Picking the right private equity (PE) partner can make or break your company. Good PE firms drive growth by investing in expertise, AI, and long-term strategies. Bad PE firms rely on debt, cost-cutting, and short-term tactics that often stifle progress or lead to bankruptcy.

Here’s what you need to know:

- Good PE Traits: Focus on growth, align with your vision, invest in modern systems like ERP/CRM, and prioritize sustainable improvements.

- Bad PE Red Flags: Aggressive cost-cutting, excessive debt, and lack of SaaS or AI expertise.

- Key Stats:

- Companies with AI integration see up to 35% ROI, while poorly managed PE-backed firms are 10x more likely to go bankrupt.

- In 2023, founder-led companies made up 62% of PE deals, emphasizing the importance of choosing the right partner.

Quick Tip: Evaluate potential PE partners by their track record, growth strategy, and how they plan to support your business beyond just funding.

Let’s dive into how to spot the difference between good and bad PE.

What to Ask a Private Equity Firm Before You Partner | Private Equity Pt. 2 Masterclass Moment

What Good PE Looks Like: Traits of Growth-Focused Private Equity

The best private equity (PE) firms don’t rely on old-school financial tricks. Instead, they focus on operational improvements that can boost productivity by 8–12% within the first two years [4]. These firms take an active role in ownership, dedicating over half their time to the business during the critical first 100 days. They meet almost daily with company executives to align on strategic goals [2]. By leveraging operating partners with expertise in areas like finance, technology, and AI, they help businesses accelerate growth [8]. A key part of their approach includes identifying and cutting “bad revenue” - those unprofitable income streams that drain resources - and redirecting funds into areas like research and development or marketing [4]. Companies that integrate advanced AI capabilities across departments often achieve nearly double the return on invested capital compared to those that don’t [6]. These results stem from PE partners who actively engage with teams to drive measurable improvements.

Shares Your Vision for the Business

Top PE firms align with your growth strategy rather than imposing a one-size-fits-all approach. They collaborate with founders to create a detailed financial model that supports long-term goals, instead of building a plan based on fleeting industry trends [4]. For them, the investment thesis shapes the leadership team - not the other way around.

Brings Expertise and Resources to Help You Scale

Great PE firms offer more than just funding - they bring the tools and expertise needed to help businesses grow. Simply injecting capital isn’t enough to scale a SaaS or AI-driven company. These firms pair investments with operational know-how, providing experienced operating partners skilled in areas like procurement, digital transformation, and AI deployment [8]. They help build management teams that are accountable for driving key value metrics.

A big focus is on upgrading foundational systems, such as ERP and CRM platforms, to create the structured data environment necessary for scaling AI tools. This approach can reduce time-to-value by 40% [6]. Take Berkshire Partners and their investment in Crown Castle in 1998. By focusing on a few strategic priorities, Crown Castle achieved a sevenfold revenue increase and grew its workforce by 40% after going public. This effort delivered a tenfold return for Berkshire Partners [9]. Additionally, top PE firms use their networks to connect founders with potential customers, partners, and top-tier talent - resources that entrepreneurs consistently rate as invaluable [7].

Invests in Long-Term Growth Over Quick Wins

Growth-focused PE firms understand that lasting value comes from building strong capabilities, not just financial restructuring. Digital initiatives often yield a 15–20% ROI, and integrating AI can push returns even higher, to 30–35% [6]. These firms focus on recruiting top talent for critical roles that align with the company’s value-creation goals [4]. To ensure everyone is working toward the same objectives, they often implement performance incentives, with CEOs and key executives earning up to 15–20% of total equity [2].

They also emphasize knowledge transfer, ensuring that expert insights are embedded into the company’s internal teams. This approach creates long-term organizational strength, standing in stark contrast to PE models that rely on short-term fixes or financial engineering. By prioritizing sustainable growth, these firms set businesses up for enduring success.

Red Flags: What Bad PE Looks Like

Spotting warning signs in private equity (PE) partnerships is just as important as identifying positive traits. Founders need to be aware of practices that could jeopardize their company’s long-term success. Some PE firms prioritize short-term financial gains over sustainable growth, often at the expense of innovation. The statistics are striking: about 20% of PE-backed companies file for bankruptcy within 10 years, compared to only 2% of similar companies that remain independent [12]. In 2024, the U.S. saw a record number of PE-backed bankruptcies, including high-profile cases like Vice Media (May 2023), Red Lobster (May 2024), Instant Brands (June 2023), and TGI Fridays (November 2024) [10]. Below are key red flags that can help distinguish between PE firms that add value and those that may harm a business.

Aggressive Cost-Cutting and Overreliance on Financial Engineering

One major red flag is a PE firm's focus on aggressive cost-cutting rather than creating sustainable operational improvements. These firms often reduce labor costs by 30%–60% through practices like "clean-sheeting", which involves eliminating positions deemed low-value [4]. Instead of investing in areas that could drive growth, they resort to short-term tactics like asset stripping, sale-leasebacks (selling property only to lease it back), and other financial maneuvers [4][9]. Secondary buyouts are also common, which can sometimes conceal a lack of meaningful value creation [12]. As former SEC Chairman John Shad famously stated:

"The more leveraged takeovers and buyouts today, the more bankruptcies tomorrow" [12].

Lack of Understanding in SaaS and AI Business Models

Another red flag is a lack of expertise in technology-driven industries like SaaS and AI. PE firms unfamiliar with these sectors often make poor strategic decisions because they fail to grasp the unique dynamics of these businesses. For instance, only 22% of PE firms consider a company’s digital maturity when making investment decisions, and just 11% tie digital progress to their exit strategies [6]. These firms often treat ERP and CRM systems as basic back-office tools, overlooking their critical role as data foundations for AI. They also apply generic approaches like "buy-and-build", ignoring the specialized strategies required for SaaS transformation or productization [13]. The contrast is clear: PE firms with experience in at least 10 software deals outperform the median IRR of other industries by 15 percentage points, while generalist firms see only a 2 percentage point boost [13].

Excessive Debt Burdens

High leverage is one of the most dangerous pitfalls of bad PE deals. Over-leveraging - such as carrying more than $7 of debt for every $1 of profit - forces companies to prioritize debt payments over reinvestment, leaving them vulnerable to market fluctuations [12]. In 2023, software companies with leveraged loans had an average interest coverage ratio of less than 2x EBITDA, meaning they had little financial cushion [5]. This heavy debt load restricts strategic flexibility, making it nearly impossible for companies to adapt to market changes or invest in critical infrastructure for AI. As a result, PE-backed firms are about 10 times more likely to go bankrupt compared to their non-PE-backed counterparts [12].

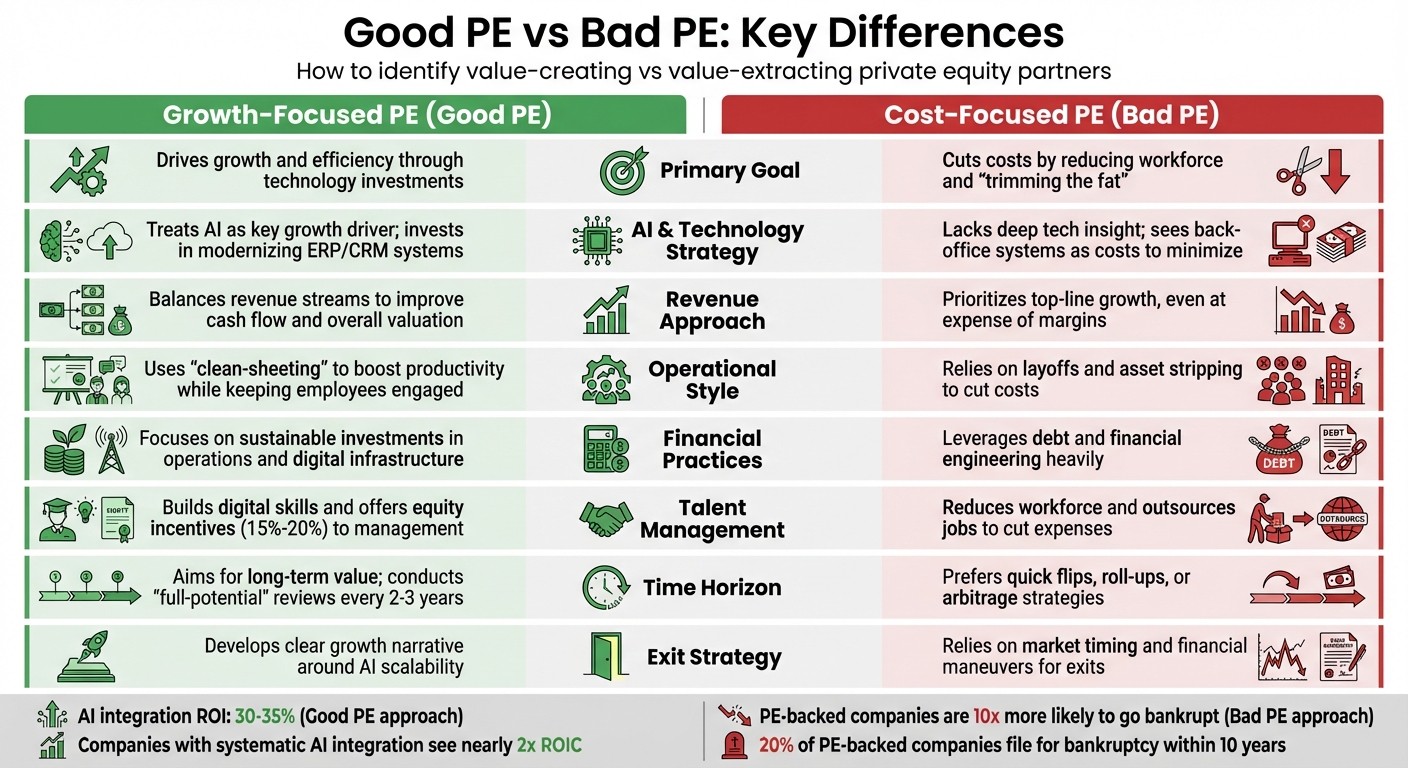

Good PE vs Bad PE: Side-by-Side Comparison

Good PE vs Bad PE: Key Differences in Private Equity Strategies

Let’s break down the key differences between good and bad private equity (PE) strategies. Choosing the right PE partner can make or break your company's future. Growth-focused firms aim to create long-term value, while extraction-focused ones often prioritize short-term gains, sometimes at the expense of the business. As Michael Tan, Director of Ecosystem and Investor at Tidemark, explains:

"PE buyouts typically are about 'trimming the fat.' Returns are created from financial engineering and outsourcing... Tech-driven roll-ups are about making businesses grow faster and more efficiently" [11].

The numbers back this up. Companies that systematically integrate AI across their operations see nearly double the return on invested capital (ROIC) compared to those that don’t [6]. Digital initiatives alone can deliver 15%–20% ROI, but when paired with AI on a solid digital foundation, returns can soar to 30%–35% [6]. Growth-oriented PE firms understand that upgrading ERP and CRM systems isn’t just a cost - it’s a necessary step toward enabling AI-driven success.

Comparison Table: Key Differences

Here’s a snapshot of how growth-focused PE firms differ from traditional, cost-focused ones:

| Aspect | Growth-Focused PE (Good PE) | Cost-Focused PE (Bad PE) |

|---|---|---|

| Primary Goal | Drives growth and efficiency through technology investments [11] | Cuts costs by reducing workforce and "trimming the fat" [11] |

| AI & Technology Strategy | Treats AI as a key growth driver; invests in modernizing ERP/CRM systems [6] | Lacks deep tech insight; sees back-office systems as costs to minimize [6] |

| Revenue Approach | Balances revenue streams to improve cash flow and overall valuation [4] | Prioritizes top-line growth, even at the expense of margins [14] |

| Operational Style | Uses "clean-sheeting" to boost productivity while keeping employees engaged [4] | Relies on layoffs and asset stripping to cut costs [4][9] |

| Financial Practices | Focuses on sustainable investments in operations and digital infrastructure [9] | Leverages debt and financial engineering heavily [11] |

| Talent Management | Builds digital skills and offers equity incentives (15%–20%) to management [2][4] | Reduces workforce and outsources jobs to cut expenses [4][6] |

| Time Horizon | Aims for long-term value; conducts "full-potential" reviews every 2–3 years [4] | Prefers quick flips, roll-ups, or arbitrage strategies [11] |

| Exit Strategy | Develops a clear growth narrative around AI scalability [6] | Relies on market timing and financial maneuvers for exits [2] |

The approach a PE firm takes can profoundly impact your company’s trajectory. Timing also plays a critical role. Companies with mature digital infrastructure can accelerate value creation by 40% compared to those skipping foundational investments. On the flip side, insufficient digital groundwork often leads to valuation drops during exit [6]. It’s no wonder that over 90% of investment professionals plan to increase digital budgets across their portfolios in the next three years [6].

sbb-itb-9cd970b

5-Point Checklist: How to Find the Right PE Partner

Choosing the right private equity (PE) partner is a decision that can shape the future of your business. With founder-led companies playing a bigger role in PE deals - rising from 54% in 2020 to 62% in 2023 - founders are staying involved longer post-acquisition. Dollar values have also jumped from 31% to 44% during the same period [1]. This makes selecting a partner who aligns with your SaaS and AI goals more critical than ever. Here’s a five-step guide to help you evaluate potential partners.

1. Check if They Share Your Growth Vision

Start by ensuring the PE firm aligns with your long-term goals. Ask for their "full potential" thesis rather than a basic projection of the status quo. A partner who shares your vision will have already factored in digital and AI assessments during their diligence phase - something only 29% of PE firms do consistently [6]. Look for firms that focus on transformative strategies to elevate your company’s growth over the next few years instead of just cutting costs.

Pay attention to their leadership philosophy. Do they prioritize ongoing learning and strategic support, like identifying partnership opportunities or crafting growth strategies, without overstepping into daily operations? The best firms strike this balance [7].

2. Review Their SaaS and AI Investment History

A firm’s track record is a window into their capabilities. Request a "Day-Zero roadmap" from a previous investment to understand how they approach digital transformation and AI opportunities [6]. PE-backed companies that embrace advanced AI capabilities often double their return on invested capital compared to those that don’t [6].

Ask whether they use digital-maturity scores to assess potential investments. While only 22% of PE firms incorporate digital readiness into their decisions [6], those that do tend to secure better outcomes. Additionally, inquire about their experience modernizing SaaS companies’ ERP and CRM systems. These systems are the backbone for collecting the structured data that powers AI.

3. Evaluate What They Bring Beyond Money

Capital is essential, but it’s not everything. With 90% of investment professionals planning to increase digital budgets across portfolios in the next three years [6], ask how the firm will support your technology roadmap. Do they launch Day-One digital sprints or bring in specialized teams for tasks like data governance? Successful firms often collaborate with digital boutiques - 70% of top-performing firms do this [6].

Also, assess their network. Ask for specific examples of partnerships or opportunities they’ve facilitated. Founders often value an investor’s connections more than the capital itself [7].

4. Examine Their Financial Practices

Take a close look at their financial modeling for your business. If their plan leans heavily on cost-cutting without a clear vision for growth, consider it a warning sign [4]. Growth-oriented PE firms focus on "good revenue" - revenue that boosts cash flow after covering costs, taxes, and reinvestments [4].

Ask how they handle unprofitable revenue and resource reallocation. While PE-owned companies often achieve productivity gains of 8% to 12% within the first two years [4], these improvements should come from smarter resource management, not indiscriminate layoffs. Also, check if they allocate 15% to 20% of total equity for management performance incentives. This shows they’re invested in long-term success [2].

5. Talk to Other Founders They’ve Worked With

References are invaluable. Speak with at least three founders who’ve partnered with the firm and ask detailed questions. Did the firm deliver on its promises of strategic support? How involved were they in daily operations? How did they handle tough situations?

Pay special attention to CEO changes. While 71% of PE acquisitions over $1 billion result in a CEO change - 38% within the first two years [4] - you’ll want to know why. Were these changes part of a deliberate strategy to align with the company’s value-creation goals, or were they reactive decisions based on short-term challenges? A strong PE partner ensures leadership aligns with the company’s growth thesis, not the other way around [4].

What Happens in Practice: Good PE vs Bad PE Results

Let’s take a closer look at how private equity (PE) can shape outcomes, for better or worse, by examining real-world examples.

Good PE: Companies That Scaled Successfully

Rewardful.com is a great case of PE creating long-term value. After SaaS Group acquired the company, its annual recurring revenue skyrocketed from $2 million to $10 million by 2024. The key? A focus on scaling operations rather than relying on financial maneuvers, ensuring sustainable growth [15].

Another success story is Flagsmith, which thrived under Polychrome's direction. Over just two years, the company’s revenue grew 20x, thanks in part to a 50-50 joint venture in 2020. By 2023, Flagsmith reported $1.1 million in revenue with only 12 employees - proof that a well-aligned PE partner can help a business grow efficiently without unnecessary bloat [15].

Cengage Group offers yet another example of smart PE-backed transformation. In 2023, the company launched eight AI-driven projects that slashed content production costs by 40% while boosting lead generation efficiency by 15% to 20%. This wasn’t about cutting corners but about finding smarter ways to work [16]. Similarly, Avalara, after being acquired by Vista Equity Partners in 2022, introduced a generative AI assistant that reduced sales response times by an impressive 65% [16].

These examples show how thoughtful PE strategies can drive meaningful, sustainable growth.

Bad PE: Companies That Struggled or Failed

On the flip side, poorly executed PE strategies can lead to significant challenges. Take Envision, for instance. After KKR implemented controversial "surprise medical billing" practices in 2019, one patient received a shocking $52,000 bill for a 20-mile airlift. The backlash led to regulatory scrutiny, brand damage, and a tarnished reputation that persists to this day [3]. This serves as a clear warning about the dangers of prioritizing quick revenue over long-term trust.

Then there’s Thrasio, an Amazon aggregator that pushed aggressive acquisition strategies to the extreme. By 2021, the company was acquiring 1.5 independent businesses per week. While this roll-up model initially showed promise, it ultimately created overwhelming pressure on entrepreneurs and lacked the operational foundation needed to handle growing competition. NYU Professor Aswath Damodaran summed it up well:

"I firmly believe that acquisitions are an addiction, that once companies start to grow through acquisitions, they cannot stop" [3].

These cautionary tales highlight the pitfalls of focusing solely on short-term gains at the expense of sustainable growth and operational health.

Conclusion: What Founders Need to Remember

Wrapping up our deep dive into private equity (PE) approaches, here’s what stands out.

Choosing the right PE partner is all about aligning with your long-term goals. The best partners focus on building value by leveraging digital tools and AI, often driving returns of 30%–35% [6]. They’ll strengthen your leadership team, offer guidance without micromanaging, and help you achieve productivity improvements of 8% to 12% within the first two years [4]. These partners see the full potential of your business, empowering you to make bold, growth-oriented decisions.

On the flip side, the wrong PE partners rely heavily on cost-cutting, piling on debt, and short-term financial tricks. The red flags are easy to spot: constant meddling in daily operations, sweeping layoffs, and little to no understanding of SaaS or AI-driven models.

As Bain & Company highlights, the only reliable way to grow a portfolio is by maximizing operating value [9]. Your PE partner will either help your company scale effectively or weigh it down with short-sighted strategies.

Do your homework. Talk to other founders, evaluate their experience with SaaS and AI investments, and ensure they bring more than just funding to the table. This reinforces the key takeaway from the 5-point checklist: align on vision, expertise, and sustainable growth. The right partner will accelerate your success, while the wrong one could stifle your progress and innovation.

Choose carefully - your company’s future depends on it.

FAQs

How do I know if a PE firm is the right fit for my company's long-term goals?

To identify a private equity (PE) firm that matches your ambitions, seek one that emphasizes working closely with your management team, has proven success in growing businesses over time, and adopts a growth-focused approach that aligns with your strategy.

Look for these key traits:

- Commitment to long-term strategic partnerships over short-term gains.

- Incentive structures designed to align both founder and investor interests.

- A focus on strong leadership and steady, sustainable expansion.

The right PE partner will keep your vision at the forefront while helping to drive impactful growth for your business.

What are the dangers of working with a PE firm that heavily relies on debt?

Partnering with a private equity (PE) firm that leans heavily on debt can bring serious challenges to your business. A high debt load often translates to larger interest payments and lower cash flow, which can put a strain on your company’s finances. Even worse, this kind of financial structure can make your business more susceptible to bankruptcy if the economy takes a downturn or unexpected issues arise.

On top of that, PE firms with a debt-focused approach tend to prioritize quick financial returns over building long-term value. This mindset can restrict your company’s ability to invest in growth areas, such as innovation, scaling operations, or responding to shifts in the market. For industries like SaaS and AI, where adaptability is key, this could mean falling behind competitors. It’s crucial to thoroughly assess a PE firm's financial strategies to ensure they align with your vision for long-term success.

Why is it important for a PE firm to have expertise in SaaS and AI?

Private equity firms with specialized knowledge in SaaS and AI are uniquely positioned to pinpoint and execute strategies that maximize potential in these sectors. This often involves using AI to streamline operations, scaling SaaS platforms effectively, and seizing opportunities in the ever-evolving digital economy.

With a clear grasp of the specific hurdles and prospects in SaaS and AI, these firms can accelerate growth, boost profitability, and achieve better returns - making them a strong choice for founders aiming for sustained success.