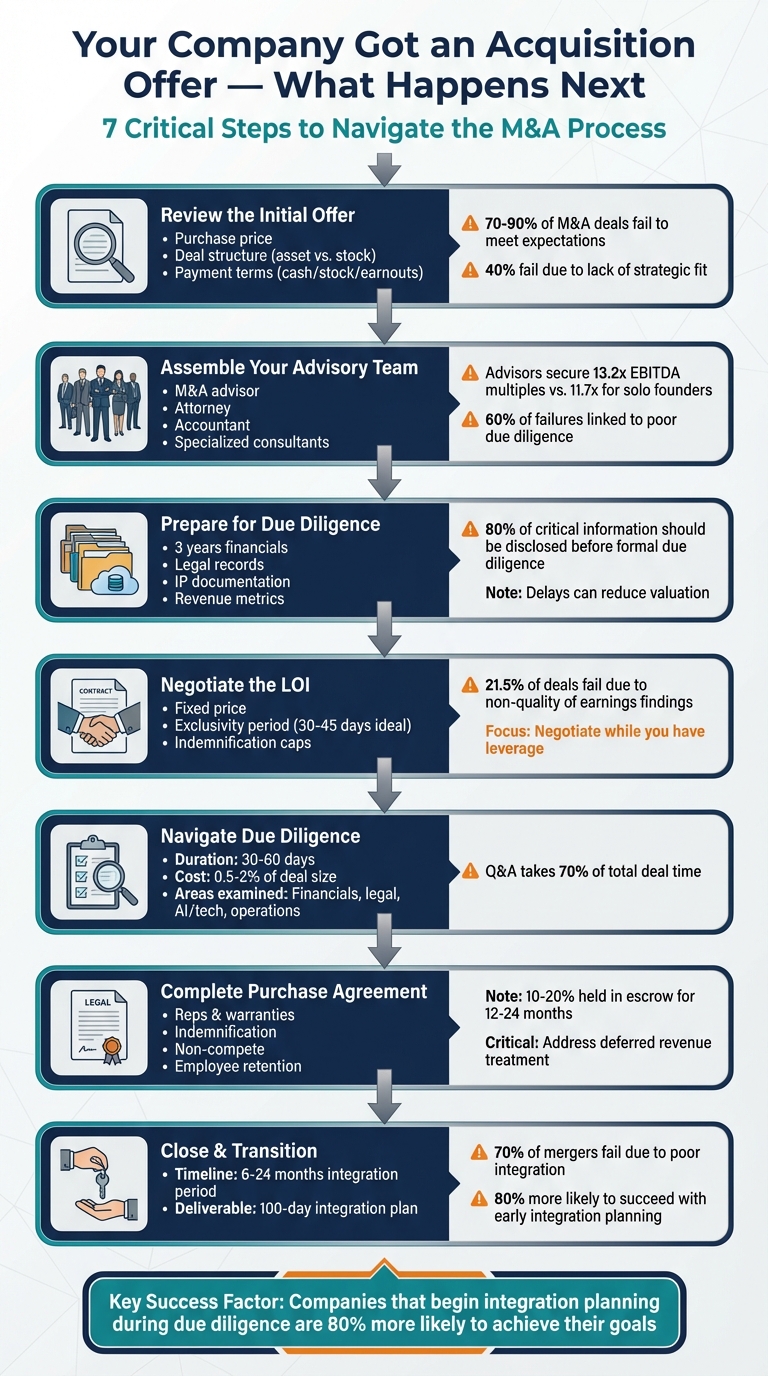

When your company receives an acquisition offer, it’s not just about the money - it’s about strategy, preparation, and making informed decisions. Most deals fail to meet expectations because founders lack a clear plan or fail to align with the buyer's goals. Here’s what you need to know:

- Review the Offer: Understand the purchase price, deal structure (asset vs. stock purchase), and payment terms (cash, stock, earnouts, etc.).

- Build Your Team: Hire an M&A advisor, attorney, and accountant to navigate the process and maximize your valuation.

- Prepare for Due Diligence: Organize financials, legal records, IP documentation, and operational data in a secure Virtual Data Room.

- Negotiate the LOI: Focus on clear terms for price, exclusivity periods, indemnifications, and working capital.

- Navigate Due Diligence: Address buyer concerns about financials, contracts, and operational risks.

- Finalize the Agreement: Ensure the purchase agreement covers all key terms, including post-sale responsibilities and employee retention.

- Plan the Transition: Develop a 100-day integration plan to ensure a smooth handover and retain key talent.

7-Step M&A Acquisition Process: From Offer to Close

Seller's 10 Steps in the M&A Process (10 Steps to Sell Your Business)

Step 1: Review the Initial Offer

The initial offer is rarely the end of the conversation - think of it as the opening move in a negotiation. At this point, your goal isn’t to accept or reject it outright but to carefully examine its details and implications before deciding what to do next.

Key Elements to Examine

Start by reviewing the purchase price and how it was calculated. Common valuation methods include Comparable Company Analysis, Discounted Cash Flow, or Precedent Transactions Analysis [3][4]. For smaller businesses, valuations often range between two to four times the seller's discretionary earnings [5].

Next, dig into the deal structure to understand what’s actually being sold. In an Asset Purchase, the buyer selects specific assets and liabilities, which can help avoid hidden risks [3]. A Stock Purchase, on the other hand, transfers ownership of the entire company, including historical liabilities and risks [3]. This distinction has major tax and legal implications.

Pay close attention to payment terms, which outline how and when you’ll get paid. These terms might include a mix of immediate cash, stock in the acquiring company, or contingent payments. Earnouts, for example, tie part of your payout to future performance targets like revenue or EBITDA [4]. Seller financing means you’re essentially loaning money to the buyer, with repayment structured over time [4][5]. Holdbacks involve keeping a portion of the purchase price in escrow until certain conditions are met after the deal closes [5].

"Prioritize key protections and allow your counsel to compromise on lesser points to improve deal outcomes." - Nathan O. Viehl, M&A Attorney, Thompson Coburn LLP [2]

Also, check for initial conditions that could derail the deal. These might include regulatory approvals, third-party consents for critical contracts, or clauses addressing "material adverse changes" in your company’s financial health [6]. Many buyers will also request an exclusivity period, typically lasting 30 to 90 days, during which you’re prohibited from negotiating with other potential buyers [6].

Deciding Whether to Move Forward

Deciding to proceed is about more than just the dollar amount on the table. Use multiple valuation methods to confirm the offer’s accuracy [4]. Keep in mind that 70% to 90% of M&A deals fail to meet expectations, and 40% of executives cite a lack of strategic fit as the main reason [8].

Consider whether the buyer brings operational benefits, cross-selling opportunities, or strategic advantages that align with your goals [7][9]. The importance of cultural alignment can’t be overstated - 83% of executives say cultural differences are the top reason acquisitions fail to deliver value [9].

Be on the lookout for warning signs. For example, if your top three customers account for more than 30% of your total sales, this concentration poses a significant risk [10]. Check for "change of control" clauses in key contracts, as these may require customer or supplier consent to finalize the deal [12][13]. Additionally, if your business heavily relies on you or a few key employees, the buyer may view this as a red flag [10][11].

Finally, don’t overlook the financial structure of the offer. While cash provides immediate liquidity, stock and earnouts depend on future performance and introduce uncertainty [7]. For deals under $2 million, about 52% include a seller transition period of one month or less [5]. Evaluating the total value package, rather than just the upfront price, is critical.

If the offer checks these boxes and aligns with your long-term objectives, it’s time to move to the next step. However, if you spot major red flags or the deal doesn’t feel like a good fit, it’s often better to walk away early rather than waste months on a deal that’s unlikely to succeed. Once you’ve assessed the initial offer, the next step is assembling an advisory team to guide your negotiation and due diligence efforts.

Step 2: Assemble Your Advisory Team

Once you've carefully reviewed your initial offer, the next step is assembling a strong advisory team. This is crucial because you're stepping into a process where the buyer likely has far more experience in acquiring companies than you have in selling one. Having the right team on your side isn't just helpful - it's a game-changer. Industry data shows that 70% to 90% of M&A deals fail to close, with 60% of failures linked to poor due diligence [15][16]. The right advisors can help ensure you’re maximizing your company’s value instead of leaving money on the table.

Who You Need on Your Team

Your M&A advisor or investment banker will lead the charge. They’ll handle everything from preparing your Confidential Information Memorandum (CIM) to screening potential buyers, managing the auction, and negotiating terms to secure the best valuation [14][18][19]. A real-world example? When Salesforce acquired Slack for $27.7 billion in July 2021, they brought in Qatalyst Partners as their buy-side advisor to bolster their negotiating power [20].

An M&A attorney is another essential member of your team. They’ll draft key documents, oversee legal due diligence, and ensure compliance with all regulations [14][18]. Similarly, an accountant or tax specialist will analyze earnings and advise on tax-efficient deal structures, helping you avoid unexpected liabilities [14][18].

For SaaS and AI companies, you’ll also want to bring in specialized consultants. These experts can evaluate technical debt, AI governance frameworks, and how well your proprietary data or AI models create a competitive edge [15][17]. Their insights are critical for determining whether your technology truly stands out in the market [25].

"Owners and their internal advisors are experts at operating and growing their business. But they'll likely be selling it to someone who's an expert in buying businesses. Which is something most owners only do once in a lifetime." - Torey Hinkson, Managing Director, Truist Securities [16]

With your core team in place, you can focus on selecting professionals to handle the daily grind of negotiations and execution.

Selecting the Right Advisors

Choosing the right advisors means finding people who combine expertise with the right personal fit. Start by interviewing multiple candidates, focusing on their experience with deals similar in size and industry to yours. Ask about their network, particularly with SaaS or AI buyers, and request references from founders who’ve been through similar transactions [18][22][23].

For SaaS and AI businesses, sector-specific knowledge is critical. Your advisors need to understand valuation metrics like Annual Recurring Revenue (ARR), Net Revenue Retention (NRR), and AI-related costs such as inference and R&D intensity [24][26]. Research shows that M&A advisors typically secure higher valuations - 13.2x EBITDA multiples on average - compared to 11.7x for founders who go it alone, a 1.5x difference [26].

It’s also essential to clarify who will handle the day-to-day work. Large firms may promise senior-level expertise but often delegate tasks to junior associates [17][20]. Boutique firms, on the other hand, tend to offer more hands-on, senior-level attention, which can be especially valuable for deals under $100 million [21][26]. And don’t overlook the importance of trust - this process can take 6 to 12 months and involves sharing sensitive information, so a strong working relationship with your advisors is key [22][26].

Be prepared for advisory fees. Retainers typically range from $25,000 to over $100,000 upfront, while success fees for deals under $100 million usually fall between 3% and 5% of the transaction value [15][17][23][26]. Many advisors offer a free initial valuation, which can be a helpful way to gauge their expertise and approach before making a commitment [22].

Step 3: Get Ready for Due Diligence

Now that you’ve got your advisory team in place, it’s time to tackle due diligence. This is the stage where buyers dig into every aspect of your business to make sure everything you’ve presented checks out. And it’s no small matter - 80% of all critical business information should be disclosed before formal due diligence begins [38]. Surprises at this point? They can derail the deal or slash your valuation.

"In a competitive M&A process, time kills deals. A disorganized or incomplete data room can delay diligence, erode buyer confidence, and even reduce valuation." - iMerge Advisors [31]

The solution? Preparation. Start organizing your data room well before you hit the market. A seller who’s ready with their documentation not only avoids delays but also positions themselves for a stronger valuation [31].

Documents You'll Need to Provide

To navigate due diligence smoothly, you’ll need to provide buyers with a complete set of documents that cover all corners of your business.

Start with three years of GAAP-compliant financial statements - including profit and loss statements, balance sheets, and cash flow reports - along with year-to-date financials formatted as SaaS P&L statements [28][31].

For corporate and legal records, ensure you have certificates of incorporation, bylaws, board meeting minutes, and a fully diluted cap table that accounts for SAFEs, options, and warrants [29][31]. On the intellectual property side, you’ll need to prove ownership of all software, code, trademarks, and patents. Missing employee or contractor signatures on IP assignments? That’s a red flag that can hurt your valuation [27][29]. Also, double-check that all third-party tools, APIs, and frameworks used in your development are properly licensed [27].

Buyers will take a close look at your revenue metrics, so have detailed reports on Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), churn rates, and Customer Acquisition Cost (CAC) ready to go [27][31]. Include a billing register covering the past three years to validate revenue streams [29]. If you’re in the AI space, be prepared to document your training data sources, licensing agreements, and model performance metrics to address compliance and bias concerns [31].

On the human resources front, provide an employee census that lists hire dates, roles, salaries, bonus structures, and locations [27][28]. For material contracts, organize active customer agreements, vendor contracts, and partnership NDAs [29][31]. It’s also a good idea to prepare a Quality of Earnings (QoE) report ahead of time - it can speed up the financial review process and strengthen your position during negotiations [31].

Creating a Data Room

Once your documents are organized, the next step is to secure them in a Virtual Data Room (VDR). A good VDR not only streamlines the review process but also protects sensitive information. Look for providers that offer 256-bit AES encryption, multi-factor authentication (MFA), and certifications like SOC 2, ISO 27001, or GDPR [32][33]. Some popular options include Firmex, Datasite, and ShareVault [31].

Structure your VDR with main folders like Financials, Legal, IP, and HR, and use clear subfolders for easy navigation [34][36]. Industry-standard index templates can help you set this up quickly and professionally [35]. Many modern VDRs also come with tools to make your life easier - automated indexing can cut structuring time by 90%, while AI-powered redaction tools are highly effective at scrubbing sensitive data for compliance [30].

Set up tiered permissions to control access at the folder or document level. Options might range from "View Only" (no downloading or printing) to "Full Admin" [32][35]. Use dynamic watermarks that display the user’s email and IP address, and consider time-limited access to prevent leaks [32][33]. Also, require all users to sign a non-disclosure agreement (NDA) upon their first login [32]. For added security, you can even use a random project name to keep the process anonymous [32].

Enable audit trails to log every view, download, and login [33][37]. This not only provides a record of disclosure but also helps you gauge what buyers are focusing on. Before going live, always use the "view as" feature to confirm that permissions are set up correctly [32][35].

"A virtual data room offers advanced security, permissions, and audit trails that basic cloud storage can't match - ensuring that governance documents stay protected, compliant, and fully traceable." - Kira Ciccarelli, Senior Manager of Research and Programs, Diligent Institute [33]

A cautionary tale? Look no further than Yahoo’s 2016 sale to Verizon. Late-stage revelations about massive data breaches led to a $350 million reduction in the final purchase price [39]. Don’t let preventable mistakes cost you millions.

Step 4: Negotiate the Letter of Intent (LOI)

Now comes the critical step of negotiating the Letter of Intent (LOI), which outlines the main terms of the deal. Once the LOI is signed, the exclusivity period begins, giving the buyer more leverage.

"For most sellers, how you negotiate the LOI holds more significance than how you negotiate the purchase agreement." – Narin de Saini, Ascenta

The LOI includes both binding and non-binding terms. Binding clauses - such as confidentiality, exclusivity (also called the "no-shop" period), and cost allocation - are enforceable even if the deal doesn’t close. Non-binding terms, on the other hand, cover aspects like the purchase price, payment structure, and closing conditions, which can still change during due diligence. It’s essential to have your attorney clearly mark which sections are binding to avoid unintended legal consequences.

Terms to Prioritize

Aim for a fixed purchase price instead of a range, and break down how it will be paid - whether through cash, stock, seller notes, or rollover equity. If the deal includes an earnout, ensure the performance metrics, accounting standards, and control requirements are clearly defined.

Another key area is the working capital peg, which reflects the normalized net working capital (Accounts Receivable + Inventory + Prepaid Expenses minus Accounts Payable + Accrued Liabilities) at closing. Specify whether this calculation will follow GAAP standards or your existing accounting methods.

Pay close attention to indemnification terms, which define your liability after the deal closes. This includes limits on how much you could owe (the "cap"), the minimum claim threshold (the "basket" or "deductible"), and how long the representations and warranties remain enforceable (the "survival period"). Sellers are often advised to limit the survival period to about 12 months and cap indemnity exposure at 10% of the purchase price.

The exclusivity period is another critical point. While buyers often request 60 to 90 days, sellers should push for a shorter window - preferably 30 to 45 days - to reduce the time spent off the market. You might also want to include a clause that cancels exclusivity if the buyer attempts to significantly lower the purchase price (e.g., by 20%) during due diligence.

"We've seen LOIs where buyers ask for 180 days. This can create an 'alligator roll,' where you're out of the market for so long, the buyer thinks they can lower the purchase price. You're in a death grip." – Joe Hogg, Managing Director, Global Wired Advisors

| Term | Seller's Ideal Position | Buyer's Typical Position |

|---|---|---|

| Exclusivity Period | 30–45 days | 60–90+ days |

| Purchase Price | Fixed cash at closing | Earnouts and holdbacks |

| Reps & Warranties | 12-month survival; 10% cap | 18–36 month survival; higher caps |

| Working Capital | Based on historical methods | Based on strict GAAP |

With these terms clearly outlined, you’ll be in a stronger position as you move forward with negotiations.

Effective Negotiation Strategies

Once you’ve defined your terms, focus on negotiation tactics to protect your interests. One of the most effective strategies is attracting multiple buyers. Competing offers can drive up the purchase price and improve the deal terms. Address contentious issues - like indemnification caps, earnout terms, and non-compete agreements - early in the process while you still hold leverage, rather than waiting until the definitive agreement stage.

For unresolved terms, use provisional language to keep the process moving forward. Setting clear milestones in the LOI for due diligence, drafting the definitive agreement, and targeting a closing date can help maintain momentum.

Be strategic about releasing sensitive information. Create a timeline for data access, and hold off on sharing highly sensitive details - like your top customer lists - until late in the due diligence phase to protect proprietary data.

Research shows that 21.5% of deals with signed LOIs fail due to non-quality of earnings findings, and 15.4% collapse because of discrepancies in EBITDA. By ensuring your LOI terms are clear and precise, you can reduce the likelihood of these issues derailing your transaction.

sbb-itb-9cd970b

Step 5: Navigate the Due Diligence Process

Once the LOI is signed, the due diligence phase begins - a deep dive into every claim and detail presented earlier. This stage, which usually lasts 30 to 60 days, is where buyers put everything under a microscope. In fact, the Q&A portion of due diligence alone can take up about 70% of the total deal time [42].

"The due diligence process is where deals are made - or broken. Buyers will scrutinize every detail of your financials, operations, contracts, and risks." – HCVT

During this phase, buyers verify your claims and look for any hidden liabilities. For SaaS and AI companies, the process extends beyond financials to include specialized reviews of data rights, AI infrastructure, and technical debt. The costs of M&A due diligence typically range from 0.5% to 2% of the total deal size [40], reflecting the depth of these evaluations.

What Buyers Will Examine

Buyers dig into several key areas during due diligence:

- Financials: They verify earnings, assess debts, and review tax filings to ensure your revenue is stable and not inflated by one-off events. This involves a closer look at recurring revenue trends and customer retention.

- Legal Matters: Contracts, intellectual property, and litigation are closely reviewed. Buyers confirm that employees and contractors have signed IP assignment agreements and that open-source code licenses are properly documented.

- AI-Specific Concerns: For AI companies, data usage is a major focus. Buyers will check if you have the legal authority to use data for training, testing, and deployment. They’ll also scrutinize your compliance with privacy laws, ownership of algorithms and model weights, and reliance on third-party models.

- Technical Infrastructure: Buyers assess the scalability and costs of your systems, including compute capabilities and cybersecurity measures (e.g., SOC 2 or ISO 27001 certifications). They’ll also evaluate your technology stack for potential technical debt and ensure that trade secrets are well-protected.

- Operational Strength: This includes analyzing your supply chain, production processes, and whether the business can thrive without your daily involvement. Retaining specialized AI talent and maintaining relationships with external research partners are also critical concerns.

| Due Diligence Area | Traditional Software Focus | AI/SaaS Specific Focus |

|---|---|---|

| Technology | Source code functionality and performance | Data sourcing, manipulation, and training processes |

| IP Protection | Copyright and patents | Trade secrets and data rights |

| Pricing Model | Per-seat or license-based | Risks to per-seat models if AI reduces human labor needs |

| Infrastructure | Standard cloud/server costs | High-cost compute and specialized AI hardware |

These thorough reviews help buyers identify potential risks and set the stage for addressing any concerns.

Addressing Buyer Concerns

When risks or issues emerge during due diligence, it doesn’t necessarily mean the deal is off the table. However, how you handle these concerns can make or break the acquisition.

Be proactive in resolving issues like financial inconsistencies, legal disputes, or regulatory compliance gaps before the deal closes. Buyers often seek contractual protections - such as warranties, representations, and indemnities - to manage risks, so being transparent and cooperative is key.

If due diligence uncovers problems that impact your company’s valuation, tools like earnouts (future performance-based payments) or vendor take-back (VTB) financing can help bridge the gap. These mechanisms allow both parties to proceed despite valuation disagreements.

For operational concerns, such as high employee turnover or reliance on key individuals, consider implementing retention plans with employment contracts or incentives to keep critical staff post-acquisition. Similarly, if supplier or customer concentration raises red flags, determine whether this reflects broader industry trends - this perspective can help reassure buyers.

It’s not uncommon for buyers to renegotiate terms if significant risks are identified. This might involve adjusting the purchase price, modifying the deal structure, or including additional holdbacks to address uncertainties. While renegotiation can be frustrating after reaching the LOI, remember that buyers are also invested in closing the deal. Staying flexible and solution-focused can keep the process on track.

"You're never going to have a deal without risk. The goal is to try to minimize the surprises post-close." – Mark Meloche, Director, Growth & Transition Capital, BDC

Step 6: Complete the Purchase Agreement

After completing due diligence, the next step is to finalize the purchase agreement. This document cements all negotiated terms and serves as the foundation for transferring ownership. Beyond the ownership transfer, it also outlines responsibilities after the deal closes, establishes dispute resolution processes, and lays out plans for managing employees and customers. For SaaS and AI companies, these agreements often include specific clauses addressing intellectual property, data rights, and strategies to ensure customer contracts remain intact.

"Legal readiness is about value protection, not just value creation." – Omeed Tabiei, M&A Lawyer [45]

Key Components of the Agreement

A well-crafted purchase agreement includes several essential sections designed to protect both parties and ensure a seamless transition:

- Representations and Warranties: These are factual statements about the business, such as confirming intellectual property ownership or the accuracy of financial records. For SaaS and AI companies, warranties may also cover data ownership, adherence to privacy laws (like GDPR and CCPA), and the legitimacy of datasets used in training AI models [44]. Getting these details right is crucial to avoid future liabilities.

- Indemnification Clauses: These clauses determine who is responsible for covering losses due to breaches or undisclosed liabilities. To mitigate risk, sellers often agree to place a portion of the purchase price in escrow during a post-closing period, which can be used to address potential claims.

- Non-Compete and Non-Solicitation Agreements: These provisions limit competitive activities and the solicitation of key stakeholders for a specified period. In SaaS and AI deals, buyers may push for broader restrictions to prevent work on similar technologies.

- Employee Retention Terms: To maintain business stability, buyers frequently require assurances that key team members - like engineers, data scientists, and sales staff - will stay on post-acquisition. This may involve retention bonuses, employment contracts, or stay packages that vest over time.

- Change of Control Provisions: Many customer and vendor contracts include clauses allowing for termination or renegotiation if the company is sold. It's essential to review these contracts ahead of time and create a communication plan for any affected parties [45].

With these terms in place, the focus can shift to managing transaction costs and addressing financial considerations.

Planning for Transaction Costs

The purchase price is just one piece of the puzzle - transaction costs like legal, financial, and advisory fees also need to be factored in. Additionally, SaaS companies must navigate sales tax compliance. Following the Wayfair ruling, SaaS businesses are required to meet sales tax obligations in states where they surpass revenue thresholds. Any unresolved tax liabilities uncovered during the final review could result in holdbacks from the purchase price [43].

If there's a gap between the buyer's offer and your valuation expectations, consider using an earnout structure. With this approach, part of the payment is tied to future performance metrics, such as ARR targets or customer retention rates [44][46]. While earnouts can bridge valuation differences, they come with risks since a portion of your compensation hinges on the company’s post-acquisition success.

"Buyers should consider explicitly expressing how they wish to treat deferred revenue in their letter of intent to avoid potential disputes later in the process." – Dan Brumwell, Partner at Weaver [43]

Finally, address deferred revenue treatment in the agreement. For companies with annual or multi-year contracts, deferred revenue - payments received upfront for services not yet delivered - can be a significant factor. Buyers often view deferred revenue as "debt-like" and may adjust the purchase price to account for it. By clarifying how deferred revenue will be handled, you can minimize disputes and avoid unexpected holdbacks.

Step 7: Close the Deal and Plan the Transition

Once the due diligence is complete and the purchase agreement is signed, the focus shifts to two critical steps: closing the deal and planning a seamless transition. These final stages are essential to ensure the success of the transaction.

What Happens on Closing Day

In today’s digital world, most closings take place virtually, with documents signed electronically and managed by an escrow agent [47]. The process involves two main components: the acquisition closing, where ownership of assets or stock is transferred, and the financial closing, where lenders provide the necessary funding to the buyer to complete the payment [50].

Closings can happen in one of two ways. They might occur simultaneously, where ownership and funds are exchanged at the same time. Alternatively, they can happen in stages, especially when regulatory approvals create delays between signing and closing [47]. Between 2018 and 2022, about 40% of transactions faced delays in the pre-closing stage due to regulatory hurdles [48].

On the actual closing day, several key documents are executed, including the Purchase Agreement, Bill of Sale, IP Assignments, Officer Certificates, Corporate Resolutions, and a Closing Statement [47][49].

"An M&A attorney will earn every penny of their fee – they've been through the process countless times and will help eliminate surprises." – Jacob Orosz, President, Morgan & Westfield [47]

It’s common for 10–20% of the purchase price to be held in escrow for 12–24 months after the deal closes [48]. To avoid any last-minute issues, your M&A advisor should conduct a closing rehearsal beforehand to ensure all paperwork is in order and signatures are complete [47]. Additionally, confirm fund transfers - via wire or certified check - at least three business days in advance to prevent banking delays [47].

One important point: maintain regular business operations until the deal officially closes. Keep up with payroll, manage inventory levels, and avoid making significant changes without the buyer’s consent. Any unexpected deviations could jeopardize the deal at the last minute [47]. Keep communication open with the buyer during this time - trust is the glue that holds the deal together until the finish line [47].

Managing the Post-Acquisition Period

Once ownership transfers and funds are received, the focus shifts to integrating operations. This post-acquisition phase can last anywhere from 6 to 24 months, depending on the complexity of the deal [51]. Unfortunately, 70% of mergers fail due to poor integration planning [51], making this stage as important as the transaction itself.

Start by creating an Integration Management Office (IMO). This cross-functional team, made up of members from both companies, will oversee the integration process, resolve conflicts, and ensure the plan is executed effectively [51][53]. Companies that begin integration planning during the due diligence phase - rather than waiting until after closing - are 80% more likely to achieve their goals [53].

There are three main approaches to integration:

- Full Integration: Combines all operations, functions, and cultures into one unified entity, aiming for maximum efficiency.

- Partial Integration: Merges specific areas, such as Finance and HR, while keeping core operations independent to maintain their strengths.

- Standalone Operations: Leaves the acquired company largely intact, preserving its brand and leadership, which is ideal when its culture or identity is a key asset [51][56].

Cultural alignment is another critical factor. Differences in leadership styles, values, and work norms can derail even the best-laid plans. About 30% of failed M&A deals are attributed to cultural clashes [58][60]. For example, Disney’s acquisition of Pixar succeeded because Disney preserved Pixar’s creative independence, while Sprint and Nextel’s merger fell apart due to incompatible technologies and cultural friction, resulting in a $30 billion write-down [51][55][56].

Retaining key talent is equally important. Identify essential employees early and implement strategies like retention bonuses or career development plans to keep institutional knowledge intact [54][57]. Similarly, assign teams to manage customer relationships during the transition to minimize client attrition [58].

Develop a detailed 100-day plan to guide the initial integration. This plan should address operational continuity, onboarding for employees, and immediate wins to build momentum [56]. Appointing a dedicated Integration Lead with the authority to make decisions can also help drive the process forward [53][54].

Standardizing systems and data is another priority. Audit IT infrastructures, ERP, and CRM systems to identify what needs to be migrated or consolidated. This is especially important because 53% of companies report experiencing significant cybersecurity challenges during mergers and acquisitions [59].

"Communication must deliver 'the right information, at the right time, through the right channel, with the right context.'" – Firstup Manifesto [52]

Clear communication is essential. Tailor your messaging to different audiences - employees, customers, and vendors - and use multiple channels to reduce uncertainty and prevent rumors [52]. Document all critical business processes, as much of this knowledge may only exist in the minds of key employees [54]. Companies that excel at integration can see up to a 9% increase in the overall value of the deal [61]. Just as thorough due diligence protected the deal’s value early on, a disciplined integration process ensures that value is fully realized.

Conclusion

An acquisition offer is just the beginning of a challenging journey that requires careful planning and strategic decision-making. From evaluating the initial offer to navigating due diligence, negotiating the LOI, and ensuring a smooth post-acquisition integration, every step demands attention and a clear strategy.

Studies reveal that many deals fail to meet expectations [1][63]. These missteps often stem from rushed decisions, lack of preparation, or poor integration planning. However, such outcomes are avoidable. By focusing on critical elements - building trust with the acquiring team from the outset, setting up clear governance frameworks, and involving integration teams early during due diligence - you can sidestep common pitfalls [1].

For SaaS and AI companies, the stakes are even higher. With 64% of SaaS buyers being non-technical, having clear documentation and a strong business model is non-negotiable [62]. As discussed earlier, addressing technical and operational due diligence is especially crucial for these industries. AI companies face unique scrutiny, as buyers evaluate whether their technology offers a "Revolution", "Transformation", or "Augmentation" opportunity [41]. For example, in October 2025, a financial sponsor assessing an AI-driven healthcare company worked with Bain's diligence team to create an "outside-in" prototype. The analysis revealed that the company’s technology could be easily outperformed by established players, prompting the sponsor to reconsider the deal [41].

"In today's market, the edge belongs to those who master AI diligence and know when to bet big and when to walk away." – Bain & Company [41]

FAQs

What should you do after receiving an acquisition offer?

When you receive an acquisition offer, the first step is to clearly define your goals for the deal. Ask yourself: What does success mean for your company in this context? Having a clear vision will help guide your decisions throughout the process.

Next, get ready for the due diligence phase. This means organizing all your financial records, legal paperwork, and operational data. A well-prepared and transparent approach can make this stage smoother and build trust with the acquiring party.

Communication plays a huge role during this time. Keep your employees and clients in the loop to maintain their trust and ensure stability. Transparency can go a long way in easing concerns and avoiding unnecessary disruptions.

As the deal moves forward, prioritize a smooth integration of teams, technology, and workflows. Retaining key employees is critical, so address their concerns and consider offering incentives to encourage them to stay. At the same time, anticipate potential hurdles and tackle them head-on. Setting up a dedicated integration team can help monitor progress and ensure the transition stays on track with your overall goals.

Preparation and adaptability are your best allies in navigating this complex process effectively.

How do cultural differences affect the success of an acquisition?

Cultural differences play a big role in shaping the success of an acquisition. When companies have conflicting values, communication styles, or workplace habits, it can make it harder to bring teams together, keep customers happy, and align on shared goals.

If these cultural gaps go unaddressed, they can lead to misunderstandings, less teamwork, and even employees leaving the company. Taking the time to identify and address these differences early on is key to ensuring a smoother transition and setting the stage for long-term success after the acquisition.

What documents should be included in a due diligence data room?

A due diligence data room should house all the critical documents that offer a transparent view of your company's operations, financial health, and legal framework. These typically include:

- Financial records: This means audited financial statements, tax filings, and balance sheets that show your company’s fiscal standing.

- Contracts and agreements: Things like customer or supplier contracts, partnership agreements, and vendor arrangements are key here.

- Legal and compliance documents: Include regulatory filings, intellectual property records, and any details about ongoing or past litigation.

- HR and employment records: Employee contracts, compensation structures, and benefit plans should be readily available.

- Insurance policies: Provide details on coverage and a history of claims.

Having these documents organized in a secure and clearly structured data room not only speeds up the due diligence process but also builds confidence with potential buyers and minimizes unnecessary holdups.