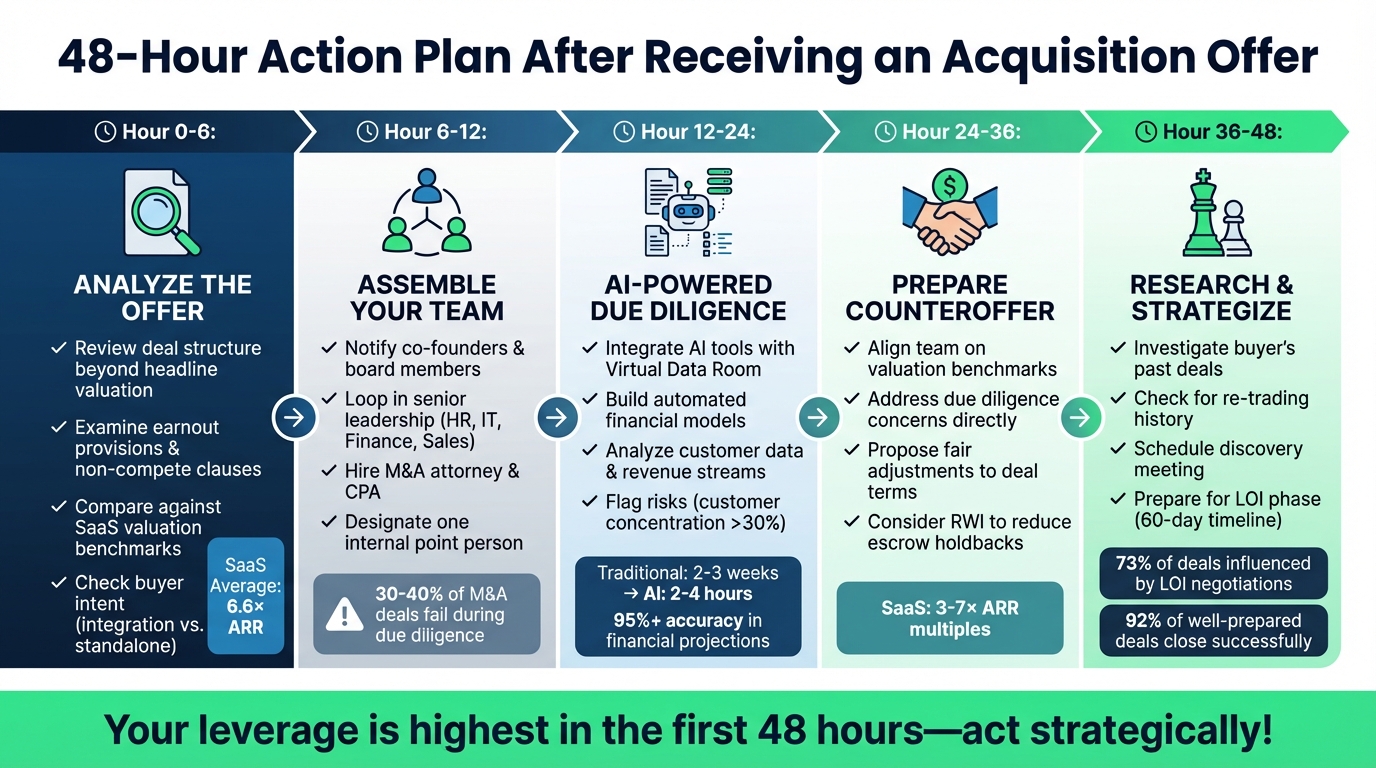

When you receive an offer for your company, the first 48 hours are critical. This is the window where your leverage is highest, and the decisions you make will shape the entire negotiation process. Here’s a quick breakdown of what to focus on:

- Hour 0-6: Analyze the offer thoroughly. Look beyond the headline valuation - review deal structure, earnout provisions, non-compete clauses, and buyer intent. Compare the offer against your business goals and SaaS valuation benchmarks.

- Hour 6-12: Assemble your team. Notify co-founders, board members, and senior leadership. Hire an experienced M&A attorney and CPA to guide you through due diligence.

- Hour 12-24: Use AI tools to speed up due diligence. Analyze financials, customer data, and contracts to identify risks and validate valuation metrics.

- Hour 24-36: Align with your team on valuation and prepare a counteroffer. Address concerns directly and propose fair adjustments to deal terms.

- Hour 36-48: Research the buyer’s history, deal patterns, and reputation. Plan your negotiation strategy and prepare for the Letter of Intent phase.

Acting quickly and strategically ensures you’re prepared to secure the best possible outcome while minimizing risks.

48-Hour Action Plan After Receiving a Business Acquisition Offer

How to Negotiate a Higher Acquisition Offer for Your Company

Hour 0-6: Review the Offer and Check Internal Alignment

When you get an offer, the first thing to do is dive into the details. Every part of the deal matters - it's not just about the headline valuation. Many founders make the mistake of focusing solely on the total number without digging into how and when the funds will actually land in their hands. This initial review is critical for ensuring the offer aligns with your business goals and strategy.

Breaking Down the Offer Components

Start by identifying the initial purchase price - this is the cash you'll receive at closing. Then, look closely at how the deal is structured. Is there a split between cash and equity? Pay special attention to earnout provisions, which tie additional payments to future performance, and any retention requirements that might come with the deal. In some Private Equity agreements, you'll be required to hold onto equity for potential future gains [6].

Next, review the non-compete clauses, employment terms, and intellectual property (IP) provisions. These will clarify what your role will look like after the deal closes and ensure you understand who retains ownership of your company's proprietary data, models, or other assets [5][6]. Lastly, consider the buyer's intent. Are they planning to integrate your business into their existing operations, or will it remain a standalone entity? This insight can help you gauge how your company will evolve post-acquisition [6].

Checking Alignment with Your Business Goals

Once you've broken down the offer, compare it to your long-term business vision. One key distinction to evaluate is whether the buyer is a Strategic acquirer or a Private Equity firm. This difference often dictates the deal's structure. Strategic buyers are typically willing to pay more upfront in cash, especially if they're acquiring your market share or technology. On the other hand, Private Equity firms often require you to retain equity and stay involved in the business. If your aim is to cash out entirely and step away, a Private Equity deal might not be the best fit [6][7].

Applying SaaS Valuation Metrics

To ensure the offer makes sense financially, benchmark it against industry valuation standards. For SaaS companies, industry-specific ARR multiples are a good starting point. For example:

- SaaS businesses generally sell for about 6.6× ARR

- ERP companies average around 8.0× ARR

- E-commerce businesses typically land at 7.7× ARR

- Cybersecurity firms hover near 7.1× ARR

- AdTech companies fall closer to 5.8× ARR [6]

Beyond ARR multiples, calculate your LTV/CAC ratio and make sure your churn rate stays below the 10% industry benchmark. These metrics can influence your valuation by up to 20% [6]. Additionally, examine your Hype Factor (Capital Raised divided by ARR). A score near 1.3 suggests financial stability, while anything above 4.0 could indicate overreliance on external funding [6]. These numbers can help you validate whether the offer is in line with market expectations.

Hour 6-12: Bring in Your Team and Advisors

At this stage, it’s time to assemble your team of experts to evaluate and negotiate the deal. Involving the right people early is critical - statistics show that 30-40% of M&A deals fall apart during due diligence, often because key issues are overlooked [2]. Once your internal team is ready, the next step is to bring in external specialists.

Notifying Key Stakeholders

Start by informing your co-founders and board members. Their approval of the Letter of Intent (LOI) is essential, and they’ll ensure the deal aligns with your company’s overall goals. Next, loop in your senior leadership team - the heads of HR, IT, Finance, and Sales. These leaders will provide critical data for the buyer’s due diligence and help identify potential integration challenges [9].

To streamline the process, designate one internal point person to handle all buyer requests and manage information flow. This approach keeps the acquisition process from consuming more than 10-20% of your management team’s time, allowing them to stay focused on running the business [2]. A great example of this strategy is the Dell-EMC acquisition, where early involvement from sales leadership helped generate significant revenue synergies [9].

Hiring External Advisors

Bringing in outside experts is just as important. For starters, engage M&A legal counsel to review your corporate structure, intellectual property (IP) ownership, and any "change-of-control" clauses [4]. For AI companies, this step is especially vital. Your legal team needs to confirm the origins of training datasets and verify rights to AI-generated outputs, as traditional IP laws may not fully protect works created solely by AI [5].

You’ll also need financial advisors who specialize in SaaS metrics like churn rates, customer acquisition cost (CAC), and lifetime value (LTV). Look for advisors with hands-on experience in running or exiting SaaS businesses - they bring a practical perspective that pure data analysts often lack [10].

Budgeting for external advisors is crucial. Comprehensive due diligence for deals ranging from $5 million to $50 million typically costs between $150,000 and $500,000+, which represents about 1-3% of the total purchase price [4].

"M&A due diligence is the make-or-break phase of any business acquisition." - Alex Lubyansky, Managing Partner, Acquisition Stars [4]

Hour 12-24: Start AI-Powered Due Diligence

During this phase, it's time to dive into AI-powered due diligence. By leveraging AI tools, you can analyze offers and company data at a pace that traditional methods simply can't match. While traditional due diligence might take 2–3 weeks for an initial review, AI tools can deliver a structured data package in just 2–4 hours [16]. This speed is essential when you're racing against a 48-hour deadline, laying the groundwork for accurate financial and operational evaluations.

Building Financial Models and Assessing Risk

Integrate AI tools with your Virtual Data Room (VDR) to automate the review of financial statements, cap tables, and vendor contracts. For example, platforms like V7 Go can process hundreds of documents, extracting data from income statements, balance sheets, and cash flow statements into standardized financial models [13][16]. This "automated financial statement spreading" not only speeds up the process but also eliminates manual errors like data transposition.

AI tools also excel at anomaly detection, flagging potential red flags such as customer concentration exceeding 30% of revenue, shrinking margins, or irregular accounting practices [13][14]. Every extracted figure is linked back to its original source, ensuring transparency and auditability [16].

"Ololand cut our initial screening time from 2 weeks to 3 hours. We can now review 5x more deals." - Sarah Chen, Managing Director, Venture Capital, Summit Partners [15]

Analyzing Customer and Revenue Data

AI can also help verify the buyer's assumptions about your revenue streams while predicting customer behavior, retention rates, and churn [11][12]. This provides a clearer picture of Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) stability, going beyond the summary metrics typically shared with buyers.

Break down ARR and MRR by customer cohorts and product lines to identify risks like revenue concentration or renewal challenges [12]. AI tools can deliver 95%+ accuracy in financial projections, uncovering revenue synergies such as cross-selling opportunities [11][12]. This data ensures that the buyer’s valuation aligns with the actual health of your customer base.

Finding Potential Problems

AI-powered due diligence also uncovers operational risks that might otherwise go unnoticed. For instance, AI agents can scan for SaaS-specific issues like contracts missing auto-renewal clauses, declining gross margins, or problematic termination provisions [13][16]. These tools can identify 95% of material risks buried in massive data rooms with 800+ pages [15].

AI can also analyze your cap table to confirm ownership percentages and flag any non-standard equity classes or liquidation preferences that might complicate the deal [16]. Pinpointing these issues early gives you the chance to address them before signing the Letter of Intent, putting you in a stronger negotiating position.

sbb-itb-9cd970b

Hour 24-36: Align Your Team and Prepare a Counteroffer

By now, you've collected the necessary data and pinpointed potential concerns. The next step? Get everyone on the same page about your company's actual worth and craft a counteroffer that reflects this value.

Agreeing on Valuation Benchmarks

Bring together your key advisors - M&A attorney, CPA, and industry consultants - to validate the metrics that will define your company's valuation. For example, SaaS companies often command 3–7x ARR multiples depending on growth rates or 2–4x revenue for high-growth businesses [8]. Using industry-specific valuation tools can help you compare the offer against current market standards and keep emotions out of the equation.

It’s also crucial to identify "deal-killers" early on. These might include customer concentration exceeding 40%, undisclosed liabilities over $100,000, or intellectual property that hasn’t been assigned properly [3]. Establish what constitutes a "Material Adverse Change" (MAC) so everyone understands what kind of performance decline could trigger renegotiation.

Once these benchmarks are locked in, you’ll be in a strong position to create a counteroffer that reflects your company’s true value.

Creating Your Counteroffer

Your counteroffer should highlight your company’s strengths - such as proprietary technology, customer lifetime value (LTV), and synergies - using key SaaS metrics like NRR, churn, CAC payback, and ARPU [2][8].

Address any due diligence concerns directly. For instance, if your contracts include change-of-control termination clauses, propose immediate resolutions. You might also suggest Representation and Warranty Insurance (RWI) to reduce or eliminate escrow holdbacks, which would allow you to receive more cash at closing [2]. To sweeten the deal, consider contingent price increases tied to milestones, such as raising the offer if a Quality of Earnings review confirms your adjusted EBITDA [8].

Earnout structures can also be tied to revenue milestones, like achieving a specific ARR within 12–24 months. Be sure to stipulate that you retain operational control during this period, as buyer-driven changes could hinder your ability to meet targets [2][17]. While buyers often push for exclusivity periods of 90–120 days, negotiate for a shorter window of 45–60 days to keep momentum and leverage on your side [2].

Comparing Cash, Stock, and Earnout Structures

Different deal structures align with different priorities, each carrying its own risks and rewards. Here’s a breakdown:

| Structure Type | Best For | Primary Advantage | Primary Risk |

|---|---|---|---|

| All-Cash | Stable, low-churn SaaS | Immediate liquidity; clean exit | Lower purchase multiple; buyer assumes all risk [17] |

| Earnout-Based | High-growth or uncertain future | Potential for higher total payout | Disputes over KPI calculations; loss of control [17] |

| Equity Swap | Strategic M&A or mergers | Upside from buyer's growth | No immediate liquidity; stock devaluation risk [17] |

| Seller Financing | Capital-constrained buyers | Higher pricing through interest income | Buyer default or business failure [17][18] |

Before finalizing your counteroffer, research the buyer's reputation by speaking with other founders they’ve acquired. Find out whether they honor earnouts and how they handle post-acquisition transitions [18]. Keep in mind that around 31% of M&A deals fall apart between the Letter of Intent and closing, often due to undisclosed debts or declining financial performance [3]. By following a structured approach, you can position yourself among the 92% of deals that successfully close [3].

This detailed preparation strengthens your negotiation stance and ensures you’re ready for the discussions ahead.

Hour 36-48: Research the Buyer and Plan Your Negotiation

At this stage, it's time to dive deeper into understanding the buyer. Building on the groundwork you've already laid - like setting your counteroffer strategy and aligning with your team - this phase focuses on researching the buyer's history and planning your Letter of Intent (LOI) approach. Why does this matter? Because LOI negotiations are a strong indicator of post-closing success, with 73% of deals being influenced by this stage [8].

Investigating the Acquirer's Past Deals

Start by examining the buyer's track record with previous acquisitions. This will give you insight into their typical deal structures, how they handle risks, and what their integration process looks like [2][19]. Key areas to focus on include:

- Deal structure preferences: Do they lean toward stock purchases or asset purchases? Are earnouts, rollover equity, or seller notes common tools they use to address valuation differences? [2][19]

- Risk allocation strategies: Investigate whether they use Representations and Warranties Insurance (RWI) or similar tools to manage risks [2][19].

- Integration approach: Do they maintain the acquired brand and teams, or do they consolidate and cut overlapping roles? [19][1]

Another critical area to evaluate is whether the buyer has a history of re-trading - a tactic where they lower the agreed-upon price during due diligence. Some buyers, for instance, may reduce the headline price by 10–20% after identifying relatively minor issues [2]. A notable example is a global manufacturing company that used advanced data scraping during diligence to uncover additional cost synergies, enabling them to make a stronger bid while staying competitive [1]. Understanding these patterns helps you anticipate potential challenges and fine-tune your negotiation strategy.

Setting Your Negotiation Priorities

Before moving forward with a written LOI, schedule a discovery meeting with the buyer. This meeting allows you to align verbally on key deal elements, reducing the risk of misunderstandings later [8]. Use this opportunity to create a detailed "issues list" that organizes your findings into three categories:

- Deal-breakers: Non-negotiable points that could lead you to walk away.

- Price adjustments: Issues that justify reducing the purchase price.

- Contractual protections: Concerns that can be addressed through warranties or indemnities [4].

For businesses in sectors like SaaS or AI, pay special attention to areas like source code escrow, intellectual property verification, and performance warranties [8]. Maintaining a collaborative tone during negotiations can help avoid triggering defensive reactions from the buyer [8]. Interestingly, studies show that once terms are put in writing, parties are 65% more likely to follow through with the transaction [8].

With clear priorities in place, you'll be ready to approach the LOI phase strategically.

Prepare for the LOI Phase

The LOI phase sets the stage for the rest of the deal. Aim for a 60-day timeline to move from LOI to closing [2]. If needed, consider using a tiered exclusivity arrangement - offering 30 days of free exclusivity followed by paid exclusivity. This approach can increase acceptance rates by 31% [8].

"The LOI creates a psychological commitment that makes both parties invested in closing. Studies show that once someone commits in writing, they're 65% more likely to follow through." - Acquisition Stars [8]

Ensure the LOI includes provisions to prevent the buyer from implementing significant organizational changes before the deal is finalized [20]. Also, be prepared for the financial aspect - middle-market transactions (valued between $5M and $50M) typically incur diligence costs ranging from $150,000 to over $500,000, which equates to 1–3% of the purchase price [4].

Conclusion: What SaaS and AI Founders Should Remember

The first 48 hours are critical in setting the tone for negotiations. Early, well-structured planning can help uncover the 83% of integration issues that often lead to failed acquisitions[21].

Summary of the 48-Hour Plan

The 48-hour framework is divided into key phases. Start by dissecting the offer, ensuring it aligns with your business goals using standard SaaS valuation metrics. Then, involve your team and trusted advisors to gather diverse perspectives on the opportunity. Use AI-powered tools to build financial models, evaluate customer data, and identify potential risks before they escalate. Finally, research the buyer’s track record and prepare a solid negotiation strategy before entering the Letter of Intent (LOI) phase.

Each step builds on the last. Early financial analysis informs your counteroffer, while buyer research shapes your approach during LOI discussions. As Bain & Company emphasizes:

"Every integration move should be dictated by and in service to the unique strategy and value potential that justified this deal"[21].

This highlights a crucial point: integration planning begins during these first 48 hours, not after the deal is signed.

How to Get the Best Deal Outcome

A structured timeline and active engagement are essential for deal success. Stay involved and understand the impact of every decision. AI-powered due diligence can enhance key SaaS metrics by up to 40% within 12 months[11], but your judgment remains crucial when it comes to assessing strategic fit, alignment, and long-term value.

Focus on decisions that truly matter. For instance, Dell’s choice to maintain separate sales teams unlocked significant cross-selling opportunities[21]. Identify these pivotal decisions early, address them thoroughly, and avoid getting bogged down by minor details.

FAQs

What should I focus on when evaluating a business acquisition offer?

When considering a business acquisition offer, it's crucial to dive into specific areas to make an informed choice. Start by examining the corporate structure to understand the foundation of the business. Review contracts to identify any obligations or risks tied to existing agreements. Scrutinize intellectual property rights to ensure ownership is clear and protected. Look into employment matters, such as staff contracts and workplace policies, and evaluate regulatory compliance to spot any legal or industry-related issues. Finally, assess litigation risks to uncover any ongoing or potential legal disputes.

Be on the lookout for warning signs like hidden liabilities, unresolved intellectual property conflicts, or regulatory breaches. These could signal deeper problems that might affect the deal's value.

Conducting a detailed review in these areas helps you spot risks, address surprises, and decide if the acquisition aligns with your goals. Using AI-driven tools can simplify the process, offering sharper insights and saving time while ensuring nothing important slips through the cracks.

How can AI tools improve due diligence in M&A transactions?

AI tools are reshaping the due diligence process in M&A by taking over repetitive tasks, analyzing massive datasets, and spotting risks faster and more accurately. They can sift through financial, legal, operational, and cybersecurity information in no time, cutting down the manual workload and reducing the chance of errors.

These tools shine when it comes to uncovering hidden liabilities, compliance problems, or regulatory risks, allowing dealmakers to zero in on the most pressing issues. While AI brings speed and efficiency to the table, human expertise is still key for interpreting results and making the final calls. By streamlining workflows, these tools help trim costs and speed up deal timelines, making them an essential part of today's M&A playbook.

What should I consider when making a counteroffer in an acquisition deal?

When preparing a counteroffer for an acquisition, it's crucial to start by thoroughly analyzing the initial offer. Pay close attention to the purchase price, the deal structure (like whether it’s an asset or stock purchase), and specific terms such as earnouts or escrow agreements. These elements can reveal areas where adjustments may be necessary to better match your valuation and long-term goals.

Conducting detailed due diligence is a must. Dive into the financial, legal, and operational aspects of the deal to identify potential risks or issues that could influence its value. Armed with this knowledge, you’ll be in a stronger position to negotiate - whether that means suggesting a revised price or proposing alternative terms that mitigate risk.

It’s also important to think beyond the numbers. Consider factors like the acquirer's willingness to negotiate, current market trends, and how much leverage you hold in the discussions. These broader dynamics can significantly shape your approach.

Finally, keep in mind that most letters of intent (LOIs) are non-binding. Focus on enforceable aspects such as confidentiality and exclusivity agreements while staying prepared for the next stages of negotiation. A well-crafted counteroffer strikes a balance between valuation, risk management, and strategic goals, setting the stage for a favorable outcome.