Selling your company to private equity (PE) is a complex, high-stakes process that requires extensive preparation. Many founders regret not knowing these key points beforehand:

- Most Offers Drop During Due Diligence: Over 80% of unsolicited offers are significantly reduced without professional representation.

- You’re Likely Staying Involved: PE firms often require founders to roll over 20–30% of equity and remain for 5–7 years post-sale.

- Key Metrics Matter: PE firms focus on profitability, recurring revenue, and metrics like ARR, MRR, and churn rates.

- Preparation is Critical: Start at least 18 months ahead by cleaning financials, addressing operational gaps, and defining your post-sale role.

The process isn’t just about the sale - it’s about setting up a long-term partnership. Founders who plan early, align with the right buyer, and avoid common mistakes stand to maximize their payout and future opportunities.

The Private Equity Survival Guide: How to Win Before You Sell | An M&A Masterclass

How Private Equity Acquisitions Work

Private equity (PE) firms operate differently from venture capitalists (VCs). While VCs prioritize growth, PE firms are laser-focused on profitability, recurring revenue, and operational efficiency. Their goal? To acquire companies, improve margins and operations, and then resell them within three to seven years at a higher valuation. This process often includes what's called the "second bite of the apple", where founders are required to roll over 20% to 30% of their equity into the new entity[7][2].

Typically, PE firms purchase SaaS companies at revenue multiples ranging from 4x to 6x. After implementing professional management practices and streamlining operations, they aim to exit at multiples of 12x or more[7]. If the company meets its growth targets and aligns with the PE firm's strategy, that rolled-over equity can sometimes yield a payout larger than the initial sale.

What PE Firms Look For in a Company

PE firms evaluate potential acquisitions with a sharp eye on profitability. Metrics like Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) are crucial because subscription-based models provide the steady cash flow needed for debt-financed deals[7]. Top-performing SaaS companies typically boast gross margins above 85%, and PE firms expect a Lifetime Value to Customer Acquisition Cost (LTV:CAC) ratio of at least 3:1[7].

Customer retention is another critical factor. For B2B SaaS businesses, a monthly churn rate below 2% signals strong product-market fit and stable revenue streams[7]. However, PE firms are cautious about customer concentration risks - if more than 20% of revenue comes from a single customer, it raises red flags during negotiations[7]. Scalability is also essential; the ability to add customers without a proportional increase in costs is a key selling point.

The quality of the management team is equally important. Unlike VCs, who may tolerate unpredictable or unconventional founders, PE firms need leaders who can thrive in a structured, performance-driven environment. These leaders must consistently hit quarterly targets and manage effectively under board oversight[8][3]. As Daniel Debow, VP of Product at Shopify, explains:

"One of the most important things for founders to understand is that you are selling something to an executive, who has a problem. And as the startup CEO - you are that solution."[3]

With these priorities in mind, PE acquisitions follow a structured process that founders must navigate carefully.

The PE Acquisition Timeline

The journey to a PE acquisition unfolds over five key stages. It begins with sourcing, where founders build relationships with PE executives - often VPs or Directors who act as their "champions." Cold outreach rarely works here; warm introductions and long-term connections are far more effective[3][1].

Next comes initial diligence, where the PE firm conducts a high-level financial review and drafts an internal "deal memo." At this stage, founders must shift the conversation from "cost to build" to "strategic value", demonstrating how their software complements the buyer's portfolio beyond just development costs or team size[1]. Signing a Letter of Intent (LOI) signals the start of the most grueling phase: due diligence. Founders often spend 20–30 hours per week on legal, tax, and technical audits - all while continuing to run their business[1].

A real-world example illustrates the process. In July 2025, Core Sound CEO Mark Smith received unsolicited interest from 12 buyers. Initially, he ran an internal process that resulted in two Indications of Interest (IOIs). Later, he enlisted Software Equity Group to manage a structured, competitive process. By properly framing financials and fostering competition among buyers, the final deal exceeded the original IOIs by over 50%[4]. Reflecting on the experience, Smith said:

"You make 80 percent of your mistakes the first time you do something, and I didn't want to make a mistake on selling my company."[4]

It’s worth noting that PE firms often "retrade" - lower the offer price - after uncovering issues during due diligence, such as disorganized financial records, high churn rates, or misclassified Cost of Goods Sold (COGS). To avoid surprises and delays, having a well-prepared data room with clean financial, legal, and HR documentation can save time and protect your valuation[3][1].

Common Mistakes Founders Regret

Steering clear of these common pitfalls can make all the difference when selling to a private equity (PE) firm. Many founders who’ve gone through the process reflect on what they wish they had done differently. In fact, a striking 76% of business owners report feeling regret after selling their company [10]. Often, this regret stems from avoidable missteps during preparation and negotiation. These mistakes typically fall into three areas: financial mismanagement, unclear post-sale roles, and operational gaps.

Here’s a closer look at the most frequently regretted mistakes.

Not Having Clean Financials Ready

Even the best in-house accounting teams can miss critical issues that derail due diligence. Dan Lansen, Founder of Lansen Capital Partners, emphasizes this point:

"You may have a world-class in-house accounting team, but always hire an outside accounting firm to review the books before initiating discussions with PE firms." [5]

For example, if one client accounts for 70% of your revenue, most PE firms will walk away, regardless of an impressive EBITDA of $8 million [5]. Founders also regret trying to hide financial flaws or inflating numbers, only for these issues to surface during diligence, leading to reduced valuations. Tax planning is another area where mistakes can be costly. Overlooking strategies like Qualified Small Business Stock (QSBS) early on can significantly impact your post-tax payout [1].

Unclear Roles After the Sale

Selling your company often means rolling over 30% of equity, committing you to a multi-year role post-sale [2]. Yet, many founders fail to define what their role will look like after the deal closes. Greice Murphy, founder of Advanced Care Partners, avoided this pitfall when she sold her company in June 2021. She chose a PE partner with a strong track record of collaboration and clearly defined her responsibilities for "Day 1" before finalizing the sale. This clarity allowed her to expand the business beyond the U.S. Southeast while continuing to focus on patient care [6]. Without such discussions, founders risk facing burnout, losing their sense of purpose, or being replaced by new leadership before they’re ready to step away [2][11].

Overlooking Operational Weaknesses

Outdated IT systems and missing documentation are red flags that can slow down due diligence and reduce valuations [12][13]. Waiting until the sale process begins to address these issues often backfires. According to McKinsey research, potential IT integration challenges can deter buyers or lead to lower offers [13]. The solution? Conduct a readiness assessment at least 18 months before the sale to identify and fix operational weaknesses. Use this time to establish a solid performance track record [13]. Additionally, ensure your data room is organized well in advance [1], perform internal audits on intellectual property ownership and regulatory compliance, and streamline reporting systems to make the diligence process smoother [14].

sbb-itb-9cd970b

How to Prepare for a PE Acquisition

Preparation is the key to making a private equity (PE) acquisition a success. Founders who have gone through the process stress that starting early can make all the difference. Take Mark Friedman of Accruent LLC, for example. Back in 2013, after receiving investment from Vista Equity Partners and TA Associates, he put together a mock banker book to clarify the company’s future metrics, product plans, and expansion strategies. This preparation informed a strategic operating plan that, three years later, helped Accruent secure a $2 billion acquisition by Fortive Corp. in 2016[16].

CEOs often spend just as much time preparing for a sale as they do managing the actual sales process - sometimes up to five months[15]. These examples highlight why thorough preparation across financial, operational, and leadership areas is so critical.

Get Your Financial Records in Order

A strong financial foundation is your first step toward a successful PE acquisition. Start by setting up a data room that includes historical financial records, board reports, revenue forecasts, and a cap table[15][3]. PE firms expect structured financial reporting, such as monthly reports and quarterly board packages. For many companies, this might mean hiring a professional or fractional CFO to meet these expectations[17].

If your business falls into the lower-middle-market category (with $2 million to $15 million in EBITDA), you might not yet have the financial sophistication PE firms are looking for. Beyond basic financial statements, they’ll want to see a "full potential case" that outlines the investment’s growth opportunities compared to its current trajectory, or "momentum case"[18]. This often involves analyzing profitability by product and region to identify revenue streams that are driving positive cash flow and cutting those that aren’t. For instance, one tech company boosted its cash flow by 17% simply by phasing out unprofitable product lines[18].

Also, your revenue projections need to be both ambitious and grounded in reality. Use evidence from pilots or field trials to back up your claims[9].

Define Your Role Before Closing

In many PE deals, founders are expected to roll over equity into the new entity, meaning you’ll likely stay on to help run the business for several years. This is often referred to as getting a "second bite of the apple"[2][7]. Think of the early negotiations as an opportunity to define your role moving forward[2][3].

Draft a Memorandum of Understanding (MOU) that spells out how you’ll collaborate day-to-day, how often you’ll communicate, decision-making boundaries, and the exit strategy[8]. Before signing the Letter of Intent (LOI), make sure you know which decisions you’ll control and which will require board approval.

Choosing the right board chairperson is just as important. A strong chairperson can help balance your vision for the business with the PE firm’s data-driven goals[8]. For example, when Daniel Debow sold Rypple to Salesforce in 2011, he worked with designers to create mockups showing how Rypple would integrate into Salesforce’s platform. This not only set clear expectations for his role but also aligned his vision with Salesforce’s goals[3].

Once your role is clearly defined, you can shift your focus to improving operations with your PE partner.

Work with PE Firms to Scale

PE firms don’t just purchase companies - they aim to transform them. On average, PE-owned companies see productivity gains of 8% to 12% within the first two years of acquisition, compared to just 2% to 4% for public companies[18]. To make the most of this potential, you’ll need to identify operational gaps early by conducting regular full-potential due diligence to uncover hidden opportunities and costs.

Labor often accounts for 40% to 80% of a company’s expenses. By applying clean-sheeting practices - like eliminating low-value tasks, centralizing teams, and reallocating work to top performers - you could cut labor costs by as much as 60% in just six months[18].

Finally, show your PE partners that you’re ready to collaborate on improving operations. Highlight which products or customer segments are generating strong, sustainable revenue, and present a clear plan to address areas that aren’t performing as well[18].

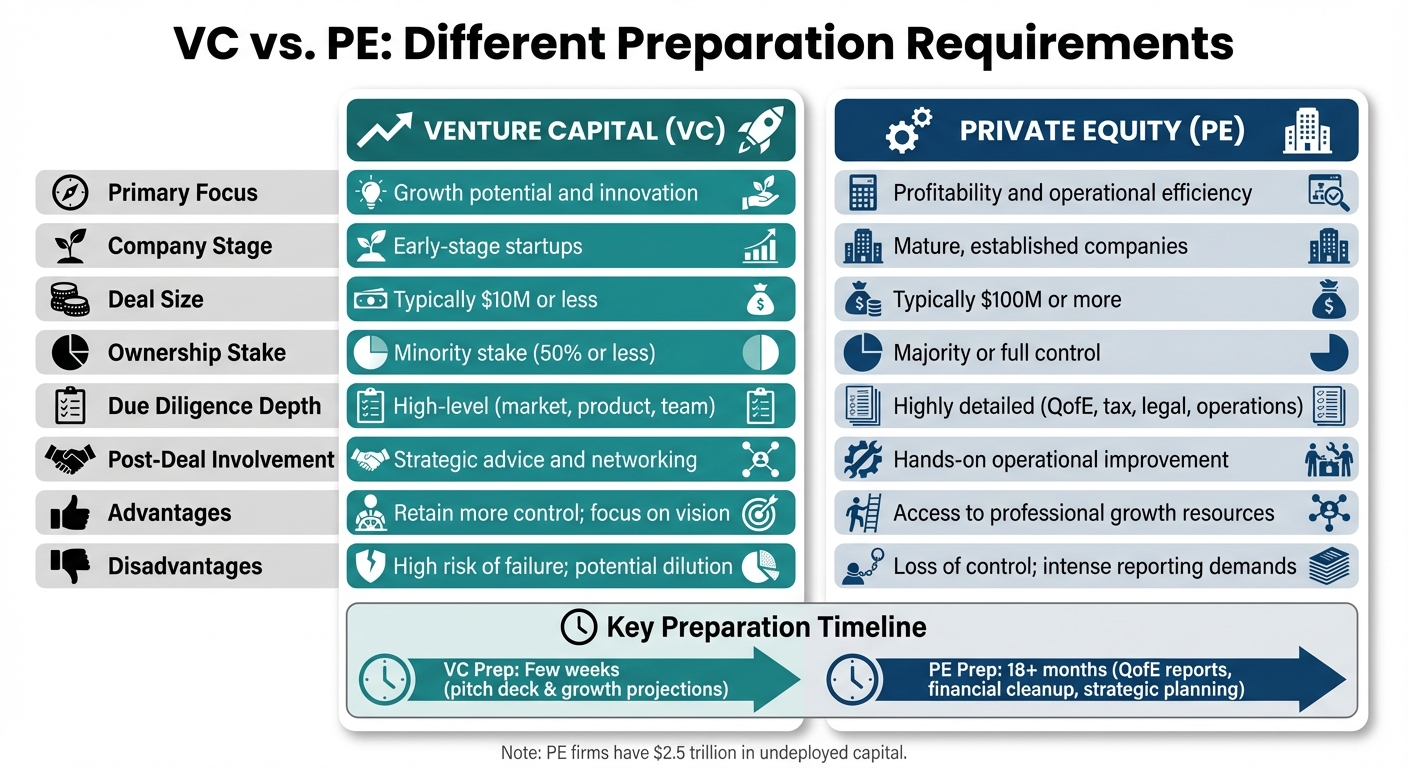

VC vs. PE: Different Preparation Requirements

Venture Capital vs Private Equity: Key Differences for Founders

When preparing for an investor, understanding their unique expectations is crucial. Venture capital (VC) and private equity (PE) firms evaluate opportunities through very different lenses, so tailoring your approach to each is key. What works for one may not resonate with the other.

VC firms focus on high-growth startups. Their strategy involves placing smaller bets - usually $10 million or less - across many companies, knowing that most won’t succeed. This approach allows them to be less involved in daily operations. Daniel Debow, VP of Product at Shopify, sums it up well:

"When you're dealing with corporate executives, they don't want to deal with wild cards. Remember that they don't have to pull the trigger. If a founder shows up and acts entitled, arrogant, or doesn't act like a team player - those execs will walk away."

VC investors value founders who are collaborative and approachable. A sense of entitlement or lack of teamwork can quickly turn them off.

PE firms, on the other hand, have a very different playbook. They target mature, profitable businesses and often acquire full control, with deals typically exceeding $100 million. Because of the significant capital involved and their hands-on role post-acquisition, PE firms conduct in-depth due diligence. This includes quality of earnings (QofE) reports, operational audits, and thorough financial reviews to ensure everything aligns with their standards.

The preparation timelines also vary significantly. Securing VC funding might mean spending a few weeks perfecting your pitch deck and growth projections. Preparing for a PE acquisition, however, requires much more groundwork. Founders should start at least 18 months ahead, commissioning a sell-side QofE to address financial inconsistencies, refining cost of goods sold (COGS) classifications, and building a detailed three-to-five-year strategic plan.

Here’s a breakdown of the key differences between VC and PE approaches:

VC vs. PE Comparison

| Criteria | Venture Capital (VC) | Private Equity (PE) |

|---|---|---|

| Primary Focus | Growth potential and innovation | Profitability and operational efficiency |

| Company Stage | Early-stage startups | Mature, established companies |

| Deal Size | Typically $10 million or less | Typically $100 million or more |

| Ownership Stake | Minority stake (50% or less) | Majority or full control |

| Due Diligence Depth | High-level (market, product, team) | Highly detailed (QofE, tax, legal, operations) |

| Post-Deal Involvement | Strategic advice and networking | Hands-on operational improvement |

| Advantages | Retain more control; focus on vision | Access to professional growth resources |

| Disadvantages | High risk of failure; potential dilution | Loss of control; intense reporting demands |

To succeed, you’ll need to align your preparation with the type of investor you’re targeting. For PE firms, think of the process as a job interview for a long-term partnership rather than a simple transaction. Show that you’re ready to collaborate and stay involved post-deal. Acting entitled or resistant to change can be a dealbreaker, regardless of how strong your financials may be. Tailor every aspect of your strategy to meet the expectations of your chosen investor, just as you would with your financial and operational performance.

Conclusion

Selling to a private equity (PE) firm isn’t just a transaction - it’s the start of a long-term partnership. To make it successful, preparation is key. Think of it as laying the groundwork for a journey that spans years. Focus on four critical areas: getting your financials audit-ready, clearly defining your role after the sale, addressing operational challenges like customer concentration, and choosing a partner whose values align with yours - not just the one offering the highest price.

Start planning at least 18 months before you aim to sell. This includes commissioning a Quality of Earnings report early, organizing a well-structured data room, and being upfront about any potential issues. Surround yourself with a deal team that has deep M&A expertise - they’ll be your guide through the complexities of the process.

In many PE deals, founders typically roll over about 30% of their equity and stay involved for another 5–7 years to reap the rewards of a "second bite of the apple." With PE firms sitting on over $2.5 trillion in undeployed capital [4], the opportunities are immense. However, the right partner is just as important as the right price. A mismatch in values or vision can jeopardize the benefits of that second exit.

To get started, tap into resources specifically designed for founders navigating this process. Platforms like agilegrowthlabs.com provide tailored support for SaaS and AI founders, helping them refine their exit strategy, scale recurring revenue, and boost company valuation. By following these steps, you’ll be well-positioned to make your PE sale a success.

FAQs

What are the biggest mistakes founders make when selling their company to private equity?

Founders often face hurdles when selling to private equity firms, but steering clear of common pitfalls can significantly impact the outcome.

One frequent mistake is concealing problems within the business. Private equity firms leave no stone unturned during due diligence, so any hidden issues will likely surface. This can lead to a reduced valuation or even derail the deal entirely. Another misstep is entering post-sale roles without clear agreements. Founders sometimes assume they’ll retain control or stay involved in specific ways, but without these details spelled out in the contract, misunderstandings can easily occur.

Thorough preparation is another critical factor. Disorganized financials, operational data, or legal documents can weaken your position during negotiations. Relying on a single buyer or becoming overly focused on achieving the highest price can also backfire. Engaging multiple buyers fosters competition and provides leverage. Lastly, poor communication with employees throughout the process can damage morale and disrupt operations.

To set yourself up for success, focus on transparency, organize your documentation, define expectations clearly, and keep your team in the loop. These steps can go a long way toward ensuring a smoother, more successful sale.

What should founders do to prepare their financials before selling to private equity firms?

Founders need to ensure their financials are accurate, transparent, and well-structured if they want to leave a strong impression on private equity (PE) firms. Start by tidying up the core financial statements - balance sheet, income statement, and cash flow statement - and ensure they align with GAAP standards. Whenever possible, have these statements audited or reviewed by an external CPA. Break down revenue clearly into recurring and non-recurring streams, verify that ARR (annual recurring revenue) is calculated correctly, and document your revenue recognition practices to showcase the stability of your income.

PE investors care about specific metrics, so be sure to highlight them. Share historical gross margins, EBITDA margins, and profitability trends to paint a clear picture of your financial performance. Include unit economics like CAC payback periods and LTV-to-CAC ratios, along with retention metrics (both gross and net dollar retention) segmented by cohort. These figures demonstrate the predictability of your cash flow. Additionally, a forward-looking financial model with base, upside, and downside scenarios can help build confidence in your company’s growth potential.

Lastly, gather all your documentation - financial statements, tax filings, customer churn data, subscription contracts, and other relevant materials - into a secure, well-organized data room. This level of preparation not only streamlines the due diligence process but also signals operational discipline, which can lead to better deal terms and potentially a higher valuation.

What happens to a founder's role after selling their company to a private equity firm?

When founders sell their business to a private equity (PE) firm, they often remain involved during a transition period, which typically lasts between 12 and 24 months. During this time, they might continue to oversee operations, lead their teams, and work toward hitting performance targets. Their compensation is frequently tied to these results through an earn-out agreement.

That said, this involvement is usually temporary. PE firms often prefer to install their own management team or operating partners, which means founders may eventually step aside - whether by choice or as part of the firm's overall plan. Even after stepping back from daily responsibilities, many founders hold onto equity in the business. This allows them to share in the company’s future growth without being involved in the day-to-day grind.