When your company receives an acquisition offer, it’s a defining moment that requires careful planning and swift decisions. Here’s what you need to know:

- Acquisition Offers Are Complex: Beyond the price, consider the buyer’s strategy, your team’s future, and the long-term implications for your company.

- Key Metrics Matter: Metrics like Annual Recurring Revenue (ARR), Net Revenue Retention (NRR), and the Rule of 40 significantly influence your valuation.

- Preparation Is Critical: Organize financial, legal, and operational documents in a secure Virtual Data Room (VDR) to streamline due diligence and avoid deal-breaking surprises.

- Understand the Buyer: Private equity buyers focus on cash flow and ROI, while corporate buyers prioritize synergies and strategic value. Tailor your approach accordingly.

- Plan for Integration: Post-acquisition success depends on aligning teams, integrating systems, and addressing potential conflicts early on.

Whether the offer aligns with your goals depends on your company’s readiness, the buyer’s intentions, and your willingness to navigate the challenges ahead. A structured approach, clear priorities, and expert guidance can help you make the right decision.

How to evaluate an acquisition offer based on the level of debt the acquirer plans to use

Step 1: Assess Whether the Offer Fits Your Business

Before diving into financial calculations, take a step back and ask yourself: does this deal genuinely align with your company’s goals? A high price tag might seem tempting, but it doesn’t automatically mean the acquisition is a good fit. The buyer’s motivations and your company’s readiness will ultimately determine whether this partnership creates value - or becomes an expensive misstep.

What the Buyer Wants to Achieve

Understanding the buyer’s goals can reveal a lot about the potential structure of the deal. Strategic buyers, often competitors or companies in related markets, are usually looking to achieve specific objectives - things like consolidating market share, entering new regions or industries, or acquiring proprietary technology and intellectual property [5].

Private equity firms, on the other hand, often operate with a "buy and build" mindset. Their playbook involves acquiring multiple companies to create a larger, more efficient entity or driving operational improvements to hit specific return-on-investment targets. These firms typically aim to double their investment within three years or triple it within five [7].

Sometimes, the buyer’s focus isn’t even on your product - it’s on your team. In what’s known as an acquihire, the buyer is primarily interested in your talent. Teams with a proven track record of working well together can be highly attractive, especially if they can speed up product development [2]. Other buyers may take a defensive approach, acquiring intellectual property to avoid potential patent disputes or legal issues [2].

Jason Lemkin, Founder of SaaStr, sums it up well:

"The best founders understand that every M&A conversation is really three conversations: the current opportunity, future intelligence gathering, and relationship building" [5].

Even if selling isn’t on your radar right now, understanding the buyer’s strategy can help you determine if your visions align. For example, if the buyer plans to merge multiple acquisitions without a clear integration plan, you could end up running a fragmented division rather than a cohesive business [5].

By understanding the buyer’s intent, you can better evaluate whether your company’s metrics and operational independence align with the expectations of an acquisition.

Is Your Company Ready for Acquisition

Just because your company is attractive doesn’t mean it’s ready to be acquired. Buyers will scrutinize your financial health, operational independence, and customer metrics to decide if you’re worth the investment - and whether the deal can survive the due diligence process.

A good starting point is the Rule of 40. This benchmark combines your growth rate and profit margin, and the total should exceed 40%. High performers typically score between 35 and 55, while companies exceeding 60% often command valuations 2–3 times higher than their peers [6].

Net Revenue Retention (NRR) is another key metric. SaaS companies with NRR above 120% often secure valuation premiums of 1x to 3x their base Annual Recurring Revenue (ARR) multiples [6]. For instance, Snowflake’s IPO showcased an NRR of over 170%, enabling ARR multiples of more than 40x. Similarly, Datadog’s NRR of around 130% supported valuations in the 15–20x ARR range [6].

Customer concentration can also be a deal-breaker. If a single customer accounts for more than 25% of your revenue, buyers may see this as a significant risk [3]. Diversifying your customer base before entering acquisition discussions can greatly improve your position.

Lastly, consider how dependent your business is on you. If your company can’t operate without you, buyers might insist on extended earnouts. As Acquisition.net puts it:

"If your company can't function without you, you're not selling a business - you're selling yourself into an extended employment contract with your buyer" [9].

Be proactive about identifying and addressing potential red flags, like missing intellectual property assignments, regulatory compliance issues (e.g., GDPR or CCPA), or misclassified employees. Tackling legal, financial, and technical issues 12–18 months before a potential sale can help ensure the deal doesn’t fall apart at the last minute.

Step 2: Calculate Your Company's Worth

Private Equity vs Corporate Buyers: Key Differences in SaaS Acquisitions

Once you've confirmed that the offer aligns with your goals, the next step is to estimate your company's value. SaaS valuations are guided by specific benchmarks that buyers rely on to shape their offers.

Metrics That Determine Valuation

For SaaS companies, Annual Recurring Revenue (ARR) is the foundation of valuation. Unlike traditional businesses that focus on EBITDA, SaaS companies are prized for their predictable revenue streams. Why? Predictable revenue lowers risk for investors and makes your business easier to model and assess [10].

Your growth rate plays a massive role as a multiplier in these valuations. Faster growth rates can command higher ARR multiples. For example, mature SaaS companies might see ARR multiples around 6.0x, while early-stage companies with less than $10M ARR could reach multiples of 7.5x–10.0x [6].

Net Revenue Retention (NRR) is another key factor. It measures how "sticky" your product is. Companies with NRR above 120% often secure higher valuation multiples, sometimes adding 1x to 3x to their base ARR multiple [6]. For instance, by late 2024, ServiceNow maintained a premium valuation of 19.5x ARR, thanks in part to a Rule of 40 score of 37% [12][13].

Gross margin is critical for showing scalability. SaaS gross margins typically range between 70% and 85% [10]. Higher margins mean you have more funds to reinvest in growth rather than just maintaining operations. Buyers will also scrutinize your unit economics, particularly the LTV/CAC ratio. A ratio above 3:1 signals a strong, efficient customer acquisition strategy [6].

The Rule of 40 has become an important benchmark, especially in 2026. Strong performers tend to score between 35 and 55, favoring balanced growth over reckless expansion [6]. Data from Q3 2025 shows that every 10-point improvement in a company's Rule of 40 score correlates with about a 1.1x increase in EV/Revenue multiples [14].

For a quick value estimate, Flow Capital suggests this formula: Valuation = 10 x ARR x Growth Rate x NRR. This formula works best for companies with growth rates above 50% and NRR above 100% [10]. Of course, the more detailed your KPIs and financial data, the more precise your valuation will be [19].

Now let’s explore how different types of buyers evaluate these metrics.

Private Equity vs. Corporate Buyers

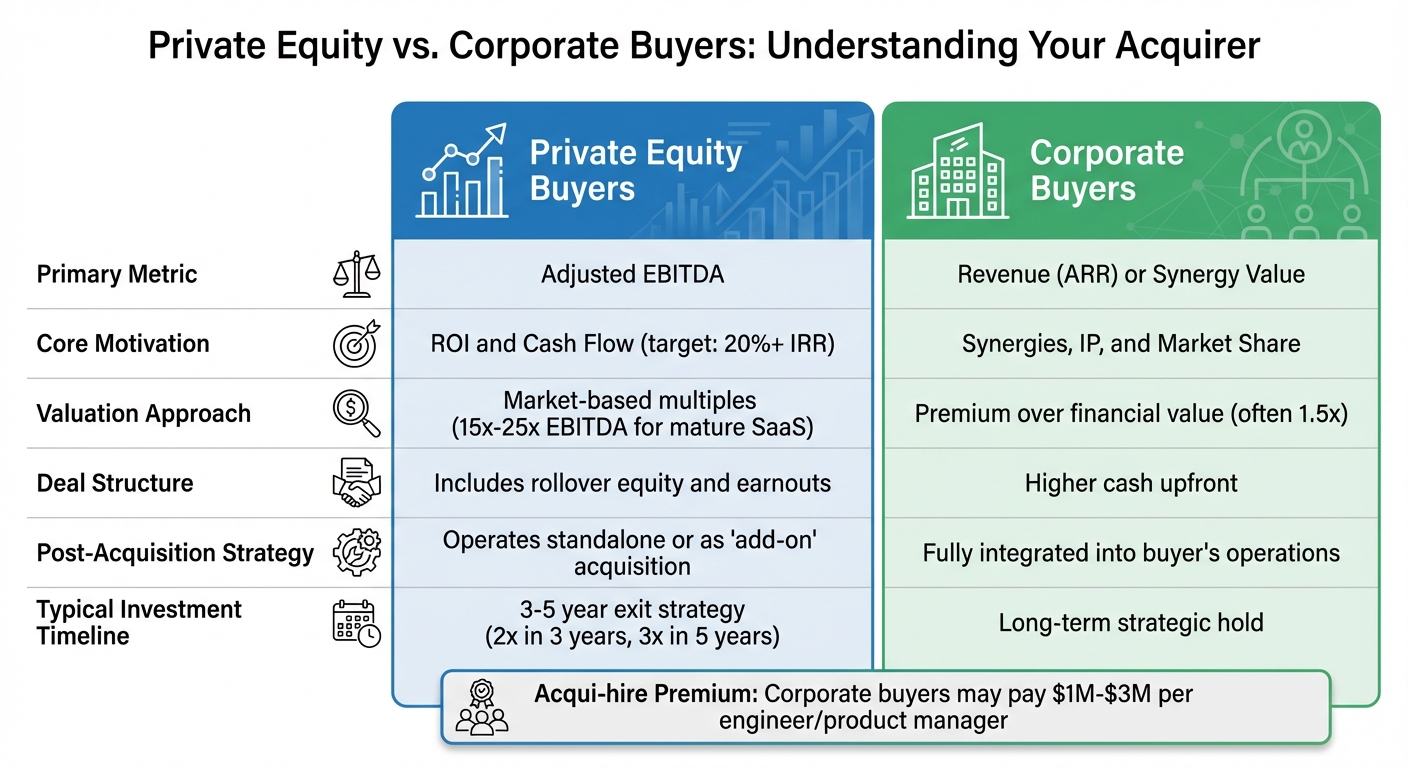

Private equity (PE) firms and corporate buyers approach valuations with different priorities and methods.

Private Equity Buyers

PE firms are financial buyers who base valuations on metrics like Adjusted EBITDA and cash flow. They generally aim for an internal rate of return (IRR) of 20% or more [17]. Mature SaaS companies with solid profitability often trade at EBITDA multiples ranging from 15x to 25x [6]. Size also plays a role - larger revenue tiers attract higher multiples due to the scarcity of high-quality platform assets [15].

PE firms often use a "buy and build" strategy. They acquire smaller companies at lower multiples (e.g., 5x EBITDA) and later sell the combined platform at a higher multiple (e.g., 10x+ EBITDA) [15][17].

Corporate Buyers

Corporate buyers, on the other hand, focus on strategic value. They often use ARR multiples or calculate the cost of replicating your technology in-house [6][16]. These buyers also look at synergies, such as cost savings or revenue opportunities. This approach can lead to valuations that exceed the standalone financial value of your business [17].

For example, in 2024, Publicis Groupe acquired Influential, an influencer marketing firm, for $500M. The deal was driven by strategic synergy - Publicis wanted to integrate Influential's social media capabilities into its client offerings [17]. Strategic buyers often pay a premium (around 1.5x) because your business holds additional value in their ecosystem [17].

| Factor | Private Equity Buyers | Corporate Buyers |

|---|---|---|

| Primary Metric | Adjusted EBITDA [15] | Revenue (ARR) or Synergy Value [6][17] |

| Core Motivation | ROI and Cash Flow [16][17] | Synergies, IP, and Market Share [11][17] |

| Valuation Level | Market-based multiples [15] | Often a premium over financial value [17] |

| Deal Structure | Includes rollover equity and earnouts [15][17] | More likely to offer higher cash upfront [11] |

| Post-Acquisition | Operates standalone or as an "add-on" [15] | Fully integrated into the buyer [5][18] |

Corporate buyers may also pay between $1M and $3M per engineer or product manager in acqui-hire scenarios [18].

Understanding whether you're dealing with a private equity or corporate buyer is crucial. Tailor your financial documentation and pitch to highlight the metrics and value drivers that matter most to them.

Step 3: Get Ready for Due Diligence

Once an offer is made, buyers will dive into your company’s details over a 60–90 day period. This phase, called due diligence, is where deals often falter - 30% to 40% of M&A deals fall apart during this stage because sellers either aren’t adequately prepared or fail to disclose critical issues [3].

"M&A due diligence is the make-or-break phase of any business acquisition... the 60–90 days after LOI can uncover deal-killing issues - or give you the confidence to move forward smoothly."

- Alex Lubyansky, Managing Partner, Acquisition Stars [27]

The takeaway? Preparation is everything. Sellers who get their materials in order ahead of time can close deals 2–3 times faster [3]. Ideally, start preparing 3 to 6 months before receiving an offer.

Setting Up Your Data Rooms

Virtual Data Rooms (VDRs) are essential for securely sharing sensitive information. Look for VDRs with features like audit trails, access controls, and watermarking [23]. Organize your files into clear categories that align with what buyers will want to review.

Here’s a breakdown of the key documents to prepare:

- Financial documents: Include 2 to 3 years of audited or reviewed financial statements following GAAP, along with tax returns, budgets, debt agreements, and revenue recognition documentation (ASC 606). SaaS companies should also provide churn rates and net revenue retention figures.

- Legal and corporate records: Upload articles of incorporation, bylaws, board minutes, shareholder agreements, and a current cap table. Include all material contracts, such as customer MSAs, vendor agreements, and partnership deals. Check for change-of-control clauses that might disrupt revenue [23].

- Intellectual property (IP) documentation: Ensure all founders, employees, and contractors have signed IP assignment agreements. Include patents, trademarks, open-source licenses, and a Software Bill of Materials (SBOM) to track code dependencies [3].

- Human resources: Provide an employee census, compensation plans, benefits documentation, and contractor agreements. Verify that all workers are properly classified to avoid legal issues [21].

- IT and security materials: Share architecture diagrams, SOC 2 Type II reports, penetration testing results, and documentation of GDPR or CCPA compliance. For AI companies, include details about training dataset origins and usage rights [22].

A tiered disclosure approach can help protect your sensitive information. For example:

- Tier 1 (pre-LOI): Share high-level pitch decks and summary financials.

- Tier 2 (post-LOI): Allow full data room access for detailed reviews.

- Tier 3 (late-stage): Include highly sensitive items like source code or detailed customer lists. For particularly sensitive data, consider using "clean teams" with restricted access [25].

To streamline navigation, standardize file names (e.g., "2025_SaaS-Agreement_ClientName.pdf") and convert documents to PDF. Redact any personally identifiable information, such as Social Security numbers, before uploading [3].

| Folder Category | Key Documents to Include |

|---|---|

| Corporate | Articles of Incorporation, Bylaws, Board/Shareholder Minutes, Cap Table [23] |

| Financial | Audited Statements (2–3 years), Tax Returns, Budgets, Debt Agreements [20] |

| Intellectual Property | Patents, Trademarks, IP Assignments, Open Source Licenses (SBOM) [21] |

| Material Contracts | Customer MSAs, Vendor Agreements, Partnership/Joint Venture Deeds [24] |

| Human Resources | Employee/Contractor Lists, Compensation Plans, Non-compete Agreements [21] |

| IT & Security | Architecture Diagrams, SOC 2 Reports, Pen Test Results, GDPR Policies [22] |

Once your data rooms are organized, double-check that everything complies with legal standards to avoid surprises after the LOI.

Compliance and Documentation Requirements

With your data neatly organized, the next step is proving that your business operates within legal and regulatory boundaries. Non-compliance can lower your valuation - or even kill the deal.

Data privacy compliance is a top priority. If you serve European customers, you’ll need to demonstrate GDPR compliance. For California-based users, ensure adherence to CCPA. Add policies and agreements for industry-specific regulations like HIPAA (healthcare) or PCI DSS (payment processors) [20].

Standard Operating Procedures (SOPs) are also crucial. These documents offer buyers a glimpse into your day-to-day operations. Include workflows for customer onboarding, product development, IT, and support processes [22]. This helps reassure buyers that the company isn’t overly dependent on key individuals (a common concern known as "Founder Syndrome").

For example, TE Connectivity faced delays in 2025 because their manual workflows slowed the due diligence process by threefold. After adopting the Diligent Third-Party Risk Management platform, they automated procedures, identified bottlenecks, and sped up decision-making [20].

"It was clear that our process was taking too long. So, we needed to understand where the major delays were and how we could make this process easier for our stakeholders."

- Brian Risser, Business Partner Program Manager, TE Connectivity [20]

Another way to avoid surprises is by running a Quality of Earnings (QoE) report before opening your data room. This independent review confirms EBITDA and cash flow, which can increase your valuation by 5% to 10% and speed up the transaction by 20% to 30% [27].

Transparency about known issues is equally important. For instance, in a 2025 deal worth $2 million, a seller couldn’t account for 15% of issued shares. This led to the discovery of a dispute with a former employee and required a $300,000 escrow to resolve [27].

Start your compliance review 12 to 18 months before your planned exit. This gives you time to fix curable issues, like missing signatures or outdated contracts, without appearing rushed [26]. Keep in mind, due diligence costs typically range from 1% to 3% of the total purchase price [27].

sbb-itb-9cd970b

Step 4: Assemble Your Negotiation Team

Once your compliance checks are done and your data room is set, it’s time to pull together the team that will secure the best deal possible. Research shows that effective LOI negotiations can lead to a 73% success rate post-closing [1]. Having the right advisors can safeguard your interests, streamline tax structures, and help you sidestep costly errors.

Keep your negotiation team small to maintain confidentiality and focus. A tight-knit team of no more than three internal members should handle materials, oversee the data room, and prep for buyer meetings [4][2]. Add external advisors who specialize in M&A to round out the team. From there, identify the key players who will drive the process forward.

Who Should Be on Your Team

Start with M&A legal counsel experienced in deals similar to yours in size and industry. These attorneys will draft the LOI and Purchase Agreement, oversee legal due diligence, and protect you with indemnification clauses and reps and warranties provisions [3][1][29]. Look for firms that proactively identify risks - like intellectual property gaps or regulatory challenges - rather than reacting to issues as they arise [30]. Some firms even offer fixed-fee LOI reviews to provide cost predictability for startups [1].

Next, bring in financial advisors and accountants. They’ll handle company valuation, prepare GAAP-compliant financials, and advise on tax-efficient deal structures, such as whether to pursue a stock or asset sale [3][7][29]. When choosing an advisor, ask for case studies of deals they’ve worked on in your industry and confirm their connections to strategic buyers or private equity firms [31][32]. Boutique firms often provide more personalized attention, while larger firms come with global networks and resources [31].

Your technical and product leaders will play a critical role in validating the tech stack, product roadmap, and intellectual property during technical due diligence [4][2]. Meanwhile, HR and operations leads should focus on integration planning, reviewing employee benefits, and crafting retention strategies for key talent [2]. Don’t forget to involve the Board and key investors for final negotiation approvals and valuation insights. It’s wise to get informal verbal approvals from major investors with veto rights before formal negotiations begin to avoid roadblocks later [29].

| Role | Primary Responsibility | Key Contribution |

|---|---|---|

| Founder/CEO | Manage Relationships | Strategic alignment and vision selling |

| M&A Attorney | Legal Documentation | Risk mitigation and contract enforcement |

| CFO/Accountant | Financial Verification | Valuation protection and tax guidance |

| Technical Lead | Tech Due Diligence | IP validation and stack integration |

| HR Lead | People Operations | Talent retention and organizational fit |

| M&A Advisor | Process Management | Buyer vetting and competitive tension |

As the founder or CEO, your role is unique. You’re the primary "solutions salesperson", tasked with building trust with buyers and positioning your company as the answer to their business challenges [4].

"One of the most important things for founders to understand is that you are selling something to an executive, who has a problem. And as the startup CEO - you are that solution."

Once your team is set, make sure everyone is aligned on a clear negotiation strategy to protect your interests.

How to Negotiate Deal Terms

Before negotiations begin, establish three price points: a "perfect" price, a "good" price, and a "walkaway" price. This will help you avoid making emotional decisions under pressure [28]. Create a "living Q&A" document to track all buyer questions and answers, ensuring consistent communication across your team [28].

The LOI (Letter of Intent), while mostly non-binding, locks in key terms like exclusivity, confidentiality, and expense responsibilities [1]. Sellers should negotiate shorter exclusivity periods - 45 to 60 days - to maintain leverage, while buyers often push for 90 to 120 days [3]. Once an LOI is signed, there’s a 65% chance the deal will close [1].

Key terms to negotiate include:

- Earnouts: Performance-based payments post-closing.

- Equity Rollovers: Retaining a stake in the combined entity.

- Payment Structures: Cash versus stock.

- Transition Support: Defining how long you’ll stay post-acquisition.

For example, escrow holdbacks often range from 10% to 20% of the purchase price and are held for 12 to 24 months to cover potential indemnification claims [3]. Representation and Warranty Insurance (RWI) can reduce these holdbacks, but it typically costs 2% to 6% of the coverage limit [3].

The structure of the deal - stock purchase versus asset purchase - also has major implications. In a stock purchase, the buyer takes on all liabilities (known and unknown), while in an asset purchase, only specific liabilities are assumed [3]. Your legal and financial advisors will guide you through these complexities and help determine the most tax-efficient structure.

Keep your Board and investors informed throughout the process to avoid distrust or delays [4]. If you’re dealing with a private equity buyer, consider appointing a neutral board chairperson to mediate any disagreements between you and the PE firm [7].

Step 5: Plan for Life After the Acquisition

Once the deal is signed, the real work begins - integration. This step is critical, as it often determines whether the acquisition succeeds or fails. In fact, 83% of M&A deals fail due to integration issues [33]. The goal now is to merge operations and align teams to fully realize the deal's potential.

Rather than treating integration as a simple checklist, approach it as a dynamic process. Successful acquirers adapt their strategies to match the specific goals of the acquisition. For instance, if the deal focuses on gaining new technology or entering new markets, preserving the target's culture and innovation capabilities is key. On the other hand, if the goal is to turn around underperforming operations, swift integration into the acquirer's structure may be the better route. Frequent acquirers have seen their advantage in shareholder returns jump from 57% to 130% over the past two decades, largely due to their ability to balance these decisions effectively [33].

Bringing Teams and Cultures Together

Cultural misalignment is one of the biggest deal-breakers in M&A. Identifying potential "fault lines" - areas where teams may clash - should happen during the diligence phase, not after the deal closes. Nearly half (47%) of top-performing acquirers prioritize cultural alignment as part of their integration strategy [34].

Leadership appointments are a crucial first step. Filling key roles early can help retain top talent and stabilize the organization. For example, a global information company named a target executive as its new COO months before the deal closed, leading to the retention of critical talent and an increase in market share [34].

"The sooner you select the new leaders, the quicker you can fight the flight of talent and customers and get on with the integration." - Bain & Company [33]

A solid 100-day plan is essential. This plan should focus on leadership alignment, functional integration, and building a shared corporate culture [35]. To ease the transition, consider using "change champions" - respected employees from both organizations who can help bridge gaps and foster collaboration [36]. When Hitachi acquired GlobalLogic in 2021, they used workshops, in-person visits, and cross-cultural teams to preserve the innovation-driven culture of their Silicon Valley-based target while applying those lessons across their broader organization [33].

Developing a unified vision that combines the strengths of both companies is vital. Address power dynamics and organizational conflicts early to avoid instability, and once cultural alignment is achieved, shift focus to streamlining operations and integrating technology.

Combining Tech Stacks and Operations

Technology integration is often where deals either succeed or falter. Start with a systems inventory to determine which technologies to keep, replace, or retire [37]. Research shows that decisions about just nine core platforms - such as ERP, CRM, and employee management systems - can account for 70% of technology synergies [8].

One pharmaceutical company, for example, focused exclusively on these nine decisions, reducing its integration timeline from 36 months to 24 months [8]. The key is to prioritize systems that deliver the most value without incurring excessive costs [8].

Early integration of critical systems can also drive revenue. For instance, Dell's $67 billion acquisition of EMC succeeded in part because they prioritized cross-selling products through separate sales teams rather than immediately merging systems. This approach generated multibillion-dollar synergies within the first year [33].

Standardizing tools like DevOps pipelines, code repositories, and cloud services can further streamline operations. Cybersecurity should also be a top priority, as cyberattacks on target companies increase by 10 to 100 times after a deal is announced [8]. To ensure smooth operations from "Day One", address access credentials, system transitions, and emergency protocols in advance [37].

Using AI Tools to Support Growth

AI is changing how companies manage integration. Currently, 22% of companies use generative AI to streamline integration planning [33]. These tools can compare data sets across organizations, flag risks, and track synergies, making the process more efficient.

Relationship intelligence tools like 4Degrees can also be invaluable. These platforms consolidate deal management, automate data capture, and map stakeholder networks, revealing opportunities for collaboration that traditional analysis might overlook [36].

Setting up an Integration Management Office (IMO) with a dedicated leader, such as a "Chief Integration Officer", can help keep the process on track. The IMO can also serve as a "culture lab", identifying and addressing cultural friction points before they escalate [33]. Rather than getting bogged down in functional checklists, focus on high-impact decisions, such as aligning operating models or R&D strategies.

The best acquirers treat integration as a skill to be refined over time. By investing in a dedicated team and continuously improving their approach, they ensure that each deal builds on the lessons of the last [33].

Conclusion: Making the Right Choice

An acquisition offer is a rare opportunity that can redefine your company's future. HubSpot co-founder Brian Halligan once shared that, despite the company’s valuation exceeding $30 billion, they received no "real, strong acquisition offers" over 18 years [5]. This highlights just how uncommon these moments can be.

When faced with an offer, it’s crucial to clarify your priorities. Are you aiming for a financial exit or seeking accelerated growth through new resources? If your independent trajectory appears stronger, it’s fair to set higher expectations [5][7]. The offer should align with your three-to-five-year vision, ensuring the buyer can genuinely contribute to achieving those goals [7].

Remember, you’re not just selling to a company - you’re selling to people. As Daniel Debow, VP of Product at Shopify, puts it:

"One of the most important things for founders to understand is that you are selling something to an executive, who has a problem. And as the startup CEO - you are that solution." [4]

Post-acquisition, a transition period is inevitable. Treat every meeting with the acquiring team as if it were a job interview; building trust early is essential for a smooth integration [4].

Preparation is only the first step. Expert guidance can make a significant difference. Research shows that skilled negotiation and an experienced advisory team can add an average of $2.3 million in deal value and speed up the process [1][3]. Engage M&A counsel early, maintain transparency with your board, and assemble a team capable of objectively assessing both the financial terms and the compatibility of company cultures. This methodical approach ensures your decision supports both your financial objectives and your broader mission.

Ultimately, the best decision isn’t just about the price tag. It’s about ensuring alignment with your goals, honoring your team’s efforts, and setting the stage for long-term success well beyond the closing date. Strong metrics, clear priorities, and a trusted team will guide you through this pivotal process.

FAQs

What should I evaluate to ensure an acquisition offer aligns with my company's goals?

When considering an acquisition offer, it's essential to weigh several critical factors to ensure it aligns with your company's plans and ambitions. Start by examining the financial terms and structure of the deal. Are the terms reasonable, and do they support your company’s growth trajectory?

Next, think about how the offer fits with your strategic goals and long-term vision. Consider its potential impact on your team, workplace dynamics, and standing in the market.

Take a close look at the valuation metrics to ensure they accurately represent your company’s value. Also, evaluate the potential synergies with the acquiring company. Will this partnership strengthen your ability to compete or innovate within your industry?

By carefully analyzing these aspects, you can make a thoughtful decision that positions your company for success both now and in the years ahead.

What steps should I take to prepare my company for the due diligence process during an acquisition?

To get ready for the due diligence process, start by gathering and organizing all your legal, financial, and operational documents. Make sure everything is accurate, up-to-date, and easy to access. A well-structured data room is key - include essential records like financial statements, contracts, intellectual property information, and compliance documents.

It’s also important to identify and address any potential risks ahead of time. These could include undisclosed liabilities, intellectual property conflicts, or regulatory concerns. Tackling these issues early can help you avoid unexpected problems that might delay or even derail the deal. At the same time, ensure your team is familiar with the due diligence process, which typically involves thorough reviews in areas like legal, financial, operational, and technical aspects.

Being well-prepared not only makes the process smoother but also strengthens your position during negotiations, setting the stage for a more seamless deal closure.

How do private equity and corporate buyers differ in how they value a company?

Private equity buyers tend to focus on financial performance when determining a company's value. They often rely on metrics like EBITDA multiples to gauge profitability and assess growth potential. Their primary goal is to identify opportunities for strong financial returns.

Corporate buyers, however, prioritize strategic synergies. They may assign a higher value to a company if it aligns with their broader objectives - whether that's increasing market share, streamlining operations, or incorporating new technologies. This emphasis on long-term strategic benefits can result in valuations that go beyond just financial metrics.