Selling your SaaS or AI company? Private equity (PE) firms focus heavily on one thing during due diligence: the quality of your recurring revenue. It’s not just about how much revenue you make - it’s about how stable, predictable, and transferable it is.

Here’s what PE firms look for:

- Net Revenue Retention (NRR): Should be above 110%. Top companies hit 120% or more.

- Churn Rate: Annual churn under 5% is ideal. Anything above 15% signals trouble.

- Gross Margins: Target 80% or higher.

- Customer Concentration: No single customer should account for more than 10–20% of revenue.

- LTV:CAC Ratio: Should be at least 3:1 to show efficient customer acquisition.

Weak metrics lower your valuation, while strong numbers - like retention rates and predictable growth - can secure premium multiples of 8–12× EBITDA. PE firms want proof your business can scale with minimal risk.

The key takeaway? Audit your recurring revenue, fix weak spots, and use AI-powered growth insights to present reliable data and attract top offers.

2025 SaaS M&A Market Insights and Founder Takeaways | The SaaS CFO | Special Episode

sbb-itb-9cd970b

The #1 Factor PE Firms Evaluate: Recurring Revenue Quality

Strong vs Weak SaaS MRR Metrics: PE Firm Benchmarks

When private equity (PE) firms talk about "recurring revenue quality", they’re looking at how stable, predictable, and defensible a company’s revenue is. Aaron Solganick, CEO of Solganick & Co., puts it this way:

"If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple. The more KPIs and the more financial data I have to work with, the more accurate your valuation will be." [7]

Why does this matter? Reliable revenue reduces risk. For example, a business generating $5 million in ARR from 500 diverse customers is seen as much more scalable and resilient than one earning the same amount from just five clients. This stability is the foundation for a deeper dive into key metrics.

The Metrics PE Firms Examine

PE firms rely on specific metrics to analyze recurring revenue. Metrics like Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) provide a baseline for understanding the revenue stream. But Net Revenue Retention (NRR) goes a step further, showing whether existing customers are spending more over time. A strong NRR - above 100% - signals growth, while top-performing companies often hit around 120% [3].

Another critical metric is Gross Dollar Churn, which measures revenue lost from cancellations or downgrades. For B2B SaaS businesses, keeping monthly churn below 2% (or annual churn under 10%) is a strong indicator of health [4]. Cohort analysis also plays a role, helping firms track customer behavior over time to uncover issues like product quality or market fit.

PE firms also scrutinize Customer Acquisition Cost (CAC) and Gross Margin. A solid business typically boasts an LTV:CAC ratio of at least 3:1 - meaning each customer generates three times the cost of acquiring them. Gross margins, meanwhile, should fall between 75% and 85%, with the top companies exceeding 85% [4] [5]. Together, these metrics paint a picture of whether a company’s revenue is strong or weak.

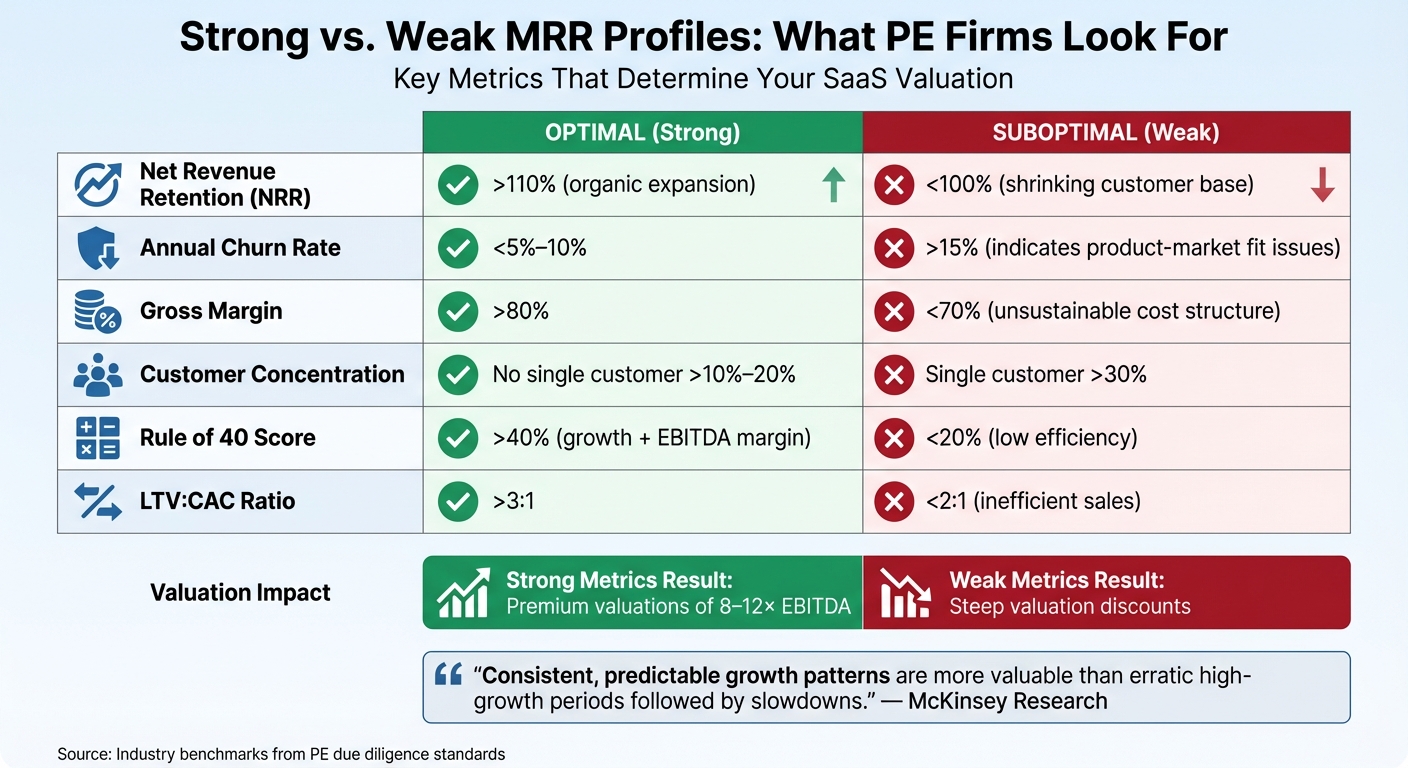

Strong vs. Weak MRR Profiles

| Metric | Optimal | Suboptimal |

|---|---|---|

| Net Revenue Retention (NRR) | >110% (organic expansion) [3] | <100% (shrinking customer base) [3] |

| Annual Churn Rate | <5%–10% [4] | >15% (indicates product-market fit issues) [4] |

| Gross Margin | >80% [4] [1] | <70% (unsustainable cost structure) [3] |

| Customer Concentration | No single customer >10%–20% [4] [1] | Single customer >30% [4] |

| Rule of 40 Score | >40% (growth + EBITDA margin) [6] | <20% (low efficiency) [6] |

| LTV:CAC Ratio | >3:1 [4] [5] | <2:1 (inefficient sales) [4] |

Companies with strong metrics often secure premium valuations, with multiples of 8–12 times EBITDA. On the other hand, weak metrics can lead to steep discounts. The key isn’t just high numbers - it’s consistent and predictable performance.

"Consistent, predictable growth patterns are more valuable than erratic high-growth periods followed by slowdowns." - McKinsey Research (via Axial) [7]

If your metrics fall into the suboptimal category, it’s a clear sign to make adjustments. In the next section, we’ll look at how poor revenue quality can hurt your valuation and explore ways to improve your metrics before PE firms come calling.

Why Poor Recurring Revenue Reduces Your Company's Value

If your recurring revenue isn’t solid, private equity (PE) firms will likely see warning signs everywhere. Weak retention rates and unstable monthly recurring revenue (MRR) patterns can severely impact your company’s valuation. PE firms are hesitant to pay high multiples when the risks seem unpredictable. Let’s dig into how specific challenges, like high churn, can chip away at your company’s value.

How High Churn Affects Your Valuation

High churn is a clear signal to PE firms that your revenue is anything but stable [9][12]. Even if you’re bringing in new customers, you’re essentially running in place - replacing lost revenue instead of achieving genuine growth. This constant churn forces you to spend heavily on customer acquisition just to maintain your current revenue levels [8]. The result? Profitability takes a hit, and scaling becomes an uphill battle.

Here’s the stark reality: a company with 5% churn can outpace a similar company with 10% churn by over 500% in just two years [8]. It’s no wonder PE firms grow cautious when they see gross MRR churn exceeding 1–2% per month. To them, this suggests a deeper issue - perhaps a failure to deliver clear value or return on investment [10]. Nathan Latka, CEO of Founderpath, sums it up well:

"The quickest way to build your SaaS company valuation is to keep current customers paying for 50+ months (2% or less gross monthly churn) and drive expansion revenue from the current customer base." [10]

Retention is everything. Companies with strong retention - Net Dollar Retention (NDR) above 110% - can command revenue multiples of 10× or more. On the flip side, businesses with high churn face much lower valuations and often struggle to close deals [9]. The difference between being “investable” or a “pass” often comes down to whether your annual churn is below 10–15% or creeping above 20% [9].

Why Weak Projections Concern PE Investors

Churn isn’t the only issue. Unreliable growth projections can also scare off investors. When your MRR is unstable, it’s tough to create accurate forecasts. If your Net Revenue Retention (NRR) falls below 100%, even strong new sales might just be masking deeper problems [15]. For PE firms, shrinking revenue from your existing customer base signals trouble. It means that growth is overly reliant on expensive new customer acquisition rather than predictable expansion within your current accounts.

Trust in your data is critical. If your MRR metrics include one-time setup fees or show unexplained revenue spikes, PE firms may question the reliability of your numbers [14]. Lior Ronen, Founder of Finro Financial Consulting, explains it like this:

"A realistic NRR assumption can turn an aggressive forecast into a credible one, while an inflated one can quietly undermine the forecast." [15]

Low retention also creates what investors call “revenue visibility” issues [1][16]. When customer behavior is inconsistent and churn patterns are unpredictable, PE firms struggle to establish a reliable baseline for future performance [15]. Allen Cinzori, Managing Director at Software Equity Group, breaks it down:

"In an uncertain environment, if an investor is buying an asset for future revenue growth, they're less sure that growth will materialize. They do know if the company has strong retention... those customers likely aren't going anywhere. This creates a baseline for growth." [16]

Without dependable recurring revenue, PE firms adjust valuations downward - often significantly. It’s all about trust, stability, and the confidence that your business can deliver steady, predictable growth.

How to Improve Your Recurring Revenue Metrics

Fine-tuning your metrics, boosting customer retention, and crafting reliable forecasts are essential steps to take before private equity (PE) firms evaluate your business. Don’t wait for them to start asking tough questions - address potential weaknesses and create forecasts that instill confidence well in advance.

How to Audit Your Revenue Quality

Start by conducting a mock due diligence. Imagine a PE firm is already scrutinizing your retention rates, pricing strategies, and pipeline accuracy. Can your data stand up to their questions? Ensure that all your metrics are clearly defined and aligned with GAAP standards [13]. If your numbers don’t match across systems, it could raise doubts about the reliability of your operations.

Next, dive into your churn taxonomy. Don’t just track how many customers are leaving - figure out why they’re leaving. Use reason codes like product misalignment, pricing concerns, or deviations from your ideal customer profile (ICP) [13][18]. This level of detail can reveal operational gaps. For instance, if pricing is a recurring issue, you might need to rethink your packaging or offer more flexible options.

Cohort analysis is another powerful tool. Segment customers by the time they signed up and track how retention has changed over time [13][18]. Improving retention rates over successive cohorts signals strong operational health to investors. On the other hand, if retention is declining, it’s a red flag you’ll need to address. Additionally, break down your revenue data by customer type, ACV band, and product line to identify any weak spots [13].

Pay close attention to revenue concentration. If a single customer accounts for more than 10% of your total revenue, it’s a risk factor for PE firms. Losing that customer could severely impact your business. As Jon Hart and Steve Wasylenko of Falcon LLC explain:

"Private equity firms typically prefer companies with lower revenue concentration because it reduces the risk associated with relying heavily on a few customers." [1]

Lastly, make sure your data room is organized. Investors expect to see clean, detailed records, including contracts, an ARR bridge (New + Expansion - Contraction - Churn), and clear documentation for every churn and expansion event [13]. Messy or incomplete data can signal poor operational discipline, which could deter potential investors.

Now, let’s explore how AI can help you stay ahead of the curve.

Using AI Tools to Strengthen Your MRR

AI can be a game-changer when it comes to reducing churn. Modern analytics platforms can analyze billing patterns and product usage to flag customers at risk of leaving [2][20]. Instead of waiting for cancellations, you can proactively engage these customers with targeted retention offers or personalized support.

AI tools also help monitor key performance indicators in real time. This makes it easier to spot trends, identify upsell opportunities, and refine your pricing strategies. For example, AI can test pricing models like value-based tiers or usage-based add-ons to maintain margins while driving revenue growth [13].

Another benefit of AI is its ability to improve revenue recovery. Automated invoicing and dunning strategies, such as retry logic for failed payments, can significantly reduce involuntary churn [2]. These tools ensure that simple issues, like an expired credit card, don’t cost you a customer.

By centralizing data from your CRM, billing, and analytics systems, you can monitor your MRR bridge and churn taxonomy in real time [19][13]. As Class VI Partners puts it:

"Recurring revenue durability, efficient growth, and retention quality... have become the decisive factors in valuation and deal certainty." [13]

Creating Reliable Growth Forecasts

Once your metrics are in order, focus on building forecasts that reflect this improved reliability. PE firms aren’t interested in guesswork - they want models based on detailed, real-time data from your billing system, CRM, and product analytics [17]. Use tools like MRR buildup, cohort modeling, and weighted pipeline forecasting to construct a clear, data-driven ARR bridge [13][17].

Your ARR bridge should break down your growth into New Logo, Expansion, Contraction, and Churn, reconciling your starting ARR to your ending ARR [13]. This level of transparency helps investors see exactly where your growth is coming from - and where you might be losing ground.

Run scenario analyses to prepare for potential challenges, like higher churn rates or slower upsell activity [17]. This shows that you’ve considered the risks and developed strategies to address them.

Finally, keep your projections realistic. Data shows that only 1.6% of software companies sustain revenue growth of 30% or more over a decade [20]. Set achievable targets based on your current customer base and the market’s compound annual growth rate (CAGR) [20].

When your forecasts are built on solid data and realistic expectations, PE firms are far more likely to trust in your ability to deliver consistent, predictable growth.

MRR Benchmarks PE Firms Expect to See

When private equity (PE) firms evaluate your company, they’re not just looking for potential - they want proof that your business can scale in a sustainable way. Knowing the benchmarks they value gives you a clear picture of where you stand before you begin negotiations. These metrics also lay the groundwork for the deeper analysis that follows.

Net Revenue Retention Above 110%

Net Revenue Retention (NRR) measures how much your current customers are spending over time, factoring in upsells, expansions, and churn. An NRR above 100% signals growth, but PE firms typically expect you to exceed the median.

For private B2B SaaS companies, the median NRR is currently 101% [24]. However, top-performing companies often hit NRR rates between 110% and 115% [21][26], with anything above 120% indicating your product is deeply integrated into your customers’ operations [2].

Companies that actively invest in advanced customer success strategies - like guiding users through specific adoption milestones - tend to achieve NRR rates about 7 percentage points higher than those relying on basic support models [26]. Designing intentional upsell opportunities, such as premium features or add-ons, also plays a big role in boosting NRR.

As McKinsey highlights:

"Efficient growth is most correlated with value creation" [26].

A strong NRR not only validates the value your product delivers but also positions your company for a higher valuation.

Annual Churn Below 5%

Churn is a direct threat to growth. As Rory O'Driscoll, Partner at Scale Venture Partners, puts it:

"Revenue Churn matters because as growth slows the impact of churn escalates and provides an upper bound on HOW BIG a company can become" [23].

PE firms generally expect annual churn rates between 5% and 7%, with enterprise-focused companies leaning closer to 5% [27].

The data supports this: companies with specialized renewals teams - distinct from their sales or customer success teams - typically see Gross Revenue Retention (GRR) rates about 4 percentage points higher than those without dedicated renewal efforts [11]. This highlights the importance of treating renewals as a focused discipline, not an afterthought.

To meet these expectations, it’s crucial to analyze your churn data and demonstrate how you’re addressing retention challenges.

Improving Cohort Retention Over Time

Cohort retention trends are a key indicator of your recurring revenue quality. PE firms look for consistent improvements in cohort retention, as this shows your company is learning from past challenges and adapting effectively.

The best-performing SaaS companies consistently maintain GRR rates between 94% and 96%, compared to a median range of 88% to 90% [21][22]. By tracking retention across customer types, contract values, and product lines, you can pinpoint where you’re excelling and where there’s room for improvement. For example, if enterprise customers are staying longer while SMB retention is slipping, it might signal a need to tweak your onboarding process or adjust your market focus.

When combined with metrics like NRR and churn, strong cohort retention trends reassure PE firms that your revenue model is solid and ready for growth. This level of detail demonstrates that you not only understand your business but are also equipped to scale effectively in the future.

Conclusion

Why MRR Quality Determines Your Exit Value

The quality of your Monthly Recurring Revenue (MRR) is a key factor in determining private equity (PE) valuations. When your revenue stream is steady, predictable, and growing efficiently, PE firms perceive lower risk and greater potential. Companies meeting the Rule of 40 - where the sum of growth rate and free cash flow margin equals 40% or more - can achieve revenue multiples nearly three times higher than those in the bottom quartile [20]. That’s the difference between a standard exit and a premium valuation.

As the focus shifts from "growth at all costs" to sustainable and efficient growth, PE firms are digging deeper into metrics like retention, cohort trends, and unit economics. Strong retention and accurate forecasting are critical to boosting your exit valuation. PE firms want to see that your business can scale without excessive cash burn or losing customers faster than you gain them. Metrics like Gross Revenue Retention above 95% and Net Revenue Retention exceeding 115% demonstrate that your product has staying power, customers are expanding their spend, and your revenue model is built for long-term success [13]. These figures highlight why robust MRR metrics are essential when preparing for an exit.

Tools to Help You Optimize Your MRR

Once you've audited your MRR, leveraging the right tools can further strengthen your position. Platforms like Clari use AI to score opportunities, track renewals, and improve revenue forecasting accuracy [28]. Rho offers real-time dashboards that break down MRR into new revenue, expansion, churn, and contraction, helping you identify trends and prepare for discussions with investors [14]. The SEG SaaS Scorecard is another valuable resource, benchmarking your business against private equity standards across 20 key metrics [25].

For funding, RevTek Capital provides non-dilutive growth capital ranging from $2 million to $20 million, tailored specifically for SaaS companies [29]. By focusing on core metrics like retention, expansion, and operational efficiency, you’ll be better positioned for a higher valuation and a smoother exit process.

FAQs

Why do private equity firms prioritize Net Revenue Retention (NRR) when evaluating SaaS or AI companies?

Private equity firms place a strong emphasis on Net Revenue Retention (NRR) because it highlights how effectively a company grows revenue from its existing customers. A high NRR signals strong customer loyalty, successful upselling efforts, and low churn rates - factors that are essential for driving steady growth.

For investors, NRR lowers risk by demonstrating the company’s ability to maintain predictable, recurring revenue streams. In industries like SaaS and AI, this metric is often seen as a reliable measure of long-term profitability and overall market opportunity.

Why is customer concentration a key factor in how PE firms value a company?

Customer concentration is a key factor private equity (PE) firms consider when evaluating a company’s value because it directly ties to the level of risk involved. When a large chunk of revenue depends on just a handful of customers, the company becomes more exposed to potential disruptions. For example, if one of those major customers stops doing business or runs into financial problems, it could lead to a significant drop in revenue.

To reduce this risk and enhance valuation, businesses should work on expanding their customer base. Having a diverse mix of clients not only lowers reliance on a few key accounts but also signals stability and adaptability to potential investors.

How can a company improve its recurring revenue to attract private equity (PE) firms?

To catch the eye of private equity (PE) firms, your company should prioritize strengthening its recurring revenue metrics. A good starting point is boosting your Contracted Annual Recurring Revenue (CARR). You can achieve this by securing long-term contracts and upselling to your existing customers - both strategies create the predictable cash flow PE firms value highly. At the same time, focus on reducing customer churn and increasing retention rates, as these are clear indicators of a stable, loyal customer base.

Another key area is diversifying your customer base. Relying too heavily on a handful of accounts can create revenue concentration risks, which PE firms tend to avoid. On top of that, work on improving your gross margins by cutting unnecessary costs and streamlining operations. Strong margins not only highlight profitability but also signal that your business is scalable.

Finally, ensure your financial metrics are rock-solid. Present accurate, detailed data that showcases consistent growth in critical areas like Annual Recurring Revenue (ARR) and Net Revenue Retention (NRR). By focusing on these strategies, you’ll make your company a more appealing and trustworthy option for private equity investors.