The first 10 days after an acquisition are critical. This period sets the tone for employee trust, customer retention, and overall success. Missteps - like poor communication or technical glitches - can create long-term issues. Here's what you need to focus on:

- Day 1: Announce the acquisition to employees and customers within 15 minutes of closing. Address job security and service continuity to prevent rumors.

- First 48 Hours: Verify payroll, email access, and vendor payments. Reach out to top customers to reassure them.

- Day 3-10: Host a town hall, review key systems, and finalize a shared tool inventory to ensure smooth operations.

The goal is stability, not immediate change. By focusing on clear communication, flawless execution of basic tasks, and maintaining trust, you can avoid pitfalls and lay a strong foundation for success.

How to Navigate the First 90 Days Post-Acquisition - The Intentional Owner #15

What Happens in the First 10 Days

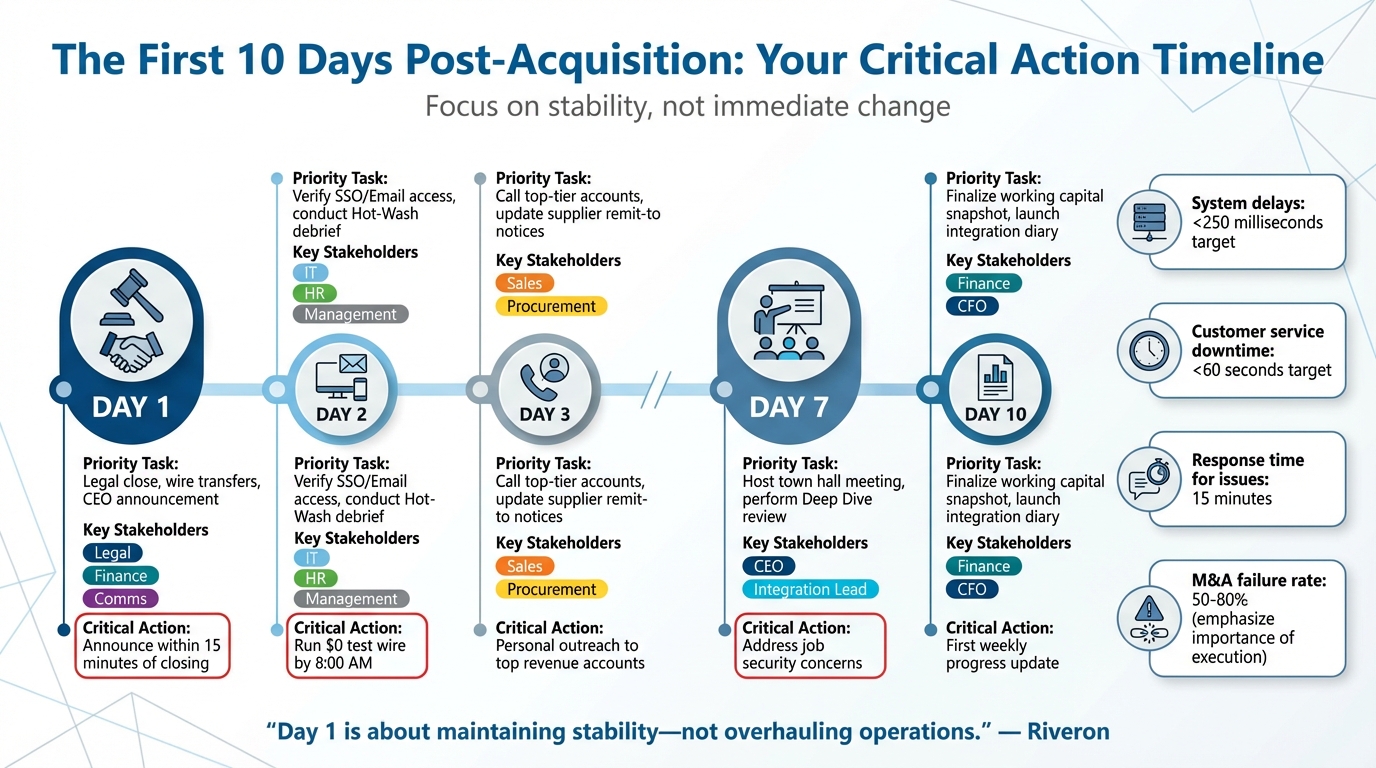

First 10 Days Post-Acquisition Timeline: Critical Tasks and Stakeholders

When the Acquisition Actually Starts

Many founders mistakenly think signing and closing are the same thing, but they’re not. Signing is the commitment to the deal, while closing - on Day 1 - is when the legal transfer officially happens. This is when everything becomes real: funds are wired, corporate registrations shift to the new owner, and banking signatories are activated [5].

By 8:00 a.m. on Day 1, it’s crucial to run a $0 test wire to confirm new banking authorities are operational. This step ensures there are no hiccups in payments, like delayed vendor invoices or payroll issues.

This precise kickoff is essential to managing both the technical and human elements of the transition.

Main Risks During the Transition

The biggest challenge during this period isn’t technical - it’s about trust. Employees, customers, and vendors all watch closely for early signals [1]. According to the Umbrex Post-Merger Integration Playbook, the impressions formed within the first 24 hours can impact employee retention and customer satisfaction for months [5].

"Silence is the breeding ground for rumor. If you don't control the narrative, someone else will." - Nate Nead, Founder and Principal, HOLD.co [1]

Even minor system failures - like badge readers not working, email access being disrupted, or payroll glitches - can erode confidence quickly. To avoid this, top-performing integrations aim for system delays under 250 milliseconds and customer service downtime of less than 60 seconds during the Day 1 transition [5].

Timeline Overview for Days 1-10

The first 10 days follow a carefully planned schedule focused on stability, not immediate change. Big moves like restructuring or cost-cutting should wait to avoid unsettling the team [2].

A clear, actionable timeline helps reduce risks and maintain operational flow.

| Day | Priority Task | Key Stakeholder |

|---|---|---|

| Day 1 | Legal close, wire transfers, CEO announcement | Legal, Finance, Comms |

| Day 2 | Verify SSO/Email access, conduct Hot-Wash debrief | IT, HR, Management |

| Day 3 | Call top-tier accounts, update supplier remit-to notices | Sales, Procurement |

| Day 7 | Host town hall meeting, perform Deep Dive review | CEO, Integration Lead |

| Day 10 | Finalize working capital snapshot, launch integration diary | Finance, CFO |

Each task is designed to maintain continuity while laying the groundwork for a smooth integration.

For example, a CEO announcement should go out within 15 minutes of the legal close [5]. Within the first 48 hours, account managers need to contact top-revenue customers to reassure them about service quality and introduce any new resources [1]. By Day 7, hold a town hall to address employee concerns, particularly about job security, and introduce the new leadership team. On Day 10, kick off your first "integration diary" - a weekly update that highlights progress and celebrates early wins to keep the momentum going [1].

What to Do Each Day: Days 1–10

Day 1: Making the Announcement

The moment the legal close is finalized, the countdown begins. Controlling the narrative right away is critical to prevent misinformation or rumors from spreading.

Start by crafting clear, targeted messages for two key audiences: employees and customers. For employees, address concerns about job security and introduce the new leadership team to establish trust. For customers, emphasize continuity - reassure them that their contracts and services remain unchanged. Use tools like Slack or Microsoft Teams to host live Q&A sessions, allowing for real-time engagement.

Industry expert Riveron underscores the importance of maintaining stability on Day 1:

"Day 1 is about maintaining stability - not overhauling operations."

- Riveron [6]

Set up a command center - either physical or virtual - to handle any immediate issues. Aim for a rapid response time of 15 minutes to tackle problems such as technical outages, which can quickly erode trust.

Once internal stability is in place, shift your focus to calming any concerns among key customers in the days that follow.

Day 3: Keeping Customers and Revenue Stable

Within 48 to 72 hours of the announcement, prioritize outreach to your top revenue-generating accounts [1]. Use your CRM to identify and rank these accounts based on ARR and potential risk.

Assign account managers or founders to personally call these customers. Start the conversation with a brief overview of any new benefits or resources they can expect, and assure them that their current contracts remain unaffected.

By the end of the first week, send a follow-up email or survey to gauge customer sentiment. This allows you to address any concerns early. Additionally, equip your sales and support teams with standardized messaging to ensure consistent communication throughout the transition.

Day 4: Transferring Technical Assets

Once communications and customer relationships are stable, shift your attention to the technical side of the transition.

Transferring technical assets requires precision and strong security protocols. Begin by creating a detailed inventory of all assets to be transferred, such as domain registrations, code repositories, cloud infrastructure, and SaaS accounts.

For domains, use the registrar's official transfer process - never take shortcuts like sharing login credentials via email. When transferring code repositories, grant the acquiring company’s administrators proper access while removing outdated permissions.

Monitor critical systems to ensure performance remains steady, with latency staying below 250 milliseconds during the transition [5]. Strengthen cybersecurity immediately, as phishing attacks often spike during mergers. Increase packet inspection thresholds and educate employees about potential risks [8].

Prepare emergency "back-out scripts" for essential systems like your ERP or CRM in case issues arise during the migration. Finally, confirm that all employees have the necessary access - whether it’s badges, email, or SSO - before wrapping up Day 4.

sbb-itb-9cd970b

Using SaaS and AI Tools During the Transition

After stabilizing operations, choosing the right SaaS and AI tools becomes crucial for a smooth integration process. The importance of this step can’t be overstated. In fact, 83% of M&A practitioners who experienced a failed deal cited integration issues as the main reason [10]. Modern SaaS and AI platforms can help minimize these risks and streamline the transition.

Which Tool Categories Matter Most

There are five key categories to focus on. Communication platforms like Slack or Microsoft Teams are essential for real-time collaboration and creating a connected digital workspace [7]. Project management tools such as Jira, Asana, or Nifty help track task dependencies and manage RAID logs (Risks, Actions, Issues, Decisions). For maintaining customer service levels, customer support systems like Zendesk or Intercom are invaluable, while AI-powered tools like Chatbase can handle FAQ automation and improve response times.

SaaS management platforms often fly under the radar but are incredibly important. On average, enterprises manage around 660 SaaS applications, and most companies underestimate this by nearly threefold [9]. Tools like Zylo can uncover hidden software use, often referred to as "shadow IT", and consolidate overlapping contracts. Lastly, HR and onboarding platforms like PeopleForce or Workday help maintain payroll accuracy and provide clarity for employees navigating their roles during the transition.

AI tools are becoming increasingly impactful. By 2024, 22% of M&A practitioners reported using generative AI for integration planning [10]. These tools can automate tasks like drafting deal-aligned communications, analyzing cultural differences, and summarizing meeting notes to keep leadership on the same page [11]. Richard Hoehn, CIO/CTO of FreightWise, highlights the importance of a seamless tech transition:

"The most important aspect to keep in mind when integrating pre- or post-merger applications is to ensure that a new tech-stack cannot adversely affect your current applications, clients, and vendors in any way." [9]

These categories provide the foundation for building a unified tech environment after an acquisition.

Creating a Tool Inventory for the New Team

Within the first 48 hours, it’s critical to audit the tools used by both companies. Start by reviewing expense reports and consulting business unit leaders, who typically oversee 70% of SaaS spending [9]. Use this information to create a shared spreadsheet that documents each tool’s purpose, monthly cost, user count, and security considerations.

To simplify this high-pressure process, rely on a verified directory like Top SaaS & AI Tools Directory, which features curated and vetted solutions. Pay close attention to tools that overlap between the two organizations - these are prime candidates for consolidation and can demonstrate immediate cost-saving opportunities to stakeholders [1].

Establish a command center using cloud-based platforms that integrate chat, video conferencing, and shared dashboards. This central hub allows the team to monitor real-time KPIs, such as system uptime and customer ticket volume [5]. With everyone accessing the same data, the transition team can address issues quickly and ensure a coordinated effort.

Mistakes to Avoid and How to Fix Them

M&A deals fail to meet expectations between 50% and 80% of the time [12]. Many of these failures can be traced back to avoidable errors made during the critical first 10 days. Recognizing these missteps - and knowing how to address them - is often the key to a smooth integration rather than a costly setback.

While tools and systems play a role, understanding and avoiding common mistakes is equally important.

Common Mistakes in SaaS Acquisitions

One of the most frequent errors is delaying transition planning until after the deal closes. John McCullough, Partner at OpenView, emphasizes:

"Integration should begin before the deal closes. Way before" [12].

This reactive mindset often leads to operational hiccups, such as system access issues, customer confusion, and invoicing delays.

Another major pitfall is poor communication. When founders fail to quickly address concerns about job security, benefits, or reporting structures, uncertainty spreads across the organization. The impressions formed within the first 24 hours can have long-lasting effects, including reduced customer retention and lower Net Promoter Scores [5].

Rushing into drastic changes too soon can also backfire. Aggressive cost-cutting or operational overhauls in the first week can destabilize the business and harm employee morale. Research suggests that the initial focus should be on maintaining stability rather than pushing for immediate transformation [2]. Even minor technical glitches - like badge-reader failures, email access issues, or delayed paychecks - can erode trust and create a perception of disorganization [5].

Another critical oversight is not appointing a dedicated integration lead. Without someone clearly responsible for overseeing the transition, response times can lag when problems arise. The table below highlights common mistakes along with strategies to prevent them:

| Mistake Category | Specific Error | Prevention Strategy |

|---|---|---|

| Communication | Inconsistent messaging across teams | Develop a core narrative with three key talking points for all leaders [5] |

| Technical | Failures with SSO or email credentials | Validate IT/HR files together 24 hours before close [5] |

| Financial | Delays in payroll or vendor payments | Confirm banking signatories and treasury dashboards on Day 1 [5] [2] |

| Cultural | Early layoffs or changes to benefits | Assure employees their roles are secure during the initial phase [2] |

| Strategic | Lack of clear success metrics | Define KPIs for revenue, customer retention, and milestones [12] |

How to Prevent Problems with Tools

To avoid these common pitfalls, establish strong controls and clear procedures. A dedicated operations command center can help manage the transition effectively.

Set up a 72-hour command center with a rotating team to monitor system performance, customer support tickets, and social media sentiment in real time [5]. Within the first few hours, conduct a test wire to verify banking authorities. Prepare and distribute a Day 1 FAQ document that addresses common employee concerns about job security, benefits, and reporting lines [12].

Maintain a master risk register to track high-priority issues with a 15-minute response time [5]. Make this document accessible to the entire integration team and update it regularly. Within 48 hours, have account managers personally contact your top-revenue customers to reinforce service commitments and introduce any new resources [1].

During the first 10 days, focus on keeping operations steady - ensure payroll, invoicing, and customer support run smoothly - rather than introducing new products or rebranding efforts [1] [2]. Stability takes precedence over innovation. For instance, Dell and EMC achieved $1.7 billion in cost synergies in their first year by prioritizing disciplined value management over rushing changes [3].

Conclusion

The first 10 days after an acquisition are all about executing critical tasks with precision and focus. As the Umbrex Post-Merger Integration Playbook explains:

"Day-1 is not about grand gestures; it is about flawless execution of a few non-negotiable activities under a live spotlight" [5].

The priority during this period should be maintaining stability. This means ensuring payroll processes are seamless, customer support is responsive, and employees have uninterrupted access to essentials like email and building badges.

Clear and timely communication is just as important. Within 15 minutes of the legal close, align your CEO announcement with updates to the company intranet and social media platforms [5]. By Day 7, host a town hall meeting to introduce new leadership and address any immediate concerns [1]. The impressions formed in the first 24 hours can have a lasting impact on employee morale and customer satisfaction for months to come [5].

Operational continuity relies heavily on SaaS tools, which act as the backbone of your systems. Establish a centralized command center - whether physical or digital - to monitor key metrics like system uptime, customer ticket volumes, and payment processing in real time [5]. Early in the process, compile a complete inventory of SaaS tools from both organizations. This allows you to identify overlapping licenses and quickly capture cost savings [1].

Avoiding missteps in these early days is critical. Many M&A failures can be traced back to mistakes made during this period. By focusing on stability over immediate synergy, you set the stage for long-term success. Ensure banking authorities are verified, top customers are contacted, and system performance is maintained. These actions, discussed in detail earlier, form the backbone of a smooth transition.

Ultimately, the goal of any acquisition is to create value greater than the sum of its parts. As Alex Castelli, Managing Partner at CohnReznick, puts it:

"Ideally, an acquisition should be accretive to your company. The goal of any transaction is to make one plus one equal three" [4].

The first 10 days are pivotal. Execute them with care and precision to lay the groundwork for success in the months and years ahead.

FAQs

How can founders build employee trust during the first 10 days after an acquisition?

To establish trust during the critical first 10 days of an acquisition, focus on open communication, stability, and employee engagement. Start strong with an all-hands meeting on Day 1. Use this opportunity to introduce the new leadership team, explain the reasons behind the acquisition, and address any concerns about job security. Follow up with written FAQs and a detailed timeline to ensure clarity and prevent rumors from spreading.

Stability is key during this period. Keep existing workflows, tools, and processes unchanged to show respect for the team’s current way of working. Avoid rushing into major changes like rebranding or restructuring. This approach reassures employees that their expertise is valued and helps maintain confidence in the transition. Introducing small, positive adjustments can also reflect the new leadership’s commitment to improvement without causing disruption.

Finally, involve employees in the process. Develop an onboarding plan that includes regular check-ins, a buddy system to foster connections, and channels for feedback. By making employees feel heard and supported, you not only ease the integration process but also lay the foundation for trust and collaboration moving forward.

What impact can technical issues have on the success of an acquisition in the first 10 days?

Technical hiccups in the early stages of an acquisition can do more than just slow things down - they can erode trust and derail momentum. If key systems like infrastructure, data pipelines, or security measures falter, customers might experience outages or data issues. The result? Frustration, potential churn, and harm to the company’s reputation. On top of that, these setbacks can stall integration efforts, shifting focus from executing the strategic vision to scrambling to fix problems.

Even seemingly minor glitches during this period can snowball into bigger issues, like reduced customer satisfaction, lower retention rates, or even a hit to the company’s valuation. To steer clear of these pitfalls, it’s crucial to conduct thorough technical due diligence before the acquisition. Pair that with a well-prepared Day-1 execution plan, and you’re better positioned to tackle challenges head-on, ensuring a smoother transition and safeguarding the deal’s long-term value.

Why is it crucial to focus on stability instead of making immediate changes after an acquisition?

Maintaining stability in the initial days after an acquisition is crucial for keeping business operations on track and preserving trust among employees, customers, and stakeholders. Abrupt changes during this period can lead to uncertainty, disrupt workflows, and create confusion, all of which can negatively impact morale and productivity.

Focusing on continuity allows founders to protect the company's core strengths while rolling out changes in a measured and intentional manner. This careful approach encourages teamwork across departments and lays the groundwork for sustained success.