Private equity (PE) often gets misunderstood by founders, especially in SaaS and AI industries. Unlike venture capital (VC), which funds early-stage startups focused on growth at all costs, private equity targets mature, profitable businesses with stable cash flow. PE firms aim to improve these companies, not just cut costs, and their approach is built around driving efficiency and profitability. Here’s what founders frequently get wrong:

- PE isn’t just about cost-cutting: Modern private equity focuses on improving operations, boosting productivity by 8–12% within two years.

- Growth vs. profitability: PE values cash flow and profitability over rapid revenue growth. Metrics like EBITDA and customer retention matter more than top-line growth.

- Founders don’t always lose control: PE firms often work with founders, offering resources and expertise without taking over day-to-day operations.

- PE avoids early-stage startups: PE seeks established companies with proven revenue models, not pre-revenue startups.

- AI features don’t guarantee higher valuations: PE firms look for AI that delivers measurable results, not surface-level integrations.

To align with PE expectations, founders should prioritize profitability, streamline operations, and ensure AI tools deliver tangible outcomes. PE-backed companies often achieve higher EBITDA margins and long-term growth by focusing on efficiency rather than chasing unsustainable growth.

Growth Equity vs. PE vs. VC: What Founders Need to Know

Misconception 1: Private Equity Only Cares About Rapid Growth

Many founders mistakenly believe that private equity (PE) firms, unlike venture capitalists (VCs), don't chase aggressive growth. This assumption is off the mark. While VCs often accept losses in pursuit of market share, PE firms take a different approach: they focus on consistent cash flow. For PE investors, cash generation is the cornerstone of their investment strategy, and this emphasis shifts the conversation from rapid growth to profitability and strong margins.

Why Profit Margins Take Priority Over Revenue Growth

In software deals, the real value lies in EBITDA growth, not just in expanding revenue [1]. PE firms evaluate businesses based on the cash they generate after covering all costs, rather than prioritizing top-line growth. Enterprise software is particularly appealing to PE investors because of its dependable cash flow, driven by high customer retention [1]. However, revenue growth only enhances valuation if it directly contributes to net cash flow [2].

As Bain & Company explains:

"The challenge software investors face... is the often pressing need for management teams to transition from all-out growth to sustainable profitability at scale." [1]

The Risks for SaaS Founders Who Focus Solely on Growth

Prioritizing rapid revenue growth at the expense of operational fundamentals can harm SaaS founders in the long run. Companies that emphasize growth over profitability often fail to meet the basic criteria PE firms look for. These firms favor businesses with strong gross margins and steady cash flow. On the other hand, companies built on "growth at any cost" rarely qualify [1].

Even worse, chasing revenue without considering margins can lead to what PE firms call "bad revenue" - customers who increase revenue numbers but reduce cash flow and strain resources [2]. Neglecting operational efficiency can result in a valuation drop of at least 5% [4] and, in some cases, CEO turnover in 71% of large PE deals [2].

In contrast, PE-backed companies often achieve productivity gains of 8% to 12% within two years, far outpacing the 2% to 4% gains seen in public companies [2]. PE firms excel at driving operational improvements - but they need a solid foundation to start with.

Misconception 2: Private Equity Takes Over Your Company

One of the biggest concerns for founders considering private equity (PE) is the fear of losing control of their company. This hesitation stems from the outdated perception that PE firms prioritize taking over and extracting value. However, the modern approach to private equity tells a different story. Today, PE firms focus on building stronger businesses through "operational value creation" rather than solely relying on "financial engineering" [7][3].

How PE Firms Collaborate With Founders

PE firms typically operate under two distinct models when working with founders.

- Consultative Model: In this setup, the PE firm supports the existing management team by providing board oversight and guidance on specific challenges. This model is ideal for companies with strong leadership already in place.

- Directive Model: Here, the PE firm takes a more hands-on role in shaping the company’s strategic direction. This might involve developing or enhancing the management team to execute a well-defined investment plan. This approach is often used for businesses that require significant transformation [7].

Take the example of Camber Partners. In August 2023, they invested $20 million in Beamer, a no-code product engagement platform. Instead of overhauling the team, Camber supported Beamer with their internal Growth team, providing expertise in go-to-market strategies and data science. This partnership helped Beamer scale rapidly and acquire Userflow in February 2024 for over $60 million [6].

Another example is Polychrome’s 2020 joint venture with Flagsmith, an open-source feature flagging platform. Polychrome entered a 50-50 partnership, allowing founder Ben Rometsch to remain as CEO. Over 18 months, Polychrome’s operating partners worked closely with Flagsmith to implement growth frameworks, leading to a 20x revenue increase within two years [6].

These examples highlight how PE firms can collaborate with founders rather than taking over, offering resources and expertise while preserving the founder's role in the business.

Leveraging PE Resources Without Losing Direction

One of the biggest advantages of partnering with a PE firm is access to resources that many founders might not have. These include expertise in areas like procurement, data science, go-to-market strategies, and executive talent networks [7][6]. PE firms often secure board seats or establish Transformation Management Offices to drive performance improvements. But here’s the key: founders can use these resources to their advantage without giving up control.

PE firms frequently implement a structured 100-day planning process to lay out a five- to seven-year strategy. This plan typically includes exploring new markets, launching products, and aligning management incentives. Importantly, this process is about creating alignment - not taking over. Founders remain in charge of steering the company’s strategic direction and ensuring teams focus on the value drivers tied to the investment thesis [8].

It’s true that 71% of PE acquisitions valued above $1 billion result in a CEO change, with 38% of those changes happening within the first two years [2]. However, these leadership shifts usually occur when founders fail to align with the PE firm’s value-creation plan - not because PE firms automatically replace them. Founders who understand the priorities of PE firms and adapt their strategies accordingly are far more likely to maintain their leadership roles and thrive in the partnership.

Misconception 3: Private Equity Funds Early-Stage AI Startups

Private Equity vs Venture Capital: Key Differences for SaaS Founders

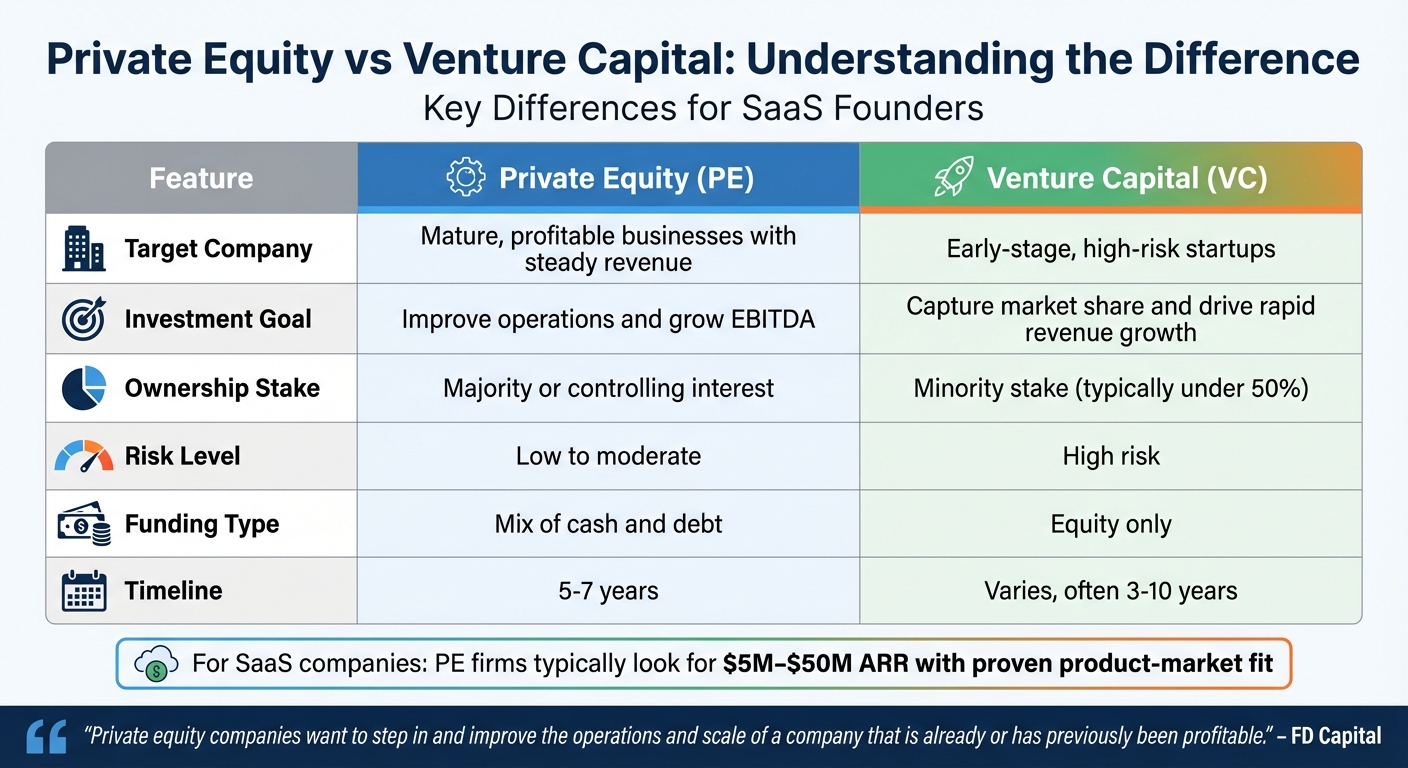

Many founders with early-stage AI ideas mistakenly expect private equity (PE) funding, similar to venture capital (VC). However, PE firms steer clear of unproven, pre-revenue startups. Instead, they focus on established businesses with steady revenue and proven models [9]. While both PE and VC provide funding to tech companies, their approaches, risk tolerance, and objectives are worlds apart. Let’s break down what PE firms look for and how they operate.

What PE Looks for in SaaS and AI Companies

PE firms are drawn to companies that have already hit significant milestones. They want to see recurring revenue, a strong product-market fit, and a clear path to profitability [6][1]. For SaaS companies, this often means annual recurring revenue between $5 million and $50 million. For AI companies, PE firms expect a solid tech foundation, often referred to as a "digital backbone." This includes structured data in ERP or CRM systems, cloud-first architecture, and API-ready infrastructure that supports scalable AI solutions [4].

The software PE firms invest in is typically mission-critical - think ERP systems, cybersecurity platforms, or specialized vertical SaaS products that businesses rely on even during economic downturns [6][1]. Financial health is another top priority. Companies with high gross margins and gross revenue retention rates above 80% are particularly attractive [6].

A great example of PE strategy is Ionic Partners’ acquisition of Sparkrock in June 2022. Sparkrock, a provider of ERP software for K-12 schools and nonprofits, was later integrated with Edsembli in March 2024 and School-Day in February 2025. This created a comprehensive educational software platform, showcasing PE’s focus on acquiring profitable companies and combining them into larger, more efficient platforms [6].

How PE Differs From VC Funding

The differences between PE and VC funding highlight why PE firms prefer established businesses over startups.

| Feature | Private Equity (PE) | Venture Capital (VC) |

|---|---|---|

| Target Company | Mature, profitable, steady revenue | Early-stage, high-risk startups |

| Investment Goal | Improve operations and grow EBITDA | Capture market share and drive rapid revenue growth |

| Ownership Stake | Majority or controlling interest | Minority stake (typically under 50%) |

| Risk Level | Low to moderate | High risk |

| Funding Type | Mix of cash and debt | Equity only |

PE firms make large investments in fewer, well-established companies. As FD Capital puts it:

"Private equity companies instead want to step in and improve the operations and scale of a company that is already or has previously been profitable." – FD Capital [9]

Debt plays a significant role in PE investments, which means they require companies with stable, predictable cash flow to manage that debt - something early-stage startups generally lack [9][1]. PE firms also operate on longer timelines, typically five to seven years, focusing on operational improvements rather than quick exits.

If you’re an early-stage founder with an AI idea, your best bet is to pursue VC funding first. Build a profitable business with strong revenue and retention metrics, and then consider private equity as a growth partner down the line.

sbb-itb-9cd970b

Misconception 4: Adding AI Features Increases Your Valuation

Contrary to popular belief, private equity (PE) firms aren't swayed by surface-level AI features. They expect depth and measurable results from AI initiatives. Simply adding something like a ChatGPT integration or basic automation won't boost your valuation. While 59% of PE funds now see AI as a key driver of value creation[10], they’re looking for meaningful, transformative applications - not just flashy add-ons.

What PE Firms Actually Value in AI Companies

What truly catches a PE firm's attention is AI that creates a competitive edge. Take, for example, a healthcare analytics company that used its proprietary patient database to drive a machine-learning engine. This unique, defensible asset helped the company secure a 12x revenue multiple[10], a valuation competitors couldn’t touch.

Another key factor is EBITDA improvement. AI-driven demand forecasting, for instance, has been shown to boost EBITDA multiples from 7x to 9x. Similarly, AI-powered routing software can cut fuel costs by 15% while increasing service levels by 65%[10]. These are the kinds of measurable results PE firms value.

Companies with mature digital infrastructure - such as cloud systems, APIs, and modern ERP/CRM platforms - also stand out. Businesses with these systems can achieve 30%–35% total returns when integrating AI, compared to just 15%–20% from traditional digital initiatives[4]. On the flip side, companies lagging in digital maturity risk valuation cuts of 5% or more, with 40% of investors reporting such haircuts[4].

Next, let’s explore why simply marketing AI capabilities often fails to meet these high expectations.

Why AI Marketing Claims Don't Impress PE Firms

PE firms don’t just take AI claims at face value - they dig deep to assess whether AI is truly embedded into a company’s operations. As Paren Knadjian, Partner at EisnerAmper, explains:

"Buyers scrutinize whether AI adoption is superficial (e.g., using publicly available products such as ChatGPT) or deeply embedded and seamlessly integrated into business operations." [10]

Increased productivity alone isn’t enough. Timothy Tracy, EY Americas Private Equity Leader, highlights the importance of tying AI initiatives to tangible outcomes:

"Productivity on its own is not value... Value is only created when leaders deliberately redeploy that freed-up capacity to a defined and measurable KPI." [11]

In other words, if your AI tools save your team time, PE firms want to see exactly how that time is being used to drive revenue or cut costs. Vague claims about efficiency won’t hold up without hard data to back them.

How to Align Your SaaS Business With PE Expectations

Bridging the gap between founder priorities and private equity (PE) expectations often requires fine-tuning financial practices and upgrading digital systems. By addressing common misconceptions, you can realign your strategy to better meet the standards PE firms value.

Changes SaaS Founders Should Make

Start by shifting your focus from chasing raw revenue growth to achieving a balance between growth and profitability. PE firms often use the Rule of 40 - the sum of your growth rate and EBITDA margin should hit at least 40% - as a benchmark for sustainable performance. Companies that meet this standard are more likely to secure higher valuations[12].

Another key move is eliminating unprofitable revenue streams. This might include phasing out customers or product lines that drain resources, even if it means a temporary dip in Annual Recurring Revenue (ARR). PE firms prioritize cash flow and operational efficiency over vanity metrics.

Your metrics also matter. Aim for a customer acquisition cost (CAC) payback period of under 12 months and maintain a Net Revenue Retention (NRR) rate above 110%. These numbers show that your go-to-market strategy is both efficient and scalable. Additionally, document how AI-driven tools contribute to revenue growth or cost savings by freeing up resources.

Lastly, upgrade your digital infrastructure before scaling AI initiatives. Modernizing systems like ERP/CRM platforms and APIs can improve AI implementation efficiency by 40% and yield returns between 30% and 35%[4]. Without these upgrades, your company could face a valuation penalty - potentially up to 5% - as noted by 40% of investors when assessing businesses with outdated digital systems[4].

What Founders Think vs. What PE Firms Want

Here’s a side-by-side comparison to highlight the disconnect between founder assumptions and PE priorities:

| Aspect | What Founders Think | What PE Firms Want | What You Should Do |

|---|---|---|---|

| Growth Focus | Prioritize ARR growth at all costs | Balance profitability with growth | Focus on achieving a CAC payback period of less than 12 months |

| AI Integration | Adding new features increases valuation | Build defensible data moats | Invest in proprietary datasets to strengthen your competitive edge |

Conclusion: What Founders Need to Know About Private Equity

Private equity offers a path to build stronger businesses more quickly without sacrificing control or chasing unsustainable growth. On average, companies backed by private equity see productivity improvements of 8–12% within two years, compared to the 2–4% gains typically achieved by public companies. This success stems from a focus on operational discipline rather than short-term tactics[2].

These outcomes highlight why a strategic shift is essential. Moving from the venture capital mindset of "growth at all costs" to private equity's focus on efficiency requires a rethinking of your business approach. This means prioritizing cash flow, eliminating unprofitable revenue streams, and proving that your AI solutions deliver clear, measurable value. For context, private equity-backed SaaS companies grow at an average of 12% ARR, slightly behind public companies at 15%, but they achieve much higher EBITDA margins - 32% compared to 16%[14].

The numbers speak for themselves: Between 2007 and 2023, private equity firms delivered an annualized return of 12%, outperforming public equities, which averaged 7%. This success is driven by valuing time, investing strategically in talent, and modernizing digital infrastructure early on[13]. To meet private equity expectations, founders should focus on operational excellence rather than relying solely on product innovation. Companies that embrace this approach not only enhance their valuations but also retain significant founder influence.

Interestingly, the share of private equity deals involving founder-led companies rose from 54% in 2020 to 62% in 2023[5]. This trend shows that founders who adapt to the operational demands of private equity can remain actively involved in their businesses. Ultimately, the key to success lies in transitioning from a high-growth, unsustainable model to one that is consistently profitable and well-positioned for long-term success.

FAQs

What’s the difference between private equity and venture capital when it comes to growth and profitability goals?

Private equity zeroes in on established, mature businesses, aiming to boost profitability and ensure steady cash flow by refining operations. On the other hand, venture capital sets its sights on early-stage startups, focusing on rapid revenue growth and expanding their market presence rather than immediate profits.

Private equity typically involves restructuring or scaling a business that's already proven its success. Venture capital, however, is all about driving innovation and helping new companies carve out a space in competitive markets. These two investment strategies cater to different phases of a company's journey, each offering distinct advantages based on the business's goals and stage of development.

Can founders still have control over their company after partnering with a private equity firm?

Founders can retain a degree of control after joining forces with a private equity (PE) firm, but it largely hinges on the terms agreed upon during the deal. To keep some influence, founders should negotiate for protective provisions like board representation, veto rights, or specific decision-making authority.

Without these measures in place, private equity ownership can often reduce a founder's control, as PE firms usually aim to play an active role in steering the company’s direction. It's crucial for founders to align their vision with the PE firm's strategy to create a partnership that works for both sides.

What do private equity firms look for when investing in AI and SaaS companies?

Private equity firms hone in on a few critical areas when deciding whether to invest in AI and SaaS companies. A major focus is on financial performance. They dig into metrics like Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR), as well as profit margins, customer churn rates, and revenue growth trends. These numbers offer a snapshot of the company’s financial health and stability.

Another key area is customer dynamics. Firms look at how diverse the customer base is, the terms of customer contracts, and whether revenue is overly dependent on a small group of clients. A well-balanced customer portfolio can signal reduced risk.

On the technical front, the company's technology stack is under close scrutiny. This includes its AI and machine learning capabilities, data assets, software architecture, and how well the technology can scale. The expertise and strength of the engineering team are equally important, as they’re the ones driving innovation and maintaining the product.

Lastly, firms assess the market potential. They analyze the size of the market, its growth trajectory, and the competitive landscape to ensure it aligns with their investment goals.

For founders, understanding these factors can help them position their companies to not only attract private equity investment but also build lasting value.