If you've spent your career running someone else’s business, Entrepreneurship Through Acquisition (ETA) offers a faster path to ownership. Instead of building a company from scratch, you can buy an existing, profitable business and start as the owner on day one. Here's why this matters:

- 12 million businesses, worth over $10 trillion, will change hands in the next decade, as many baby boomer owners retire.

- ETA reduces startup risks. You’re buying a company with proven revenue, customers, and operations.

- Search funds using ETA have delivered a 35.1% IRR and 4.5x ROI historically.

This guide explains how to transition from operator to owner, covering funding options, finding the right business, due diligence, and scaling for growth. Whether you're targeting SaaS, AI, or service-heavy industries, ETA can turn your expertise into ownership.

Search to Success: Entrepreneurship Through Acquisition

sbb-itb-9cd970b

What is Entrepreneurship Through Acquisition (ETA)?

Entrepreneurship Through Acquisition (ETA) is a business strategy where you acquire and manage an existing small-to-medium-sized company instead of building one from scratch [1][4]. Instead of starting with a blank slate and testing products or services, you take over a business that already has revenue, customers, and operational systems in place. The focus shifts from creating something new to improving and managing what’s already working [7][5].

This approach offers immediate benefits. You gain access to an established customer base, a functioning supply chain, and experienced employees right from the start [7][4]. Unlike startups, which often face years of financial losses and uncertainty, ETA entrepreneurs can generate revenue immediately and begin paying off acquisition debt [3][2]. The risks also change - you’re no longer asking, “Will this product sell?” but instead, “Can I manage and grow this business effectively?” [3][2]. As Kevin Noble from the ETA Affinity Group at Operators Guild explains:

"ETA doesn't remove uncertainty. It reshapes where it lives. Ownership shifts uncertainty from 'Will customers buy this at all?' to 'How do we run this business well today?'" [5]

The numbers back this up. Around 90% of startups fail within their first few years [3][2], but search funds - a structured ETA method - have historically delivered a 35.1% internal rate of return (IRR) and a 4.5x return on investment [2]. The timing for ETA is especially favorable, as baby boomers own 51% of privately held businesses, and 78% of retiring small business owners lack a formal succession plan [2]. This creates a vast pool of opportunities, with over $10 trillion in small business assets expected to change hands in the next decade [4][2][6].

This model is particularly appealing for those interested in applying it to technology-driven sectors.

Why ETA Works Well for SaaS and AI Operators

SaaS and AI companies are especially attractive for ETA because they combine high margins with recurring revenue models. This steady cash flow makes it easier to service acquisition loans and sustain operations [3]. Unlike traditional businesses that scale by adding more employees, SaaS businesses can grow revenue without significantly increasing costs. This makes them a great fit for debt-financed acquisitions, as their predictable monthly recurring revenue (MRR) supports loan repayments.

For operators with technical expertise, AI can add another layer of value. Acquiring service-heavy businesses - like bookkeeping or customer support - and integrating AI to automate repetitive tasks can transform these companies into highly scalable operations with SaaS-like profitability [8][2]. AI tools also enable new owners to predict customer churn and fine-tune pricing strategies, both of which are crucial for maintaining the competitive edge of SaaS businesses [8].

The market rewards such innovations. AI-integrated SaaS companies often command 20% to 50% higher valuations because of their ability to scale efficiently [8]. On average, AI-enhanced firms sell at EBITDA multiples that are 30% higher than businesses without AI adoption [8]. A real-world example: In January 2026, Dominic Sullivan sold an AI-driven application on Flippa after achieving $455,000 in revenue without spending a dime on advertising. This highlights the growth potential of AI-powered assets when managed effectively [3].

| Feature | Traditional ETA Target | SaaS/AI ETA Target |

|---|---|---|

| Primary Value Lever | Operations | AI-enhanced scalability |

| Revenue Model | Often transactional or contract-based | Recurring subscription revenue |

| Scalability | Limited by human capital/headcount | Decoupled from headcount via AI |

| Valuation Multiple | 3x - 5x EBITDA | 5x - 10x+ EBITDA (AI-enabled) |

| Risk Profile | Stable but slower growth | Lower risk with high growth potential |

Next, we’ll explore the operational strategies that drive success in ETA models.

What Makes an ETA Model Successful

Success in ETA depends on more than just acquiring a business; it requires a strong foundation and smart leadership. The most successful ETA ventures share a few key characteristics. First, they focus on businesses with steady recurring revenue, such as subscription models or companies with loyal customers. These types of businesses are less likely to falter during ownership transitions compared to project-based operations [9]. Second, they target businesses with efficient operations that are not overly reliant on the original owner, making it easier to scale under new management [2].

Matching the operator’s skill set to the business is another critical factor. When evaluating a potential acquisition, prioritize businesses with predictable operations ("durability") over those requiring extensive creativity or reinvention ("optionality") [5]. Successful buyers spend significant time understanding the day-to-day operations and company culture, not just reviewing financial statements [4][5]. For example, Edward McDonnell (MBA '16) used a traditional search fund in 2018 to acquire Botanical Designs, a commercial biophilic design firm. Over six years, he expanded the company from a single location with 80 employees to a national operation with 200 employees, culminating in an equity recapitalization in 2022 [9].

Financial discipline is equally important. Ensure the business generates enough cash flow to comfortably cover debt payments, with a buffer of at least 1.5x to 2x debt coverage [2]. Smaller businesses typically sell for 2x to 6x EBITDA, while larger, higher-quality businesses can command 6x to 10x EBITDA [2]. Target companies with margins of at least 15% to ensure resilience during economic downturns [3]. As Les Alexander, a professor at UVA Darden, wisely notes:

"Failure is not failing to find a business. Failure is buying a bad business." [9]

Getting Ready to Become an Owner

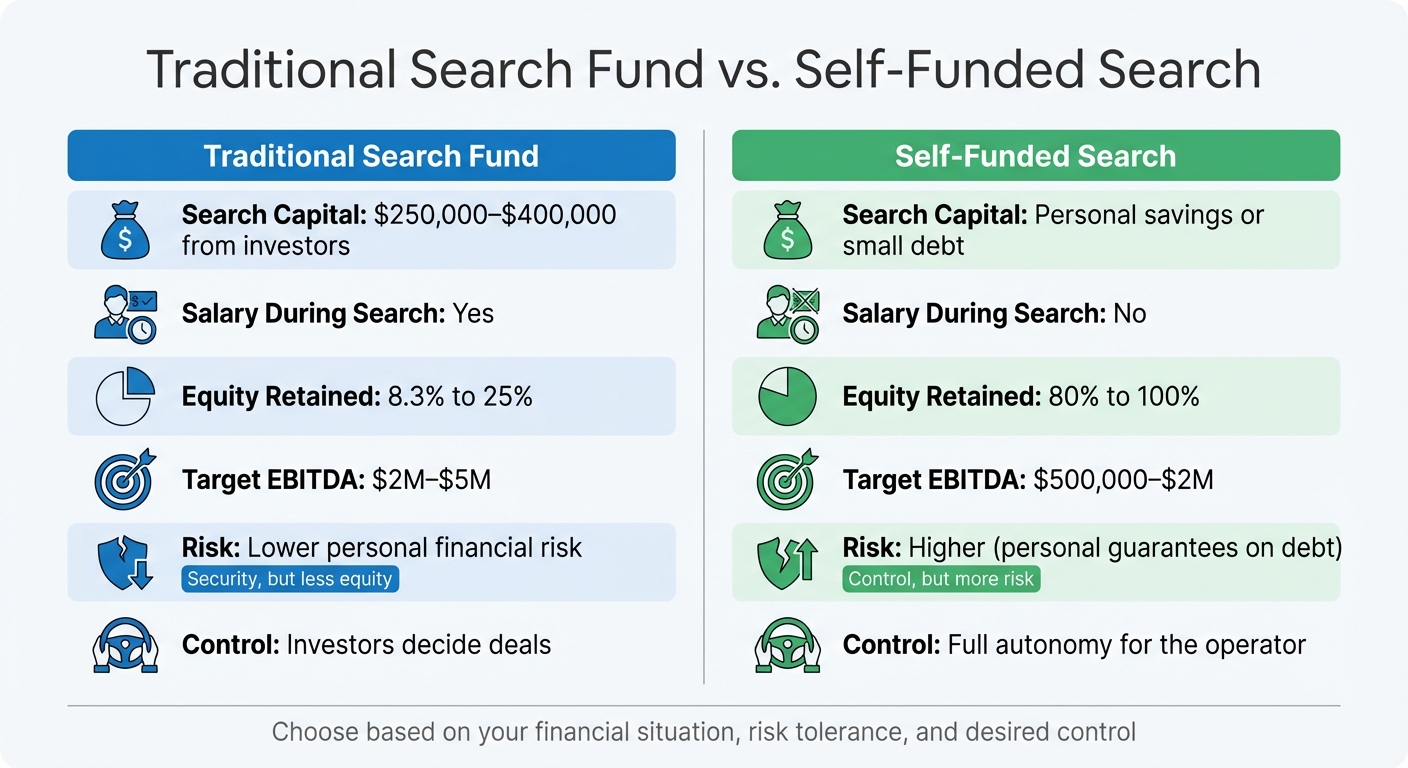

Traditional Search Fund vs Self-Funded Search: ETA Funding Comparison

Before diving into the search for a business acquisition, it's crucial to build the right skills and determine your funding path. Transitioning from operator to owner isn't just about having the financial resources - it’s about developing the expertise and mindset needed to succeed. Let’s look at the key skills to focus on and the funding options available.

Skills You Need to Develop

Start by strengthening your financial literacy. Learn to navigate accrual-basis accounting, including interpreting profit and loss statements, balance sheets, and cash flow over the last 24–36 months [11]. For SaaS businesses, you’ll need to understand metrics like monthly recurring revenue (MRR) bridges, Net Revenue Retention (NRR), customer acquisition cost (CAC) payback periods, and lifetime value to CAC ratios [11]. Amanda White emphasizes this point:

"A clean MRR bridge is more valuable than a pretty deck" [11].

Reconcile reported revenue with billing systems like Stripe and bank statements to avoid discrepancies that could derail a deal [11]. Additionally, understanding how businesses are valued is essential. Small businesses often sell for 4x to 6x EBITDA, while top-tier SaaS platforms can command multiples of 8x to 12x [2]. Familiarize yourself with debt structures, such as SBA 7(a) loans, which can finance up to $5 million with just 10–20% equity from the buyer, as well as seller financing options [2].

Equally important is adopting the right mindset. As Sean Kearns from the University of Denver explains:

"You need to build your credibility in ETA. Can you actually come up with the money to get the deal done? Can you run the company?" [13].

This shift involves moving from hypothetical thinking to making high-stakes decisions, like negotiating with a major customer or addressing the loss of a key employee [13]. Neil Pollard, also from the University of Denver, offers this perspective:

"You don't need to be the best machinist in order to own a machine shop. I just need to have the best machinists" [13].

Your role is to lead and inspire - not to be the technical expert.

Funding Options: Self-Funded vs. Search Funds

When financing your acquisition, you’ll typically choose between a traditional search fund and a self-funded approach. Each has its own balance of risk, control, and potential rewards.

- Traditional Search Fund: This model involves raising capital from 10–20 investors who provide both search funding ($250,000 to $400,000) and acquisition financing [2]. It offers the security of a salary during the 18–24 months spent searching for a business, reducing immediate financial stress [2][10]. However, searchers retain only 8.3% to 25% equity, with additional equity awarded over five years based on performance [2][12]. Investors also have the final say on which deals to pursue. As Les Alexander from UVA Darden explains:

"If a searcher loves one company and wants to buy it, but the investors don't want to fund it, you typically can't get the deal done" [10].

Traditional search funds usually target larger businesses with EBITDA between $2 million and $5 million [12].

- Self-Funded Search: This path relies on personal savings, SBA loans, or small private groups to finance both the search and acquisition [2]. While this approach involves higher personal financial risk - often requiring personal guarantees on debt - it allows you to retain 80% to 100% of the equity [2][12]. Self-funded searchers typically focus on smaller businesses with EBITDA ranging from $500,000 to $2 million [12]. Though the median search lasts 20–23 months, only about 57% of self-funded searchers successfully acquire a business [2]. Those who do, however, enjoy greater ownership and control.

| Feature | Traditional Search Fund | Self-Funded Search |

|---|---|---|

| Search Capital | $250,000–$400,000 from investors [2] | Personal savings or small debt [2] |

| Salary During Search | Yes [2][10] | No [2][10] |

| Equity Retained | 8.3% to 25% [2][12] | 80% to 100% [2][12] |

| Target EBITDA | $2M–$5M [2][12] | $500,000–$2M [2][12] |

| Risk | Lower personal financial risk [12] | Higher (personal guarantees on debt) [2][10] |

| Control | Investors decide deals [10] | Full autonomy for the operator [10] |

Choosing the right path depends on your financial situation, comfort with risk, and how much control you want over the process. By honing your skills and selecting a funding strategy that aligns with your goals, you’ll be well-positioned to identify and acquire a business that fits your vision.

Finding and Assessing Businesses to Buy

Once you've honed your skills and secured funding, the next step is finding a business with strong fundamentals and room to grow. Here's a closer look at where to search and how to evaluate these opportunities.

Where to Find SaaS and AI Businesses for Sale

Online marketplaces tailored for digital businesses are a great starting point. Acquire.com (formerly MicroAcquire) is a standout platform for SaaS acquisitions. It offers vetted listings with real-time metrics linked to payment processors and AI analytics tools [14]. Tara Reed, CEO of Apps Without Code, praises the platform:

"My favorite site to find tools and software companies is Acquire.com. It's the best. I like the combination of quality and responsiveness from founders." [14]

Other platforms like Flippa, BizBuySell, and BizQuest also list SaaS and AI businesses, though their vetting processes can vary [2]. Using filters - such as revenue range, profit margins, and churn rate - can help you zero in on businesses that align with your budget and goals.

However, the best opportunities often aren’t found on public marketplaces. Direct outreach, such as connecting with founders on LinkedIn, tapping into industry networks, or working with trusted M&A advisors, can uncover hidden gems [2]. Harris Osserman, founder of TalkHiring, shared his success story:

"Acquire was instrumental in selling my SaaS business. I went out on my own at first to try to get offers without a broker, and I received 1 LOI. When I posted the business on Acquire, I got 6 LOIs." [14]

This highlights how platforms can speed up deal flow, while networking and industry connections can reveal opportunities before they hit the market. Look for businesses with steady revenue, a diverse customer base (no single client making up more than 20% of revenue), and a strong position in a growing sector [2].

How to Evaluate Business Quality and Finances

Once you’ve identified potential targets, a thorough financial assessment is crucial to ensure the acquisition aligns with your goals.

Start by analyzing the MRR bridge, which breaks down revenue into new gains, expansions, contractions, and churn [17]. Always cross-check reported revenue with payment processor data and bank statements to verify accuracy [16].

A quick financial health check is the Rule of 40: add the business's growth rate to its profit margin. If the total exceeds 40%, that’s generally a positive sign [15]. For instance, a SaaS company growing at 25% annually with a 20% profit margin scores 45%. Additionally, monitor churn rates: healthy B2B SaaS churn is under 5%, while B2C can go up to 10% [16].

Customer concentration is another key metric. Avoid businesses where a single client accounts for more than 20% of revenue, as losing that client could have a major impact [2]. Also, evaluate Net Revenue Retention (NRR) - an NRR above 100% shows that existing customers are increasing their spending over time [17].

Don’t overlook the tech stack. Check for outdated dependencies, poor test coverage, or rising cloud hosting costs, as these could signal scaling challenges that require immediate post-acquisition investments [17].

For AI businesses, pay attention to inference unit economics to ensure profit margins remain strong as token costs grow with usage [16]. Also, assess vendor flexibility - can the product easily switch providers (like OpenAI) if needed? Alex Boyd, founder of Wildfront, stresses the importance of looking beyond the code:

"Code is not a moat. Code is a commodity. What matters is: Community, Distribution, and Hard-to-get certifications." [16]

Be cautious about overpaying for software that could be rebuilt inexpensively using AI tools. The value lies in a strong distribution network, loyal users, or critical certifications like HIPAA or SOC 2. Small SaaS businesses typically sell for 2x to 5x annual profit, with higher-quality companies commanding 4x to 5x earnings [2].

Finally, build a financial model to test scenarios like a 5% increase in churn or slower growth. This helps confirm the business’s resilience [17].

| Metric | Quality Benchmark | Red Flag |

|---|---|---|

| Monthly Churn | < 5% (B2B) / < 10% (B2C) | > 10% for B2B |

| Customer Concentration | Ideally, no single client > 10%; avoid > 20% | Single client > 20% |

| Net Profit Margin | 30% to 50% or higher | Declining margins |

| Payment Dispute Rate | Less than 0.1% | Above 0.5% |

| Rule of 40 | Combined Growth + Profit > 40% | Below 40% may indicate stress |

Performing Due Diligence and Completing the Purchase

Due diligence is a make-or-break step in acquisitions, and skipping over key details can lead to failure. In fact, nearly one-third of M&A deals collapse due to undiscovered issues [21]. However, following structured processes can significantly improve outcomes, with a 92% close rate after a letter of intent (LOI) [23].

Think of due diligence as a deep dive into the business. As David Deeds, Professor of Entrepreneurship at the University of St. Thomas, aptly says:

"Financial statements are the start, not the truth." [18]

Your goal is to verify every claim and uncover any hidden risks.

What to Review During Due Diligence

Once you've identified the acquisition target and reviewed its financial basics, due diligence takes raw numbers and turns them into actionable insights.

Start with the financials. Review key documents like accrual-basis profit and loss (P&L) statements (covering 24–36 months), balance sheets, cash flow statements, and three years of tax returns. Cross-check reported revenue against payment processor data and bank statements [11]. For SaaS businesses, pay close attention to the MRR/ARR bridge, which tracks revenue changes from new sales, upsells, churn, and downgrades [11].

Amanda White, a SaaS Acquisition Specialist, emphasizes the importance of preparation:

"The fastest way to lose a great offer is to look unprepared." [11]

Even minor discrepancies between systems can cause delays or lead to price cuts. On average, post-LOI diligence results in a 23% price reduction [23].

Beyond the numbers, examine the operational side. Spend time on-site to observe workflows and identify inefficiencies. Talk to employees one-on-one to distinguish between minor problems and deeper organizational challenges. It's also crucial to assess whether customer loyalty is tied to the owner or the company - personal relationships can lead to revenue drops post-acquisition [18].

On the technical front, focus on risks that could demand immediate investment after the purchase. Audit for outdated dependencies, poor test coverage, or rising cloud costs [22]. Confirm that all intellectual property (IP) is properly assigned through written agreements with founders, employees, and contractors. Missing IP documentation can lead to legal headaches, as seen in Marriott's acquisition of Starwood, where inadequate IT diligence missed a pre-existing data breach, resulting in a $123 million fine [20].

For SaaS businesses, review deferred revenue schedules, as these represent service obligations you'll inherit [11]. Check material customer contracts for change-of-control clauses that could trigger renegotiation or termination. Finally, normalize EBITDA by excluding one-time expenses, related-party rent, or non-market compensation to get a clear picture of the business's true profitability [18].

| Due Diligence Category | Key Items to Review | Critical Red Flags |

|---|---|---|

| Financial | P&L (24–36 months), tax returns, MRR/ARR bridge, deferred revenue | Revenue mismatches; improper EBITDA adjustments |

| Operational | Customer list, churn analysis, employee interviews, workflows | Over-reliance on one customer (20%+ revenue); owner-dependent relationships |

| Legal/IP | Formation documents, IP agreements, contracts | Missing IP agreements; problematic change-of-control clauses |

| Technical | Code audit, security checks, infrastructure review | High technical debt; outdated systems; security flaws |

These steps help lay the groundwork for a smooth transition post-acquisition.

Negotiating the Deal and Getting Financing

The insights you gather during due diligence will shape your negotiation strategy and financing plan. Deals typically combine cash at closing, seller notes (10–30% of the purchase price), and performance-based earnouts [21].

For financing, SBA 7(a) loans are a popular option, covering up to $5 million of the purchase price with just 10–20% equity required from the buyer [2]. This approach keeps upfront costs manageable while giving sellers confidence. Ensure the business maintains a debt service coverage ratio of at least 1.5x (ideally 2x or higher) to handle any performance dips [2].

When negotiating, use a strategic approach. Rather than pushing for one large price cut, create an "Issues List" that highlights smaller deductions for each identified problem, such as unpaid vacation liabilities or outdated equipment. This "Death by 1000 Cuts" strategy can help you secure better terms while maintaining goodwill [23]. Be ready to concede on minor points to gain leverage on more critical issues [23].

For SaaS and AI businesses, focus on revenue quality rather than just EBITDA. Metrics like ARR/MRR consistency, net dollar retention, and LTV/CAC ratios should guide your valuation [19]. If there's a gap between your valuation and the seller's expectations, consider structuring an earnout to bridge the difference. Sellers may also request that you operate the business in the "ordinary course" post-close to protect their earnout targets [21].

To make your offer more attractive, consider Reps & Warranties Insurance (RWI). This reduces the seller's escrow holdback - typically 10–20% of the purchase price for 12–24 months - and allows for a cleaner exit [21].

Be mindful of timelines. Sellers often push for 45–60 days of exclusivity, while buyers typically need 90–120 days to complete due diligence [21]. On average, it takes 20–23 months to find a suitable target business, and 31% of deals fall apart between the LOI and closing [23]. For example, the Aurias search fund, which acquired Saepio in 2024, reviewed over 4,000 potential companies before finalizing their choice [2].

Lastly, decide on the deal structure. For SaaS and tech companies, stock purchases (buying the entire company, including liabilities) are common. In contrast, asset purchases (acquiring specific assets and liabilities) are more typical for distressed or asset-heavy businesses [21].

Taking Over and Growing the Business

Closing the deal is just the beginning - what follows is the hard work of turning plans into action. As Chase Murdock from Local Legends explains:

"Ownership is tactical and real. It's where hypotheticals need to convert into reality. As an owner, you need to move from thinking like an evaluator to acting like a builder."

- Chase Murdock, Local Legends

After completing your acquisition due diligence, your focus shifts to stabilizing operations and setting the stage for growth. The first few months are critical - approach the business as it is, rather than immediately forcing theoretical changes.

Your First 100 Days as Owner

Start by ensuring administrative continuity. During your first week, prioritize setting up new bank accounts, payroll systems, and accounting platforms. Sam Rosati from SMBootcamp highlights the importance of this step:

"The last thing you want in an ownership transition is to mess up your first payroll. Mistakes are costly when you're trying to earn the respect of your new employees."

- Sam Rosati, SMBootcamp

On day one, update all critical system credentials, like App Store consoles, Stripe, and hosting accounts. This not only reduces security risks but also signals that you're stepping into your role as the new owner.

Hold an initial team meeting to establish trust and tackle small operational challenges for some quick wins. Avoid overpromising - focus on building credibility through consistent actions, open communication, and honoring your commitments. Over the first 90 days, lean on your team for their deep knowledge of daily operations.

It's wise to maintain a short-term consulting arrangement with the former owner (6–12 months) to ensure a smooth transition. Reassure customers by identifying key accounts - especially those critical to revenue - and having account managers reach out to reaffirm service levels. For retention bonuses, consider splitting payments, offering part upfront and the rest after a year to align incentives with long-term goals. Finally, focus on tasks that only you, as the owner, can handle, and delegate other responsibilities to empower your team.

Growing Your SaaS or AI Business After Acquisition

Once operations are stable, shift your attention to growth. Start with an operational audit of your tech stack, including third-party APIs, SDKs, and SaaS tools. This helps identify redundancies and cut unnecessary costs. Use AI tools to map your tech stack and uncover opportunities to save money or boost revenue.

Within 60 days, consolidate overlapping SaaS tools and explore cross-selling opportunities with key customers to secure quick wins. AI and automation can be game-changers for lead generation, marketing, and customer engagement - strategies that can help achieve high profitability, especially in service-heavy industries.

To scale further, consider a programmatic acquisition strategy. McKinsey research shows that companies pursuing multiple smaller acquisitions outperform their peers 65–70% of the time [2]. This approach allows you to buy smaller firms at lower multiples (around 5x EBITDA) and later combine them into a larger entity that can command higher valuations (8–12x EBITDA).

Ultimately, the business becomes truly yours when you establish your own standards for success. Define what excellence looks like for your team and customers, rather than simply following the previous owner's blueprint.

Conclusion

ETA provides a path for those looking to transition from operator to owner while managing risk. Instead of wondering whether customers will buy, your focus shifts to running a business that’s already proven its worth day-to-day [5].

"ETA doesn't remove uncertainty. It reshapes where it lives."

- Operators Guild [5]

Preparation is critical. While many searches lead to acquisitions, the difference between success and years spent searching without a deal lies in the groundwork. Build your buy-side team early, craft an acquisition thesis centered on recurring revenue and low customer concentration, and understand that the average search takes 20 to 23 months [2]. This foundation is essential for navigating due diligence effectively.

When conducting due diligence, assess the company’s technological relevance and potential for AI integration. Businesses that successfully adopt AI often see valuation premiums of 20% to 50% [8]. Scrutinize operational and financial metrics carefully before committing to a deal [2].

Once the acquisition is complete, execution becomes the priority. Stabilize the business quickly, earn employee trust, and ensure operations continue smoothly. From there, explore strategic uses of AI and automation to improve efficiency. Programmatic acquisitions can also create opportunities for multiple arbitrage - acquiring businesses at 4–6× EBITDA and building a platform that could later sell at 8–12× EBITDA [2]. With $10 trillion in small business assets projected to change hands over the next decade, well-prepared operators have a rare chance to step into ownership and build lasting financial success [6].

FAQs

How do I know if ETA is right for me?

If you have hands-on experience running operations, a desire to take charge of an established business, and prefer a less risky route to entrepreneurship, ETA could be a strong option. This path suits professionals looking for immediate ownership, the ability to make key decisions, and an opportunity to put their business knowledge into action. Keep in mind, though, that it demands both financial resources and operational dedication, along with expertise in areas like deal sourcing and due diligence. Take the time to assess your goals and preparedness before diving in.

What’s the safest way to finance my first acquisition?

The safest route for many entrepreneurs is to explore SBA-backed loans, such as the SBA 7(a) loan. These loans typically require only 5–10% equity, offer borrower-friendly terms, and help limit personal financial exposure.

Another option is the self-funded search model, where you use your own capital to retain full ownership. This approach is often combined with SBA financing to balance risk and secure the funds needed for your first acquisition. Both methods are practical ways to reduce risk while pursuing business ownership.

What are the biggest deal-breakers in SaaS/AI due diligence?

When evaluating SaaS and AI companies, there are often hidden risks that can derail stability and growth. Some of the biggest red flags include:

- Financial instability: Issues like weak cash flow or a pattern of late payments can signal trouble.

- Legal problems: Compliance violations or unresolved legal disputes can pose significant risks.

- Technical weaknesses: Relying on poorly documented or outdated technology can lead to operational headaches.

To address these concerns, due diligence needs to dig deep into key areas like financial health, legal standing, operational reliability, and the technical foundation. This process helps uncover potential risks and lays the groundwork for managing them effectively.