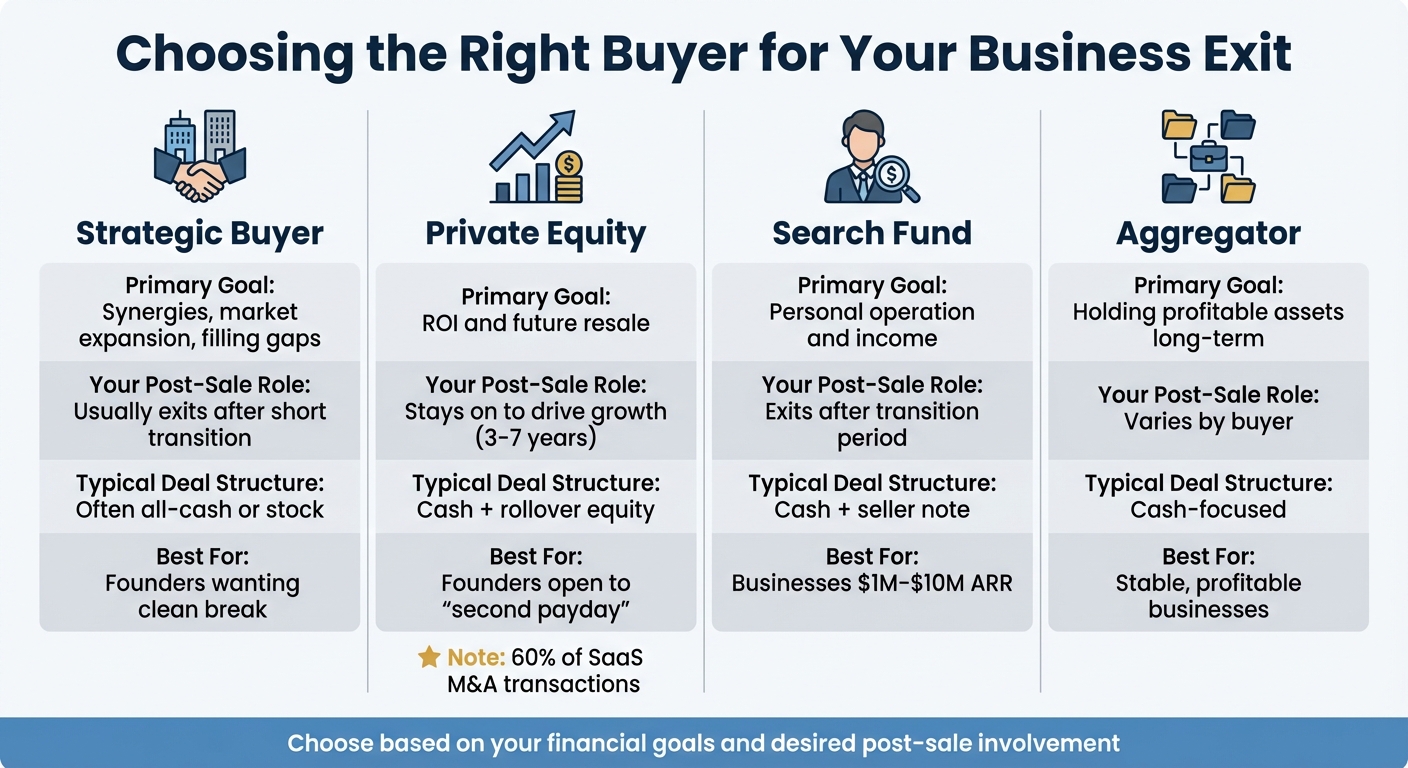

Buyer Types Comparison for Business Exit Strategy

Once your operations and documentation are in order, it’s time to focus on finding the right buyer - one whose goals align with your exit plan. While private equity firms account for about 60% of SaaS M&A transactions [4], other types of buyers come with their own advantages, influencing the sale price and your involvement after the deal. Each buyer type has unique motivations that shape the terms of the deal and your role post-sale.

Compare Different Types of Buyers

Strategic buyers are often competitors or larger companies within your industry. They’re looking to acquire businesses that help expand their market reach, eliminate competition, or fill gaps in their product offerings [1][8]. Because they can quickly integrate your business to cut costs or boost revenue, they’re often willing to pay higher multiples. However, these buyers typically prefer a clean break, meaning you’re likely to exit after a brief transition period [8].

Private equity firms prioritize return on investment, cash flow, and the potential for future resale. They target businesses with strong management teams and growth potential, aiming to improve operations and sell the company within 3–7 years [4][8]. If you sell to a PE firm, you’ll likely remain involved post-sale, often through rollover equity, which gives you a stake in the company’s future resale, sometimes referred to as a "second payday" [1][2].

"Business owners need to consider the cultural fit of potential successors, [as their] values and vision could potentially be misaligned with the company's mission and strategy." – Mark Valentino, Head of Business Banking at Citizens [5]

Search funds and individual buyers are often entrepreneurs seeking businesses in the $1M–$10M ARR range to operate themselves [2]. These buyers usually offer a mix of cash and a seller note, with your exit occurring after a transition period. Aggregators and holding companies, on the other hand, focus on acquiring profitable assets to hold long-term rather than flipping them quickly [2].

| Buyer Type | Primary Goal | Your Post-Sale Role | Typical Deal Structure |

|---|---|---|---|

| Strategic Buyer | Synergies, market expansion, filling gaps [1][8] | Usually exits after a short transition [8] | Often all-cash or stock |

| Private Equity | ROI and future resale [1][4] | Stays on to drive growth [8] | Cash + rollover equity |

| Search Fund | Personal operation and income [2] | Exits after transition [2] | Cash + seller note |

| Aggregator | Holding profitable assets long-term [2] | Varies by buyer | Cash-focused |

Choosing the right type of buyer is critical to achieving an exit that aligns with your personal and business goals. Once you understand the buyer landscape, partnering with experienced M&A advisors can help you navigate the complexities of the process.

Work with M&A Advisors

M&A advisors play a crucial role in buyer selection, valuation, and structuring deals. They also help you avoid pitfalls, like last-minute changes to terms. To build buyer confidence, conduct sell-side due diligence by preparing a Quality of Earnings report and strong financial projections. Only grant exclusivity to a buyer when you’re confident in their reputation and ability to follow through. Be cautious of advisors with a track record of altering deal terms late in the process [8].

Understand Different Deal Structures

Cash offers provide immediate liquidity, allowing you to walk away with your payout upfront. However, this structure may come at a discount, and you won’t benefit from the company’s future success under new ownership [2].

Earnouts tie part of your payout to hitting future performance milestones. While this setup offers the potential for a higher total payout, it also carries the risk of missing those targets [2].

Equity rollovers allow you to retain a stake in the company, giving you the chance for a "second payday" when a private equity firm resells the business [1][2]. This structure is common with private equity buyers who want to keep you motivated and aligned with growth goals.

Your choice of deal structure should reflect your financial priorities and risk tolerance. If you’re looking for maximum cash upfront and a quick exit, strategic buyers offering all-cash deals are often the best fit [1][2]. If you’re open to staying involved and want to share in future growth, a private equity deal with rollover equity might be more appealing [1][2].

"The best way to work through this is by having a plan in place years before you are looking to sell." – Andrew Van Alstyne, Financial Planner and Investment Manager at Fiduciary Financial Advisors [5]

Execute a Smooth Transition

Once you’ve found the right buyer, the next step is ensuring a smooth handover. After the deal is finalized, employees, customers, and stakeholders need reassurance that the business will continue to operate effectively. A poorly managed transition can harm your business’s value and reputation, while a well-planned handoff sets the stage for the new owner’s success.

Retain Key Employees During the Transition

The continuity of your management team and the retention of technical expertise are critical to buyers [15]. If key executives leave during the transition, the new owner may face challenges that could jeopardize the deal or reduce its value. To avoid this, consider offering retention bonuses or converting equity for essential staff members as part of the agreement [2]. These measures keep your top employees motivated and committed during the ownership change.

A strong leadership team also ensures operational stability. As Merge explains:

"If you're the business, your business isn't sellable. Buyers want scalability and autonomy" [2]

Beyond increasing the business’s valuation, a capable management team takes the lead during due diligence, managing the collection and verification of financial and legal documents needed to close the deal [1].

Finally, maintaining clear and consistent communication with everyone involved helps reinforce confidence throughout the transition.

Communicate Clearly with All Parties

Transparency is key, but timing is everything. Start by forming a small group of trusted advisors who can help you maintain confidentiality and craft a clear narrative [8]. When it’s time to inform a broader audience, be ready to explain the reasons for the sale in an honest and straightforward way. Any ambiguity can create doubts among buyers and stakeholders [3].

Dr. Michael Barbera, Chief Behavioral Officer at Clicksuasion Labs, emphasizes the importance of consistency:

"Change often leads to uncertainty, which can make employees, customers, and stakeholders nervous about the future. To prevent unnecessary concern, business owners should focus on maintaining consistency in practices, policies, and communication" [5]

During the transition, keep operations, policies, and communication steady to reassure everyone involved. Introduce the new owners to key clients and empower your leadership team to manage daily operations independently of your direct involvement.

Once the business is on solid footing, it’s time to focus on your personal financial planning.

Plan How to Manage Your Wealth After the Sale

With your financial goals in mind, take a strategic approach to managing your wealth post-sale. Work with a wealth advisor, tax professional, and CPA to evaluate different financial scenarios based on the deal structure and current market conditions [6]. Determine your "walk-away" number - the amount you’ll need after taxes and fees to support your lifestyle or retirement plans [2][6].

Experts can help you structure the deal to minimize taxes, take advantage of favorable long-term capital gains rates, and optimize your net proceeds. Diversifying your portfolio is another key step to managing risk [6].

As Commons Capital puts it:

"A business built to sell is, by definition, a business built to last. It is operationally efficient, financially transparent, and strategically positioned for future growth" [6]

If your deal includes rollover equity, you may benefit from additional gains when the private equity buyer resells the business [1][6]. Transitioning from active business ownership to generating passive income from your proceeds is an essential part of planning for your financial future [16].

Conclusion

Plan your exit strategy with care to ensure it aligns with both your personal and business goals. Without a clear roadmap, many business owners find themselves grappling with regret after a sale. Start by determining your walk-away number, setting an ideal timeline, and deciding on your level of post-sale involvement. These steps will help you avoid settling for a deal that leaves you unsatisfied down the line.

Begin preparing your exit at least 12–24 months in advance to get the most value from your business. Focus on making it operationally independent by documenting Standard Operating Procedures (SOPs), empowering a capable leadership team, and improving key SaaS metrics. Aim for metrics like Net Revenue Retention above 100% and gross margins in the 75–90% range [2]. These foundational efforts will guide every decision you make during the exit process. As Certified Exit Planning Advisors often say, "No client ever told me, 'I wish I'd started later'" [7].

As discussed earlier, the best exit isn't necessarily about securing the highest offer. It's about finding the right buyer and structuring a deal that meets your financial and personal objectives. Whether you’re considering a strategic or financial buyer, understanding deal structures and working with seasoned M&A advisors can make all the difference in navigating negotiations with confidence.

It’s worth noting that 76% of former business owners report feeling regret within a year of selling their business [7]. Early and thoughtful planning can help you avoid that. By taking control of the process, building a business that can thrive without you, and preparing for life after the sale, you’ll set yourself up for long-term satisfaction. From defining your goals to ensuring a seamless transition, every step plays a crucial role in achieving a regret-free exit.

As Commons Capital wisely puts it, "A business built to sell is, by definition, a business built to last" [6]. Review your strategy, refine your operations, and choose a buyer who shares your vision for the future.

FAQs

How do I know when it’s the right time to sell my business?

The ideal moment to sell your business is when it’s thriving, showing steady growth, and built on a solid foundation. To get the best results, aim to plan your exit 12 to 24 months ahead. This gives you time to align your personal goals, assess market conditions, and focus on the factors that drive your business’s value. Proper preparation helps you avoid rushing the process and sets you up for a better outcome.

Timing plays a critical role - selling in a strong market and during a period of stability for your business can make a big difference in the success of the deal. Use this time to evaluate your readiness, carefully consider potential buyers, and ensure your plans align with both your long-term business vision and personal aspirations.

What are the pros and cons of deal structures like earnouts and equity rollovers?

An earnout links part of the sale price to the future performance of the business, serving as a way to bridge valuation differences between buyers and sellers. For buyers, this approach lowers upfront costs and reduces the risk of overpaying if the business doesn’t perform as expected. Sellers, on the other hand, can benefit from additional payouts if specific performance targets - like revenue or EBITDA - are achieved after the sale. That said, earnouts come with a level of uncertainty. Payments may take years to materialize, and disagreements over how performance is measured or when payments are due can lead to disputes. To minimize potential conflicts, contracts should clearly define metrics, timelines, and audit rights.

An equity rollover gives sellers the option to keep a stake in the business rather than taking the full payment in cash. This arrangement offers the chance for future financial gains if the business grows and can also defer some tax obligations, as retained equity is typically treated as a capital gain. For buyers, it signals the seller’s confidence in the company’s future, which can help smooth the transition. However, sellers take on market risks and often have limited control over business decisions under new ownership. To address these concerns, negotiating governance rights and anti-dilution protections can provide added security.

How can I make sure my business thrives without me after I exit?

To keep your SaaS or AI business running seamlessly after your exit, it’s essential to prepare a self-sustaining foundation well ahead of time. Start by focusing on creating predictable revenue streams, like multi-year contracts or subscription-based models, while keeping churn rates low. This ensures a stable cash flow that’s attractive to potential buyers. Additionally, document all key processes - such as customer onboarding, billing, and security compliance - in detailed, step-by-step guides. Store these in a centralized knowledge base that the new owners can easily access.

Building a strong management team is equally important. Delegate responsibilities, set measurable goals, and tie incentives, such as bonuses, to performance metrics. This empowers the team to handle day-to-day operations without relying on your input. Incorporating automation tools for tasks like finance, reporting, and customer success can further reduce dependence on any one individual, making the business easier to transition to new ownership.

Finally, ensure a smooth transition by preparing a clear plan that includes governance details, handovers of key relationships, and a defined timeline for the buyer. Bringing in experienced advisors early to audit your processes and confirm the business is ready to operate independently can help secure its long-term success and protect the legacy you’ve worked hard to build.