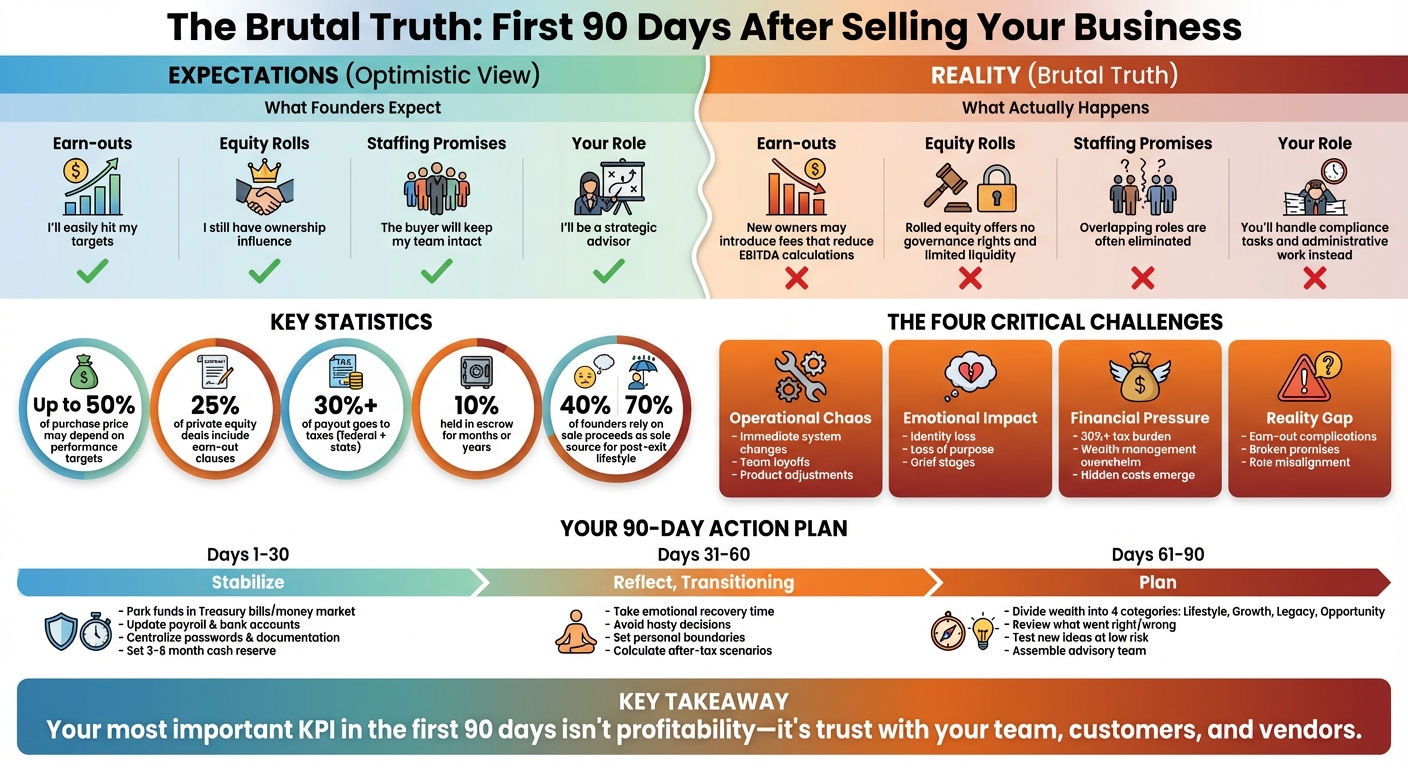

When you sell your business, the first 90 days can be far more challenging than you might expect. Here's what you need to know:

- Operational Chaos: Buyers often make immediate changes - new systems, layoffs, and product adjustments - causing disruptions for your team and customers.

- Emotional Impact: Selling your business can leave you feeling lost, as your identity and purpose were likely tied to it.

- Financial Pressure: Taxes can take over 30% of your payout, and managing your newfound wealth may feel overwhelming.

- Reality vs. Expectations: Earn-outs, staffing promises, and your role post-sale often don't align with what you envisioned.

To navigate this period successfully, plan ahead for integration challenges, take time to adjust emotionally, and avoid rushing into financial or career decisions. Use this transition to reflect, regroup, and prepare for your next move.

Expectations vs Reality: What Happens After Selling Your Business

Common Myths About Selling Your Business

What Founders Expect vs. What Actually Happens

When SaaS and AI founders decide to sell their businesses, they often walk into the process with expectations that don't quite match reality - especially during the first 90 days after the sale. Take the "Nothing Will Change" myth, for example. Many believe their company will continue operating as it always has. But in practice, buyers often make sweeping changes: revamping product offerings, redesigning websites, and replacing internal systems like accounting and marketing to fit their own workflows [1]. What seemed like a well-oiled machine can quickly feel like a construction zone.

Another widespread misconception is the "Team Safety" myth. Founders often trust initial promises that the team will remain intact. However, layoffs are common - particularly among overlapping management roles. Without negotiating severance packages upfront, your loyal team could face unexpected reductions [1]. Then there's the "Guaranteed Payout" fallacy, where founders assume they'll pocket the full sale price. The truth? Up to 50% of the payout might hinge on performance targets, with nearly 25% of private equity-backed deals including earn-out clauses that tie payments to future milestones [8].

And let’s not forget the "Instant Freedom" fantasy. Many founders dream of walking away immediately post-sale, but the reality is often far from that. Instead of relaxing, they find themselves buried in administrative tasks, delaying any sense of personal freedom [1]. Plus, transitioning from being the ultimate decision-maker to a figurehead with little authority can be a tough adjustment [1][8].

These myths underscore how critical it is to understand the fine print of your deal, as it can significantly shape your post-sale experience.

How Deal Structures Shape Your First 90 Days

The structure of your deal plays a huge role in determining whether your transition is smooth or chaotic. For instance, cash deals offer the simplest exit - you get paid upfront, handle immediate tax obligations (which can exceed 30% when combining federal and state rates), and are free to move on [6]. But most SaaS and AI exits are far more intricate.

Take earn-outs, for example. These arrangements often require you to stay involved in the business to meet specific EBITDA or revenue targets. Complicating matters, buyers may introduce new costs or obligations that make hitting these targets harder [8]. Escrow provisions can also delay access to up to 10% of the sale price, holding those funds back for months - or even years - to cover unforeseen liabilities [8]. And if you roll equity into the new entity, you’ll likely find yourself at the bottom of the repayment chain, with bank debts and other obligations taking priority [8].

Consider Justin Klemm’s story. In 2014, he sold his bootstrapped SaaS company, Ghost Inspector, to Runscope and stayed on as an employee for 18 months. This involvement gave him the opportunity to repurchase the company later at 20 times its original value. He eventually sold it again in 2022 to SureSwift Capital for a much higher valuation [4]. His journey highlights how flexible deal structures can open doors - but only if you're ready to handle the challenges that come with them.

To better understand how expectations can differ from reality, here’s a breakdown of key deal components:

| Deal Component | What Founders Expect | What Actually Happens |

|---|---|---|

| Earn-outs | "I'll easily hit my targets" | New owners may introduce fees that reduce the EBITDA used for calculations [8] |

| Equity Rolls | "I still have ownership influence" | Rolled equity typically offers no governance rights and limited liquidity [8] |

| Staffing Promises | "The buyer will keep my team intact" | Overlapping roles are often eliminated as buyers tighten their criteria [1] |

| Your Role | "I'll be a strategic advisor" | You'll likely handle compliance tasks and administrative work instead [1][8] |

Operational Problems and Integration Issues

Integration Problems in SaaS and AI Businesses

Once the sale is finalized, the process of dismantling and rebuilding the business begins almost immediately. The new owners often replace existing SaaS tools - accounting software, marketing platforms, and operational systems - with their preferred alternatives [1]. For the remaining staff, this can mean a steep learning curve during an already uncertain time when job security feels fragile.

Unresolved technical issues and undocumented code can complicate the transition. If you’ve left behind what SureSwift Capital refers to as "tech mysteries", you're essentially passing along a significant challenge to the new team, potentially disrupting the entire transition process [4]. A real-world example comes from Brandon Pindulic, who sold OpGen Media in March 2021. Although his financial records were clean for tax purposes, they lacked the detailed reporting required by private equity buyers. This oversight forced him to hire a fractional CFO to address these gaps [12].

"Too much tech debt will sink a SaaS business before it even gets acquired... if you leave the new owners with an absolute mess of code, you're handing down a huge, time-consuming headache as your legacy."

- SureSwift Capital [4]

Beyond technology, administrative updates often catch founders off guard. Tasks like updating payroll systems can take weeks [1][10]. Payroll continuity is non-negotiable - missing the first paycheck destroys employee trust, so setting up new bank accounts and payroll systems must be a top priority in Week 1 [10]. Financial leakage is another risk: legacy vendor invoices or personal expenses tied to old company credit cards can slip through if not carefully monitored [9].

Tackling these integration challenges demands a well-thought-out plan, which is outlined below.

How to Manage Operational Changes

To navigate operational challenges effectively, a structured 90-day roadmap is essential. Develop a 90-day plan that outlines changes by department - Finance, HR, Sales, and Operations [11]. Take a phased approach: dedicate the first month to learning and gathering team input, use the second month for detailed planning without implementing major changes, and begin execution in the third month [13].

Security and compliance should be addressed immediately. Centralize all business passwords using tools like 1Password or NordPass, and document how customer data is collected and stored [4]. Separate personal accounts from business ones before closing the deal to ensure new owners receive clean, organized historical data [4]. For SaaS companies, conducting code reviews and using automated testing tools like Ghost Inspector can help clarify system functionality [4].

Maintaining staff stability is key. Offer retention bonuses or incentives to key employees, such as developers or managers, to retain institutional knowledge during the first 90 to 180 days [13]. Immediately cancel all previous company credit cards and audit payroll to remove any ineligible recipients, like family members or former employees [9]. Most middle-market deals include a 90- to 180-day working capital settlement period to finalize the opening balance sheet, so be prepared for ongoing financial adjustments during this time [9].

"During the initial 90 days, your most important KPI isn't profitability or cash flow. It's trust with your team, your customers, and your vendors."

- Sam Rosati, Founder, SMBootcamp [10]

Emotional Struggles and Identity Loss

Why Founders Feel Lost After Selling

When the funds from a sale land in their account, many founders expect to feel relief. Instead, they often find themselves disoriented and unsure of what comes next [7]. Statistically, only 1 in 10 startups succeed, and for those who reach the milestone of a liquidity event, the period after the sale can feel more challenging than running the business itself [14].

Years of building a business often intertwine a founder’s identity, status, and daily purpose with the company’s success. Once the business is sold, the role of the "wartime CEO" who thrives in problem-solving and decision-making is no longer needed [7][2]. Without that identity, even simple daily interactions can feel unfamiliar and uncomfortable [2]. Entrepreneur Jeff Giesea captures this sentiment perfectly:

"When you spend years architecting your life around a business and suddenly it's gone, you're probably going to have an identity crisis" [2].

Dr. Daniel Lerner, Founder of Strategic Family Solution, LLC, adds:

"Quality of life and mental health after the sale is highly correlated on who you were and what you valued while building your business" [7].

Dr. Kim Henderson, Head of Wealth Management Health and Wellness Education at Morgan Stanley, echoes these thoughts, explaining that selling a business you’ve nurtured can trigger feelings of grief, often following the stages of denial, anger, bargaining, depression, and acceptance [7]. Notably, 40% of business owners who sold without a post-exit plan later regretted their lack of preparation [15]. Some even become so restless that they attempt to repurchase their business a few years later [5].

For SaaS founders who transition into corporate roles post-sale, the adjustment can be especially jarring. After years of being the decision-maker, working as an employee within a larger organization often leads to frustration and a sense of losing direction [1][2]. The passion that once fueled their efforts often fades within months of the sale [1].

Understanding these emotional shifts is essential to preparing for life after the sale and finding a new sense of purpose.

Creating Your Personal 90-Day Recovery Plan

Navigating the emotional turbulence of a business sale requires a thoughtful approach, and a 90-day recovery plan can help you regain balance both personally and professionally. Treat these first 90 days as a time to pause and reflect, not rush into your next venture. Avoid making hasty decisions or deploying capital immediately. Instead, park your proceeds in safe, easily accessible accounts like Treasury bills or money market funds, giving yourself the space to think clearly without financial pressure [2][6]. Around 50% of entrepreneurs find that taking this time to rest and recharge physically and mentally is crucial before making any major post-sale moves [15].

Replace the structure your business once provided with new, measurable personal goals. Rather than diving into investment strategies, focus on activities that bring structure to your days - whether that’s reconnecting with loved ones, traveling, or rediscovering hobbies that were sidelined during the demanding years of building your business [2][15]. Jodie Cook, a founder who successfully navigated this transition, shares:

"If you're a Type A personality... you might struggle to feel fine not knowing who you are, what's next and how to spend your time" [3].

It’s also important to set clear social boundaries early on. Have open conversations with former colleagues about how to stay connected without becoming involved in business matters that are no longer your responsibility [7]. George Deeb, Managing Partner at Red Rocket Ventures, advises:

"Your 'baby' is grown up now and post-sale is somebody else's 'teenager' to worry about, not yours" [1].

Avoid offering unsolicited advice to the new owners - chances are, it won’t be well-received.

Before committing to a new role or identity, experiment with low-pressure opportunities like mentoring or serving on boards [3][16]. Begin exploring non-financial goals that can fill the purpose void left by selling your business. This might include joining nonprofit boards, starting passion projects, or connecting with networks of other entrepreneurs who’ve experienced similar transitions [6][15]. Finding a new professional community can help replace the camaraderie and sense of belonging that business ownership once provided.

Taking these steps not only helps address the emotional challenges of selling your business but also lays the groundwork for tackling the financial and operational decisions that come next. A structured recovery plan ensures you’re better equipped to move forward with clarity and purpose.

sbb-itb-9cd970b

Financial Realities and Risk Management

Managing Your Money After the Sale

When the proceeds from your sale hit your account, it’s a game-changer: for 70% of founders, these funds become the sole source for financing their post-exit lifestyle [25]. Matthew Lang, a Certified Financial Planner and Private Wealth Advisor at Morgan Stanley, sums it up well:

"Threading the needle of personal, financial and business planning leads to a better post-sale outcome" [25].

To start off on the right foot, consider pausing for 90 days. During this time, park your funds in Treasury bills or money market accounts and run a "dry run" analysis. This means calculating your after-tax outcomes under best, base, and worst-case scenarios [2][22]. Why? Many founders underestimate hidden costs that were previously covered by their business, like vehicles, travel, or insurance premiums. Amy Kux, CFO at Unbabel, notes:

"Cash management in the early stages is one of the hardest things" [21].

Set up a cash reserve to cover three to six months of essential expenses [23]. Then, divide your remaining funds into specific categories: Lifestyle, Growth, Legacy, and Opportunity. Treat your post-sale budget with the same discipline you applied to quarterly business forecasts. Track your monthly burn rate carefully to avoid ending up asset-rich but cash-poor [22].

If your deal includes earn-outs or stock-based payments, keep in mind that up to 50% of the purchase price might be paid over time [8]. This means the liquidity you have right now may be far less than the headline figure suggests. Once you’ve sorted out your liquidity strategy, it’s time to tackle the tax and investment challenges ahead.

Tax and Investment Considerations

As you secure your funds, navigating tax obligations becomes a top priority. Capital gains tax is due immediately after the sale, and it’s often larger than expected. The exact amount depends on your jurisdiction and deal structure - an asset sale, for instance, has different tax implications than a share purchase [19]. Aventis Advisors recommends:

"It's advisable to work with a tax advisor or financial planner who can help you understand the tax implications of your sale, identify strategies to minimize your tax liability, and guide you in investing and managing your post-sale finances" [19].

Your deal structure also impacts tax timing. Stock-based compensation or earn-out payments, for example, can create deferred tax liabilities [19]. These aren’t unusual - nearly 25% of private equity-backed deals include contingent considerations that are paid after the closing date [8].

To stay ahead, consider using AI-based tax planning tools for predictive scenario analysis [18]. As Jacobson Lawrence & Co explains:

"AI enables predictive tax planning by analyzing historical data and modeling potential tax scenarios based on projected business performance" [18].

If your sale involves international entities, you’ll need to navigate cross-border tax regulations, VAT/GST compliance, and GDPR requirements [17]. Don’t forget about R&D tax credits - prior investments in innovation might qualify for credits that reduce your tax liability [18].

Certain strategies can also help you defer taxes. For instance, if you sold to an ESOP, Section 1042 rollovers allow you to defer federal and state taxes by reinvesting in qualified replacement property [20]. Additionally, in the year of your sale, consider "charitable bunching." Making a significant donation to a Donor Advised Fund can offset high ordinary income taxes. And don’t overlook estate planning - the federal estate tax exemption is set to increase to approximately $15 million per person in 2026 [6].

It’s crucial to assemble your advisory team early, ensuring your tax, estate, and investment decisions are aligned [24]. The CPA who managed your business might not be the best fit for handling your personal wealth post-exit. As Justin Fisher, Partner at Moss Adams, points out:

"Business owners are very intentional about the value creation of their business; but at times, they aren't as intentional about the value creation of their wealth as a family operator" [24].

Planning Your Next Move

Reviewing What Went Right and Wrong

After completing the sale of your business, it’s crucial to step back and analyze what worked and what didn’t. Start by looking at how the earn-out terms played into the overall outcome. Did they affect performance metrics in ways you didn’t anticipate? Were there any unexpected changes introduced by the new owners that impacted your payout? These experiences can provide valuable insights for structuring future exits [8].

Next, evaluate the operational handoff. Was everything organized, or did you leave behind technical debt or incomplete records? A messy transition can tarnish your reputation and limit future opportunities. Justin Klemm’s experience highlights just how critical a smooth operational handoff can be [4].

Finally, think about how selling the business has impacted your sense of identity. Jeff Giesea puts it perfectly:

"When you spend years architecting your life around a business and suddenly it's gone, you're probably going to have an identity crisis" [2].

Take time to reflect on what aspects of building the business you enjoyed most and which parts felt draining. This clarity can help guide your next steps, whether that’s starting another business, exploring angel investing, or charting an entirely new course. These reflections will help you make smarter decisions moving forward.

Finding New Opportunities in SaaS and AI

Before jumping into a new venture, take a moment to understand why you sold your previous business in the first place. Was it part of a long-term plan, or was it a reaction to burnout or other pressures? Nearly 40% of business owners who sell without a clear post-exit plan later regret not having one [15]. Whatever your next move is, make sure it aligns with the life you want - not just a repeat of the startup grind.

One way to clarify your vision is through the "Painted Picture" exercise. Spend two hours imagining a typical day three years from now: Where are you? What kind of work are you doing? What does your ideal routine look like? Use this vision to rule out ventures that don’t fit [26]. This approach ensures you’re pursuing something meaningful rather than reacting to an identity shift.

When exploring opportunities in SaaS or AI, focus on finding a niche or delivering a standout user experience. In these competitive spaces, success often comes from excelling in a specific area rather than offering broad, generic solutions [27]. For instance, after selling MeetEdgar to SureSwift Capital, Laura Roeder launched Paperbell, a coaching management platform that, by late 2025, had generated over $24 million in user profits [4]. Similarly, Poya Farighi tapped into his B2B SaaS expertise to create Gateway, a hospitality recruitment platform serving major clients in Dubai [4].

Stay up-to-date with industry trends using resources like the Top SaaS & AI Tools Directory, which tracks emerging tools and market shifts. This can help you spot gaps in the market and validate your ideas before committing resources. Also, don’t forget to review any non-compete or non-solicitation agreements tied to your previous sale, as these could restrict your ability to start a similar business in the same niche [8].

Testing New Ideas Before Committing

Armed with lessons from your last exit and a clear vision for the future, it’s time to test your ideas - but do so cautiously. Avoid jumping headfirst into a new venture. Instead, use this time to adjust, reflect, and gain clarity before investing significant resources [2]. Many founders rush into "rebound ventures", only to later regret the decision. Consider testing the waters through low-risk roles, like joining boards, mentoring other entrepreneurs, or participating in angel funds [2][6].

When you’re ready to test an idea, set up proper infrastructure to avoid legal or operational issues. For example, create a separate email account and credentials for researching new concepts. Michael Lynch, after selling TinyPilot in April 2024 for $598,000 (2.4x annual earnings), followed this approach. He structured a 30-day transition period capped at 80 hours of consulting, relied on detailed playbooks in Notion, and used a centralized Bitwarden account for all credentials. This setup minimized the buyer’s need for his involvement to just 25 hours, allowing him to focus on his next steps sooner [28].

Lastly, separate your financial resources into "opportunity capital" and "lifestyle funds." This ensures your personal financial security while giving you the freedom to experiment. Treat each new venture like a professional investment: diversify, document your process, and limit your financial exposure during the testing phase [6]. Keep experiments short - 90 days is a good timeframe to gauge market interest. If the data doesn’t support your idea, be ready to walk away. This disciplined approach can save you from costly mistakes down the road.

Conclusion

The first 90 days after a sale can be a whirlwind of adjustments. Financial settlements might take anywhere from 90 to 180 days to finalize [9], and balancing administrative tasks with the shift from being the company’s founder to an outsider can bring unexpected hurdles [1].

To start, consider placing your proceeds in secure, liquid accounts like Treasury bills or money market funds. This gives you breathing room to assess your next steps during this transitional phase [2]. On the operational side, prioritize essentials like updating software access, bank accounts, and regulatory filings to ensure everything runs smoothly [9][10]. Once these immediate tasks are handled, it’s time to turn your focus inward.

Selling your business often comes with a significant identity shift, so it’s important to acknowledge this change. Create a 90-day plan to help you reconnect with life outside of the business world. This period of personal recovery lays the groundwork for whatever comes next.

On the operational front, technology can be a game-changer. Tools like AI-powered knowledge management platforms can safeguard institutional knowledge, while churn prediction software can help you address customer concerns before they escalate [29][30]. By leaning on these tools, you can focus more on strategy and less on day-to-day tasks.

As you map out your 90-day strategy, think about dividing your wealth into four categories: Lifestyle (for daily expenses), Growth (long-term investments), Legacy (philanthropy or family needs), and Opportunity (funds for future ventures) [2]. This approach not only protects your financial future but also gives you the freedom to explore new possibilities. With thoughtful planning and the right tools, you can turn these initial challenges into the foundation for lasting success.

FAQs

How can I prepare emotionally for the first 90 days after selling my business?

Selling your business can be an emotional rollercoaster. Pride in your accomplishments might mix with uncertainty about what comes next. It’s completely normal to feel a sense of loss or even experience the "post-sale blues" as you adapt to life without the daily demands the business once brought. Start by giving yourself some breathing room - take a few weeks to reflect instead of diving headfirst into new projects. Use this time to process your emotions, jot down your thoughts in a journal, and think deeply about what’s most important to you as you step into this new phase.

To ease the transition, try focusing on what your future could look like. Begin separating your identity from the business by setting personal goals. Maybe it’s time to dive into hobbies you’ve always wanted to try, strengthen relationships with loved ones, or dedicate time to causes that resonate with you. Don’t go it alone - lean on a support network of mentors, peers, or even a therapist who can offer perspective and encouragement. And don’t forget to celebrate this major milestone. Whether it’s a heartfelt dinner with your team or starting a personal project that excites you, marking the occasion helps you acknowledge the journey and welcome the opportunities ahead.

What financial mistakes should I avoid in the first 90 days after selling my business?

After selling your business, it’s important to steer clear of financial mistakes that could jeopardize your success. One of the biggest missteps? Tax mismanagement. Knowing how your sale is taxed - whether as ordinary income or capital gains - can save you from surprise tax bills down the line. Another risk to watch for is keeping too much of your proceeds tied up in the same company stock. This creates a concentration risk, which could leave your wealth vulnerable to market fluctuations. Diversifying your portfolio is a smart way to reduce that exposure.

Impulsive spending is another trap many fall into. It’s tempting to splurge on luxury purchases like expensive cars or vacation homes, but without a solid budget in place, your newfound wealth can vanish faster than you think. Then there’s risk management - things like insurance and estate planning. Overlooking these can leave your finances exposed to unexpected events, putting your hard-earned wealth at risk.

Finally, don’t forget to have a clear strategy for investing your proceeds. Parking all your money in cash might feel safe, but it limits growth and leaves you vulnerable to inflation. On the flip side, putting everything into high-risk investments could jeopardize your financial security.

By tackling these challenges head-on, you can protect your wealth and make the most of your business sale.

How do earn-outs impact the first 90 days after selling a business?

Earn-outs are a type of deal structure where a portion of the sale price - typically between 10% and 50% - is tied to how the business performs after the sale. Instead of receiving the entire payment upfront, the seller must meet certain performance targets over a set period, often spanning several years, to collect the remaining payout.

The first 90 days after the sale can be particularly intense for both parties. Buyers keep a close eye on critical metrics like revenue, churn rates, and cash flow to assess whether the earn-out goals are within reach. On the other hand, sellers might feel pressured to prioritize short-term wins, such as increasing renewals or postponing expenses, to meet those targets. Meanwhile, buyers may implement operational changes, like introducing new reporting systems or altering staffing, which can lead to friction and added stress during this transitional phase.

To make this process smoother, it’s crucial to outline clear earn-out terms, agree on achievable performance benchmarks, and maintain open lines of communication. Having a well-structured plan in place helps both parties align expectations and manage the transition more effectively.