When founders think about private equity (PE), they often get it wrong. Many assume PE firms only buy failing businesses, prioritize short-term profits, or ruin company culture. In reality, PE firms target stable, growing companies, focus on long-term growth, and actively improve operations. Misaligned expectations can lead to friction, especially when founders misunderstand PE’s goals, timelines, or hands-on involvement.

Key Takeaways:

- Misconceptions: PE is not just about financial engineering or quick cash-outs. It’s about improving efficiency and scaling growth.

- Reality: PE firms invest in companies with strong recurring revenue, focus on profitability, and often require founders to reinvest equity.

- Alignment Matters: Founders must align their vision with PE’s goals to avoid conflicts, especially regarding growth timelines and leadership roles.

- Preparation Tips: Build strong data systems, clarify post-investment roles, and demonstrate readiness to scale using SaaS and AI tools.

Understanding the gap between perception and reality is crucial for founders considering PE partnerships.

Pros and Cons for a Growth Company to Take PE Capital | Jason Mironov w/ Kison Patel

What Founders Think PE Does

Understanding the reality of private equity (PE) partnerships starts with debunking some common myths about their role in growing SaaS and AI companies.

Myth: PE Is Just a Cash-Out Opportunity

Many founders see PE as a quick way to cash out, believing investors are only interested in short-term wins. But that’s far from the truth. PE firms typically operate on a 3–5 year timeline, aiming for sustainable growth and long-term value creation rather than a fast payout [5] [7] [8]. Their approach involves strategic planning and flexibility in exit options, focusing on building businesses for the future - not just immediate financial gain. This misconception often spills over into misunderstandings about PE's operational role, which we’ll explore next.

Myth: PE Only Cares About Financial Engineering

Another common belief is that PE firms are solely focused on financial restructuring - loading companies with debt and tweaking short-term metrics. While financial performance is an important aspect, this stereotype misses a key point: PE firms prioritize operational improvements to achieve lasting growth. For instance, while targeting a 22% internal rate of return is common [9], these firms are more interested in unlocking a company’s underlying potential. They don’t just focus on distressed companies or niche tech sectors; instead, they invest across a wide range of industries, favoring established, profitable businesses with room for growth [6] [8].

Myth: PE Firms Ruin Company Culture

Founders often worry that PE involvement will disrupt the culture they’ve worked hard to build. Concerns about management changes and cost-cutting are particularly common [8] [4] [5]. It’s true that about half of CEOs in PE-backed companies are replaced, but this typically happens because their vision doesn’t align with the PE firm’s goals. In fact, 97% of PE investors and CEOs prioritize evaluating and upgrading the executive team within the first six months [5]. The goal isn’t to dismantle culture but to bring in the leadership and skills needed to achieve growth.

As John Connaughton, Co-managing Partner of Bain Capital, puts it:

"You often need new executives and capabilities to create discontinuous change and achieve the vision and strategy of new ownership" [5].

Ultimately, the tension often arises from differing views between founders and PE firms on what success looks like, not from an intent to undermine the company’s culture.

What PE Actually Does in SaaS and AI Deals

Private Equity (PE) firms take a hands-on approach when working with SaaS and AI companies, focusing on operational improvements and long-term growth.

How PE Firms Drive Operational Improvements

PE firms have shifted away from traditional financial tactics, emphasizing meaningful operational changes instead. They enhance critical areas like sales processes and performance analytics, often using AI-driven tools to gain a competitive edge [11]. By embedding AI into core operations, they aim to create sustained value rather than relying on quick fixes. Many firms now have dedicated AI Operating Partners or Centers of Excellence to guide their portfolio companies through these transformations [12][13]. The goal is to apply AI where it aligns with the business strategy, ensuring it supports growth rather than becoming the sole focus [12][15]. This methodical approach reflects a commitment to lasting operational success.

A Focus on Sustainable Growth Over Quick Profits

Rather than chasing fast exits, PE firms prioritize building businesses with steady, long-term growth potential. They target SaaS companies with scalable models, recurring revenue, and room for strategic improvements. This approach allows them to make foundational changes - like upgrading data infrastructure, refining processes, and enhancing IT systems - to fully capitalize on AI's potential [15]. By focusing on operational efficiency and technological advancements, they create a solid foundation for sustainable growth. PE firms understand that meaningful transformation takes time, but the payoff is a stronger, more competitive business.

Leveraging SaaS and AI Tools for Better Performance

Generative and agentic AI are top priorities for over half of PE experts, with expected productivity gains ranging from 35% to 85% [3]. These tools are used to refine key areas like competitor analysis, financial reviews, and business models [3]. Such advancements build on earlier operational improvements, reinforcing PE's dedication to long-term value creation. However, success with AI depends on having mature data, skilled talent, and robust infrastructure in place [13][15]. By carefully integrating AI tools, PE firms aim to enhance operational efficiency and support scalable growth after their investment [3][12][14]. This strategic use of technology ensures that their portfolio companies are well-positioned for future success.

sbb-itb-9cd970b

Myths vs Reality: Direct Comparisons

Private Equity Myths vs Reality: What Founders Need to Know

Understanding the gap between what founders expect and the realities of private equity (PE) is key to making smart decisions when engaging with PE firms.

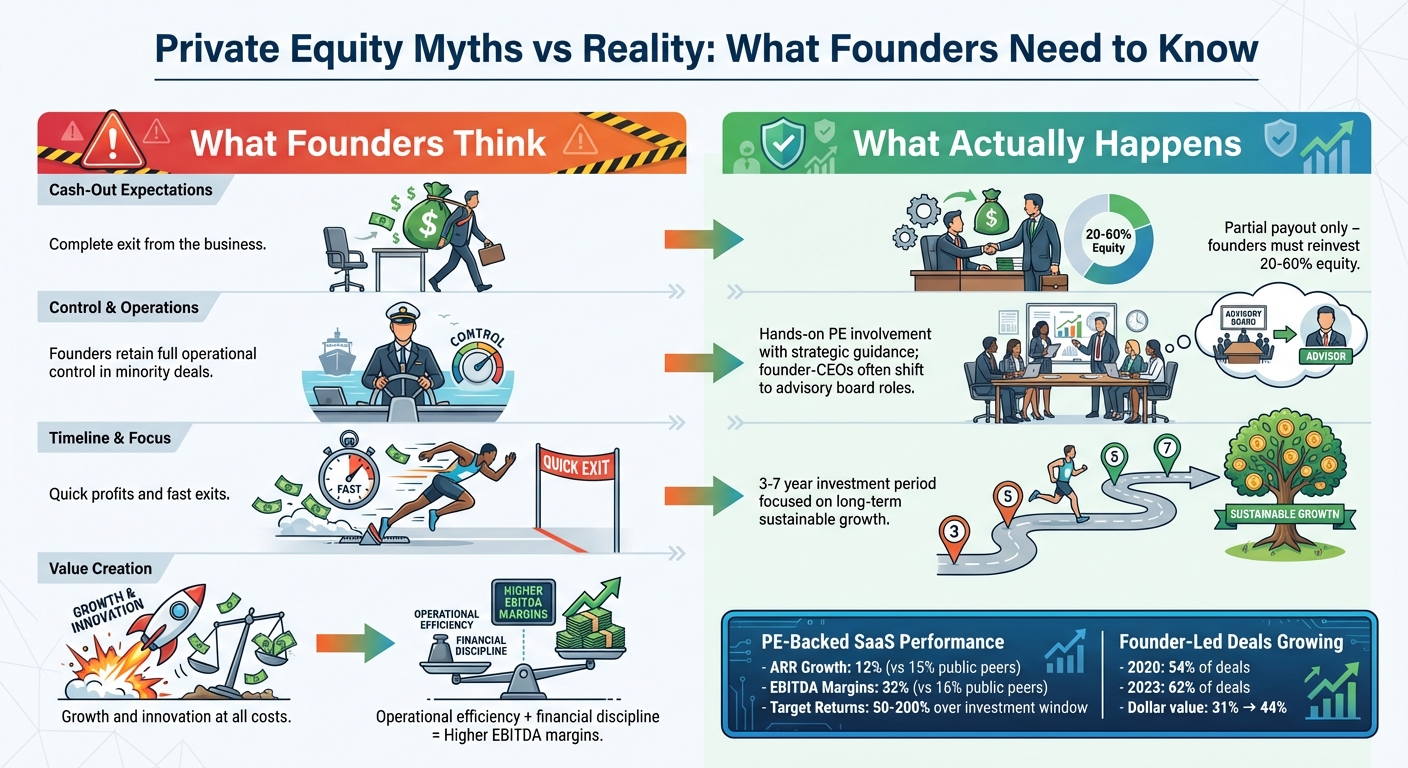

What Founders Think vs What Actually Happens

Founders often approach PE deals with assumptions that don’t align with how these transactions typically work. A common misconception is about the cash-out process. Many believe a PE deal means they can completely exit the business. In reality, PE buyers usually only offer a partial payout, requiring founders to reinvest 20-60% of their equity into the new entity [16]. This setup essentially makes founders significant private investors in their own companies, banking on future growth.

Control is another area where expectations often clash with reality. Founders pursuing minority deals may assume they’ll retain full operational control. However, these arrangements often come with unexpected strings attached [2]. PE firms are rarely passive partners. They play a hands-on role, often providing detailed strategic guidance and stepping in to make leadership changes if growth targets aren’t met within the typical 3-7 year investment period [17]. In many cases, founder-CEOs shift to advisory roles on the board, while PE-appointed executives take over daily operations [16]. The governance structure, discussed later, sheds light on how these dynamics are managed.

The focus on value creation also differs significantly. Founders may prioritize growth or innovation at all costs, while PE firms concentrate on operational efficiency and financial discipline. Their goal is to optimize revenue and cost structures, aiming for high EBITDA margins and returns of 50-200% within their investment window [1][17]. For example, PE-backed SaaS companies grow slightly slower than their public peers (12% vs. 15% ARR growth) but achieve double the EBITDA margins (32% vs. 16%) [1].

These mismatched expectations set the stage for how PE firms design deals to align incentives, which is explored in the next section.

How PE Firms Align Incentives with Founders

To address misconceptions about cash-outs and control, PE firms structure deals so their success is tied directly to the company’s growth. The typical 5-7 year investment horizon encourages a focus on long-term planning and sustainable value creation instead of short-term earnings [10]. This allows PE firms to invest heavily in growth initiatives like R&D, employee development, and other strategies that may reduce short-term profits but pave the way for substantial gains down the line.

Randy Dobbs, who served as CEO of US Investigations Services (USIS) under Welsh, Carson, Anderson & Stowe, shared his experience with this approach. After missing first-quarter targets, his managing director reassured him:

"Understand one thing: Quarter to quarter, this isn't a big public company... our objective is the return on the business in three to four years" [5].

This perspective gave Dobbs the freedom to make strategic investments in wages and hiring that initially hurt profits but ultimately positioned the company for long-term success.

PE firms also use forward-looking planning tools - like drafting hypothetical press releases or mock exit materials - to align everyone’s priorities around shared goals, such as client wins, product development, and market expansion [5].

Control and Transparency in PE Partnerships

Aligned incentives are reinforced by governance structures designed to ensure transparency and strategic input. PE firms vary in their level of involvement, ranging from hands-off to deeply engaged [5]. It’s important to note that active involvement doesn’t signal a lack of confidence. Bill Ford, CEO of General Atlantic, explains:

"A new CEO may misperceive active involvement as a vote of low confidence, but we see it as a positive opportunity to support the leader's growth plan by applying our organizational capabilities and leveraging our experiences in similar situations" [5].

Transparency is achieved through structured reporting and strategic oversight rather than micromanagement. PE firms typically avoid interfering in daily operations unless issues arise, at which point they offer strategic guidance [6]. Mark Friedman, founder of Accruent LLC, initially found Vista Equity Partners’ involvement "extremely hands-on", with deep engagement in areas like deal closures and sales commission structures. Over time, however, he came to see Vista's approach as a collection of proven best practices developed over 15 years. Reflecting on his experience, Friedman said he "learned more in his first two years with Vista than in his previous 19 years as a CEO" [5].

The trend of PE firms working with founder-led companies is growing. The proportion of such deals increased from 54% in 2020 to 62% in 2023, with the dollar value of founder-involved deals rising from 31% to 44% during the same period [18]. This shift highlights the increasing recognition by PE firms of the value founders bring and the importance of creating partnership structures that work for both sides.

How to Prepare Your SaaS or AI Company for PE

Understanding the role and expectations of private equity (PE) is just the beginning. To position your company for success, you need to ensure it aligns with the structured and disciplined approach PE firms demand.

Getting ready for a PE partnership goes beyond showcasing impressive financials. It’s about proving that your business is built to scale and can operate with the precision and discipline PE firms value.

Build Strong Metrics and Data Systems

PE firms assess SaaS and AI companies using both hard numbers and qualitative factors like market potential and team capabilities [20][21]. To meet their standards, your data systems must deliver accurate, real-time metrics. Key data points include annual recurring revenue (ARR), net revenue retention, customer acquisition costs, and churn rates.

Having structured and reliable data isn’t just a checkbox - it’s critical. This data provides the foundation for AI-driven insights that PE firms will scrutinize during due diligence [19]. Ensuring your metrics are both accurate and accessible demonstrates that your company is ready for the next level.

Clarify Your Role and Goals After Investment

Before approaching PE firms, define what you want from the partnership. PE firms differ in their strategies - some focus on rapid growth, while others emphasize cost-cutting or consolidation efforts. Their typical investment horizon ranges from 3 to 7 years [25].

To avoid misalignment, ensure your vision, growth goals, and company culture are compatible with the PE firm’s strategy. Just as important, clarify your role post-investment. Will you stay on to lead, or transition to an advisory role?

Start shaping your "equity story" at least 18 months in advance. This involves aligning your strategy with your long-term exit goals [26]. If a PE firm’s approach doesn’t align with your vision, don’t hesitate to walk away [25]. Defining these elements early sets the foundation for scaling operations and leveraging advanced SaaS and AI tools effectively.

Use SaaS and AI Tools to Scale and Report

SaaS and AI tools are game-changers when it comes to scaling and reporting. They provide the real-time operational and financial metrics needed for GAAP compliance and thorough due diligence [22]. AI-powered platforms, in particular, can turn complex business data into actionable insights. They allow you to query everything from documents to meetings and deals in a natural, intuitive way [23][24].

Many of these tools come with pre-built templates for common business scenarios, such as deal win/loss analysis, sales performance tracking, account health monitoring, and competitive intelligence. This kind of streamlined reporting not only saves time but also shows that your company has the infrastructure to scale efficiently.

For tailored solutions, resources like the Top SaaS & AI Tools Directory offer a curated selection of tools designed for lead generation, sales optimization, and analytics. Leveraging these technologies signals to PE firms that your business is ready to grow and adapt at scale.

Conclusion

Many founders step into private equity partnerships with expectations shaped by outdated beliefs. A common worry is that PE firms prioritize short-term profits over long-term success. However, the industry has shifted significantly in recent years.

Since 2020, PE firms have moved away from relying solely on financial leverage. Instead, they’ve embraced strategies focused on operational improvements and steady, sustainable growth. This shift has led to returns that are two to three percentage points higher, showcasing the effectiveness of this approach [27].

What’s clear is that successful partnerships now depend on blending a founder’s unique qualities - like creativity, independence, and emotional commitment - with the structured, goal-driven methods of today’s PE firms. This evolution challenges old perceptions and highlights how modern PE partnerships are increasingly geared toward sustainable, long-term success.

FAQs

How can founders ensure their goals align with a private equity firm's strategy?

When choosing a private equity (PE) partner, founders should take the time to thoroughly assess the firm's investment priorities, operational strategies, and long-term plans. The goal is to find a partner whose approach aligns with your company's objectives and values.

Equally important is establishing clear and honest communication from the outset. Share your vision and expectations openly, and ensure the terms you negotiate safeguard your company’s core mission. This creates a foundation for a collaborative partnership that supports growth without compromising your original goals.

What areas do private equity firms typically improve in SaaS and AI companies?

Private equity firms tend to zero in on specific strategies to fuel growth and streamline operations for SaaS and AI companies. A big focus is on automating workflows, which helps cut down on tedious manual tasks. They also rely heavily on advanced customer analytics to guide smarter decisions. Another game-changer? AI-driven personalization to sharpen sales performance and make customer interactions more impactful. On top of that, AI tools are often used to trim operational costs and boost profit margins, enabling companies to scale up efficiently while increasing their market value.

What happens to a founder's role after a private equity investment?

After a private equity (PE) investment, the role of a founder can shift significantly, depending on the deal's structure, their individual aspirations, and what the company requires moving forward. Some founders choose to stay hands-on, continuing as operational leaders or serving as advisors. Others may step into a board member role or gradually phase out their involvement altogether.

Founders often play a crucial part in ensuring a smooth transition, using their knowledge and experience to maintain stability during this period. Their level of engagement usually hinges on the PE firm's strategy for scaling the business and achieving long-term growth. Whether they remain actively involved or decide to step back, the process typically aims to balance the company's future success with the founder's original vision and personal goals.