Private equity (PE) firms prioritize maximizing returns, often aiming to double or triple their investments within 3–5 years. Their negotiation strategies, particularly in software and AI deals, are designed to secure favorable terms while mitigating risks. Here's what you need to know:

-

Key Focus Areas:

- PE firms value SaaS and AI companies based on predictable revenue, scalability, and growth insights with AI analytics like ARR, churn rate, and gross margins.

- AI integration is increasingly critical, with firms favoring companies that leverage AI for efficiency, unique data, or new growth opportunities.

-

Negotiation Tactics:

- Common strategies include emphasizing flaws to lower valuations and prolonging negotiations to pressure sellers.

- Earnouts, often tied to performance metrics like EBITDA, are used to address valuation gaps and share risks between buyers and sellers.

-

Risk Assessment:

- PE firms conduct rigorous due diligence, analyzing financial transparency, technical risks, and AI-specific vulnerabilities.

- They evaluate whether companies can sustain growth organically or require acquisitions to meet targets.

-

Add-On Strategies:

- PE firms often grow value through acquisitions, focusing on revenue, cost, and capital synergies while integrating systems quickly.

To navigate these negotiations effectively, founders should prepare detailed financial data, understand their company's worth, and set clear terms to counteract PE tactics.

PE Re-Trades & Pressure Plays: When to Walk, When to Counter | PE Q&A Masterclass Moment

sbb-itb-9cd970b

How PE Firms Value SaaS and AI Companies

Key SaaS Metrics PE Firms Evaluate During Valuations

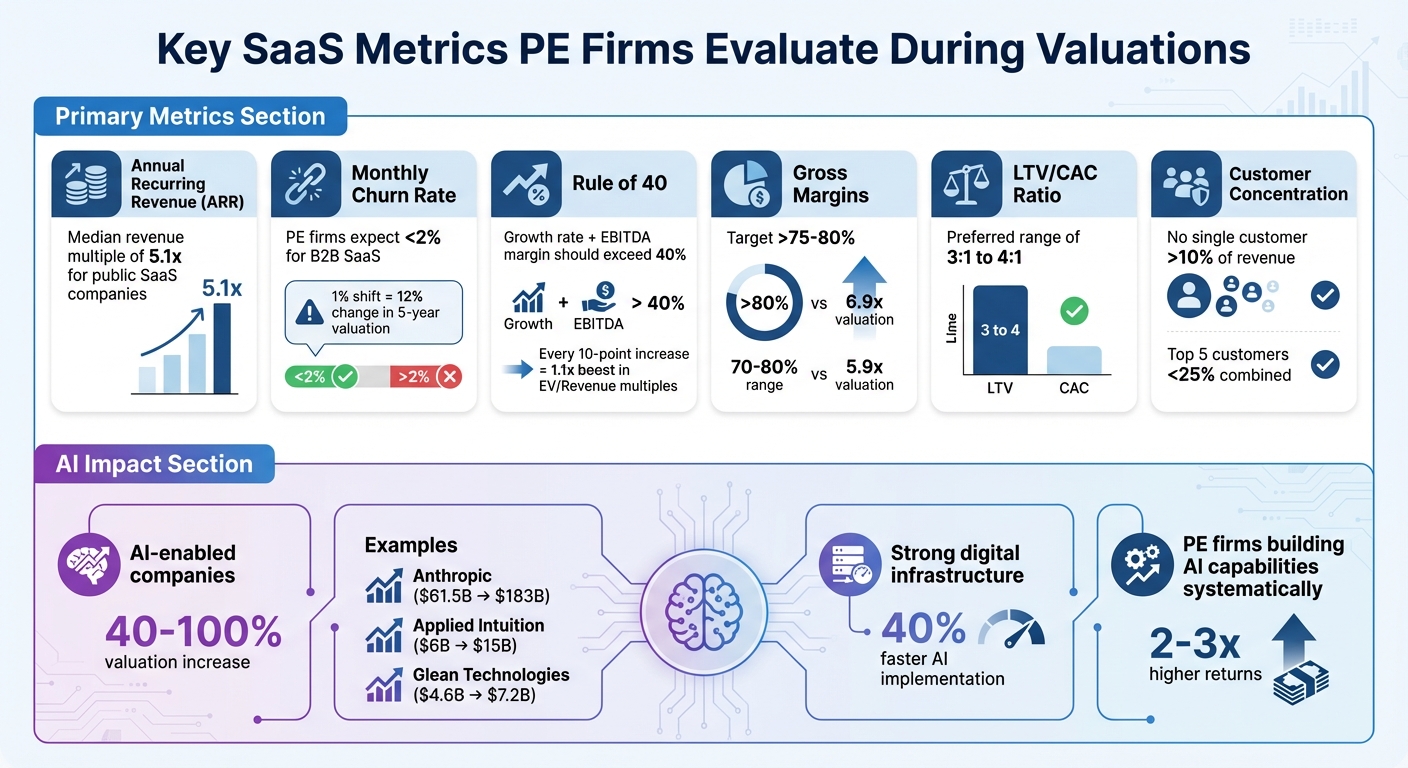

Private equity (PE) firms evaluate SaaS companies by focusing on metrics that demonstrate profitability, scalability, and resilience. For SaaS leaders, understanding these valuation factors is essential to negotiate effectively. PE firms pay particular attention to predictable revenue streams, operational efficiency, and increasingly, the role of AI in both products and business operations.

Key Metrics: ARR, Churn, and Scalability

Annual Recurring Revenue (ARR) is a cornerstone metric for SaaS valuations, with public companies showing a median revenue multiple of 5.1x [8]. Aaron Solganick, CEO of Solganick & Co., highlights the importance of detailed data:

"If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple. The more KPIs and the more financial data I have to work with, the more accurate your valuation will be." [9]

Beyond ARR, additional key performance indicators (KPIs) significantly refine valuation estimates.

Net Revenue Retention (NRR) is another critical metric, as it measures how well a company retains and grows revenue from its existing customers [7][10].

Churn rate is a make-or-break factor. For B2B SaaS businesses, PE firms generally expect monthly churn rates below 2% [9]. Even small changes in churn can have a big impact - a 1% shift can alter a five-year valuation by 12% [9]. High churn, such as losing 5% of customers monthly, raises red flags about product–market fit.

The Rule of 40 has become an industry benchmark for balancing growth with profitability. By adding your growth rate to your EBITDA margin, you can gauge your standing. A combined score above 40% puts you in a strong valuation position. For example, in Q3 2025, every 10-point increase in the Rule of 40 score correlated with a 1.1x boost in EV/Revenue multiples [8]. Whether it's 30% growth with a 10% margin or 10% growth with a 30% margin, the balance matters [9].

Gross margins are another key indicator of scalability. PE firms typically look for margins above 75–80%. Companies exceeding 80% gross margins achieve better valuation multiples - 6.9x compared to 5.9x for those in the 70–80% range [9].

The LTV/CAC ratio helps assess the sustainability of your customer acquisition strategy. PE firms prefer ratios between 3:1 and 4:1 [9]. Additionally, customer concentration is scrutinized - no single customer should account for more than 10% of revenue, and the top five customers combined should make up no more than 25% [9].

While these metrics form the foundation of valuation, the depth of AI integration is becoming a critical differentiator.

AI Integration and Long-Term Viability

PE firms are increasingly focused on how AI contributes to measurable outcomes. They’re not interested in surface-level AI features but in implementations that improve operational efficiency, reduce churn, or provide a competitive edge through unique data.

The valuation gap between traditional SaaS companies and those leveraging AI has grown significantly. AI-enabled companies have seen their valuations rise by 40–100%. Examples include Anthropic’s leap from $61.5 billion to $183 billion, Applied Intuition’s growth from $6 billion to $15 billion, and Glean Technologies’ increase from $4.6 billion to $7.2 billion [11].

However, PE firms approach AI valuations with caution. As Orlando Bravo, founder of Thoma Bravo, put it:

"Valuations in AI are at a bubble... You cannot value a $50 million ARR company at $10 billion." [12]

Beyond hype, firms assess whether a company's digital infrastructure supports scalable AI deployment. Companies with strong cloud and API frameworks can implement AI 40% faster and achieve better returns [2]. They also evaluate whether AI creates proprietary data moats - unique datasets that enhance models and are hard for competitors to replicate using general-purpose AI tools [8].

AI governance and ethical practices are equally important. Weaknesses in these areas can lead to delays or even derail an exit, as noted in EY research [5]. By late 2025, 84% of PE firms had appointed Chief AI Officers [5], signaling their expectation for portfolio companies to demonstrate responsible AI practices that minimize regulatory and reputational risks.

PE firms are moving beyond simple optimization. They’re looking for companies that use AI to rethink business models entirely, not just automate existing processes. Firms that embrace this approach achieve returns 2–3 times higher [5]. For PE firms, the question isn’t just how AI improves efficiency - it’s whether AI can unlock entirely new opportunities for growth.

How PE Firms Assess Risk in SaaS and AI Deals

When it comes to SaaS and AI deals, private equity (PE) firms know that risk assessment often carries more weight than simple valuation. Interestingly, only 9% of buyers focus on tech-related risks, which makes a thorough, integrated approach to technical, financial, and commercial due diligence absolutely critical[4]. The firms that get it right combine these disciplines into a unified, thesis-driven process. This meticulous financial groundwork paves the way for a deeper dive into AI-specific risks.

Financial Transparency and Due Diligence

Top-performing PE teams don’t just skim the surface; they dig deep into the numbers. By reconstructing revenue using detailed invoice and usage data, they conduct a "Quality of Earnings" analysis, uncovering issues that might be hidden in high-level General Ledger summaries[16]. Cohort analysis is another powerful tool, helping firms determine whether strong net revenue retention stems from loyal, long-term customers or whether it’s being dragged down by high churn rates among newer clients. Such findings can signal problems like a weak product-market fit or ineffective onboarding processes[16]. They also adjust for one-time gains that could disguise troubling margin compression[16].

For example, in 2022, a major PE firm evaluated a fintech leader boasting 15% annual growth and 17% margins. But during tech diligence, they discovered two red flags: a recent ransomware attack had breached customer contracts, and the company was relying on outdated infrastructure nearing obsolescence. Despite the promising growth metrics, the risks were too great, and the deal was abandoned[4].

In another case, a healthcare information company merger revealed a surprising twist. "Company B", which initially appeared to have better front-end services, was found to be running on outdated architecture with over 10 million lines of bloated code spread across seven platforms. This revelation led the PE firm to scrap its original integration plan and instead migrate Company B’s services to Company A’s modern cloud platform[4].

"The due diligence process is no longer a box to tick before wire instructions. It is the instrument panel investors use to decide where to price risk."

While financial due diligence exposes hidden fiscal risks, PE firms know that assessing technological vulnerabilities is just as critical, especially when deciding how to approach AI capabilities.

AI Disruption and Build vs. Buy Decisions

When it comes to AI, PE firms break disruption risks into three categories: Revolution, where the business model itself is under threat (a rare scenario affecting less than 10% of companies); Transformation, which requires significant process overhauls; and Augmentation, where AI enhances efficiency without altering the core business model[15]. This classification helps firms decide whether to develop AI capabilities in-house or acquire them through strategic add-ons.

Take the example of a $2 billion carve-out involving an operating system software developer. Technical experts discovered that the existing product roadmap couldn’t hit revenue targets organically. This insight reshaped the strategy, shifting focus to an M&A plan that included several add-on acquisitions for next-gen IT services. The result? A successful IPO exit[4].

The decision to build or buy often hinges on whether the company’s existing R&D can realistically meet growth targets or if external acquisitions are necessary[4]. Alongside this, PE firms scrutinize "black box" risks - AI systems that lack transparency in decision-making, which could lead to bias or compliance issues[14].

Data quality also plays a massive role. PE firms conduct rigorous audits of ERP and CRM systems to ensure the structured data required for AI is both accurate and reliable[2]. Without clean data, even the most advanced AI tools can produce flawed outcomes[14]. These detailed risk assessments directly shape deal terms, aligning negotiation strategies with the financial and technological vulnerabilities uncovered during due diligence.

Deal Structures and Earnouts

Private equity (PE) firms craft deal structures that reflect their confidence in a company’s future performance, often based on detailed risk assessments. The way a deal is structured reveals more about a PE firm’s true perspective than any valuation discussion or presentation ever could. When there’s a disconnect between buyers and sellers over future growth - especially with high-growth SaaS companies scaling at rates between 50% and 100% annually - earnouts become a popular solution. For instance, 21% of private M&A deals in the U.S. in 2022 included earnout provisions, up from 17% the previous year. Similarly, about 18% of PE-led deals utilized earnouts during the same period [17][18]. These structures not only address growth uncertainties but also establish a framework for sharing risks between parties.

Earnouts typically allocate 10%-25% of the purchase price to specific performance targets after the deal closes [18]. In 2022, 44% of PE earnouts relied on EBITDA growth as the primary performance metric, a significant rise from just 10% in 2021 [17]. This change highlights an increased focus on profitability over mere revenue growth.

Earnouts vs. Fixed-Price Deals: Comparison

The decision between an earnout and a fixed-price deal fundamentally shifts how risk is distributed. Earnouts divide the risk between the buyer and seller, while fixed-price deals place the entire burden on the buyer. A notable example is Emerson Electric’s 2023 sale of its climate technologies unit to Blackstone for $14 billion. The deal included a $2.25 billion 10-year seller note at 5% interest, alongside $5.5 billion in commercial debt, to complete the funding [17].

Here’s a quick look at how these two deal structures differ:

| Aspect | Earnouts | Fixed-Price Deals |

|---|---|---|

| Risk Allocation | Shared between buyer and seller | All risk on buyer |

| Payout Timelines | Contingent on performance (1–3 years) | Immediate payment at closing |

| SaaS Applicability | Ideal for high-growth, uncertain outcomes | Best for stable, predictable businesses |

"In today's market, buyers are worried about paying too much and sellers are worried about selling for too little."

Closing Valuation Gaps in Sub-$50M Deals

For SaaS companies valued under $50 million, earnouts play a dual role: resolving valuation disagreements while keeping founders motivated. The earnout period has shifted toward two years, as sellers resist longer timelines [21]. More than 90% of IT and software transactions now include earnouts, with the earnout portion narrowing from the historical range of 30–40% to just over 30% today [21].

Deal structure matters. PE firms are increasingly leaning toward "sliding scale" earnouts rather than "binary" ones. Sliding scale earnouts offer proportional payouts based on how closely targets are met, appealing to sellers who want to avoid the risk of losing everything over minor shortfalls [19]. Founders in smaller deals should prioritize revenue-based metrics over EBITDA, as revenue is more straightforward and less susceptible to manipulation through post-acquisition cost adjustments [20][21].

"Earnouts and seller's notes are not free money; they are debt on the business as someone has to pay the contingent payments when they are due."

- Reed Van Gorden, Managing Director, Deerpath Capital [17]

Add-On Acquisition Strategies for SaaS

Private equity (PE) firms often grow portfolio value through structured add-on acquisitions. Instead of relying solely on a single platform company, these firms acquire a core business - referred to as the "platform" - and then integrate smaller companies to enhance the overall valuation.

This "buy-and-build" approach delivers impressive results. On average, these deals achieve an Internal Rate of Return (IRR) of 31.6%, with smaller platform companies (under $70 million) reaching an even higher IRR of 52.4%. In comparison, standalone deals average an IRR of 23.1%. The strategy’s popularity is evident: add-on acquisitions represented nearly 74% of all PE deal activity in North America by 2025. This is a dramatic rise from 20% in 2000, 53% in 2012, and 70% by 2023.

How PE Firms Execute Add-On Acquisitions

PE firms often leverage "multiple arbitrage", acquiring a platform company at a higher valuation multiple (e.g., 8× EBITDA) and smaller add-ons at lower multiples (e.g., 5× or 6× EBITDA). This practice increases the combined entity's overall valuation.

Take Advent International as an example. Between 2011 and 2018, they transformed Morrison Supply Company (later rebranded as MORSCO) by executing six major acquisitions complemented by smaller "tuck-in" deals. By centralizing operations in a 128,000-square-foot distribution center, they streamlined the business, eventually selling it to Reece Group for $1.44 billion in 2018. In the SaaS space, Ionic Partners followed a similar path. They acquired Sparkrock in June 2022, a provider of ERP software for K–12 schools and nonprofits, and later strengthened the platform with acquisitions of Edsembli in March 2024 and School-Day in February 2025.

"The objective is to assemble a powerful new business whose whole is worth significantly more than the parts."

- Bain & Company [23]

To assess potential add-ons, PE firms evaluate three key synergies:

- Revenue synergies: Cross-selling opportunities to new customer bases.

- Cost synergies: Centralizing systems like ERP, CRM, and back-office operations.

- Capital synergies: Consolidating infrastructure and optimizing asset management.

Firms tend to favor acquisitions that deepen their industry presence rather than diversifying into unrelated markets. Core-focused deals yield an IRR of 43.5%, while diversification strategies average only 16.4%.

Top-performing firms aim to complete and integrate add-ons within three years. They track "Time-to-Integration" (TTI) as a critical metric, with the best firms integrating key systems within six months of closing a deal. For instance, in February 2024, Camber Partners facilitated the acquisition of Userflow by portfolio company Beamer for over $60 million, enhancing Beamer's product engagement tools for its 700+ customers.

Preparing Your SaaS Company for MRR-Driven Acquisitions

To make your SaaS company an attractive add-on target, it's crucial to focus on metrics that PE firms value. At the top of the list is Net Revenue Retention (NRR), which highlights your ability to upsell and cross-sell. On the flip side, high churn rates can signal customer instability, potentially jeopardizing a deal.

Clean, transparent financial reporting is also essential. PE firms prefer companies with unified systems and a well-documented "value creation story" that clearly outlines pre- and post-acquisition metrics. For example, in August 2023, Redbrick, backed by PE funding, acquired Animoto, a cloud-based video creation platform serving 70,000 customers. This acquisition played a key role in helping Redbrick surpass $100 million in annualized revenue.

| KPI | PE Priorities |

|---|---|

| Net Revenue Retention | Validates upsell/cross-sell traction [22] |

| SG&A as % of Revenue | Reflects operational scalability [22] |

| Time-to-Integration | Measures execution speed of the M&A playbook [22] |

| Churn Rate | Highlights customer stability and brand trust [22] |

Modernizing your infrastructure is equally important. PE firms are drawn to companies with cloud-native architectures and up-to-date ERP/CRM systems that can be seamlessly integrated. Outdated systems and manual processes can slow down integration and reduce your appeal as a target.

"PE sellers with a clearly documented 'value creation story' showing pre/post metrics per add-on tend to achieve higher exit multiples."

- David Morris, Advisory Specialist, CohnReznick [22]

Some PE firms specialize in specific acquisition profiles. For instance, Camber Partners focuses on B2B SaaS companies with product-led growth models and annual recurring revenue (ARR) between $3 million and $20 million. Meanwhile, Valsoft Corporation has adopted a "buy and hold forever" strategy, moving away from traditional short-term exits. Knowing which firms align with your business model and growth stage can give you an edge when entering negotiations.

Conclusion

Private equity firms approach negotiations with a laser focus on achieving high returns [1][6]. For SaaS and AI executives, understanding this returns-driven mindset is a game-changer. PE firms often employ strategies like highlighting flaws, pausing strategically, and exploiting divisions among shareholders to push valuations lower [3]. To counter these moves, insist on solid financial data and conduct a comprehensive data audit well before entering negotiations [1][3][13].

In today’s landscape, digital maturity isn’t just a nice-to-have - it’s a must-have for AI success. A strong digital foundation is essential for achieving the full potential of AI-driven results [2]. Research shows that PE-backed companies systematically building AI capabilities across their operations can see nearly double the return on invested capital compared to those that don’t [2]. On the flip side, when digital readiness lags, 40% of investors report valuation reductions of 5% or more [2]. Upgrading systems like ERP, CRM, and cloud infrastructure not only supports AI deployment but also directly enhances valuation [2].

"Digital transformation is no longer optional or merely a collection of bolt-on capabilities... but rather the essential foundation for AI deployment and driving outsized value creation." - Moritz Hagenmüller, Clark O'Niell, Wilhelm Schmundt, Gerwin Fels, and Luisa Richter [2]

Given these realities, thorough preparation is critical before stepping into negotiations. Start by auditing financial and operational records early, establish a strong price anchor, and ensure shareholders present a united front to neutralize PE tactics [1][3][13]. Additionally, set firm deadlines to counteract the PE strategy of prolonging talks to create pressure [3]. If earnouts are part of the deal, negotiate for upfront cash and clear, achievable milestones [3].

The companies that excel in PE negotiations are those that come prepared, armed with a clear understanding of their worth, solid documentation, and the willingness to walk away if the terms don’t align. With technology deals making up 31% of all buyouts [4] and PE firms holding significant reserves of capital, the leverage isn’t entirely in their hands - if you know how to use it. With these strategies, SaaS and AI leaders can confidently navigate the complexities of PE negotiations.

FAQs

How do private equity firms evaluate the value of AI in SaaS companies?

Private equity (PE) firms see AI in SaaS companies as more than just a tech upgrade - it’s a way to drive substantial growth. They evaluate how AI impacts critical business metrics like recurring revenue, customer retention, and gross margins. For instance, AI-powered tools can boost average contract values, speed up customer acquisition, and reduce costs tied to support or infrastructure. These benefits are integrated into financial models to predict how AI will influence future cash flow and overall company valuation.

During due diligence, PE firms also rely on advanced analytics and AI tools to uncover hidden risks and opportunities. These tools dig into product roadmaps, user data, and market trends, offering insights that traditional methods often miss. By quantifying the current and future value AI adds, PE firms can accurately assign a dollar value to its impact, ensuring the SaaS platform’s potential is fully reflected in negotiations.

What strategies do private equity firms use when negotiating software and AI deals?

Private equity (PE) firms take a calculated approach when negotiating software and AI deals, aiming to reduce risks while maximizing returns. A common tactic they use is to point out potential risks or shortcomings, such as customer concentration, operational challenges, or weak market positioning, as a way to argue for lower valuations. Sellers are often expected to provide detailed, data-driven explanations to address these issues.

Another strategy revolves around framing negotiations around risk management. PE firms rely on financial models that focus on worst-case scenarios, ensuring that potential downsides are thoroughly considered. At the same time, they place significant emphasis on growth opportunities and proprietary technology, carefully examining intellectual property, product development plans, and research pipelines to gauge scalability and long-term revenue potential.

To align incentives, deals often include a combination of upfront payments and performance-based payouts (like earn-outs). This structure ensures that both the buyer and the management team remain committed to achieving growth targets post-acquisition.

By combining risk-focused valuation methods, in-depth technology evaluations, and flexible deal structures, PE firms position themselves to secure favorable terms while keeping the door open for future gains if growth expectations are met.

How can SaaS founders prepare to negotiate favorable terms with private equity firms?

To gear up for private equity (PE) negotiations, SaaS founders need to dive into the PE mindset. These firms are laser-focused on short-term returns (usually within 3–5 years) while keeping an eye on potential for long-term growth. Your goal? Craft a persuasive, data-backed story that showcases your company’s strengths. Highlight areas like your technology (think product roadmap, intellectual property, and R&D), management expertise, growth strategies, and operational efficiency.

Start by conducting a tech due diligence audit. This step is crucial for identifying and addressing risks like code quality, scalability, and security before the PE team digs in. On top of that, ensure your financials and metrics - like ARR, churn rates, and customer contracts - are neatly organized in an updated data room. To confidently back your valuation, benchmark it against recent SaaS industry transactions.

When it’s time to negotiate, expect PE firms to use tactics like valuation discounts. Be ready to counter with hard data to support your numbers. Scenario analyses can be a powerful tool here - show how operational tweaks or strategic acquisitions could boost EBITDA. Additionally, negotiate for performance-based incentives tied to growth milestones. Protect your company’s future by securing retention packages for key team members, keeping a meaningful equity stake, and ensuring you have a voice in strategic decisions through board representation. By presenting a clear growth plan and aligning goals, you can steer the conversation toward mutual value creation and land better terms.