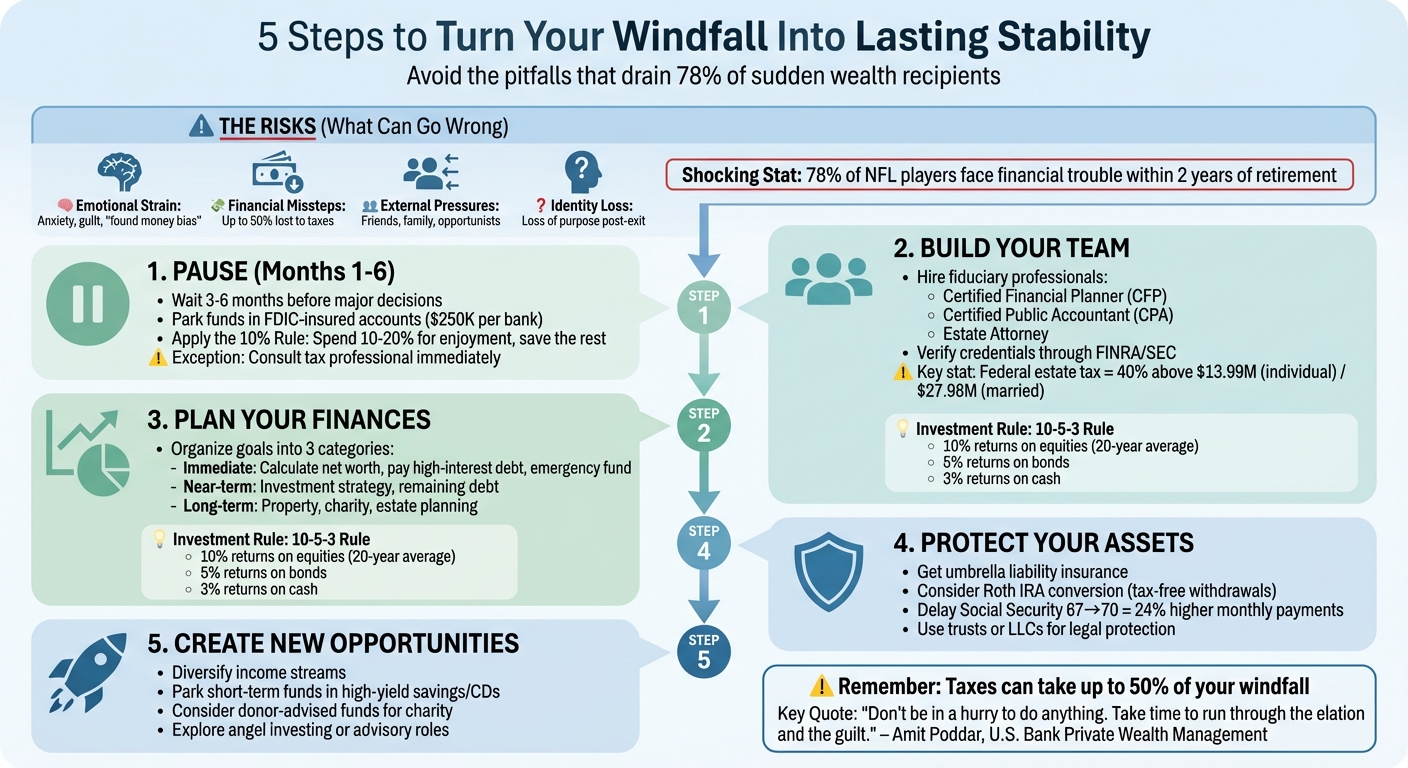

Receiving a large financial windfall might seem like a dream come true, but it often leads to unexpected challenges. From emotional stress to poor financial decisions, sudden wealth can disrupt your life in ways you might not expect. Here's a quick breakdown:

- Emotional Strain: Anxiety, guilt, and fear of losing it all are common reactions.

- Financial Missteps: Impulsive spending, poor planning, and underestimating taxes can quickly drain funds.

- External Pressures: Family, friends, and even strangers may request money, creating tension.

- Identity Loss: For business owners, selling a company may lead to a loss of purpose.

To avoid these pitfalls, take a step back before making any major decisions. Build a team of trusted financial experts, plan for taxes, and focus on long-term goals. Thoughtful management is key to turning sudden wealth into lasting stability.

5-Step Guide to Managing Sudden Wealth After a Financial Windfall

Common Mistakes After Receiving a Large Payout

Emotional Stress and Rushed Decisions

Receiving a significant payout can stir up a whirlwind of emotions, often leading to impulsive choices. This phenomenon, called "found money bias," makes people treat unexpected wealth differently than their regular income. The result? A tendency to spend recklessly, which can quickly drain even the largest windfalls [4].

"The first thing to do is take a deep breath. We often rush to make a decision, and quick choices can lead to regret." - H. Jude Boudreaux, Financial Planner [4]

On the flip side, some people freeze under the weight of too many options. Whether it’s deciding on investments, lifestyle changes, or how to handle requests for help, the sheer number of decisions can feel overwhelming. This anxiety can lead to rash commitments or complete inaction [5][7].

Another emotional hurdle is "ticker shock," where individuals obsessively track market changes, fearing they’ll lose their newfound wealth [5]. Others grapple with survivor's guilt, questioning if they deserve their fortune. This guilt can lead to self-sabotaging financial choices, compounding the emotional and financial strain [4][5].

Tax Problems and Poor Financial Planning

Taxes are another major stumbling block for those handling a windfall. Many underestimate the hefty tax obligations that can consume up to 50% of their payout [6]. For example, lottery winnings over $5,000 are subject to an automatic 24% federal withholding, but the final tax bill could be even higher depending on your state [2][8]. Similarly, lump-sum payouts from selling a business are taxed as ordinary income, often pushing recipients into the top tax bracket [8].

Adding to the problem is the "illusion of large numbers" - a cognitive bias that makes people believe huge sums will last forever [7]. Take the case of a Glassman Wealth Services client who sold a business for $15 million. They spent $4 million on real estate, only to face $100,000 in annual costs for taxes, maintenance, and insurance. These ongoing expenses quickly drained their remaining funds [7].

"We have a bias to think that large sums of money will last a long time. There is so much motivation to take the big lump sum and so much that wants to part us from that money." - Sheryl Garrett, Founder, Garrett Planning Network [7]

Pressure from Family, Friends, and Opportunists

Sudden wealth doesn’t just bring personal and financial challenges - it also attracts external pressures. Once people learn about your windfall, you may face a flood of requests from family, friends, and even strangers [7][8]. Long-lost acquaintances might resurface, each with a story or a sense of entitlement. This is especially tough for entrepreneurs, who may already feel a mix of guilt and disbelief about their success [6].

"The sheer elation or happiness that comes with receiving a large windfall is often followed by a strong desire to help others. People come out the woodwork, and suddenly, family members, friends, and acquaintances request a share." - Amit Poddar, Senior Vice President and Market Leader, U.S. Bank Private Wealth Management [6]

The consequences of giving in to these pressures can be severe. Lending money to friends can strain relationships if the loans go unpaid, while uneven gifts to family members can spark long-term resentment [3][8]. For instance, a November 2022 Powerball winner faced immediate legal challenges, highlighting how sudden wealth can attract opportunistic lawsuits [3]. Even strangers may file frivolous claims, seeing your payout as an easy target [3].

"When it comes to money, someone within a circle of family and friends will have problems. It could be the receiver of the windfall, or it could be a brother-in-law who feels he deserves some of it. People get greedy." - Sheryl Garrett, Founder, Garrett Planning Network [7]

sbb-itb-9cd970b

How to Manage a Sudden Money Windfall: IPOs, Business Sale, or Inheritance

How to Manage Sudden Wealth Effectively

Now that we've discussed the challenges sudden wealth can bring, let's focus on practical strategies to secure your financial future.

Wait 3-6 Months Before Making Big Decisions

Take a breather before making any major life changes. Financial advisors often recommend waiting 3 to 6 months before making big decisions like quitting your job, buying a home, or diving into long-term investments. This pause gives you time to process your emotions and avoid hasty choices you might regret later.

During this waiting period, park your money in a liquid, insured account. Keep in mind that FDIC insurance covers up to $250,000 per depositor, per bank. If your windfall exceeds this limit, consider spreading the funds across multiple banks. However, one immediate step you shouldn't delay is consulting a tax professional. Taxes can take a huge bite - up to 50% of your windfall - so it's crucial to calculate your liability and set aside the necessary amount.

A good rule of thumb is the "10% Rule": allocate 10%–20% of your newfound wealth for immediate enjoyment while safeguarding the rest for future plans. This reflection period prepares you for the next step - assembling a team of experts.

Hire a Wealth Management Team

Once you've had time to adjust, your next priority is to gather a team of financial professionals who are legally obligated to act in your best interest. At the very least, this team should include a Certified Public Accountant (CPA), an estate attorney, and a Certified Financial Planner (CFP). These experts can help you navigate tax complexities, set sustainable spending rates, and plan for long-term wealth preservation.

"To protect your money, it's critical to get the right team of people around you." - Amit Poddar, Senior Vice President and Market Leader, U.S. Bank Private Wealth Management [6]

Before hiring anyone, verify their fiduciary status and check their disciplinary records through organizations like FINRA, the SEC, or your state’s regulatory boards. Look for professionals experienced in sudden wealth situations - they can help shield you from external pressures, such as friends or family seeking financial help. It's also worth noting that in 2025, the federal estate tax exemption is $13.99 million per individual (or $27.98 million for married couples), with any amount above that taxed at 40% [12].

Create a Sustainable Financial Plan

With your team in place, it's time to build a financial plan that addresses both the emotional and financial challenges of sudden wealth. Start by organizing your goals into three categories: immediate, near-term, and long-term.

- Immediate goals: Calculate your net worth after taxes, pay off high-interest debt, and establish an emergency fund.

- Near-term goals: Develop an investment strategy and tackle any remaining debt.

- Long-term goals: Focus on larger objectives like buying property, making charitable contributions, or updating your estate plan.

When building your investment strategy, consider diversifying your portfolio using the 10, 5, 3 Rule - aim for 10% long-term returns on equities, 5% on bonds, and 3% on cash over a 20-year period [13]. Additionally, increase your personal liability coverage with an umbrella insurance policy to protect your assets.

Write down your financial values and goals to help you stay grounded when faced with high-pressure sales pitches or impulsive requests. Even those with high earnings - like NFL players, who earned a minimum of $705,000 in 2022 - can face financial trouble. In fact, 78% of retired NFL players encounter serious financial challenges within two years of leaving the league [7]. A well-thought-out plan can help you make the most of your windfall while steering clear of common pitfalls.

Building Long-Term Stability After a Windfall

Once your financial plan is in place, it’s time to shift gears - from growing your wealth to preserving it. This is how you create lasting stability.

Define Your Personal and Financial Goals

Start by defining what success means to you. Is it retiring comfortably, launching a new business, or funding a loved one’s education? Break your goals into short-, medium-, and long-term categories. For example, you might prioritize building an emergency fund, purchasing a home, or planning for retirement. Write these goals down and revisit them regularly to stay on track. Assigning a purpose to each goal can help you stay focused and intentional [14].

Interestingly, about 20% of Baby Boomers have already received at least one inheritance, and those who document their goals tend to make better decisions with their windfalls [9].

"It's important to take the time to figure out how this money fits with your long-term financial goals." - Terri Lyders, Vice President of Advanced Planning, Fidelity Investments [16]

With your goals clearly outlined, the next step is protecting what you’ve gained.

Protect Your Assets

When you come into significant wealth, you might attract unwanted attention, including frivolous lawsuits. That’s why legal protection is critical [3]. Consider purchasing an umbrella liability insurance policy. This type of coverage extends beyond your standard homeowner or auto insurance, offering an extra layer of security [3].

Tax planning is another area you can’t afford to overlook. For instance, you might use part of your windfall to convert a traditional IRA into a Roth IRA. This move ensures that future withdrawals are tax-free [4]. If retirement is on the horizon, delaying Social Security benefits from age 67 to 70 can increase your monthly payments by 24% for the rest of your life [4].

Once your assets are secure, you can start exploring ways to create new income streams.

Create New Income Streams and Opportunities

A windfall can open doors to new opportunities. Many successful entrepreneurs, such as SaaS and AI founders, use their financial gains to take on advisory roles, invest as angels, or launch fresh ventures. The key here is diversification - don’t rely on a single source of income.

To start, consider balancing your short-term investments while planning your next steps. Parking funds in high-yield savings accounts, short-term Certificates of Deposit (CDs), or money market funds can help you earn interest with little risk [16][15]. This approach gives you the breathing room to explore new opportunities without feeling rushed.

If philanthropy appeals to you, setting up a donor-advised fund can be a great option. This allows you to make charitable contributions, claim an immediate tax deduction, and distribute grants over time [16].

For those with substantial wealth, transitioning to capital preservation may also involve exploring illiquid, higher-risk investments designed to benefit future generations [16]. Whatever path you choose, make sure it aligns with your documented goals and personal values.

Conclusion: Making the Most of Your Financial Windfall

This section ties together the strategies we've explored, underscoring the importance of thoughtful planning over impulsive decisions.

Key Lessons for SaaS and AI Founders

Receiving a substantial payout requires careful, measured management. Start by pausing for 3–6 months before making any major financial moves[6][11]. This waiting period helps you process emotions, avoiding decisions that could be driven by excitement or guilt.

The next step is assembling a team of trusted professionals. Bring in a Certified Financial Planner (CFP) for overall financial guidance, a CPA to handle tax strategies, and an estate attorney to manage the legal complexities of sudden wealth[1][11]. These experts can shield you from the inevitable influx of requests from friends, family, or opportunists. Keep in mind, taxes - both federal and state - can take nearly half of your windfall, so understanding your true net liquidity is essential[6].

Lastly, set your sights on long-term objectives. Define what success looks like for you, whether that's launching a new venture, funding education, or securing generational wealth. Protect your assets through legal structures like trusts or LLCs, and explore new income opportunities, such as angel investing or advisory roles[10][11]. It's also wise to allocate 10–20% of your windfall for discretionary spending, leaving the majority to fuel sustainable growth[4].

By following these steps, you can create a disciplined, forward-thinking financial plan.

Final Thoughts on Managing Sudden Wealth

The strategies outlined here highlight the mindset needed to turn a financial windfall into enduring security. A sudden influx of wealth isn't just a financial event - it's a chance to build a stable and prosperous future. With patience and expert advice, you can turn this opportunity into a foundation for long-term success. Stay grounded, take your time, and ensure your financial choices align with your most important goals.

"Don't be in a hurry to do anything. Take time to run through the elation and the guilt. And don't make any big purchases or donations until you get hold of your own emotions." - Amit Poddar, Senior Vice President and Market Leader, U.S. Bank Private Wealth Management[6]

FAQs

How can I prepare myself emotionally for a sudden financial windfall?

Receiving a large financial windfall - whether from selling a business or closing a major deal - can bring a whirlwind of emotions. Excitement, anxiety, or even a sense of letdown once the initial rush subsides are all completely normal. Recognizing these feelings as part of the process can make navigating this life-changing moment a bit easier.

One of the best things you can do is pause before making any major decisions. Give yourself a few weeks to let the news settle. This isn’t the time for impulsive spending or sharing too many details about your newfound wealth. Instead, use this period to focus on assembling a team of professionals you trust. A financial planner, tax advisor, and therapist can provide valuable guidance, helping you craft a solid plan that addresses budgeting, taxes, and your long-term goals. Taking the time to adjust and leaning on expert advice can transform this overwhelming event into a stepping stone toward a secure and meaningful future.

What should I know about taxes when receiving a large sum of money?

Receiving a significant financial windfall in the United States often comes with notable tax responsibilities. If the money originates from income sources - such as selling a business, receiving a bonus, or exercising stock options - it’s usually taxed as ordinary income based on your federal marginal tax rate. On the other hand, if the windfall involves selling appreciated assets, you might face capital gains taxes, which could be short-term or long-term depending on how long you've held the asset.

A sudden increase in wealth could also push your net worth above the federal estate and gift tax exemption, which is set at $13.99 million in 2025. If that happens, your estate might be subject to taxes on future transfers. Keep in mind that state-level taxes vary widely, so understanding your specific obligations is essential.

To stay ahead of any tax surprises, it’s wise to consult a qualified tax professional. They can help you set aside the appropriate amount for taxes, create a solid financial plan, and manage your wealth in a way that supports long-term growth while minimizing tax burdens.

How can I manage money requests from family and friends after receiving a financial windfall?

Managing requests for money after experiencing a financial windfall can be tricky, but having a clear plan in place can make things a lot easier. One effective strategy is to create a written process for handling these requests. For example, you could use a checklist that outlines key details like the purpose of the money, the amount being asked for, and whether it aligns with your financial priorities or a pre-determined gifting budget. This method helps you approach decisions calmly and thoughtfully, cutting down on emotional stress.

Another important step is to establish firm limits, such as setting a maximum annual gift amount or defining specific criteria for offering financial help. If a request falls outside these boundaries, it’s okay to say no. A polite but firm response like, "I’m unable to assist this time", can help you maintain boundaries without damaging relationships. Additionally, offering non-monetary support - like guidance or introductions - can be a meaningful alternative. By taking a structured and thoughtful approach, you can safeguard your financial well-being while managing relationships responsibly.