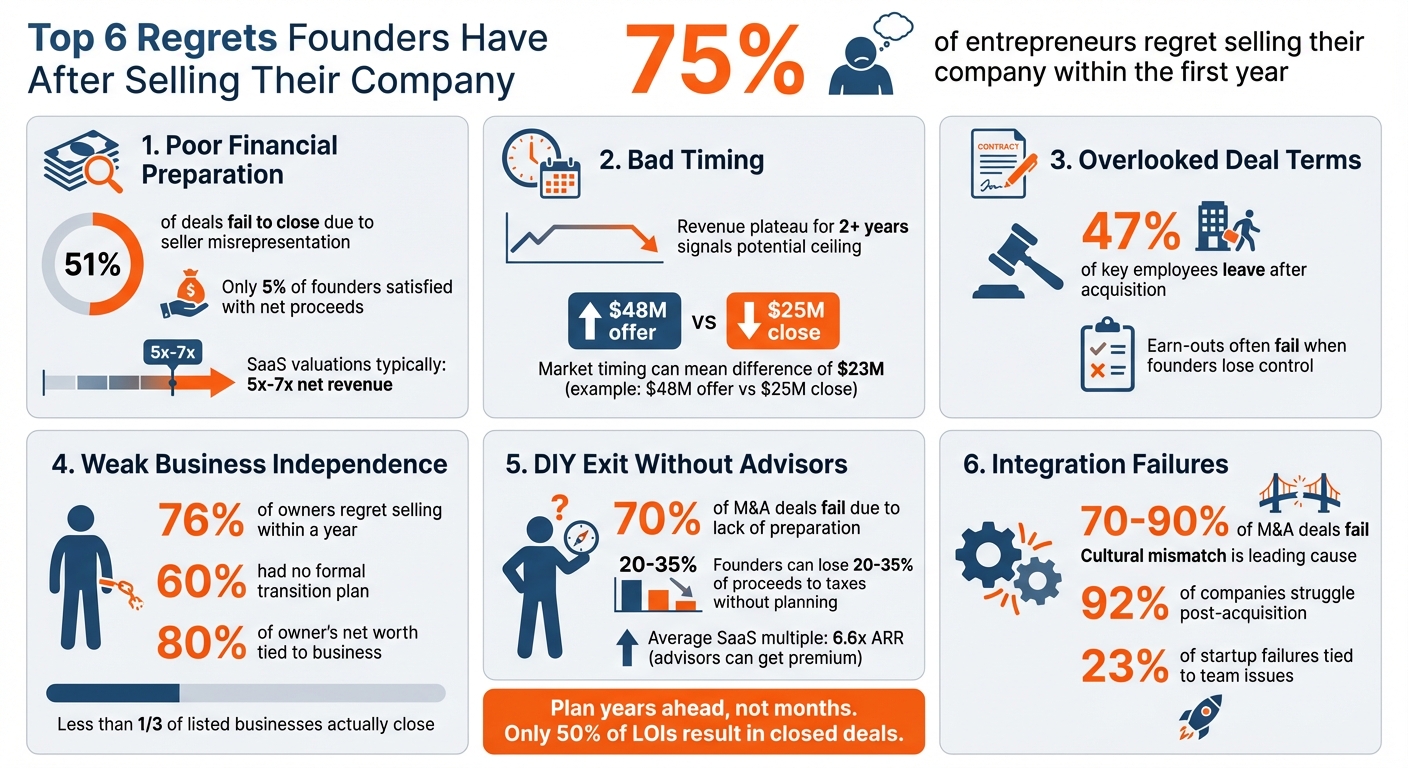

Selling your company might seem like the ultimate goal, but for 75% of entrepreneurs, it leads to regret. This regret often stems from emotional struggles, poor financial preparation, bad timing, and unfavorable deal terms - not the sale price itself. Common issues include:

- Emotional Loss: Founders often feel a loss of purpose and identity post-sale.

- Financial Mistakes: Many leave money on the table due to poor valuations or tax planning.

- Bad Timing: Selling too early or too late can cost millions.

- Overlooked Deal Terms: Earn-outs, team retention, and post-sale roles are frequently mishandled.

- Integration Failures: Buyers may dismantle the business or mismanage its culture.

To avoid these pitfalls, start planning years ahead. Build a self-sufficient business, hire advisors, and carefully vet buyers. Most importantly, define your life’s direction beyond your company to ensure personal fulfillment after the exit.

Top 6 Regrets Founders Have After Selling Their Company: Key Statistics

Why Founders Regret Their Exit (And How to Avoid It)

Regret 1: Poor Financial Preparation and Undervaluation

Many founders regret leaving substantial money on the table because they failed to prepare financially. Take the case of a manufacturing founder who received a $60 million LOI (Letter of Intent). After taxes, the net proceeds were far less than expected - nowhere near enough to fund his retirement. This forced him to delay the sale and restructure his business [5]. Stories like this highlight the importance of thorough financial preparation when planning an exit.

The issue isn’t just about accepting a low offer - it’s about underestimating the true value of your business. Harry Glaser, who sold Periscope Data for $130 million in 2019, explained how previous fundraising valuations often set a "hard floor" for acquisition offers. Buyers won’t go below that number because they don’t want to upset your venture capital investors [7]. However, if your financial records are disorganized, you lose the leverage needed to negotiate beyond that baseline.

Why Accurate Valuation Matters

Buyers expect audited financial records and strong financial controls [8]. If your business still operates on cash-based accounting rather than accrual-based profit and loss statements, you’re already at a disadvantage. Professional advisors can help uncover "add-backs" - one-time expenses that won’t carry over to the buyer. These adjustments can significantly increase your EBITDA and overall valuation [9].

For SaaS companies, valuations often range between 5x and 7x the previous year’s net revenue [10]. But without organized financials and a well-prepared data room, buyers may offer lower multiples - or walk away entirely. It’s worth noting that 51% of deals fail to close due to seller misrepresentation or unrealistic expectations [12]. In this context, clean financial records aren’t just helpful - they’re essential.

DIY vs. Professional Valuation: A Comparison

| Feature | DIY Valuation | Professional Valuation |

|---|---|---|

| Accuracy | Relies on "gut feelings" or outdated industry benchmarks, risking undervaluation. | Uses precise methods like SaaS ARR multiples, EBITDA adjustments, and market comparables. |

| Time Investment | Pulls founders away from focusing on revenue growth. | Requires minimal founder involvement; advisors handle financial modeling and data room setup. |

| Deal Value Impact | Often results in undervalued deals, with only 5% of founders satisfied with net proceeds [12]. | Maximizes value by identifying strategic buyers and creating competition [7]. |

| Risk of Deal Collapse | High; disorganized records breed distrust during due diligence. | Lower; vetted financials speed up the closing process [11]. |

"You will lose almost every negotiation after you sign [the LOI] because lawyers get involved, and theirs are more numerous and better paid." - Harry Glaser, Founder, Periscope Data [7]

To maximize the value of your exit, clear financial organization and expert valuation aren’t optional - they’re essential building blocks for success.

Regret 2: Selling at the Wrong Time

Deciding when to sell a company is one of the hardest calls a founder can make. Many look back and wish they had timed their exit differently. This regret typically falls into two camps: selling too soon and missing out on further growth, or holding on too long and watching the market window close.

Take Jyoti Bansal, for example. He sold his company just days before its planned IPO, a decision he later admitted left him feeling regretful. Speaking to CNBC, he shared:

I realized that I really enjoyed building the company... I also felt like we didn't fully finish what we could've done [1].

Determined to avoid the same mistake, Bansal went on to launch Harness, vowing to see the journey through.

On the flip side, waiting too long can also backfire. Sharon Gillenwater, founder of Boardroom Insiders, faced this dilemma in 2021. She received an unsolicited verbal offer of $48 million during a time when SaaS company valuations were soaring. Recognizing the opportunity, she brought in a banker and sold the company nine months later for $25 million in cash to Euromoney in early 2022. The timing turned out to be critical - just one month after the deal closed, tech stocks took a nosedive [15]. As M&A bankers often caution:

Time is not your friend [15].

Dharmesh Shah, co-founder of HubSpot, also learned a tough lesson about timing with his first startup. He held onto the business for three to four years longer than he should have, even after his passion had faded. Reflecting on his experience, Shah advised:

If your heart's not in it, be willing to make the sacrifice to let something go so you can free yourself up for whatever new things are ahead [4].

For Shah, the regret wasn’t about selling - it was about delaying his ability to move on to his next venture. These stories highlight a key takeaway: timing isn’t just about luck; it’s a decision that requires strategy.

How to Identify the Right Time to Sell

Timing an exit involves more than just financial readiness. It comes down to three critical factors: growth trajectory, market conditions, and personal energy.

Start by evaluating your growth trajectory. If your revenue has plateaued for two years or more, it might signal that your business has hit a natural ceiling under its current setup [13]. But a plateau doesn’t always mean it’s time to sell. Ask yourself: do you still have a strong vision for exploring new markets or launching new products? If the answer is yes, your business may still have untapped potential [1].

Market conditions are another major piece of the puzzle. After assessing your growth, take a hard look at the broader market. Are valuation multiples in your industry hitting historic highs? For SaaS companies, for instance, a strong pipeline paired with soaring multiples can signal an ideal moment to exit [15]. Sharon Gillenwater’s decision to sell came at a time when her company had a "mammoth pipeline" and confidence in hitting $5 million ARR [15]. On the other hand, if competitors are raising large amounts of venture capital or launching new, attention-grabbing products, your position in the market could weaken faster than you expect [16].

Finally, consider your personal energy. Garrett Gunderson, founder of Multiplier, put it best:

When your vision is compelling enough, you'll handle the inevitable challenges. But when problems outweigh your vision, that's when you start dreaming of an exit [2].

That said, feeling burned out doesn’t always mean it’s time to sell. Sometimes, it’s a signal to step back and bring in new leadership while the company continues to grow [14]. Before making your decision, ask yourself whether the business has genuinely reached its limits - or if you have.

Regret 3: Ignoring Deal Terms Beyond the Price

A flashy purchase price can grab your attention, but it’s easy to lose sight of the fine print that defines the real outcome of a sale. Many founders get so caught up in the headline number that they overlook the details - details that can determine their payout, future role, and even the fate of their team. And when those terms don’t align with their expectations, the regret can be overwhelming.

Kelly Bayett, founder of Barking Owl, knows this all too well. She sold her music and recording studio with a five-year payout plan, assuming it meant she’d stay involved. But within a year, the new owners removed her name from the website and shut her out completely.

"My husband and I were essentially debt to the new owners and had no real power or say in the company's future. I was gutted, but it was also my fault. I didn't ask for involvement or say - I had made an incorrect assumption" [18].

The numbers back up stories like Kelly’s. 75% of founders regret selling their business within the first year [6]. And it’s not just the founders who feel the impact - 47% of key employees leave shortly after a major transaction [6]. These outcomes often stem from overlooked deal terms: earn-outs that never materialize, roles that vanish, and teams that are let go despite verbal promises.

Eric Smith, Business Owner Advisory Strategist at Wells Fargo, summed it up:

"Some sellers are led to believe a buyer will keep their employees only to see them fired not long after the sale. Many owners later feel remorse when the employees were not rewarded or were unable to retain their jobs" [3].

The bottom line? The purchase price is just one piece of the puzzle. What truly matters is how much cash you receive upfront, whether you maintain any authority post-sale, and what happens to the people who helped you build your business. Without clear, written terms protecting these elements, you’re leaving your future - and theirs - up to chance.

How to Evaluate Complete Deal Structures

Given these cautionary tales, it’s critical to dig into every aspect of a deal before signing. Start by identifying your non-negotiables. Amy Balliett, founder of Killer Visual Strategies, spent six months defining hers before going to market in 2018. For her, team career opportunities and learning from more experienced founders were more important than the headline price. That clarity helped her avoid the regret so many founders experience. As she put it:

"If your only motivation for selling your company is money, then you'll likely end up among the 75 percent of unhappy entrepreneurs, post-sale" [6].

You’ll also want to weigh your upfront cash needs against the risks of tied performance. Earn-outs can boost the headline price, but they’re far from guaranteed. If you lose operational control or the new owners shift priorities, that second payout may never come. Founders tied to earn-outs often feel more like "debt" than valued partners [18].

Another critical step? Define your post-sale role - in writing. Don’t assume a financial stake ensures continued involvement. Negotiate your title, decision-making authority, and the length of your stay explicitly. Take Jyoti Bansal’s sale of AppDynamics to Cisco for $3.7 billion in 2017. The deal made about 300 employees millionaires, with dozens receiving $5 million or more [1]. Despite the financial success, Bansal later described it as his "saddest day", feeling the company’s mission was unfinished. Even though Cisco allowed AppDynamics some independence, he felt the work remained incomplete [1].

Deal Terms: Pros, Cons, and Risk Mitigation

Understanding the trade-offs of various deal terms can help you secure an agreement that aligns with your priorities. Here’s a breakdown of common deal terms, their advantages, potential pitfalls, and strategies to manage risks:

| Deal Term | Pros | Cons | Risk Mitigation |

|---|---|---|---|

| Earn-outs | Higher total purchase price; aligns interests | Payout isn’t guaranteed; loss of control | Define clear, achievable KPIs; include "acceleration" clauses for termination. |

| Upfront Cash | Immediate liquidity; avoids performance risk | Lower overall valuation/headline price | Work with tax advisors to manage the tax impact of a lump sum. |

| Post-Sale Role | Smooth transition; lets founder "finish mission" | Potential for friction; loss of autonomy | Explicitly outline reporting structure, authority, and exit timeline. |

| Team Retention | Protects company culture; rewards employees | May reduce purchase price; limits restructuring | Negotiate stay-bonuses or minimum employment periods for key team members. |

Each term carries weight beyond the dollar figure. The key is knowing what matters most to you and ensuring those priorities are locked into the agreement before the deal closes.

sbb-itb-9cd970b

Regret 4: Weak Business Independence and Poor Transition Planning

If your business can't thrive without you, it’s not just a warning sign for potential buyers - it’s a recipe for post-sale regret. Statistics reveal that 76% of business owners regret selling their company within a year of exiting, and 60% had no formal personal plan for the transition [19]. With 80% of an owner’s net worth tied to their business [19], failing to plan - both structurally and personally - can lead to deals that fall apart and leave you feeling lost.

Building Systems Before the Sale

A successful sale often depends on how well you’ve built systems that allow the business to run without you. Instead of hovering over every task, founders should focus on delegating entire roles. Garrett Gunderson emphasizes this point:

"Delegate roles, not tasks – give team members autonomy over objectives." [2]

One way to evaluate your business’s independence is to take an extended break, like a sabbatical, before you even think about selling. If you return to find your inbox overflowing, projects on hold, or clients demanding your personal attention, it’s a clear indication that the business is still too dependent on you [20].

David Hauser, the founder of Grasshopper, shared his own experience:

"I wish I had focused more time, thought and money into the company culture from day one. I have since discovered this to be the most important factor in the success of scaling any business." [17]

Creating a business that can thrive without you requires building a strong culture and robust systems that outlast your involvement. Start early by assembling a small M&A team - no more than three people - to maintain confidentiality and ensure your documentation is ready for potential buyers [11]. It’s worth noting that less than one-third of businesses listed for sale actually close deals [20].

Preparing your business for independence is only half the equation. You also need to plan for your life after the sale.

Planning for Life After the Exit

Just as a self-reliant business is essential for a smooth exit, having a vision for your post-sale life is equally critical. Financial success doesn’t automatically translate to personal satisfaction. Jyoti Bansal, for example, described the day he sold his company as his "saddest", leading to months of depression and a lack of direction [1]. It wasn’t until he embarked on a six-month bucket list - including adventures in the Himalayas and Machu Picchu - that he found clarity and purpose. This journey eventually inspired him to launch Harness, which reached a $3.7 billion valuation by 2022 [1].

Jerome Myers, founder of Exit to Excellence, offers valuable advice:

"Make sure you exit to something, instead of exiting from something." [22]

After selling his $20 million business, Myers experienced a profound identity crisis. He now encourages founders to set ambitious personal goals before finalizing a sale. For many entrepreneurs, simple pastimes like golfing or traveling aren’t enough to fill the void left by leaving a business behind.

Financial advisors, once considered secondary in 2013, have risen to become the most important advisors by 2023 [19][21]. Engaging one early can help you turn your newfound wealth into lasting financial freedom. To avoid being overwhelmed by the sudden freedom that comes with a sale, map out a detailed activity plan for the first month, six months, year, and three years post-exit [20][21]. Align these plans with your spouse or partner to prevent disagreements that could jeopardize the deal [20].

Without thorough planning, it can take up to 10 years for founders to fully adjust - emotionally and financially - to life after selling their business [21]. Address all three critical areas - personal, business, and financial planning - at the same time, not one after the other [19]. Your future self will be glad you did.

Regret 5: Pursuing a DIY Exit Without Advisors

Selling your company without the help of experienced M&A advisors is a bit like representing yourself in court - it’s not impossible, but it’s rarely a good idea. The numbers tell a sobering story: over 70% of M&A deals fail due to lack of preparation and expertise [23], and 75% of entrepreneurs regret selling their business [2]. The issue isn’t just closing a deal; it’s closing the right deal. The goal is to secure terms that protect your financial and strategic interests, and that’s where seasoned M&A advisors can make a world of difference.

As Harry Glaser pointed out earlier, signing a Letter of Intent (LOI) often shifts the negotiating power to the buyer. LOIs from acquirers close less than half the time [7], and founders attempting a DIY sale frequently find themselves stuck with unfavorable terms. Without an advisor acting as a buffer, it’s easy for emotions to interfere with negotiations that might otherwise work in your favor [23].

Jay Jung, founder of Embarc Advisors, sums it up perfectly:

"No matter how much you prepare, you're leaving something on the table. But the more you prepare, the more you keep." [23]

The financial stakes are enormous. Without proper planning, founders can lose 20% to 35% or more of their proceeds to taxes [23]. Many wait until the LOI stage to think about tax strategies, missing out on opportunities like the Qualified Small Business Stock (QSBS) exclusion, which could save them millions. Worse, DIY sellers often settle for average market multiples - such as the 6.6x ARR multiple for SaaS businesses [24] - while advisors can identify strategic buyers willing to pay a premium for your company’s unique strengths.

What M&A Advisors Actually Do

This is where professional advisors step in to change the game. They do far more than just find buyers - they create competition, which increases your company’s valuation. Daniel Debow, VP of Product at Shopify, explains the importance of this approach:

"Create the perception (through reality) that there is an alternate bidder - always. That creates the competitive tension that gets you to a fair price." [11]

Advisors excel at finding the right buyers, often sourcing strategic acquirers who see your company as essential to their own growth plans [23]. They also ensure that critical terms - like liability caps, non-compete clauses, and transition periods - are negotiated and locked in during the LOI stage, preserving your leverage [25]. Additionally, they handle the heavy lifting of due diligence, including conducting a sell-side Quality of Earnings (QofE) assessment to help you defend your adjusted EBITDA.

One of the most valuable things advisors do is free you up to focus on running your business. Selling a company is a time-consuming process, and founders who try to juggle both deal-making and daily operations often burn out. This can lead to declining business performance, which buyers may use as leverage to lower their offer [23]. Jay Jung explains why this is so critical:

"If you don't do a seller's Quality of Earnings, you don't know what your fully loaded, maximized, adjusted EBITDA is. That's the equivalent of selling your home without knowing the actual square footage." [23]

While hiring advisors does come with costs - whether through success fees or hourly rates - it’s often a fraction of what you’d lose in a DIY sale. Eric Smith, Business Owner Advisory Strategist at Wells Fargo, has seen the consequences firsthand:

"In some cases, owners realize during or after the deal that they may not have been competently advised and made decisions that cost them dearly." [3]

The bottom line? Skipping professional advice might save you money upfront, but it could cost you far more in the long run.

Regret 6: Post-Acquisition Problems and Integration Failures

Closing a deal is just the beginning; the real test lies in integrating with the buyer's culture. While issues like misvaluation and poor timing are common, integration failures often become the ultimate stumbling block. In fact, between 70%–90% of mergers and acquisitions (M&A) fail, with cultural mismatches being a leading cause. For many founders, selling to the wrong buyer can turn what seems like a financial success into a deeply personal regret.

Take the case of Kelly Bayett, the founder of Barking Owl, a sound studio she ran for 13 years. After selling her business with a five-year payout plan, she found herself cut out entirely within a year. Her name was removed from the website, and the company’s culture shifted from a close-knit, transparent environment to a rigid, corporate atmosphere.

Even when the numbers look good, the emotional toll can be heavy. Jyoti Bansal, who sold AppDynamics to Cisco for $3.7 billion in 2017, described the experience as unfulfilling, feeling that the company’s vision remained incomplete. Similarly, Harry Glaser, who sold Periscope Data for $130 million, warns that 92% of companies struggle post-acquisition, often because the buyer mismanages the business or sidelines the product entirely. [7]

The fallout isn’t just emotional. Eric Smith, a Business Owner Advisory Strategist at Wells Fargo, highlights a harsh reality:

"Some sellers are led to believe a buyer will keep their employees only to see them fired not long after the sale." [3]

To avoid watching your life's work be dismantled in favor of short-term metrics, it’s essential to negotiate protections upfront. This underscores the importance of choosing the right buyer - someone who values and preserves your vision.

How to Choose the Right Acquirer

The key to avoiding these pitfalls lies in thoroughly vetting potential buyers. It’s not just about getting the highest offer; it’s about finding a partner who will respect and protect what you’ve built. A bad match can quickly unravel years of hard work - 23% of startup failures are tied to team-related issues, and poor integration planning can harm client relationships, drive away employees, and even kill products. [27] [9]

Start by building direct relationships with decision-makers like the CEO, Chief Product Officer, or VP of a relevant business unit. These individuals will ultimately decide the future of your product post-acquisition. Ask pointed questions: How do you handle acquisitions? What happened with your last three deals? Can I speak with the founders of those companies?

Look for buyers with a track record of granting acquired companies substantial independence. For example, Cisco earned praise from Jyoti Bansal for allowing AppDynamics to operate autonomously. [1] On the other hand, steer clear of buyers known for rigid bureaucracy. The Sprint-Nextel merger is a cautionary tale - by 2008, it resulted in a $30 billion write-off due to cultural clashes and poor integration. [26]

It’s also crucial to assess the buyer’s mindset. Garrett Gunderson advises distinguishing between "value creators" and "value extractors." The latter often prioritize cost-cutting and short-term gains over long-term success. [2] Conduct in-depth demonstrations of your technology and processes to ensure the buyer truly understands what they’re acquiring. If they don’t grasp your business model, they’re likely to mismanage it. [7]

Finally, secure cultural and retention agreements before signing the Letter of Intent. Once you enter the exclusivity period, your negotiating leverage diminishes significantly. Document clear commitments regarding product direction, team autonomy, and employee retention timelines.

Strategic vs. Financial Buyers: A Comparison

Understanding the type of buyer you’re dealing with is critical for making the right decision.

| Factor | Strategic Acquirers [26] | Financial Buyers (PE/VC) [2] [9] |

|---|---|---|

| Primary Goal | Expand market share, integrate products, or leverage technical synergies. | Focus on cost-cutting, ROI, and optimizing KPIs. |

| Integration Risk | High risk of cultural clashes and restructuring. | Risk of losing the company’s "soul" due to excessive focus on short-term metrics. |

| Upside Potential | Access to larger markets and distribution channels. | Opportunity for a future payout during resale ("second bite of the apple"). |

| Team Impact | Possible redundancies or cultural shifts, though autonomy is possible with trust. | Key staff may leave due to a focus on short-term metrics. |

| Founder Role | Often integrated into a corporate structure with reduced decision-making power. | Founders may be sidelined or replaced if financial targets dominate. |

History offers plenty of lessons. Consider the AOL-Time Warner merger in 2000. AOL acquired Time Warner for $165 billion to create a $360 billion powerhouse, but cultural clashes and a lack of vision led to a $100 billion goodwill write-off by 2002. The market cap plummeted from $226 billion to just $20 billion. [26]

Another example is the Daimler Benz-Chrysler merger in 1998. What was supposed to be a merger of equals turned into a hostile takeover, with Daimler selling Chrysler for just $7 billion - a staggering loss from the original $37 billion purchase price. [26]

The takeaway? Cultural alignment often matters more than the purchase price. Startups backed by strategic corporate investors are three times more likely to achieve a successful exit, but only if the buyer’s operating style aligns with your company’s DNA. Choose your partner carefully, secure explicit agreements, and don’t rely on vague assurances that "things will work out" after the deal is done.

Conclusion: Key Lessons for Founders Preparing to Exit

The journey of founders navigating their exits highlights one undeniable truth: selling your company is a major decision, and it comes with its share of challenges. A striking 75% of founders regret their decision to sell [2]. Interestingly, this regret often isn’t tied to the sale price but instead stems from poor preparation, rushed decisions, mismatched buyers, and a lack of planning for life after the sale.

The biggest takeaway? Plan years ahead, not months [3]. Start cultivating relationships with key decision-makers - like CEOs and VPs at companies that might acquire your business. These individuals are often the ones driving deals, not the development teams [7]. Ensure your business can run smoothly without you by delegating key responsibilities, and make sure every critical agreement is documented before signing the Letter of Intent (LOI). Why? Because only about 50% of LOIs actually result in closed deals, and once exclusivity begins, your negotiating power diminishes significantly [7]. Laying this groundwork early can make the entire process more seamless.

Equally important is figuring out who you are beyond your company. Founders like Jyoti Bansal and Garrett Gunderson have shared how their exits left them feeling a deep loss of purpose, proving that financial success alone doesn’t equate to personal fulfillment [1][2]. Defining your identity outside of your business is crucial.

Another critical step is thoroughly vetting potential buyers. Research their history with acquisitions, and talk to other founders who’ve worked with them. Negotiate protections for your employees and commitments to workplace culture upfront - these are much harder to secure after the deal is done. The right buyer will add value, not just take over [2].

Lastly, put together a strong advisory team early on. Legal, tax, and business advisors can help you navigate the complexities of selling, especially if it’s your first time [3]. Keep the process confidential to protect your business in case the deal falls through. And, above all, continue running your company as if the sale won’t happen - because it might not. Your reputation depends on following through on commitments to your employees and investors [7].

FAQs

How can founders prepare emotionally for life after selling their company?

Selling your company is a huge milestone, but it can stir up emotions you might not expect. Many founders feel a sense of loss or even emptiness as they step away from the business that has been such a big part of their identity. To make this transition smoother, it’s helpful to start planning your post-sale life early. Think about what will keep you motivated and fulfilled - whether it’s mentoring others, taking on advisory roles, or diving into new ventures. Having a clear vision for your next chapter can make the adjustment less overwhelming.

It’s equally important to acknowledge and work through the emotions that come with this big change. Be honest with yourself about what to expect emotionally, and don’t hesitate to lean on a trusted peer group or even a therapist for support. You might also find it meaningful to create rituals or moments to mark this transition. Instead of seeing the sale as an ending, try to view it as the start of a new chapter - one where you can continue to make an impact in fresh and exciting ways.

What financial steps should I take before selling my business?

Before putting your business on the market, it’s crucial to get your financial records in order. Sloppy bookkeeping or undisclosed liabilities can lead to your company being undervalued. Make sure your income statements, balance sheets, and cash flow reports are fully reconciled or audited. Don’t forget to ensure all tax filings are up-to-date. Keeping well-organized records - such as contracts, expense receipts, payroll logs, and equity grants - can save you from last-minute headaches and inspire confidence in potential buyers.

You’ll also want to pay close attention to cash flow and tax planning. Run through different exit scenarios, factor in any outstanding debts or liabilities, and work with a tax advisor to structure the sale in a way that reduces your tax burden while maximizing your take-home proceeds. Thoughtful preparation not only strengthens your bargaining power but also helps you avoid post-sale regrets.

How can founders preserve their company’s culture after selling it?

To keep your company’s culture intact after an acquisition, make it a focal point during the negotiation process. Spell out your core values, traditions, and mission clearly in the agreement, and ensure the buyer agrees to uphold these aspects for a specific period. This might involve safeguarding elements like your team structure, product approach, or even the company’s name.

You might also consider staying involved during the transition phase. Founders or key team members can play a pivotal role in maintaining the company’s culture by managing hiring, onboarding, and internal communications for 12–18 months post-sale. This hands-on involvement can help reinforce the company’s original spirit before the new owner’s systems fully take over.

Be prepared for potential cultural friction, especially if the buyer is a larger organization. To minimize disruptions, ask for key practices - like team meetings or feedback systems - to remain in place. Tools like regular employee surveys or tracking retention metrics can help you gauge the cultural pulse and address concerns early. These strategies can give your company a solid chance to preserve its identity through the transition.